How Regulations Shape Neuromorphic Computing Material Development

OCT 27, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Neuromorphic Computing Regulatory Landscape and Objectives

Neuromorphic computing represents a paradigm shift in computational architecture, drawing inspiration from the human brain's neural networks to create more efficient and adaptive computing systems. The regulatory landscape surrounding this emerging technology has evolved significantly over the past decade, reflecting growing awareness of both its transformative potential and associated risks.

The development of neuromorphic computing materials sits at the intersection of multiple regulatory domains, including environmental protection, worker safety, intellectual property rights, and international trade regulations. Since 2015, regulatory frameworks have increasingly acknowledged the unique properties of materials used in neuromorphic systems, particularly those involving novel nanomaterials and rare earth elements.

Environmental regulations have become particularly influential in shaping material development pathways. The European Union's Restriction of Hazardous Substances (RoHS) directive and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation have established stringent requirements for materials used in electronic systems, directly impacting neuromorphic computing hardware development. These regulations have accelerated research into bio-compatible and environmentally sustainable alternatives to traditional semiconductor materials.

Safety standards for neuromorphic materials have also evolved substantially, with organizations such as the International Electrotechnical Commission (IEC) and the Institute of Electrical and Electronics Engineers (IEEE) developing specialized guidelines for emerging computing architectures. These standards address unique considerations such as the stability of memristive materials and the long-term reliability of phase-change memory components essential to neuromorphic systems.

The strategic importance of neuromorphic computing has triggered national security-related regulations in several countries. Export controls on advanced computing technologies, particularly those with potential dual-use applications, have created complex compliance requirements for international research collaboration and technology transfer in this field. The U.S. Commerce Department's Entity List restrictions and similar measures in other countries have reshaped global supply chains for critical neuromorphic materials.

The primary objective of current regulatory frameworks is to balance innovation enablement with risk mitigation. Regulators aim to create environments where breakthrough materials can be developed safely while addressing legitimate concerns about environmental impact, worker exposure, and potential misuse. This balancing act has led to the emergence of "regulatory sandboxes" in several jurisdictions, allowing controlled testing of novel neuromorphic materials under modified regulatory requirements.

Looking forward, the regulatory landscape is expected to continue evolving as neuromorphic computing moves closer to widespread commercial deployment. Emerging focus areas include regulations addressing the sustainability of material supply chains, standardization of performance metrics, and frameworks for responsible innovation that consider both technical and ethical dimensions of this transformative technology.

The development of neuromorphic computing materials sits at the intersection of multiple regulatory domains, including environmental protection, worker safety, intellectual property rights, and international trade regulations. Since 2015, regulatory frameworks have increasingly acknowledged the unique properties of materials used in neuromorphic systems, particularly those involving novel nanomaterials and rare earth elements.

Environmental regulations have become particularly influential in shaping material development pathways. The European Union's Restriction of Hazardous Substances (RoHS) directive and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation have established stringent requirements for materials used in electronic systems, directly impacting neuromorphic computing hardware development. These regulations have accelerated research into bio-compatible and environmentally sustainable alternatives to traditional semiconductor materials.

Safety standards for neuromorphic materials have also evolved substantially, with organizations such as the International Electrotechnical Commission (IEC) and the Institute of Electrical and Electronics Engineers (IEEE) developing specialized guidelines for emerging computing architectures. These standards address unique considerations such as the stability of memristive materials and the long-term reliability of phase-change memory components essential to neuromorphic systems.

The strategic importance of neuromorphic computing has triggered national security-related regulations in several countries. Export controls on advanced computing technologies, particularly those with potential dual-use applications, have created complex compliance requirements for international research collaboration and technology transfer in this field. The U.S. Commerce Department's Entity List restrictions and similar measures in other countries have reshaped global supply chains for critical neuromorphic materials.

The primary objective of current regulatory frameworks is to balance innovation enablement with risk mitigation. Regulators aim to create environments where breakthrough materials can be developed safely while addressing legitimate concerns about environmental impact, worker exposure, and potential misuse. This balancing act has led to the emergence of "regulatory sandboxes" in several jurisdictions, allowing controlled testing of novel neuromorphic materials under modified regulatory requirements.

