Tantalum vs. Niobium: Price Volatility and Long-Term Supply Risks

JUL 9, 2025 |

Tantalum and niobium are two critical metals that serve essential roles in various high-tech industries. Both elements belong to the refractory metals group, prized for their resistance to heat and corrosion, making them indispensable in electronics, aerospace, medical devices, and other advanced technologies. While they share similar properties and applications, their market dynamics, characterized by price volatility and supply risks, differ significantly.

Price Volatility: Analyzing Market Trends

The prices of tantalum and niobium are subject to fluctuations driven by factors such as geopolitical tensions, changes in demand, and mining disruptions. Tantalum prices have historically been more volatile due to its reliance on a limited number of suppliers, primarily from the Democratic Republic of Congo (DRC) and Rwanda. The civil unrest and political instability in these regions can lead to abrupt supply chain disruptions, driving prices up unpredictably.

Niobium, on the other hand, tends to experience less volatility. Brazil is the leading producer, accounting for over 90% of global niobium supply, primarily through the Araxá mine operated by CBMM (Companhia Brasileira de Metalurgia e Mineração). The stable political climate in Brazil contributes to predictable production levels, thus offering more stable prices.

Factors Influencing Tantalum and Niobium Markets

Several factors influence the market dynamics of tantalum and niobium. Firstly, technological advancements continually shift the demand for these metals. The rapid growth in electronics, aerospace, and energy sectors drives demand, often exceeding supply capabilities, thus influencing market prices.

Secondly, environmental and ethical considerations are increasingly impacting market trends. Tantalum sourcing, in particular, is under scrutiny due to concerns over conflict minerals. This has led to initiatives aimed at ensuring ethical supply chains, which can affect both production costs and consumer demand.

Lastly, trade policies and international relations play a significant role. Tariffs, export restrictions, and trade agreements can alter the flow and cost of these metals, making the market sensitive to changes in global political landscapes.

Long-Term Supply Risks: Evaluating Sustainability

The sustainability of tantalum and niobium supply is a crucial concern for industries relying on these metals. Tantalum faces more pronounced supply risks due to its uneven geographical distribution and reliance on politically unstable regions. Efforts to diversify sources, such as exploring deposits in Australia and Canada, are underway but face considerable challenges in terms of cost and feasibility.

Niobium's long-term supply risks are relatively lower due to Brazil's strong production capacity. However, the concentration of supply in a single country presents its own risks, including potential monopolistic control and vulnerability to national policy changes. Thus, while the current supply is stable, any significant geopolitical or environmental changes in Brazil could have far-reaching implications.

Mitigating Risks and Ensuring Stability

To mitigate price volatility and supply risks, several strategies can be employed. Diversification of supply sources is paramount, requiring investment in exploration and development of new mines in geopolitically stable regions. Additionally, recycling initiatives for tantalum and niobium can reduce reliance on mined materials, providing a more sustainable supply chain.

Technological innovations in mining and processing can also enhance efficiency and reduce costs. By improving extraction techniques and developing alternative materials to replace or supplement tantalum and niobium, industries can buffer against potential shortages and price spikes.

Conclusion: Navigating Future Challenges

In conclusion, while both tantalum and niobium are essential for modern technologies, their market dynamics present unique challenges. Tantalum's price volatility and supply risks necessitate proactive measures to ensure stability, while niobium's concentrated supply underscores the importance of strategic diversification. As global demand for these metals continues to grow, industries must navigate these challenges with innovative solutions and a commitment to sustainable practices.

