Peptide Therapeutics Evolution and Objectives

Therapeutic peptides have emerged as a promising class of drugs, bridging the gap between small molecules and larger biologics. The evolution of peptide therapeutics can be traced back to the early 20th century with the discovery of insulin, which revolutionized the treatment of diabetes. Since then, the field has experienced significant advancements, driven by improved understanding of peptide chemistry, biology, and technological innovations in synthesis and delivery methods. The development of solid-phase peptide synthesis in the 1960s by Bruce Merrifield marked a pivotal moment, enabling the production of complex peptides at scale. This breakthrough paved the way for the exploration of peptides as potential therapeutic agents for a wide range of diseases.

Exploring the future of therapeutic peptides and their market impact? Eureka Technical Q&A connects you with biotechnology and pharmaceutical experts who can explain the latest trends, applications, and breakthroughs in peptide therapeutics—helping you stay ahead of industry innovations and informed about emerging opportunities.

In recent years, the peptide therapeutics market has witnessed remarkable growth, fueled by the increasing prevalence of chronic diseases, advancements in peptide engineering techniques, and the growing demand for targeted therapies with improved efficacy and reduced side effects. The global peptide therapeutics market is projected to continue its upward trajectory, with estimates suggesting it could reach $50 billion by 2025. This growth is driven by the unique advantages peptides offer, including high specificity, low toxicity, and the ability to target previously “undruggable” proteins and protein-protein interactions.

The objectives of therapeutic peptide development are multifaceted. Researchers aim to overcome the inherent limitations of peptides, such as poor oral bioavailability, short half-life, and susceptibility to enzymatic degradation. Efforts are focused on enhancing peptide stability, improving delivery methods, and optimizing pharmacokinetic properties. Another key objective is to expand the application of peptides beyond their traditional use in endocrine and metabolic disorders to areas such as oncology, neurology, and cardiovascular diseases. The development of peptide-drug conjugates and the exploration of cell-penetrating peptides represent promising avenues for achieving these goals.

Looking ahead, the field of therapeutic peptides is poised for further innovation. The integration of artificial intelligence and machine learning in peptide design and discovery processes is expected to accelerate the identification of novel peptide candidates with enhanced therapeutic properties. Additionally, the convergence of peptide therapeutics with other emerging technologies, such as nanotechnology and gene therapy, opens up new possibilities for developing more effective and personalized treatment options. As the field continues to evolve, the overarching goal remains to harness the full potential of peptides in addressing unmet medical needs and improving patient outcomes across a broad spectrum of diseases.

Market Demand Analysis for Therapeutic Peptides

The therapeutic peptides market is growing rapidly, driven by the increasing prevalence of chronic diseases and advancements in peptide synthesis technologies. Experts predict the global market will reach $50 billion by 2026, with a compound annual growth rate (CAGR) of around 9%. This growth reflects the unique benefits of peptide-based drugs, such as high specificity, low toxicity, and the ability to target previously “undruggable” proteins.

Market Demand Across Therapeutic Areas

Therapeutic peptides are in high demand across various therapeutic areas. Oncology, metabolic disorders, and cardiovascular diseases are the main drivers of market expansion. In oncology, peptides are increasingly used in targeted drug delivery systems and as immunotherapeutic agents. The growing global incidence of cancer is expected to further fuel the demand for peptide-based cancer treatments.

Metabolic disorders, especially diabetes, also represent a significant market segment. The success of glucagon-like peptide-1 (GLP-1) receptor agonists in diabetes management has stimulated more research and development. This success will likely continue to drive innovation in this area.

Cardiovascular diseases, which remain a leading cause of death worldwide, are another factor boosting the demand for peptide-based therapies. Peptides such as natriuretic peptides and angiotensin-(1-7) show promise in treating heart failure and hypertension. Additionally, there is growing interest in using therapeutic peptides for neurological disorders like Alzheimer’s and multiple sclerosis, which is contributing to market growth.

Personalized Medicine and Drug Delivery Technologies

The increasing focus on personalized medicine is propelling the demand for therapeutic peptides. Innovations in drug delivery technologies and peptide synthesis techniques have improved the stability and bioavailability of peptides. These advancements address the challenges that once limited their therapeutic use. Moreover, the rising interest in combination therapies—where peptides are paired with small molecules or biologics—is opening new doors for market expansion.

