Reliance Infrastructure Ltd. is a diversified player in India’s infrastructure sector, spanning energy, transport, defence, and EPC. This article explores the company’s strategic evolution, financial resurgence, and innovation initiatives—including how you can uncover deeper IP and technology insights using the Patsnap Discovery and PatSnap Eureka AI Agent.

Company Overview

Reliance Infrastructure Limited (R-Infra), part of the Reliance Group led by Anil Ambani, is a major Indian conglomerate in infrastructure development. Its operations span across power, transportation, defence, and EPC (Engineering, Procurement, and Construction) segments.

| Category | Details |

|---|---|

| Company Name | Reliance Infrastructure Ltd |

| Former Name | Bombay Suburban Electric Supply (BSES) |

| Founded | 1929 |

| Headquarters | Navi Mumbai, Maharashtra, India |

| Stock Ticker | BOM: 500390 (also listed on NSE as RELINFRA) |

| Key Executives | Anil Ambani (Chairman), Punit Narendra Garg (CEO), Pinkesh Rohit Shah (CFO) |

| Employees | ~5,400+ |

| Parent Group | Reliance Group (Anil Ambani-led) |

| Financial Highlights | Net Worth: ₹14,287 cr; Zero standalone bank debt as of FY25 |

| Official Website | www.rinfra.com |

Business Model & Services

Reliance Infrastructure Ltd operates through an integrated model across public infrastructure:

| Service Segment | Description | Revenue Model | Key Partners |

|---|---|---|---|

| EPC Projects | Engineering, procurement, construction for infra works | Project-based billing | State governments, NHAI |

| Power Distribution | Electricity transmission and retail | Tariff + Gov subsidies | BSES Rajdhani & BSES Yamuna |

| Metro Rail | Urban mass transit systems (e.g., Mumbai Metro) | Fare + Infra subsidy | MMRDA, Delhi Metro |

| Defence Manufacturing | Defence electronics, drones, naval systems | Govt contracts | DRDO, HAL |

| Toll Roads | BOT highway operations | Toll collection | NHAI, MoRTH |

Market Presence & Financials

- Revenue FY25: ₹13,057 cr

- Profit After Tax FY25: ₹4,387 cr (vs. loss in FY24)

- Standalone Net Worth: ₹14,287 cr

- Zero Bank Debt (as of March 2025)

- Stock Metrics:

- P/E: ~4x

- Debt/Equity: 0.44

- Market Cap: ~₹16,000 cr

- Investor interest up 426% MoM

News & Developments

- Financial turnaround in FY25 with record profit.

- Legal win: NCLAT stay on adverse order sparks stock rally.

- Defence exports: ₹10,000 cr pipeline; ties with Rheinmetall & Diehl Defence.

- EV ambitions: Exploring entry into electric vehicle manufacturing & giga battery plants.

Technology & Innovation

- Digital EPC: Modern construction tech and digital project planning.

- Defence Tech: Focus on high-tech naval and missile systems.

- EV/Battery Plans: Targeting 250k–750k EV production capacity, 10–75 GWh battery systems.

- Smart Grid Innovations: Intelligent power distribution initiatives in urban networks.

PatSnap Eureka AI Agent Capabilities

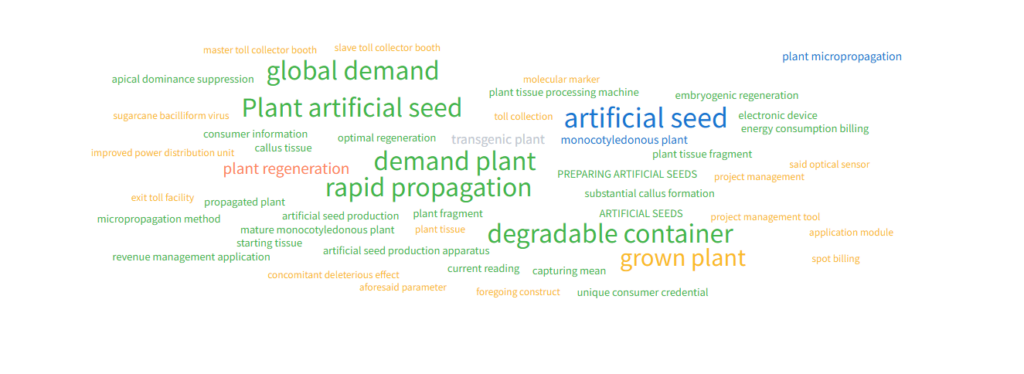

To uncover how companies innovate in the domain of plant biotechnology, artificial seeds, and micropropagation, we leverage the PatSnap Discovery and PatSnap Eureka AI Agent—an advanced AI-powered innovation intelligence engine.

This tool allows users to:

- Identify key patent trends and technical clusters like “plant artificial seed,” “rapid propagation,” and “degradable container.”

- Benchmark companies involved in plant cloning, seed innovation, or agri-biotech.

- Visualize emerging IP themes in the regenerative agriculture space using keyword clouds like the one below.

This capability empowers analysts and investors with real-time strategic foresight—well beyond traditional financial or market data.

Conclusion

Reliance Infrastructure Ltd. is no longer just a legacy power utility—it’s a next-gen infrastructure innovator. From high-speed metros and defence exports to EV infrastructure, the company’s financial turnaround and strategic refocus signal a bold chapter ahead.

With Discovery by PatSnap Eureka AI, analysts and innovators can decode R-Infra’s evolving IP, technology bets, and long-term direction—staying ahead in a sector that’s critical to India’s economic future.