How Logistic Regression Helps in Credit Risk Scoring

JUN 26, 2025 |

Logistic regression is a fundamental statistical technique often used in the realm of predictive analytics. Unlike linear regression, which predicts a continuous outcome, logistic regression is utilized when the dependent variable is binary. This makes it particularly valuable in fields where the outcomes are dichotomous, such as credit risk scoring in the financial sector. Through logistic regression, we can model the probability that a given input falls into one of the two categories. This is executed by employing the logistic function to squeeze the output of a linear equation between 0 and 1, making it a suitable method for probability estimation.

The Role of Credit Risk Scoring

Credit risk scoring is a critical component of financial institutions' decision-making processes. It represents the likelihood that a borrower will default on their debt obligations. Accurate risk scoring is vital as it directly affects loan approval decisions, interest rates, and overall financial stability. Traditionally, credit risk scoring involved subjective judgment; however, with advancements in data analytics, objective, data-driven models like logistic regression have gained prominence.

Logistic Regression in Credit Risk Scoring

When applied to credit risk scoring, logistic regression provides a robust framework for evaluating the probability of default. This is accomplished by analyzing historical data on borrower behavior, credit history, income levels, and other relevant variables. Logistic regression allows financial institutions to quantify how each factor contributes to the likelihood of default, assigning appropriate weights to different credit characteristics.

Building the Model

The process of building a logistic regression model for credit risk scoring involves several steps. Initially, relevant data must be collected and preprocessed. This includes handling missing values, encoding categorical variables, and normalizing numerical data. Once the dataset is prepared, the logistic regression model is trained using historical data. The model learns by finding the best-fitting coefficients that minimize prediction errors. The result is a scoring model that estimates the probability of default for new credit applicants.

Interpreting the Results

One of the major advantages of logistic regression in credit risk scoring is its interpretability. The coefficients derived from the model provide insights into the strength and direction of the relationship between each predictor and the likelihood of default. A positive coefficient indicates that as the predictor increases, the probability of default also increases, and vice versa for negative coefficients. This interpretability is crucial for financial institutions as it aids in understanding why certain applicants are deemed riskier than others.

Model Validation and Challenges

After developing a logistic regression model, it is essential to validate its performance to ensure accuracy and reliability. This typically involves dividing the dataset into training and testing subsets to evaluate the model's predictive power on unseen data. Various metrics, such as the Receiver Operating Characteristic (ROC) curve and the Area Under the Curve (AUC), are used to assess model performance.

However, logistic regression is not without its challenges. It assumes a linear relationship between the independent variables and the log odds of the dependent variable, which might not always hold true. Additionally, multicollinearity among predictors can affect model stability. Despite these challenges, logistic regression remains a preferred method due to its simplicity, efficiency, and ease of interpretation.

The Future of Credit Risk Scoring with Logistic Regression

As the financial landscape continues to evolve with increasing data availability and computational power, logistic regression is likely to remain a cornerstone of credit risk scoring. Enhancements, such as integrating logistic regression with machine learning techniques, can offer even more precise models. By incorporating new data sources, such as social media activity and alternative financial data, the accuracy and inclusivity of credit risk assessment can be significantly improved.

In conclusion, logistic regression offers a reliable, interpretable, and efficient approach to credit risk scoring, helping financial institutions make informed lending decisions. As the field progresses, continued innovations will likely enhance the capabilities and applications of logistic regression in credit risk assessment, ensuring its relevance and effectiveness in the years to come.

