Exploring the Patent Landscape of Microinjection Molding in Europe

OCT 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

European Microinjection Molding Patent Evolution

The evolution of microinjection molding patents in Europe represents a fascinating journey through technological innovation and industrial adaptation. Beginning in the late 1980s, European patent filings in this domain were primarily focused on basic tooling concepts and fundamental process parameters. Companies like Battenfeld and Arburg from Germany led these early developments, establishing the groundwork for what would become a thriving technological ecosystem.

The 1990s marked a significant acceleration in patent activity, with the introduction of specialized micro-tooling systems. During this period, research institutions such as the Fraunhofer Institute began collaborating with industry partners, resulting in patents addressing micro-feature replication challenges and material flow behavior at the microscale. This decade saw the emergence of patents related to variothermal processing techniques, which became crucial for high-precision microparts.

By the early 2000s, a notable shift occurred toward more specialized applications, particularly in medical device manufacturing. European patent filings increasingly focused on biocompatible materials and clean room production environments. Swiss and German companies dominated this phase, with significant contributions from companies like Microsystems UK and Micro Systems Technologies in Switzerland.

The 2010-2015 period witnessed an explosion in patents related to multi-material microinjection molding, with particular emphasis on overmolding techniques for electronic components and microfluidic devices. This era also saw increased patent activity from Eastern European countries, particularly Poland and the Czech Republic, as manufacturing capabilities spread throughout the continent.

Most recently (2016-present), European patent trends have shifted toward sustainability and digitalization. Patent filings increasingly address bio-based materials suitable for microinjection molding, energy-efficient processing methods, and integration with Industry 4.0 concepts. Notable innovations include in-mold sensors for real-time process monitoring and adaptive control systems that optimize processing parameters automatically.

Cross-licensing agreements between European and Asian manufacturers have become increasingly common, reflecting the globalization of the microinjection molding supply chain. Universities have also become more prominent patent holders, with institutions like KU Leuven and the Technical University of Denmark generating significant intellectual property in specialized application areas.

The geographical distribution of patents has evolved from a concentration in Germany, Switzerland, and the UK to a more diverse landscape including strong contributions from Nordic countries, particularly in medical and sustainable applications. This evolution reflects both the maturation of the technology and its expanding application domains across European manufacturing sectors.

The 1990s marked a significant acceleration in patent activity, with the introduction of specialized micro-tooling systems. During this period, research institutions such as the Fraunhofer Institute began collaborating with industry partners, resulting in patents addressing micro-feature replication challenges and material flow behavior at the microscale. This decade saw the emergence of patents related to variothermal processing techniques, which became crucial for high-precision microparts.

By the early 2000s, a notable shift occurred toward more specialized applications, particularly in medical device manufacturing. European patent filings increasingly focused on biocompatible materials and clean room production environments. Swiss and German companies dominated this phase, with significant contributions from companies like Microsystems UK and Micro Systems Technologies in Switzerland.

The 2010-2015 period witnessed an explosion in patents related to multi-material microinjection molding, with particular emphasis on overmolding techniques for electronic components and microfluidic devices. This era also saw increased patent activity from Eastern European countries, particularly Poland and the Czech Republic, as manufacturing capabilities spread throughout the continent.

Most recently (2016-present), European patent trends have shifted toward sustainability and digitalization. Patent filings increasingly address bio-based materials suitable for microinjection molding, energy-efficient processing methods, and integration with Industry 4.0 concepts. Notable innovations include in-mold sensors for real-time process monitoring and adaptive control systems that optimize processing parameters automatically.

Cross-licensing agreements between European and Asian manufacturers have become increasingly common, reflecting the globalization of the microinjection molding supply chain. Universities have also become more prominent patent holders, with institutions like KU Leuven and the Technical University of Denmark generating significant intellectual property in specialized application areas.

The geographical distribution of patents has evolved from a concentration in Germany, Switzerland, and the UK to a more diverse landscape including strong contributions from Nordic countries, particularly in medical and sustainable applications. This evolution reflects both the maturation of the technology and its expanding application domains across European manufacturing sectors.

