Cloud Computing Architectures in Financial Services

JUL 4, 2025 |

In recent years, the financial services industry has witnessed significant transformation, largely driven by technological advancements. Among these, cloud computing stands out as a pivotal innovation, revolutionizing how financial institutions operate and deliver services. Cloud computing enables organizations to enhance their scalability, reduce costs, and improve customer experiences. This article explores the various cloud computing architectures utilized in financial services, highlighting their benefits, challenges, and the future potential they hold for the industry.

Types of Cloud Computing Architectures

Cloud computing architectures in the financial sector can be broadly categorized into three primary types: public cloud, private cloud, and hybrid cloud.

Public Cloud

The public cloud is a cloud computing model where services are delivered over the internet by third-party providers. This model offers significant advantages such as cost-effectiveness, scalability, and flexibility. Financial institutions leverage the public cloud to handle non-sensitive operations, such as customer relationship management (CRM) and data analytics, where the need for rapid scalability and vast computational resources outweighs concerns over data privacy.

Private Cloud

Private cloud architecture is designed for exclusive use by a single organization, providing enhanced security and control over data and applications. This model is particularly favored by financial institutions for handling sensitive operations, such as processing transactions and storing confidential customer data. By maintaining dedicated hardware and infrastructure, private clouds offer a secure environment that complies with stringent regulatory requirements.

Hybrid Cloud

The hybrid cloud combines the best of both public and private cloud models, allowing financial institutions to optimize their operations by dynamically allocating workloads to either environment based on specific needs. This flexibility enables organizations to maintain a balance between cost and security, ensuring sensitive data resides in the private cloud while leveraging the public cloud for less sensitive tasks.

Benefits of Cloud Computing in Financial Services

Scalability and Flexibility

One of the most significant advantages of cloud computing is its ability to scale resources up or down based on demand. This scalability is particularly beneficial for financial institutions that experience fluctuating workloads, such as during peak trading hours. Cloud computing allows these organizations to efficiently manage resources without the need for significant upfront investments in hardware.

Cost Efficiency

Cloud computing reduces the need for on-premises infrastructure, leading to substantial cost savings in hardware, maintenance, and energy consumption. Financial institutions can shift from capital expenditure to operational expenditure, paying only for the resources they consume. This cost-effective model enables organizations to allocate funds towards innovation and strategic initiatives.

Enhanced Security and Compliance

With advancements in cloud security, financial institutions can leverage cloud computing to enhance their security posture. Cloud providers invest heavily in state-of-the-art security measures and offer compliance with industry standards and regulations. This enables financial organizations to maintain data integrity and confidentiality, crucial for building trust with customers and regulatory bodies.

Challenges in Adopting Cloud Computing

Despite its many benefits, adopting cloud computing in financial services comes with its set of challenges. Key concerns include data privacy, regulatory compliance, and the integration of legacy systems.

Data Privacy and Security

Data privacy is a paramount concern for financial institutions operating in the cloud. Organizations must ensure that sensitive data is protected from unauthorized access and breaches. This requires implementing robust encryption techniques and access controls to safeguard customer information.

Regulatory Compliance

The financial industry is highly regulated, with stringent compliance requirements. Cloud adoption necessitates a thorough understanding of the regulatory landscape to ensure compliance with data protection laws and financial regulations. Financial institutions must work closely with cloud providers to ensure that their services meet these requirements.

Integration with Legacy Systems

Many financial institutions rely on legacy systems that are not inherently compatible with cloud technologies. Successful cloud adoption requires developing strategies to integrate these systems, ensuring a seamless transition and minimizing disruptions to existing operations.

The Future of Cloud Computing in Financial Services

The future of cloud computing in financial services looks promising, with the potential to drive further innovation and transformation. As cloud technologies continue to evolve, financial institutions will be better positioned to harness the power of artificial intelligence, machine learning, and big data analytics. These advancements will enable organizations to offer personalized customer experiences, optimize risk management, and enhance decision-making capabilities.

In conclusion, cloud computing architectures present significant opportunities for financial services organizations to enhance their operations, reduce costs, and improve customer satisfaction. By addressing the challenges associated with cloud adoption and leveraging the benefits of these architectures, financial institutions can stay competitive in an increasingly digital landscape.

