Silicon photonics and its implications for digital currency security.

JUL 17, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Silicon Photonics Evolution and Objectives

Silicon photonics has emerged as a transformative technology in the field of integrated optics, revolutionizing the way we process and transmit information. The evolution of this technology can be traced back to the late 1980s when researchers first began exploring the potential of integrating optical components with silicon-based electronic circuits. Over the past three decades, silicon photonics has experienced rapid advancements, driven by the increasing demand for high-speed data transmission and processing in various applications.

The primary objective of silicon photonics is to leverage the well-established silicon manufacturing infrastructure to create photonic integrated circuits (PICs) that can manipulate light at the chip scale. This integration aims to overcome the limitations of traditional electronic circuits in terms of speed, power consumption, and bandwidth. By utilizing silicon as the primary material for photonic devices, researchers and engineers have been able to achieve unprecedented levels of integration and functionality.

One of the key drivers behind the development of silicon photonics has been the telecommunications industry's need for faster and more efficient data transmission systems. As the volume of data traffic continues to grow exponentially, traditional copper-based interconnects are reaching their fundamental limits. Silicon photonics offers a promising solution by enabling the transmission of data using light, which can travel at much higher speeds and with lower power consumption compared to electrical signals.

In recent years, the scope of silicon photonics has expanded beyond telecommunications to encompass a wide range of applications, including data centers, high-performance computing, and sensing. The technology's ability to integrate multiple photonic functions on a single chip has opened up new possibilities for compact, energy-efficient, and high-speed devices. This has led to increased interest from various industries, including the financial sector, where the potential for enhanced security in digital currency transactions has become a significant focus.

The evolution of silicon photonics has been marked by several key milestones, including the development of efficient silicon-based modulators, photodetectors, and waveguides. These advancements have paved the way for the creation of complex photonic circuits capable of performing a wide range of functions, from signal routing to wavelength division multiplexing. As the technology continues to mature, researchers are exploring new frontiers, such as the integration of silicon photonics with other emerging technologies like quantum computing and artificial intelligence.

Looking ahead, the objectives for silicon photonics in the context of digital currency security are multifaceted. The technology aims to provide ultra-secure communication channels for cryptocurrency transactions, leveraging the inherent properties of light to create tamper-resistant systems. Additionally, silicon photonics seeks to enable faster and more energy-efficient processing of complex cryptographic algorithms, potentially revolutionizing the way digital currencies are mined, traded, and secured.

The primary objective of silicon photonics is to leverage the well-established silicon manufacturing infrastructure to create photonic integrated circuits (PICs) that can manipulate light at the chip scale. This integration aims to overcome the limitations of traditional electronic circuits in terms of speed, power consumption, and bandwidth. By utilizing silicon as the primary material for photonic devices, researchers and engineers have been able to achieve unprecedented levels of integration and functionality.

One of the key drivers behind the development of silicon photonics has been the telecommunications industry's need for faster and more efficient data transmission systems. As the volume of data traffic continues to grow exponentially, traditional copper-based interconnects are reaching their fundamental limits. Silicon photonics offers a promising solution by enabling the transmission of data using light, which can travel at much higher speeds and with lower power consumption compared to electrical signals.

In recent years, the scope of silicon photonics has expanded beyond telecommunications to encompass a wide range of applications, including data centers, high-performance computing, and sensing. The technology's ability to integrate multiple photonic functions on a single chip has opened up new possibilities for compact, energy-efficient, and high-speed devices. This has led to increased interest from various industries, including the financial sector, where the potential for enhanced security in digital currency transactions has become a significant focus.

The evolution of silicon photonics has been marked by several key milestones, including the development of efficient silicon-based modulators, photodetectors, and waveguides. These advancements have paved the way for the creation of complex photonic circuits capable of performing a wide range of functions, from signal routing to wavelength division multiplexing. As the technology continues to mature, researchers are exploring new frontiers, such as the integration of silicon photonics with other emerging technologies like quantum computing and artificial intelligence.

