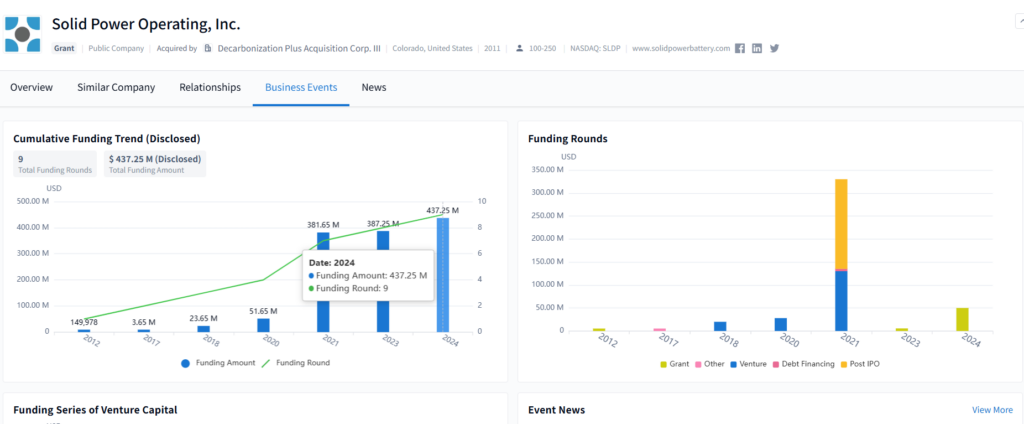

Solid Power is a Colorado-based energy storage company focused on the development and commercialization of all-solid-state battery technology. Positioned at the intersection of electrification and advanced materials, the company is redefining what’s possible in energy density, safety, and scalability.

This article provides a full breakdown of Solid Power’s business model, product portfolio, and innovation strategy—backed by insights from PatSnap Eureka AI Agent.

Company Overview

| Field | Details |

|---|---|

| Company Name | Solid Power, Inc. |

| Founded | 2011 |

| Headquarters | Louisville, Colorado, USA |

| Website | https://www.solidpowerbattery.com |

| Industry | Advanced Energy Storage |

| Key Executives | Douglas Campbell (CEO), Derek Johnson (CTO) |

| Employees | ~165 |

| Company Type | Public |

| Stock Ticker | SLDP (NASDAQ) |

| BOM | Solid electrolytes, lithium metal anodes, NMC cathodes |

Organizational Structure

Solid Power operates as a vertically integrated entity with dedicated departments for electrolyte production, cell manufacturing, and R&D. The company’s growth strategy includes strong ties with OEM partners and major automotive joint ventures such as those with Ford and BMW. It has expanded pilot production lines to scale both materials and cell prototyping in-house.

Products & Services

Solid Power’s core offering is all-solid-state battery (ASSB) cells for electric mobility and grid storage. Its product portfolio includes:

All-Solid-State Batteries (ASSBs)

- High-Energy EV Cells: Designed for next-generation electric vehicles with higher energy density (>400 Wh/kg), improved safety, and longer cycle life.

- Battery Packs for Prototyping: Modular battery packs delivered to OEMs for evaluation and integration testing.

Solid Electrolyte Materials

- Sulfide-Based Solid Electrolytes: Engineered for high ionic conductivity and manufacturability.

- Electrolyte Manufacturing Services: Offers pilot-scale production and collaborative R&D partnerships for electrolyte integration.

Strategic Licensing

- IP Licensing for OEMs: Solid Power licenses its battery cell designs and manufacturing processes to automotive partners, enabling localized gigafactory deployment without direct capital outlay.

Business Model

Solid Power’s business model blends product development with licensing revenue. Revenue sources include:

- Direct sales of electrolyte materials and test cells

- Joint development agreements (JDAs) with automotive OEMs

- Technology licensing for scaled manufacturing

Its customers primarily include EV manufacturers and Tier 1 automotive suppliers. The company uses both direct channels and strategic alliances to expand commercial impact.

Innovation & Technology

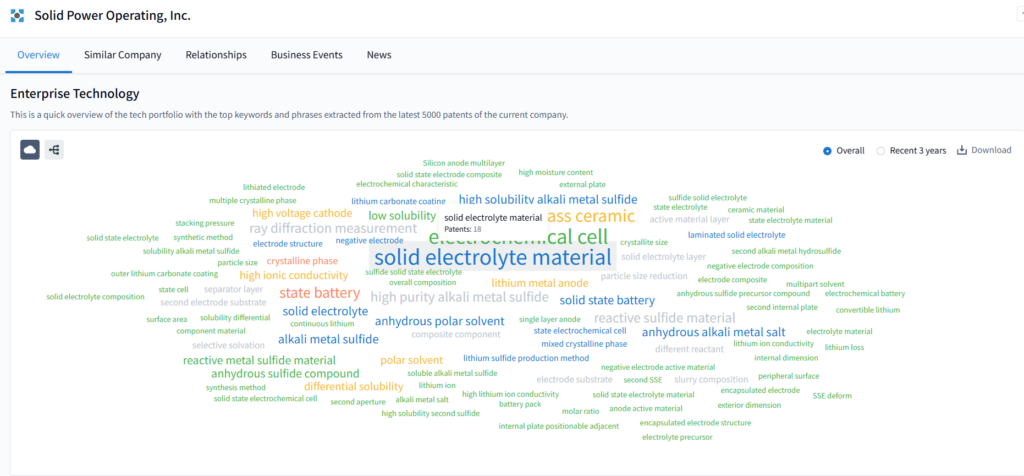

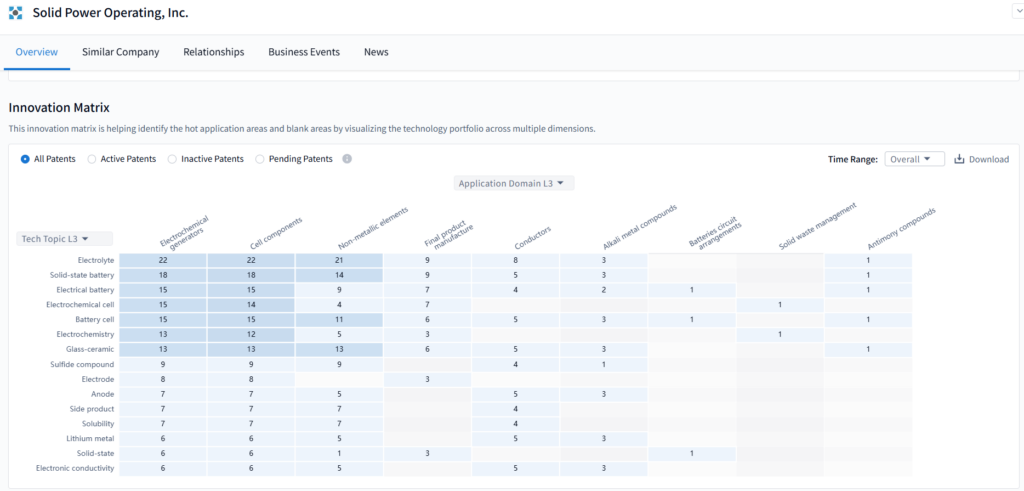

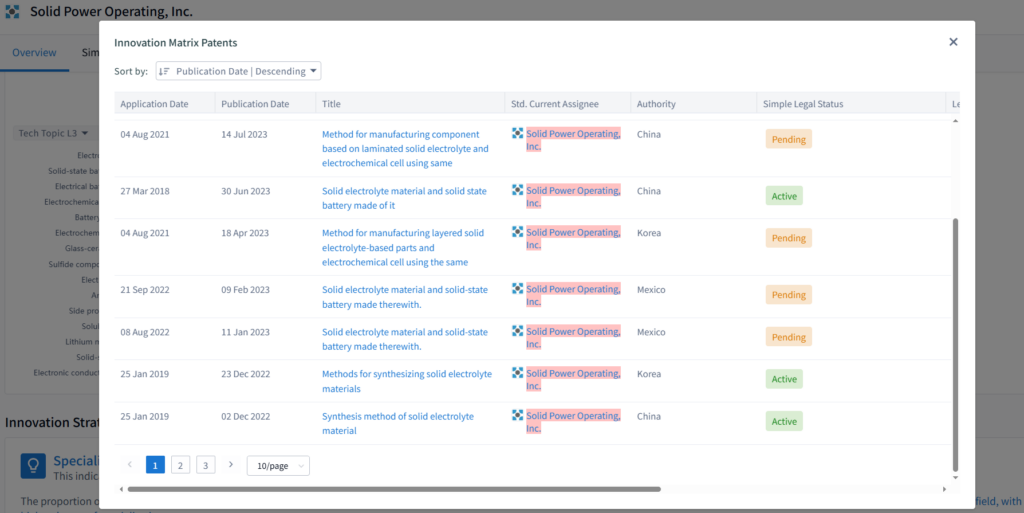

Solid Power’s innovation profile reveals a strong focus on scalable solid-state battery components and manufacturable electrolyte systems. Insights powered by PatSnap Eureka highlight a comprehensive and defensible IP strategy.

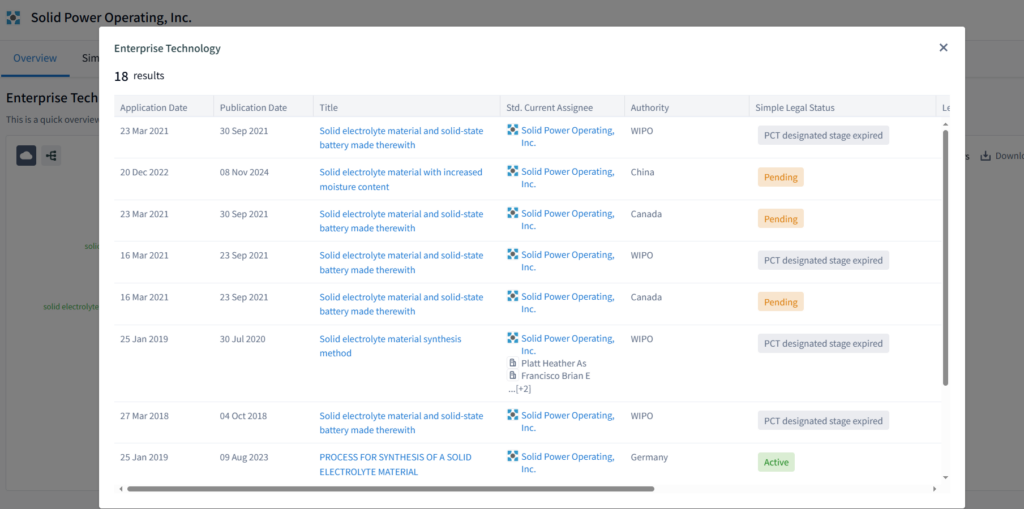

Patent Landscape

Solid Power holds granted and pending patents, distributed across several key domains:

- Sulfide Electrolyte Compositions: Covering proprietary lithium thiophosphate-based solid electrolytes with superior ionic conductivity (>10^-3 S/cm), wide electrochemical windows, and moisture tolerance enhancements.

- Interface Engineering: Novel designs to reduce impedance and dendrite formation at cathode-electrolyte and anode-electrolyte interfaces, enabling stable lithium metal operation under high current density.

- Dry Electrode and Coating Techniques: Mechanically robust methods for applying cathode layers and solid electrolytes in dry processing, minimizing the use of volatile solvents and streamlining roll-to-roll manufacturability.

