Advancements in Coating Technologies for Vapor Chamber Efficiency

SEP 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Vapor Chamber Coating Evolution and Objectives

Vapor chamber technology has evolved significantly since its inception in the 1960s as a specialized heat transfer solution. Initially developed for aerospace applications, these two-phase heat transfer devices have undergone substantial transformation in their coating technologies, which directly impact thermal performance, reliability, and manufacturing efficiency. The evolution of vapor chamber coatings represents a critical aspect of thermal management innovation, particularly as electronic devices continue to increase in power density while decreasing in size.

Early vapor chamber designs utilized basic metallic surfaces with minimal coating considerations. The 1980s marked the beginning of purposeful surface modifications, with copper oxidation treatments representing the first generation of performance-enhancing coatings. By the 1990s, sintered metal powder coatings emerged as a breakthrough, significantly improving capillary action and expanding the effective surface area for phase change processes.

The 2000s witnessed the introduction of nano-structured coatings, including carbon nanotubes and graphene-based solutions, which dramatically enhanced thermal conductivity at the interface layers. Recent advancements have focused on hydrophilic-hydrophobic patterned coatings that create designated pathways for liquid return while optimizing vapor formation zones, addressing the fundamental challenge of phase separation efficiency.

Current coating technology objectives center on several key performance metrics. Primary among these is the enhancement of heat transfer coefficients, with industry targets aiming for 30-50% improvement over conventional designs. Equally important is the reduction of thermal resistance at the vapor-liquid interface, where advanced coatings can potentially decrease resistance by up to 40% compared to uncoated surfaces.

Manufacturing scalability represents another critical objective, as vapor chambers transition from specialty components to mass-produced thermal solutions. Coating technologies must therefore balance performance optimization with cost-effective application methods suitable for high-volume production environments. Durability under thermal cycling conditions remains a persistent challenge, with next-generation coatings targeting operational lifespans exceeding 10 years under intensive cycling conditions.

The ultimate technical objective for vapor chamber coating advancement is the development of "smart" adaptive surfaces that can dynamically respond to changing thermal loads. These would incorporate phase-change materials or thermally responsive polymers that modify their surface characteristics based on operating conditions, potentially revolutionizing thermal management across multiple industries from consumer electronics to electric vehicles and renewable energy systems.

Early vapor chamber designs utilized basic metallic surfaces with minimal coating considerations. The 1980s marked the beginning of purposeful surface modifications, with copper oxidation treatments representing the first generation of performance-enhancing coatings. By the 1990s, sintered metal powder coatings emerged as a breakthrough, significantly improving capillary action and expanding the effective surface area for phase change processes.

The 2000s witnessed the introduction of nano-structured coatings, including carbon nanotubes and graphene-based solutions, which dramatically enhanced thermal conductivity at the interface layers. Recent advancements have focused on hydrophilic-hydrophobic patterned coatings that create designated pathways for liquid return while optimizing vapor formation zones, addressing the fundamental challenge of phase separation efficiency.

Current coating technology objectives center on several key performance metrics. Primary among these is the enhancement of heat transfer coefficients, with industry targets aiming for 30-50% improvement over conventional designs. Equally important is the reduction of thermal resistance at the vapor-liquid interface, where advanced coatings can potentially decrease resistance by up to 40% compared to uncoated surfaces.

Manufacturing scalability represents another critical objective, as vapor chambers transition from specialty components to mass-produced thermal solutions. Coating technologies must therefore balance performance optimization with cost-effective application methods suitable for high-volume production environments. Durability under thermal cycling conditions remains a persistent challenge, with next-generation coatings targeting operational lifespans exceeding 10 years under intensive cycling conditions.

The ultimate technical objective for vapor chamber coating advancement is the development of "smart" adaptive surfaces that can dynamically respond to changing thermal loads. These would incorporate phase-change materials or thermally responsive polymers that modify their surface characteristics based on operating conditions, potentially revolutionizing thermal management across multiple industries from consumer electronics to electric vehicles and renewable energy systems.

