Source丨Yiyao

Title picture丨Picture insect creativity

What is the end of AI? Some investors said it was photovoltaics, while others said it was electricity. The answer given by NVIDIA was biopharmaceuticals.

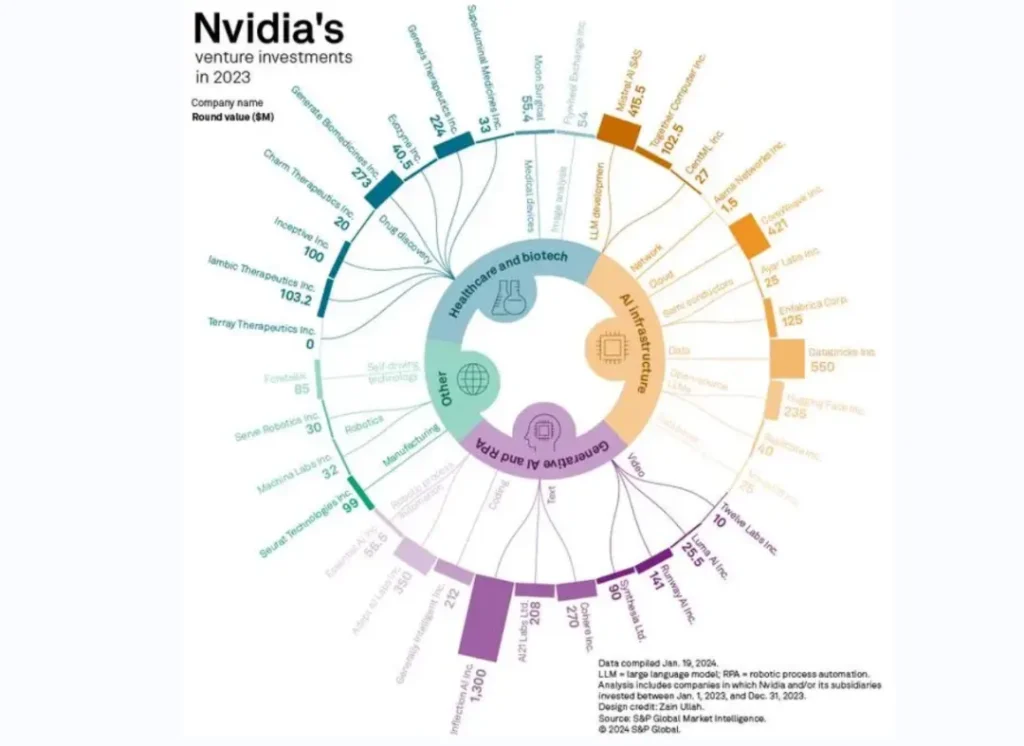

In NVIDIA’s 2023 investment landscape, in addition to the basic algorithms and infrastructure of the AI industry, biopharmaceuticals are the core track of its focus. Kimberly Powell, vice president of Nvidia Healthcare, even bluntly said: “Since the computer-aided design industry has won the first chip company with a market value of US$2 trillion, why can’t the computer-aided drug discovery industry create the next drug company worth a trillion US dollars? “

Chart: Nvidia’s investment map in 2023

It is not difficult to see from this that NVIDIA is full of confidence in the future of the “AI + biomedical industry” track, and it hopes to create another “NVIDIA”. Why is Nvidia so optimistic about this track? To understand this problem, we must first understand the core pain points and underlying logic of the medical track.

1、Anti-Moore’s Law

The reason why AI technology can enter the public eye so quickly is inseparable from the rapid development of the integrated circuit industry.

After studying the semiconductor industry for many years, Intel founder Gordon Moore put forward this empirical statement: the number of transistors that can be accommodated on an integrated circuit will double approximately every 18 to 24 months. This is the famous Moore’s Law.

Moore’s Law means that as the industry continues to evolve, the performance of processors will double approximately every two years, while the price will drop to half of what it was before. It is this process of continuous technological iteration that has enabled the rapid development of human computer technology and the realization of more and more “fantasy” functions.

Different from the development of Moore’s Law in the semiconductor industry, although the biopharmaceutical industry is also making continuous progress, its development is showing an “anti-Moore’s Law” trend.

There has always been a “double ten law” in the research and development of innovative drugs, that is, it takes ten years and costs US$1 billion to develop a new drug. However, these data are already in the past. The first data shows that the average research and development cost of innovative drugs worldwide is about 2.6 billion US dollars, and the average research and development cycle is about 10.5 years.

