Consumer finance anti-fraud system and method based on dynamic rule library

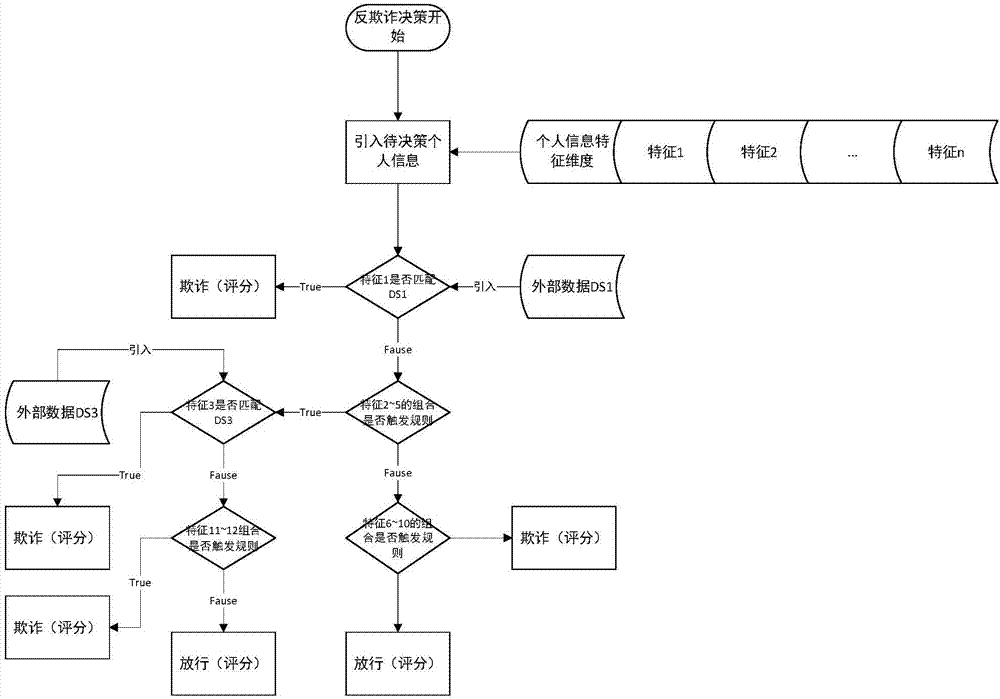

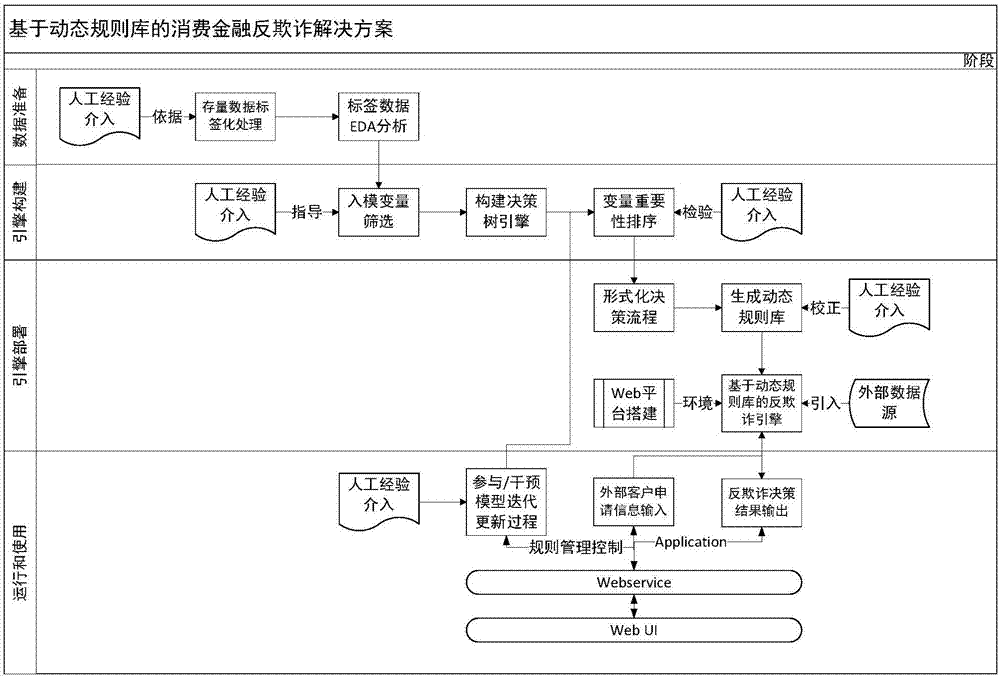

A rule-based and dynamic technology, applied in the consumer finance anti-fraud system, the anti-application fraud system for consumer finance, can solve the problem of difficult to build and train models, help consumer finance companies and institutions to master independent risk control capabilities, loss and other problems, to achieve the effect of improving security and usability, reducing the difficulty of cold start, and rapid iterative update

