How Econometrics Concepts Are Used in Machine Learning

JUN 26, 2025 |

Econometrics and machine learning are two fields that have increasingly found common ground in recent years. While econometrics traditionally deals with the application of statistical methods to economic data, machine learning is known for its focus on algorithms and models that allow computers to improve performance through experience. Despite their different origins and focuses, these fields share a key interest in understanding and predicting patterns in data. Econometrics concepts play a pivotal role in enhancing the analytical capabilities of machine learning models, especially when dealing with economic data.

Regression Analysis: The Bridge Between Econometrics and Machine Learning

One of the foundational concepts in econometrics is regression analysis, which is equally significant in the realm of machine learning. Regression analysis is used to model the relationship between a dependent variable and one or more independent variables. In econometrics, the emphasis is often on interpreting the coefficients of these relationships, understanding causality, and hypothesis testing.

In machine learning, regression is used primarily for prediction. Techniques such as linear regression, ridge regression, and lasso regression are staples in both econometrics and machine learning. The econometric focus on assumptions and diagnostics enhances the robustness of machine learning models, ensuring they are not just accurate but also credible.

Dealing with Endogeneity

Endogeneity is a frequent concern in econometrics, referring to situations where an explanatory variable is correlated with the error term. This can lead to biased and inconsistent estimates. Machine learning models can inadvertently suffer from similar issues, particularly in complex real-world datasets.

Econometric techniques such as instrumental variable (IV) regression can be applied to machine learning to address endogeneity issues. By identifying valid instruments—variables that are correlated with the endogenous explanatory variables but uncorrelated with the error term—econometricians and data scientists can achieve more reliable estimations, thereby improving the validity of machine learning predictions.

Time Series Analysis

Econometrics has a rich history in time series analysis, which involves analyzing data points collected or recorded at successive points over time. Techniques such as ARIMA (AutoRegressive Integrated Moving Average) and GARCH (Generalized Autoregressive Conditional Heteroskedasticity) are used extensively in econometrics to model and forecast economic and financial time series data.

Machine learning has adopted these time series techniques to enhance its predictive power. For example, machine learning models can incorporate ARIMA to handle trends and seasonality in data, improving the model's effectiveness in time-sensitive applications such as stock market predictions or economic forecasting.

Causal Inference and A/B Testing

Causal inference, a core component in econometrics, is crucial for understanding the cause-and-effect relationships within data. In machine learning, causal inference is gaining traction, particularly in the context of A/B testing and experimental design. This involves comparing two groups to determine the effects of a particular variable, akin to a controlled experiment.

Econometric methods such as difference-in-differences and regression discontinuity designs provide robust frameworks for causal inference, helping machine learning practitioners conduct more reliable A/B tests. These methods improve the interpretability and actionable insights derived from machine learning models.

Handling Multicollinearity and Overfitting

Multicollinearity occurs when two or more independent variables in a regression model are highly correlated, which can destabilize model estimates. Econometricians often use techniques such as principal component analysis (PCA) to address multicollinearity.

In machine learning, similar techniques are used to prevent overfitting, a situation where a model learns noise in the training data instead of the actual pattern. By incorporating econometric strategies, machine learning practitioners can build more generalized models that perform well on unseen data.

Conclusion

The intersection of econometrics and machine learning offers a powerful toolkit for data analysis, blending rigorous statistical methodologies with predictive algorithmic techniques. By integrating econometric concepts, machine learning models can achieve greater accuracy, reliability, and interpretability, making them invaluable for tackling complex real-world problems. As these fields continue to evolve, the synergy between them promises to unlock new potentials in data-driven decision-making.