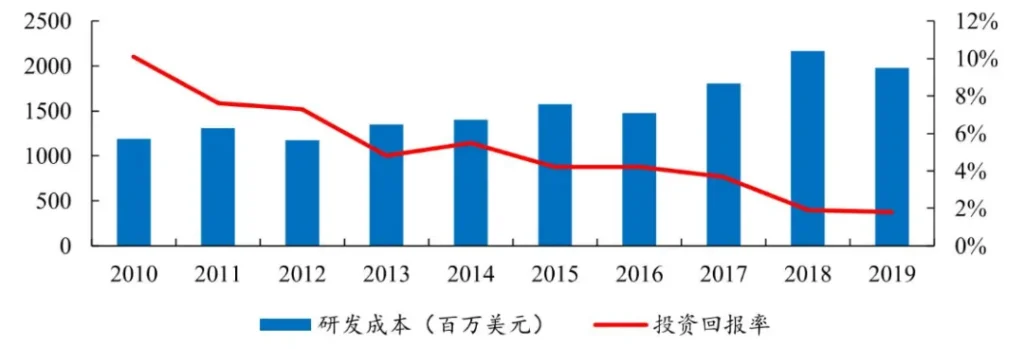

As a result of the long R&D cycle and high R&D costs, the R&D of innovative drugs is extremely risky. Not only does it require a large amount of funds to do it, but there is also a very high risk of failure. What’s even more fatal is that the difficulty of research and development continues to increase over time. That is, as humans discover more drugs and targets, the cost of subsequent discovery of drugs and targets will also be greater. The investment rate of return continues to decline.

Figure: Cost of research and development of innovative drugs, source: Kaiyuan Securities

Under this anti-Moore’s Law, the threshold for innovative drug research and development continues to rise, and investors’ risks are increasing. Gradually, innovative drugs have become the business of industrial giants. But in fact, the development of the pharmaceutical industry is destined to be driven by the “marginal revolution”. New technologies often appear in start-up companies. When the technology is continuously verified, giants begin to enter the layout.

In fact, there has been an obvious scissor gap between the laws of industrial development and the driving forces of industrial development. This is a very unusual phenomenon, which means that the progress of human medical technology will gradually stagnate. I believe no one wants to see this situation.

There is a need for change in the biopharmaceutical industry, and the rising costs of research and development of innovative drugs leave enough room for this. These two points are the reasons why Nvidia is optimistic that AI technology can reshape the pharmaceutical industry.

2、experience and intuition

The modern pharmaceutical industry is a besieged city built by intuition.

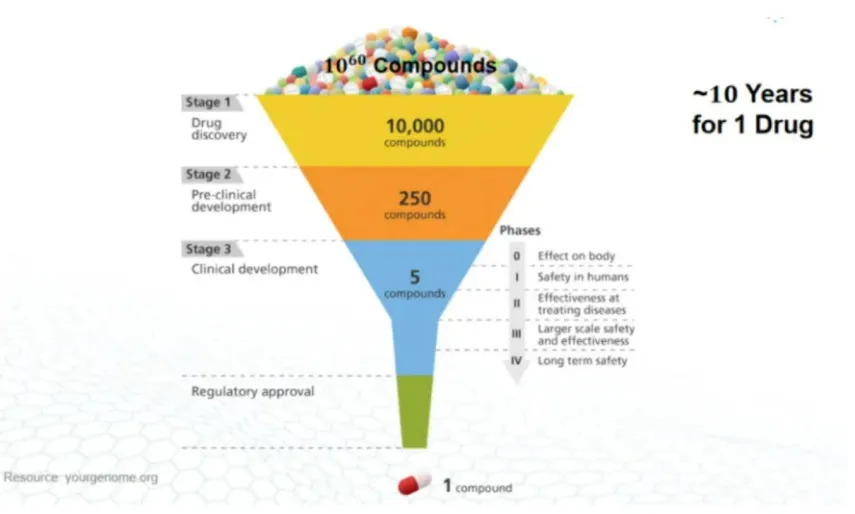

Although innovative drugs need to undergo rigorous and systematic clinical verification to be launched on the market, the process of drug discovery is full of randomness. The drug development path is funnel-shaped. The establishment of a drug requires three stages: drug discovery, pre-clinical verification, and clinical verification. The number of successful pipelines at each stage continues to decrease.