Looking ahead, the objectives for silicon photonics in the context of digital currency security are multifaceted. The technology aims to provide ultra-secure communication channels for cryptocurrency transactions, leveraging the inherent properties of light to create tamper-resistant systems. Additionally, silicon photonics seeks to enable faster and more energy-efficient processing of complex cryptographic algorithms, potentially revolutionizing the way digital currencies are mined, traded, and secured.

Digital Currency Security Market Analysis

The digital currency security market has experienced significant growth in recent years, driven by the increasing adoption of cryptocurrencies and blockchain technology. As the value and volume of digital transactions continue to rise, the demand for robust security solutions has become paramount. This market encompasses a wide range of products and services, including hardware wallets, encryption technologies, multi-factor authentication systems, and secure key management solutions.

The market size for digital currency security is projected to expand substantially over the next decade. This growth is fueled by several factors, including the proliferation of cryptocurrency exchanges, the emergence of decentralized finance (DeFi) platforms, and the growing interest from institutional investors. Additionally, the increasing frequency and sophistication of cyber attacks targeting digital assets have heightened awareness of the need for advanced security measures.

One of the key trends shaping the digital currency security market is the integration of hardware-based security solutions. Hardware wallets and secure elements have gained popularity due to their ability to provide offline storage and protection against various forms of cyber threats. The market has also seen a surge in demand for multi-signature wallet solutions, which offer enhanced security by requiring multiple approvals for transactions.

The regulatory landscape plays a crucial role in shaping the digital currency security market. As governments and financial institutions worldwide grapple with the implications of cryptocurrencies, there is a growing emphasis on compliance and risk management. This has led to increased demand for security solutions that not only protect digital assets but also facilitate regulatory compliance and auditing.

Silicon photonics technology has the potential to significantly impact the digital currency security market. Its ability to enable high-speed, low-latency communication and data processing could enhance the performance and security of blockchain networks. Furthermore, the integration of silicon photonics in hardware security modules and quantum-resistant cryptographic systems could provide a new level of protection against emerging threats, including those posed by quantum computing.

The competitive landscape of the digital currency security market is diverse, with a mix of established cybersecurity firms, blockchain-specific startups, and hardware manufacturers. As the market matures, we are likely to see increased consolidation through mergers and acquisitions, as well as strategic partnerships between technology providers and financial institutions.

Looking ahead, the digital currency security market is expected to evolve rapidly, driven by technological advancements and changing regulatory requirements. The integration of artificial intelligence and machine learning for threat detection and prevention, as well as the development of quantum-safe cryptographic algorithms, are likely to be key areas of innovation in the coming years.

The market size for digital currency security is projected to expand substantially over the next decade. This growth is fueled by several factors, including the proliferation of cryptocurrency exchanges, the emergence of decentralized finance (DeFi) platforms, and the growing interest from institutional investors. Additionally, the increasing frequency and sophistication of cyber attacks targeting digital assets have heightened awareness of the need for advanced security measures.

One of the key trends shaping the digital currency security market is the integration of hardware-based security solutions. Hardware wallets and secure elements have gained popularity due to their ability to provide offline storage and protection against various forms of cyber threats. The market has also seen a surge in demand for multi-signature wallet solutions, which offer enhanced security by requiring multiple approvals for transactions.

The regulatory landscape plays a crucial role in shaping the digital currency security market. As governments and financial institutions worldwide grapple with the implications of cryptocurrencies, there is a growing emphasis on compliance and risk management. This has led to increased demand for security solutions that not only protect digital assets but also facilitate regulatory compliance and auditing.

Silicon photonics technology has the potential to significantly impact the digital currency security market. Its ability to enable high-speed, low-latency communication and data processing could enhance the performance and security of blockchain networks. Furthermore, the integration of silicon photonics in hardware security modules and quantum-resistant cryptographic systems could provide a new level of protection against emerging threats, including those posed by quantum computing.

The competitive landscape of the digital currency security market is diverse, with a mix of established cybersecurity firms, blockchain-specific startups, and hardware manufacturers. As the market matures, we are likely to see increased consolidation through mergers and acquisitions, as well as strategic partnerships between technology providers and financial institutions.