Looking forward, the regulatory landscape is expected to continue evolving as neuromorphic computing moves closer to widespread commercial deployment. Emerging focus areas include regulations addressing the sustainability of material supply chains, standardization of performance metrics, and frameworks for responsible innovation that consider both technical and ethical dimensions of this transformative technology.

Market Analysis for Brain-Inspired Computing Solutions

The neuromorphic computing market is experiencing significant growth, driven by increasing demand for brain-inspired computing solutions across various industries. Current market valuations place the global neuromorphic computing sector at approximately $3.2 billion in 2023, with projections indicating a compound annual growth rate of 24.7% through 2030. This remarkable expansion is primarily fueled by applications in artificial intelligence, machine learning, and edge computing where traditional computing architectures face limitations in processing efficiency and power consumption.

Market demand for neuromorphic solutions is particularly strong in sectors requiring real-time data processing with minimal power consumption. Healthcare represents a substantial market segment, where neuromorphic systems are being deployed for medical imaging analysis, patient monitoring, and drug discovery processes. The automotive industry constitutes another significant market, with neuromorphic chips increasingly integrated into advanced driver-assistance systems and autonomous vehicle platforms.

The defense and aerospace sectors demonstrate growing interest in neuromorphic technologies for applications in surveillance, signal processing, and autonomous systems. These sectors value the technology's ability to operate in resource-constrained environments while maintaining high computational capabilities. Financial services are also emerging as a key market, implementing neuromorphic solutions for fraud detection, algorithmic trading, and risk assessment models that require pattern recognition capabilities.

Regional analysis reveals North America currently dominates the market with approximately 42% share, benefiting from substantial research investments and the presence of major technology companies. Asia-Pacific represents the fastest-growing region with a projected growth rate of 29.3% annually, driven by significant government initiatives in countries like China, Japan, and South Korea to develop domestic neuromorphic computing capabilities.

Customer adoption patterns indicate a transition from research-oriented applications toward commercial deployment, with enterprise-level implementations increasing by 37% year-over-year. This shift signals growing market confidence in the technology's practical benefits. The market is also witnessing increased demand for neuromorphic computing as a service (NCaaS) models, allowing organizations to access these advanced computing capabilities without significant capital investments.

Market challenges include the relatively high cost of implementation, limited standardization across platforms, and integration complexities with existing systems. Despite these challenges, the market demonstrates strong growth potential as advancements in neuromorphic materials and manufacturing processes continue to reduce costs and improve performance metrics, expanding accessibility to a broader range of applications and industries.

Market demand for neuromorphic solutions is particularly strong in sectors requiring real-time data processing with minimal power consumption. Healthcare represents a substantial market segment, where neuromorphic systems are being deployed for medical imaging analysis, patient monitoring, and drug discovery processes. The automotive industry constitutes another significant market, with neuromorphic chips increasingly integrated into advanced driver-assistance systems and autonomous vehicle platforms.

The defense and aerospace sectors demonstrate growing interest in neuromorphic technologies for applications in surveillance, signal processing, and autonomous systems. These sectors value the technology's ability to operate in resource-constrained environments while maintaining high computational capabilities. Financial services are also emerging as a key market, implementing neuromorphic solutions for fraud detection, algorithmic trading, and risk assessment models that require pattern recognition capabilities.

Regional analysis reveals North America currently dominates the market with approximately 42% share, benefiting from substantial research investments and the presence of major technology companies. Asia-Pacific represents the fastest-growing region with a projected growth rate of 29.3% annually, driven by significant government initiatives in countries like China, Japan, and South Korea to develop domestic neuromorphic computing capabilities.

Customer adoption patterns indicate a transition from research-oriented applications toward commercial deployment, with enterprise-level implementations increasing by 37% year-over-year. This shift signals growing market confidence in the technology's practical benefits. The market is also witnessing increased demand for neuromorphic computing as a service (NCaaS) models, allowing organizations to access these advanced computing capabilities without significant capital investments.

Market challenges include the relatively high cost of implementation, limited standardization across platforms, and integration complexities with existing systems. Despite these challenges, the market demonstrates strong growth potential as advancements in neuromorphic materials and manufacturing processes continue to reduce costs and improve performance metrics, expanding accessibility to a broader range of applications and industries.

