Financial Networks: Achieving Microsecond Latency for Trading Systems

JUL 14, 2025 |

In the fast-paced world of financial trading, speed is not just an advantage; it's a necessity. High-frequency trading (HFT) firms and financial institutions are in a constant race against time, seeking to execute transactions at lightning speeds. This is where the concept of microsecond latency comes into play. Reducing latency to microsecond levels can significantly enhance the competitiveness of trading systems. In this blog, we will delve into the intricacies of achieving microsecond latency in financial networks.

Understanding Latency in Financial Trading

Latency, in the context of financial trading, refers to the time it takes for a trading order to travel from the trader's system to the exchange and back. The goal for many firms is to minimize this time to gain a competitive edge. Lower latency allows for quicker decision-making and order execution, which is crucial in markets where prices can change in fractions of a second.

The Components of Network Latency

To effectively reduce latency, it's essential to understand its primary components: propagation delay, serialization delay, and queuing delay. Propagation delay is the time it takes for a signal to travel from the sender to the receiver. Serialization delay is the time taken to convert a message or data packet into a format suitable for transmission. Queuing delay occurs when data packets are held up in queues before they are transmitted or processed. Each of these components must be addressed to achieve microsecond latency.

Leveraging Cutting-Edge Technology

One of the key strategies for achieving microsecond latency is leveraging advanced technology. High-performance networking hardware, such as field-programmable gate arrays (FPGAs) and application-specific integrated circuits (ASICs), can process data at unprecedented speeds. These technologies are designed to handle immense volumes of data with minimal delay, making them ideal for HFT environments.

Optimizing Network Infrastructure

Optimizing the physical infrastructure of a network is another crucial step. This involves strategically locating data centers near financial exchanges to reduce propagation delay. Moreover, using high-speed fiber optic cables instead of traditional copper cables can significantly enhance data transmission speed. Additionally, implementing low-latency routing protocols ensures that data takes the most efficient path between locations.

Software Optimization and Algorithmic Efficiency

In addition to hardware improvements, software and algorithmic optimizations play a pivotal role. Streamlining algorithms to process data faster and more efficiently can drastically reduce execution time. Implementing low-latency programming languages and optimizing code at the software level can help in achieving microsecond latency. Furthermore, reducing the complexity of trading algorithms can decrease the time taken to make trading decisions.

Risk Management and Latency Optimization

While reducing latency is critical, it's equally important to balance speed with risk management. High-speed trading systems must incorporate robust risk controls to prevent adverse effects due to rapid market movements. Implementing real-time monitoring and risk assessment tools can help traders manage risks effectively while maintaining low latency.

Future Trends and Developments

As technology continues to evolve, the quest for lower latency in financial networks is likely to persist. Emerging technologies such as quantum computing and machine learning offer promising avenues for further reducing latency and enhancing trading system efficiency. Continuous research and development in this field will be essential for traders looking to stay ahead in the competitive world of financial markets.

Conclusion

Achieving microsecond latency in financial networks is a complex but rewarding endeavor. It requires a holistic approach that encompasses advanced technology, optimized network infrastructure, efficient algorithms, and effective risk management. As trading systems evolve, staying at the forefront of latency reduction will remain a critical factor for success in high-frequency trading. By understanding and implementing the strategies discussed in this blog, financial institutions can significantly enhance their trading capabilities and maintain a competitive edge in the markets.

From 5G NR to SDN and quantum-safe encryption, the digital communication landscape is evolving faster than ever. For R&D teams and IP professionals, tracking protocol shifts, understanding standards like 3GPP and IEEE 802, and monitoring the global patent race are now mission-critical.

