Method and system for providing downside protection of stock market investments

a technology of downside protection and stock market investments, applied in the field of investment tracking systems, can solve the problems of limited options to protect investment from market decline, failure to allow protection of gains, failure to provide combination type of protection, etc., and achieve the effect of downside protection of stock market investments

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

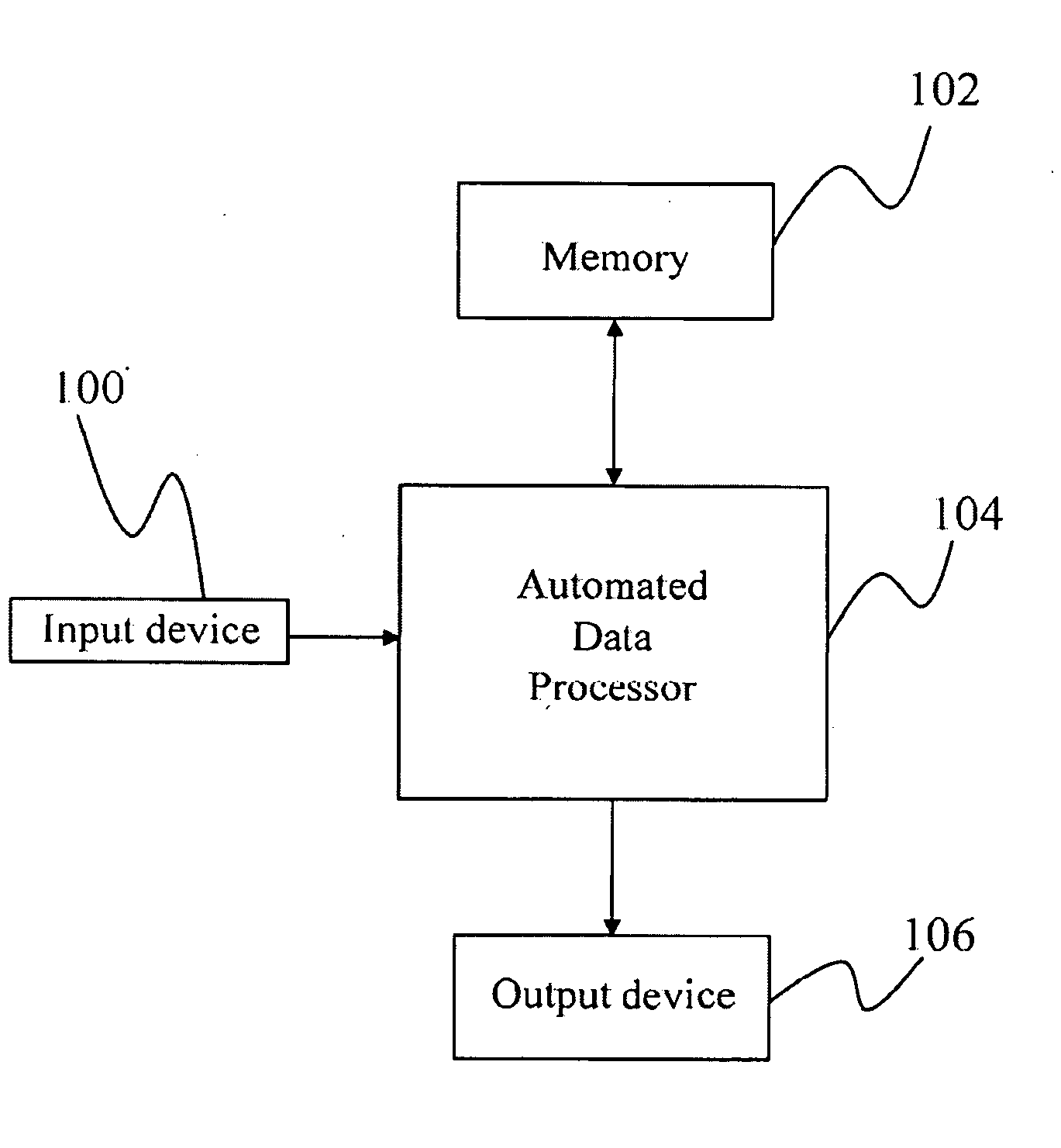

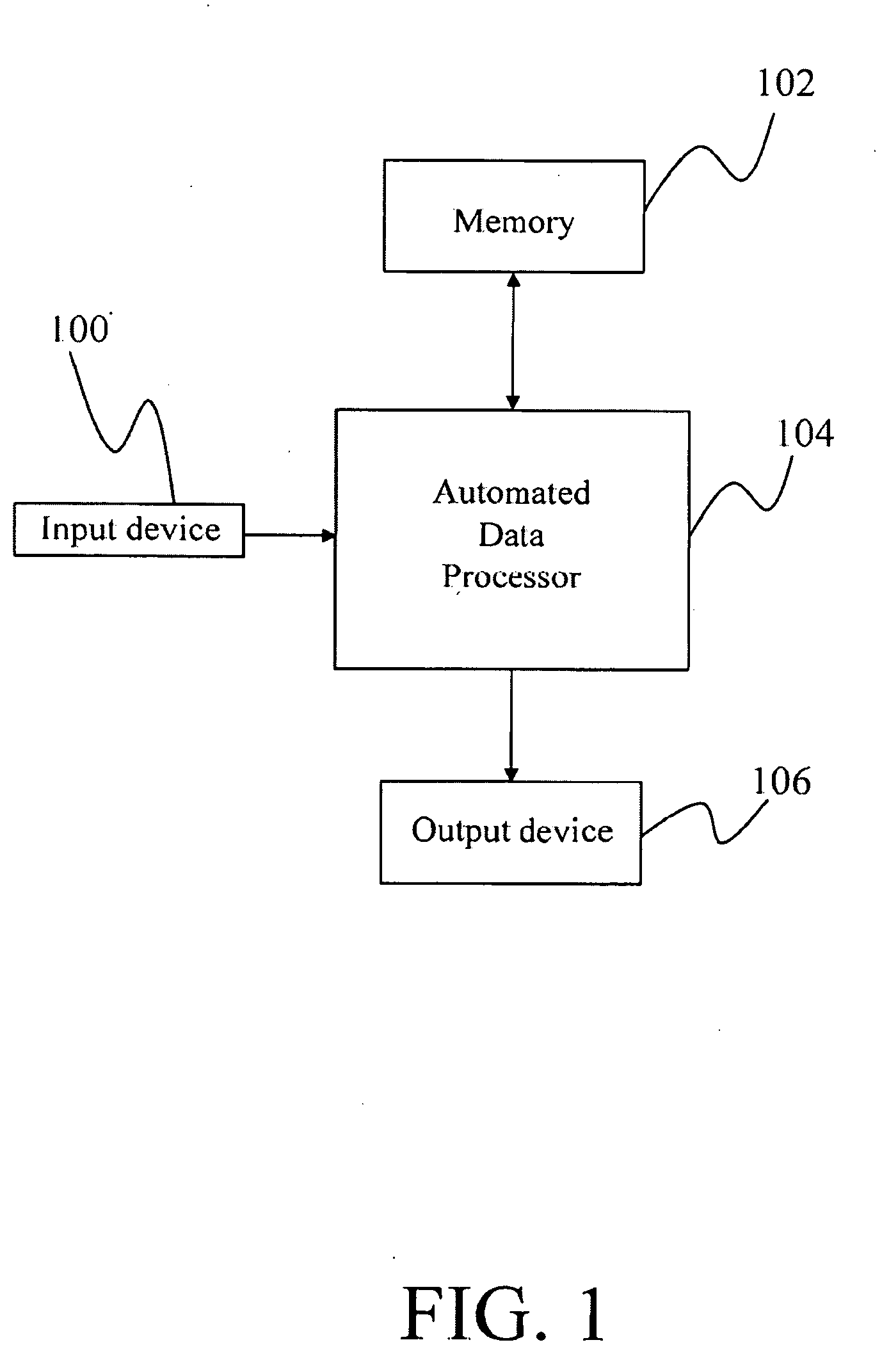

[0047]The present invention relates to the field of stock market computer programs. More specifically, this disclosure presents a method and system for providing downside protection of stock market investments. The following description is presented to enable one of ordinary skill in the art to make and use the invention and to incorporate it in the context of particular applications. Various modifications, as well as a variety of uses in different applications will be readily apparent to those skilled in the art, and the general principles defined herein may be applied to a wide range of embodiments. Thus, the present invention is not intended to be limited to the embodiments presented, but is to be accorded the widest scope consistent with the principles and novel features disclosed herein.