- Anode-Free Battery Designs: Intellectual property around lithium-free anodes during assembly, which are plated in situ during charge cycles—enhancing safety and energy efficiency.

- Multi-Layer Cell Architecture: Innovations allowing stackable cell designs while maintaining structural and electrochemical integrity under stress conditions.

Technology Strengths

- High Energy Density: Solid Power’s lithium-metal batteries target energy densities >400 Wh/kg, nearly 50–70% higher than traditional Li-ion.

- Thermal and Chemical Stability: Unlike liquid electrolyte systems, sulfide-based electrolytes are non-flammable and maintain performance across wider temperature ranges.

- Scalable Manufacturing: All cell designs are compatible with existing lithium-ion manufacturing lines, using roll-to-roll techniques for rapid scalability and cost competitiveness.

- Cycling Performance: Early lab-scale results show over 400 cycles at 80% capacity retention in full-cell configurations, with further improvements in development.

- Fast-Charging Potential: The solid electrolyte architecture allows for high-voltage tolerance and lower degradation during high C-rate charging.

Recent Developments

- In 2023, Solid Power successfully shipped A-sample cells to Ford and BMW for in-vehicle testing.

- The company completed commissioning of its electrolyte production line, enabling >30 metric tons/year throughput.

- Transition to B-sample production is underway, aligned with OEM milestones.

PatSnap Eureka’s landscape analytics confirm Solid Power as a technology leader in interface stabilization and dry-coating electrolyte processing, positioning it at the frontier of next-gen solid-state battery manufacturing.

Market Position & Competition

Solid Power operates in a highly competitive solid-state battery sector. Key competitors include QuantumScape, ProLogium, and Toyota Battery R&D.

| Criteria | Solid Power | QuantumScape | ProLogium | Toyota Battery Lab |

|---|---|---|---|---|

| Core Focus | ASSBs for EVs | ASSBs for EVs | ASSBs + Semi-Solid | Solid-state R&D |

| Target Markets | Automotive OEMs | Automotive OEMs | Consumer + Auto | Automotive OEMs |

| Geographic Presence | North America | North America | Asia + EU | Japan |

| Product Differentiation | OEM-licensable design | Proprietary single-layer | Multi-layer stacking | Internal R&D only |

| Technology Strengths | Sulfide-based, Li-metal | Ceramic separator, Li-metal | Ceramic-polymer hybrids | In-house prototyping |

| Strategic Partners | Ford, BMW | VW Group | Gogoro, Mercedes | Toyota |

PatSnap Eureka AI Agent Capabilities

PatSnap Eureka’s Company Search AI Agent offers powerful insights into Solid Power by:

- Mapping its core IP clusters in electrolyte and anode interface engineering

- Benchmarking against competitors’ patent densities and technology timelines

- Identifying untapped white space in EV battery form factors and material compositions

Whether you’re an investor, analyst, or innovation manager, Eureka makes Solid Power’s roadmap and patent edge easier to track and act on.

Conclusion

Solid Power stands at the forefront of solid-state battery innovation, combining deep materials expertise with scalable designs and OEM-aligned business models. As EV adoption accelerates, its technology could play a pivotal role in shaping safer, denser, and more sustainable energy storage.

Want to explore patents, supplier trends, or the latest innovations in Solid Power?

👉 Explore deeper insights using PatSnap Eureka AI Agent to uncover deep technical insights, forecast material performance, and benchmark innovation leaders—faster and smarter.

FAQs

Solid Power specializes in solid-state battery technology for electric vehicles and stationary storage.

Solid Power’s cells use solid electrolytes and lithium metal anodes, offering higher energy and safety.

Yes. It trades on NASDAQ under the ticker SLDP.

Key collaborators include BMW and Ford, with whom it has licensing and development agreements.

Use PatSnap Eureka’s Company Search AI Agent to visualize its patent strengths and competitive edge.