Aurora Innovation, Inc., a pioneer in autonomous vehicle technology, is reshaping the future of transportation with its full-stack self-driving platform. Founded in 2017 and headquartered in Pittsburgh, Pennsylvania, the company develops cutting-edge solutions in sensing, perception, motion planning, and vehicle control. With a strong focus on logistics and freight through its Aurora Driver system, the company is building toward safe, scalable, and commercially viable autonomy.

This article explores Aurora Innovation’s business structure, proprietary technologies, product landscape, and competitive advantages in the autonomous vehicle sector—offering a deeper understanding of its innovations through the PatSnap Eureka AI Agent, a powerful tool for analyzing IP and corporate strategy across frontier technologies.

Company Overview of Aurora Innovation

| Category | Details |

|---|---|

| Company Name | Aurora Innovation, Inc. |

| Founded | 2017 |

| Headquarters | Pittsburgh, Pennsylvania, USA |

| Founders | Chris Urmson, Sterling Anderson, Drew Bagnell |

| Public Listing | NASDAQ: AUR (via SPAC merger with Reinvent Technology Partners Y, 2021) |

| Core Focus | Autonomous vehicle technology and logistics automation |

| Primary Product | Aurora Driver (self-driving software stack) |

Corporate Structure

| Unit | Function |

|---|---|

| Aurora Driver Development | Core R&D for autonomous driving software |

| Hardware Integration | LIDAR, radar, cameras, and sensor suite development |

| Aurora Horizon | Autonomous freight product for commercial trucking |

| Aurora Connect | Interface for fleet and ride-hailing integration |

| Operations & Testing | Manages on-road testing, safety validation, and tele-operations support |

| Partnerships Division | Collaborations with Volvo, PACCAR, Uber, Toyota, FedEx, and others |

Products and Services of Aurora Innovation

Aurora Driver is Aurora’s flagship self-driving technology stack, adaptable to multiple vehicle types—especially Class 8 trucks.

Key components include:

- Perception systems: Fusion of LIDAR, radar, and cameras for object recognition

- Localization and Mapping: High-definition maps and GPS-free positioning

- Motion Planning: Safe path computation, route selection, and decision-making

- Control Systems: Autonomous throttle, braking, and steering

Service Offerings:

- Aurora Horizon – Driverless freight transportation

- A service suite built around the Aurora Driver tailored for logistics and trucking fleets:

- Features:

- Autonomous operation on long-haul routes (e.g., Dallas to Houston)

- Remote monitoring via teleoperations center

- Integration with dispatch and fleet management systems

- Customer Benefits:

- Aurora Connect – Software APIs and vehicle integrations for ride-hailing platforms

- Aurora Connect is designed to integrate the Aurora Driver into third-party ride-hailing networks (like Uber).

- Features:

- APIs for rider/driver interface

- Fleet routing and availability coordination

- UX modules (pickup/drop-off zones, passenger feedback loop)

Business Model of Aurora Innovation

Aurora operates a platform-as-a-service (PaaS) model targeting logistics and transportation companies.

| Revenue Stream | Description |

|---|---|

| Licensing | Self-driving software platform to OEMs and fleet operators |

| Partnerships | Strategic deployments with PACCAR, Toyota, Uber Freight, etc. |

| Pilot Programs | Paid testing and feedback loops with partners |

| Data Monetization | Vehicle data for model training and performance enhancement |

| Autonomous Freight | Fee-based transport operations through Aurora Horizon |

Market Position

Aurora is recognized as a leader in autonomous trucking.

- Core Focus Area: Long-haul freight (Class 8 trucks)