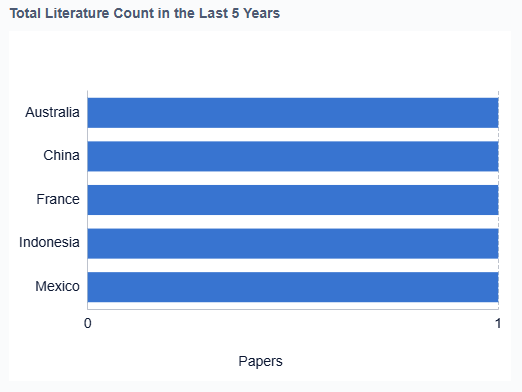

Geographic Market Insights

North America currently leads the therapeutic peptides market, followed by Europe and Asia-Pacific. However, emerging economies in Asia-Pacific and Latin America are expected to experience the fastest growth. Factors driving this growth include improving healthcare infrastructure, rising healthcare spending, and increasing awareness of peptide-based therapies.

The COVID-19 pandemic has highlighted the potential of therapeutic peptides in managing infectious diseases. This new focus may create fresh opportunities in the market, contributing to its expansion.

Current Challenges in Peptide Drug Development

Despite the promising potential of therapeutic peptides, their development faces several significant challenges. One of the primary obstacles is the inherent instability of peptides in biological environments. Peptides are susceptible to rapid degradation by proteases in the bloodstream and tissues, leading to short half-lives and reduced therapeutic efficacy. This instability necessitates frequent dosing or high doses, which can be impractical for patients and increase the risk of side effects. Additionally, peptides often exhibit poor oral bioavailability due to their limited ability to cross biological membranes, particularly the gastrointestinal epithelium. This limitation restricts the administration routes for peptide drugs, often requiring invasive delivery methods such as injections, which can negatively impact patient compliance and quality of life.

Another significant challenge is the manufacturing complexity and associated high production costs of peptide drugs. The synthesis of longer peptides, especially those with complex structures or modifications, can be technically challenging and expensive. This complexity often results in lower yields and higher production costs compared to small molecule drugs, potentially limiting the commercial viability of peptide therapeutics.

Immunogenicity is another concern in peptide drug development. The human immune system may recognize peptide drugs as foreign entities, leading to the production of anti-drug antibodies. This immune response can neutralize the therapeutic effect of the peptide and potentially cause adverse reactions in patients. Overcoming immunogenicity often requires careful peptide design and modification strategies.

Formulation and delivery challenges also persist in peptide drug development. Many peptides are sensitive to environmental factors such as temperature, pH, and mechanical stress, making it difficult to develop stable formulations with adequate shelf life. Moreover, achieving targeted delivery to specific tissues or cells remains a significant hurdle, as peptides may not naturally accumulate in desired locations within the body.

Regulatory challenges add another layer of complexity to peptide drug development. The unique properties of peptides often place them in a gray area between small molecule drugs and biologics, leading to uncertainties in regulatory pathways and requirements. This ambiguity can result in longer development timelines and increased costs for pharmaceutical companies.

Lastly, the optimization of peptide properties, such as improving target selectivity and reducing off-target effects, remains an ongoing challenge. Achieving the right balance between efficacy, safety, and pharmacokinetic properties often requires extensive structure-activity relationship studies and iterative optimization processes, which can be time-consuming and resource-intensive.

