Li-S Vs Li-Ion: Specific Energy, Safety And Cycle Stability

SEP 12, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Li-S vs Li-Ion Battery Technology Background

Battery technology has evolved significantly over the past few decades, with lithium-ion (Li-ion) batteries becoming the dominant energy storage solution across various applications. However, as energy demands continue to increase, researchers have been exploring alternative battery chemistries with higher energy densities and improved safety profiles. Among these alternatives, lithium-sulfur (Li-S) batteries have emerged as a promising candidate.

Li-ion batteries, first commercialized by Sony in 1991, utilize lithium cobalt oxide (LiCoO2) or other lithium metal oxides as cathodes and graphite as anodes. The working principle involves lithium ions moving between the electrodes through an electrolyte during charge and discharge cycles. This technology has revolutionized portable electronics and is now powering electric vehicles and grid-scale energy storage systems.

Li-S batteries represent a different approach to energy storage, using sulfur as the cathode material and lithium metal as the anode. The theoretical energy density of Li-S batteries (2,567 Wh/kg) significantly exceeds that of conventional Li-ion batteries (387-800 Wh/kg), making them particularly attractive for applications requiring high energy density, such as electric aviation and advanced electric vehicles.

The development of Li-S technology dates back to the 1960s, but significant progress has only been made in the past two decades. The renewed interest stems from advancements in materials science and nanotechnology, which have helped address some of the inherent challenges of Li-S systems, including polysulfide shuttle effects, volume expansion, and limited cycle life.

From a historical perspective, Li-ion batteries have undergone continuous improvements in energy density, increasing approximately 5-7% annually. However, they are approaching their theoretical limits. In contrast, Li-S technology is still in its early stages of development, with substantial room for improvement through innovative materials and cell designs.

The evolution of both technologies has been driven by different market demands. Li-ion development has focused on balancing energy density, power capability, cycle life, and cost. Li-S research, meanwhile, has prioritized maximizing energy density while addressing cycle stability issues, with less emphasis on high-power applications.

Safety considerations have also shaped the development trajectory of both technologies. Li-ion batteries face challenges related to thermal runaway and flammable electrolytes, leading to the development of various safety mechanisms. Li-S batteries offer potentially improved safety due to the lower reactivity of sulfur compared to metal oxides, though they face their own safety challenges related to lithium metal anodes.

Li-ion batteries, first commercialized by Sony in 1991, utilize lithium cobalt oxide (LiCoO2) or other lithium metal oxides as cathodes and graphite as anodes. The working principle involves lithium ions moving between the electrodes through an electrolyte during charge and discharge cycles. This technology has revolutionized portable electronics and is now powering electric vehicles and grid-scale energy storage systems.

Li-S batteries represent a different approach to energy storage, using sulfur as the cathode material and lithium metal as the anode. The theoretical energy density of Li-S batteries (2,567 Wh/kg) significantly exceeds that of conventional Li-ion batteries (387-800 Wh/kg), making them particularly attractive for applications requiring high energy density, such as electric aviation and advanced electric vehicles.

The development of Li-S technology dates back to the 1960s, but significant progress has only been made in the past two decades. The renewed interest stems from advancements in materials science and nanotechnology, which have helped address some of the inherent challenges of Li-S systems, including polysulfide shuttle effects, volume expansion, and limited cycle life.

From a historical perspective, Li-ion batteries have undergone continuous improvements in energy density, increasing approximately 5-7% annually. However, they are approaching their theoretical limits. In contrast, Li-S technology is still in its early stages of development, with substantial room for improvement through innovative materials and cell designs.

The evolution of both technologies has been driven by different market demands. Li-ion development has focused on balancing energy density, power capability, cycle life, and cost. Li-S research, meanwhile, has prioritized maximizing energy density while addressing cycle stability issues, with less emphasis on high-power applications.

