Why Competitive Landscape Analysis Matters in Today’s Market

In today’s fast-moving market, businesses of every size must keep a close eye on their competitors. Whether you’re launching a startup, scaling a small business, or refining a marketing strategy, understanding the competitive landscape is essential. A competitive landscape analysis helps you see where your rivals stand—and where your business fits. It reveals what others do well, where they fall short, and how you can gain an edge. This structured approach highlights market trends, growth opportunities, and potential threats before they affect your bottom line.

Done right, competitive analysis turns data into strategy. It guides smarter decisions, sharper positioning, and stronger long-term success.

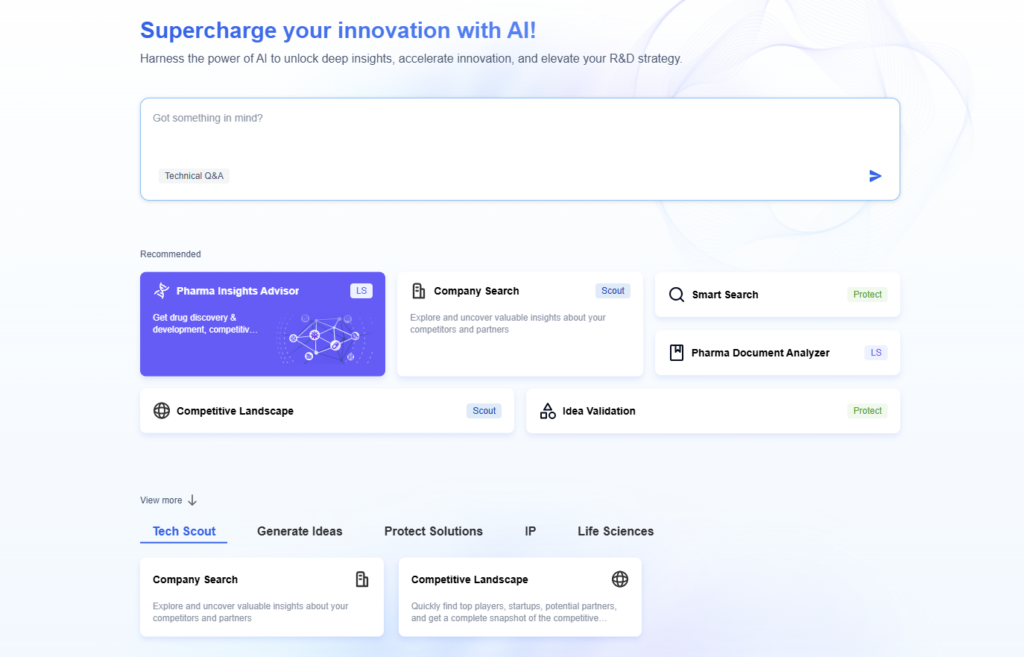

Crush your competition faster with PatSnap Eureka AI Agent!

Step 1: Define Your Objectives and Scope

Before diving into a competitive landscape analysis, start by defining what you want to achieve. Are you trying to understand your market position? Or are you looking to identify what makes your brand stand out? Setting specific goals helps focus your research and ensures it delivers real value.

Next, define the scope of your analysis. Decide whether this will be a one-time assessment or part of an ongoing strategy. Clarify which product lines, services, or business units to include. You might also want to limit the analysis to a specific region or customer segment. Keeping your scope focused makes the process more manageable and the results more actionable.

When your objectives and scope are clear, your analysis becomes far more effective. You’ll gather insights that directly support smarter business decisions. For example, decide if this is a one-time project or if you will review competitors regularly. Clarify which product lines or services to include. Focus on a specific region or product category to keep the analysis manageable. Setting clear objectives keeps your research focused and practical.

Step 2: Identify Your Competitors

Once your goals and scope are set, the next step is to identify the companies you’re competing with. Start by listing your direct competitors—those offering similar products or services at similar prices, targeting the same customer base. These are the businesses most likely to impact your market share.

Next, broaden your view to include indirect or alternative competitors. These companies may offer different products, but they serve the same customer need. To keep your analysis organized, categorize your competitors into three groups:

- Direct (Primary) Competitors: Businesses offering nearly identical products or services.

- Secondary Competitors: Companies with similar products but different customer segments or pricing models.

- Tertiary (Alternative) Competitors: Firms offering different solutions that still meet the same customer need.

To build your list, use multiple sources. Search online, review trade publications, and analyze industry reports. Ask your customers which other brands they considered before choosing yours. Tools like Crunchbase, LinkedIn, and industry directories can also help you discover smaller or less-visible competitors.

For example, a local hardware store shouldn’t just look at other nearby stores. It should also consider national chains, online retailers, and even home improvement apps that attract the same audience.stry lists or search tools (Crunchbase, LinkedIn) to uncover smaller or hidden competitors. For example, a local hardware store should consider a national chain and online retailers as competitors.

Step 3: Gather Key Competitive Data

Next, collect detailed information about each competitor. Look at their offerings and market presence.

- Gather Detailed Data on Each Competitor

After identifying your key competitors, the next step is to collect detailed information about each one. This data helps you understand how they operate, where they succeed, and where they fall short. Focus on the following areas: - Products and Services

Start by listing the core products or services each competitor offers. Pay attention to unique features, quality, and any standout characteristics that might appeal to customers. - Pricing and Packages

Review their pricing structure. Note payment plans, discounts, subscription models, or any value-added offers. Understanding their pricing helps you position your offerings more competitively. - Market Positioning

Explore how competitors present themselves to the market. Read their mission statements, taglines, and brand messages. This reveals how they differentiate themselves and which customer values they emphasize. - Online Presence and Content

Visit each competitor’s website. Check their “About” page, blog, and press releases for strategic updates. Analyze how they communicate their value and expertise online. - Marketing and Promotion

Look at their advertising efforts. Review social media channels, paid ads, email campaigns, and other promotional materials. This shows how they engage audiences and where they focus their marketing spend.

To build a full picture, use multiple sources—Google, news outlets, industry reports, and even customer interviews. As you collect insights, keep everything organized in a spreadsheet. This makes it easier to spot patterns and compare across competitors.

Step 4: Analyze Competitor Marketing and Content

Once you’ve gathered basic data, take a deeper look at how each competitor communicates with customers. This step helps you understand their marketing voice, value propositions, and how they guide prospects through the buying journey.

Start by reviewing their advertising and branding. Pay attention to slogans, visuals, and tone of voice. Are they positioning themselves around affordability, innovation, or premium quality? These cues show what they believe matters most to their audience.

Next, explore their website content. Read blog posts, case studies, and whitepapers. These materials often reveal a company’s priorities, industry expertise, and the customer pain points they’re trying to solve.

Don’t overlook multimedia. Watch videos, webinars, and listen to podcasts if available. These formats often offer a behind-the-scenes view of how the company educates and engages its audience.

Also, pay close attention to their calls-to-action (CTAs). Look at how they prompt visitors to take the next step—whether it’s booking a demo, downloading a guide, or making a purchase. CTAs provide insight into how competitors convert interest into action.

To dig deeper, subscribe to their email list. Analyze the type of content, offers, and frequency they use to nurture leads. This can reveal their sales funnel strategy and customer engagement tactics.

Finally, consider acting like a potential customer. Sign up for a free trial, request a demo, or join a webinar. This gives you a front-row seat to the full customer journey and exposes the content and messaging used at every stage. As Oktopost suggests, walking through this process can reveal key marketing and sales touchpoints your competitors rely on.

Step 5: Monitor Social Media and Public Feedback

Social media offers one of the richest sources of competitor intelligence. By monitoring how competitors engage their audiences online, you can uncover valuable trends and spot potential opportunities.

Start by visiting their social media profiles. Pay attention to the tone, brand voice, and content they share. Look for ongoing campaigns, viral posts, or unique content formats that gain traction. Strong engagement often indicates a message that resonates well with their audience.

Next, dive into comments and reviews. Platforms like Google, Yelp, or industry-specific forums can reveal real customer experiences. These insights help you identify common complaints or praise. For example, repeated issues with customer service or shipping delays may highlight a weakness your business can address more effectively.

Use social listening tools to monitor mentions of competitor brands or industry keywords. These tools track brand sentiment, trending topics, and real-time feedback across platforms. You can also monitor relevant hashtags to keep tabs on conversations around your niche.

To stay informed, set up Google Alerts or brand mention trackers for competitor names. This way, you’ll receive updates when new content, reviews, or discussions appear online. For example, tracking hashtags on Twitter or Instagram can help you catch live industry chatter or spot rising influencers.

By consistently watching your competitors’ social media presence, you gain early insight into their strategies, strengths, and vulnerabilities—giving your business a clear advantage.

Step 6: Evaluate Pricing, Offers, and Distribution

To build a competitive pricing model, you need to understand how your rivals price and distribute their products. Start by evaluating their price points in relation to product quality. Are they positioned as premium, mid-range, or budget brands? This insight will help you decide where your brand should sit in the market.

Next, look for any pricing tactics they use. Do they offer discounts, free trials, or bundle deals? These strategies can strongly influence customer decisions. Also, examine what’s included in the price—such as free shipping, extended warranties, or customer support. These extras impact how customers perceive overall value.

Now, analyze their sales channels. Are they selling directly through their website, using retail stores, or partnering with third-party platforms? Understanding where and how they sell helps you identify potential gaps or opportunities in your own distribution approach.