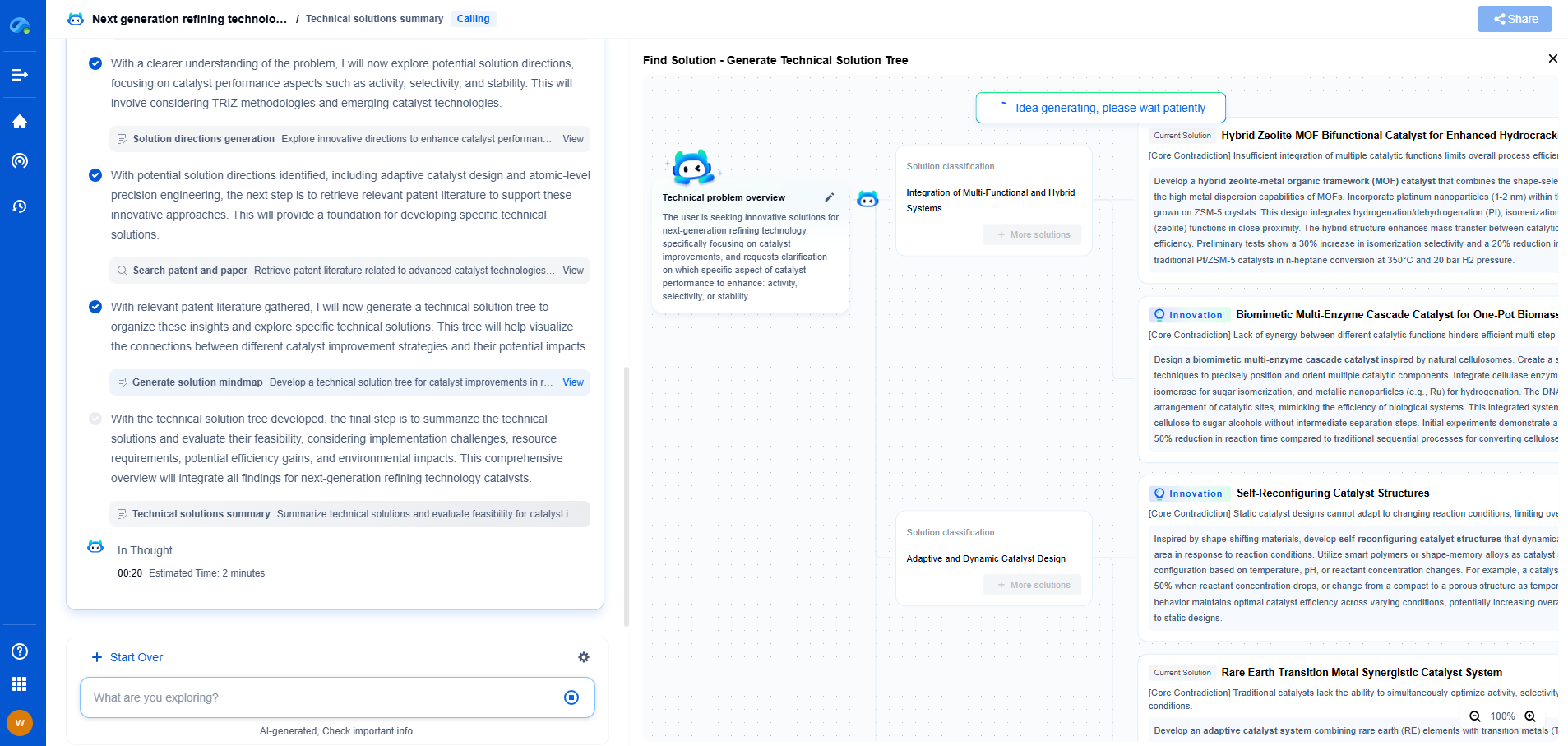

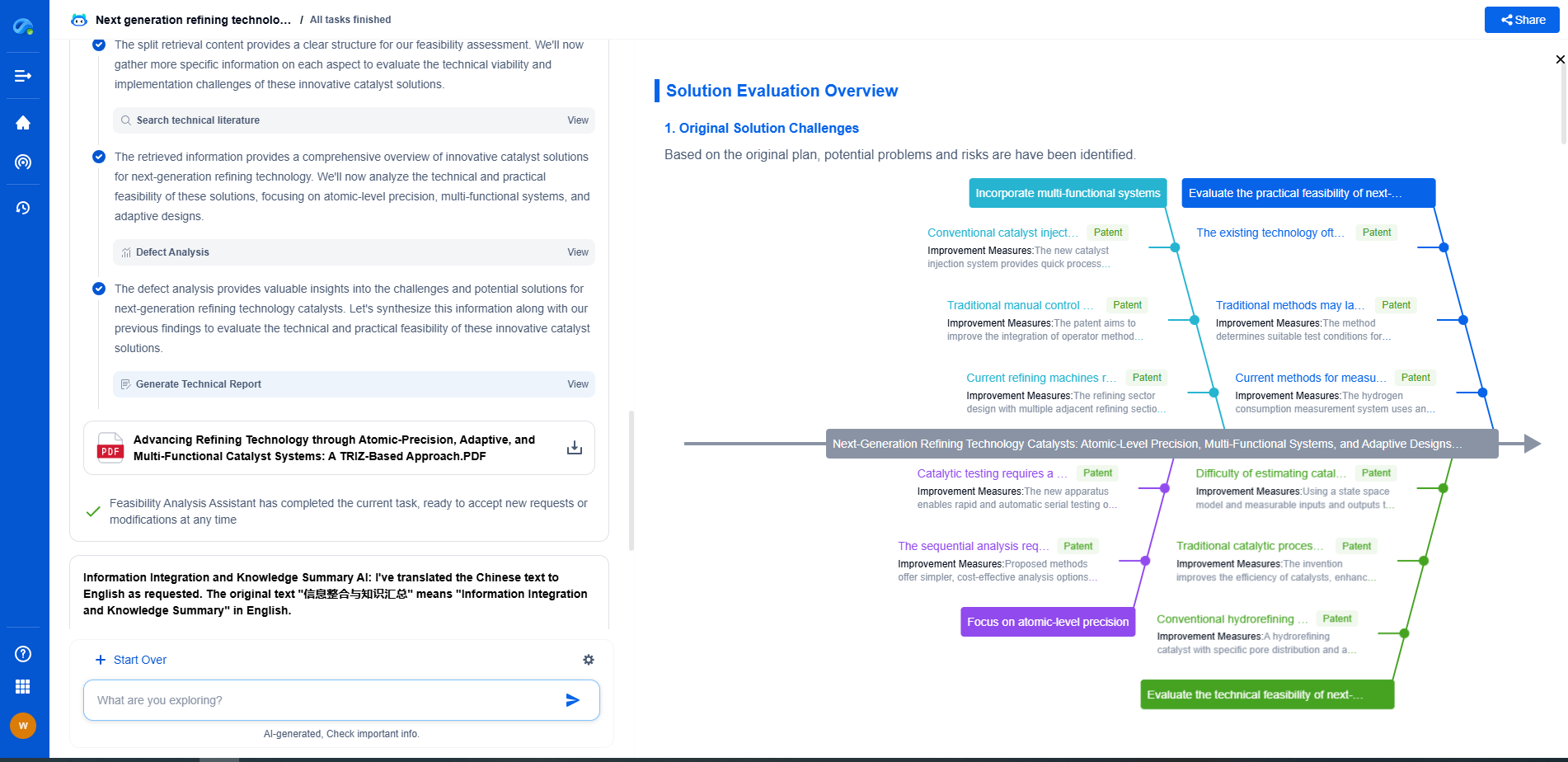

Looking to accelerate your capacitor innovation pipeline?

As capacitor technologies evolve—from miniaturized MLCCs for smartphones to grid-scale energy storage devices—so must the way your team accesses critical knowledge.

Patsnap Eureka, our intelligent AI assistant built for R&D professionals in high-tech sectors, empowers you with real-time expert-level analysis, technology roadmap exploration, and strategic mapping of core patents—all within a seamless, user-friendly interface.

Try Patsnap Eureka now and discover a faster, smarter way to research and innovate in capacitor technology.

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com