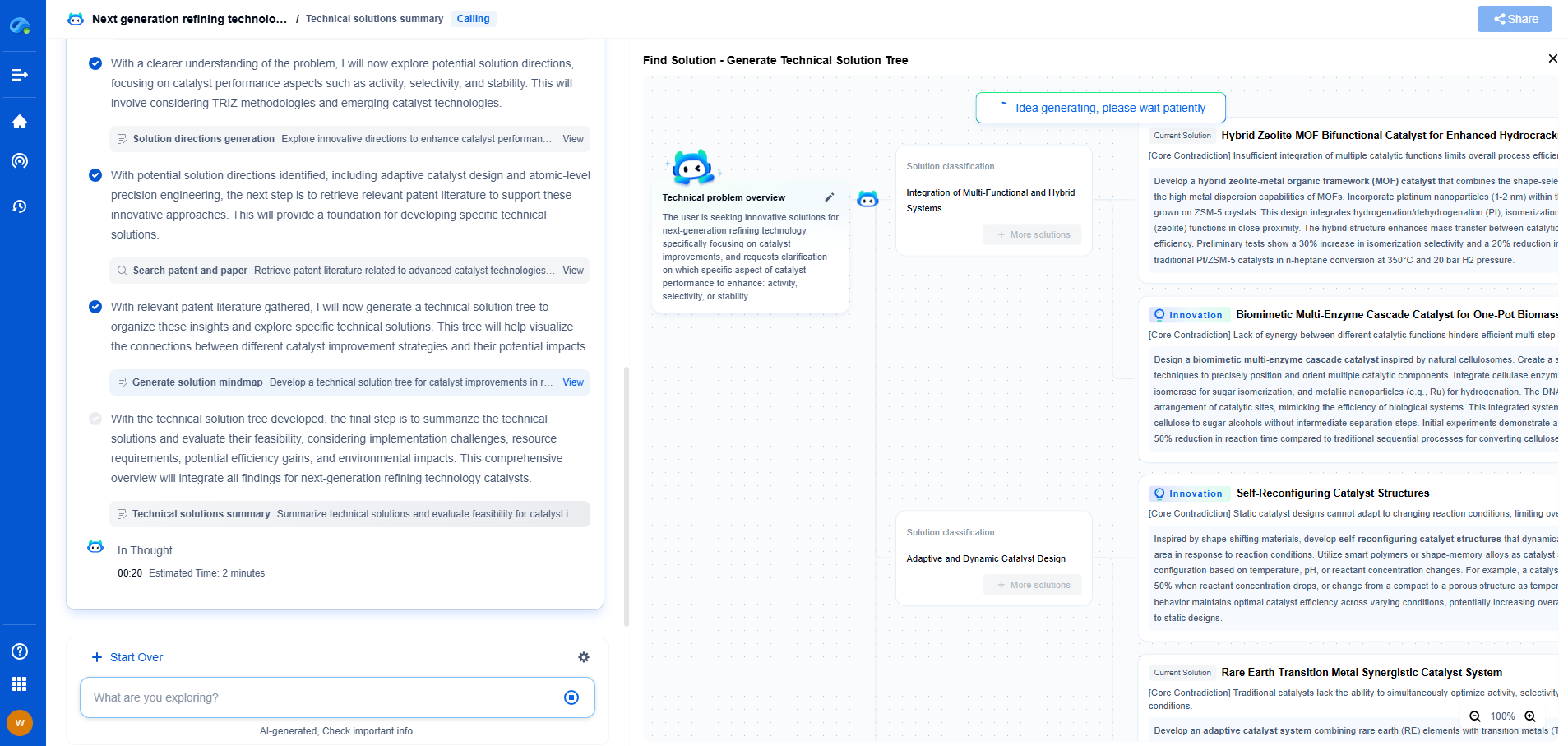

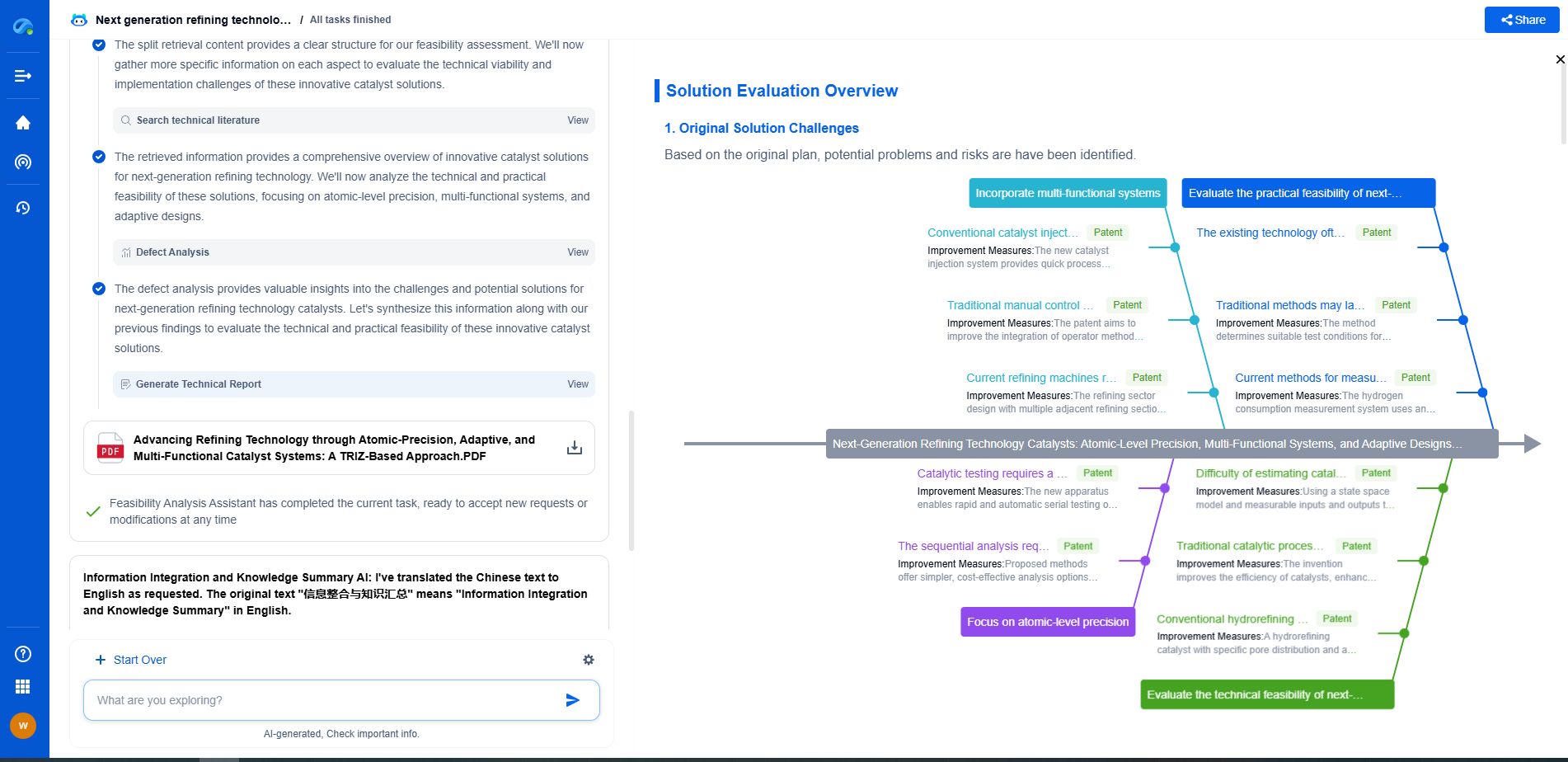

Unleash the Full Potential of AI Innovation with Patsnap Eureka

The frontier of machine learning evolves faster than ever—from foundation models and neuromorphic computing to edge AI and self-supervised learning. Whether you're exploring novel architectures, optimizing inference at scale, or tracking patent landscapes in generative AI, staying ahead demands more than human bandwidth.

Patsnap Eureka, our intelligent AI assistant built for R&D professionals in high-tech sectors, empowers you with real-time expert-level analysis, technology roadmap exploration, and strategic mapping of core patents—all within a seamless, user-friendly interface.

👉 Try Patsnap Eureka today to accelerate your journey from ML ideas to IP assets—request a personalized demo or activate your trial now.

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com