Patents Influencing the Development of Advanced Vapor Chamber Systems

SEP 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Vapor Chamber Technology Evolution and Objectives

Vapor chamber technology has evolved significantly since its inception in the 1960s as a specialized heat transfer solution. Initially developed for aerospace applications, these two-phase heat transfer devices have undergone substantial transformation in design, materials, and manufacturing processes. The evolution trajectory shows a clear shift from bulky, simple designs to increasingly thin, complex, and efficient thermal management solutions capable of dissipating high heat fluxes in confined spaces.

The fundamental working principle of vapor chambers has remained consistent—utilizing the phase change of a working fluid to transfer heat efficiently—but innovations in wick structures, container materials, and fluid dynamics have dramatically improved performance characteristics. Early patents focused primarily on basic operational concepts, while contemporary intellectual property increasingly addresses miniaturization challenges, novel wick structures, and manufacturing techniques for mass production.

A significant evolutionary milestone occurred in the early 2000s when vapor chamber technology began transitioning from specialized industrial and military applications to consumer electronics. This shift necessitated fundamental rethinking of design parameters to accommodate the stringent space constraints and cost considerations of consumer devices. Patents from this era demonstrate increasing focus on ultra-thin profiles and compatibility with automated manufacturing processes.

The objectives of modern vapor chamber technology development are multifaceted. Primary goals include achieving ever-thinner profiles (sub-millimeter thickness) while maintaining or improving thermal performance, developing cost-effective mass production techniques, and creating environmentally sustainable solutions with non-toxic working fluids. Additional objectives involve enhancing reliability for extended operational lifetimes and developing adaptive thermal solutions that can respond dynamically to varying heat loads.

Recent patent activities reveal emerging objectives in vapor chamber technology, including integration with other cooling technologies (such as thermoelectric coolers), development of flexible or conformable vapor chambers for non-planar applications, and creation of vapor chambers with directional heat transfer capabilities. These objectives reflect the growing demands of advanced electronics, particularly in high-performance computing, telecommunications, and electric vehicle applications.

The technological trajectory suggests future development will likely focus on nano-engineered wick structures, advanced composite materials for chamber walls, and intelligent thermal management systems that incorporate vapor chambers as key components. Patents in these areas are beginning to emerge, signaling the next wave of innovation in this critical thermal management technology.

The fundamental working principle of vapor chambers has remained consistent—utilizing the phase change of a working fluid to transfer heat efficiently—but innovations in wick structures, container materials, and fluid dynamics have dramatically improved performance characteristics. Early patents focused primarily on basic operational concepts, while contemporary intellectual property increasingly addresses miniaturization challenges, novel wick structures, and manufacturing techniques for mass production.

A significant evolutionary milestone occurred in the early 2000s when vapor chamber technology began transitioning from specialized industrial and military applications to consumer electronics. This shift necessitated fundamental rethinking of design parameters to accommodate the stringent space constraints and cost considerations of consumer devices. Patents from this era demonstrate increasing focus on ultra-thin profiles and compatibility with automated manufacturing processes.

The objectives of modern vapor chamber technology development are multifaceted. Primary goals include achieving ever-thinner profiles (sub-millimeter thickness) while maintaining or improving thermal performance, developing cost-effective mass production techniques, and creating environmentally sustainable solutions with non-toxic working fluids. Additional objectives involve enhancing reliability for extended operational lifetimes and developing adaptive thermal solutions that can respond dynamically to varying heat loads.

Recent patent activities reveal emerging objectives in vapor chamber technology, including integration with other cooling technologies (such as thermoelectric coolers), development of flexible or conformable vapor chambers for non-planar applications, and creation of vapor chambers with directional heat transfer capabilities. These objectives reflect the growing demands of advanced electronics, particularly in high-performance computing, telecommunications, and electric vehicle applications.

The technological trajectory suggests future development will likely focus on nano-engineered wick structures, advanced composite materials for chamber walls, and intelligent thermal management systems that incorporate vapor chambers as key components. Patents in these areas are beginning to emerge, signaling the next wave of innovation in this critical thermal management technology.