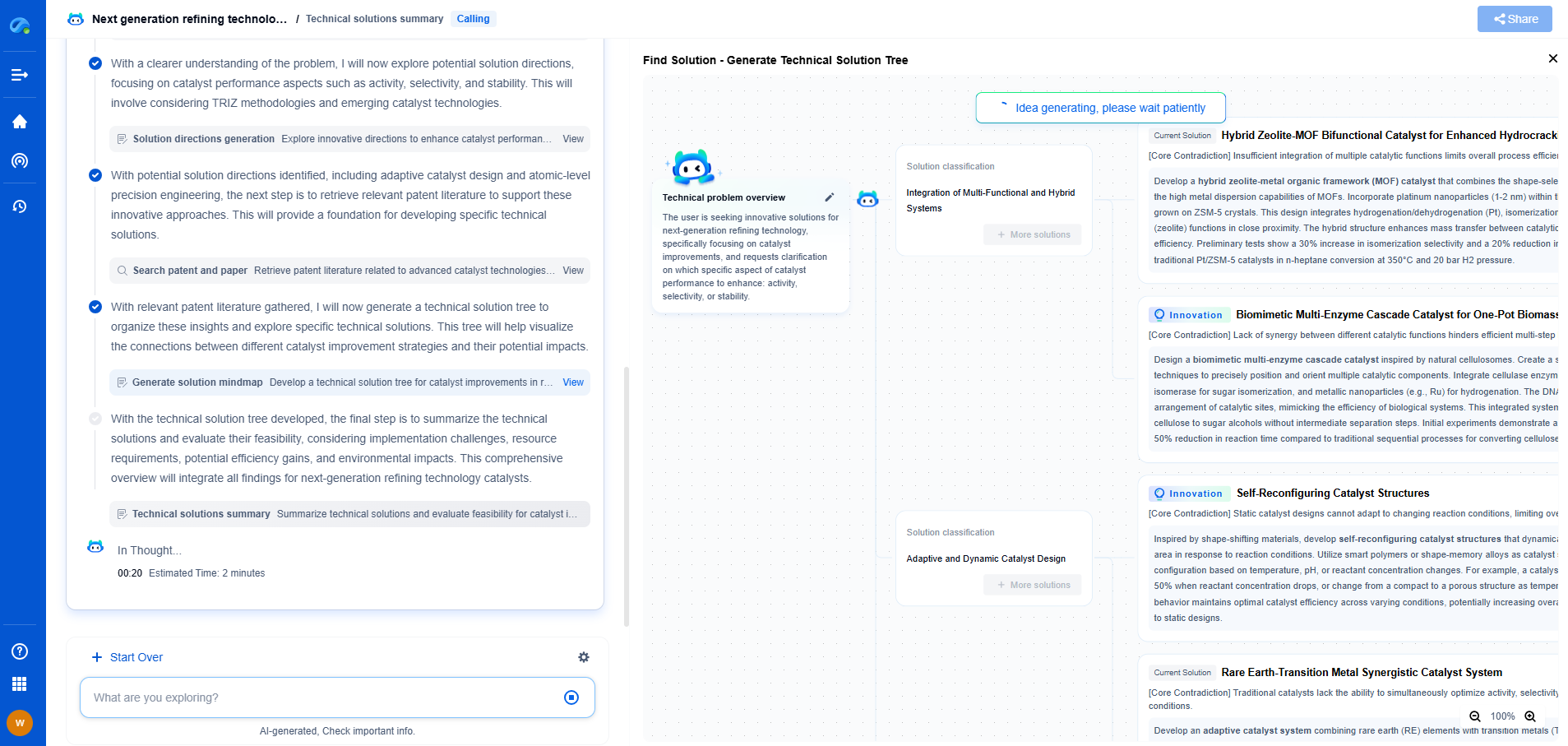

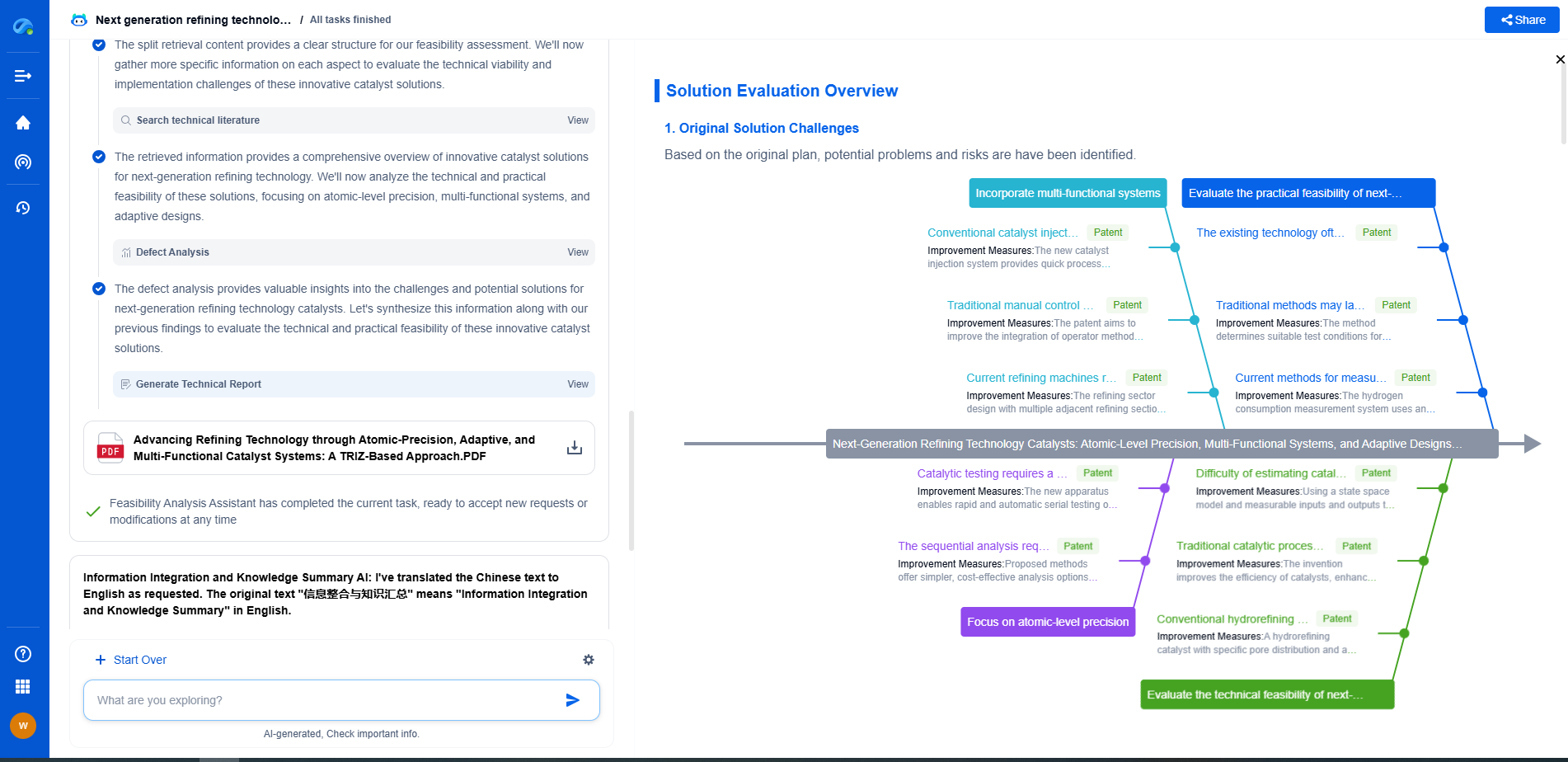

Patsnap Eureka, our intelligent AI assistant built for R&D professionals in high-tech sectors, empowers you with real-time expert-level analysis, technology roadmap exploration, and strategic mapping of core patents—all within a seamless, user-friendly interface.

📡 Experience Patsnap Eureka today and unlock next-gen insights into digital communication infrastructure, before your competitors do.

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com