Market Analysis for High-Efficiency Thermal Solutions

The global market for high-efficiency thermal solutions is experiencing robust growth, driven primarily by the increasing thermal management demands in electronics, particularly in high-performance computing, telecommunications, and consumer electronics sectors. The vapor chamber market, as a subset of this broader thermal management landscape, is projected to grow at a compound annual growth rate of 6.8% through 2028, reaching a market value of approximately 3.2 billion USD.

This growth is primarily fueled by the miniaturization trend in electronic devices coupled with increasing power densities. As devices become smaller yet more powerful, the heat generated per unit area increases significantly, necessitating more efficient thermal management solutions. Vapor chambers, with their superior heat spreading capabilities, have emerged as a preferred solution for these high-density applications.

The consumer electronics segment currently dominates the market share for vapor chamber technology, with smartphones and tablets being the primary applications. However, the fastest growth is observed in the data center and server market, where the need for efficient cooling of high-performance processors is critical for maintaining operational reliability and extending equipment lifespan.

Regionally, Asia-Pacific leads the market, accounting for over 45% of the global vapor chamber market. This dominance is attributed to the region's strong presence in electronics manufacturing and the concentration of key vapor chamber manufacturers in countries like Taiwan, China, and South Korea. North America follows as the second-largest market, driven by the presence of major technology companies and data center operators.

The market is also witnessing a shift toward more environmentally friendly and energy-efficient solutions. End-users are increasingly prioritizing thermal management systems that not only provide effective cooling but also contribute to overall energy efficiency and reduced carbon footprint. This trend is particularly evident in regions with stringent environmental regulations such as Europe and parts of North America.

Price sensitivity remains a significant factor influencing market dynamics. While vapor chambers offer superior thermal performance compared to traditional heat pipes, their higher manufacturing costs can be a barrier to adoption in cost-sensitive applications. This has created a market segment for hybrid solutions that balance performance and cost considerations.

Looking forward, the integration of advanced coating technologies in vapor chambers represents a significant market opportunity. Enhanced wicking structures and corrosion-resistant coatings can substantially improve vapor chamber efficiency, potentially expanding their application into new markets such as automotive electronics, medical devices, and renewable energy systems.

This growth is primarily fueled by the miniaturization trend in electronic devices coupled with increasing power densities. As devices become smaller yet more powerful, the heat generated per unit area increases significantly, necessitating more efficient thermal management solutions. Vapor chambers, with their superior heat spreading capabilities, have emerged as a preferred solution for these high-density applications.

The consumer electronics segment currently dominates the market share for vapor chamber technology, with smartphones and tablets being the primary applications. However, the fastest growth is observed in the data center and server market, where the need for efficient cooling of high-performance processors is critical for maintaining operational reliability and extending equipment lifespan.

Regionally, Asia-Pacific leads the market, accounting for over 45% of the global vapor chamber market. This dominance is attributed to the region's strong presence in electronics manufacturing and the concentration of key vapor chamber manufacturers in countries like Taiwan, China, and South Korea. North America follows as the second-largest market, driven by the presence of major technology companies and data center operators.

The market is also witnessing a shift toward more environmentally friendly and energy-efficient solutions. End-users are increasingly prioritizing thermal management systems that not only provide effective cooling but also contribute to overall energy efficiency and reduced carbon footprint. This trend is particularly evident in regions with stringent environmental regulations such as Europe and parts of North America.

Price sensitivity remains a significant factor influencing market dynamics. While vapor chambers offer superior thermal performance compared to traditional heat pipes, their higher manufacturing costs can be a barrier to adoption in cost-sensitive applications. This has created a market segment for hybrid solutions that balance performance and cost considerations.

