Performance optimization for high-frequency trading systems

JUL 4, 2025 |

Hardware Optimization

The foundation of any high-frequency trading system is its hardware. To achieve optimal performance, it is crucial to invest in the right hardware components. High-frequency traders should consider using low-latency network cards, solid-state drives (SSDs) for faster data access, and high-speed processors. Co-locating servers close to exchanges can also significantly reduce latency, providing a critical edge over competitors.

Furthermore, it’s important to regularly evaluate and upgrade hardware components to keep up with technological advancements. Even the slightest reduction in processing time can lead to substantial gains in high-frequency trading.

Software Optimization

Software plays a pivotal role in the performance of HFT systems. Developers must focus on writing efficient code that minimizes latency and maximizes throughput. One way to achieve this is through the use of low-level programming languages like C or C++, which allow for greater control over system resources compared to higher-level languages.

Additionally, software optimizations such as reducing the number of context switches, optimizing memory usage, and employing parallel processing techniques can enhance performance. Leveraging just-in-time (JIT) compilation can also help by optimizing code execution at runtime, ensuring that the software runs as efficiently as possible.

Algorithmic Efficiency

The algorithms driving high-frequency trading strategies must be finely tuned to operate at peak performance. This involves optimizing the decision-making processes and ensuring that algorithms can process incoming data and execute trades with minimal delay.

Algorithmic efficiency can be improved through techniques such as data pre-fetching and the use of efficient data structures. Reducing computational complexity and minimizing the number of calculations required for each trade can lead to faster execution times. Additionally, employing machine learning models can help in refining algorithmic strategies by adapting to new market conditions in real-time.

Network Latency Reduction

Network latency is a critical factor that can significantly impact the performance of high-frequency trading systems. Reducing latency involves optimizing network connections and choosing the fastest communication protocols. Traders should consider using multicast protocols for market data distribution, which can reduce the time it takes to disseminate data across the network.

Furthermore, employing direct market access (DMA) can help reduce latency by bypassing intermediary brokers and connecting directly to exchanges. This not only speeds up trade execution but also decreases the risk of information delays.

Monitoring and Analysis

Continuous monitoring and analysis are essential for maintaining the performance of high-frequency trading systems. Implementing comprehensive monitoring solutions can help identify bottlenecks and areas for improvement in real-time. Analyzing performance metrics, such as latency, throughput, and error rates, allows traders to make data-driven decisions on where to focus optimization efforts.

Regular performance audits and stress testing can also help in identifying potential issues before they affect trading operations. By simulating various market conditions and assessing the system's response, traders can ensure that their systems remain robust and resilient.

Risk Management

While optimizing for speed and efficiency, it is crucial not to overlook risk management. High-frequency trading carries inherent risks due to the rapid pace and volume of trades. Ensuring that systems have built-in safeguards against erroneous trades and market anomalies is vital.

Implementing circuit breakers, kill switches, and real-time risk assessment tools can help mitigate potential losses. Balancing performance optimization with risk management ensures that high-frequency trading systems remain both fast and secure.

Conclusion

Performance optimization for high-frequency trading systems is a multifaceted endeavor that requires attention to hardware, software, algorithms, network infrastructure, and risk management. By continuously refining these elements, traders can maintain a competitive edge in the fast-evolving landscape of financial markets. With careful planning and ongoing improvements, high-frequency trading systems can achieve the optimal balance of speed, efficiency, and reliability.