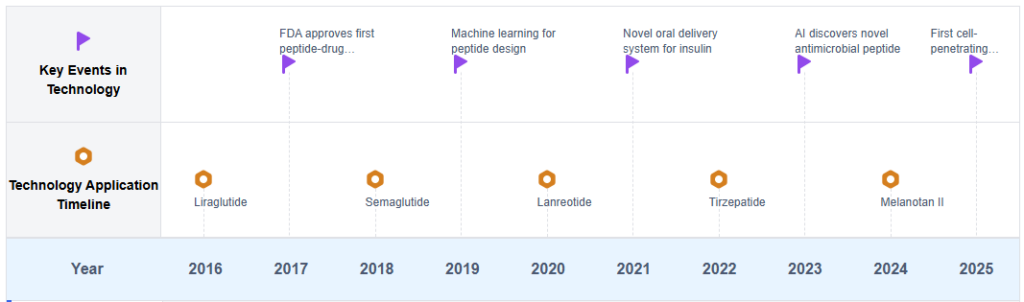

Therapeutic Peptides Technology Roadmap

Key Players in Peptide Therapeutics Industry

The therapeutic peptides market is in a growth phase, driven by increasing applications in various diseases and advancements in peptide synthesis technologies. The market size is expanding rapidly, with projections indicating significant growth in the coming years. Technologically, the field is maturing, with companies like Novo Nordisk, Ambrx, and Merck Patent GmbH leading in innovation. Research institutions such as the National Research Council of Canada and SRI International are contributing to the advancement of peptide therapeutics. The competitive landscape is diverse, featuring both established pharmaceutical companies and specialized biotech firms like Immatics Biotechnologies and Zydus Lifesciences. Emerging players such as ReAlta Life Sciences and enGene are also making strides in this dynamic field, indicating a robust and competitive market environment.

Novo Nordisk A/S

Novo Nordisk A/S

Technical Solution

Novo Nordisk has developed a proprietary peptide engineering platform called GLP-1 (Glucagon-Like Peptide-1) analogs for therapeutic peptides. This technology involves modifying the natural GLP-1 hormone to create long-acting peptides with improved pharmacokinetic profiles. Their approach includes amino acid substitutions, fatty acid attachments, and fusion proteins to enhance stability and extend the half-life of peptides in the body. This platform has led to successful products like Ozempic (semaglutide) for type 2 diabetes and obesity treatment.

Strengths: Proven track record in peptide therapeutics, especially for metabolic disorders. Extensive experience in large-scale peptide production and commercialization.

Weaknesses: Heavy focus on diabetes and obesity may limit diversification into other therapeutic areas.

Ambrx, Inc.

Ambrx, Inc.

Technical Solution

Ambrx specializes in developing Engineered Precision Biologics (EPBs) using their proprietary expanded genetic code technology platform. This platform allows for site-specific incorporation of non-natural amino acids into proteins and peptides, enabling precise control over their structure and function. For therapeutic peptides, Ambrx utilizes this technology to create novel peptide-drug conjugates with enhanced pharmacological properties, including improved stability, targeting, and efficacy. Their approach allows for the creation of highly optimized peptide therapeutics with tailored pharmacokinetics and reduced immunogenicity.

Strengths: Unique technology platform enabling precise peptide engineering. Potential for creating highly differentiated peptide therapeutics.

Weaknesses: Relatively new player in the field with fewer marketed products compared to established companies.

Piramal Enterprises Ltd.

Piramal Enterprises Ltd.

Technical Solution

Piramal Enterprises has developed a peptide synthesis and modification platform focusing on both solid-phase and solution-phase peptide synthesis. Their approach includes the use of various protecting group strategies, coupling reagents, and purification techniques to produce high-quality therapeutic peptides. They have also invested in developing novel formulation technologies for peptide delivery, including lipid-based nanocarriers and polymer-based sustained release systems. This integrated approach allows them to address both the synthesis and delivery challenges associated with peptide therapeutics.

Strengths: Strong capabilities in both peptide synthesis and formulation. Diverse portfolio spanning multiple therapeutic areas.

Weaknesses: Less focused on cutting-edge peptide engineering compared to some competitors.

ReAlta Life Sciences, Inc.

ReAlta Life Sciences, Inc.

Technical Solution

ReAlta Life Sciences focuses on developing peptide therapeutics based on their PIC1 (Peptide Inhibitor of Complement C1) technology platform. This platform centers around a family of peptides derived from astrovirus coat protein that can modulate the complement system, a key component of innate immunity. Their lead peptide, RLS-0071, is designed to inhibit both the classical and lectin pathways of complement activation. The company’s approach involves optimizing these peptides for various inflammatory and autoimmune conditions, leveraging their ability to control excessive complement activation without compromising overall immune function.

Strengths: Unique focus on complement-modulating peptides with broad therapeutic potential. Novel mechanism of action distinct from traditional complement inhibitors.

Weaknesses: Early-stage company with products still in clinical development, facing regulatory and commercialization challenges.

Alexion Pharmaceuticals, Inc.

Alexion Pharmaceuticals, Inc.