Looking forward, the integration of advanced coating technologies in vapor chambers represents a significant market opportunity. Enhanced wicking structures and corrosion-resistant coatings can substantially improve vapor chamber efficiency, potentially expanding their application into new markets such as automotive electronics, medical devices, and renewable energy systems.

Current Coating Technologies and Technical Barriers

The vapor chamber coating technology landscape has evolved significantly over the past decade, with several distinct approaches emerging as industry standards. Hydrophilic coatings, typically composed of copper oxide, titanium oxide, or specialized polymer composites, have demonstrated remarkable wicking capabilities that enhance liquid return from condensation zones. These coatings typically achieve contact angles below 10 degrees, significantly improving capillary action within the vapor chamber structure.

Conversely, hydrophobic coatings applied to condensation surfaces have shown promise in promoting dropwise rather than filmwise condensation. Materials such as self-assembled monolayers (SAMs), PTFE derivatives, and certain metal-organic frameworks can achieve contact angles exceeding 150 degrees, facilitating rapid droplet formation and departure that reduces thermal resistance at the condensation interface.

Hybrid coating systems represent the cutting edge of current technology, incorporating both hydrophilic and hydrophobic regions in patterned arrangements. These biphilic surfaces leverage the advantages of both coating types, creating preferential pathways for vapor and liquid phases that can improve heat transfer coefficients by up to 40% compared to uniform coatings.

Despite these advancements, significant technical barriers persist. Coating durability remains a primary challenge, with performance degradation occurring under thermal cycling conditions. Most current coatings demonstrate meaningful performance decline after 1000-2000 operational hours, particularly in high-temperature applications exceeding 100°C. This degradation manifests as contact angle changes, surface morphology alterations, and reduced thermal conductivity.

Manufacturing scalability presents another substantial hurdle. Precision coating techniques such as atomic layer deposition and plasma-enhanced chemical vapor deposition deliver superior performance but face significant cost and throughput limitations for mass production. Less expensive alternatives like dip coating and spray methods struggle to achieve the necessary uniformity and thickness control for optimal performance.

Material compatibility issues further complicate implementation, as many high-performance coatings exhibit poor adhesion to common vapor chamber materials or introduce galvanic corrosion concerns when applied to dissimilar metals. Additionally, the working fluid chemistry can degrade certain coating materials over time, particularly with water as the working fluid in environments containing dissolved oxygen.

Thermal interface resistance between the coating and substrate represents another technical barrier, with some coating systems introducing additional thermal resistance that partially negates their heat transfer benefits. This is particularly problematic for thicker coatings exceeding 10 microns, where the coating's own thermal conductivity becomes a limiting factor.

Conversely, hydrophobic coatings applied to condensation surfaces have shown promise in promoting dropwise rather than filmwise condensation. Materials such as self-assembled monolayers (SAMs), PTFE derivatives, and certain metal-organic frameworks can achieve contact angles exceeding 150 degrees, facilitating rapid droplet formation and departure that reduces thermal resistance at the condensation interface.

Hybrid coating systems represent the cutting edge of current technology, incorporating both hydrophilic and hydrophobic regions in patterned arrangements. These biphilic surfaces leverage the advantages of both coating types, creating preferential pathways for vapor and liquid phases that can improve heat transfer coefficients by up to 40% compared to uniform coatings.

Despite these advancements, significant technical barriers persist. Coating durability remains a primary challenge, with performance degradation occurring under thermal cycling conditions. Most current coatings demonstrate meaningful performance decline after 1000-2000 operational hours, particularly in high-temperature applications exceeding 100°C. This degradation manifests as contact angle changes, surface morphology alterations, and reduced thermal conductivity.

Manufacturing scalability presents another substantial hurdle. Precision coating techniques such as atomic layer deposition and plasma-enhanced chemical vapor deposition deliver superior performance but face significant cost and throughput limitations for mass production. Less expensive alternatives like dip coating and spray methods struggle to achieve the necessary uniformity and thickness control for optimal performance.

