Understanding Microinjection Molding Regulations in North America

OCT 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Microinjection Molding Regulatory Evolution and Objectives

Microinjection molding technology has evolved significantly since its inception in the 1980s, initially developed to meet the growing demand for miniaturized components in various industries. This manufacturing process, characterized by the injection of polymer materials into micro-scale cavities, has undergone substantial refinement over the past four decades, particularly in response to increasingly stringent regulatory frameworks in North America.

The regulatory landscape governing microinjection molding in North America has been shaped by several key milestones. In the early 1990s, the FDA established the first comprehensive guidelines for medical device manufacturing, which included specific provisions for micro-molded components. These initial regulations focused primarily on material biocompatibility and process validation requirements.

By the early 2000s, the regulatory framework expanded significantly with the introduction of ISO 13485 standards, which North American regulatory bodies increasingly referenced. This period marked a shift toward more harmonized international standards, though regional variations in implementation remained substantial across the United States, Canada, and Mexico.

The 2010s witnessed a transformative phase in regulatory evolution, characterized by increased emphasis on risk management and traceability requirements. The FDA's introduction of Unique Device Identification (UDI) systems in 2013 significantly impacted microinjection molding operations, requiring enhanced documentation and quality control processes throughout the supply chain.

Current regulatory objectives in North America center around several key priorities. First, ensuring product safety through comprehensive material qualification and process validation remains paramount, particularly for applications in medical devices and pharmaceutical delivery systems. Second, environmental sustainability has emerged as a critical regulatory focus, with increasing requirements for recyclable materials and reduced waste in manufacturing processes.

Technological advancement objectives are closely aligned with regulatory compliance. The industry aims to develop more precise molding techniques capable of meeting tightening dimensional tolerances while maintaining consistency across high-volume production runs. Additionally, there is growing emphasis on developing validated processes for new biocompatible and biodegradable materials that can satisfy both performance requirements and evolving environmental regulations.

Looking forward, the regulatory trajectory suggests increasing harmonization between North American standards and global frameworks, particularly those established by the European Union and emerging Asian markets. This convergence aims to reduce compliance burdens for manufacturers operating across multiple jurisdictions while maintaining rigorous safety and quality standards.

The regulatory landscape governing microinjection molding in North America has been shaped by several key milestones. In the early 1990s, the FDA established the first comprehensive guidelines for medical device manufacturing, which included specific provisions for micro-molded components. These initial regulations focused primarily on material biocompatibility and process validation requirements.

By the early 2000s, the regulatory framework expanded significantly with the introduction of ISO 13485 standards, which North American regulatory bodies increasingly referenced. This period marked a shift toward more harmonized international standards, though regional variations in implementation remained substantial across the United States, Canada, and Mexico.

The 2010s witnessed a transformative phase in regulatory evolution, characterized by increased emphasis on risk management and traceability requirements. The FDA's introduction of Unique Device Identification (UDI) systems in 2013 significantly impacted microinjection molding operations, requiring enhanced documentation and quality control processes throughout the supply chain.

Current regulatory objectives in North America center around several key priorities. First, ensuring product safety through comprehensive material qualification and process validation remains paramount, particularly for applications in medical devices and pharmaceutical delivery systems. Second, environmental sustainability has emerged as a critical regulatory focus, with increasing requirements for recyclable materials and reduced waste in manufacturing processes.

Technological advancement objectives are closely aligned with regulatory compliance. The industry aims to develop more precise molding techniques capable of meeting tightening dimensional tolerances while maintaining consistency across high-volume production runs. Additionally, there is growing emphasis on developing validated processes for new biocompatible and biodegradable materials that can satisfy both performance requirements and evolving environmental regulations.

Looking forward, the regulatory trajectory suggests increasing harmonization between North American standards and global frameworks, particularly those established by the European Union and emerging Asian markets. This convergence aims to reduce compliance burdens for manufacturers operating across multiple jurisdictions while maintaining rigorous safety and quality standards.

North American Market Demand for Microinjection Molded Products

The North American microinjection molding market demonstrates robust demand across multiple sectors, with healthcare and medical devices leading consumption. The medical device industry alone accounts for approximately 35% of the microinjection molded products market in North America, driven by increasing needs for minimally invasive surgical tools, drug delivery systems, and diagnostic equipment. This sector's demand is projected to grow at 7.8% annually through 2028, outpacing overall market growth.