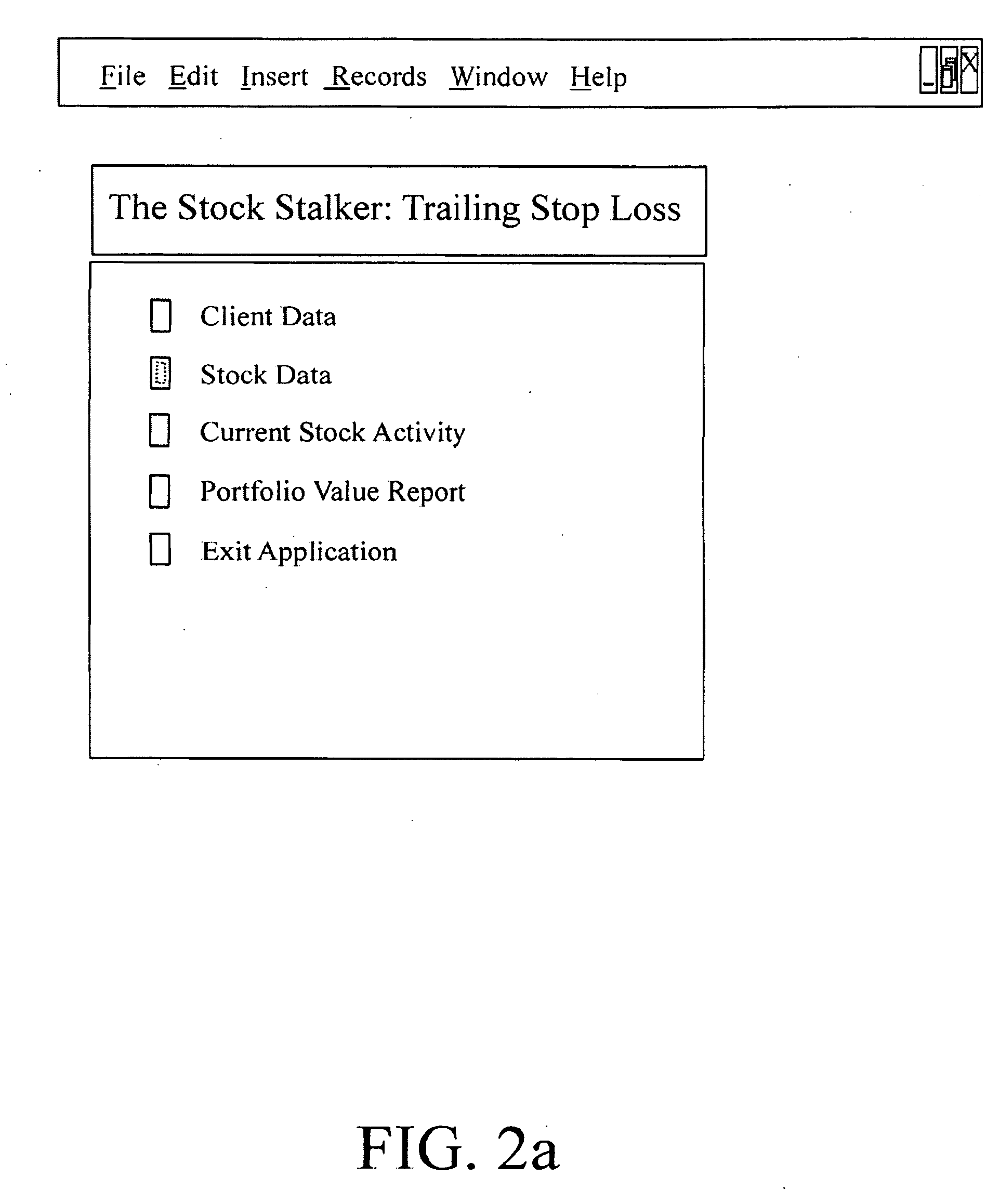

[0048]The present invention is useful for providing downside protection of stock market investments. A few of the goals of the present invention include allowing stock prices to be expressed as ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com