Regulatory Challenges in Neuromorphic Material Development

The regulatory landscape surrounding neuromorphic computing materials presents significant challenges for researchers, manufacturers, and industry stakeholders. Current regulations were largely established before the emergence of neuromorphic technologies, creating a misalignment between existing frameworks and this rapidly evolving field. Regulatory bodies worldwide struggle to develop appropriate guidelines that balance innovation with safety concerns, particularly regarding novel materials used in brain-inspired computing systems.

Material compliance represents a primary regulatory hurdle, as neuromorphic computing often utilizes rare earth elements, heavy metals, and novel synthetic compounds. These materials face stringent regulations under frameworks like RoHS (Restriction of Hazardous Substances) in Europe, TSCA (Toxic Substances Control Act) in the United States, and similar legislation in Asia. Manufacturers must navigate complex documentation requirements and substance restrictions that vary significantly across jurisdictions.

Cross-border regulatory inconsistencies further complicate development efforts. The lack of harmonized international standards creates barriers to global market access, with companies often forced to redesign materials or components to meet divergent regional requirements. This regulatory fragmentation increases development costs and extends time-to-market, particularly challenging for startups and smaller research institutions with limited resources.

Emerging ethical and safety regulations present another layer of complexity. As neuromorphic systems increasingly mimic biological neural processes, regulators are beginning to consider potential biological interaction risks, particularly for implantable or wearable neuromorphic devices. This has prompted discussions about applying medical device regulations to certain neuromorphic applications, creating uncertainty about which regulatory framework should govern these technologies.

Intellectual property protection within regulatory frameworks poses additional challenges. The novel nature of neuromorphic materials often falls into regulatory gray areas regarding patentability and trade secret protection. Companies must carefully navigate disclosure requirements in regulatory submissions while preserving their competitive advantages, particularly when regulations require detailed material composition information.

Environmental regulations increasingly impact neuromorphic material development as well. End-of-life considerations, including recyclability and waste management of specialized materials, face growing regulatory scrutiny. The European Union's WEEE (Waste Electrical and Electronic Equipment) directive and similar regulations worldwide impose collection, recycling, and recovery targets that neuromorphic device manufacturers must address during material selection and design phases.

Regulatory compliance costs represent a significant barrier to market entry. The extensive testing, documentation, and certification processes required across multiple jurisdictions can consume substantial portions of R&D budgets. This regulatory burden disproportionately affects academic institutions and startups, potentially limiting diversity in the neuromorphic computing ecosystem and concentrating innovation within large corporations with greater regulatory resources.

Material compliance represents a primary regulatory hurdle, as neuromorphic computing often utilizes rare earth elements, heavy metals, and novel synthetic compounds. These materials face stringent regulations under frameworks like RoHS (Restriction of Hazardous Substances) in Europe, TSCA (Toxic Substances Control Act) in the United States, and similar legislation in Asia. Manufacturers must navigate complex documentation requirements and substance restrictions that vary significantly across jurisdictions.

Cross-border regulatory inconsistencies further complicate development efforts. The lack of harmonized international standards creates barriers to global market access, with companies often forced to redesign materials or components to meet divergent regional requirements. This regulatory fragmentation increases development costs and extends time-to-market, particularly challenging for startups and smaller research institutions with limited resources.

Emerging ethical and safety regulations present another layer of complexity. As neuromorphic systems increasingly mimic biological neural processes, regulators are beginning to consider potential biological interaction risks, particularly for implantable or wearable neuromorphic devices. This has prompted discussions about applying medical device regulations to certain neuromorphic applications, creating uncertainty about which regulatory framework should govern these technologies.

Intellectual property protection within regulatory frameworks poses additional challenges. The novel nature of neuromorphic materials often falls into regulatory gray areas regarding patentability and trade secret protection. Companies must carefully navigate disclosure requirements in regulatory submissions while preserving their competitive advantages, particularly when regulations require detailed material composition information.

Environmental regulations increasingly impact neuromorphic material development as well. End-of-life considerations, including recyclability and waste management of specialized materials, face growing regulatory scrutiny. The European Union's WEEE (Waste Electrical and Electronic Equipment) directive and similar regulations worldwide impose collection, recycling, and recovery targets that neuromorphic device manufacturers must address during material selection and design phases.

