Tech Mahindra, headquartered in Pune, India, is a global leader in digital transformation and consulting. Operating in over 90 countries with more than 148,000 employees, it offers systems integration, AI, cloud, cyber‑security, and R&D innovation services through its PatSnap Eureka AI Agent-validated capabilities in telecom, BFSI, manufacturing, and more.

This article provides an in-depth look at Tech Mahindra’s business model, digital services, and strategic advantages—uncovered via PatSnap Eureka AI Agent.

Company Overview

| Category | Details |

|---|---|

| Founded | 1986 as Mahindra British Telecom; renamed Tech Mahindra in 2006 |

| Headquarters | Pune, Maharashtra, India |

| Employees | ~148,700 globally (Mar 2025) |

| Revenue | $6.2 billion (FY2025) |

| Parent Group | Mahindra Group (260,000 employees) |

| Stock Ticker | BSE: 532755, part of NSE SENSEX/NIFTY50 |

Corporate Structure

| Division | Focus Area |

|---|---|

| Consulting & Innovation | Strategy, digital consulting (incl. Makers Lab) |

| Application Services | ERP (SAP, Oracle), CRM, telecom apps |

| Cloud & Infrastructure | Cloud migrations, datacenter operations |

| Business Process Services | BPO, finance, supply chain, customer service |

| Network & 5G Services | Telecom engineering, 5G deployment, Open RAN |

| Next-Gen Digital Platforms | Cybersecurity, blockchain, Metaverse, AI |

| Sector Solutions | Tailored offerings for banking, telecom, manufacturing, healthcare |

Products and Services

Tech Mahindra delivers a full spectrum of digital and IT solutions:

- Digital Consulting & Makers Lab

- Strategy: Enterprise digitization, ESG, industry transformation

- Innovation lab: Research in foundational AI, quantum computing, IoT, metaverse

- Application and Enterprise Platforms

- ERP transformation (SAP, Oracle), CRM platforms (Salesforce, Microsoft), digital product passports

- Cloud & Infrastructure Management

- Cloud consulting and modernization, hybrid IT support

- Network Engineering & Telecom

- 5G rollout, network lifecycle services, managed services for global operators

- BPS and Automation

- 24/7 multilingual service desks, AI-powered TAC, RPA-led financial and supply chain operations

- Next-Gen Services

- Cybersecurity, blockchain, Metaverse, GenAI, analytics, IoT/Edge

- Industry-Specific Solutions

- Retail: AI-driven supply chains, ecommerce transformation

- BFSI: Core banking, payments, system integration

- Engineering Services

- CAD design, industrial engineering, automotive (via Pininfarina acquisition)

Business Model

Tech Mahindra combines consulting, managed services, and digital product offerings in a mix model:

- Revenue Streams

- Consulting & transformation programs

- Long-term managed contracts (IT, network, BPO)

- Subscription/platform fees for digital solutions (e.g., Yantr.ai)

- Ecosystem & Partnerships

- Strategic alliances with SAP, Oracle, Microsoft, AWS

- Telco partners (BT, Altiostar)

- Innovation-Led Growth

- Makers Lab accelerates IP development and POC pipelines

- Industry Diversification

- Transitioning from telecom-heavy portfolio to BFSI, manufacturing, healthcare

- Scalable Talent Hub

- ~150k strong workforce enables global delivery and nearshore/offshore scalability

Innovation & Technology

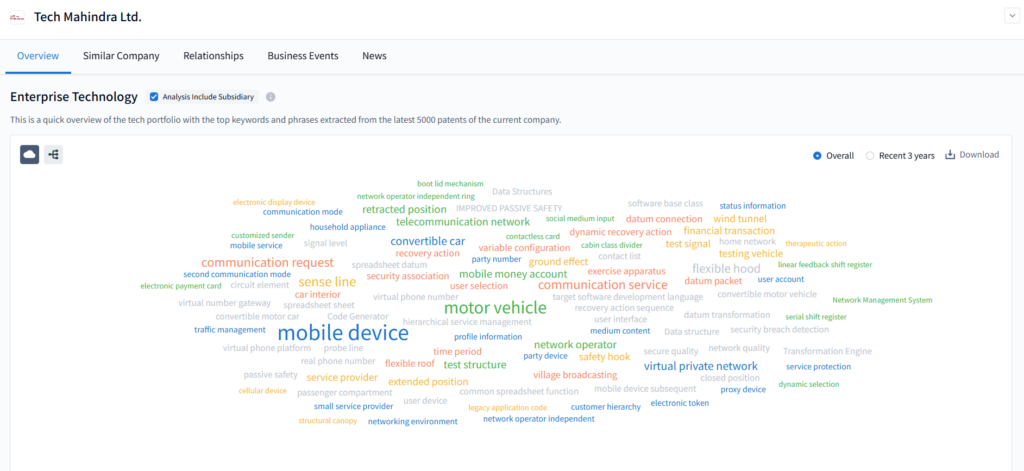

Thanks to PatSnap Eureka’s Company Search AI Agent, we can see Tech Mahindra’s IP investments aren’t purely defensive—they’re built around emerging digital domains and niche telecom-enabling tech.

Key Innovation Domains:

- Next-Gen Networks & 5G

- Comprehensive IP in Open RAN, private 5G networks, and telco automation tools.

- Partnership with Nokia on private wireless cloud-based networks

- Metaverse & Web3

- Over 70 active metaverse deals, including AR/VR, digital twins, metaverse retail/banking/demo environments

- Launched TechMVerse practice blending AI, blockchain, spatial computing and telecom infrastructure .

- Under the “SmarTrust” brand, blockchain is extended to NFTs, Web3 identity, and trust platforms

- Artificial & Generative AI

- ~15,500-strong workforce in AI, computer vision, NLP, and GenAI deployment

- Pioneered Project Indus, an LLM for Indian languages in 5 months under $5 M

- Offering LLM-based tools like Email “AmplifAIer” and generative AI studio capabilities

- Edge & IoT

- IP in spatial computing and enterprise digital twin infrastructures (e.g., industrial metaverse).

- Rapid monetization in APAC via IoT-enabled cybersecurity and telecom digital twins

- Blockchain & Trust Platforms

- SmarTrust integrates enterprise-grade blockchain with metaverse, NFTs, and supply chain use cases (e.g., pharma traceability)

- IP Ownership & Strategy

- Holds over 2,300 patents globally in cloud, AI, 5G, blockchain, and edge—adding

₹1,200 cr ($145 M) revenue in FY22 - Most patents reside in cloud-native automation, telecom innovation, and AI orchestration platforms.

- Holds over 2,300 patents globally in cloud, AI, 5G, blockchain, and edge—adding

Strategic IP Highlights:

| Domain | Focus Areas |

|---|---|

| 5G & Telco Networks | Open RAN, private 5G, network lifecycle automation, cloud-native cores |

| Metaverse & Spatial | AR/VR UX, digital twins, metaverse retail/banking, spatial computing |

| AI/ML & LLMs | NLP, generative agents, Email assistants, foundational Indian LLM |

| Blockchain/Web3 | Enterprise blockchain, NFTs, trust in ecosystems, DeFi use-cases |

| Edge Computing & IoT | Telecom cybersecurity, IoT digital twins, 5G-enabled edge deployments |

Market Presence and Financials

Tech Mahindra has strategically repositioned itself from a telecom-centric provider to a diversified digital transformation powerhouse, with robust growth in multiple sectors:

- Revenue Mix Transformation: While telecom once accounted for ~40% of revenue, the company is aggressively shifting toward BFSI—CEO Mohit Joshi targeting an increase from 16% to 25% of total revenue by FY27

- Recovery in BFSI & Media: Even amid telecom slowdown, Q3 FY25 saw 8.3% growth in BFSI and 3.5% in media, offsetting a 5.6% telecom dip .

- APAC Expansion: A strong pipeline in Asia–Pacific—including AI-driven deployments across telecom, BFSI, retail, and manufacturing—denotes regional momentum

- Brand & Sustainability Accolades: Ranked a top-10 IT services brand by Brand Finance in 2025, with a brand value of $3.4B and AA+ rating; also top-ranked in IT services in India’s S&P DJSI .