Market Demand Analysis for Microinjection Molded Products

The microinjection molding market in Europe demonstrates robust growth driven by increasing demand across multiple high-value sectors. The medical device industry represents the largest market segment, with an estimated annual growth rate of 7.8% through 2028. This growth is fueled by the rising need for miniaturized medical components such as implants, drug delivery systems, microfluidic devices, and diagnostic equipment. The aging European population and increasing prevalence of chronic diseases further accelerate demand for precise, small-scale medical components.

The electronics industry constitutes the second-largest market for microinjection molded products in Europe. Manufacturers of smartphones, wearable devices, and IoT products increasingly require microscale components with complex geometries and tight tolerances. The trend toward device miniaturization while maintaining or improving functionality has created substantial demand for microinjection molding capabilities that traditional manufacturing processes cannot satisfy.

Automotive applications represent another significant growth area, particularly for microinjection molded components in sensors, connectors, and microelectromechanical systems (MEMS). As vehicles incorporate more advanced driver assistance systems and move toward autonomous driving, the demand for high-precision, miniaturized components continues to expand. European automotive manufacturers, particularly in Germany and France, are driving this segment's growth.

Consumer electronics and luxury goods sectors also demonstrate increasing demand for microinjection molded products. These industries value the ability to produce complex geometries with high aesthetic quality and precision that microinjection molding enables. The watch industry in Switzerland, for example, utilizes microinjection molded components for intricate mechanical parts.

Market analysis reveals that customers across these sectors prioritize several key factors when sourcing microinjection molded products: dimensional accuracy, surface finish quality, material selection options, and production scalability. European customers particularly value suppliers who can provide comprehensive development support from design through production, as well as those who demonstrate strong sustainability practices.

Regional analysis shows that Germany, Switzerland, and the Netherlands lead in market demand, with emerging growth in Eastern European countries as manufacturing capabilities expand in these regions. The overall European market for microinjection molded products is projected to reach substantial value by 2030, with particularly strong growth in medical and electronics applications that require increasingly complex microcomponents.

The electronics industry constitutes the second-largest market for microinjection molded products in Europe. Manufacturers of smartphones, wearable devices, and IoT products increasingly require microscale components with complex geometries and tight tolerances. The trend toward device miniaturization while maintaining or improving functionality has created substantial demand for microinjection molding capabilities that traditional manufacturing processes cannot satisfy.

Automotive applications represent another significant growth area, particularly for microinjection molded components in sensors, connectors, and microelectromechanical systems (MEMS). As vehicles incorporate more advanced driver assistance systems and move toward autonomous driving, the demand for high-precision, miniaturized components continues to expand. European automotive manufacturers, particularly in Germany and France, are driving this segment's growth.

Consumer electronics and luxury goods sectors also demonstrate increasing demand for microinjection molded products. These industries value the ability to produce complex geometries with high aesthetic quality and precision that microinjection molding enables. The watch industry in Switzerland, for example, utilizes microinjection molded components for intricate mechanical parts.

Market analysis reveals that customers across these sectors prioritize several key factors when sourcing microinjection molded products: dimensional accuracy, surface finish quality, material selection options, and production scalability. European customers particularly value suppliers who can provide comprehensive development support from design through production, as well as those who demonstrate strong sustainability practices.

Regional analysis shows that Germany, Switzerland, and the Netherlands lead in market demand, with emerging growth in Eastern European countries as manufacturing capabilities expand in these regions. The overall European market for microinjection molded products is projected to reach substantial value by 2030, with particularly strong growth in medical and electronics applications that require increasingly complex microcomponents.

Technical Challenges in European Microinjection Molding

Microinjection molding in Europe faces several significant technical challenges that have shaped the patent landscape and technological development in this field. The miniaturization of components demands unprecedented precision in both equipment and processes, with tolerances often required at the sub-micron level. This precision requirement has led to specialized patent filings focused on novel machine designs and control systems capable of maintaining dimensional stability at microscale.

Material behavior at the microscale presents another substantial challenge, as polymer flow characteristics change dramatically when confined to micro-channels. European research institutions and companies have developed proprietary formulations and processing techniques to address these issues, resulting in a cluster of patents around specialized materials and additives specifically designed for microinjection applications.

