Using Time Series Decomposition in Financial Forecasting

JUN 26, 2025 |

In the ever-evolving world of finance, accurate forecasting is crucial for making informed decisions, minimizing risks, and maximizing returns. One of the most effective techniques for forecasting in finance is time series decomposition. This method allows analysts to break down complex financial data into simpler, more manageable components, providing a clearer view of underlying patterns and trends. This blog explores the use of time series decomposition in financial forecasting, highlighting its importance, components, and practical applications.

Understanding Time Series Decomposition

Time series decomposition involves breaking down a series of data points, typically collected at consistent time intervals, into several distinct components. These components usually include the trend, seasonality, and irregular (or residual) components. Each component represents a different aspect of the data, and understanding them can help analysts gain insights into the behavior of financial variables over time.

1. Trend Component

The trend component represents the long-term movement in the data. In financial contexts, this could be the gradual increase or decrease in stock prices, interest rates, or economic indicators over time. Identifying the trend helps forecasters understand the general direction in which a financial variable is moving, which is essential for long-term decision-making.

2. Seasonal Component

Seasonality refers to the repeating patterns or cycles observed in the data over specific intervals, such as months or quarters. In finance, seasonality might manifest in quarterly earnings reports, holiday sales patterns, or recurring market fluctuations. Understanding seasonal variations can help analysts account for predictable changes and make more accurate short-term forecasts.

3. Irregular Component

The irregular component comprises the random, unpredictable fluctuations in the data. These are often caused by unforeseen events or anomalies, such as economic shocks, political changes, or natural disasters. While the irregular component is inherently unpredictable, identifying and isolating it can help analysts focus on the more predictable components of the time series.

Applications in Financial Forecasting

Time series decomposition is widely used in various financial forecasting scenarios. By separating the data into its components, analysts can better understand the dynamics driving financial markets and make more informed predictions.

Stock Price Forecasting

In stock price forecasting, decomposing time series data allows analysts to identify the underlying trend and account for seasonal effects. By isolating these components, they can develop models that provide more reliable predictions, helping investors make better buy or sell decisions.

Economic Indicators

Economic indicators, such as GDP, inflation rates, and employment figures, are crucial for understanding the overall health of an economy. Time series decomposition helps analysts discern the long-term trends and seasonal patterns in these indicators, enabling them to forecast future economic conditions and adjust investment strategies accordingly.

Risk Management

Time series decomposition also plays a vital role in risk management. By analyzing the trend and seasonality in historical data, financial institutions can better predict potential risks and devise strategies to mitigate them. This approach is especially valuable in scenarios where sudden, unexpected changes could have significant financial implications.

Conclusion

Time series decomposition is a powerful tool in the arsenal of financial analysts and forecasters. By breaking down complex financial data into trend, seasonal, and irregular components, analysts can gain a clearer understanding of the factors influencing financial markets and make more informed predictions. Whether it's stock price forecasting, analyzing economic indicators, or managing risks, time series decomposition provides valuable insights that enhance decision-making and strategic planning in the financial sector. As financial markets continue to evolve, mastering this technique will remain a crucial skill for analysts seeking to navigate the complexities of modern finance.