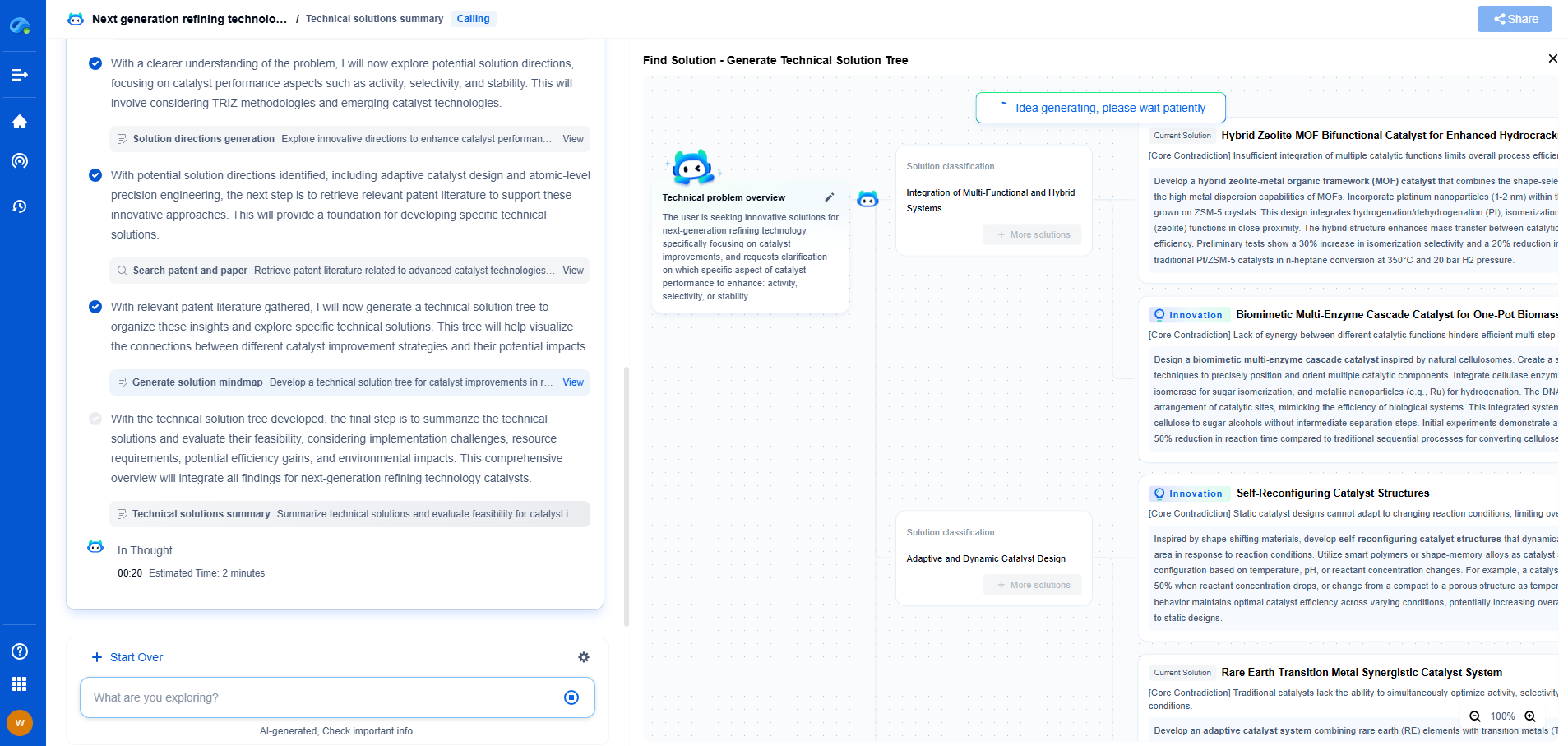

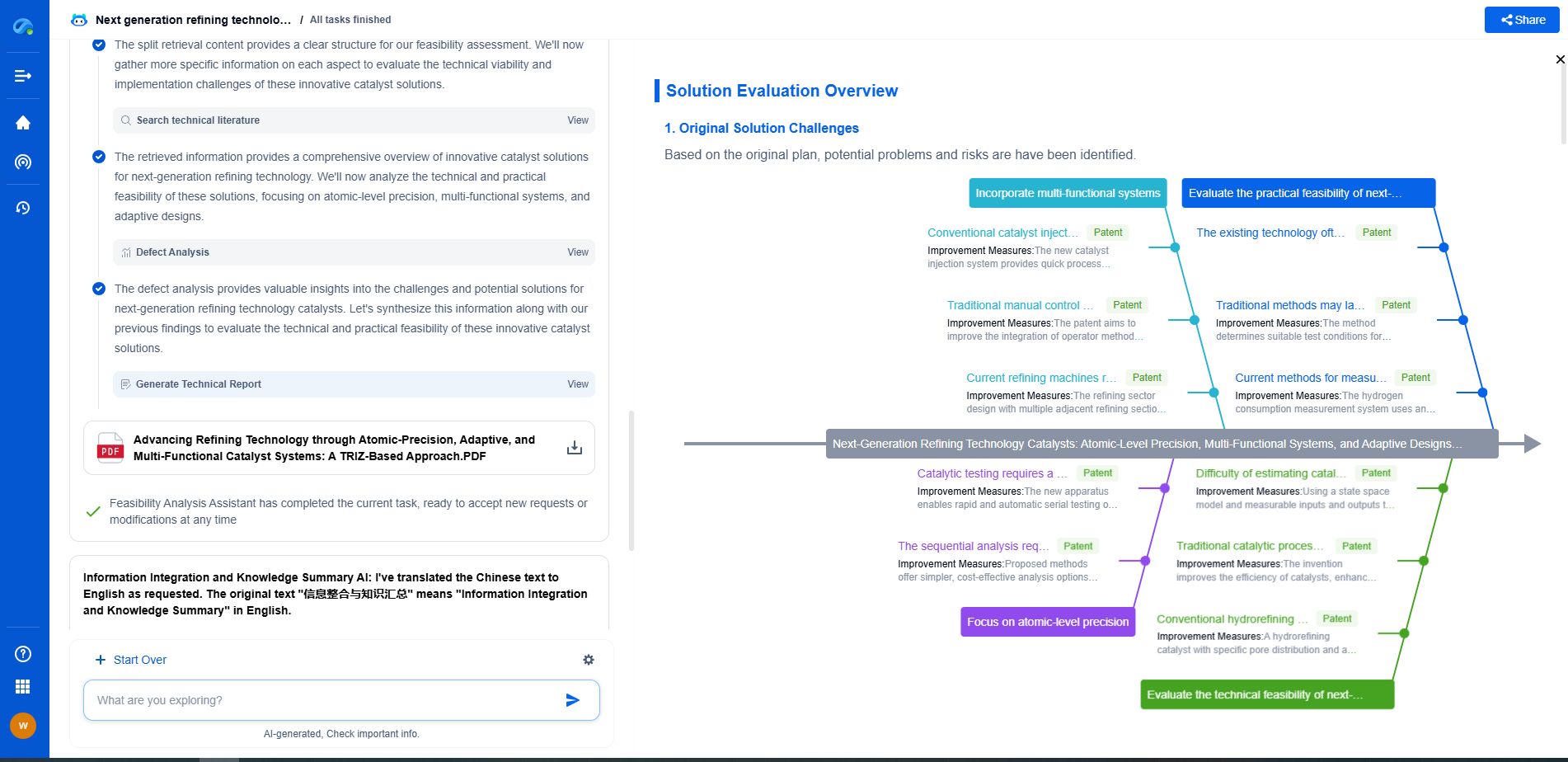

Unleash the Full Potential of AI Innovation with Patsnap Eureka

The frontier of machine learning evolves faster than ever—from foundation models and neuromorphic computing to edge AI and self-supervised learning. Whether you're exploring novel architectures, optimizing inference at scale, or tracking patent landscapes in generative AI, staying ahead demands more than human bandwidth.

Patsnap Eureka, our intelligent AI assistant built for R&D professionals in high-tech sectors, empowers you with real-time expert-level analysis, technology roadmap exploration, and strategic mapping of core patents—all within a seamless, user-friendly interface.

👉 Try Patsnap Eureka today to accelerate your journey from ML ideas to IP assets—request a personalized demo or activate your trial now.

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com