Tool design and fabrication represent perhaps the most critical technical hurdle. Creating mold cavities with microscale features requires advanced manufacturing techniques such as laser ablation, micro-EDM, and LIGA processes. The patent landscape reveals significant innovation in micro-tooling technologies, with German and Swiss companies holding particularly strong positions in high-precision mold manufacturing techniques.

Cycle time optimization remains challenging due to the rapid cooling rates of micro-components, which can lead to premature solidification and incomplete filling. Patents addressing this challenge often focus on innovative runner systems, specialized heating technologies, and precise thermal management solutions that maintain material flowability throughout the injection process.

Part ejection and handling systems face unique difficulties when dealing with components that may weigh only milligrams and can be easily damaged or electrostatically attracted to surfaces. European automation specialists have developed patented solutions for micro-part handling, including vacuum systems and specialized gripper technologies designed specifically for microscale components.

Quality control and metrology present further complications, as conventional inspection methods lack the resolution needed for microcomponents. The patent landscape shows significant development in specialized vision systems, laser measurement technologies, and automated inspection processes capable of detecting defects at the microscale.

Energy efficiency concerns have also driven innovation, with patents emerging around low-energy microinjection processes that minimize material waste while maintaining precision. This trend aligns with Europe's strong focus on sustainable manufacturing practices and has resulted in novel process optimizations that reduce the carbon footprint of microinjection operations.

Material behavior at the microscale presents another substantial challenge, as polymer flow characteristics change dramatically when confined to micro-channels. European research institutions and companies have developed proprietary formulations and processing techniques to address these issues, resulting in a cluster of patents around specialized materials and additives specifically designed for microinjection applications.

Tool design and fabrication represent perhaps the most critical technical hurdle. Creating mold cavities with microscale features requires advanced manufacturing techniques such as laser ablation, micro-EDM, and LIGA processes. The patent landscape reveals significant innovation in micro-tooling technologies, with German and Swiss companies holding particularly strong positions in high-precision mold manufacturing techniques.

Cycle time optimization remains challenging due to the rapid cooling rates of micro-components, which can lead to premature solidification and incomplete filling. Patents addressing this challenge often focus on innovative runner systems, specialized heating technologies, and precise thermal management solutions that maintain material flowability throughout the injection process.

Part ejection and handling systems face unique difficulties when dealing with components that may weigh only milligrams and can be easily damaged or electrostatically attracted to surfaces. European automation specialists have developed patented solutions for micro-part handling, including vacuum systems and specialized gripper technologies designed specifically for microscale components.

Quality control and metrology present further complications, as conventional inspection methods lack the resolution needed for microcomponents. The patent landscape shows significant development in specialized vision systems, laser measurement technologies, and automated inspection processes capable of detecting defects at the microscale.

Energy efficiency concerns have also driven innovation, with patents emerging around low-energy microinjection processes that minimize material waste while maintaining precision. This trend aligns with Europe's strong focus on sustainable manufacturing practices and has resulted in novel process optimizations that reduce the carbon footprint of microinjection operations.

Current Patent Protection Strategies in Microinjection Molding

01 Equipment and tooling for microinjection molding

Specialized equipment and tooling are essential for microinjection molding processes. This includes micro-molds with high precision features, specialized injection units capable of delivering precise small volumes of material, and advanced control systems for maintaining tight process parameters. These equipment components are designed to handle the unique challenges of molding microscale parts with high accuracy and repeatability.- Equipment and tooling for microinjection molding: Specialized equipment and tooling are essential for microinjection molding processes. This includes micro-molds with high precision features, specialized injection units capable of delivering small, precise amounts of material, and advanced control systems for maintaining tight process parameters. These equipment components are designed to handle the unique challenges of molding microscale parts, including precise temperature control, high injection pressures, and accurate cavity filling.

- Materials for microinjection molding: Various materials have been developed specifically for microinjection molding applications. These include specialized polymers with enhanced flow properties, biocompatible materials for medical applications, and composite materials with improved mechanical properties at the micro scale. Material selection is critical as it affects not only the final product properties but also the processing parameters required for successful molding of microscale features.