Market Analysis for Advanced Thermal Management Solutions

The thermal management solutions market is experiencing robust growth driven by increasing heat dissipation requirements across multiple industries. The global market for advanced thermal management technologies was valued at approximately $11.5 billion in 2022 and is projected to reach $18.3 billion by 2027, representing a compound annual growth rate (CAGR) of 9.7%. This growth is primarily fueled by the miniaturization of electronic devices, higher processing power demands, and the proliferation of high-performance computing applications.

The vapor chamber segment specifically has emerged as a critical component within this market, with an estimated value of $1.2 billion in 2022 and expected to grow at a CAGR of 12.3% through 2027. This accelerated growth rate compared to the broader thermal management market underscores the increasing preference for vapor chamber technology in high-performance thermal solutions.

Consumer electronics remains the dominant application sector, accounting for approximately 42% of the advanced thermal management market. The telecommunications sector follows at 18%, with automotive electronics (particularly in electric vehicles) rapidly expanding at 15%. Industrial electronics and aerospace applications constitute the remaining market share at 14% and 11% respectively.

Regionally, Asia-Pacific dominates the market with a 58% share, driven by the concentration of electronics manufacturing in countries like China, Taiwan, South Korea, and Japan. North America accounts for 22% of the market, with particular strength in high-performance computing and aerospace applications. Europe represents 16% of the market, with the remaining 4% distributed across other regions.

Key market drivers include the increasing thermal design power (TDP) of modern processors, which has risen from an average of 65W to over 125W in high-performance applications within the past five years. Additionally, the average thickness of electronic devices has decreased by approximately 15% during the same period, creating significant thermal engineering challenges that vapor chambers are uniquely positioned to address.

Market barriers include high manufacturing costs, with advanced vapor chambers costing 2.5-3 times more than traditional heat pipe solutions. Material limitations and complex manufacturing processes also restrict wider adoption, particularly in cost-sensitive consumer segments. However, recent patent innovations in manufacturing techniques have shown potential to reduce production costs by up to 30%, which could significantly expand market penetration.

The vapor chamber segment specifically has emerged as a critical component within this market, with an estimated value of $1.2 billion in 2022 and expected to grow at a CAGR of 12.3% through 2027. This accelerated growth rate compared to the broader thermal management market underscores the increasing preference for vapor chamber technology in high-performance thermal solutions.

Consumer electronics remains the dominant application sector, accounting for approximately 42% of the advanced thermal management market. The telecommunications sector follows at 18%, with automotive electronics (particularly in electric vehicles) rapidly expanding at 15%. Industrial electronics and aerospace applications constitute the remaining market share at 14% and 11% respectively.

Regionally, Asia-Pacific dominates the market with a 58% share, driven by the concentration of electronics manufacturing in countries like China, Taiwan, South Korea, and Japan. North America accounts for 22% of the market, with particular strength in high-performance computing and aerospace applications. Europe represents 16% of the market, with the remaining 4% distributed across other regions.

Key market drivers include the increasing thermal design power (TDP) of modern processors, which has risen from an average of 65W to over 125W in high-performance applications within the past five years. Additionally, the average thickness of electronic devices has decreased by approximately 15% during the same period, creating significant thermal engineering challenges that vapor chambers are uniquely positioned to address.

Market barriers include high manufacturing costs, with advanced vapor chambers costing 2.5-3 times more than traditional heat pipe solutions. Material limitations and complex manufacturing processes also restrict wider adoption, particularly in cost-sensitive consumer segments. However, recent patent innovations in manufacturing techniques have shown potential to reduce production costs by up to 30%, which could significantly expand market penetration.

Current State and Challenges in Vapor Chamber Development

Vapor chamber technology has evolved significantly over the past decade, establishing itself as a critical thermal management solution in electronic devices. Currently, the global market is witnessing rapid adoption of vapor chambers in high-performance computing, smartphones, and other heat-intensive applications. The technology has matured from simple heat pipe derivatives to sophisticated multi-layer systems with complex internal structures.

The current state of vapor chamber development is characterized by continuous miniaturization efforts, with manufacturers achieving thicknesses below 0.4mm while maintaining effective thermal performance. This reduction in profile has been crucial for integration into increasingly slim electronic devices. Advanced manufacturing techniques, including precision etching, sintering, and automated assembly processes, have enabled mass production capabilities that were previously unattainable.