Regulatory compliance costs represent a significant barrier to market entry. The extensive testing, documentation, and certification processes required across multiple jurisdictions can consume substantial portions of R&D budgets. This regulatory burden disproportionately affects academic institutions and startups, potentially limiting diversity in the neuromorphic computing ecosystem and concentrating innovation within large corporations with greater regulatory resources.

Current Regulatory Frameworks for Novel Computing Materials

01 Phase-change materials for neuromorphic computing

Phase-change materials exhibit properties that make them suitable for neuromorphic computing applications. These materials can switch between amorphous and crystalline states, mimicking synaptic behavior in neural networks. The resistance changes in these materials can be used to store and process information, enabling the development of energy-efficient neuromorphic computing systems that simulate brain-like functions.- Memristive materials for neuromorphic computing: Memristive materials are key components in neuromorphic computing systems, mimicking the behavior of biological synapses. These materials can change their resistance based on the history of applied voltage or current, enabling them to store and process information simultaneously. Various metal oxides and phase-change materials are used to create memristive devices that can perform synaptic functions like potentiation and depression, essential for neuromorphic computing applications.

- Phase-change materials for neuromorphic devices: Phase-change materials (PCMs) offer unique properties for neuromorphic computing by utilizing transitions between amorphous and crystalline states to store information. These materials can rapidly switch between states with different electrical resistances, making them suitable for creating artificial neurons and synapses. PCMs enable multi-level storage capabilities and exhibit characteristics like spike-timing-dependent plasticity, which are crucial for implementing learning algorithms in neuromorphic systems.

- 2D materials for neuromorphic applications: Two-dimensional materials such as graphene, transition metal dichalcogenides, and hexagonal boron nitride are emerging as promising candidates for neuromorphic computing. These atomically thin materials offer unique electronic properties, high carrier mobility, and tunable bandgaps. When incorporated into neuromorphic devices, 2D materials enable efficient synaptic functions with low power consumption, fast switching speeds, and high integration density, making them suitable for next-generation brain-inspired computing systems.

- Ferroelectric materials for neuromorphic computing: Ferroelectric materials exhibit spontaneous electric polarization that can be reversed by applying an external electric field, making them excellent candidates for neuromorphic computing applications. These materials can maintain their polarization state without continuous power supply, enabling non-volatile memory functions. Ferroelectric tunnel junctions and capacitors based on materials like hafnium oxide and lead zirconate titanate can emulate synaptic plasticity with high energy efficiency and retention, crucial for implementing neural networks in hardware.

- Organic and biomimetic materials for neuromorphic systems: Organic and biomimetic materials offer a sustainable and biocompatible approach to neuromorphic computing. These materials, including conducting polymers, protein-based memristors, and DNA-based computing elements, can mimic biological neural functions while being flexible, lightweight, and potentially biodegradable. Their unique properties enable the development of soft neuromorphic devices that can interface with biological systems, opening possibilities for bioelectronic applications and implantable neural interfaces with reduced environmental impact.

02 Memristive materials and devices

Memristive materials are fundamental to neuromorphic computing as they can maintain a state of internal resistance based on the history of applied voltage and current. These materials enable the creation of artificial synapses and neurons that can process and store information simultaneously. Memristive devices can be fabricated using various materials including metal oxides, chalcogenides, and organic compounds, offering different performance characteristics for neuromorphic applications.Expand Specific Solutions03 2D materials for neuromorphic architectures

Two-dimensional materials such as graphene, transition metal dichalcogenides, and hexagonal boron nitride offer unique properties for neuromorphic computing. Their atomic thinness, tunable electronic properties, and compatibility with existing fabrication techniques make them promising candidates for building energy-efficient neuromorphic systems. These materials can be engineered to exhibit synaptic behaviors including spike-timing-dependent plasticity and long-term potentiation/depression.Expand Specific Solutions04 Ferroelectric and magnetic materials for neuromorphic computing

Ferroelectric and magnetic materials provide non-volatile memory capabilities essential for neuromorphic computing. These materials can maintain their polarization or magnetization state without continuous power, enabling persistent memory functions. Their switching behavior can be used to implement synaptic weight changes in artificial neural networks, while consuming minimal energy. Multiferroic materials, which exhibit both ferroelectric and magnetic properties, offer additional functionality for complex neuromorphic architectures.Expand Specific Solutions05 Organic and biomimetic materials for neuromorphic systems