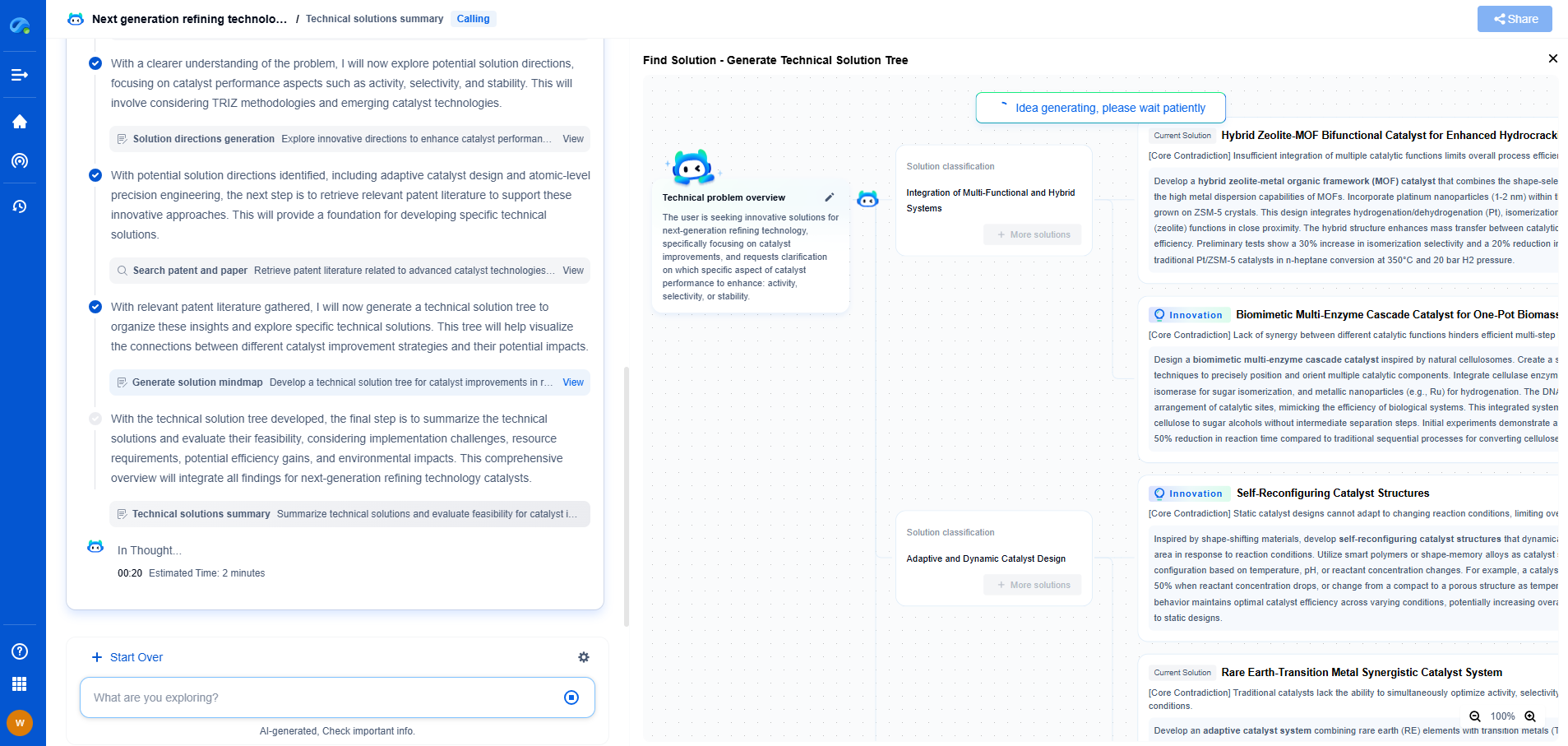

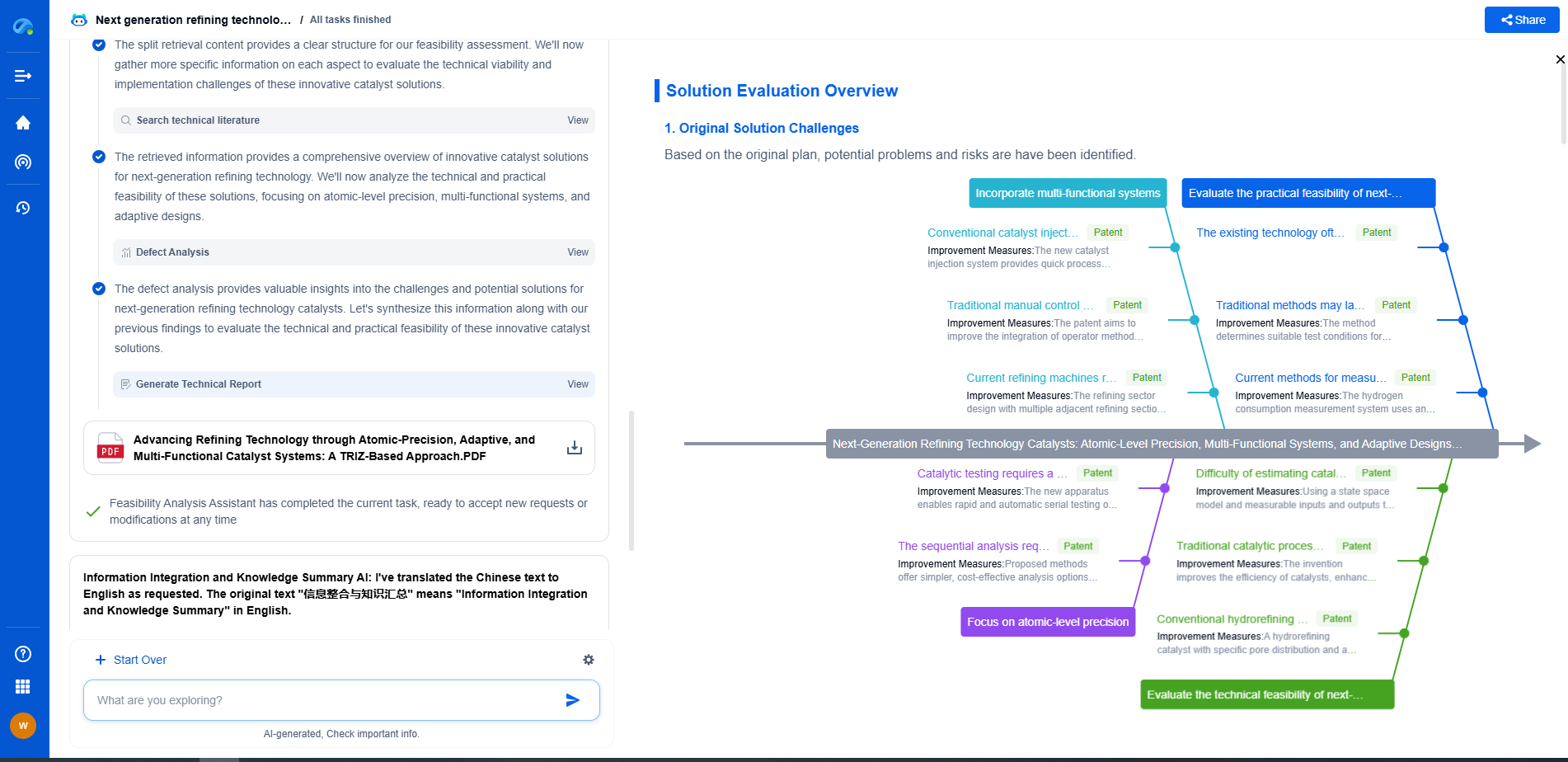

Accelerate Breakthroughs in Computing Systems with Patsnap Eureka

From evolving chip architectures to next-gen memory hierarchies, today’s computing innovation demands faster decisions, deeper insights, and agile R&D workflows. Whether you’re designing low-power edge devices, optimizing I/O throughput, or evaluating new compute models like quantum or neuromorphic systems, staying ahead of the curve requires more than technical know-how—it requires intelligent tools.

Patsnap Eureka, our intelligent AI assistant built for R&D professionals in high-tech sectors, empowers you with real-time expert-level analysis, technology roadmap exploration, and strategic mapping of core patents—all within a seamless, user-friendly interface.

Whether you’re innovating around secure boot flows, edge AI deployment, or heterogeneous compute frameworks, Eureka helps your team ideate faster, validate smarter, and protect innovation sooner.

🚀 Explore how Eureka can boost your computing systems R&D. Request a personalized demo today and see how AI is redefining how innovation happens in advanced computing.

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com