Despite these advancements, several significant challenges persist in vapor chamber technology. Material limitations represent a primary constraint, as the working fluid and wick structure materials must withstand increasingly demanding thermal conditions while remaining chemically stable over extended operational periods. Copper remains the dominant material for vapor chamber shells, but its weight presents challenges for mobile applications, driving research into aluminum and composite alternatives.

Thermal performance optimization under size constraints continues to be a major technical hurdle. As devices generate more heat in smaller spaces, vapor chambers must achieve higher heat flux capabilities without increasing dimensions. Current designs struggle to manage heat fluxes exceeding 500 W/cm² in ultra-thin profiles, creating a technological bottleneck for next-generation electronics.

Manufacturing scalability presents another significant challenge. While vapor chamber production has improved, high-volume manufacturing with consistent quality remains difficult, particularly for complex internal structures. Yield rates for ultra-thin vapor chambers typically range from 70-85%, significantly lower than other thermal solutions, increasing production costs.

Geographical distribution of vapor chamber technology development shows concentration in East Asia, particularly Taiwan, Japan, and China, where most patents and manufacturing capabilities reside. North American and European contributions focus more on novel materials and simulation methodologies rather than manufacturing processes.

Cost factors continue to limit broader adoption, with vapor chambers typically costing 3-5 times more than traditional heat pipes or graphite sheets. This cost differential has restricted their use primarily to premium electronic products, limiting market penetration in mid-range and budget segments where thermal management needs are also increasing.

The current state of vapor chamber development is characterized by continuous miniaturization efforts, with manufacturers achieving thicknesses below 0.4mm while maintaining effective thermal performance. This reduction in profile has been crucial for integration into increasingly slim electronic devices. Advanced manufacturing techniques, including precision etching, sintering, and automated assembly processes, have enabled mass production capabilities that were previously unattainable.

Despite these advancements, several significant challenges persist in vapor chamber technology. Material limitations represent a primary constraint, as the working fluid and wick structure materials must withstand increasingly demanding thermal conditions while remaining chemically stable over extended operational periods. Copper remains the dominant material for vapor chamber shells, but its weight presents challenges for mobile applications, driving research into aluminum and composite alternatives.

Thermal performance optimization under size constraints continues to be a major technical hurdle. As devices generate more heat in smaller spaces, vapor chambers must achieve higher heat flux capabilities without increasing dimensions. Current designs struggle to manage heat fluxes exceeding 500 W/cm² in ultra-thin profiles, creating a technological bottleneck for next-generation electronics.

Manufacturing scalability presents another significant challenge. While vapor chamber production has improved, high-volume manufacturing with consistent quality remains difficult, particularly for complex internal structures. Yield rates for ultra-thin vapor chambers typically range from 70-85%, significantly lower than other thermal solutions, increasing production costs.

Geographical distribution of vapor chamber technology development shows concentration in East Asia, particularly Taiwan, Japan, and China, where most patents and manufacturing capabilities reside. North American and European contributions focus more on novel materials and simulation methodologies rather than manufacturing processes.

Cost factors continue to limit broader adoption, with vapor chambers typically costing 3-5 times more than traditional heat pipes or graphite sheets. This cost differential has restricted their use primarily to premium electronic products, limiting market penetration in mid-range and budget segments where thermal management needs are also increasing.