Electronics represents the second-largest market segment, constituting roughly 28% of regional demand. The miniaturization trend in consumer electronics, automotive systems, and telecommunications equipment has significantly increased requirements for micro-molded connectors, switches, and component housings. The automotive sector specifically has shown accelerated adoption rates as vehicles incorporate more electronic systems and sensors.

Regional analysis reveals the United States dominates the North American market with approximately 70% share, followed by Canada (18%) and Mexico (12%). However, Mexico demonstrates the fastest growth rate at 9.2% annually, attributed to expanding manufacturing capabilities and increasing foreign direct investment in high-tech production facilities.

Consumer preferences are shifting toward products with enhanced functionality in smaller form factors, driving manufacturers to adopt microinjection molding technologies. This trend is particularly evident in wearable technology, where the market for micro-molded components has expanded by 22% over the past three years.

Material demand patterns show biocompatible polymers leading in the medical sector, while high-performance engineering thermoplastics dominate in electronics and automotive applications. Liquid silicone rubber (LSR) microinjection molding has emerged as a rapidly growing segment, particularly for applications requiring flexibility, biocompatibility, and resistance to extreme temperatures.

Supply chain analysis indicates that approximately 65% of North American manufacturers source microinjection molded components domestically, with the remainder imported primarily from Asia. This represents a 12% increase in domestic sourcing over the past five years, reflecting growing concerns about supply chain resilience and intellectual property protection.

Market forecasts suggest the North American microinjection molding market will reach $2.7 billion by 2027, with compound annual growth rates varying significantly by application: medical (7.8%), electronics (6.5%), automotive (5.9%), and consumer products (4.7%). These growth projections are supported by increasing adoption of microfluidic devices, implantable medical technologies, and advanced sensor systems across industries.

Electronics represents the second-largest market segment, constituting roughly 28% of regional demand. The miniaturization trend in consumer electronics, automotive systems, and telecommunications equipment has significantly increased requirements for micro-molded connectors, switches, and component housings. The automotive sector specifically has shown accelerated adoption rates as vehicles incorporate more electronic systems and sensors.

Regional analysis reveals the United States dominates the North American market with approximately 70% share, followed by Canada (18%) and Mexico (12%). However, Mexico demonstrates the fastest growth rate at 9.2% annually, attributed to expanding manufacturing capabilities and increasing foreign direct investment in high-tech production facilities.

Consumer preferences are shifting toward products with enhanced functionality in smaller form factors, driving manufacturers to adopt microinjection molding technologies. This trend is particularly evident in wearable technology, where the market for micro-molded components has expanded by 22% over the past three years.

Material demand patterns show biocompatible polymers leading in the medical sector, while high-performance engineering thermoplastics dominate in electronics and automotive applications. Liquid silicone rubber (LSR) microinjection molding has emerged as a rapidly growing segment, particularly for applications requiring flexibility, biocompatibility, and resistance to extreme temperatures.

Supply chain analysis indicates that approximately 65% of North American manufacturers source microinjection molded components domestically, with the remainder imported primarily from Asia. This represents a 12% increase in domestic sourcing over the past five years, reflecting growing concerns about supply chain resilience and intellectual property protection.

Market forecasts suggest the North American microinjection molding market will reach $2.7 billion by 2027, with compound annual growth rates varying significantly by application: medical (7.8%), electronics (6.5%), automotive (5.9%), and consumer products (4.7%). These growth projections are supported by increasing adoption of microfluidic devices, implantable medical technologies, and advanced sensor systems across industries.

Current Regulatory Framework and Technical Barriers

Microinjection molding in North America operates within a complex regulatory framework that varies across the United States, Canada, and Mexico. The FDA serves as the primary regulatory body in the U.S., particularly through its Center for Devices and Radiological Health (CDRH) for medical applications. For microinjection molded components used in medical devices, compliance with 21 CFR Part 820 (Quality System Regulation) is mandatory, requiring extensive documentation of manufacturing processes, validation protocols, and quality control measures.