The most difficult part of this is the drug discovery stage, which requires screening about 10,000 suitable compounds among countless compounds, and then screening step by step to finally find the suitable compound. The discovery and establishment of a certain target is not only quite accidental, but the verification process is extremely cumbersome, and finding the right molecule is even more difficult.

Figure: Drug screening process, source: Zheshang Securities

Although generations of innovative drug research and development efforts have gradually led to drug discovery, in the face of huge compound data, everything is still highly dependent on the intuition of researchers, and data can provide little help. The premise of hard work is to go in the right direction. If you choose the wrong track, no matter how hard you work, it will be in vain. Over-reliance on intuition makes traditional drug research and development uncontrollable, which is the essential reason why the cost of innovative drug research and development continues to rise.

If the modern pharmaceutical industry wants to reduce costs, it must abandon its past reliance on expert intuition and become more data-driven. The so-called data is actually the crystallization of experience. Dataization does not mean that innovative drug research and development will not fail, but that this failure can be transformed into the cornerstone of the next research and development. Through systematic large-scale model training, AI will be faster and more accurate for drug screening.

In fact, innovative drug research and development is like a Roguelike game. It seems that everything is composed of randomness, and each game experience may be different. However, in the process of failure again and again, the game will continue to accumulate experience and data, thereby reducing the difficulty of solving the next game.

AI pharmaceuticals essentially abandon the expert intuition of the past, rely heavily on data feedback, and find the correct research and development path through continuous model training. Switching from relying on expert intuition to AI large model screening is a process from concreteness to data, and it is also a path from perceptuality to rationality.

Especially for many unexplored blank indications, the success of expert intuition may be the same as rolling dice. Continuous high-throughput AI model trial and error is the best way to reduce the failure rate. AI pharmaceuticals not only reduce R&D costs, but also effectively improve R&D efficiency.

3、Data resources are the most precious

Algorithms, computing power, and databases are the three core elements of AI technology.

In most scenarios of AI applications, algorithms are the final link among the three elements. Although computing power and database are also important, most investors still pay more attention to the construction of large model algorithms.

But in the field of biopharmaceuticals, the situation where algorithms are king may not apply. Compared with other scenarios, the data resources in the biopharmaceutical track are more precious. It is non-open source and is the core resource of major pharmaceutical companies. Regardless of success or failure, they are all achieved through expensive clinical trials. It can be seen that the database is the core competitiveness of the AI pharmaceutical track.

Looking at the hot domestic AI pharmaceutical companies, most of them are transformed from CRO companies. Compared with ordinary pharmaceutical companies, CRO companies have extremely rich research and development experience. Although the final research and development data belongs to Party A, it can subtly accumulate a large amount of process data and methodologies in research and development again and again. This makes CRO companies have unique advantages in building databases.

Based on the non-open source nature of biopharmaceutical data, the development of AI pharmaceuticals is likely to eventually go in two directions. The first is MNCs with strong financial resources, which have accumulated a large amount of R&D experience and data over the years, and have begun to invest in AI assets; the second is domestic CRO companies that are mainly transforming into AI pharmaceuticals, because they have previously undertaken With a large number of domestic and foreign R&D projects, it has strong database construction capabilities. What it lacks is the construction of large algorithm models. The computing power problem can be solved through cooperation with technology companies such as Alibaba Cloud and Tencent Cloud.

Since the domestic biopharmaceutical industry has just started and MNCs with long-term innovative drug research and development layout have not yet been formed, the first model is likely to be difficult to work in China. In the next few decades, CRO companies are likely to become the core assets of China’s AI pharmaceuticals, while overseas it is more of a confrontation and competition between various MNCs, and they will not be willing to open data to third parties. Even if NVIDIA wants to enter the game, it needs to invest in biopharmaceutical companies.

At this stage, domestic AI pharmaceuticals are in the early stages of development and can be roughly divided into three echelons. The first echelon is companies that have deployed AI pharmaceutical technology for many years, such as Chengdu HitGen, Hongbo Pharmaceuticals, Jingtai Technology, Yaoshi Technology, etc.; the second echelon is companies with rich R&D experience, but their deployment in the field of AI pharmaceuticals has just started. , such as WuXi AppTec, Medicilon, Haoyuan Pharmaceutical, etc.; the third echelon is other CRO companies with rich research and development experience, but have not yet deployed too deeply in AI.

In the field of AI pharmaceuticals, data is the industry’s first priority. The value of databases is much higher than the value of algorithms and computing power. This is why CRO companies are at the forefront of the domestic AI pharmaceutical industry.