Safety considerations have also shaped the development trajectory of both technologies. Li-ion batteries face challenges related to thermal runaway and flammable electrolytes, leading to the development of various safety mechanisms. Li-S batteries offer potentially improved safety due to the lower reactivity of sulfur compared to metal oxides, though they face their own safety challenges related to lithium metal anodes.

Market Demand Analysis for High Energy Density Batteries

The global market for high energy density batteries is experiencing unprecedented growth, driven primarily by the expanding electric vehicle (EV) sector, portable electronics, and renewable energy storage systems. Current projections indicate the high-energy battery market will reach approximately $120 billion by 2030, with a compound annual growth rate exceeding 18% between 2023 and 2030.

Consumer demand for extended range in electric vehicles represents the most significant market driver. As EV adoption accelerates globally, manufacturers are prioritizing battery technologies that can deliver greater energy density to overcome range anxiety—consistently cited as a primary barrier to EV adoption in consumer surveys. The average consumer now expects EVs to deliver minimum ranges of 300-400 miles per charge, creating substantial pressure for battery innovation.

The portable electronics sector continues to demand batteries with higher capacity in increasingly compact form factors. Smartphone manufacturers, wearable technology companies, and laptop producers all seek battery solutions that can extend device operation while maintaining or reducing device dimensions. This market segment values energy density improvements that don't compromise safety or device design.

Aerospace and defense applications represent a premium market segment with stringent requirements for high energy density batteries. These applications can tolerate higher costs for superior performance, creating opportunities for advanced battery technologies like Li-S systems that may initially be too expensive for consumer markets.

Grid-scale energy storage represents another expanding market, particularly as renewable energy integration increases. This sector requires batteries with excellent cycle stability, reasonable costs, and improved safety profiles—areas where next-generation technologies must demonstrate advantages over conventional Li-ion systems.

Safety concerns have become increasingly prominent in battery market requirements following high-profile thermal runaway incidents. Manufacturers and consumers alike now demand batteries with enhanced safety features, creating market opportunities for inherently safer chemistries like Li-S batteries with their lower thermal runaway risk compared to conventional Li-ion cells.

The sustainability profile of battery technologies is emerging as a significant market differentiator. Consumers and regulatory bodies increasingly consider environmental impact and resource utilization in technology adoption decisions. Li-S batteries' potential advantages in using abundant, lower-cost sulfur rather than costly metals like cobalt and nickel could provide market advantages as sustainability concerns grow.

Price sensitivity varies significantly across market segments, with consumer electronics and mass-market EVs highly sensitive to battery costs, while aerospace and premium vehicle segments can absorb higher costs for performance advantages. Any new battery technology must present a viable path to cost competitiveness to achieve widespread market adoption.

Consumer demand for extended range in electric vehicles represents the most significant market driver. As EV adoption accelerates globally, manufacturers are prioritizing battery technologies that can deliver greater energy density to overcome range anxiety—consistently cited as a primary barrier to EV adoption in consumer surveys. The average consumer now expects EVs to deliver minimum ranges of 300-400 miles per charge, creating substantial pressure for battery innovation.

The portable electronics sector continues to demand batteries with higher capacity in increasingly compact form factors. Smartphone manufacturers, wearable technology companies, and laptop producers all seek battery solutions that can extend device operation while maintaining or reducing device dimensions. This market segment values energy density improvements that don't compromise safety or device design.

Aerospace and defense applications represent a premium market segment with stringent requirements for high energy density batteries. These applications can tolerate higher costs for superior performance, creating opportunities for advanced battery technologies like Li-S systems that may initially be too expensive for consumer markets.

Grid-scale energy storage represents another expanding market, particularly as renewable energy integration increases. This sector requires batteries with excellent cycle stability, reasonable costs, and improved safety profiles—areas where next-generation technologies must demonstrate advantages over conventional Li-ion systems.

