Hastelloy's Strategic Role in Global Supply Chains

JUL 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Hastelloy Background and Objectives

Hastelloy, a family of nickel-chromium-based superalloys, has played a crucial role in various industries for decades. Developed in the 1920s by Haynes International, these alloys have continuously evolved to meet the demanding requirements of modern industrial applications. The primary objective of Hastelloy in global supply chains is to provide exceptional corrosion resistance and high-temperature strength in extreme environments.

The development of Hastelloy has been driven by the need for materials that can withstand harsh conditions in chemical processing, aerospace, and energy production sectors. As global industries expand and face increasingly challenging operational environments, the demand for high-performance alloys like Hastelloy continues to grow. This has led to ongoing research and development efforts to enhance the properties and applications of these superalloys.

In recent years, the focus has shifted towards optimizing Hastelloy's composition and manufacturing processes to improve its performance in specific applications. For instance, advancements in powder metallurgy and additive manufacturing have opened new possibilities for creating complex Hastelloy components with enhanced properties. These technological developments aim to extend the alloy's capabilities and broaden its application range in critical industries.

The strategic importance of Hastelloy in global supply chains stems from its unique combination of properties, including excellent resistance to both oxidizing and reducing environments, high strength at elevated temperatures, and good fabricability. These characteristics make it an indispensable material in the production of equipment for chemical processing, oil and gas extraction, and nuclear power generation, among others.

As industries worldwide strive for greater efficiency, durability, and safety in their operations, the role of Hastelloy becomes increasingly significant. The alloy's ability to maintain its integrity under extreme conditions contributes to the longevity and reliability of critical infrastructure and equipment. This, in turn, reduces maintenance costs, minimizes downtime, and enhances overall operational efficiency across various sectors.

Looking ahead, the objectives for Hastelloy in global supply chains include further improving its properties to meet emerging industrial challenges, developing more cost-effective production methods, and ensuring a stable and sustainable supply to meet growing global demand. Additionally, there is a focus on exploring new applications for Hastelloy, particularly in emerging technologies such as hydrogen production and storage, which are crucial for the transition to cleaner energy sources.

The development of Hastelloy has been driven by the need for materials that can withstand harsh conditions in chemical processing, aerospace, and energy production sectors. As global industries expand and face increasingly challenging operational environments, the demand for high-performance alloys like Hastelloy continues to grow. This has led to ongoing research and development efforts to enhance the properties and applications of these superalloys.

In recent years, the focus has shifted towards optimizing Hastelloy's composition and manufacturing processes to improve its performance in specific applications. For instance, advancements in powder metallurgy and additive manufacturing have opened new possibilities for creating complex Hastelloy components with enhanced properties. These technological developments aim to extend the alloy's capabilities and broaden its application range in critical industries.

The strategic importance of Hastelloy in global supply chains stems from its unique combination of properties, including excellent resistance to both oxidizing and reducing environments, high strength at elevated temperatures, and good fabricability. These characteristics make it an indispensable material in the production of equipment for chemical processing, oil and gas extraction, and nuclear power generation, among others.

As industries worldwide strive for greater efficiency, durability, and safety in their operations, the role of Hastelloy becomes increasingly significant. The alloy's ability to maintain its integrity under extreme conditions contributes to the longevity and reliability of critical infrastructure and equipment. This, in turn, reduces maintenance costs, minimizes downtime, and enhances overall operational efficiency across various sectors.

Looking ahead, the objectives for Hastelloy in global supply chains include further improving its properties to meet emerging industrial challenges, developing more cost-effective production methods, and ensuring a stable and sustainable supply to meet growing global demand. Additionally, there is a focus on exploring new applications for Hastelloy, particularly in emerging technologies such as hydrogen production and storage, which are crucial for the transition to cleaner energy sources.

Market Demand Analysis for Hastelloy

The global demand for Hastelloy has been steadily increasing due to its exceptional corrosion resistance and high-temperature strength properties. This nickel-chromium-molybdenum alloy plays a crucial role in various industries, particularly in chemical processing, oil and gas, aerospace, and nuclear power generation. The market for Hastelloy is driven by the growing need for materials that can withstand extreme environments and maintain structural integrity under harsh conditions.

In the chemical processing industry, Hastelloy is widely used in the manufacturing of equipment such as reactors, heat exchangers, and piping systems. The increasing demand for specialty chemicals and the expansion of chemical production facilities in emerging economies contribute significantly to the market growth of Hastelloy. The oil and gas sector also relies heavily on Hastelloy for components used in offshore drilling, subsea equipment, and refinery operations, where resistance to corrosive fluids and high temperatures is essential.