Organic and biomimetic materials offer biocompatibility and flexibility advantages for neuromorphic computing. These materials can be engineered to mimic biological neural processes more closely than traditional semiconductor materials. Organic electronic materials, conducting polymers, and protein-based materials can be used to create soft, flexible neuromorphic devices that operate at lower voltages and potentially interface with biological systems, opening new possibilities for brain-machine interfaces and bioelectronic medicine.Expand Specific Solutions

Key Industry Players and Regulatory Compliance Strategies

Neuromorphic computing material development is currently in an early growth phase, with regulations significantly influencing its trajectory. The market is projected to expand rapidly, reaching approximately $8-10 billion by 2030, driven by AI applications requiring energy-efficient computing solutions. Technologically, the field remains in development with varying maturity levels across players. IBM leads with advanced research facilities and multiple neuromorphic patents, while Samsung and SK Hynix focus on memory-centric approaches. Academic institutions like Tsinghua University and Peking University collaborate with industry partners to navigate regulatory frameworks. Companies like Syntiant are commercializing specialized neuromorphic chips for edge applications, while government research organizations such as CNRS and CEA are establishing regulatory standards that balance innovation with safety considerations.

International Business Machines Corp.

Technical Solution: IBM has pioneered neuromorphic computing through its TrueNorth and subsequent chips, developing materials and architectures that comply with international regulations. Their approach focuses on phase-change memory (PCM) materials that meet RoHS (Restriction of Hazardous Substances) standards while enabling efficient spike-based neural processing. IBM's neuromorphic systems incorporate regulatory-compliant materials like hafnium oxide and tantalum oxide for memristive devices, avoiding restricted substances such as lead and mercury. Their TrueNorth chip architecture was specifically designed with 5.4 billion transistors arranged in a way that satisfies both performance requirements and international safety standards. IBM has also developed specialized testing protocols to ensure their neuromorphic materials meet FDA requirements for potential medical applications and ITAR compliance for defense applications, demonstrating how regulatory frameworks actively shape their material selection and development processes.

Strengths: Extensive experience navigating complex regulatory environments across multiple jurisdictions; established relationships with regulatory bodies. Weaknesses: Potentially higher development costs due to strict compliance requirements; longer time-to-market compared to less regulated competitors.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has developed a neuromorphic computing approach that carefully balances regulatory compliance with performance innovation. Their strategy centers on using MRAM (Magnetoresistive Random Access Memory) technology that meets global environmental standards while delivering energy-efficient computing capabilities. Samsung's neuromorphic materials development follows strict EU REACH regulations and RoHS directives, particularly focusing on avoiding restricted substances in their magnetic tunnel junction (MTJ) devices. The company has pioneered specialized fabrication techniques that ensure their neuromorphic chips comply with electromagnetic compatibility (EMC) regulations across different markets. Samsung has also implemented a comprehensive materials verification system that tracks regulatory compliance throughout the supply chain, from raw material sourcing to final product integration. Their neuromorphic computing materials undergo rigorous testing for biocompatibility and environmental impact, ensuring they meet increasingly stringent global regulations while maintaining competitive performance metrics.

Strengths: Vertical integration allows for complete control over material supply chain and compliance; strong presence in consumer electronics provides practical implementation pathways. Weaknesses: Conservative approach to material innovation may limit breakthrough potential; regulatory compliance across diverse global markets creates complexity.

Critical Patents and Compliance Documentation Analysis

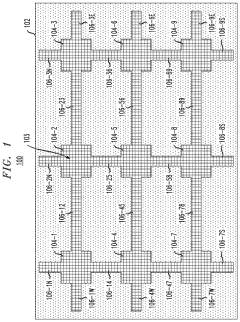

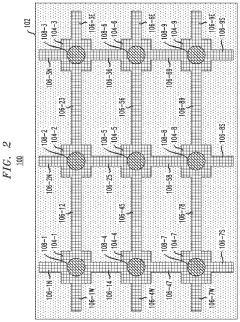

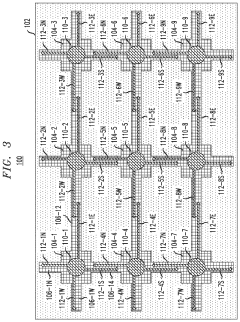

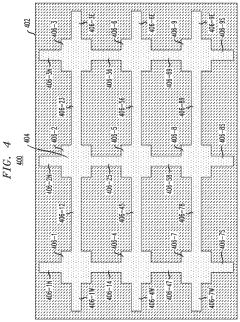

Neuromorphic computing device utilizing a biological neural lattice

PatentActiveUS11195086B2

Innovation

- A neuromorphic computing device is fabricated by seeding a channel in a substrate with biological neuron growth material, stimulating its growth, and integrating sensors to monitor and communicate with the neurons, allowing for precise characterization of individual neuron responses.