Safety concerns have become increasingly prominent in battery market requirements following high-profile thermal runaway incidents. Manufacturers and consumers alike now demand batteries with enhanced safety features, creating market opportunities for inherently safer chemistries like Li-S batteries with their lower thermal runaway risk compared to conventional Li-ion cells.

The sustainability profile of battery technologies is emerging as a significant market differentiator. Consumers and regulatory bodies increasingly consider environmental impact and resource utilization in technology adoption decisions. Li-S batteries' potential advantages in using abundant, lower-cost sulfur rather than costly metals like cobalt and nickel could provide market advantages as sustainability concerns grow.

Price sensitivity varies significantly across market segments, with consumer electronics and mass-market EVs highly sensitive to battery costs, while aerospace and premium vehicle segments can absorb higher costs for performance advantages. Any new battery technology must present a viable path to cost competitiveness to achieve widespread market adoption.

Technical Challenges in Li-S Battery Development

Despite the promising theoretical energy density of Li-S batteries (2600 Wh/kg compared to Li-ion's 387 Wh/kg), several significant technical challenges have impeded their widespread commercial adoption. The most prominent issue is the "shuttle effect," where soluble polysulfide intermediates migrate between electrodes during cycling, causing rapid capacity fading and shortened battery life. This phenomenon fundamentally limits cycle stability, with most Li-S prototypes achieving only 100-500 cycles compared to Li-ion's 1000+ cycles.

Material degradation presents another substantial hurdle. The sulfur cathode undergoes volumetric expansion exceeding 80% during lithiation, leading to mechanical stress that damages electrode structures. This expansion-contraction cycle creates microcracks, reduces electrical contact, and ultimately accelerates capacity loss. Additionally, lithium metal anodes in Li-S systems suffer from dendrite formation, which increases internal resistance and creates potential safety hazards.

Electrolyte optimization remains particularly challenging for Li-S technology. The ideal electrolyte must simultaneously facilitate ion transport, minimize polysulfide dissolution, protect the lithium anode, and maintain stability across wide voltage windows. Current electrolyte formulations struggle to balance these competing requirements, often sacrificing one performance aspect to enhance another.

Low sulfur utilization efficiency represents another critical limitation. Theoretical calculations suggest sulfur should deliver 1675 mAh/g capacity, but practical implementations typically achieve only 50-70% of this value due to poor electrical conductivity of sulfur and incomplete reaction kinetics. This efficiency gap significantly reduces the real-world energy density advantage over Li-ion systems.

Manufacturing scalability presents formidable barriers to commercialization. Current laboratory-scale production methods for specialized Li-S components (carbon hosts, separators, electrolytes) are complex and costly. The transition to mass production requires substantial process engineering to maintain performance while reducing costs. Additionally, quality control becomes increasingly difficult at scale, particularly for controlling the uniform distribution of sulfur within carbon matrices.

Temperature sensitivity further complicates Li-S deployment. These batteries exhibit significantly reduced performance at low temperatures due to decreased ionic conductivity and sluggish reaction kinetics. At elevated temperatures, accelerated polysulfide shuttling and potential thermal runaway present both performance and safety concerns that must be addressed through advanced thermal management systems.

Material degradation presents another substantial hurdle. The sulfur cathode undergoes volumetric expansion exceeding 80% during lithiation, leading to mechanical stress that damages electrode structures. This expansion-contraction cycle creates microcracks, reduces electrical contact, and ultimately accelerates capacity loss. Additionally, lithium metal anodes in Li-S systems suffer from dendrite formation, which increases internal resistance and creates potential safety hazards.

Electrolyte optimization remains particularly challenging for Li-S technology. The ideal electrolyte must simultaneously facilitate ion transport, minimize polysulfide dissolution, protect the lithium anode, and maintain stability across wide voltage windows. Current electrolyte formulations struggle to balance these competing requirements, often sacrificing one performance aspect to enhance another.

