NPV Calculation: Lead-Acid vs Lithium-Ion for Telecom Towers

JUN 26, 2025 |

In the dynamic world of telecommunications, ensuring reliable and uninterrupted service is paramount. Telecom towers, the backbone of mobile networks, require continuous power to operate efficiently. Energy storage solutions like lead-acid and lithium-ion batteries play a crucial role in providing backup power. This blog explores how we can employ Net Present Value (NPV) calculations to compare these two battery technologies, offering insights into their financial viability for telecom towers.

Understanding the Basics of NPV

Before diving into the comparison, it’s essential to understand what NPV entails. NPV is a financial metric that helps determine the profitability of an investment. It calculates the present value of future cash flows, considering the time value of money. A positive NPV indicates that the projected earnings (in present dollars) exceed the anticipated costs, making the investment potentially profitable.

Lead-Acid Batteries: An Established Choice

Lead-acid batteries have been used for decades in various applications, including telecom towers. Known for their reliability and lower upfront costs, these batteries provide a familiar choice for many operators. However, they come with certain limitations, such as shorter lifespan, higher maintenance requirements, and lower energy density.

Calculating NPV for Lead-Acid Batteries

To calculate the NPV for lead-acid batteries, consider the initial investment cost, maintenance expenses, replacement costs, and expected lifespan. Typically, lead-acid batteries have a lifespan of around 3-5 years. The calculation also factors in the cost of capital, reflecting the opportunity cost of investing resources elsewhere.

For example, suppose a telecom operator needs to invest $10,000 initially in lead-acid batteries, with annual maintenance costs of $500 and replacement costs of $3,000 every five years. Assuming a discount rate of 8%, the NPV calculation can help identify whether this investment will generate positive returns over its operational life.

Lithium-Ion Batteries: The Modern Alternative

Lithium-ion batteries have gained popularity due to their longer lifespan, higher energy density, and lower maintenance needs. Although they come with a higher upfront cost, their extended operational life and efficiency can lead to cost savings over time, making them an attractive option for telecom towers.

Calculating NPV for Lithium-Ion Batteries

The NPV calculation for lithium-ion batteries includes the initial investment, significantly lower maintenance costs, and a lifespan of around 10-15 years. Despite the higher upfront cost, these batteries typically require less frequent replacement, reducing long-term expenses.

Consider a scenario where lithium-ion batteries require an initial investment of $20,000, with annual maintenance costs of $200. With a similar discount rate of 8%, and no replacement cost for at least 10 years, the NPV analysis can reveal if the higher initial investment will yield financial benefits over the long term.

Comparative Analysis: Lead-Acid vs Lithium-Ion

When comparing lead-acid and lithium-ion batteries for telecom towers, the NPV calculation provides a clear picture of their financial implications. While lead-acid batteries offer lower initial costs, their ongoing maintenance and replacement expenses can outweigh the initial savings. Conversely, lithium-ion batteries, despite a higher initial investment, may prove more cost-effective over time due to their longevity and efficiency.

Factors Influencing the Choice

Several factors can influence the decision between lead-acid and lithium-ion batteries. These include the location of the telecom tower, environmental conditions, regulatory requirements, and the operator’s financial strategy. Additionally, advancements in battery technology and potential changes in energy prices can impact the overall NPV calculation.

Conclusion: Making an Informed Decision

In conclusion, calculating the NPV for lead-acid and lithium-ion batteries provides a comprehensive financial analysis that can guide telecom tower operators in making informed decisions. While lead-acid batteries may seem appealing due to their lower upfront costs, lithium-ion batteries offer long-term financial advantages that cannot be overlooked. Ultimately, the choice between the two depends on various factors, including budget constraints, long-term operational goals, and the evolving landscape of energy storage technology. By conducting thorough NPV analyses, operators can ensure they choose the most economically viable solution for their specific needs.