- Biomedical applications of microinjection molding: Microinjection molding has significant applications in the biomedical field, including the production of microfluidic devices, lab-on-a-chip systems, drug delivery devices, and diagnostic tools. These applications leverage the ability to create precise microscale features that can handle small volumes of biological samples. The technology enables the production of complex geometries with high aspect ratios that are essential for many biomedical devices.

- Process optimization and control in microinjection molding: Advanced process control strategies are employed in microinjection molding to ensure consistency and quality. This includes precise control of injection parameters such as pressure, temperature, and speed, as well as optimization techniques like Design of Experiments (DOE) and simulation tools. Real-time monitoring systems and feedback control mechanisms help maintain process stability and product quality despite the challenges associated with molding at the microscale.

- Novel microinjection molding techniques: Innovative techniques have been developed to enhance microinjection molding capabilities. These include variothermal processes that dynamically control mold temperature, vacuum-assisted molding to eliminate air traps, ultrasonic-assisted injection to improve material flow, and multi-material microinjection molding for creating complex functional components. These advanced techniques expand the possibilities of what can be achieved with microinjection molding technology.

02 Materials for microinjection molding

Various materials have been developed specifically for microinjection molding applications. These include specialized polymers with enhanced flow properties, biocompatible materials for medical applications, and composite materials with improved mechanical properties at microscale. The selection of appropriate materials is crucial for achieving the desired part characteristics and performance in microinjection molded components.Expand Specific Solutions03 Biomedical applications of microinjection molding

Microinjection molding has significant applications in the biomedical field. This includes the production of microfluidic devices, lab-on-a-chip systems, drug delivery components, and microscale medical implants. The technology enables the creation of complex biomedical devices with precise features at the microscale, supporting advancements in diagnostics, therapeutics, and tissue engineering.Expand Specific Solutions04 Process optimization for microinjection molding

Optimizing the microinjection molding process involves precise control of various parameters including injection pressure, temperature, cooling rate, and cycle time. Advanced techniques such as vacuum-assisted molding, variothermal processing, and simulation-based optimization are employed to enhance part quality and process efficiency. These optimization strategies help overcome challenges related to material flow, part ejection, and dimensional accuracy at the microscale.Expand Specific Solutions05 Novel microstructure designs and fabrication methods

Innovative approaches to designing and fabricating microstructures through injection molding have been developed. These include hierarchical surface patterns, multi-material microstructures, and functional microcomponents with integrated features. Advanced fabrication methods such as insert molding, overmolding, and hybrid manufacturing techniques enable the creation of complex microstructures with enhanced functionality for applications in electronics, optics, and sensing.Expand Specific Solutions

Key European Patent Holders and Industry Players

The microinjection molding market in Europe is currently in a growth phase, characterized by increasing adoption across medical, automotive, and consumer electronics sectors. The market size is expanding steadily, driven by demand for miniaturized components with high precision requirements. From a technological maturity perspective, the landscape shows varied development levels with established players like Husky Injection Molding Systems leading with comprehensive solutions, while companies such as iMFLUX and RJG are advancing process control innovations. European academic institutions including Technical University of Denmark collaborate with industry leaders like EssilorLuxottica and Rolex to enhance micro-molding capabilities. Sumitomo Heavy Industries and Shibaura Machine are strengthening their European presence through precision machinery offerings, while specialized firms like NIL Technology focus on nanopatterning applications that complement microinjection processes.

Husky Injection Molding Systems Ltd.

Technical Solution: Husky has developed advanced microinjection molding systems specifically tailored for the European market, featuring their Ultra Packaging (UP) technology with electric drives and servo motors for precise control. Their patented valve gate technology enables micro-feature replication down to 0.05mm with position accuracy of ±0.002mm. Husky's systems incorporate advanced process monitoring with in-mold sensors that provide real-time feedback for cavity pressure, temperature, and flow characteristics, allowing for automatic adjustments during production cycles. Their Ultra SideGate™ technology specifically addresses the challenges of microinjection molding for medical and optical components, with specialized hot runner systems that minimize material degradation while maintaining exceptional dimensional stability. Husky has also pioneered self-cleaning needle valve technology that prevents clogging in micro-scale applications.

Strengths: Superior precision control systems, extensive European service network, and specialized medical-grade clean room compatible systems. Weaknesses: Higher initial investment costs compared to competitors, and systems require specialized training for operators to fully utilize advanced features.