Material compatibility issues further complicate implementation, as many high-performance coatings exhibit poor adhesion to common vapor chamber materials or introduce galvanic corrosion concerns when applied to dissimilar metals. Additionally, the working fluid chemistry can degrade certain coating materials over time, particularly with water as the working fluid in environments containing dissolved oxygen.

Thermal interface resistance between the coating and substrate represents another technical barrier, with some coating systems introducing additional thermal resistance that partially negates their heat transfer benefits. This is particularly problematic for thicker coatings exceeding 10 microns, where the coating's own thermal conductivity becomes a limiting factor.

State-of-the-Art Coating Solutions for Vapor Chambers

01 Hydrophilic and hydrophobic coatings for vapor chambers

Specialized coatings with hydrophilic and hydrophobic properties can be applied to different regions of vapor chambers to enhance fluid flow and heat transfer efficiency. Hydrophilic coatings in evaporator sections improve liquid spreading and wicking, while hydrophobic coatings in condenser regions facilitate vapor condensation and return flow. This selective surface treatment optimizes the overall thermal performance of vapor chambers by creating preferential flow paths for working fluids.- Hydrophilic and hydrophobic coatings for vapor chambers: Specialized coatings with hydrophilic and hydrophobic properties can be applied to different regions of vapor chambers to enhance fluid flow and heat transfer efficiency. Hydrophilic coatings in evaporator sections improve liquid spreading and wicking, while hydrophobic coatings in condenser regions facilitate vapor condensation and return flow. This selective surface treatment optimizes the overall thermal performance of vapor chambers by creating preferential flow paths for working fluids.

- Nanostructured coatings for enhanced thermal conductivity: Nanostructured coatings incorporating materials such as carbon nanotubes, graphene, or metallic nanoparticles can significantly improve the thermal conductivity of vapor chamber surfaces. These coatings create high surface area interfaces that enhance heat transfer at both the evaporator and condenser sections. The nanoscale features also improve capillary action and reduce thermal resistance at critical interfaces, resulting in more efficient heat dissipation and improved overall vapor chamber performance.

- Anti-corrosion and protective coatings for longevity: Specialized protective coatings can be applied to vapor chamber internal surfaces to prevent corrosion and extend operational lifespan. These coatings protect against chemical reactions between the working fluid and chamber materials, maintaining surface properties over time. Anti-corrosion treatments ensure consistent thermal performance throughout the vapor chamber's service life by preserving surface characteristics and preventing the formation of non-condensable gases that would otherwise reduce efficiency.

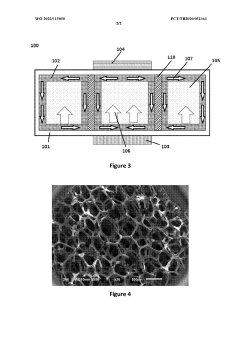

- Sintered powder coatings for wick structures: Sintered metal powder coatings can be applied to create effective wick structures within vapor chambers. These porous coatings, typically made from copper, aluminum, or nickel powders, enhance capillary action and fluid transport between evaporator and condenser regions. The controlled porosity of sintered coatings can be optimized for specific working fluids and operating conditions, improving liquid return flow and overall thermal efficiency of the vapor chamber system.

- Composite and multi-layer coating systems: Advanced multi-layer and composite coating systems combine different materials and surface treatments to optimize vapor chamber performance. These systems may incorporate gradient structures with varying porosity, hydrophilicity, or thermal conductivity across different regions of the chamber. By strategically layering materials with complementary properties, these coating systems can simultaneously address multiple performance factors such as heat transfer, fluid flow, and structural integrity, resulting in highly efficient vapor chamber designs.