Looking ahead, the digital currency security market is expected to evolve rapidly, driven by technological advancements and changing regulatory requirements. The integration of artificial intelligence and machine learning for threat detection and prevention, as well as the development of quantum-safe cryptographic algorithms, are likely to be key areas of innovation in the coming years.

Silicon Photonics: Current State and Challenges

Silicon photonics has emerged as a transformative technology in the field of integrated optics, offering unprecedented capabilities for high-speed data transmission and processing. However, the current state of silicon photonics faces several significant challenges that need to be addressed for its widespread adoption and application in digital currency security.

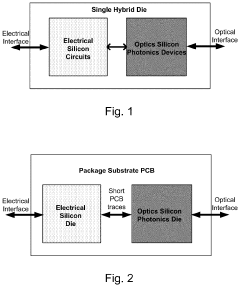

One of the primary challenges is the integration of photonic components with electronic circuits. While silicon photonics offers superior performance in terms of bandwidth and energy efficiency, seamlessly combining optical and electrical components on a single chip remains a complex task. This integration is crucial for realizing the full potential of silicon photonics in secure digital currency systems, where both optical and electronic processing are required.

Another major hurdle is the development of efficient light sources compatible with silicon photonics. Silicon itself is an indirect bandgap material, making it inherently inefficient for light emission. While progress has been made in integrating III-V materials for light generation, achieving high-performance, cost-effective, and scalable on-chip light sources remains a significant challenge.

The miniaturization of photonic components is another area of ongoing research and development. As digital currency systems demand increasingly compact and portable solutions, reducing the size of photonic devices while maintaining their performance is crucial. This includes the development of novel waveguide structures, compact modulators, and efficient photodetectors.

Thermal management presents another significant challenge in silicon photonics. The thermo-optic effect in silicon can lead to performance variations and instabilities in photonic devices. Developing effective thermal control mechanisms and temperature-insensitive designs is essential for ensuring the reliability and consistency of silicon photonic systems in digital currency applications.

Manufacturing and scalability issues also pose challenges to the widespread adoption of silicon photonics. While the technology leverages existing CMOS fabrication processes, achieving high yields and cost-effective production of complex photonic circuits remains difficult. Overcoming these manufacturing hurdles is crucial for the large-scale deployment of silicon photonics in digital currency security systems.

Furthermore, the development of standardized design and testing methodologies for silicon photonic devices and systems is an ongoing challenge. Establishing industry-wide standards and protocols is essential for ensuring interoperability and reliability across different platforms and applications in the digital currency ecosystem.

Lastly, the current state of silicon photonics faces challenges in achieving ultra-low power consumption, which is critical for energy-efficient digital currency systems. While photonics offers inherent advantages in terms of energy efficiency, further improvements in device design and system architecture are needed to minimize power consumption without compromising performance.

One of the primary challenges is the integration of photonic components with electronic circuits. While silicon photonics offers superior performance in terms of bandwidth and energy efficiency, seamlessly combining optical and electrical components on a single chip remains a complex task. This integration is crucial for realizing the full potential of silicon photonics in secure digital currency systems, where both optical and electronic processing are required.

Another major hurdle is the development of efficient light sources compatible with silicon photonics. Silicon itself is an indirect bandgap material, making it inherently inefficient for light emission. While progress has been made in integrating III-V materials for light generation, achieving high-performance, cost-effective, and scalable on-chip light sources remains a significant challenge.

The miniaturization of photonic components is another area of ongoing research and development. As digital currency systems demand increasingly compact and portable solutions, reducing the size of photonic devices while maintaining their performance is crucial. This includes the development of novel waveguide structures, compact modulators, and efficient photodetectors.

Thermal management presents another significant challenge in silicon photonics. The thermo-optic effect in silicon can lead to performance variations and instabilities in photonic devices. Developing effective thermal control mechanisms and temperature-insensitive designs is essential for ensuring the reliability and consistency of silicon photonic systems in digital currency applications.