- Strategic Shift: From robo-taxis to freight logistics

- Commercial Launch Target: End of 2024 for driverless freight on select routes

- Key Partners: FedEx, Uber Freight, PACCAR, Volvo

Innovation & Technology of Aurora Innovation

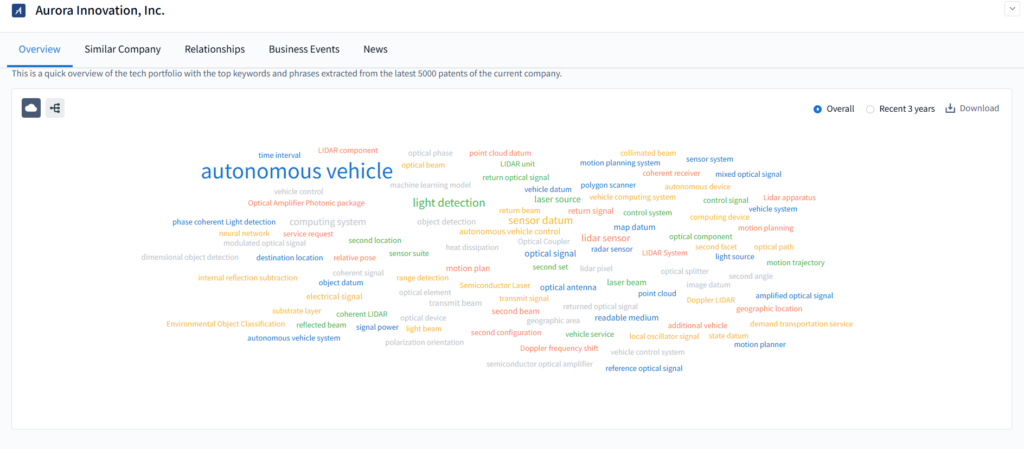

Aurora’s innovation is underpinned by a highly sophisticated tech stack and a deep patent portfolio. PatSnap Eureka reveals that Aurora’s R&D is heavily concentrated in next-gen LIDAR systems, sensor fusion, motion planning algorithms, and real-time object detection—all essential to safe autonomy.

Patent Portfolio Themes & Keyword Mapping

PatSnap Eureka’s keyword mapping tool reveals a dense cluster around the following technical areas:

| Innovation Cluster | Sample Keywords from Aurora’s IP Filings |

|---|---|

| LIDAR & Photonics | Doppler LIDAR, optical antenna, coherent LIDAR, return signal, laser source |

| Perception Algorithms | neural network, environmental object classification, point cloud, reflected beam |

| Sensor Fusion | optical phase, signal power, object datum, second location, vehicle control system |

| Vehicle Motion Control | motion planning, motion trajectory, geographic location, vehicle datum |

| Computing Infrastructure | computing device, readable medium, control system, optical path, heat dissipation |

| Safety & Redundancy | internal reflection subtraction, sensor suite, amplified optical signal |

These filings demonstrate Aurora’s integrated approach, combining hardware innovation (e.g., polarization-sensitive LIDAR) with software intelligence (e.g., neural nets for 3D object recognition).

Advanced Sensing Systems

Aurora’s technology stack includes multiple sensing modalities, fused in real-time:

- First-of-its-kind LIDAR:

Aurora acquired Blackmore in 2019 to bring frequency-modulated continuous wave (FMCW) LIDAR in-house. This allows for:- Simultaneous range and velocity detection

- High-resolution object tracking

- Immunity to sensor cross-talk and sunlight interference

- Detection of small or low-reflectivity objects (e.g., tire fragments)

- Radar + Camera Fusion:

Aurora combines short- and long-range radar with HD cameras to enrich perception models and create redundancy under adverse weather or lighting conditions.

AI & Machine Learning Models

Aurora heavily relies on ML to interpret data, predict behaviors, and plan routes.

- Prediction Models: Anticipate object movements (e.g., vehicle lane changes, pedestrian crossings)

- Behavioral Planning: Context-aware decision logic (e.g., merging, yielding, overtaking)

- Model Training: Uses a hybrid of real-world driving data and synthetic data generated via simulation

Hardware & System Integration

Unlike many AV players, Aurora takes a holistic approach:

- In-house design of key hardware elements (LIDAR boards, compute units)

- Modular software stack adaptable to PACCAR, Volvo, and Toyota platforms

- Heat dissipation and photonic package design for rugged automotive environments

Closed-Loop Simulation and Testing

Aurora leverages closed-loop simulation systems to test edge cases (e.g., jaywalking, sudden braking) at scale—crucial for safety validation.

Through PatSnap Eureka, users can trace the evolution of these innovations, identify white spaces, and uncover potential licensing or partnership opportunities—based on Aurora’s IP filing patterns.uise.