Low sulfur utilization efficiency represents another critical limitation. Theoretical calculations suggest sulfur should deliver 1675 mAh/g capacity, but practical implementations typically achieve only 50-70% of this value due to poor electrical conductivity of sulfur and incomplete reaction kinetics. This efficiency gap significantly reduces the real-world energy density advantage over Li-ion systems.

Manufacturing scalability presents formidable barriers to commercialization. Current laboratory-scale production methods for specialized Li-S components (carbon hosts, separators, electrolytes) are complex and costly. The transition to mass production requires substantial process engineering to maintain performance while reducing costs. Additionally, quality control becomes increasingly difficult at scale, particularly for controlling the uniform distribution of sulfur within carbon matrices.

Temperature sensitivity further complicates Li-S deployment. These batteries exhibit significantly reduced performance at low temperatures due to decreased ionic conductivity and sluggish reaction kinetics. At elevated temperatures, accelerated polysulfide shuttling and potential thermal runaway present both performance and safety concerns that must be addressed through advanced thermal management systems.

Current Solutions for Energy Density and Safety

01 Specific energy comparison between Li-S and Li-ion batteries

Lithium-sulfur (Li-S) batteries generally offer higher theoretical specific energy compared to conventional lithium-ion batteries. Li-S batteries can theoretically deliver up to 2600 Wh/kg, which is significantly higher than the 387-600 Wh/kg theoretical capacity of traditional Li-ion batteries. This higher energy density makes Li-S batteries potentially advantageous for applications requiring longer operation times or lighter weight power sources, such as electric vehicles and portable electronics.- Specific energy comparison between Li-S and Li-ion batteries: Lithium-sulfur (Li-S) batteries offer significantly higher theoretical specific energy (around 2600 Wh/kg) compared to conventional lithium-ion (Li-ion) batteries (typically 100-265 Wh/kg). This substantial energy density advantage makes Li-S batteries particularly promising for applications requiring high energy storage in lightweight packages, such as electric vehicles and portable electronics. The higher specific energy of Li-S batteries is primarily due to sulfur's higher theoretical capacity and the lighter weight of sulfur compared to transition metal oxides used in Li-ion cathodes.

- Safety characteristics of Li-S versus Li-ion batteries: Li-S batteries generally offer improved safety profiles compared to conventional Li-ion batteries. Li-S systems typically operate at lower voltages and use less reactive materials, reducing thermal runaway risks. Additionally, sulfur cathodes are less prone to oxygen release during thermal events compared to metal oxide cathodes in Li-ion batteries. However, Li-S batteries still face safety challenges related to lithium metal anodes, which can form dendrites leading to short circuits. Various safety enhancement strategies include solid-state electrolytes, protective coatings, and advanced battery management systems to monitor and control operating conditions.

- Cycle stability challenges in Li-S batteries: Li-S batteries face significant cycle stability challenges compared to Li-ion batteries. The primary issues include the dissolution of lithium polysulfides in the electrolyte (shuttle effect), volume expansion of sulfur during cycling (up to 80%), and lithium anode degradation. These mechanisms lead to capacity fading, reduced coulombic efficiency, and shortened battery lifespan. Current Li-S batteries typically achieve 200-500 cycles before significant degradation, whereas commercial Li-ion batteries can exceed 1000-2000 cycles. Research focuses on confinement strategies, electrolyte modifications, and protective layers to improve the cycling performance of Li-S batteries.

- Advanced materials for improving Li-S battery performance: Novel materials are being developed to address the limitations of Li-S batteries. These include carbon-based materials (graphene, carbon nanotubes, porous carbon) to host sulfur and trap polysulfides, functional separators with selective permeability, and protective coatings for lithium metal anodes. Additionally, novel electrolyte formulations with additives that suppress the shuttle effect are being explored. These material innovations aim to simultaneously improve specific energy, safety, and cycle stability of Li-S batteries to make them competitive with or superior to conventional Li-ion batteries for commercial applications.

- Hybrid and composite battery systems combining Li-S and Li-ion technologies: Hybrid battery systems that combine elements of both Li-S and Li-ion technologies are being developed to leverage the advantages of each chemistry while mitigating their respective limitations. These approaches include dual-chemistry cells, composite electrodes incorporating both sulfur and conventional Li-ion materials, and battery packs with mixed cell types. Such hybrid approaches aim to achieve balanced performance in terms of specific energy, safety, and cycle stability. These systems often employ advanced battery management systems to optimize the performance of the different chemistries working together.

02 Safety characteristics of Li-S versus Li-ion batteries

Safety is a critical consideration in battery technology. Li-S batteries generally offer improved safety profiles compared to conventional Li-ion batteries due to their inherent chemistry. Li-S batteries typically have lower risks of thermal runaway and are less prone to combustion under extreme conditions. The sulfur cathode material is less reactive than the transition metal oxide cathodes used in Li-ion batteries, reducing the risk of exothermic reactions during battery failure or damage.Expand Specific Solutions03 Cycle stability challenges in Li-S batteries

Despite their higher energy density, Li-S batteries face significant cycle stability challenges compared to Li-ion batteries. The primary issues include the dissolution of polysulfide intermediates into the electrolyte (shuttle effect), volume expansion of sulfur during cycling, and lithium dendrite formation. These factors contribute to capacity fading, reduced cycle life, and decreased coulombic efficiency. Various approaches to address these issues include advanced electrolyte formulations, protective coatings for electrodes, and novel separator designs.Expand Specific Solutions04 Electrode materials and designs for improved battery performance

Advanced electrode materials and designs play a crucial role in enhancing the performance of both Li-S and Li-ion batteries. For Li-S batteries, carbon-based materials with high surface area and porosity help contain sulfur and trap polysulfides. For Li-ion batteries, silicon-based anodes and high-nickel cathodes can increase energy density. Novel electrode architectures, such as 3D structures and nanocomposites, can improve electron transport, accommodate volume changes, and enhance overall battery performance in terms of energy density, safety, and cycle life.Expand Specific Solutions05 Electrolyte innovations for battery stability and safety

Electrolyte formulations significantly impact battery stability, safety, and performance. For Li-S batteries, specialized electrolytes can suppress the polysulfide shuttle effect and protect the lithium anode. Solid-state and gel electrolytes offer improved safety for both Li-S and Li-ion systems by reducing flammability risks. Additives such as lithium nitrate for Li-S batteries and fluorinated compounds for Li-ion batteries can form protective interfaces on electrodes, enhancing cycle stability and safety while preventing unwanted side reactions.Expand Specific Solutions

Key Industry Players in Advanced Battery Research

The Li-S battery market is currently in an early growth phase, characterized by significant R&D investment but limited commercial deployment. With a projected market size of $1-2 billion by 2030, Li-S technology offers theoretical energy densities 3-5 times higher than Li-Ion batteries, though cycle stability remains a key challenge. The competitive landscape features diverse players: academic institutions (MIT, University of Michigan) driving fundamental research; established corporations (Bosch, DuPont, SABIC) leveraging materials expertise; and energy specialists (Hydro-Québec, CEA) focusing on practical applications. Research organizations like Fraunhofer-Gesellschaft and CSIR are accelerating technology transfer, while battery manufacturers are exploring Li-S as a strategic alternative to conventional Li-Ion technology, particularly for applications requiring higher energy density despite shorter cycle life.

Massachusetts Institute of Technology

Technical Solution: MIT has pioneered innovative approaches to Li-S battery technology through their electrochemical energy research. Their technology focuses on nanostructured carbon-sulfur composites with precisely engineered pore architectures that physically confine polysulfides while maintaining high sulfur utilization. MIT researchers have demonstrated Li-S cells achieving specific energies of 400-450 Wh/kg, substantially higher than commercial Li-ion batteries. Their safety enhancements include specialized electrolyte formulations with flame-retardant additives and physical polysulfide trapping mechanisms that reduce reactivity risks. MIT's cycle stability innovations center on protective coatings for lithium metal anodes that suppress dendrite formation and electrolyte decomposition. Their most advanced prototypes maintain 80% capacity after 300-400 cycles, representing significant progress toward commercial viability while still highlighting the cycle life gap compared to Li-ion technology.

