Financial Networks: Why Low-Latency UDP Beats TCP in Trading

JUL 14, 2025 |

In the realm of financial trading, network communication plays a pivotal role in ensuring the swift and accurate transmission of data between trading systems. The choice of communication protocol can significantly impact trading performance, especially in high-frequency environments where milliseconds can make a difference. Two primary protocols used in these networks are UDP (User Datagram Protocol) and TCP (Transmission Control Protocol). While TCP is renowned for its reliability, UDP is favored for its low latency capabilities, making it particularly advantageous in financial trading scenarios.

Understanding Latency in Trading

Latency refers to the delay between the transmission of data from one point to another. In trading, lower latency means faster execution of orders, which can be crucial for maximizing profits and minimizing risks. High-frequency trading firms often invest heavily in technology to reduce latency, as even the smallest delay can result in missed opportunities or increased exposure to market volatility.

TCP vs. UDP: A Comparative Overview

TCP is a connection-oriented protocol known for its reliability, ensuring that data packets are delivered accurately and in the correct sequence. This reliability, however, comes at the cost of increased latency due to error-checking mechanisms and data retransmission processes. These features, while beneficial for general data communication, can be cumbersome in trading environments where speed is of the essence.

On the other hand, UDP is a connectionless protocol that prioritizes speed over reliability. It allows data packets to be sent without establishing a connection, thus reducing latency. While UDP does not guarantee delivery or order of packets, this trade-off is often acceptable in trading applications where timely information is more critical than absolute accuracy. Traders can employ additional mechanisms for error checking or simply use redundant systems to ensure data integrity.

The Advantage of Low-Latency UDP in Trading

In financial trading, the ability to act quickly on market information is paramount. UDP offers a low-latency solution, allowing trading systems to process and react to data more rapidly than TCP-based systems. This is particularly beneficial in high-frequency trading, where firms deploy algorithms to execute thousands of trades in a fraction of a second. By minimizing latency, UDP enables these firms to gain competitive advantages, execute trades at optimal prices, and reduce slippage.

Moreover, the lightweight nature of UDP makes it ideal for handling the massive volume of market data generated in trading environments. As firms aim to process and analyze data streams in real-time, the reduced overhead and increased efficiency of UDP can lead to better performance and faster decision-making.

Implementing UDP in Trading Systems

While UDP offers significant benefits, implementing it in trading systems requires careful consideration. Developers must address potential data loss or unordered packet delivery by incorporating strategies such as data redundancy, error detection algorithms, or synchronization protocols. Additionally, network infrastructure must be optimized to handle the high-speed data transmission characteristic of UDP-based systems.

Furthermore, regulatory and compliance factors must be taken into account when deploying UDP in financial networks. Ensuring that trading systems meet industry standards and can effectively manage risk is critical for maintaining both operational integrity and market trust.

Future Perspectives

As financial markets continue to evolve, the demand for faster and more efficient trading systems will only increase. UDP's low-latency capabilities position it as a key enabler in the quest for speed and performance. With advancements in technology, network architecture, and algorithmic trading, the role of UDP in financial networks is likely to expand, offering new opportunities for innovation in trading strategies and market analysis.

Conclusion

In conclusion, while TCP's reliability makes it suitable for many applications, the low latency of UDP offers distinct advantages in the fast-paced world of financial trading. By prioritizing speed over reliability, UDP allows traders to execute orders more swiftly, gain competitive edges, and enhance their overall trading performance. As trading systems become increasingly sophisticated, the role of UDP as a cornerstone of financial networks is poised to grow, driving advancements in the efficiency and effectiveness of market operations.

From 5G NR to SDN and quantum-safe encryption, the digital communication landscape is evolving faster than ever. For R&D teams and IP professionals, tracking protocol shifts, understanding standards like 3GPP and IEEE 802, and monitoring the global patent race are now mission-critical.