Technical Solution

Alexion Pharmaceuticals has developed a platform for creating peptide inhibitors of the complement system, particularly focusing on the terminal complement pathway. Their approach involves designing synthetic peptides that mimic natural complement regulators or interfere with key protein-protein interactions in the complement cascade. One of their notable technologies is the development of cyclic peptides that can bind to and inhibit specific complement proteins with high affinity and selectivity. This platform has led to the development of peptide therapeutics like ravulizumab, a long-acting C5 complement inhibitor used for treating rare diseases.

Strengths: Strong expertise in complement biology and peptide-based complement inhibitors. Established presence in the rare disease market.

Weaknesses: Narrow focus on complement-related disorders may limit broader application of their peptide technologies.

Current Peptide Drug Delivery Strategies

Market analysis and forecasting

The therapeutic peptides market is experiencing significant growth, driven by advancements in peptide synthesis technologies and increasing demand for targeted therapies. Market analysis tools and forecasting methods are being employed to predict trends, assess market potential, and guide investment decisions in this rapidly evolving sector.

- Market analysis techniques for therapeutic peptides

Various techniques are employed for analyzing the therapeutic peptides market, including data mining, predictive modeling, and trend analysis. These methods help in understanding current market dynamics, identifying growth opportunities, and forecasting future trends in the peptide therapeutics sector. - Forecasting tools for therapeutic peptide market trends

Advanced forecasting tools and algorithms are utilized to predict future trends in the therapeutic peptides market. These tools incorporate historical data, current market conditions, and emerging technologies to provide accurate projections of market growth, demand patterns, and potential challenges in the peptide therapeutics industry. - Therapeutic peptide market segmentation and analysis

The therapeutic peptides market is segmented based on various factors such as application areas, peptide types, and geographical regions. This segmentation allows for detailed analysis of specific market niches, enabling businesses to identify target segments and tailor their strategies accordingly.

Technological advancements in peptide development

Innovations in peptide design, synthesis, and delivery methods are shaping the therapeutic peptides market. These advancements include improved manufacturing processes, novel formulation techniques, and enhanced peptide stability, contributing to the expansion of peptide-based drug candidates in clinical pipelines.Expand

Therapeutic applications and target areas

The therapeutic peptides market is diversifying, with applications expanding across various disease areas. Key focus areas include oncology, metabolic disorders, cardiovascular diseases, and neurological conditions. The trend towards personalized medicine is driving the development of peptide-based therapies for specific patient populations.Expand

Regulatory landscape and market access

The regulatory environment for therapeutic peptides is evolving, with agencies adapting to the unique characteristics of peptide-based drugs. Market access strategies are being developed to navigate regulatory challenges, ensure compliance, and facilitate the commercialization of peptide therapeutics across different regions.Expand

Collaborative research and development initiatives

The therapeutic peptides market is witnessing increased collaboration between pharmaceutical companies, biotechnology firms, and academic institutions. These partnerships aim to accelerate peptide drug discovery, share resources, and leverage complementary expertise to bring innovative peptide-based therapies to market more efficiently.

Breakthrough Peptide Technologies and Patents

Future Directions in Peptide-Based Therapies

Cell-Penetrating Peptides (CPPs) for Drug Delivery

Cell-penetrating peptides (CPPs) represent a promising solution in peptide-based therapies. They address one of the most significant challenges in drug delivery: cellular uptake. These short peptides, usually 5-30 amino acids long, can cross cell membranes. This ability allows them to deliver therapeutic molecules like small molecules, proteins, nucleic acids, and nanoparticles directly into the cell.

While the exact mechanism of CPP-mediated entry is still being studied, it likely involves both energy-dependent endocytosis and direct membrane translocation. By overcoming the cell membrane barrier, CPPs enhance drug delivery, making them a powerful tool for targeted treatments.

Advancements in CPP Design

Researchers are working on improving CPP sequences to enhance cellular uptake, reduce toxicity, and increase stability. Both naturally occurring CPPs, like the TAT peptide from HIV, and synthetic variants are being explored for better efficiency in drug delivery. Tailoring CPPs to match specific therapeutic cargoes is essential for maximizing their delivery efficiency. Scientists are developing CPP-cargo conjugates that maintain the bioactivity of the cargo while enhancing its cellular uptake.