- Share Outperformance: Amid a 2–8% decline in broader IT sector, Tech Mahindra’s stock soared up to 13% intraday after unveiling its turnaround plan in April 2024

These indicators position Tech Mahindra as an agile, innovation-led competitor with growing confidence across C-level circles and markets.

Competitors Analysis

| Competitor | Strengths | Tech Mahindra Differentiation |

|---|---|---|

| Infosys, TCS | Broad IT services, larger scale | Agile delivery, banking & telco focus |

| Wipro, HCL | Data analytics, cloud integrations | adds GenAI, Metaverse, Makers Lab |

| Capgemini, Accenture | Strong consulting & digital orchestration | Competitive in telecom, metaverse |

| IBM, Cognizant | Enterprise cloud, blockchain, Watson AI | Hybrid approach with in-house IP and delivery flexibility |

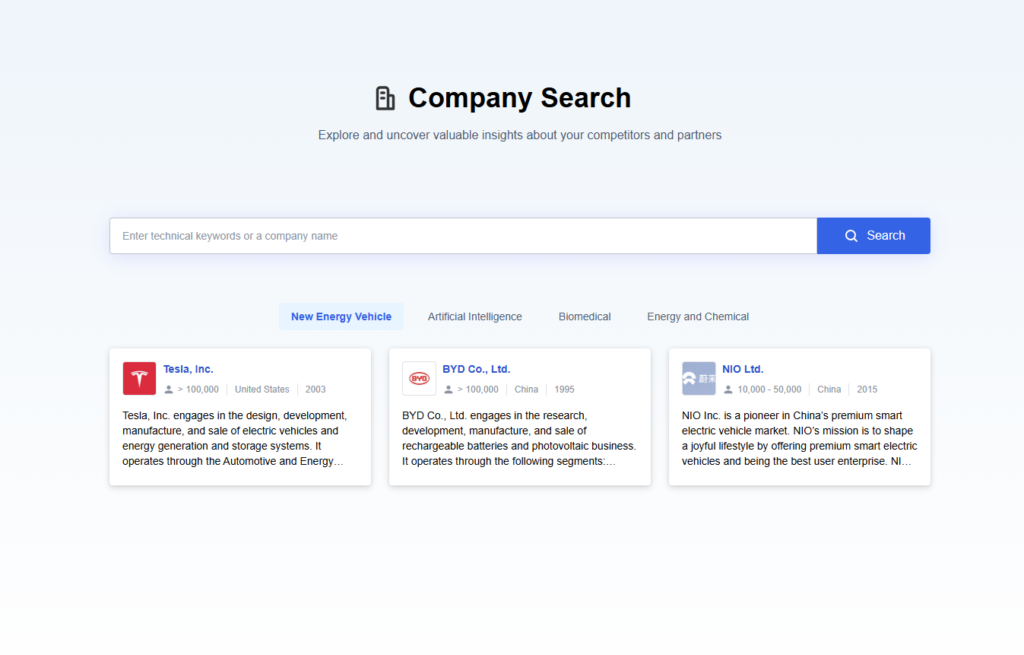

PatSnap Eureka AI Agent Capabilities

With PatSnap Eureka’s Company Search AI Agent, enterprises and innovation leaders can:

- Map Tech Mahindra’s global technology hubs, IP filings, and R&D hotspots.

- Analyze patent portfolios across telecom, AI, cloud, IoT, and metaverse domains.

- Compare their IP versus peers for strategic insight and whitespace spotting.

Eureka helps clients benchmark, strategize, and accelerate digital transformation.

Conclusion

Tech Mahindra blends scale, innovation, and client proximity to deliver end-to-end digital transformation. Beyond systems integration, its focus on AI, metaverse, network services, and Makers Lab-driven R&D positions it as a leader shaping digital futures. With PatSnap Eureka’s Company Search AI Agent, stakeholders gain a more nuanced understanding of Tech Mahindra’s IP depth—enabling sharper strategic partnerships, investment, and innovation decisions.