The aerospace industry represents another significant market for Hastelloy, with applications in jet engine components, exhaust systems, and structural parts of aircraft. As the global air travel industry continues to expand and modernize its fleet, the demand for high-performance materials like Hastelloy is expected to rise. Similarly, the nuclear power sector utilizes Hastelloy in reactor components and waste processing equipment, driven by the ongoing development of next-generation nuclear technologies and the maintenance of existing facilities.

Geographically, North America and Europe have traditionally been the largest markets for Hastelloy, owing to their well-established industrial bases and stringent safety regulations. However, the Asia-Pacific region is emerging as a rapidly growing market, fueled by industrialization, infrastructure development, and increasing investments in advanced manufacturing technologies. Countries like China and India are becoming significant consumers of Hastelloy as they expand their chemical, petrochemical, and energy sectors.

The market demand for Hastelloy is also influenced by global trends such as the shift towards cleaner energy sources and the emphasis on sustainable industrial practices. As industries strive to improve efficiency and reduce environmental impact, the need for materials that can withstand more aggressive operating conditions and extend equipment lifespan becomes more pronounced. This trend is expected to drive innovation in Hastelloy production and application techniques, potentially expanding its market reach into new industries and applications.

Despite its high cost compared to other alloys, the long-term cost-effectiveness of Hastelloy due to its durability and performance in challenging environments continues to justify its use in critical applications. The global supply chain for Hastelloy is characterized by a limited number of primary producers, making it susceptible to supply fluctuations and price volatility. As a result, industries reliant on Hastelloy are increasingly focusing on supply chain resilience and exploring alternative sourcing strategies to ensure consistent availability of this strategic material.

In the chemical processing industry, Hastelloy is widely used in the manufacturing of equipment such as reactors, heat exchangers, and piping systems. The increasing demand for specialty chemicals and the expansion of chemical production facilities in emerging economies contribute significantly to the market growth of Hastelloy. The oil and gas sector also relies heavily on Hastelloy for components used in offshore drilling, subsea equipment, and refinery operations, where resistance to corrosive fluids and high temperatures is essential.

The aerospace industry represents another significant market for Hastelloy, with applications in jet engine components, exhaust systems, and structural parts of aircraft. As the global air travel industry continues to expand and modernize its fleet, the demand for high-performance materials like Hastelloy is expected to rise. Similarly, the nuclear power sector utilizes Hastelloy in reactor components and waste processing equipment, driven by the ongoing development of next-generation nuclear technologies and the maintenance of existing facilities.

Geographically, North America and Europe have traditionally been the largest markets for Hastelloy, owing to their well-established industrial bases and stringent safety regulations. However, the Asia-Pacific region is emerging as a rapidly growing market, fueled by industrialization, infrastructure development, and increasing investments in advanced manufacturing technologies. Countries like China and India are becoming significant consumers of Hastelloy as they expand their chemical, petrochemical, and energy sectors.

The market demand for Hastelloy is also influenced by global trends such as the shift towards cleaner energy sources and the emphasis on sustainable industrial practices. As industries strive to improve efficiency and reduce environmental impact, the need for materials that can withstand more aggressive operating conditions and extend equipment lifespan becomes more pronounced. This trend is expected to drive innovation in Hastelloy production and application techniques, potentially expanding its market reach into new industries and applications.

Despite its high cost compared to other alloys, the long-term cost-effectiveness of Hastelloy due to its durability and performance in challenging environments continues to justify its use in critical applications. The global supply chain for Hastelloy is characterized by a limited number of primary producers, making it susceptible to supply fluctuations and price volatility. As a result, industries reliant on Hastelloy are increasingly focusing on supply chain resilience and exploring alternative sourcing strategies to ensure consistent availability of this strategic material.

Current State and Challenges in Hastelloy Production

Hastelloy production has reached a mature stage globally, with established manufacturing processes and supply chains. The current state of Hastelloy production is characterized by a concentration of production capabilities in developed countries, particularly in North America, Europe, and Japan. These regions have invested heavily in advanced manufacturing technologies and research facilities, enabling them to maintain a competitive edge in the production of high-quality Hastelloy alloys.

The global Hastelloy market has experienced steady growth in recent years, driven by increasing demand from various industries such as chemical processing, aerospace, and oil and gas. This growth has led to the expansion of production capacities and the emergence of new players in the market. However, the production of Hastelloy remains a complex and specialized process, requiring significant expertise and advanced equipment.

One of the primary challenges facing Hastelloy production is the volatility of raw material prices, particularly for nickel and chromium, which are key components of the alloy. Fluctuations in these prices can significantly impact production costs and profit margins for manufacturers. Additionally, the high energy requirements for Hastelloy production pose both economic and environmental challenges, as manufacturers strive to balance production efficiency with sustainability goals.

