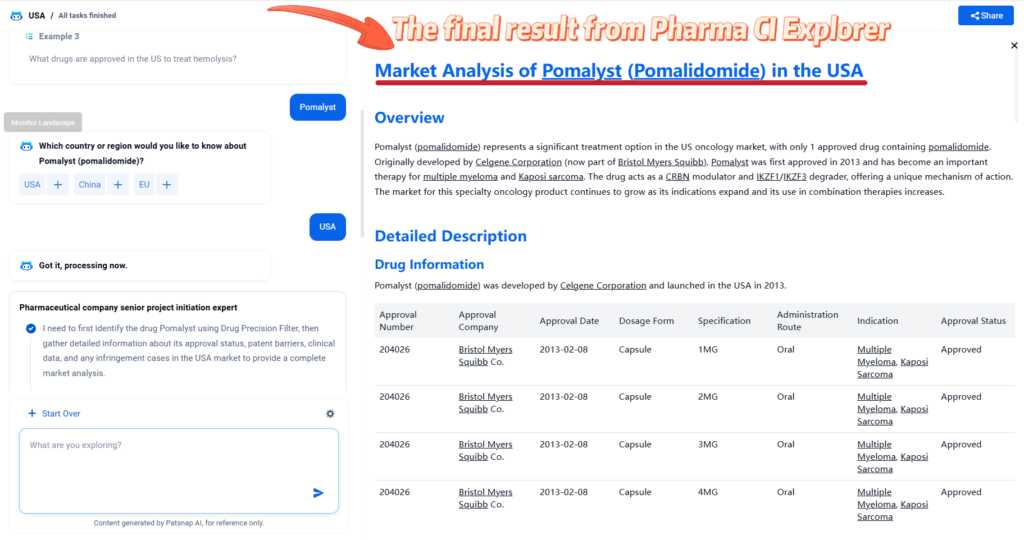

Overview

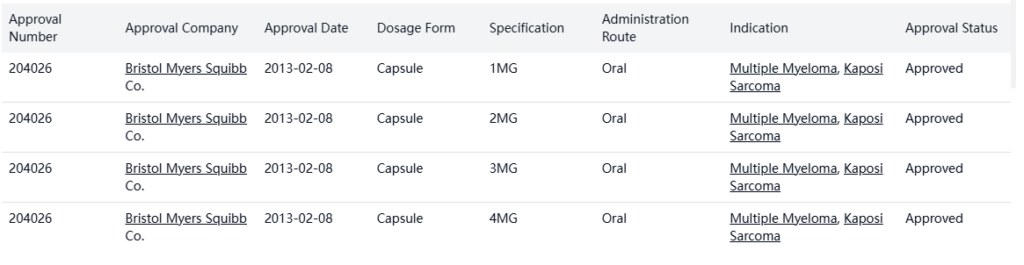

Pomalyst (pomalidomide) represents a significant treatment option in the US oncology market, with only 1 approved drug containing pomalidomide. Originally developed by Celgene Corporation (now part of Bristol Myers Squibb), Pomalyst was first approved in 2013 and has become an important therapy for multiple myeloma and Kaposi sarcoma. The drug acts as a CRBN modulator and IKZF1/IKZF3 degrader, offering a unique mechanism of action. The market for this specialty oncology product continues to grow as its indications expand and its use in combination therapies increases.

Detailed Description

Drug Information

Pomalyst (pomalidomide) was developed by Celgene Corporation and launched in the USA in 2013.

There are no bio-similars identified for this product.