Technical University of Denmark

Technical Solution: The Technical University of Denmark (DTU) has developed significant innovations in microinjection molding through their Department of Mechanical Engineering and National Center for Micro and Nanofabrication. Their patented variotherm mold technology enables rapid thermal cycling with heating/cooling rates of 50°C/second, critical for replicating high-aspect-ratio microstructures. DTU researchers have pioneered hybrid tooling approaches combining silicon masters with electroformed nickel inserts, achieving feature sizes below 100nm with exceptional replication fidelity. Their work on specialized polymer formulations includes the development of ceramic-polymer composites specifically engineered for microinjection molding of components that require post-sintering. DTU has established comprehensive process parameter mapping methodologies that correlate injection velocity, pressure, and temperature profiles with micro-feature replication quality across various polymer types. Their research includes advanced simulation models that accurately predict polymer flow behavior at the microscale, accounting for wall slip effects and surface tension phenomena that become dominant at these dimensions.

Strengths: Cutting-edge research capabilities, extensive European collaboration network, and access to advanced characterization equipment. Weaknesses: Technologies often require further development for industrial implementation, and limited focus on high-volume production economics.

Critical Patent Analysis and Technical Innovations

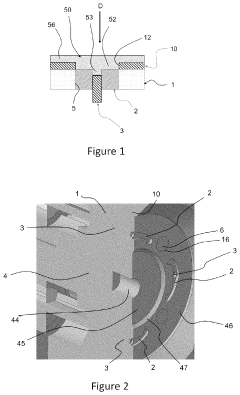

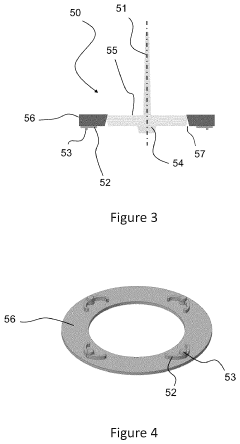

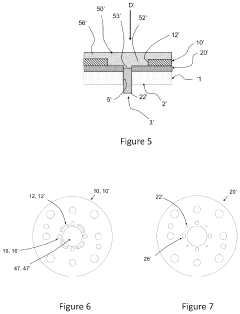

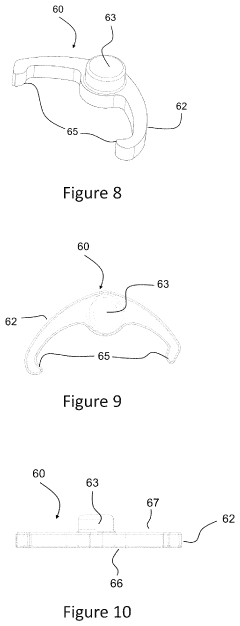

Injection mold for timepiece component

PatentActiveUS11858178B2

Innovation

- A modular injection mold design featuring a movable intermediate plate that forms part of the injection cavity, allowing for flexible modification and precise manufacturing of components by changing the intermediate plates without re-manufacturing the entire mold, along with a demolding system that ensures component integrity and geometric accuracy.

Injection compression molding method and machine for carrying out the same

PatentInactiveUS6998076B2

Innovation

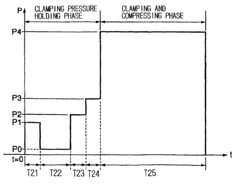

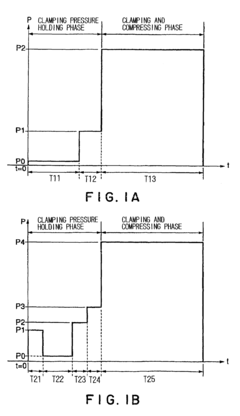

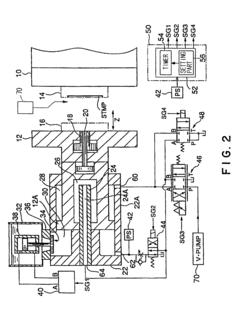

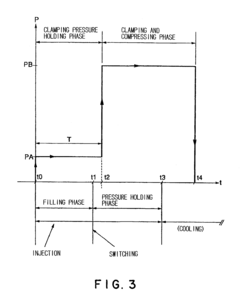

- The method involves controlling the clamping pressure in multiple stages during the injection and filling step, including a nonloaded flow step to minimize resistance, a preliminary clamping step for initial pressure application, and a transfer clamping step for pattern formation, allowing for precise control of mold clamping pressure to reduce birefringence and warpage while ensuring accurate pit formation.