For a more detailed comparison, request pricing quotes directly from competitors. This lets you see how their pricing tiers stack up against yours. Then compare each product’s features side by side. Ask yourself: what does their basic plan offer versus their premium one? How do those features justify the cost?

As Oktopost suggests, knowing what your competitors charge for similar offerings is critical. It not only guides your pricing strategy but also helps you craft a compelling value proposition.

By reviewing both price and distribution strategies, you can position your product more effectively—and ensure it stands out in a crowded market.

Step 7: Determine Competitor Positioning

Once you’ve analyzed products and pricing, it’s time to evaluate how each competitor positions itself. Positioning is the unique angle or promise a company uses to stand out in a crowded market. It defines how customers perceive their brand and what sets it apart.

Start by identifying each competitor’s unique selling proposition (USP). One company might promote the fastest delivery, while another emphasizes having the widest product selection. These messages shape brand identity and help attract specific customer segments.

Look for clues in their slogan, tagline, or mission statement. For example, a phrase like “Innovation made easy” suggests a focus on simplicity and tech-driven solutions. The words they choose often reflect their core values and priorities.

To take it further, think about the broader competitive landscape. Map out where each brand sits based on key variables—such as price vs. quality or convenience vs. customization. Visual tools like positioning charts help you clearly see gaps in the market.

Now, compare this with your own brand. Ask yourself: where can you position your business to stand out? What strengths can you emphasize that others aren’t claiming?

Understanding competitor positioning doesn’t just reveal what others are doing—it helps you define a space where your brand can lead.

Step 8: Apply Analytical Frameworks

Use strategic frameworks to structure your analysis. A common tool is a SWOT analysis. List each competitor’s Strengths, Weaknesses, Opportunities, and Threats. Strengths and weaknesses cover internal factors, while opportunities and threats are external. Try to identify each competitor’s SWOT factors and compare them to your own. For instance, a competitor’s strength might be brand recognition, but a weakness could be poor customer service. Now list your own SWOT to compare with theirs.

Another useful framework is PEST analysis. This examines Political, Economic, Social, and Technological factors in the market. For example, new regulations or tech trends might impact all companies. PEST helps reveal external pressures that could change the game. You can also use Porter’s Five Forces to gauge industry pressures, but SWOT and PEST often cover the basics.

Step 9: Synthesize Insights and Identify Opportunities

After gathering all your research, it’s time to combine the data and draw meaningful conclusions. Start by summarizing key insights for each competitor and your own business. Look across all categories—products, pricing, marketing, positioning, and customer feedback.

Use a comparison matrix or spreadsheet to view competitors side by side. This visual format helps you spot strengths, weaknesses, and overlapping strategies more clearly. Ask important questions: What advantages are common across competitors? Where do most of them fall short?

Identifying these patterns gives you a competitive benchmark. You’ll start to see where your brand can improve and where it already stands out. Pay special attention to market gaps that no one is addressing. For instance, if none of your competitors offer setup support for complex products, that could be your edge.

Look for broader trends as well. If all competitors highlight affordability, it suggests that pricing is a major concern for your target audience. You can use these trends to adjust your own messaging or product development.

To communicate your findings, create a competitor comparison chart or summary report. Share it with your team to guide product planning, marketing, and positioning efforts. For example, if a competitor lacks a feature customers value, consider adding it to your offering.

By turning competitive analysis into actionable insights, you empower your business to make smarter, faster, and more strategic moves in the market.

Step 10: Take Action and Monitor Continuously

Finally, use your analysis to guide your plans. Update your marketing strategy, product roadmap, or sales tactics based on what you learned. Set specific goals like improving a key weakness or exploiting a competitor’s gap. Document a clear action plan (like adjusting messaging or product features) based on your findings. Share these findings with stakeholders so all teams align.

Competitive analysis is not a one-time task. Markets change and new rivals can emerge. Schedule regular reviews of your competitive landscape. For example, schedule quarterly updates of this analysis to keep it up to date. By repeating this process, you avoid falling behind. In fact, one study found that 90% of large companies conduct regular competitor analysis to inform their strategy. For example, track outcomes (like increased sales or traffic) to measure how your analysis helps.

Conclusion

A systematic competitive landscape analysis helps your business stay agile and informed. By setting clear objectives, researching competitors, and analyzing data step by step, you gain a sharper view of your market. This clarity allows you to fine-tune your value proposition and make smarter strategic decisions.

When you update your analysis regularly, your company stays alert to market shifts and emerging threats. Over time, this process becomes an essential tool to maintain relevance and drive innovation. Competitive analysis isn’t a one-time task—it’s a continuous cycle that keeps you ahead of the curve.

To streamline this process and gain faster, deeper insights, leverage the PatSnap Eureka AI Agent platform—your smart partner for market intelligence and innovation strategy.

To get detailed scientific explanations of competitive landscape analysis, try Patsnap Eureka.