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment

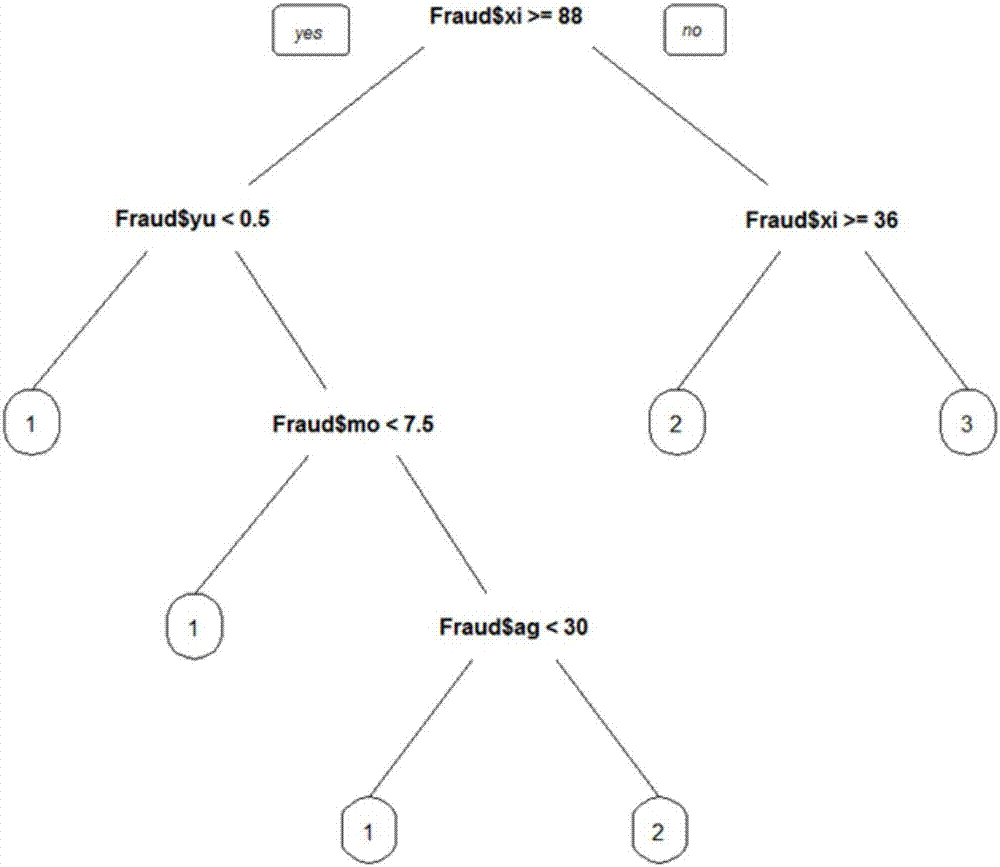

[0038] The specific implementation process of the present invention will be described below by taking the construction of an anti-fraud dynamic rule base based on the public data of an Internet consumer finance platform as an example.

[0039] The first step is to process the existing data and establish a labeling system.

[0040] Take the OVER_DUE (overdue account) and BAD_DEBT (bad debt) label data in the public data of a certain platform as the fraud data, set it as FRAUD (fraud label), a total of 175 data (that is, 175 users). Taking closed as normal data, there are a total of 3273 data sets (that is, 3273 users).

[0041] The main fields (column names) and meanings included in the original data in this embodiment are shown in Table 1 below:

[0042]

[0043]

[0044] Table 1

[0045] The second step is to perform EDA analysis on the tag data.

[0046] In this example, based on the public data of an Internet consumer finance platform, EDA analysis of label data in...

PUM

Login to view more

Login to view more Abstract

Description

Claims

Application Information

Login to view more

Login to view more - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap