When SHAP Values Lie: Feature Correlation Traps in Credit Scoring

JUN 26, 2025 |

In the rapidly evolving realm of machine learning, SHAP (SHapley Additive exPlanations) values have emerged as a widely adopted tool for interpreting model predictions. They offer insights into individual feature contributions, making complex models more transparent. However, when it comes to credit scoring, a field rife with nuances and interdependencies, relying solely on SHAP values can sometimes lead to misleading interpretations, primarily due to feature correlation. This blog delves into the intricacies of such scenarios, exploring how SHAP values can deceive and how these pitfalls can be mitigated.

Understanding SHAP Values in Machine Learning

To understand the potential pitfalls of SHAP values, it's essential first to grasp their foundation. SHAP values are grounded in cooperative game theory, considering each feature as a 'player' who contributes to a 'game' that is the model's prediction. The contribution of each feature is assessed by considering all possible feature combinations, thus offering a robust measure of a feature's importance. This theoretical underpinning makes SHAP an attractive tool for models that are often seen as black boxes.

The Role of Feature Correlation in Credit Scoring

Credit scoring models typically integrate a multitude of features, ranging from credit history and current debt levels to demographic and employment information. These features are often interdependent, and high correlation between them is common. For instance, income level and credit card limit might show a strong positive correlation. Such correlations can skew the SHAP values, as they inherently assume feature independence.

How Feature Correlation Skews SHAP Interpretations

When features are correlated, SHAP's assumption of feature independence is violated. This can result in over- or underestimation of a feature's importance. Consider a scenario where two highly correlated features, like 'current outstanding balance' and 'credit utilization ratio,' both play a significant role in predicting credit risk. SHAP might attribute the importance to one feature over the other arbitrarily, leading to biased interpretations.

A practical example might involve a situation where removing one feature causes a spike in another's SHAP value. This happens because the removed feature's contribution is reassigned to its correlated counterpart, creating a misrepresented view of feature importance.

The Pitfalls of Misleading Interpretations

Misleading interpretations in credit scoring can have far-reaching consequences. If SHAP values inaccurately depict the influence of certain features, it could lead to incorrect risk assessments. Financial institutions might either overestimate or underestimate a borrower's credit risk, leading to poor decision-making. This not only affects the individual borrower but also poses a risk to the financial institution in terms of potential defaults or lost business opportunities.

Mitigating the Impact of Feature Correlation

While SHAP values offer valuable insights, it's crucial to complement them with additional tools and techniques to account for feature correlation. Some strategies include:

1. **Feature Engineering**: Reducing correlation through careful feature selection or transformation can minimize the impact on SHAP values. Techniques like Principal Component Analysis (PCA) can help in deriving uncorrelated features.

2. **Regularization Techniques**: Implementing techniques like Lasso (L1 regularization) or Ridge (L2 regularization) can help in penalizing complex models, thus reducing the reliance on correlated features.

3. **Alternative Interpretation Methods**: Complement SHAP analyses with other interpretation methods such as Partial Dependence Plots (PDP) or Accumulated Local Effects (ALE) to gain a holistic understanding of feature importance.

4. **Domain Expertise**: Leveraging domain knowledge to question and validate the interpretations provided by SHAP values can provide a safeguard against misleading conclusions.

Conclusion

SHAP values are undoubtedly a powerful tool in the arsenal of machine learning interpretability. However, in complex fields like credit scoring, where feature correlation is prevalent, they can sometimes paint a deceptive picture. By acknowledging the limitations and complementing SHAP with additional strategies, we can harness their potential while safeguarding against the pitfalls of feature correlation. In an era where machine learning models drive critical financial decisions, ensuring the accuracy and reliability of model interpretations is not just desirable but essential.

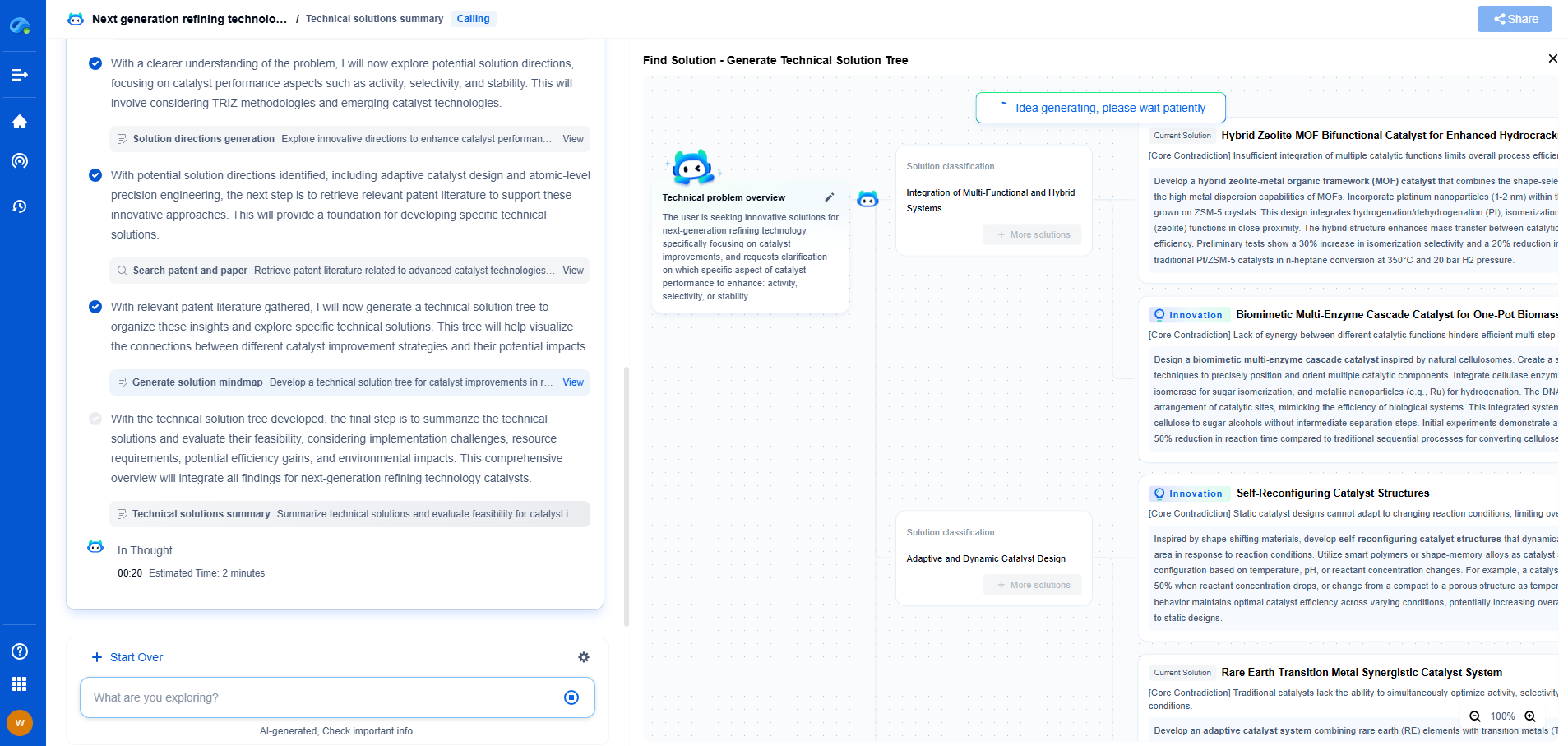

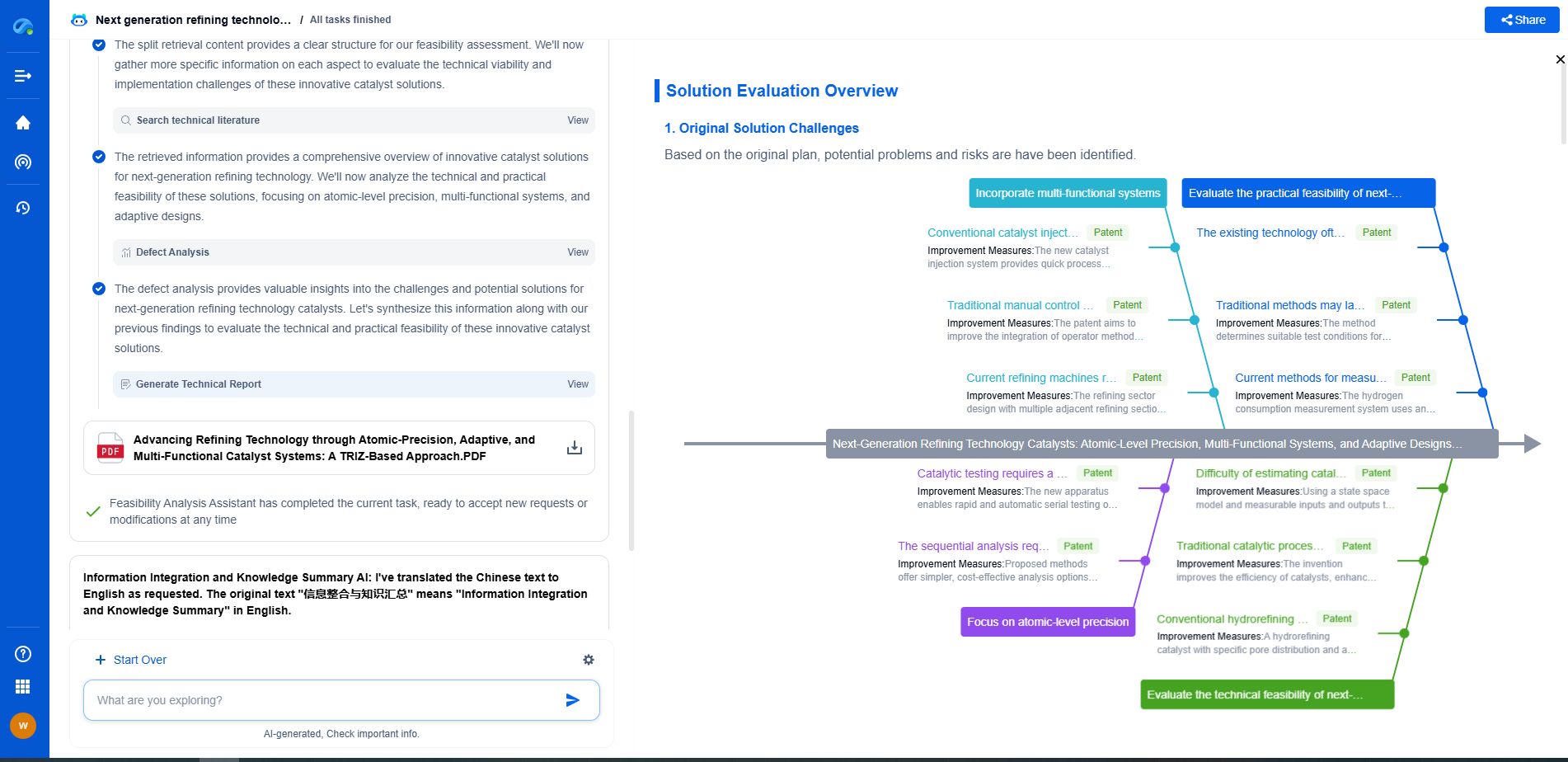

Unleash the Full Potential of AI Innovation with Patsnap Eureka

The frontier of machine learning evolves faster than ever—from foundation models and neuromorphic computing to edge AI and self-supervised learning. Whether you're exploring novel architectures, optimizing inference at scale, or tracking patent landscapes in generative AI, staying ahead demands more than human bandwidth.

Patsnap Eureka, our intelligent AI assistant built for R&D professionals in high-tech sectors, empowers you with real-time expert-level analysis, technology roadmap exploration, and strategic mapping of core patents—all within a seamless, user-friendly interface.

👉 Try Patsnap Eureka today to accelerate your journey from ML ideas to IP assets—request a personalized demo or activate your trial now.

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com