Special Review

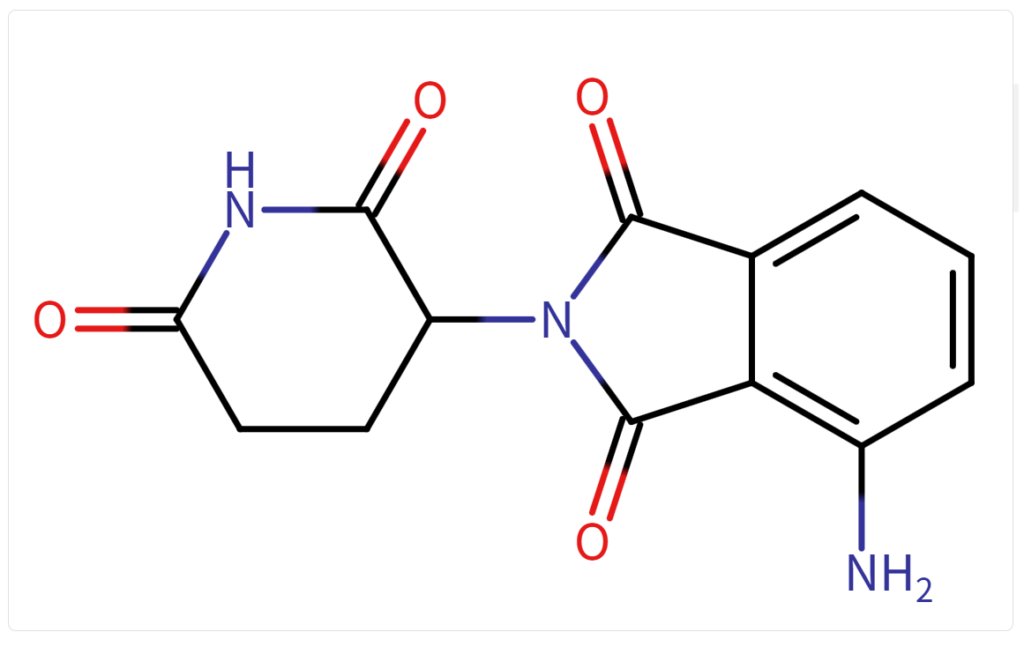

Structure

Patent Barrier Analysis

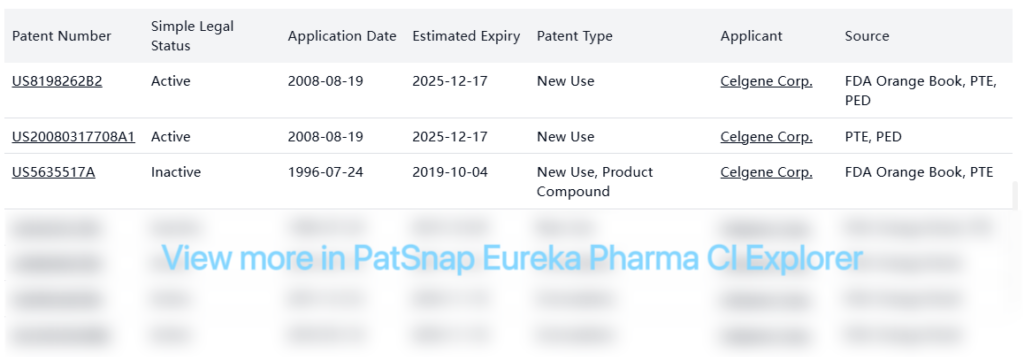

Registration Patent Analysis

The FDA Orange Book lists several patents for Pomalyst, with the key compound patent (US8198262B2) extending protection until December 2025. This patent has received Patent Term Extension (PTE) and Pediatric Exclusivity (PED).

PTE patents: The core compound patent US8198262B2 has received Patent Term Extension, extending protection until December 2025.

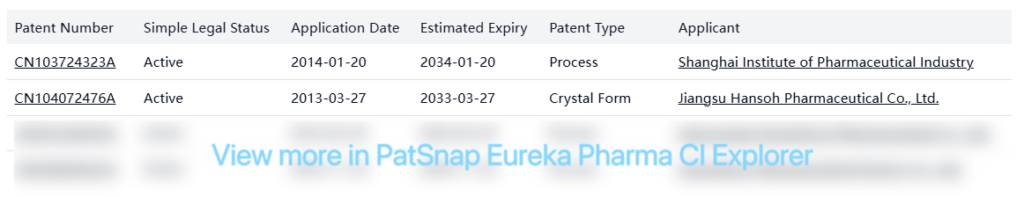

Other Patent Barrier Analysis

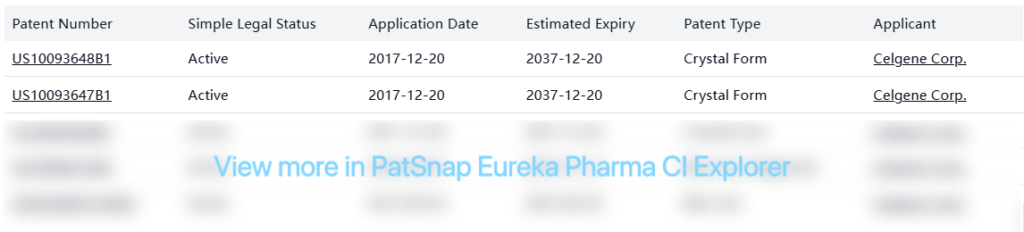

Celgene has built a robust patent portfolio around pomalidomide, including crystal forms, methods of use, and formulations that extend beyond the core patent expiry date.