Manufacturing and scalability issues also pose challenges to the widespread adoption of silicon photonics. While the technology leverages existing CMOS fabrication processes, achieving high yields and cost-effective production of complex photonic circuits remains difficult. Overcoming these manufacturing hurdles is crucial for the large-scale deployment of silicon photonics in digital currency security systems.

Furthermore, the development of standardized design and testing methodologies for silicon photonic devices and systems is an ongoing challenge. Establishing industry-wide standards and protocols is essential for ensuring interoperability and reliability across different platforms and applications in the digital currency ecosystem.

Lastly, the current state of silicon photonics faces challenges in achieving ultra-low power consumption, which is critical for energy-efficient digital currency systems. While photonics offers inherent advantages in terms of energy efficiency, further improvements in device design and system architecture are needed to minimize power consumption without compromising performance.

Silicon Photonics Solutions for Cryptocurrency Security

01 Secure optical communication systems

Silicon photonics technology is utilized to develop secure optical communication systems. These systems employ advanced encryption techniques and quantum key distribution to ensure data confidentiality and integrity in high-speed optical networks.- Secure optical communication systems: Silicon photonics technology is utilized to develop secure optical communication systems. These systems employ advanced encryption techniques and quantum key distribution to ensure data confidentiality and integrity in high-speed optical networks. The integration of silicon photonics enables miniaturization and improved performance of secure communication devices.

- Tamper-resistant photonic integrated circuits: Photonic integrated circuits (PICs) are designed with tamper-resistant features to enhance security. These circuits incorporate physical unclonable functions (PUFs) and anti-tampering mechanisms to prevent unauthorized access and protect sensitive information. The use of silicon photonics allows for the integration of complex security features directly into the chip.

- Quantum-safe cryptography using silicon photonics: Silicon photonics is employed to develop quantum-safe cryptographic systems. These systems utilize quantum key distribution and other quantum-resistant algorithms to provide security against potential threats from quantum computers. The integration of quantum cryptography with silicon photonics enables practical and scalable implementations of quantum-safe security solutions.

- Secure optical sensing and imaging: Silicon photonics technology is applied to create secure optical sensing and imaging systems. These systems incorporate advanced encryption and authentication mechanisms to protect sensor data and prevent unauthorized access. The use of silicon photonics enables the development of compact, high-performance secure sensors for various applications.

- Secure photonic neural networks: Silicon photonics is utilized to develop secure photonic neural networks for AI and machine learning applications. These networks incorporate hardware-level security features to protect sensitive data and algorithms. The integration of security mechanisms with photonic neural networks enables high-speed, energy-efficient, and secure AI processing.

02 Tamper-resistant photonic integrated circuits

Designing tamper-resistant photonic integrated circuits (PICs) using silicon photonics technology. These PICs incorporate security features such as physical unclonable functions (PUFs) and obfuscation techniques to prevent reverse engineering and unauthorized access.Expand Specific Solutions03 Quantum-safe cryptography implementation

Implementing quantum-safe cryptography algorithms on silicon photonics platforms. This approach aims to develop cryptographic systems that can withstand attacks from both classical and quantum computers, ensuring long-term security for sensitive data transmission.Expand Specific Solutions04 Secure photonic sensors and detectors

Developing secure photonic sensors and detectors using silicon photonics technology. These devices incorporate anti-tampering mechanisms and secure data processing to ensure the integrity and confidentiality of sensor readings in various applications, including IoT and industrial monitoring.Expand Specific Solutions05 Photonic hardware security modules

Creating photonic hardware security modules (HSMs) based on silicon photonics technology. These modules provide secure key storage, cryptographic operations, and random number generation for various security applications, offering improved performance and energy efficiency compared to traditional electronic HSMs.Expand Specific Solutions

Key Players in Silicon Photonics and Cryptocurrency

The silicon photonics market for digital currency security is in its early growth stage, with significant potential for expansion. The global market size is projected to reach several billion dollars by 2025, driven by increasing demand for secure and high-speed data transmission in financial transactions. While the technology is still evolving, major players like Huawei, IBM, and GlobalFoundries are investing heavily in R&D to advance silicon photonics capabilities. Companies such as TSMC and Marvell are also developing innovative solutions, indicating a competitive landscape with both established tech giants and specialized firms. The involvement of research institutions like MIT and industry collaborations suggest rapid technological progress, though full commercial maturity is still a few years away.