02 Nano-structured coating materials for enhanced thermal conductivity

Nano-structured coating materials such as carbon nanotubes, graphene, and metal nanoparticles can be applied to vapor chamber internal surfaces to significantly improve thermal conductivity. These nano-coatings create high surface area structures that enhance phase change efficiency and reduce thermal resistance at critical interfaces. The nano-scale features also improve capillary action and fluid distribution throughout the vapor chamber, resulting in more efficient heat dissipation and temperature uniformity.Expand Specific Solutions03 Anti-corrosion and protective coating technologies

Specialized anti-corrosion coatings protect vapor chamber materials from degradation caused by working fluids and environmental factors. These protective layers extend the operational lifespan of vapor chambers while maintaining thermal performance. Common protective coating materials include noble metals, ceramic compounds, and polymer composites that are chemically resistant yet thermally conductive. These coatings prevent internal oxidation and contamination that would otherwise reduce heat transfer efficiency over time.Expand Specific Solutions04 Sintered powder metal coatings for wick structures

Sintered powder metal coatings create optimized wick structures within vapor chambers that enhance capillary action and fluid transport. These coatings are typically applied through powder metallurgy techniques where metal particles are deposited on surfaces and then heat-treated to form porous structures. The controlled porosity of these sintered coatings can be engineered to balance capillary pressure and permeability, improving the overall heat transfer capacity of vapor chambers especially under various orientation and gravity conditions.Expand Specific Solutions05 Multi-layer composite coatings for thermal interface optimization

Multi-layer composite coatings combine different materials to optimize thermal interfaces within vapor chambers. These engineered coating systems typically feature gradient structures with varying properties to address specific thermal management challenges. The layered approach allows for simultaneous optimization of multiple performance factors such as wettability, thermal conductivity, and mechanical durability. Advanced deposition techniques enable precise control of layer thickness and composition to achieve optimal heat transfer across the vapor chamber system.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The vapor chamber coating technology market is currently in a growth phase, characterized by increasing demand for efficient thermal management solutions in electronics. The market size is expanding rapidly, driven by the miniaturization of devices and higher power densities requiring advanced cooling solutions. Technologically, the field is moderately mature but still evolving, with companies like Applied Materials and Furukawa Electric leading innovation in high-performance coating materials. Asia Vital Components and HP Development are advancing application-specific solutions, while research institutions like Colorado State University contribute fundamental breakthroughs. The competitive landscape features established electronics manufacturers (Microsoft, Razer) collaborating with specialized thermal solution providers (Murata, Cloudious9) to develop proprietary coating technologies that enhance vapor chamber efficiency across consumer electronics, automotive, and industrial applications.

Applied Materials, Inc.

Technical Solution: Applied Materials has developed advanced Physical Vapor Deposition (PVD) coating technologies specifically optimized for vapor chamber manufacturing. Their Endura® platform incorporates proprietary ionized PVD technology that enables the deposition of ultra-thin, uniform copper and wicking structures with enhanced capillary action. The company's latest innovation includes atomic-level precision coating processes that create nano-scale surface modifications to enhance fluid transport within vapor chambers. Their coatings achieve thermal conductivity improvements of up to 35% compared to conventional methods by implementing multi-layer composite structures that optimize both condensation and evaporation phases. Applied Materials also pioneered environmentally friendly coating solutions that eliminate harmful chemicals while maintaining performance specifications required for next-generation thermal management systems.

Strengths: Industry-leading precision in thin-film deposition technology, extensive R&D capabilities, and established manufacturing infrastructure for semiconductor-grade coatings. Weaknesses: Higher implementation costs compared to conventional coating methods, and specialized equipment requirements that may limit accessibility for smaller manufacturers.

