Why ASICs Dominate Bitcoin Mining (and Why GPUs Lost)

JUL 4, 2025 |

Bitcoin mining has undergone significant transformations since the cryptocurrency's inception in 2009. What began as a hobbyist endeavor using simple computer processors has evolved into a highly specialized industry dominated by Application-Specific Integrated Circuits (ASICs). Meanwhile, Graphics Processing Units (GPUs), once a staple in the mining community, have largely fallen by the wayside. This shift raises questions about why ASICs have risen to prominence and why GPUs have lost their foothold in this lucrative field.

The Early Days of Bitcoin Mining

In the early days of Bitcoin, mining was accessible to virtually anyone with a computer. The process relied on CPU power, and many enthusiasts mined using their personal computers. As Bitcoin's value rose and mining became more competitive, miners sought more efficient ways to mine. This led to the use of GPUs, which were far more effective than CPUs at handling the parallel computations needed for mining.

The Rise of GPUs

GPUs revolutionized Bitcoin mining by offering significantly higher hash rates compared to CPUs. Designed to handle complex calculations for rendering graphics, GPUs were well-suited to the mathematical challenges of Bitcoin mining. As a result, they quickly became the go-to technology for miners seeking to maximize their output. During this period, the mining community experienced rapid growth, with many individuals and small operations contributing to the network's security.

The Introduction of ASICs

The landscape of Bitcoin mining changed dramatically with the introduction of ASICs. These specialized devices are designed exclusively for mining cryptocurrencies. Unlike CPUs and GPUs, ASICs are engineered to perform the specific calculations required by Bitcoin's proof-of-work algorithm, offering unmatched efficiency and speed. As ASICs entered the market, they quickly demonstrated superiority in terms of hash rate and energy consumption.

Why ASICs Dominate

1. Efficiency and Performance

ASICs are unparalleled in their efficiency and performance. They can achieve hash rates that are orders of magnitude higher than those of GPUs, making them the preferred choice for serious miners. This efficiency translates into lower energy costs per unit of Bitcoin mined, which is a crucial factor given the high electricity demands of mining operations.

2. Cost-Effectiveness

Although ASICs can be more expensive upfront than GPUs, their increased mining capacity often results in a quicker return on investment. The cost-effectiveness of ASICs is further enhanced by their reduced energy consumption, which lowers operational expenses over time.

3. Market Dynamics

The highly competitive nature of Bitcoin mining has driven many operations to scale up and adopt ASICs to remain profitable. Large-scale mining farms have emerged, equipped with thousands of ASICs working in tandem. This industrialization of mining has solidified ASICs' dominance, as smaller operations relying on GPUs struggle to compete.

Why GPUs Lost

1. Decreased Viability

As the difficulty of Bitcoin mining increased, GPUs became less viable for profitable mining. The increasing competition and the superior performance of ASICs forced many GPU miners to either upgrade their hardware or exit the space altogether.

2. Shift in Utility

GPUs found new life in mining alternative cryptocurrencies that were not as dominated by ASICs. Coins with algorithms resistant to ASIC mining, such as Ethereum (prior to its transition to proof of stake), offered opportunities for GPU miners. This shift allowed GPUs to maintain some relevance in the broader cryptocurrency mining ecosystem.

3. The Impact of Technological Advancements

As ASIC technology continues to advance, the gap between ASICs and GPUs widens. Each new generation of ASICs brings improvements in speed and efficiency, further entrenching their position at the top of the mining hierarchy. GPUs simply cannot keep pace with these specialized machines in the context of Bitcoin mining.

Conclusion

The transition from GPUs to ASICs in Bitcoin mining highlights the natural progression of technology driven by market forces. While GPUs played a crucial role in the early years of Bitcoin, the advent of ASICs brought about a new era of mining characterized by heightened efficiency and competitiveness. As the industry continues to evolve, it will be interesting to observe how these dynamics shift and what innovations may arise to shape the future of cryptocurrency mining.