Huawei Technologies Co., Ltd.

Technical Solution: Huawei has been actively developing silicon photonics technologies with potential applications in digital currency security. Their approach focuses on creating high-speed, low-power photonic integrated circuits that can enhance the performance and security of blockchain networks. Huawei has demonstrated silicon photonic transceivers capable of 400 Gbps data transmission rates, which could significantly improve the speed and efficiency of digital currency transactions [9]. They have also been working on integrating silicon photonics with their AI chips to create powerful, energy-efficient systems for real-time transaction processing and fraud detection. Huawei's research extends to quantum-resistant cryptography implemented on silicon photonic platforms, aiming to future-proof digital currency systems against potential quantum computing threats [10].

Strengths: Strong integration capabilities, extensive experience in telecommunications infrastructure. Weaknesses: Geopolitical challenges affecting global market access, potential security concerns from some countries.

Taiwan Semiconductor Manufacturing Co., Ltd.

Technical Solution: TSMC has made significant strides in silicon photonics for digital currency security applications. Their approach focuses on developing advanced photonic integrated circuits (PICs) that can be seamlessly integrated with existing CMOS technology. TSMC's silicon photonics platform enables the production of high-performance, low-power chips that are crucial for secure digital currency transactions. They have achieved data transmission rates of up to 224 Gbps using their advanced silicon photonics technology [3]. TSMC's photonic chips also incorporate on-chip laser sources and high-speed modulators, which enhance the security of data transmission by enabling advanced encryption techniques. Their manufacturing process allows for the integration of multiple photonic components on a single chip, reducing the overall system complexity and improving reliability [4].

Strengths: Advanced manufacturing capabilities, high integration density of photonic components. Weaknesses: Dependence on specialized equipment, potential supply chain vulnerabilities.

Breakthrough Patents in Silicon Photonics for Cryptography

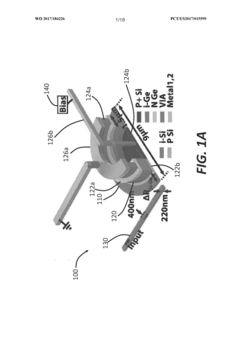

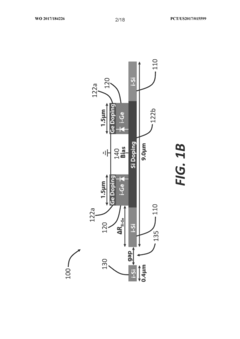

Apparatus, systems, and methods for waveguide-coupled resonant photon detection

PatentWO2017184226A1

Innovation

- A germanium layer is evanescently coupled to a resonator, allowing for extended interaction length without increasing detector size, with a bias voltage applied to convert absorbed light into electrical signals, and the internal and external quality factors of the resonator are matched for high quantum efficiency.

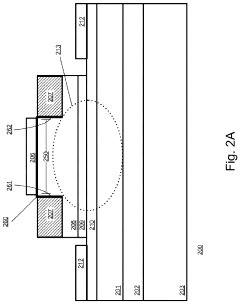

Silicon photonics based module for executing peer-to-peer transactions

PatentActiveUS11914547B2

Innovation

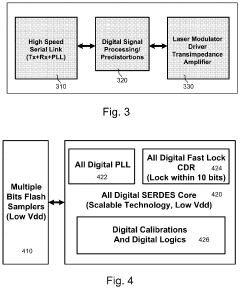

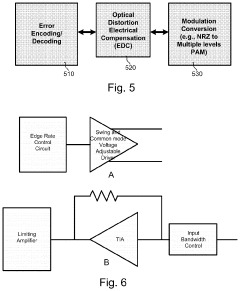

- A Silicon Photonics-based optical module is integrated into a single-chip device for high-bandwidth data transfer and secure peer-to-peer transactions, utilizing a communication interface that includes a Serializer/Deserializer block, clock data recovery, and error correction mechanisms, along with a secure encryption protocol for cryptocurrency transactions.