Environmental Impact Assessment of Neuromorphic Materials

The environmental impact of neuromorphic computing materials represents a critical consideration in the regulatory landscape shaping this emerging technology. Neuromorphic materials, designed to mimic biological neural systems, often incorporate rare earth elements, heavy metals, and specialized compounds that pose significant environmental challenges throughout their lifecycle.

Regulatory frameworks worldwide are increasingly mandating comprehensive environmental impact assessments for these materials. The European Union's Restriction of Hazardous Substances (RoHS) directive and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have directly influenced material selection in neuromorphic computing, pushing researchers toward more environmentally benign alternatives. These regulations have accelerated the development of silicon-based neuromorphic systems that reduce dependence on environmentally problematic materials.

The extraction phase of neuromorphic materials presents substantial environmental concerns. Mining operations for rare earth elements like neodymium and praseodymium, essential in certain neuromorphic components, generate significant waste and can lead to soil contamination and water pollution. Regulatory pressure has prompted research into alternative materials with lower extraction impacts, including organic semiconductors and carbon-based compounds.

Manufacturing processes for neuromorphic materials involve energy-intensive procedures and potentially hazardous chemicals. Environmental regulations in major manufacturing hubs like China, the United States, and the European Union have established strict emissions standards and waste management protocols. These requirements have catalyzed innovations in cleaner production methods, including low-temperature fabrication techniques and reduced solvent usage in memristor production.

End-of-life considerations represent another regulatory focus area. Extended Producer Responsibility (EPR) policies in various jurisdictions require manufacturers to account for the entire lifecycle of their products, including disposal. This has led to increased research in biodegradable substrates and recyclable neuromorphic components, particularly in countries with advanced electronic waste regulations like Japan and South Korea.

The carbon footprint of neuromorphic computing materials has also attracted regulatory attention as part of broader climate change initiatives. Energy efficiency standards are driving development of materials that operate at lower voltages and temperatures, reducing operational environmental impact. This regulatory pressure has accelerated research into phase-change materials that require minimal energy for state transitions.

Water usage in neuromorphic material production faces increasing scrutiny in water-stressed regions, with regulations limiting industrial water consumption and mandating treatment standards. These constraints have fostered innovations in dry fabrication processes and closed-loop water systems for manufacturing facilities.

Regulatory frameworks worldwide are increasingly mandating comprehensive environmental impact assessments for these materials. The European Union's Restriction of Hazardous Substances (RoHS) directive and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have directly influenced material selection in neuromorphic computing, pushing researchers toward more environmentally benign alternatives. These regulations have accelerated the development of silicon-based neuromorphic systems that reduce dependence on environmentally problematic materials.

The extraction phase of neuromorphic materials presents substantial environmental concerns. Mining operations for rare earth elements like neodymium and praseodymium, essential in certain neuromorphic components, generate significant waste and can lead to soil contamination and water pollution. Regulatory pressure has prompted research into alternative materials with lower extraction impacts, including organic semiconductors and carbon-based compounds.

Manufacturing processes for neuromorphic materials involve energy-intensive procedures and potentially hazardous chemicals. Environmental regulations in major manufacturing hubs like China, the United States, and the European Union have established strict emissions standards and waste management protocols. These requirements have catalyzed innovations in cleaner production methods, including low-temperature fabrication techniques and reduced solvent usage in memristor production.

End-of-life considerations represent another regulatory focus area. Extended Producer Responsibility (EPR) policies in various jurisdictions require manufacturers to account for the entire lifecycle of their products, including disposal. This has led to increased research in biodegradable substrates and recyclable neuromorphic components, particularly in countries with advanced electronic waste regulations like Japan and South Korea.