Strengths: Exceptional theoretical and practical energy density, innovative nanostructured materials that effectively address polysulfide dissolution, and potential for significantly lower material costs. Weaknesses: Cycle life remains below commercial Li-ion standards despite improvements, manufacturing scalability challenges for complex nanostructured materials, and rate capability limitations at high discharge rates.

Hydro-Québec

Technical Solution: Hydro-Québec's Center of Excellence in Transportation Electrification has developed proprietary Li-S battery technology focusing on solid-state electrolyte integration. Their approach combines high-loading sulfur cathodes (>5 mg/cm²) with specialized solid-state electrolytes that effectively block polysulfide migration. This technology demonstrates specific energy values of approximately 450-500 Wh/kg, nearly double that of conventional Li-ion batteries. Their safety innovations include non-flammable solid electrolytes that eliminate thermal runaway risks associated with liquid electrolytes in both Li-S and Li-ion systems. Hydro-Québec has also developed composite sulfur electrodes with conductive polymer networks that maintain electrical contact during volume changes, addressing a key cycle stability challenge. Their latest prototypes demonstrate over 400 cycles with capacity retention above 75%, approaching commercial viability thresholds.

Strengths: Exceptional energy density exceeding most Li-ion technologies, superior safety profile due to solid-state electrolyte implementation, and potential for lower environmental impact using abundant sulfur. Weaknesses: Higher manufacturing complexity compared to established Li-ion production, remaining challenges with rate capability at low temperatures, and still requires further cycle life improvements to match Li-ion's 1000+ cycle benchmark.

Core Patents in Li-S Battery Technology

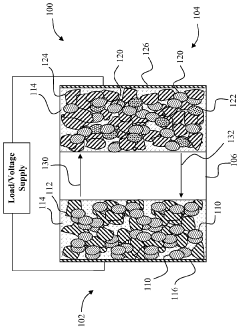

Li -ION BATTERY WITH POROUS ANODE SUPPORT

PatentInactiveEP2430691A1

Innovation

- Incorporating a porous anode support structure with a rigid framework of nanowires or conducting fibers, which provides directional lithium ion migration and expansion volume, minimizing stress on the electrode and preventing internal shorts.

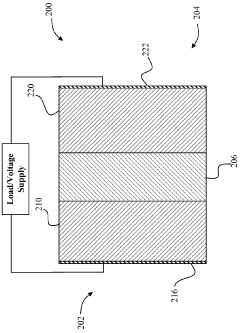

Li-ion battery with blended electrode

PatentWO2010129875A1

Innovation

- A lithium-ion battery with a blended cathode comprising a negative electrode of lithium and a positive electrode with two active materials: one incorporating sulfur and the other not, to balance energy density and rate capability, and minimize capacity fade by using lithium titanium oxide and sulfur, which react in similar voltage windows and manage power demand effectively.

Environmental Impact Assessment

The environmental impact of battery technologies has become increasingly important as the world transitions toward electrification. When comparing Li-S (Lithium-Sulfur) and Li-Ion batteries, their environmental footprints differ significantly across their life cycles, from raw material extraction to end-of-life management.

Li-S batteries offer notable environmental advantages in terms of material sourcing. Sulfur, the cathode material in Li-S batteries, is an abundant by-product of petroleum refining, making it significantly less resource-intensive than the cobalt, nickel, and manganese used in conventional Li-Ion batteries. The reduced dependency on these critical minerals, particularly cobalt which is associated with controversial mining practices in regions like the Democratic Republic of Congo, positions Li-S technology as potentially more socially and environmentally responsible.