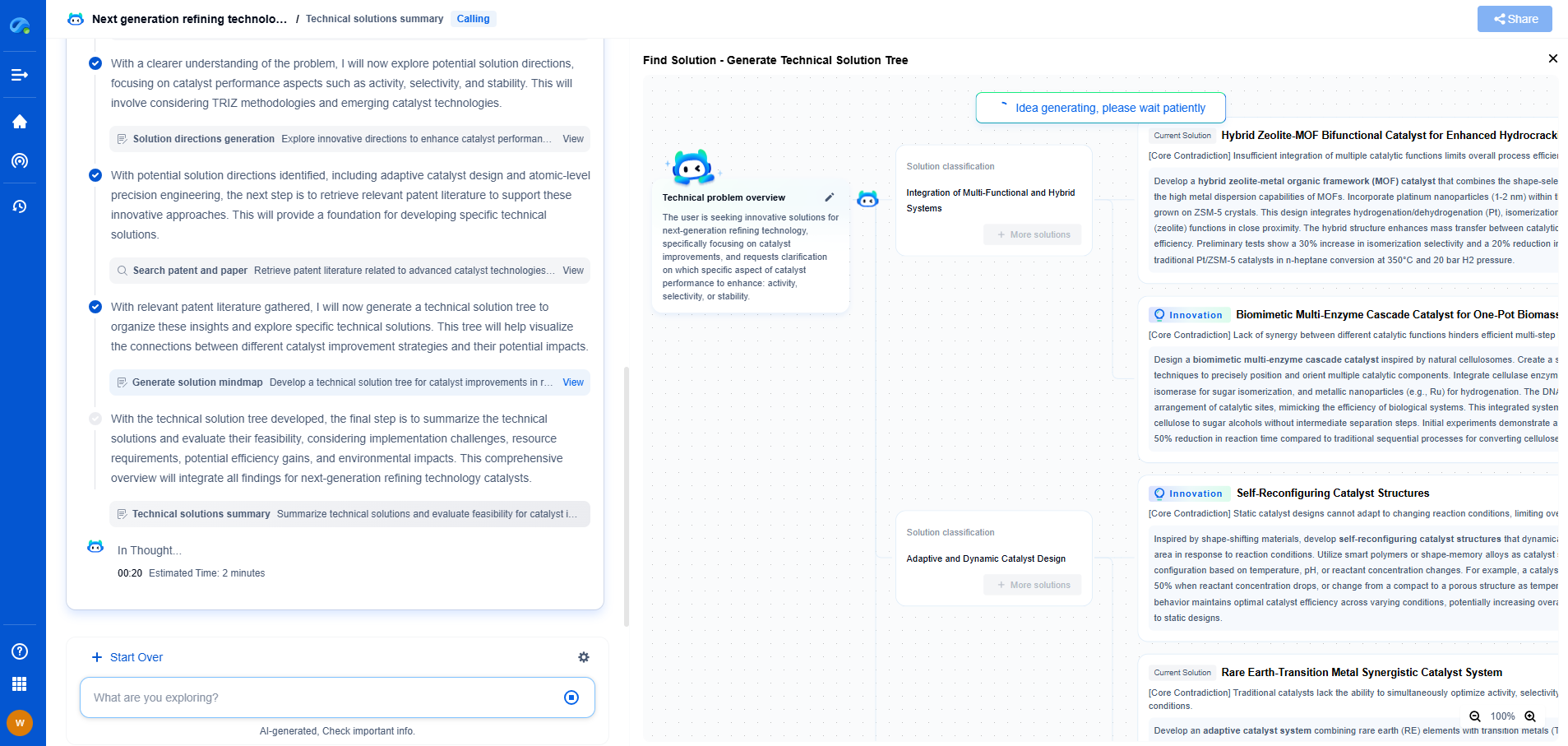

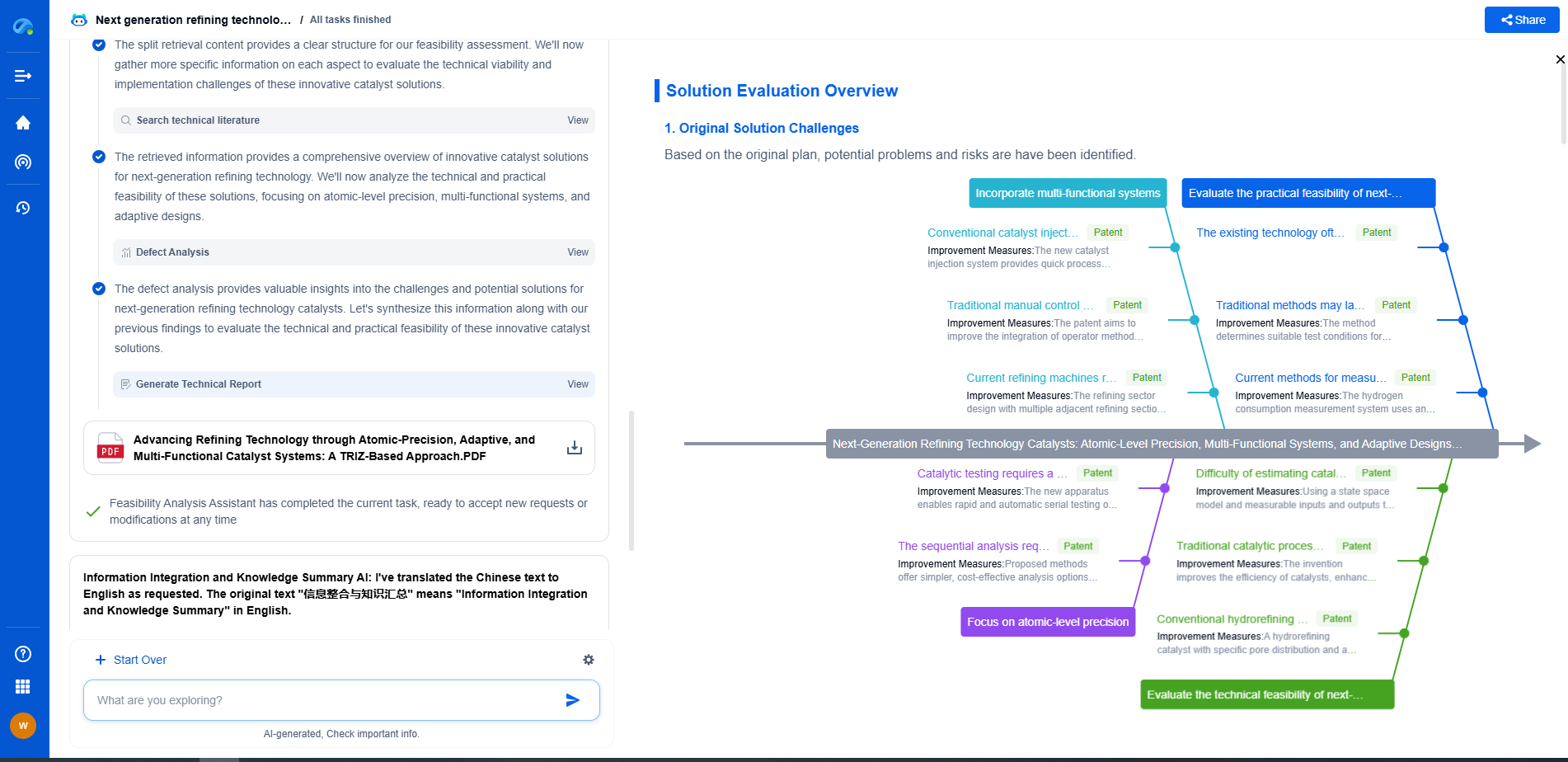

Accelerate Breakthroughs in Computing Systems with Patsnap Eureka

From evolving chip architectures to next-gen memory hierarchies, today’s computing innovation demands faster decisions, deeper insights, and agile R&D workflows. Whether you’re designing low-power edge devices, optimizing I/O throughput, or evaluating new compute models like quantum or neuromorphic systems, staying ahead of the curve requires more than technical know-how—it requires intelligent tools.

Patsnap Eureka, our intelligent AI assistant built for R&D professionals in high-tech sectors, empowers you with real-time expert-level analysis, technology roadmap exploration, and strategic mapping of core patents—all within a seamless, user-friendly interface.

Whether you’re innovating around secure boot flows, edge AI deployment, or heterogeneous compute frameworks, Eureka helps your team ideate faster, validate smarter, and protect innovation sooner.

🚀 Explore how Eureka can boost your computing systems R&D. Request a personalized demo today and see how AI is redefining how innovation happens in advanced computing.

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com