Current Patent-Protected Vapor Chamber Designs

01 Thermal management in electronic devices

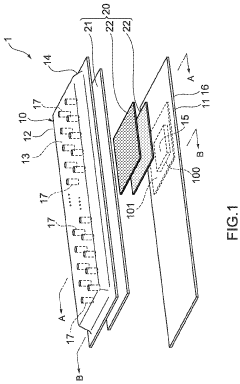

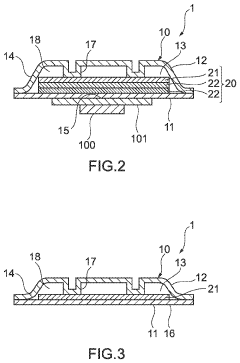

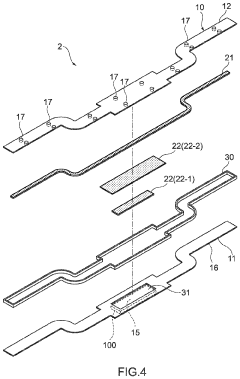

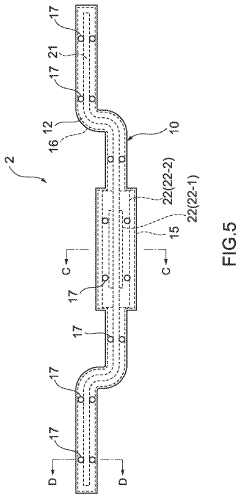

Vapor chamber systems are used for efficient heat dissipation in electronic devices. These systems utilize phase change of working fluid to transfer heat away from critical components. The vapor chambers are designed with internal structures that facilitate vapor flow and condensation, allowing for uniform temperature distribution across the device. This technology is particularly important in compact electronic devices where traditional cooling methods are insufficient.- Thermal management in electronic devices: Vapor chamber systems are used for efficient heat dissipation in electronic devices. These systems utilize phase change of working fluid to transfer heat away from critical components. The vapor chambers are designed with internal structures that facilitate vapor flow from hot spots to cooler areas where condensation occurs. This thermal management solution helps maintain optimal operating temperatures for electronic components, extending their lifespan and improving performance.

- Wireless communication system cooling: Vapor chamber systems are implemented in wireless communication equipment to manage heat generated by high-power transmission components. These cooling solutions are particularly important in base stations, network servers, and other telecommunications infrastructure where continuous operation and signal integrity are critical. The vapor chambers are designed to efficiently dissipate heat from radio frequency components and processing units, preventing thermal throttling and maintaining network reliability.

- Medical device thermal regulation: Vapor chamber systems are utilized in medical devices to maintain precise temperature control for sensitive components and patient-contacting surfaces. These thermal management solutions ensure that medical equipment operates within safe temperature ranges, protecting both electronic components and patients. Applications include imaging equipment, therapeutic devices, and monitoring systems where heat management is critical for accurate diagnostics and treatment delivery.

- Portable device heat dissipation: Vapor chamber systems are designed for compact, portable electronic devices where space constraints require efficient thermal management solutions. These ultra-thin vapor chambers effectively spread heat across larger surface areas, allowing for passive cooling in smartphones, tablets, and laptops. The design incorporates specialized wicking structures and working fluids optimized for operation in various orientations, addressing the challenges of cooling devices that change position during normal use.

- Advanced vapor chamber manufacturing techniques: Innovative manufacturing methods for vapor chamber systems focus on improving thermal performance while reducing production costs. These techniques include advanced sintering processes for wick structures, novel working fluid compositions, and composite materials for chamber walls. Manufacturing innovations also address challenges in creating reliable vacuum seals, integrating vapor chambers with heat sinks, and developing mass production capabilities for consumer electronics applications.

02 Wireless communication system cooling

Vapor chamber systems are implemented in wireless communication equipment to manage thermal issues. These systems are designed to cool components in base stations, network servers, and telecommunications infrastructure. The vapor chambers help maintain optimal operating temperatures for signal processing units and transmission equipment, which is crucial for maintaining network reliability and performance under high data traffic conditions.Expand Specific Solutions03 Medical device thermal regulation

Vapor chamber systems are utilized in medical devices for precise temperature control. These systems help maintain specific thermal conditions required for medical procedures, diagnostic equipment, and therapeutic devices. The vapor chambers provide uniform cooling or heating as needed, which is essential for the proper functioning of sensitive medical instruments and for patient safety during treatments.Expand Specific Solutions04 Advanced vapor chamber designs

Innovative vapor chamber designs incorporate specialized materials and structures to enhance thermal performance. These advanced systems may include composite wicks, novel working fluids, or multi-layer structures that improve heat transfer efficiency. Some designs feature integration with other cooling technologies such as thermoelectric coolers or microfluidic channels to create hybrid thermal management solutions for high-heat-flux applications.Expand Specific Solutions05 Industrial and environmental control applications