From a manufacturing perspective, Li-S batteries generally require less energy-intensive production processes compared to Li-Ion counterparts. Studies indicate that the carbon footprint during manufacturing could be reduced by approximately 15-20% when transitioning from Li-Ion to Li-S technology, primarily due to the simplified cathode preparation and reduced high-temperature processing requirements.

During the operational phase, both battery types produce zero direct emissions. However, the higher theoretical energy density of Li-S batteries (approximately 2-3 times that of Li-Ion) means that less battery material is needed for equivalent energy storage capacity, potentially reducing the overall environmental burden per kilowatt-hour of storage.

End-of-life considerations reveal further distinctions. Li-S batteries contain fewer toxic materials than many Li-Ion variants, particularly those using cobalt or nickel. Additionally, the recycling process for Li-S batteries may be less complex due to the simpler chemistry, though industrial-scale recycling infrastructure for Li-S technology remains underdeveloped compared to the established Li-Ion recycling pathways.

Water usage and pollution risks also differ between these technologies. Li-Ion battery production typically requires significant water resources and presents risks of heavy metal contamination if waste is improperly managed. Li-S manufacturing generally has a lower water footprint, though the potential for hydrogen sulfide formation during improper disposal presents unique environmental hazards that must be carefully managed.

Climate change implications favor Li-S technology when considering full lifecycle greenhouse gas emissions. Research suggests that Li-S batteries could offer a 25-30% reduction in lifetime carbon emissions compared to conventional Li-Ion batteries, assuming comparable cycle life is achieved through ongoing technological improvements.

Li-S batteries offer notable environmental advantages in terms of material sourcing. Sulfur, the cathode material in Li-S batteries, is an abundant by-product of petroleum refining, making it significantly less resource-intensive than the cobalt, nickel, and manganese used in conventional Li-Ion batteries. The reduced dependency on these critical minerals, particularly cobalt which is associated with controversial mining practices in regions like the Democratic Republic of Congo, positions Li-S technology as potentially more socially and environmentally responsible.

From a manufacturing perspective, Li-S batteries generally require less energy-intensive production processes compared to Li-Ion counterparts. Studies indicate that the carbon footprint during manufacturing could be reduced by approximately 15-20% when transitioning from Li-Ion to Li-S technology, primarily due to the simplified cathode preparation and reduced high-temperature processing requirements.

During the operational phase, both battery types produce zero direct emissions. However, the higher theoretical energy density of Li-S batteries (approximately 2-3 times that of Li-Ion) means that less battery material is needed for equivalent energy storage capacity, potentially reducing the overall environmental burden per kilowatt-hour of storage.

End-of-life considerations reveal further distinctions. Li-S batteries contain fewer toxic materials than many Li-Ion variants, particularly those using cobalt or nickel. Additionally, the recycling process for Li-S batteries may be less complex due to the simpler chemistry, though industrial-scale recycling infrastructure for Li-S technology remains underdeveloped compared to the established Li-Ion recycling pathways.

Water usage and pollution risks also differ between these technologies. Li-Ion battery production typically requires significant water resources and presents risks of heavy metal contamination if waste is improperly managed. Li-S manufacturing generally has a lower water footprint, though the potential for hydrogen sulfide formation during improper disposal presents unique environmental hazards that must be carefully managed.

Climate change implications favor Li-S technology when considering full lifecycle greenhouse gas emissions. Research suggests that Li-S batteries could offer a 25-30% reduction in lifetime carbon emissions compared to conventional Li-Ion batteries, assuming comparable cycle life is achieved through ongoing technological improvements.

Cost-Performance Analysis

The economic viability of battery technologies plays a crucial role in their market adoption and commercial success. When comparing Li-S and Li-ion batteries from a cost-performance perspective, several key factors emerge that influence their overall value proposition.