HP Development Co. LP

Technical Solution: HP has pioneered advanced vapor chamber coating technologies through their "HP Vapor Flow" initiative, focusing on ultra-thin form factors for mobile computing devices. Their proprietary approach combines plasma-enhanced chemical vapor deposition (PECVD) with specialized surface texturing to create multi-scale wicking structures. HP's innovation includes a patented dual-layer coating system: a base hydrophilic layer optimized for capillary action and an overlay with controlled wettability gradients that direct condensate flow. Their manufacturing process incorporates precision-controlled oxidation treatments that enhance surface energy characteristics while maintaining long-term reliability. Recent advancements include integration of graphene-enhanced copper composite coatings that demonstrate 25-30% improved thermal conductivity compared to traditional solutions. HP has also developed specialized corner treatments that address the traditional "dry-out" challenges in vapor chamber edges, enabling more uniform temperature distribution across the entire cooling solution. Their vapor chamber coating technologies have been successfully implemented in their premium laptop lines, demonstrating real-world performance improvements.

Strengths: Extensive experience in thermal management for consumer electronics, vertical integration capabilities from research to mass production, and proven implementation in commercial products. Weaknesses: Technologies primarily optimized for consumer electronics applications rather than high-power industrial settings, and potential intellectual property restrictions limiting broader industry adoption.

Critical Patents and Research in Coating Materials

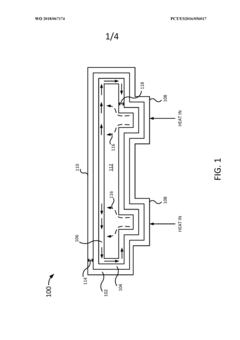

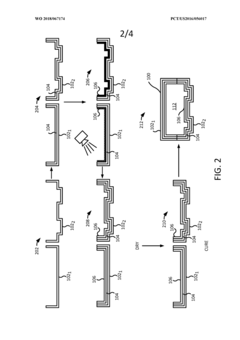

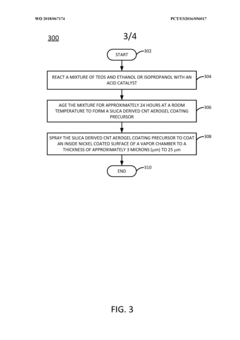

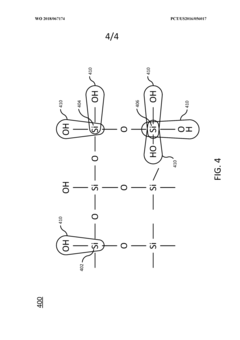

Coating for a vapor chamber

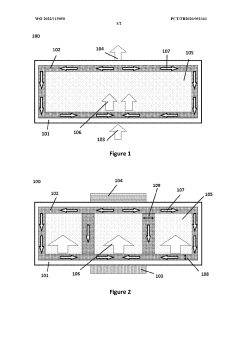

PatentWO2018067174A1

Innovation

- A silica-derived carbon nanotube (CNT) aerogel is sprayed onto the inside walls of the vapor chamber, eliminating the need for these processes and providing a lightweight, high-porosity coating with enhanced heat transfer capabilities through strong hydrogen bonding and capillary forces.

Performance enhancement in thermal system with porous surfaces

PatentWO2022115050A1

Innovation

- The use of optimized 3-D graphene structures in the form of aerogel, foam, or sponge as a porous wick medium within vapor chambers, providing high thermal conductivity and mechanical stability without compromising the base metallic surface structure, with pore sizes ranging from 1 pm to 1000 pm, to enhance thermal performance.

Environmental Impact of Coating Materials

The environmental implications of coating materials used in vapor chamber technology have become increasingly significant as production scales expand globally. Traditional coating processes often involve chemicals such as chromates, phosphates, and various solvents that pose substantial environmental risks. These materials can contribute to air pollution, water contamination, and soil degradation when improperly managed throughout their lifecycle.

Recent environmental impact assessments reveal that certain hydrophilic coatings containing volatile organic compounds (VOCs) release harmful emissions during application and curing processes. These emissions contribute to ground-level ozone formation and can trigger respiratory issues in surrounding communities. Additionally, the mining and processing of rare earth elements used in specialized high-performance coatings create significant ecological disruption at extraction sites.