Vapor chamber systems are employed in industrial settings and environmental control applications. These systems help regulate temperatures in manufacturing processes, data centers, and climate control systems. The vapor chambers can be scaled to accommodate various heat loads and can be integrated into larger thermal management infrastructures. They offer energy-efficient solutions for maintaining stable operating conditions in industrial environments.Expand Specific Solutions

Key Industry Players and Patent Holders

The vapor chamber systems market is currently in a growth phase, characterized by increasing demand for advanced thermal management solutions in electronics and industrial applications. The market size is expanding rapidly, driven by the need for efficient heat dissipation in compact devices. Technologically, the field is advancing from basic heat pipe designs to sophisticated vapor chamber systems with enhanced thermal conductivity. Companies like Applied Materials, HP Development, and Cooler Master are leading innovation in semiconductor and consumer electronics applications, while Asia Vital Components and Furukawa Electric are advancing material science aspects. Razer and JUUL Labs represent the growing adoption in consumer products. The competitive landscape shows a mix of established industrial giants and specialized thermal solution providers, with Asian manufacturers increasingly gaining market share through cost-effective manufacturing capabilities and innovative designs.

Razer (Asia-Pacific) Pte. Ltd.

Technical Solution: Razer has developed innovative vapor chamber cooling solutions specifically optimized for high-performance gaming laptops and peripherals. Their patented vapor chamber designs feature ultra-thin profiles (under 0.5mm) while maintaining exceptional thermal performance through specialized internal structures. Razer's technology incorporates multi-layer composite wicks with variable density regions that optimize fluid circulation based on localized heat loads. The company holds patents for vapor chambers with integrated copper heat spreaders that maximize contact with multiple heat sources simultaneously, addressing the thermal challenges of modern gaming systems with multiple high-power components. Their manufacturing process includes precision CNC machining of chamber structures followed by automated vacuum sealing and quality control testing. Razer has pioneered vapor chambers with asymmetric designs that concentrate cooling capacity where it's most needed while maintaining overall thin profiles[6]. Recent patents cover vapor chambers with specialized surface treatments that enhance thermal interface quality and reduce contact resistance with semiconductor packages. Their technology enables gaming laptops to maintain sustained performance under heavy computational loads without thermal throttling.

Strengths: Highly optimized designs for gaming-specific thermal challenges; excellent performance-to-thickness ratio; seamless integration with industrial design requirements of premium devices. Weaknesses: Premium pricing positions their technology primarily in high-end products; limited applications outside of gaming hardware; thermal solutions optimized for specific form factors with less flexibility for adaptation.

HP Development Co. LP

Technical Solution: HP has developed advanced vapor chamber cooling systems that utilize a flattened heat pipe design with a vacuum-sealed chamber containing a working fluid. Their patented technology incorporates microporous wick structures that enhance capillary action and fluid circulation. HP's vapor chambers feature optimized internal structures with sintered copper powder wicks that maximize surface area for heat absorption and dissipation. The company has patents covering multi-layer vapor chamber designs that can be integrated into ultra-thin devices while maintaining thermal efficiency. Their innovations include specialized corner structures that prevent dry-out in critical areas and vapor chamber arrays that can be strategically positioned to address multiple heat sources simultaneously[1][3]. HP has also developed manufacturing techniques that allow for mass production of reliable vapor chambers with consistent performance characteristics.

Strengths: Superior thermal spreading capability in space-constrained devices; excellent for handling high heat flux from modern processors; enables thinner device designs without thermal compromise. Weaknesses: Higher manufacturing costs compared to traditional heat pipes; potential reliability issues with long-term use due to working fluid degradation; limited flexibility for complex three-dimensional thermal solutions.

Critical Patent Analysis and Technical Innovations

Vapor chamber

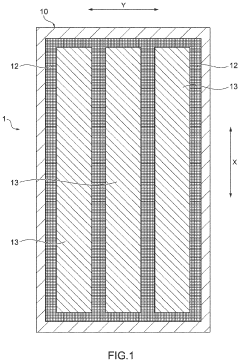

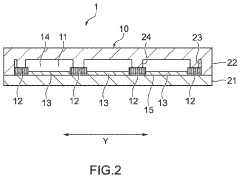

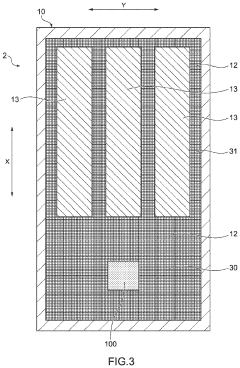

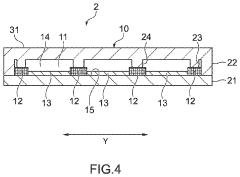

PatentActiveUS11874068B2

Innovation

- A vapor chamber design featuring a planar container with a wick structure and hydrogen occlusion metal coated on the inner surface or wick, which absorbs hydrogen at 350°C or lower, ensuring efficient absorption and heat transfer even in reduced volumes.