Targeted Delivery with CPPs

Integrating targeting moieties into CPPs enables more precise, cell- or tissue-specific delivery. This approach minimizes off-target effects and improves the therapeutic index of drugs. Researchers are also developing “smart” CPPs that respond to specific cues, such as pH, enzymes, or light. These CPPs can trigger cellular entry or release the drug when needed, offering more control over the delivery process.

Hybrid Delivery Systems

Combining CPPs with other drug delivery platforms, such as nanoparticles or liposomes, can create hybrid systems. These combinations harness the strengths of both technologies, enhancing control and efficacy in drug delivery.

Applications in Various Therapeutic Areas

CPPs have shown promise in several therapeutic areas. In cancer therapy, they can improve the delivery of chemotherapeutic agents or siRNAs directly to tumor cells. This could help overcome drug resistance and improve therapeutic outcomes.

In neurodegenerative diseases, CPPs offer a potential solution for crossing the blood-brain barrier (BBB). This breakthrough could make treatments for diseases like Alzheimer’s and Parkinson’s more effective. Additionally, CPPs can deliver genetic material, such as DNA and RNA, providing a novel approach to gene therapy.

CPPs are also useful for delivering antiviral or antibiotic agents directly to infected cells, improving treatment effectiveness for bacterial and viral infections.

Challenges and Research Directions

Despite their potential, CPPs face challenges. Some sequences may provoke immune responses or show toxicity, which researchers are addressing through sequence optimization. Many CPPs exhibit non-specific uptake, complicating their ability to target specific cells or tissues. Researchers are exploring methods to enhance specificity and improve targeted delivery.

Additionally, CPPs may degrade in biological fluids, limiting their in vivo effectiveness. Ongoing research aims to ensure stability in the body, which is crucial for realizing their full therapeutic potential.

Regulatory Landscape for Peptide Therapeutics

The regulatory landscape for peptide therapeutics is complex and dynamic. It significantly impacts the development, approval, and commercialization of these drugs. Regulatory bodies worldwide, including the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and Japan’s Pharmaceuticals and Medical Devices Agency (PMDA), set specific guidelines for peptide-based drugs. These regulations ensure the safety, efficacy, and quality of peptide therapeutics. They also address the unique challenges in peptide production and characterization.

Classification of Peptide Therapeutics

A key factor in regulation is the classification of peptide therapeutics. Depending on size, structure, and manufacturing processes, peptides may be classified as small molecule drugs or biologics. This classification influences the regulatory pathway, including the type of application needed. In the United States, peptides may require a New Drug Application (NDA) or Biologics License Application (BLA). This classification also dictates the specific manufacturing and quality control standards required.

Regulatory Guidance for Peptide Drugs

Regulatory agencies have provided specialized guidance for peptide therapeutics. These guidelines address aspects like impurity profiling, stability testing, and analytical methods. For example, the FDA offers guidance on ANDAs (Abbreviated New Drug Applications) for Highly Purified Synthetic Peptide Drug Products. This ensures consistency and safety when approving generic peptide drugs.

Manufacturing and Quality Control

Peptide therapeutics undergo stringent regulatory oversight during manufacturing. Manufacturers must adhere to Good Manufacturing Practice (GMP) guidelines to ensure product quality. Key focus areas include sourcing raw materials, synthesis methods, purification processes, and quality control. Regulatory bodies require detailed documentation and validation of the manufacturing process to ensure consistent product quality and safety.

Pharmacovigilance and Post-Market Surveillance

Pharmacovigilance and post-market surveillance are essential for peptide therapeutics. Manufacturers must establish systems for monitoring and reporting adverse events. Post-approval studies evaluate long-term safety and efficacy, ensuring the ongoing safety of the drug once it reaches the market.

Evolving Regulations for New Peptide Modalities

Peptide therapeutics are evolving, and regulatory frameworks are adapting. New technologies, such as cell-penetrating peptides (CPPs) and peptide-drug conjugates (PDCs), require updated guidance. Regulatory agencies are adapting existing regulations to address the unique properties of these innovative drug delivery systems.

International Harmonization

International harmonization efforts, such as those led by the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH), are crucial. These efforts aim to align regulatory requirements across regions, streamlining the development and approval of peptide therapeutics. This ensures safety and efficacy while fostering global access to these treatments.