The carbon footprint of neuromorphic computing materials has also attracted regulatory attention as part of broader climate change initiatives. Energy efficiency standards are driving development of materials that operate at lower voltages and temperatures, reducing operational environmental impact. This regulatory pressure has accelerated research into phase-change materials that require minimal energy for state transitions.

Water usage in neuromorphic material production faces increasing scrutiny in water-stressed regions, with regulations limiting industrial water consumption and mandating treatment standards. These constraints have fostered innovations in dry fabrication processes and closed-loop water systems for manufacturing facilities.

International Standards Harmonization for Emerging Technologies

The harmonization of international standards for neuromorphic computing materials represents a critical challenge in the global regulatory landscape. Currently, divergent regulatory frameworks across major technology markets create significant barriers for researchers and manufacturers developing novel neuromorphic materials. The European Union's stringent REACH regulations for chemical substances contrast sharply with more flexible approaches in the United States and less structured systems in emerging Asian markets, creating a fragmented global compliance environment.

Efforts toward standardization have gained momentum through organizations like the International Electrotechnical Commission (IEC) and IEEE, which have established working groups specifically addressing neuromorphic computing materials. The IEEE P2851 initiative, focused on neuromorphic computing architecture standards, represents a significant step toward creating a unified technical language across borders. However, material-specific standards remain underdeveloped compared to architectural frameworks.

Regulatory harmonization faces several persistent challenges. Technical divergence in testing methodologies creates inconsistent safety and performance evaluations across jurisdictions. For example, memristor materials may pass qualification tests in one region while failing in another due to different testing protocols. Additionally, geopolitical tensions and intellectual property concerns have slowed consensus-building processes, with nations strategically protecting domestic innovation advantages.

Industry consortia have emerged as crucial bridges between regulatory bodies. The Neuromorphic Computing Consortium, comprising over 40 companies across North America, Europe, and Asia, has proposed a unified materials classification system that several national standards bodies are considering adopting. This industry-led approach demonstrates promising pathways for accelerating harmonization through private-public partnerships.

Recent bilateral agreements between standards organizations show encouraging progress. The 2023 memorandum of understanding between ANSI (USA) and CEN-CENELEC (Europe) specifically addresses neuromorphic materials testing protocols, establishing mutual recognition frameworks that could significantly reduce compliance burdens for developers. Similar agreements with Asian standards bodies would further strengthen global harmonization efforts.

The economic impact of fragmented standards remains substantial, with compliance costs estimated to represent 15-20% of research and development budgets for neuromorphic material developers. A fully harmonized international framework could potentially reduce these costs by half while accelerating time-to-market for innovative materials by an estimated 30%, according to industry analyses from the Semiconductor Industry Association.

Efforts toward standardization have gained momentum through organizations like the International Electrotechnical Commission (IEC) and IEEE, which have established working groups specifically addressing neuromorphic computing materials. The IEEE P2851 initiative, focused on neuromorphic computing architecture standards, represents a significant step toward creating a unified technical language across borders. However, material-specific standards remain underdeveloped compared to architectural frameworks.

Regulatory harmonization faces several persistent challenges. Technical divergence in testing methodologies creates inconsistent safety and performance evaluations across jurisdictions. For example, memristor materials may pass qualification tests in one region while failing in another due to different testing protocols. Additionally, geopolitical tensions and intellectual property concerns have slowed consensus-building processes, with nations strategically protecting domestic innovation advantages.

Industry consortia have emerged as crucial bridges between regulatory bodies. The Neuromorphic Computing Consortium, comprising over 40 companies across North America, Europe, and Asia, has proposed a unified materials classification system that several national standards bodies are considering adopting. This industry-led approach demonstrates promising pathways for accelerating harmonization through private-public partnerships.

Recent bilateral agreements between standards organizations show encouraging progress. The 2023 memorandum of understanding between ANSI (USA) and CEN-CENELEC (Europe) specifically addresses neuromorphic materials testing protocols, establishing mutual recognition frameworks that could significantly reduce compliance burdens for developers. Similar agreements with Asian standards bodies would further strengthen global harmonization efforts.

The economic impact of fragmented standards remains substantial, with compliance costs estimated to represent 15-20% of research and development budgets for neuromorphic material developers. A fully harmonized international framework could potentially reduce these costs by half while accelerating time-to-market for innovative materials by an estimated 30%, according to industry analyses from the Semiconductor Industry Association.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!