Quantum-Resistant Cryptography with Silicon Photonics

Silicon photonics has emerged as a promising technology for enhancing the security of digital currencies in the face of quantum computing threats. By leveraging the unique properties of light and silicon-based integrated circuits, quantum-resistant cryptography can be implemented to safeguard digital transactions and communications.

The integration of silicon photonics with quantum-resistant cryptography offers several advantages. First, it enables the generation of high-quality random numbers, which are essential for robust encryption algorithms. Silicon photonic devices can exploit quantum effects to produce truly random bits at high speeds, surpassing the capabilities of traditional electronic random number generators.

Furthermore, silicon photonics facilitates the implementation of quantum key distribution (QKD) protocols. QKD leverages the principles of quantum mechanics to establish secure communication channels that are theoretically immune to eavesdropping. By encoding information in the quantum states of photons, silicon photonic circuits can transmit and process quantum keys with high efficiency and low error rates.

Another significant application of silicon photonics in quantum-resistant cryptography is the development of photonic-based post-quantum cryptographic algorithms. These algorithms are designed to withstand attacks from both classical and quantum computers. Silicon photonic circuits can accelerate the execution of complex mathematical operations required by post-quantum cryptographic schemes, such as lattice-based or multivariate cryptography.

The scalability and compatibility of silicon photonics with existing semiconductor manufacturing processes make it an attractive platform for implementing quantum-resistant cryptography in digital currency systems. Silicon photonic chips can be mass-produced using established CMOS fabrication techniques, enabling cost-effective deployment of secure cryptographic solutions.

Moreover, the high-speed operation and low power consumption of silicon photonic devices offer significant advantages for digital currency applications. These characteristics allow for rapid encryption and decryption of transactions, as well as efficient key management and distribution, without compromising the energy efficiency of cryptocurrency networks.

As quantum computing continues to advance, the integration of silicon photonics and quantum-resistant cryptography will play a crucial role in ensuring the long-term security of digital currencies. By combining the strengths of both technologies, robust cryptographic systems can be developed to protect against potential quantum attacks while maintaining the performance and scalability required for widespread adoption of digital currencies.

The integration of silicon photonics with quantum-resistant cryptography offers several advantages. First, it enables the generation of high-quality random numbers, which are essential for robust encryption algorithms. Silicon photonic devices can exploit quantum effects to produce truly random bits at high speeds, surpassing the capabilities of traditional electronic random number generators.

Furthermore, silicon photonics facilitates the implementation of quantum key distribution (QKD) protocols. QKD leverages the principles of quantum mechanics to establish secure communication channels that are theoretically immune to eavesdropping. By encoding information in the quantum states of photons, silicon photonic circuits can transmit and process quantum keys with high efficiency and low error rates.

Another significant application of silicon photonics in quantum-resistant cryptography is the development of photonic-based post-quantum cryptographic algorithms. These algorithms are designed to withstand attacks from both classical and quantum computers. Silicon photonic circuits can accelerate the execution of complex mathematical operations required by post-quantum cryptographic schemes, such as lattice-based or multivariate cryptography.

The scalability and compatibility of silicon photonics with existing semiconductor manufacturing processes make it an attractive platform for implementing quantum-resistant cryptography in digital currency systems. Silicon photonic chips can be mass-produced using established CMOS fabrication techniques, enabling cost-effective deployment of secure cryptographic solutions.

Moreover, the high-speed operation and low power consumption of silicon photonic devices offer significant advantages for digital currency applications. These characteristics allow for rapid encryption and decryption of transactions, as well as efficient key management and distribution, without compromising the energy efficiency of cryptocurrency networks.