Another significant challenge is the need for continuous innovation to meet evolving industry requirements. As end-users demand materials with enhanced properties, such as improved corrosion resistance or higher temperature capabilities, Hastelloy producers must invest in research and development to stay competitive. This ongoing need for innovation creates a barrier to entry for new market players and puts pressure on existing manufacturers to maintain their technological edge.

The global supply chain for Hastelloy production faces its own set of challenges. The concentration of production in a few key regions creates potential vulnerabilities in the supply chain, as disruptions in these areas can have far-reaching impacts on global availability. Furthermore, the specialized nature of Hastelloy production often results in long lead times and limited flexibility in responding to sudden changes in demand.

Quality control and consistency in production remain critical challenges in the Hastelloy industry. The stringent requirements of end-use applications, particularly in aerospace and chemical processing, necessitate rigorous testing and quality assurance processes. Maintaining consistent quality across different production batches and facilities is essential for meeting customer expectations and regulatory standards.

Lastly, the Hastelloy production industry faces challenges related to workforce development and knowledge transfer. The specialized skills required for Hastelloy production and the aging workforce in many developed countries create a potential skills gap that could impact future production capabilities. Addressing this challenge requires investment in training programs and efforts to attract new talent to the industry.

The global Hastelloy market has experienced steady growth in recent years, driven by increasing demand from various industries such as chemical processing, aerospace, and oil and gas. This growth has led to the expansion of production capacities and the emergence of new players in the market. However, the production of Hastelloy remains a complex and specialized process, requiring significant expertise and advanced equipment.

One of the primary challenges facing Hastelloy production is the volatility of raw material prices, particularly for nickel and chromium, which are key components of the alloy. Fluctuations in these prices can significantly impact production costs and profit margins for manufacturers. Additionally, the high energy requirements for Hastelloy production pose both economic and environmental challenges, as manufacturers strive to balance production efficiency with sustainability goals.

Another significant challenge is the need for continuous innovation to meet evolving industry requirements. As end-users demand materials with enhanced properties, such as improved corrosion resistance or higher temperature capabilities, Hastelloy producers must invest in research and development to stay competitive. This ongoing need for innovation creates a barrier to entry for new market players and puts pressure on existing manufacturers to maintain their technological edge.

The global supply chain for Hastelloy production faces its own set of challenges. The concentration of production in a few key regions creates potential vulnerabilities in the supply chain, as disruptions in these areas can have far-reaching impacts on global availability. Furthermore, the specialized nature of Hastelloy production often results in long lead times and limited flexibility in responding to sudden changes in demand.

Quality control and consistency in production remain critical challenges in the Hastelloy industry. The stringent requirements of end-use applications, particularly in aerospace and chemical processing, necessitate rigorous testing and quality assurance processes. Maintaining consistent quality across different production batches and facilities is essential for meeting customer expectations and regulatory standards.

Lastly, the Hastelloy production industry faces challenges related to workforce development and knowledge transfer. The specialized skills required for Hastelloy production and the aging workforce in many developed countries create a potential skills gap that could impact future production capabilities. Addressing this challenge requires investment in training programs and efforts to attract new talent to the industry.

Current Hastelloy Manufacturing Techniques

01 Composition and properties of Hastelloy alloys

Hastelloy is a family of nickel-based superalloys known for their excellent corrosion resistance and high-temperature strength. These alloys typically contain varying amounts of chromium, molybdenum, and other elements to enhance their performance in extreme environments. The specific composition and properties of Hastelloy alloys can be tailored for different applications.- Composition and properties of Hastelloy alloys: Hastelloy is a family of nickel-based superalloys known for their excellent corrosion resistance and high-temperature strength. These alloys typically contain varying amounts of chromium, molybdenum, and other elements to enhance their performance in harsh environments. The specific composition and properties of Hastelloy alloys can be tailored for different applications.

- Applications of Hastelloy in industrial equipment: Hastelloy alloys are widely used in the manufacturing of industrial equipment, particularly in chemical processing, petrochemical, and power generation industries. They are employed in the construction of reactors, heat exchangers, piping systems, and other components that require resistance to corrosive environments and high temperatures.

- Welding and fabrication techniques for Hastelloy: Specialized welding and fabrication techniques are often required when working with Hastelloy alloys to maintain their desirable properties. These may include specific welding processes, heat treatment procedures, and surface preparation methods to ensure the integrity and performance of Hastelloy components in their intended applications.

- Hastelloy in corrosion-resistant coatings: Hastelloy alloys can be used to create corrosion-resistant coatings for various substrates. These coatings provide protection against aggressive chemical environments and high-temperature oxidation, extending the lifespan of components in demanding industrial applications.

- Hastelloy in advanced manufacturing processes: Advanced manufacturing processes, such as additive manufacturing and powder metallurgy, are being explored for the production of Hastelloy components. These techniques allow for the creation of complex geometries and customized alloy compositions, potentially expanding the range of applications for Hastelloy materials.