Stay Ahead in Power Systems Innovation

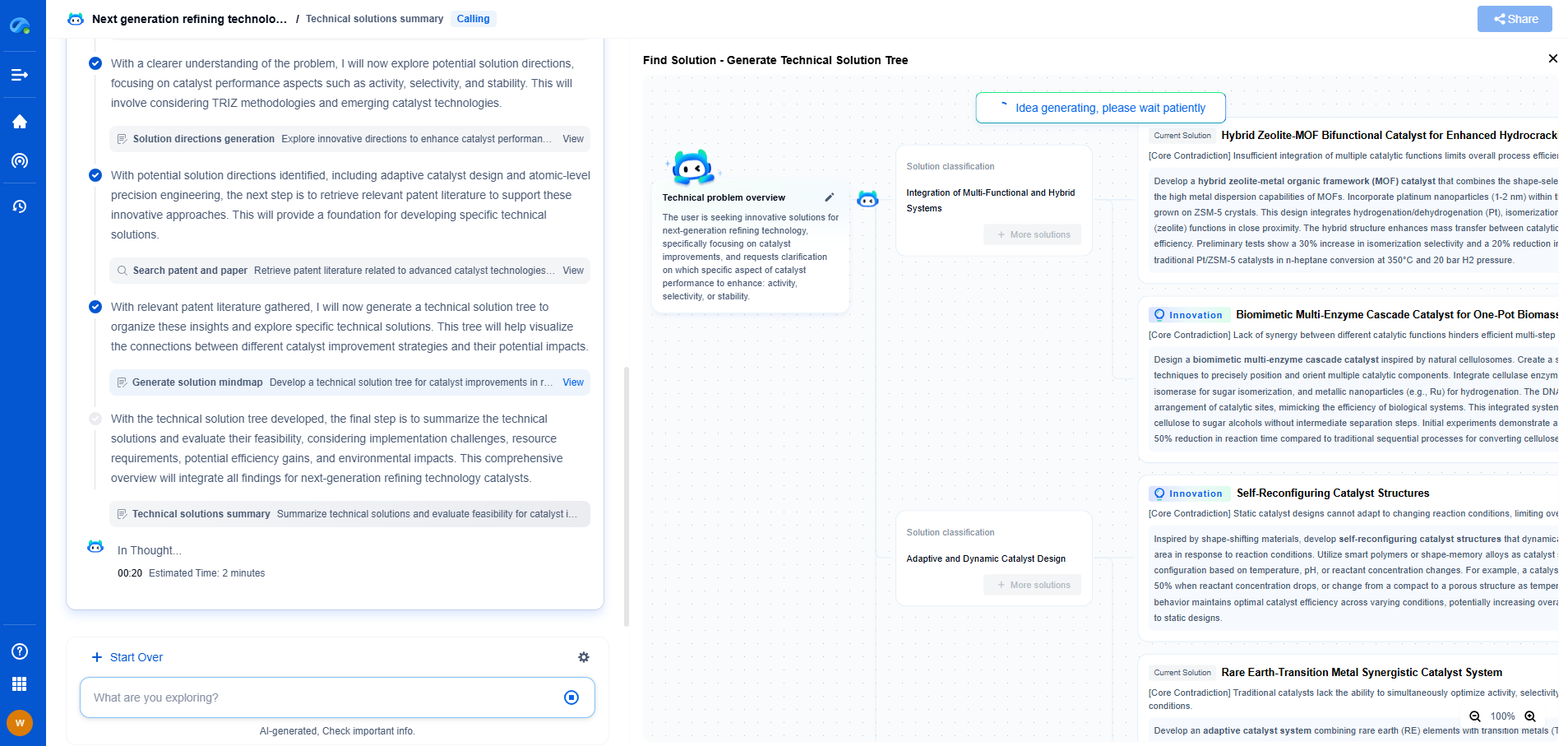

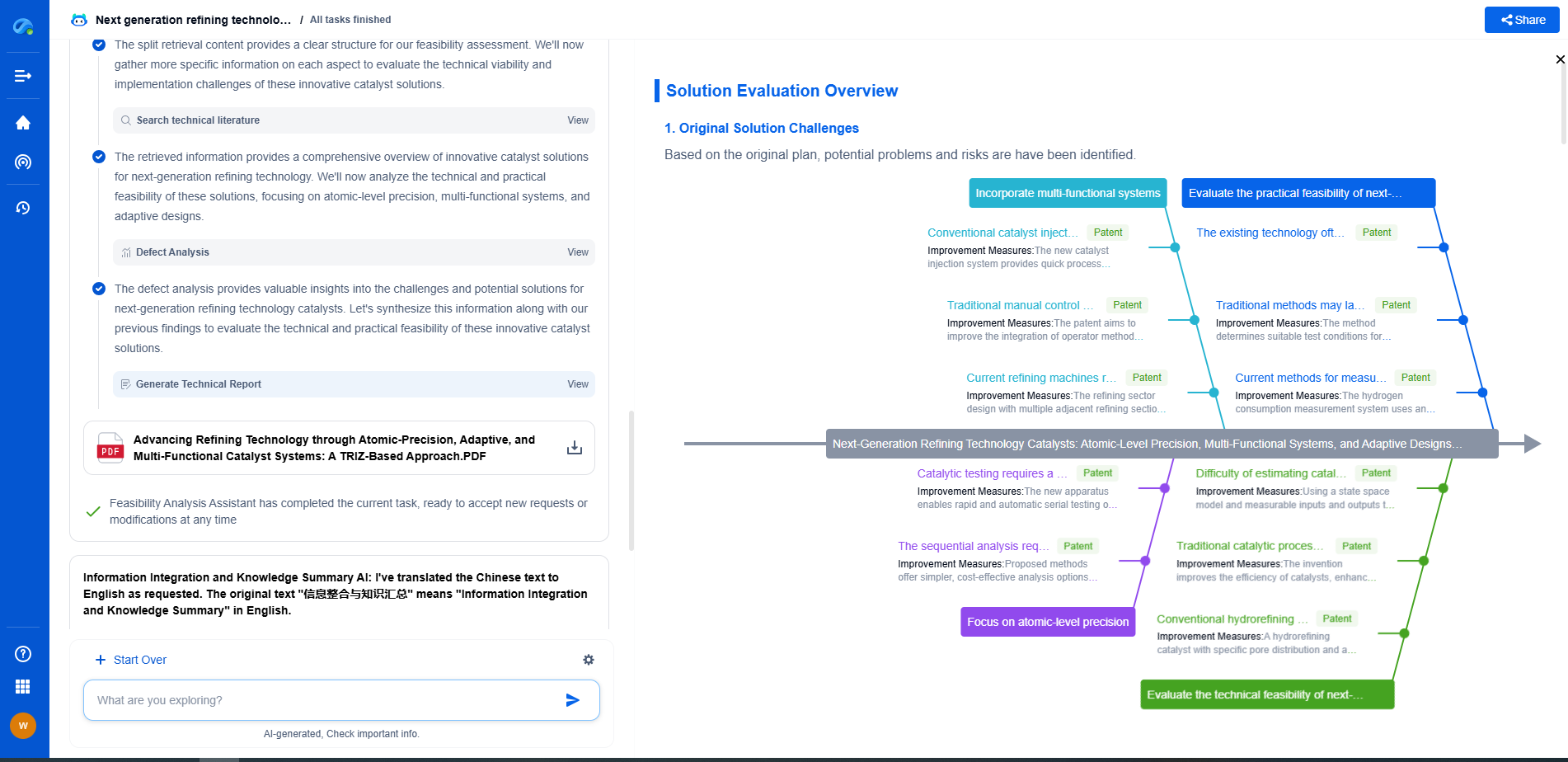

From intelligent microgrids and energy storage integration to dynamic load balancing and DC-DC converter optimization, the power supply systems domain is rapidly evolving to meet the demands of electrification, decarbonization, and energy resilience.

In such a high-stakes environment, how can your R&D and patent strategy keep up?

Patsnap Eureka, our intelligent AI assistant built for R&D professionals in high-tech sectors, empowers you with real-time expert-level analysis, technology roadmap exploration, and strategic mapping of core patents—all within a seamless, user-friendly interface.

👉 Experience how Patsnap Eureka can supercharge your workflow in power systems R&D and IP analysis. Request a live demo or start your trial today.

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com