As quantum computing continues to advance, the integration of silicon photonics and quantum-resistant cryptography will play a crucial role in ensuring the long-term security of digital currencies. By combining the strengths of both technologies, robust cryptographic systems can be developed to protect against potential quantum attacks while maintaining the performance and scalability required for widespread adoption of digital currencies.

Regulatory Framework for Photonic Cryptocurrency Security

The regulatory framework for photonic cryptocurrency security is a critical aspect of the evolving landscape where silicon photonics intersects with digital currency protection. As governments and financial institutions grapple with the implications of this emerging technology, a comprehensive regulatory approach is essential to ensure the integrity and security of digital transactions.

At the forefront of this regulatory framework is the need for standardization of photonic encryption methods. Regulatory bodies must establish clear guidelines for the implementation of quantum-resistant cryptographic algorithms that leverage the unique properties of silicon photonics. These standards should address key generation, transmission, and storage protocols to maintain the highest level of security against both classical and quantum attacks.

Another crucial element of the regulatory framework is the certification process for photonic security devices and systems. Regulatory agencies need to develop rigorous testing and validation procedures to ensure that photonic-based cryptocurrency security solutions meet stringent performance and security requirements. This certification process should include regular audits and updates to keep pace with technological advancements and emerging threats.

Data protection and privacy regulations must also be adapted to accommodate the unique characteristics of photonic cryptocurrency security. Regulators should focus on establishing guidelines for secure key management, data retention policies, and user privacy protection in photonic-enabled digital currency systems. These regulations should strike a balance between security requirements and individual privacy rights.

International cooperation and harmonization of regulations are essential components of an effective regulatory framework. As digital currencies and photonic security technologies transcend national borders, regulatory bodies must collaborate to create consistent global standards. This cooperation should include information sharing, joint research initiatives, and coordinated enforcement efforts to combat potential cross-border security threats.

The regulatory framework should also address the environmental impact of photonic cryptocurrency security systems. As these technologies may require significant energy resources, regulators should establish guidelines for energy efficiency and sustainable practices in the development and operation of photonic security infrastructure.

Lastly, the framework must include provisions for ongoing research and development support. Regulators should encourage innovation in photonic security technologies through funding initiatives, tax incentives, and public-private partnerships. This support will ensure that the regulatory framework remains adaptive and responsive to technological advancements in the rapidly evolving field of photonic cryptocurrency security.

At the forefront of this regulatory framework is the need for standardization of photonic encryption methods. Regulatory bodies must establish clear guidelines for the implementation of quantum-resistant cryptographic algorithms that leverage the unique properties of silicon photonics. These standards should address key generation, transmission, and storage protocols to maintain the highest level of security against both classical and quantum attacks.

Another crucial element of the regulatory framework is the certification process for photonic security devices and systems. Regulatory agencies need to develop rigorous testing and validation procedures to ensure that photonic-based cryptocurrency security solutions meet stringent performance and security requirements. This certification process should include regular audits and updates to keep pace with technological advancements and emerging threats.

Data protection and privacy regulations must also be adapted to accommodate the unique characteristics of photonic cryptocurrency security. Regulators should focus on establishing guidelines for secure key management, data retention policies, and user privacy protection in photonic-enabled digital currency systems. These regulations should strike a balance between security requirements and individual privacy rights.

International cooperation and harmonization of regulations are essential components of an effective regulatory framework. As digital currencies and photonic security technologies transcend national borders, regulatory bodies must collaborate to create consistent global standards. This cooperation should include information sharing, joint research initiatives, and coordinated enforcement efforts to combat potential cross-border security threats.

The regulatory framework should also address the environmental impact of photonic cryptocurrency security systems. As these technologies may require significant energy resources, regulators should establish guidelines for energy efficiency and sustainable practices in the development and operation of photonic security infrastructure.

Lastly, the framework must include provisions for ongoing research and development support. Regulators should encourage innovation in photonic security technologies through funding initiatives, tax incentives, and public-private partnerships. This support will ensure that the regulatory framework remains adaptive and responsive to technological advancements in the rapidly evolving field of photonic cryptocurrency security.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!