Health Canada maintains similar but distinct requirements through the Medical Devices Regulations (SOR/98-282), which classify devices into four risk categories with corresponding regulatory controls. Mexican regulations are administered by COFEPRIS (Federal Commission for Protection against Sanitary Risk), which has been harmonizing its standards with international norms but still maintains unique documentation requirements.

Beyond medical applications, microinjection molded components for food contact applications must comply with FDA 21 CFR 177.1520 for olefin polymers and similar regulations for other polymer types. The regulatory landscape is further complicated by state-level regulations, particularly California's Proposition 65, which imposes stringent requirements for consumer notification regarding potentially harmful chemicals.

A significant technical barrier in the regulatory compliance process is material validation. Microinjection molding often utilizes specialized polymers and additives that may not have established regulatory precedents. Manufacturers must conduct extensive leachable and extractable testing, particularly for medical and food contact applications, which can extend development timelines by 6-18 months.

Process validation presents another major challenge. The miniaturized nature of microinjection molding introduces unique process variables that are difficult to monitor and control within regulatory frameworks designed for conventional molding. Statistical Process Control (SPC) methodologies often require adaptation for the micro-scale, as standard sampling techniques may be inadequate for components with critical dimensions in the micrometer range.

Documentation requirements constitute a substantial barrier, particularly for smaller manufacturers. The FDA's Case for Quality initiative and similar programs in Canada require comprehensive process validation documentation that can exceed 1,000 pages for a single microinjection molded component used in critical applications.

Cross-border harmonization remains incomplete despite efforts through the USMCA (United States-Mexico-Canada Agreement). Manufacturers operating across North American markets must navigate different submission requirements, testing protocols, and approval timelines, often necessitating redundant testing and documentation that can increase compliance costs by 30-40% compared to single-market operations.

Health Canada maintains similar but distinct requirements through the Medical Devices Regulations (SOR/98-282), which classify devices into four risk categories with corresponding regulatory controls. Mexican regulations are administered by COFEPRIS (Federal Commission for Protection against Sanitary Risk), which has been harmonizing its standards with international norms but still maintains unique documentation requirements.

Beyond medical applications, microinjection molded components for food contact applications must comply with FDA 21 CFR 177.1520 for olefin polymers and similar regulations for other polymer types. The regulatory landscape is further complicated by state-level regulations, particularly California's Proposition 65, which imposes stringent requirements for consumer notification regarding potentially harmful chemicals.

A significant technical barrier in the regulatory compliance process is material validation. Microinjection molding often utilizes specialized polymers and additives that may not have established regulatory precedents. Manufacturers must conduct extensive leachable and extractable testing, particularly for medical and food contact applications, which can extend development timelines by 6-18 months.

Process validation presents another major challenge. The miniaturized nature of microinjection molding introduces unique process variables that are difficult to monitor and control within regulatory frameworks designed for conventional molding. Statistical Process Control (SPC) methodologies often require adaptation for the micro-scale, as standard sampling techniques may be inadequate for components with critical dimensions in the micrometer range.

Documentation requirements constitute a substantial barrier, particularly for smaller manufacturers. The FDA's Case for Quality initiative and similar programs in Canada require comprehensive process validation documentation that can exceed 1,000 pages for a single microinjection molded component used in critical applications.

Cross-border harmonization remains incomplete despite efforts through the USMCA (United States-Mexico-Canada Agreement). Manufacturers operating across North American markets must navigate different submission requirements, testing protocols, and approval timelines, often necessitating redundant testing and documentation that can increase compliance costs by 30-40% compared to single-market operations.

Compliance Strategies and Technical Requirements

01 Equipment and tooling for microinjection molding

Specialized equipment and tooling are essential for microinjection molding processes. This includes micro-molds with high precision features, specialized injection units capable of delivering small, precise amounts of material, and advanced control systems for maintaining tight process parameters. These equipment components are designed to handle the unique challenges of molding microscale parts, such as accurate metering of small material volumes and precise temperature control throughout the molding cycle.- Microinjection molding equipment and machinery: Specialized equipment and machinery designed for microinjection molding processes. These include precision injection molding machines with advanced control systems, micro-molds with high accuracy features, and auxiliary equipment specifically designed for handling small parts. The equipment often incorporates features for precise temperature control, high-speed injection, and vacuum-assisted molding to ensure the quality of micro-molded components.