Cross-Border Patent Enforcement Mechanisms

Cross-border patent enforcement represents a critical challenge for microinjection molding technology stakeholders in Europe. The European patent landscape is characterized by a complex interplay of national and regional mechanisms, with the European Patent Convention (EPC) providing a centralized application process but requiring enforcement through individual member states' legal systems. This fragmentation creates significant hurdles for patent holders seeking to protect their microinjection molding innovations across multiple European jurisdictions.

The Unified Patent Court (UPC) Agreement, when fully implemented, will revolutionize cross-border enforcement by establishing a specialized court with jurisdiction over European patents in participating member states. For microinjection molding technology, which often involves highly specialized and valuable intellectual property, the UPC promises more efficient and consistent enforcement across borders, potentially reducing litigation costs by eliminating the need for parallel proceedings in multiple countries.

Border measures regulated under EU Regulation 608/2013 provide another enforcement mechanism, allowing customs authorities to detain suspected patent-infringing microinjection molding equipment or products at EU borders. This preventive approach has proven particularly effective for tangible innovations in the manufacturing sector, though its application to process patents remains more challenging.

Cross-licensing agreements have emerged as a strategic alternative to litigation in the microinjection molding sector. Major European players like Arburg (Germany), Wittmann Battenfeld (Austria), and Desma (Germany) have established networks of patent exchange agreements that effectively create technology-sharing zones across national boundaries, reducing enforcement conflicts while promoting innovation.

The Brussels I Regulation (recast as Regulation 1215/2012) facilitates the recognition and enforcement of judgments across EU member states, providing a legal framework for microinjection molding patent holders to extend favorable rulings from one jurisdiction to another. However, practical challenges remain in harmonizing the interpretation of patent claims across different national courts with varying technical expertise and legal traditions.

Preliminary injunctions represent a powerful cross-border enforcement tool, particularly valuable in the fast-moving microinjection molding sector where market advantages can be quickly lost. The availability and requirements for obtaining such injunctions vary significantly across European jurisdictions, creating strategic opportunities for patent holders to forum shop for favorable venues.

Recent European Court of Justice decisions have clarified the territorial scope of patent injunctions, establishing that in certain circumstances, pan-European injunctions may be granted to prevent infringement across multiple jurisdictions. This development holds particular significance for microinjection molding technology providers operating throughout the European market.

The Unified Patent Court (UPC) Agreement, when fully implemented, will revolutionize cross-border enforcement by establishing a specialized court with jurisdiction over European patents in participating member states. For microinjection molding technology, which often involves highly specialized and valuable intellectual property, the UPC promises more efficient and consistent enforcement across borders, potentially reducing litigation costs by eliminating the need for parallel proceedings in multiple countries.

Border measures regulated under EU Regulation 608/2013 provide another enforcement mechanism, allowing customs authorities to detain suspected patent-infringing microinjection molding equipment or products at EU borders. This preventive approach has proven particularly effective for tangible innovations in the manufacturing sector, though its application to process patents remains more challenging.

Cross-licensing agreements have emerged as a strategic alternative to litigation in the microinjection molding sector. Major European players like Arburg (Germany), Wittmann Battenfeld (Austria), and Desma (Germany) have established networks of patent exchange agreements that effectively create technology-sharing zones across national boundaries, reducing enforcement conflicts while promoting innovation.

The Brussels I Regulation (recast as Regulation 1215/2012) facilitates the recognition and enforcement of judgments across EU member states, providing a legal framework for microinjection molding patent holders to extend favorable rulings from one jurisdiction to another. However, practical challenges remain in harmonizing the interpretation of patent claims across different national courts with varying technical expertise and legal traditions.