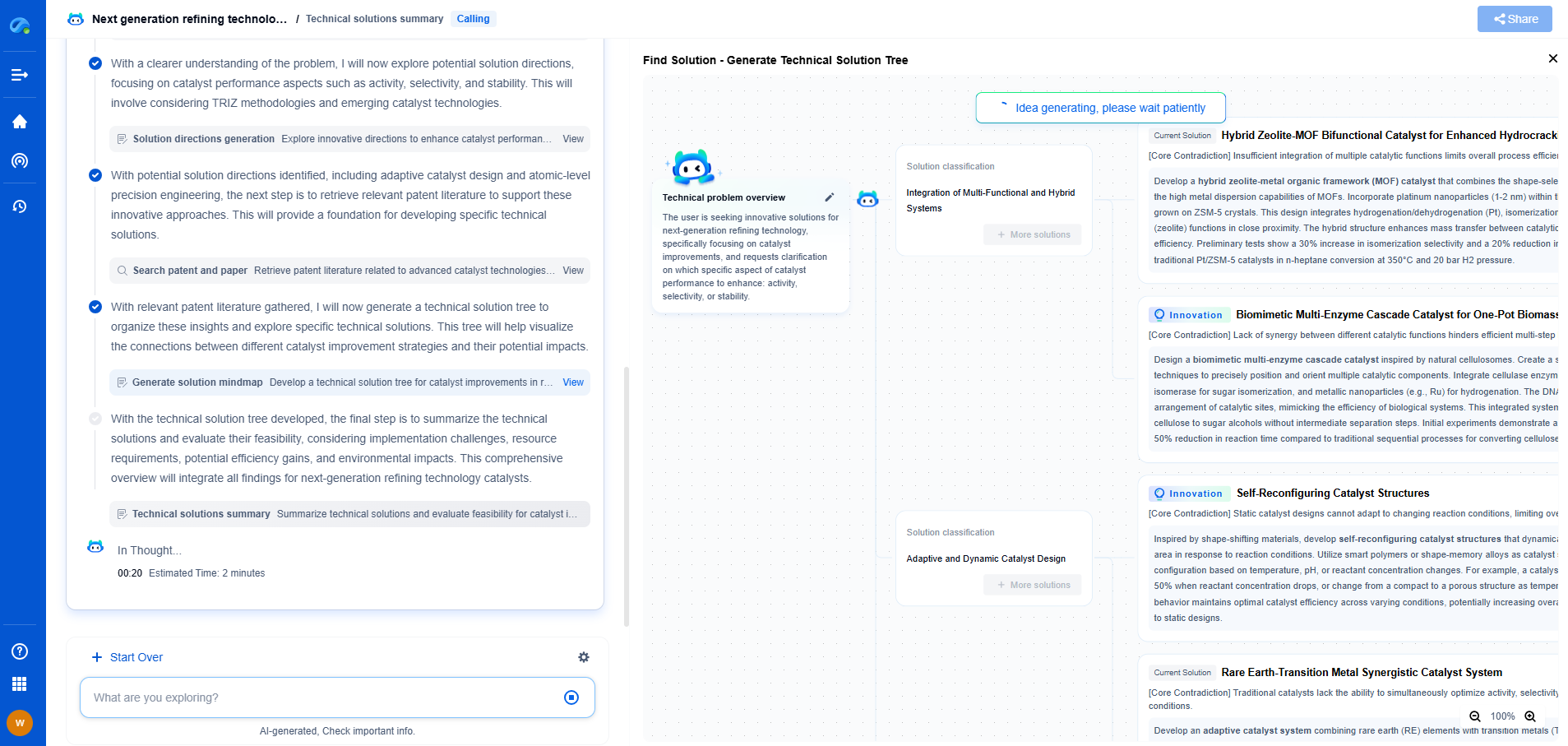

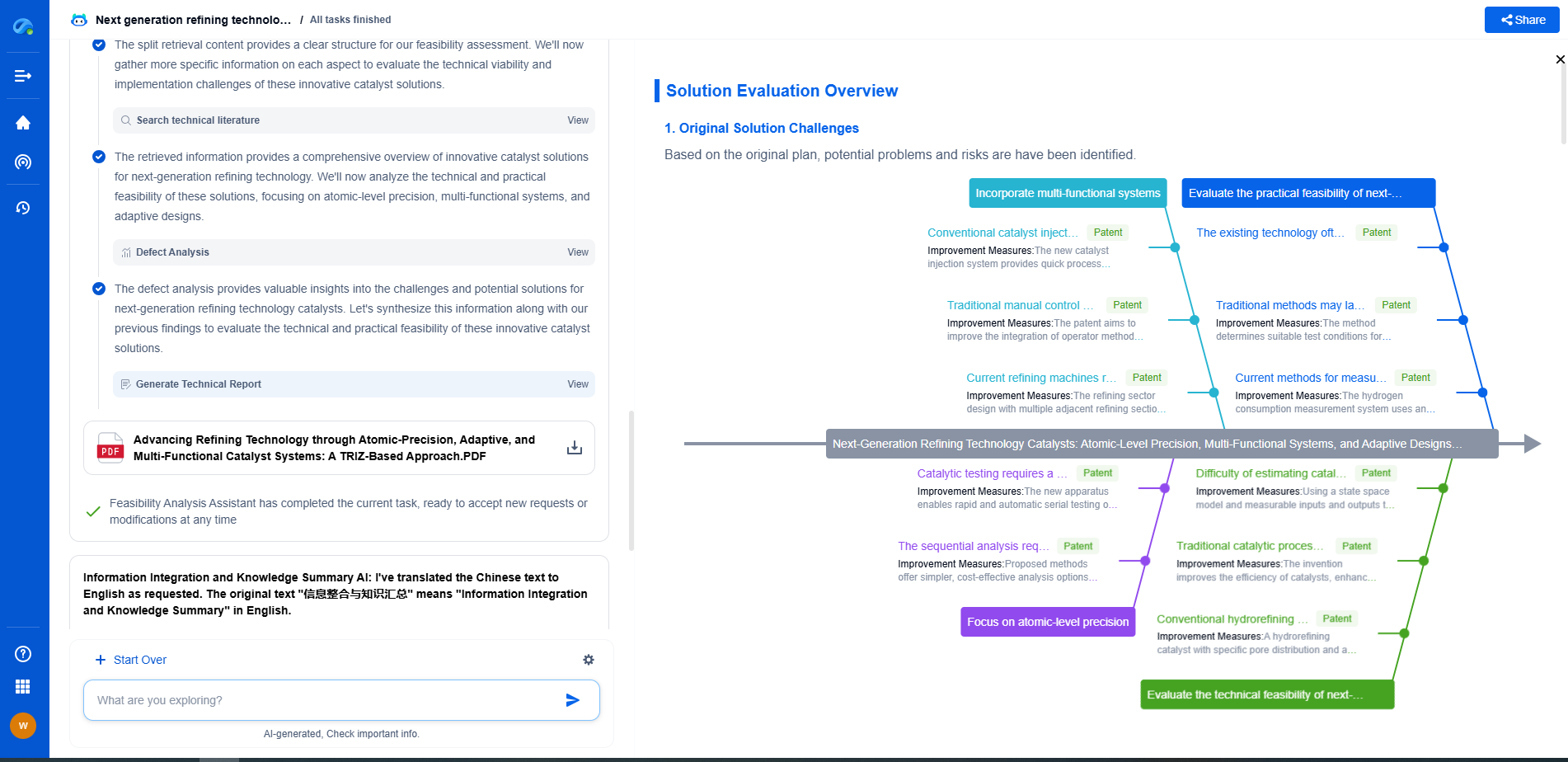

Patsnap Eureka, our intelligent AI assistant built for R&D professionals in high-tech sectors, empowers you with real-time expert-level analysis, technology roadmap exploration, and strategic mapping of core patents—all within a seamless, user-friendly interface.

📡 Experience Patsnap Eureka today and unlock next-gen insights into digital communication infrastructure, before your competitors do.

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com