- Materials for microinjection molding: Various materials suitable for microinjection molding applications, including specialized polymers, biocompatible materials, and composite materials. These materials are selected based on their flow properties, shrinkage characteristics, and mechanical properties when molded at the micro scale. The formulations often include additives to enhance flowability, reduce viscosity, and improve surface finish of the final micro-molded parts.

- Microinjection molding for biomedical applications: Application of microinjection molding technology in the biomedical field, including the production of medical devices, drug delivery systems, and diagnostic tools. This includes techniques for molding biocompatible materials, creating microfluidic channels, and producing components for implantable devices. The process enables the production of complex geometries with high precision required for medical applications.

- Process optimization for microinjection molding: Methods and techniques for optimizing the microinjection molding process to achieve higher precision, better surface quality, and improved dimensional stability. This includes parameter optimization such as injection pressure, temperature profiles, cooling strategies, and cycle time reduction. Advanced techniques like vacuum-assisted molding, variothermal process control, and in-mold sensors for real-time monitoring are employed to enhance process stability and part quality.

- Microinjection molding for microelectronic components: Application of microinjection molding in the production of microelectronic components and devices. This includes techniques for creating housings for electronic components, connectors, micro-switches, and integrated circuit packaging. The process allows for the production of complex 3D microstructures with embedded electronic elements, enabling miniaturization of electronic devices while maintaining functionality and reliability.

02 Materials for microinjection molding

Various materials are specifically formulated for microinjection molding applications. These include specialized polymers with enhanced flow properties, biocompatible materials for medical applications, and high-performance composites that maintain their properties at the microscale. Material selection is critical as it must accommodate the high shear rates and rapid cooling conditions typical in microinjection molding while still achieving the desired mechanical, optical, or electrical properties in the final microparts.Expand Specific Solutions03 Biomedical applications of microinjection molding

Microinjection molding is widely used in biomedical applications for producing components such as microfluidic devices, drug delivery systems, and diagnostic tools. The process enables the production of complex, miniaturized medical components with high precision and reproducibility. These microparts can incorporate features such as microchannels, reservoirs, and sensing elements, making them valuable for point-of-care diagnostics, lab-on-a-chip devices, and minimally invasive medical instruments.Expand Specific Solutions04 Process optimization and control in microinjection molding

Advanced process optimization and control techniques are crucial for successful microinjection molding. This includes precise control of injection parameters such as pressure, temperature, and velocity profiles, as well as specialized approaches to filling, packing, and cooling phases. Simulation tools, in-mold sensors, and real-time monitoring systems help manufacturers achieve consistent quality in microparts by addressing challenges such as incomplete filling, trapped air, and residual stresses that are magnified at the microscale.Expand Specific Solutions05 Novel microinjection molding techniques and innovations

Innovative techniques are continuously being developed to enhance microinjection molding capabilities. These include variothermal processes that dynamically control mold temperature, multi-material microinjection molding for creating complex functionality, and hybrid processes that combine microinjection with other manufacturing methods. Other innovations focus on improving surface quality, reducing cycle times, and enabling the production of increasingly smaller and more complex microstructures with higher aspect ratios and tighter tolerances.Expand Specific Solutions

Major Regulatory Bodies and Industry Stakeholders

The microinjection molding regulatory landscape in North America is evolving within a maturing industry characterized by increasing technical sophistication and specialized applications. The market is experiencing steady growth, projected to reach significant expansion as medical device manufacturing and consumer electronics drive demand. Leading players demonstrate varying levels of technical maturity, with established manufacturers like Husky Injection Molding Systems and KraussMaffei Technologies showing advanced capabilities in precision molding technologies. Companies such as iMFLUX (Procter & Gamble subsidiary) and 3M Innovative Properties are advancing proprietary technologies, while Canon and Stratasys are integrating microinjection with additive manufacturing approaches. The competitive landscape features both specialized molding experts and diversified industrial conglomerates adapting to increasingly stringent regulatory frameworks across medical, automotive, and consumer product applications.

Husky Injection Molding Systems Ltd.