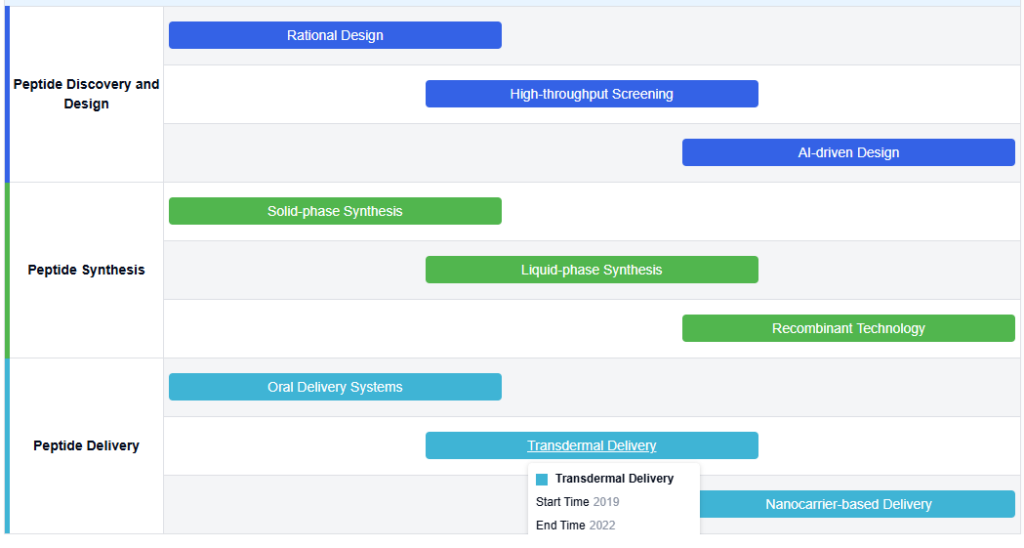

Peptide Manufacturing and Scale-up Considerations

Peptide manufacturing and scale-up are critical steps in the development of peptide-based therapeutics, presenting unique challenges and opportunities within the biopharmaceutical industry. As the demand for peptide therapeutics continues to rise, efficient and cost-effective production methods have become more crucial. Solid-phase peptide synthesis (SPPS) remains the primary method for small-scale peptide production, but its limitations in scalability and cost-effectiveness have led to the exploration of alternative approaches for large-scale manufacturing.

Alternative Synthesis Methods for Large-Scale Manufacturing

Solution-phase synthesis and hybrid methods combining solid-phase and solution-phase techniques have gained attention for producing longer peptides or those requiring complex modifications. These approaches offer significant advantages in scalability and cost reduction, particularly for peptides longer than 30-40 amino acids. However, they often require more extensive purification processes, and maintaining consistent product quality across batches can present challenges.

Recombinant DNA Technology in Peptide Production

Recombinant DNA technology has emerged as a promising alternative for manufacturing complex peptides, particularly those requiring post-translational modifications. By leveraging the cellular machinery of host organisms like E. coli or yeast, this method allows for the production of peptides with high fidelity at potentially lower costs. However, recombinant techniques may not be suitable for all peptide sequences and often require significant optimization of expression systems and downstream processing.

Scale-up Considerations and Purification Challenges

Scale-up considerations go beyond synthesis methods. Purification processes, such as chromatography and filtration, need to be optimized to handle larger volumes while maintaining high purity and yield. Analytical techniques for characterization and quality control must be adapted for scaling to ensure consistent product quality across different production stages.

Regulatory Compliance in Peptide Manufacturing

Regulatory compliance is crucial in peptide manufacturing scale-up. Peptides must be produced in accordance with Good Manufacturing Practice (GMP) guidelines. This includes maintaining detailed documentation, sourcing high-quality raw materials, and implementing rigorous quality control measures. Proper batch records and validation processes are essential to meet regulatory standards and ensure consistent product quality.

Emerging Technologies in Peptide Manufacturing

As the peptide industry advances, continuous flow chemistry and automated synthesis platforms are gaining traction. These technologies hold the potential to increase throughput, reduce solvent consumption, and improve overall process control. While still in its early stages, their implementation at industrial scales offers promising prospects for improving efficiency and reducing production costs. Further development and validation of these technologies are necessary to achieve large-scale industrial application.

To get detailed scientific explanations of therapeutic peptides, try Patsnap Eureka.