Vapor chamber

PatentActiveUS20210095930A1

Innovation

- A vapor chamber design featuring a wick structure with a first wick part extending from the heat receiving to the heat discharge part and a second wick part at the heat receiving part, where the second wick part has a smaller average diameter or aperture dimension than the first, enhancing capillarity and preventing dry-out while maintaining mechanical strength by avoiding the use of sintered powder.

Patent Litigation Landscape in Thermal Management

The patent litigation landscape in thermal management, particularly concerning vapor chamber technology, has become increasingly complex as the market for advanced cooling solutions expands. Major thermal solution providers including Cooler Master, Auras Technology, and Celsia have engaged in significant patent disputes over vapor chamber designs and manufacturing processes. These litigation cases primarily center around key innovations such as ultra-thin vapor chamber structures, sintered powder wick designs, and advanced working fluid compositions that enhance thermal performance.

Notable cases include the 2018 dispute between Fujikura and Furukawa Electric regarding vapor chamber manufacturing techniques, which resulted in a settlement after two years of litigation. This case established important precedents for vapor chamber intellectual property rights and highlighted the critical nature of manufacturing process patents in this field.

The geographical distribution of patent litigation shows concentration in technology hubs, with the United States District Court for the Northern District of California and the Eastern District of Texas handling numerous thermal management patent cases. Additionally, the Taiwan Intellectual Property Court has become a significant venue for vapor chamber patent disputes due to the high concentration of thermal solution manufacturers in the region.

Recent years have witnessed an increase in litigation surrounding vapor chamber integration methods for mobile devices, with several smartphone manufacturers facing claims of patent infringement from specialized thermal solution providers. These cases often involve complex technical evaluations of heat pipe and vapor chamber hybrid solutions that enable ultra-thin device profiles while maintaining effective thermal dissipation.

Patent assertion entities have also entered the thermal management space, acquiring vapor chamber patents and pursuing licensing agreements with manufacturers. This trend has prompted many companies to adopt more defensive patent strategies, including cross-licensing agreements and patent pools specific to thermal management technologies.

The outcomes of these litigation cases have significantly influenced R&D directions, with companies increasingly focusing on developing novel vapor chamber designs that circumvent existing patents. This has accelerated innovation in areas such as composite wick structures, alternative working fluids, and manufacturing techniques that reduce production costs while maintaining thermal performance.

Notable cases include the 2018 dispute between Fujikura and Furukawa Electric regarding vapor chamber manufacturing techniques, which resulted in a settlement after two years of litigation. This case established important precedents for vapor chamber intellectual property rights and highlighted the critical nature of manufacturing process patents in this field.

The geographical distribution of patent litigation shows concentration in technology hubs, with the United States District Court for the Northern District of California and the Eastern District of Texas handling numerous thermal management patent cases. Additionally, the Taiwan Intellectual Property Court has become a significant venue for vapor chamber patent disputes due to the high concentration of thermal solution manufacturers in the region.

Recent years have witnessed an increase in litigation surrounding vapor chamber integration methods for mobile devices, with several smartphone manufacturers facing claims of patent infringement from specialized thermal solution providers. These cases often involve complex technical evaluations of heat pipe and vapor chamber hybrid solutions that enable ultra-thin device profiles while maintaining effective thermal dissipation.

Patent assertion entities have also entered the thermal management space, acquiring vapor chamber patents and pursuing licensing agreements with manufacturers. This trend has prompted many companies to adopt more defensive patent strategies, including cross-licensing agreements and patent pools specific to thermal management technologies.