Technical Solution: Husky has developed comprehensive technical solutions for microinjection molding that comply with North American regulations, particularly FDA 21 CFR Part 820 for medical devices. Their HyPET HPP5 platform incorporates advanced process control systems that ensure consistent part quality through precise cavity pressure monitoring and control. The company's Ultra Helix valve gate technology provides superior gate quality and longevity specifically designed for micro-molded parts with tight tolerances. Husky's Altanium mold controllers offer industry-leading temperature control accuracy to ±0.1°C, critical for the precise thermal management required in microinjection molding processes. Their systems include full documentation capabilities for regulatory compliance, with automated process parameter recording and traceability features that satisfy FDA validation requirements for medical device manufacturing. Husky also provides specialized technical support for customers navigating the complex regulatory landscape of microinjection molding in North America, including assistance with material selection that meets biocompatibility standards under USP Class VI and ISO 10993.

Strengths: Industry-leading precision control systems specifically optimized for microinjection applications; extensive experience with medical device regulatory compliance; comprehensive validation documentation capabilities. Weaknesses: Higher initial investment costs compared to standard injection molding equipment; specialized systems may require additional operator training; proprietary control systems may limit integration with third-party equipment.

3M Innovative Properties Co.

Technical Solution: 3M has developed proprietary microinjection molding technologies specifically designed to meet North American regulatory standards, particularly for medical and healthcare applications. Their approach integrates material science expertise with advanced process controls to achieve consistent micro-feature replication at high volumes. 3M's technology incorporates specialized mold surface treatments that enhance micro-feature definition while maintaining compliance with FDA requirements for patient-contacting devices. Their process monitoring systems provide real-time quality control with documented traceability for each production batch, satisfying FDA 21 CFR Part 820 requirements for quality management systems. 3M has pioneered specialized venting designs for micro-molds that prevent air entrapment issues common in microinjection molding while maintaining clean room compatibility. Their technology includes proprietary material formulations specifically developed for microinjection applications that meet biocompatibility requirements under USP Class VI and ISO 10993 standards. 3M's approach also addresses the challenges of part ejection and handling at the micro scale through automated systems designed to prevent contamination and maintain sterility where required by regulations.

Strengths: Extensive materials science expertise allows for custom formulations optimized for specific microinjection applications; integrated approach combining materials, process, and regulatory compliance; established history of successful medical device commercialization. Weaknesses: Solutions may be more focused on 3M's proprietary materials than equipment flexibility; potentially higher costs associated with proprietary technology ecosystem; limited public information about specific technical implementations.

Critical Standards and Certification Processes

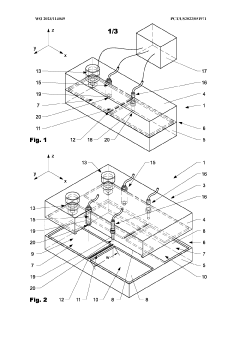

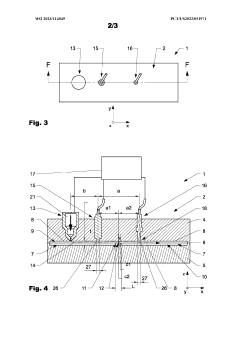

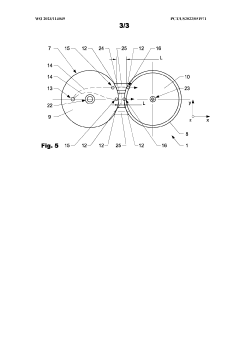

Injection molding device and method

PatentWO2023114049A1

Innovation

- An injection molding device with a controller that uses sensor arrangements in the cavity to monitor and adjust viscosity by calculating shear stress and flow rate, ensuring optimal viscosity and pressure management across the constriction area, thereby maintaining mechanical properties within specified boundaries.

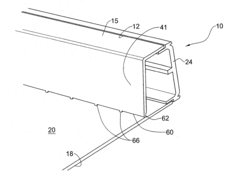

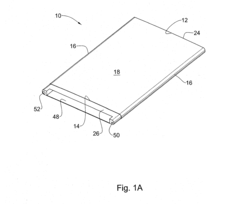

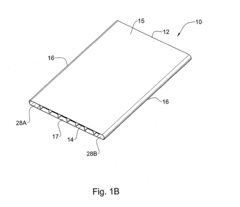

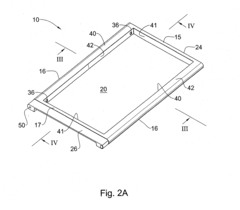

Injection molded panel, a mold and a method for its manufacture

PatentInactiveUS20140050906A1

Innovation

- The use of a transition wall portion significantly thinner than the rib thickness, extending from the back surface to the front surface, and configured as a non-continuous undulating structure, allows for adequate molten plastic flow and structural support while minimizing sink marks by reducing the contact area between the transition wall and the panel.