Li-S batteries demonstrate significant cost advantages in raw materials. Sulfur, the primary cathode material, costs approximately $0.10-0.20 per kilogram, dramatically lower than the $15-40 per kilogram for cobalt and nickel used in Li-ion cathodes. This fundamental material cost difference suggests Li-S batteries could potentially achieve 70-80% lower material costs at scale compared to conventional Li-ion technologies.

Manufacturing complexity presents a different picture. Current Li-S production requires specialized handling of sulfur compounds and faces challenges with electrolyte stability. These manufacturing hurdles currently result in 30-40% higher production costs compared to the highly optimized Li-ion manufacturing processes, partially offsetting the raw material advantages.

When analyzing total cost of ownership, the cycle life limitations of Li-S batteries (typically 200-500 cycles versus 1,000-2,000 for Li-ion) significantly impact their long-term economics. Despite higher initial costs, Li-ion batteries often deliver lower cost per kWh over their lifetime due to superior durability.

Energy density economics favor Li-S systems. With theoretical energy densities of 2,500 Wh/kg compared to Li-ion's 250-300 Wh/kg, Li-S batteries could potentially deliver energy at 40-60% lower cost per kWh in applications where weight is critical, such as aviation or specialized portable electronics.

Market segmentation analysis reveals Li-S batteries are currently economically viable primarily in niche applications where energy density commands premium pricing. The technology remains 3-5 years from cost competitiveness in mainstream markets like electric vehicles or grid storage.

Performance degradation costs must also be considered. Li-S batteries' faster capacity fade translates to higher replacement frequency and therefore higher lifetime system costs in many applications, despite their lower initial material costs.

Recent industry cost projections suggest Li-S battery pack costs could reach $150-200/kWh by 2025 with scaled production, compared to Li-ion's projected $100-120/kWh. This narrowing gap indicates improving economic viability for Li-S technology as manufacturing processes mature and cycle stability improves through ongoing research efforts.

Li-S batteries demonstrate significant cost advantages in raw materials. Sulfur, the primary cathode material, costs approximately $0.10-0.20 per kilogram, dramatically lower than the $15-40 per kilogram for cobalt and nickel used in Li-ion cathodes. This fundamental material cost difference suggests Li-S batteries could potentially achieve 70-80% lower material costs at scale compared to conventional Li-ion technologies.

Manufacturing complexity presents a different picture. Current Li-S production requires specialized handling of sulfur compounds and faces challenges with electrolyte stability. These manufacturing hurdles currently result in 30-40% higher production costs compared to the highly optimized Li-ion manufacturing processes, partially offsetting the raw material advantages.

When analyzing total cost of ownership, the cycle life limitations of Li-S batteries (typically 200-500 cycles versus 1,000-2,000 for Li-ion) significantly impact their long-term economics. Despite higher initial costs, Li-ion batteries often deliver lower cost per kWh over their lifetime due to superior durability.

Energy density economics favor Li-S systems. With theoretical energy densities of 2,500 Wh/kg compared to Li-ion's 250-300 Wh/kg, Li-S batteries could potentially deliver energy at 40-60% lower cost per kWh in applications where weight is critical, such as aviation or specialized portable electronics.

Market segmentation analysis reveals Li-S batteries are currently economically viable primarily in niche applications where energy density commands premium pricing. The technology remains 3-5 years from cost competitiveness in mainstream markets like electric vehicles or grid storage.

Performance degradation costs must also be considered. Li-S batteries' faster capacity fade translates to higher replacement frequency and therefore higher lifetime system costs in many applications, despite their lower initial material costs.

Recent industry cost projections suggest Li-S battery pack costs could reach $150-200/kWh by 2025 with scaled production, compared to Li-ion's projected $100-120/kWh. This narrowing gap indicates improving economic viability for Li-S technology as manufacturing processes mature and cycle stability improves through ongoing research efforts.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!