Several non-original patents from other companies focus primarily on alternative processes, formulations, and crystal forms, suggesting ongoing interest in developing generic versions:

Patent Statement Information

There is one patent statement for Pomalyst with the following details:

| Trade Name | Submission Date | ANDAs Submit Number | 180-day Status | First Applicant Approval Date |

|---|---|---|---|---|

| Pomalyst | 2017-02-08 | 6 | Non-Forfeiture Deferred | 2020-10-03 |

Clinical Results

Based on FDA label clinical insights, pomalidomide has been extensively studied in both nonclinical and clinical settings:

- Mechanism of Action: Pomalidomide binds to cereblon, a component of a cullin ring E3 ubiquitin ligase complex, leading to the degradation of substrate proteins like Aiolos and Ikaros. This results in direct cytotoxic and immunomodulatory effects, including inhibition of tumor cell proliferation, induction of apoptosis, and enhancement of T cell and NK-cell mediated immunity.

- Clinical Studies in Multiple Myeloma: Clinical trials evaluated pomalidomide at 4 mg/day in repeated 28-day cycles (days 1-21) for patients with multiple myeloma, assessing efficacy, hematologic toxicity, and thromboembolic event risks .

- Kaposi Sarcoma Studies: An open-label, single-arm study evaluated pomalidomide (5 mg daily, days 1-21 of 28-day cycles) in 28 patients with AIDS-related and HIV-negative Kaposi sarcoma, with overall response rate as the primary endpoint.

- Safety Profile: Nonclinical toxicology studies revealed potential carcinogenic effects (one monkey developed acute myeloid leukemia at 15-fold human exposure) and teratogenic effects in animal models. Drug interaction studies showed significant increases in pomalidomide exposure when co-administered with CYP1A2 inhibitors.

Infringement Cases

No patent infringement cases related to pomalidomide were identified in the search.

Policy and Regulatory Risk Warning

After comprehensive research, Pomalyst benefits from regulatory exclusivity in the US through several mechanisms:

- Orphan Drug Designation for multiple myeloma (granted 2003) and Kaposi sarcoma (granted 2018)

- Patent Term Extension on the core patent US8198262B2

- Pediatric Exclusivity (PED) extending patent protection

Generic entry prior to December 2025 would face significant regulatory and patent barriers, with additional formulation patents extending until 2031.

Market Entry Assessment & Recommendations

Based on the comprehensive analysis of Pomalyst’s patent landscape and regulatory status:

- For Innovator (Bristol Myers Squibb):

- Focus on lifecycle management through new formulations and combination therapies

- Continue clinical development for additional indications beyond multiple myeloma and Kaposi sarcoma

- Consider strategic partnerships for combination therapies with complementary mechanisms

- Develop patient support programs to maintain market share as generic competition approaches

- For Generic Manufacturers:

- Begin preparing for entry after December 2025 when the core patent with PTE/PED expires

- Consider challenging the formulation patents extending to 2031 through Paragraph IV certifications

- Develop alternative formulations that may circumvent existing formulation patents

- Invest in developing robust manufacturing processes, as pomalidomide is a complex molecule with stringent handling requirements due to teratogenicity

- Market Considerations:

- The pomalidomide market will likely see generic competition beginning in late 2025/early 2026

- Formulation patents may restrict certain dosage forms until 2031

- Specialized distribution systems (REMS program) will be required for all manufacturers due to teratogenicity concerns

- Crystal form patents extending to 2037 may present additional barriers for some manufacturing processes

- Regulatory Strategy:

- Generic manufacturers should engage early with FDA regarding REMS requirements

- Consider opportunities for 505(b)(2) applications with improved formulations or delivery systems

- Monitor ongoing clinical trials for potential new indications that could expand market opportunities

The pomalidomide market represents a valuable opportunity with relatively limited competition currently, but will face increasing generic competition after 2025, with complex regulatory requirements that may limit the number of market entrants.

For more scientific and detailed information of pomalidomide, try PatSnap Eureka Pharma CI Explorer.

Only takes 4 steps to unlock the detailed result 👇