Cross-Border Regulatory Harmonization Efforts

Cross-border regulatory harmonization efforts for microinjection molding in North America have gained significant momentum in recent years, driven by the need to streamline compliance processes and reduce barriers to trade. The United States, Canada, and Mexico have established various frameworks to align their regulatory approaches, most notably through the United States-Mexico-Canada Agreement (USMCA), which replaced NAFTA in 2020. This agreement includes specific provisions for harmonizing technical standards and conformity assessment procedures relevant to manufacturing industries, including microinjection molding.

The Regulatory Cooperation Council (RCC) between the United States and Canada represents another important initiative, focusing on reducing unnecessary regulatory differences while maintaining high standards of public health, safety, and environmental protection. For microinjection molding manufacturers, this has translated into more consistent requirements for material safety documentation, process validation protocols, and quality management systems across borders.

Industry-specific harmonization efforts have emerged through organizations such as the Society of the Plastics Industry (SPI) and the American National Standards Institute (ANSI), which work with their Canadian and Mexican counterparts to develop common standards. The Medical Device Single Audit Program (MDSAP) is particularly relevant for microinjection molding companies serving the healthcare sector, allowing for a single regulatory audit to satisfy requirements across multiple North American jurisdictions.

Despite progress, challenges persist in achieving full regulatory alignment. Different interpretations of similar regulations continue to create compliance complexities, particularly regarding material biocompatibility testing requirements and documentation formats. Variations in environmental regulations concerning plastic waste management and recycled content requirements also present obstacles to seamless cross-border operations.

The Mutual Recognition Agreements (MRAs) between regulatory authorities have helped address some of these challenges by allowing for the acceptance of conformity assessment results across borders. For microinjection molding companies, this means test results or certifications obtained in one country may be recognized in another, reducing duplicate testing and associated costs.

Looking forward, digital harmonization initiatives are gaining traction, with efforts to standardize electronic submission formats for regulatory documentation and implement shared databases for material safety information. These technological approaches promise to further streamline cross-border compliance processes and enhance regulatory transparency throughout North America's microinjection molding industry.

The Regulatory Cooperation Council (RCC) between the United States and Canada represents another important initiative, focusing on reducing unnecessary regulatory differences while maintaining high standards of public health, safety, and environmental protection. For microinjection molding manufacturers, this has translated into more consistent requirements for material safety documentation, process validation protocols, and quality management systems across borders.

Industry-specific harmonization efforts have emerged through organizations such as the Society of the Plastics Industry (SPI) and the American National Standards Institute (ANSI), which work with their Canadian and Mexican counterparts to develop common standards. The Medical Device Single Audit Program (MDSAP) is particularly relevant for microinjection molding companies serving the healthcare sector, allowing for a single regulatory audit to satisfy requirements across multiple North American jurisdictions.

Despite progress, challenges persist in achieving full regulatory alignment. Different interpretations of similar regulations continue to create compliance complexities, particularly regarding material biocompatibility testing requirements and documentation formats. Variations in environmental regulations concerning plastic waste management and recycled content requirements also present obstacles to seamless cross-border operations.

The Mutual Recognition Agreements (MRAs) between regulatory authorities have helped address some of these challenges by allowing for the acceptance of conformity assessment results across borders. For microinjection molding companies, this means test results or certifications obtained in one country may be recognized in another, reducing duplicate testing and associated costs.

Looking forward, digital harmonization initiatives are gaining traction, with efforts to standardize electronic submission formats for regulatory documentation and implement shared databases for material safety information. These technological approaches promise to further streamline cross-border compliance processes and enhance regulatory transparency throughout North America's microinjection molding industry.