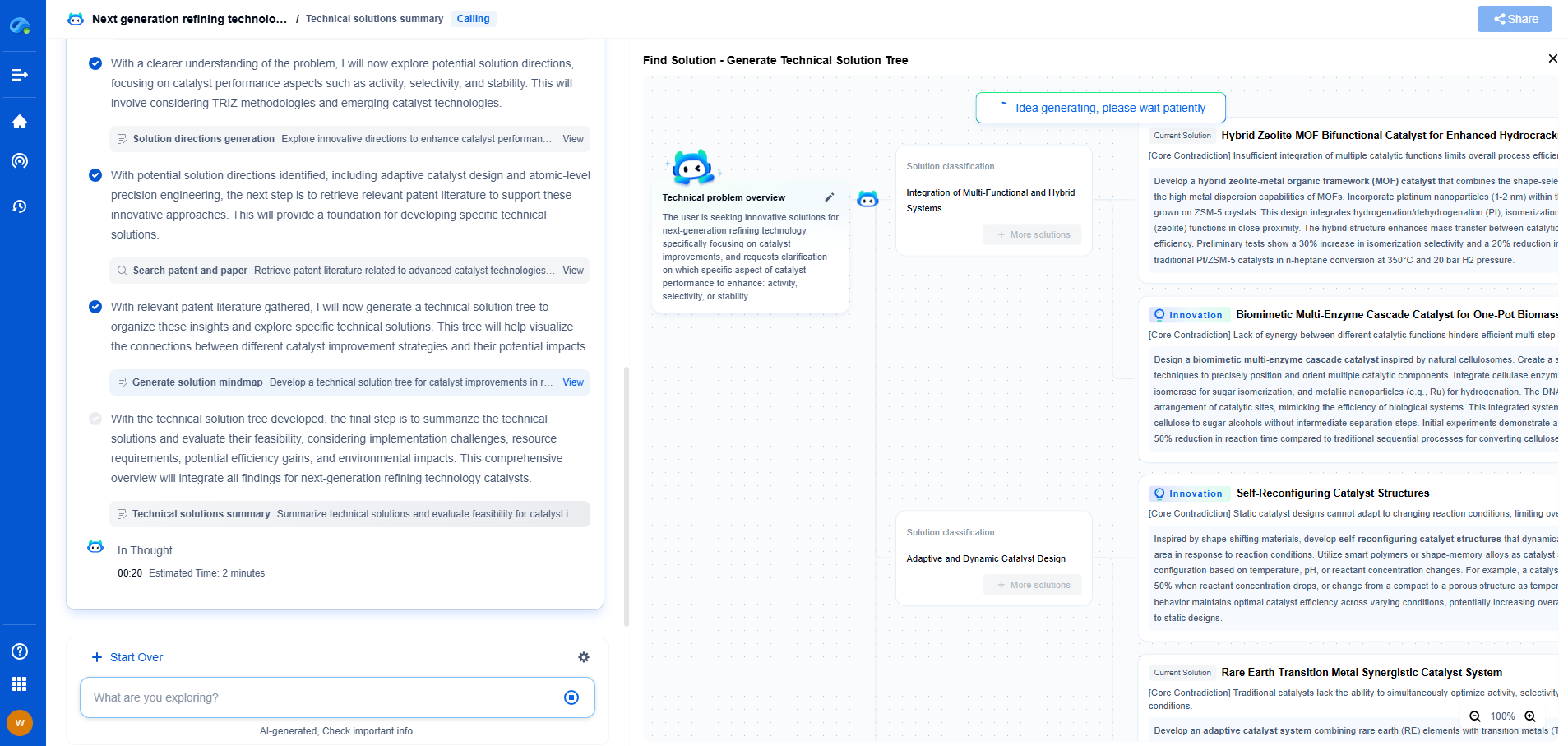

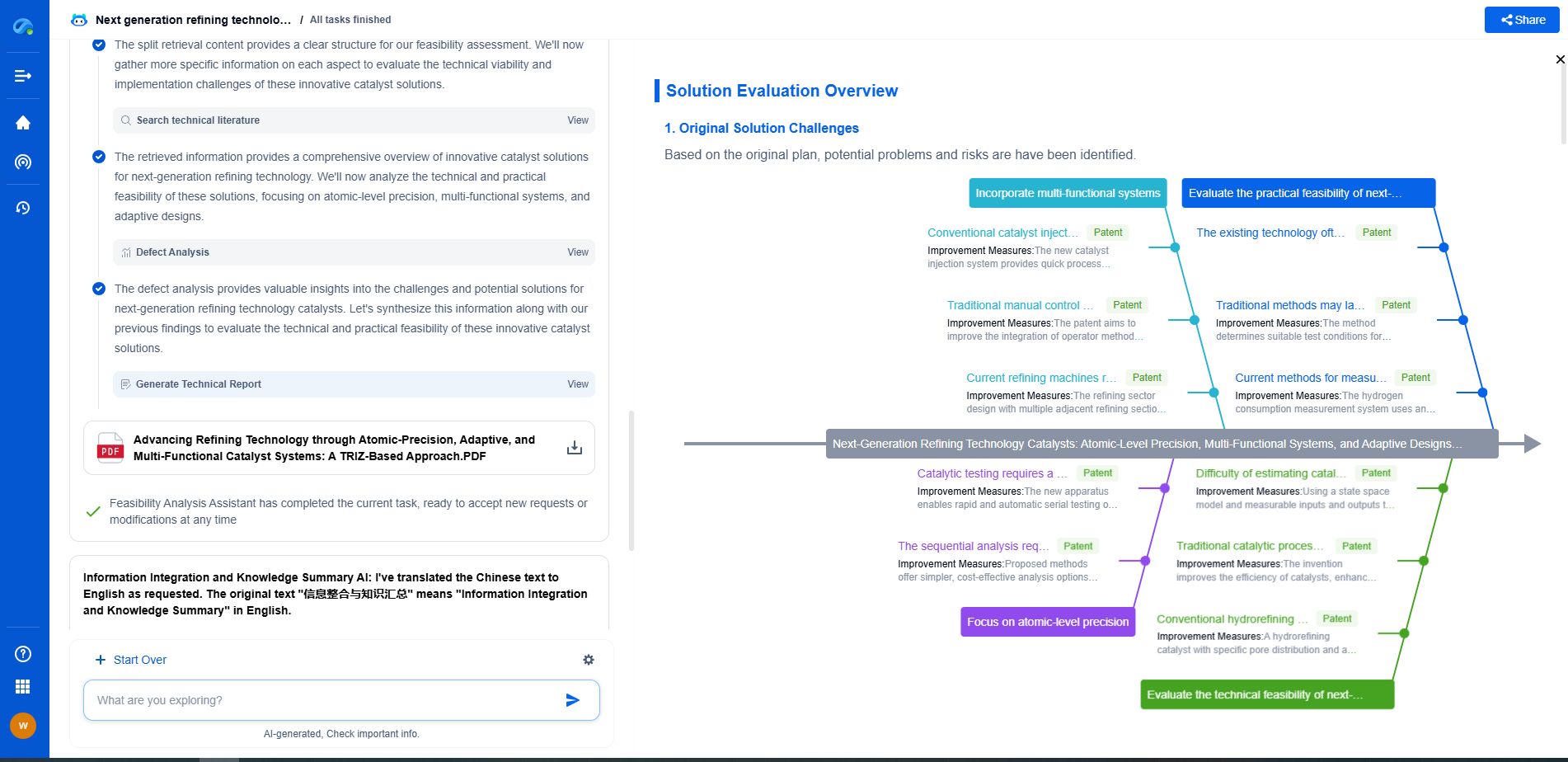

Unleash the Full Potential of AI Innovation with Patsnap Eureka

The frontier of machine learning evolves faster than ever—from foundation models and neuromorphic computing to edge AI and self-supervised learning. Whether you're exploring novel architectures, optimizing inference at scale, or tracking patent landscapes in generative AI, staying ahead demands more than human bandwidth.

Patsnap Eureka, our intelligent AI assistant built for R&D professionals in high-tech sectors, empowers you with real-time expert-level analysis, technology roadmap exploration, and strategic mapping of core patents—all within a seamless, user-friendly interface.

👉 Try Patsnap Eureka today to accelerate your journey from ML ideas to IP assets—request a personalized demo or activate your trial now.

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com