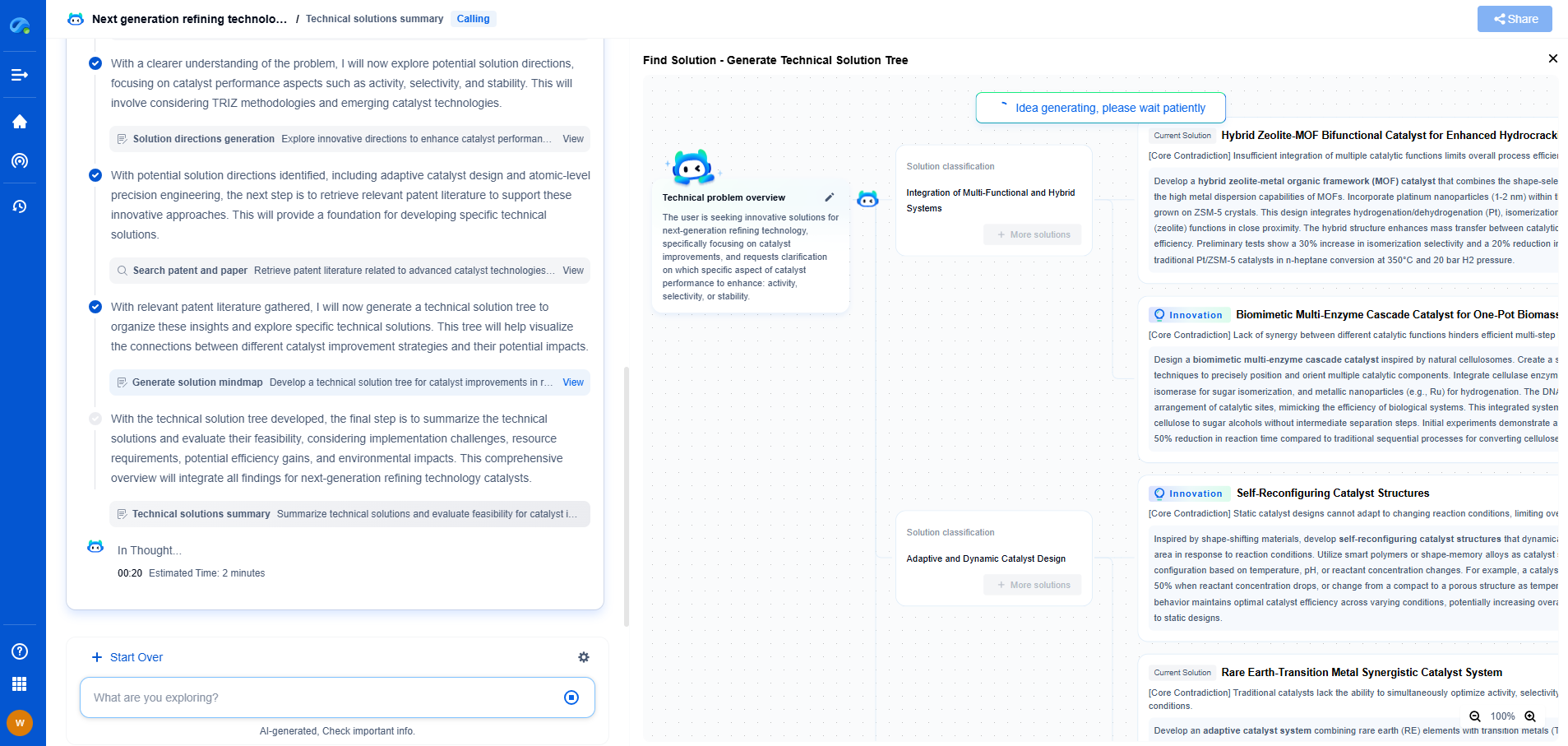

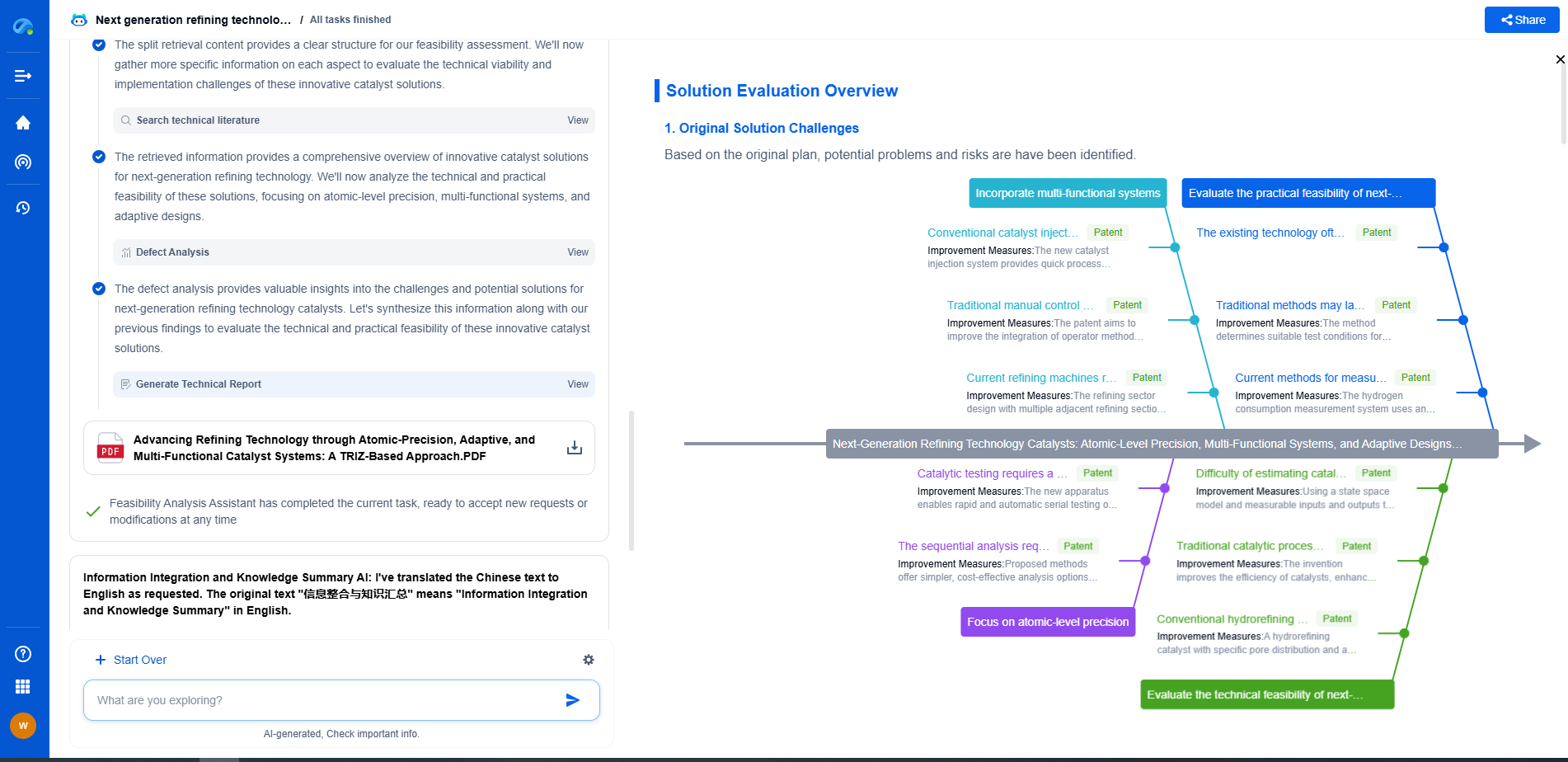

Accelerate Breakthroughs in Computing Systems with Patsnap Eureka

From evolving chip architectures to next-gen memory hierarchies, today’s computing innovation demands faster decisions, deeper insights, and agile R&D workflows. Whether you’re designing low-power edge devices, optimizing I/O throughput, or evaluating new compute models like quantum or neuromorphic systems, staying ahead of the curve requires more than technical know-how—it requires intelligent tools.

Patsnap Eureka, our intelligent AI assistant built for R&D professionals in high-tech sectors, empowers you with real-time expert-level analysis, technology roadmap exploration, and strategic mapping of core patents—all within a seamless, user-friendly interface.

Whether you’re innovating around secure boot flows, edge AI deployment, or heterogeneous compute frameworks, Eureka helps your team ideate faster, validate smarter, and protect innovation sooner.

🚀 Explore how Eureka can boost your computing systems R&D. Request a personalized demo today and see how AI is redefining how innovation happens in advanced computing.

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com