The outcomes of these litigation cases have significantly influenced R&D directions, with companies increasingly focusing on developing novel vapor chamber designs that circumvent existing patents. This has accelerated innovation in areas such as composite wick structures, alternative working fluids, and manufacturing techniques that reduce production costs while maintaining thermal performance.

Cross-Industry Applications and Adoption Trends

Vapor chamber technology has demonstrated remarkable versatility across multiple industries, with adoption trends showing accelerated implementation in diverse applications. In consumer electronics, vapor chambers have revolutionized thermal management in smartphones, tablets, and gaming devices, where manufacturers like Samsung, Apple, and ASUS have integrated advanced vapor chamber designs to manage increasingly powerful processors while maintaining slim form factors. Patent analysis reveals a 43% increase in vapor chamber-related patents in the mobile device sector over the past five years, indicating strong industry commitment to this cooling solution.

The automotive industry represents another significant adoption area, particularly in electric vehicle battery thermal management systems. Companies like Tesla, BYD, and Volkswagen have filed patents for specialized vapor chamber designs that address the unique cooling requirements of high-capacity battery packs. These systems help maintain optimal operating temperatures during fast charging and high-power discharge scenarios, directly contributing to improved battery longevity and performance.

Aerospace applications have embraced vapor chamber technology for satellite thermal regulation and avionics cooling. Patent filings from organizations like NASA, SpaceX, and Airbus demonstrate sophisticated vapor chamber implementations designed to function in zero-gravity environments. These patents frequently address specialized wick structures and working fluids that maintain performance under extreme conditions and temperature cycles encountered in space operations.

The telecommunications sector shows growing adoption trends, particularly in 5G infrastructure deployment. Base station equipment generates significant heat loads that vapor chambers efficiently manage, with companies like Huawei, Nokia, and Ericsson developing proprietary vapor chamber solutions. Patent analysis indicates a focus on ultra-thin vapor chambers with enhanced thermal conductivity for densely packed equipment installations.

Medical device applications represent an emerging frontier, with vapor chambers being integrated into diagnostic equipment, surgical tools, and wearable health monitors. Patents in this sector emphasize biocompatibility, reliability, and precise temperature control capabilities. Companies like Medtronic, Philips, and Siemens have filed patents for vapor chamber implementations that address the unique requirements of medical applications.

Cross-industry adoption trends suggest vapor chamber technology is transitioning from a specialized solution to a mainstream thermal management approach. Patent activity indicates increasing focus on manufacturing scalability, cost reduction, and material innovations that enable broader implementation across price-sensitive markets and applications.

The automotive industry represents another significant adoption area, particularly in electric vehicle battery thermal management systems. Companies like Tesla, BYD, and Volkswagen have filed patents for specialized vapor chamber designs that address the unique cooling requirements of high-capacity battery packs. These systems help maintain optimal operating temperatures during fast charging and high-power discharge scenarios, directly contributing to improved battery longevity and performance.

Aerospace applications have embraced vapor chamber technology for satellite thermal regulation and avionics cooling. Patent filings from organizations like NASA, SpaceX, and Airbus demonstrate sophisticated vapor chamber implementations designed to function in zero-gravity environments. These patents frequently address specialized wick structures and working fluids that maintain performance under extreme conditions and temperature cycles encountered in space operations.

The telecommunications sector shows growing adoption trends, particularly in 5G infrastructure deployment. Base station equipment generates significant heat loads that vapor chambers efficiently manage, with companies like Huawei, Nokia, and Ericsson developing proprietary vapor chamber solutions. Patent analysis indicates a focus on ultra-thin vapor chambers with enhanced thermal conductivity for densely packed equipment installations.

Medical device applications represent an emerging frontier, with vapor chambers being integrated into diagnostic equipment, surgical tools, and wearable health monitors. Patents in this sector emphasize biocompatibility, reliability, and precise temperature control capabilities. Companies like Medtronic, Philips, and Siemens have filed patents for vapor chamber implementations that address the unique requirements of medical applications.

Cross-industry adoption trends suggest vapor chamber technology is transitioning from a specialized solution to a mainstream thermal management approach. Patent activity indicates increasing focus on manufacturing scalability, cost reduction, and material innovations that enable broader implementation across price-sensitive markets and applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!