Environmental Sustainability Requirements and Implications

The microinjection molding industry in North America faces increasingly stringent environmental sustainability requirements that significantly impact manufacturing processes and business operations. Current regulations focus on reducing the environmental footprint of plastic production through material selection, energy consumption, and waste management protocols. The EPA's Clean Air Act and Clean Water Act directly regulate emissions and effluent discharges from molding facilities, requiring comprehensive monitoring and reporting systems.

Material selection has become a critical compliance factor, with regulations increasingly restricting the use of certain additives, plasticizers, and fillers. Particularly noteworthy is the growing limitation on phthalates and bisphenol A (BPA) in medical and food-contact applications. This regulatory landscape has accelerated the adoption of biodegradable and bio-based polymers, with PLA (polylactic acid) and PHA (polyhydroxyalkanoates) gaining prominence in microinjection applications.

Energy efficiency requirements present another significant regulatory dimension. Many jurisdictions have implemented mandatory energy efficiency standards for manufacturing equipment, including injection molding machines. California's Title 24 energy standards and similar regulations across North America have established benchmarks for maximum energy consumption per production unit, driving manufacturers toward more efficient hydraulic systems and all-electric molding machines that can reduce energy consumption by up to 70%.

Waste management regulations have evolved beyond basic recycling mandates to encompass comprehensive life-cycle management approaches. Extended Producer Responsibility (EPR) programs in several Canadian provinces and U.S. states now hold manufacturers accountable for post-consumer waste. These programs typically require detailed documentation of material flows and waste reduction strategies, creating additional compliance burdens for microinjection molders.

The economic implications of these sustainability requirements are substantial. Initial compliance costs for small to medium-sized molders can range from $50,000 to $250,000, depending on facility size and existing infrastructure. However, research indicates that companies embracing sustainability requirements often realize long-term cost savings through reduced energy consumption, material optimization, and waste reduction. Industry data suggests that comprehensive sustainability programs can reduce operational costs by 15-20% over a five-year period.

Looking forward, the regulatory landscape is expected to continue evolving toward more stringent requirements. Emerging trends include carbon footprint disclosure mandates, chemical registration requirements similar to Europe's REACH regulation, and potential plastic taxes based on recycled content percentages. Manufacturers engaged in proactive compliance strategies will likely gain competitive advantages through improved market access and reduced regulatory risk exposure.

Material selection has become a critical compliance factor, with regulations increasingly restricting the use of certain additives, plasticizers, and fillers. Particularly noteworthy is the growing limitation on phthalates and bisphenol A (BPA) in medical and food-contact applications. This regulatory landscape has accelerated the adoption of biodegradable and bio-based polymers, with PLA (polylactic acid) and PHA (polyhydroxyalkanoates) gaining prominence in microinjection applications.

Energy efficiency requirements present another significant regulatory dimension. Many jurisdictions have implemented mandatory energy efficiency standards for manufacturing equipment, including injection molding machines. California's Title 24 energy standards and similar regulations across North America have established benchmarks for maximum energy consumption per production unit, driving manufacturers toward more efficient hydraulic systems and all-electric molding machines that can reduce energy consumption by up to 70%.

Waste management regulations have evolved beyond basic recycling mandates to encompass comprehensive life-cycle management approaches. Extended Producer Responsibility (EPR) programs in several Canadian provinces and U.S. states now hold manufacturers accountable for post-consumer waste. These programs typically require detailed documentation of material flows and waste reduction strategies, creating additional compliance burdens for microinjection molders.

The economic implications of these sustainability requirements are substantial. Initial compliance costs for small to medium-sized molders can range from $50,000 to $250,000, depending on facility size and existing infrastructure. However, research indicates that companies embracing sustainability requirements often realize long-term cost savings through reduced energy consumption, material optimization, and waste reduction. Industry data suggests that comprehensive sustainability programs can reduce operational costs by 15-20% over a five-year period.

Looking forward, the regulatory landscape is expected to continue evolving toward more stringent requirements. Emerging trends include carbon footprint disclosure mandates, chemical registration requirements similar to Europe's REACH regulation, and potential plastic taxes based on recycled content percentages. Manufacturers engaged in proactive compliance strategies will likely gain competitive advantages through improved market access and reduced regulatory risk exposure.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!