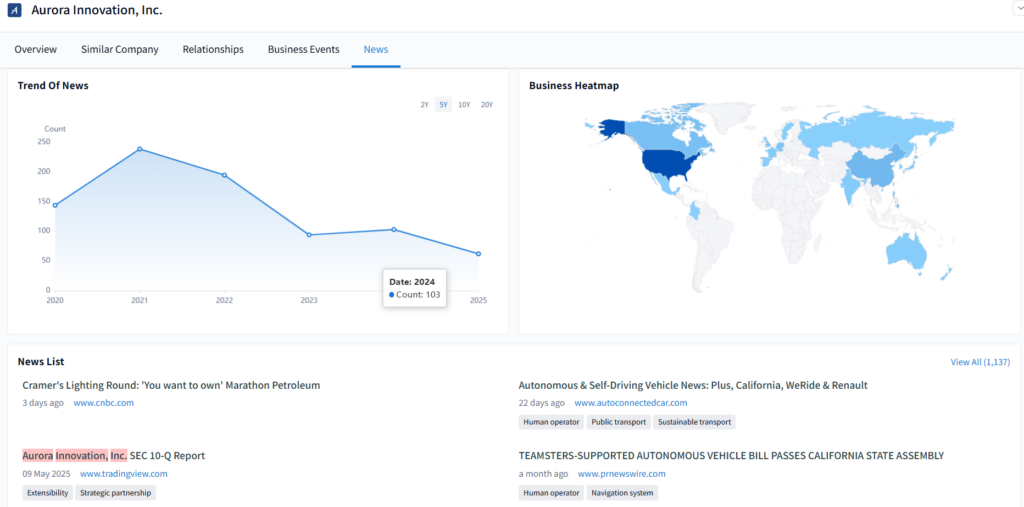

Market Presence and Financials of Aurora Innovation

| Metric | Value (2024) |

|---|---|

| Market Cap | ~$4.2 billion |

| Cash Reserves | ~$1.1 billion (reported Q1 2025) |

| R&D Spending | >$300 million annually |

| Primary Markets | U.S. freight corridors (Texas, Arizona, etc.) |

| Employees | ~1,800 employees |

Aurora Innovation continues to invest heavily in road testing, L4 autonomy, and commercial readiness, while maintaining financial resilience via investor backing and SPAC capital.

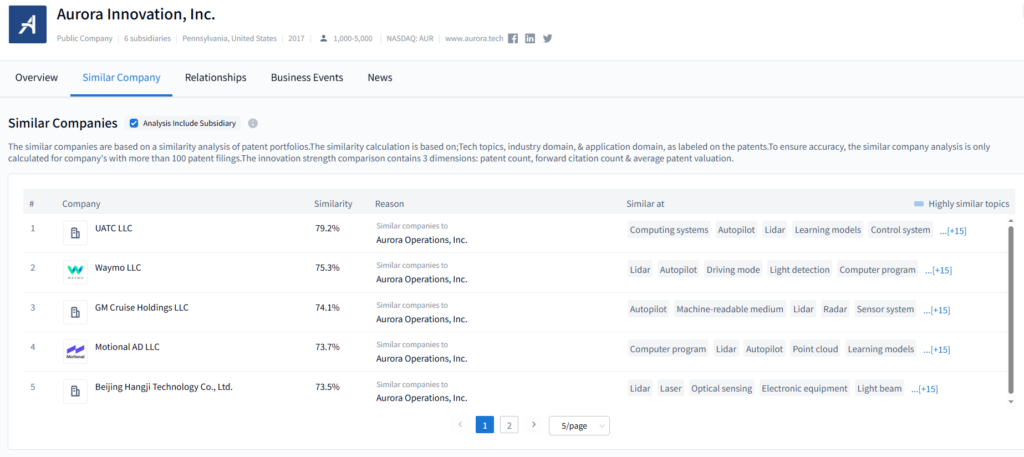

Aurora Innovation Competitors Analysis — Autonomous Trucking & Robotaxi Market

The autonomous vehicle industry is shaped by intense competition between major players in both robotaxi services and self-driving freight transportation. Aurora Innovation competes with several strong rivals, each holding a distinct market advantage.