Water consumption represents another critical environmental concern, as conventional coating processes may require substantial amounts of water for preparation, application, and cleaning phases. In regions facing water scarcity, this intensive usage creates additional environmental pressure and potential conflicts with other essential water needs.

The disposal of coating waste materials presents ongoing challenges for manufacturers. Residual coating materials, spent solvents, and contaminated containers often contain hazardous substances requiring specialized disposal procedures. Improper handling can lead to leaching of toxic compounds into groundwater systems, affecting both ecosystem health and human water supplies.

Encouragingly, the industry has begun shifting toward more environmentally responsible alternatives. Water-based coatings with reduced VOC content are gaining traction, demonstrating comparable performance while significantly decreasing harmful emissions. Powder coating technologies eliminate many liquid solvents entirely, reducing both air pollution and waste generation. Bio-based coating materials derived from renewable resources show promising results in preliminary testing, potentially offering sustainable alternatives to petroleum-based products.

Life cycle assessment (LCA) studies indicate that newer eco-friendly coating technologies may reduce environmental impact by 30-45% compared to conventional methods when considering the entire production-to-disposal cycle. However, these improvements often come with higher initial production costs, creating market adoption barriers despite their long-term environmental benefits.

Regulatory frameworks worldwide are increasingly addressing these environmental concerns. The European Union's REACH regulations, China's strengthened environmental protection laws, and the United States EPA guidelines have all established stricter standards for coating materials, driving innovation toward greener alternatives in vapor chamber manufacturing processes.

Recent environmental impact assessments reveal that certain hydrophilic coatings containing volatile organic compounds (VOCs) release harmful emissions during application and curing processes. These emissions contribute to ground-level ozone formation and can trigger respiratory issues in surrounding communities. Additionally, the mining and processing of rare earth elements used in specialized high-performance coatings create significant ecological disruption at extraction sites.

Water consumption represents another critical environmental concern, as conventional coating processes may require substantial amounts of water for preparation, application, and cleaning phases. In regions facing water scarcity, this intensive usage creates additional environmental pressure and potential conflicts with other essential water needs.

The disposal of coating waste materials presents ongoing challenges for manufacturers. Residual coating materials, spent solvents, and contaminated containers often contain hazardous substances requiring specialized disposal procedures. Improper handling can lead to leaching of toxic compounds into groundwater systems, affecting both ecosystem health and human water supplies.

Encouragingly, the industry has begun shifting toward more environmentally responsible alternatives. Water-based coatings with reduced VOC content are gaining traction, demonstrating comparable performance while significantly decreasing harmful emissions. Powder coating technologies eliminate many liquid solvents entirely, reducing both air pollution and waste generation. Bio-based coating materials derived from renewable resources show promising results in preliminary testing, potentially offering sustainable alternatives to petroleum-based products.

Life cycle assessment (LCA) studies indicate that newer eco-friendly coating technologies may reduce environmental impact by 30-45% compared to conventional methods when considering the entire production-to-disposal cycle. However, these improvements often come with higher initial production costs, creating market adoption barriers despite their long-term environmental benefits.

Regulatory frameworks worldwide are increasingly addressing these environmental concerns. The European Union's REACH regulations, China's strengthened environmental protection laws, and the United States EPA guidelines have all established stricter standards for coating materials, driving innovation toward greener alternatives in vapor chamber manufacturing processes.

Cost-Benefit Analysis of Advanced Coating Technologies

The implementation of advanced coating technologies for vapor chambers represents a significant investment decision for manufacturers. When evaluating these technologies from a cost-benefit perspective, initial capital expenditure must be weighed against long-term operational advantages and market competitiveness.

Primary cost factors include equipment acquisition, material expenses, and specialized workforce training. Hydrophilic coating systems typically require investments ranging from $150,000 to $500,000 depending on production scale, while more advanced nano-structured coating technologies may necessitate investments exceeding $1 million. Additionally, ongoing maintenance costs and potential production line modifications must be factored into the total cost of ownership.