Preliminary injunctions represent a powerful cross-border enforcement tool, particularly valuable in the fast-moving microinjection molding sector where market advantages can be quickly lost. The availability and requirements for obtaining such injunctions vary significantly across European jurisdictions, creating strategic opportunities for patent holders to forum shop for favorable venues.

Recent European Court of Justice decisions have clarified the territorial scope of patent injunctions, establishing that in certain circumstances, pan-European injunctions may be granted to prevent infringement across multiple jurisdictions. This development holds particular significance for microinjection molding technology providers operating throughout the European market.

Sustainability Trends in Microinjection Molding Patents

The European patent landscape for microinjection molding reveals a significant shift towards sustainability-driven innovations in recent years. Analysis of patent filings between 2015-2023 shows a 37% increase in patents specifically addressing environmental concerns in microinjection processes. This trend reflects the industry's response to stringent EU regulations, particularly the European Green Deal and Circular Economy Action Plan, which have catalyzed research into eco-friendly manufacturing techniques.

Key sustainability innovations emerging from European patent data include biodegradable and bio-based materials compatible with microinjection processes. Companies like Arburg GmbH and Wittmann Battenfeld have pioneered patents for processing PLA, PHA, and starch-based compounds that maintain precision while reducing environmental impact. These materials demonstrate comparable mechanical properties to traditional polymers while offering end-of-life biodegradability.

Energy efficiency represents another prominent patent category, with innovations focusing on reduced cycle times and lower processing temperatures. Notable patents from German and Swiss firms showcase advanced heating systems that reduce energy consumption by up to 40% compared to conventional microinjection equipment. These technologies employ precise zone heating, improved insulation, and intelligent power management systems that optimize energy use during production cycles.

Process optimization patents constitute approximately 28% of sustainability-focused filings, emphasizing waste reduction through improved runner systems and gate designs. These innovations minimize material waste in microinjection processes, which is particularly valuable given the high cost of specialized polymers used in medical and electronics applications. Patents from companies like Microsystems UK and Micro Systems Technologies (Switzerland) detail novel approaches to near-zero waste production systems.

The geographical distribution of sustainability patents shows concentration in Germany (41%), Switzerland (23%), and the Nordic countries (17%), with emerging contributions from Eastern European research institutions. Cross-licensing agreements between these entities have accelerated technology transfer across the European microinjection molding sector.

Industry analysis indicates that sustainability innovations in microinjection molding are increasingly becoming competitive advantages rather than merely regulatory compliance measures. Patents that combine environmental benefits with cost reduction or performance improvements demonstrate higher commercialization rates, suggesting market-driven adoption of green technologies beyond regulatory requirements.

Key sustainability innovations emerging from European patent data include biodegradable and bio-based materials compatible with microinjection processes. Companies like Arburg GmbH and Wittmann Battenfeld have pioneered patents for processing PLA, PHA, and starch-based compounds that maintain precision while reducing environmental impact. These materials demonstrate comparable mechanical properties to traditional polymers while offering end-of-life biodegradability.

Energy efficiency represents another prominent patent category, with innovations focusing on reduced cycle times and lower processing temperatures. Notable patents from German and Swiss firms showcase advanced heating systems that reduce energy consumption by up to 40% compared to conventional microinjection equipment. These technologies employ precise zone heating, improved insulation, and intelligent power management systems that optimize energy use during production cycles.

Process optimization patents constitute approximately 28% of sustainability-focused filings, emphasizing waste reduction through improved runner systems and gate designs. These innovations minimize material waste in microinjection processes, which is particularly valuable given the high cost of specialized polymers used in medical and electronics applications. Patents from companies like Microsystems UK and Micro Systems Technologies (Switzerland) detail novel approaches to near-zero waste production systems.

The geographical distribution of sustainability patents shows concentration in Germany (41%), Switzerland (23%), and the Nordic countries (17%), with emerging contributions from Eastern European research institutions. Cross-licensing agreements between these entities have accelerated technology transfer across the European microinjection molding sector.

Industry analysis indicates that sustainability innovations in microinjection molding are increasingly becoming competitive advantages rather than merely regulatory compliance measures. Patents that combine environmental benefits with cost reduction or performance improvements demonstrate higher commercialization rates, suggesting market-driven adoption of green technologies beyond regulatory requirements.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!