Waymo — Urban Autonomous Mobility Pioneer

Waymo is widely recognized as one of the most advanced autonomous trucking and robotaxi competitors, backed by Google’s parent company, Alphabet Inc. Its strengths lie in deep AI and perception technology, advanced HD mapping, and operational experience from early Level 4 robotaxi launches in cities like Phoenix and San Francisco. This early-mover advantage gives Waymo a strong foothold in urban autonomous ride-hailing markets.

Cruise — GM-Backed Robotaxi Expansion

Cruise, majority-owned by General Motors, focuses on dense urban navigation and operates a growing robotaxi fleet in major U.S. cities. Its close integration with GM’s manufacturing and vehicle platforms enables rapid scaling. As a competitor, Cruise is positioned as one of the top challengers to both Waymo and Aurora in the urban L4 driving segment.

Kodiak Robotics — Lean Freight-Focused Challenger

Kodiak is a specialized player in autonomous freight trucking. Its differentiator is a lean operational model combined with simplified retrofit solutions for existing Class 8 trucks. By focusing on cost-effective deployment, Kodiak aims to win in the long-haul self-driving trucking market, where speed to market is crucial.

Aurora Innovation — Full-Stack Freight Leader with LIDAR IP

Aurora sets itself apart with deep LiDAR and perception technology expertise and broad OEM partnerships with major truck manufacturers. Its full-stack self-driving freight platform integrates sensors, software, and operational tools, targeting large-scale deployment in commercial freight. This positions Aurora not just as a technology provider but as a market leader in autonomous freight transportation solutions.

Aurora’s unique edge lies in its vertically integrated platform for trucking, whereas others focus more on passenger mobility.

PatSnap Eureka AI Agent Capabilities

With PatSnap Eureka’s Company Search AI Agent, users can:

- Explore Aurora’s patent landscape in LIDAR, motion planning, and AI

- Visualize tech trends across autonomous vehicle control and photonics

- Benchmark Aurora’s IP vs. rivals across domains like environmental object detection or signal processing

- Analyze partnership strategies and M&A through business event intelligence

Eureka transforms raw innovation data into actionable insights—ideal for investors, OEMs, and R&D strategists seeking clarity in the AV race.

Conclusion

Aurora Innovation stands at the forefront of autonomous freight technology, driven by a world-class team and a robust, IP-rich technology stack. With its sights set on commercial deployment by 2024, Aurora’s focus on scalable, safe logistics automation sets it apart in a competitive landscape dominated by passenger AVs.

FAQ

Analyst sentiment leans cautiously optimistic: most reports give Aurora (NASDAQ: AUR) a consensus of “Buy” or “Moderate Buy”, with 12-month price targets ranging between $10.25 and $11.18—potential upside of approximately 60–65% from current levels. Technical indicators more recently suggest a “buy” signal, though signs of selling pressure remain evident.

Aurora recently marked its commercial “driver-out” milestone—launching driverless trucking on public roads—but faced scrutiny over timeline delays . Shortly after, the company reinstated a human observer due to prototype constraints with its manufacturing partner, Paccar, leading to roughly a 25% stock drop over several trading days.

Aurora Innovation develops self-driving systems under the flagship Aurora Driver platform. This technology combines sensors—including proprietary FirstLight LiDAR—software, and hardware into a full-stack autonomous driving suite designed for both freight trucks and passenger vehicles.

Aurora is widely regarded as a technologically solid and innovation-driven autonomous vehicle company. Employees describe it as composed of “incredibly smart and passionate” teams under highly experienced leadership.

Chris Urmson serves as Aurora’s Co-Founder, CEO, and Chairman. He brings deep experience in autonomous vehicle R&D, having led Google’s self-driving car efforts from 2009 to 2016 and directed Carnegie Mellon robotics teams in DARPA challenges

Aurora’s stock has experienced significant spikes in the past: It jumped ~35% after a major deal with Nvidia and Continental to deploy driverless trucks. Earlier surges also followed positive statements about launching its driverless trucking system. More recently, upgrades from analysts like Goldman Sachs and Canaccord Genuity, along with stronger-than-expected earnings results, triggered a 2.7% gain.

To track Aurora Innovation’s breakthroughs and IP evolution, you can harness the PatSnap Eureka’s Company Search AI Agent—a gateway to real-time innovation intelligence across the autonomous frontier.