Material costs vary significantly across coating types. Traditional copper sintered wicks cost approximately $5-8 per unit, while advanced nano-coatings may range from $12-20 per unit. However, this cost differential must be evaluated against performance improvements and extended product lifecycles.

From a benefits perspective, enhanced thermal efficiency represents the most quantifiable advantage. Field tests demonstrate that vapor chambers with advanced hydrophilic coatings achieve 15-30% improved heat transfer coefficients compared to uncoated alternatives. This translates to potential energy savings of 8-12% in cooling systems, with cumulative savings potentially offsetting initial investments within 18-24 months in high-utilization scenarios.

Product differentiation provides another significant benefit. Manufacturers implementing cutting-edge coating technologies can command premium pricing, with market analysis indicating price premiums of 20-35% for high-performance thermal management solutions incorporating advanced coatings. This premium positioning strengthens profit margins while establishing technological leadership.

Reliability improvements represent another quantifiable benefit. Accelerated life testing shows vapor chambers with specialized coatings maintain performance parameters 30-40% longer than conventional alternatives. This extended operational lifespan reduces warranty claims and replacement costs while enhancing brand reputation.

Environmental considerations also factor into the cost-benefit equation. While some coating processes involve higher initial resource consumption, their efficiency improvements reduce overall energy consumption throughout the product lifecycle. Carbon footprint analyses indicate net positive environmental impacts when considering full product lifecycles, potentially qualifying for environmental certifications and incentives in certain markets.

Return on investment timelines vary by application, with high-performance computing implementations typically achieving ROI within 12-18 months, while consumer electronics applications may require 24-36 months to realize full financial benefits. These timelines are accelerating as manufacturing processes mature and economies of scale improve cost structures.

Primary cost factors include equipment acquisition, material expenses, and specialized workforce training. Hydrophilic coating systems typically require investments ranging from $150,000 to $500,000 depending on production scale, while more advanced nano-structured coating technologies may necessitate investments exceeding $1 million. Additionally, ongoing maintenance costs and potential production line modifications must be factored into the total cost of ownership.

Material costs vary significantly across coating types. Traditional copper sintered wicks cost approximately $5-8 per unit, while advanced nano-coatings may range from $12-20 per unit. However, this cost differential must be evaluated against performance improvements and extended product lifecycles.

From a benefits perspective, enhanced thermal efficiency represents the most quantifiable advantage. Field tests demonstrate that vapor chambers with advanced hydrophilic coatings achieve 15-30% improved heat transfer coefficients compared to uncoated alternatives. This translates to potential energy savings of 8-12% in cooling systems, with cumulative savings potentially offsetting initial investments within 18-24 months in high-utilization scenarios.

Product differentiation provides another significant benefit. Manufacturers implementing cutting-edge coating technologies can command premium pricing, with market analysis indicating price premiums of 20-35% for high-performance thermal management solutions incorporating advanced coatings. This premium positioning strengthens profit margins while establishing technological leadership.

Reliability improvements represent another quantifiable benefit. Accelerated life testing shows vapor chambers with specialized coatings maintain performance parameters 30-40% longer than conventional alternatives. This extended operational lifespan reduces warranty claims and replacement costs while enhancing brand reputation.

Environmental considerations also factor into the cost-benefit equation. While some coating processes involve higher initial resource consumption, their efficiency improvements reduce overall energy consumption throughout the product lifecycle. Carbon footprint analyses indicate net positive environmental impacts when considering full product lifecycles, potentially qualifying for environmental certifications and incentives in certain markets.

Return on investment timelines vary by application, with high-performance computing implementations typically achieving ROI within 12-18 months, while consumer electronics applications may require 24-36 months to realize full financial benefits. These timelines are accelerating as manufacturing processes mature and economies of scale improve cost structures.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!