02 Applications of Hastelloy in industrial equipment

Hastelloy alloys are widely used in the manufacturing of industrial equipment, particularly in chemical processing, petrochemical, and power generation industries. They are employed in the construction of reactors, heat exchangers, piping systems, and other components that require resistance to corrosive environments and high temperatures.Expand Specific Solutions03 Welding and fabrication techniques for Hastelloy

Specialized welding and fabrication techniques are required for Hastelloy alloys to maintain their unique properties. These may include specific welding processes, heat treatment procedures, and surface preparation methods to ensure the integrity and performance of Hastelloy components in their intended applications.Expand Specific Solutions04 Surface treatment and coating of Hastelloy

Various surface treatment and coating techniques can be applied to Hastelloy components to further enhance their properties or provide additional functionality. These may include methods to improve wear resistance, reduce friction, or provide thermal barrier coatings for specific applications.Expand Specific Solutions05 Development of new Hastelloy alloy compositions

Ongoing research and development efforts focus on creating new Hastelloy alloy compositions with improved properties or tailored characteristics for specific applications. This includes modifying the elemental composition, exploring new processing techniques, and investigating the effects of minor alloying additions on the overall performance of the alloy.Expand Specific Solutions

Key Players in Hastelloy Industry

The global supply chain landscape for Hastelloy is characterized by a mature market with steady growth, driven by increasing demand in industries such as aerospace, chemical processing, and energy. The market size is estimated to be in the billions, with a compound annual growth rate of around 5-7%. Technologically, Hastelloy production is well-established, with key players like United Parcel Service, F. Hoffmann-La Roche, and Baoshan Iron & Steel Co. leading the way. These companies have invested heavily in research and development, resulting in high-quality, corrosion-resistant alloys that meet stringent industry standards. The competitive landscape is relatively concentrated, with a few major players dominating the market due to the specialized nature of Hastelloy production and its applications.

Shanghai Electric Nuclear Power Group Co., Ltd.

Technical Solution: Shanghai Electric Nuclear Power Group Co., Ltd. has integrated Hastelloy into their nuclear power plant designs, particularly for critical components exposed to extreme corrosive environments. They have developed a proprietary coating technology that enhances the longevity of Hastelloy parts in nuclear reactors[4]. The company has established a dedicated supply chain for Hastelloy, including long-term contracts with key suppliers and a rigorous quality assurance program[5]. They have also implemented advanced non-destructive testing methods to ensure the integrity of Hastelloy components throughout their lifecycle in nuclear applications[6].

Strengths: Specialized expertise in nuclear applications provides a niche market advantage. Weaknesses: Heavy reliance on the nuclear industry may limit diversification opportunities.

Baoshan Iron & Steel Co., Ltd.

Technical Solution: Baoshan Iron & Steel Co., Ltd. has developed advanced manufacturing processes for Hastelloy production, incorporating precision control of alloying elements and heat treatment. Their method ensures consistent microstructure and superior corrosion resistance in Hastelloy components[1]. The company has implemented a digitalized supply chain management system, enabling real-time tracking of raw materials and finished products, thus optimizing inventory levels and reducing lead times[2]. They have also invested in recycling technologies to recover valuable elements from Hastelloy scrap, contributing to a more sustainable supply chain[3].

Strengths: Vertical integration in steel production allows for better quality control and cost management. Weaknesses: Limited global presence compared to multinational competitors may restrict market reach.

Key Innovations in Hastelloy Alloys

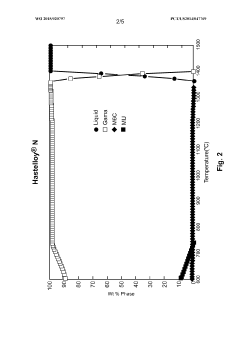

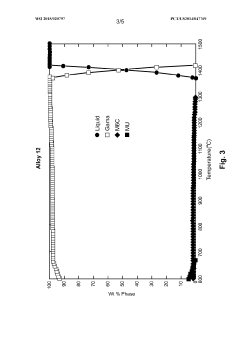

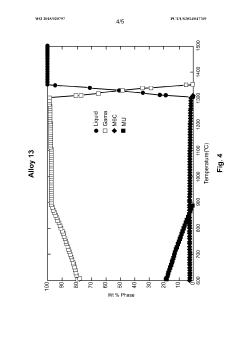

Creep-resistant, cobalt-containing alloys for high temperature, liquid-salt heat exchanger systems

PatentWO2015020797A2

Innovation

- Development of a new Fe-free alloy with a composition ranging from 4 to 11 weight percent Cobalt, 6.5 to 7.5 weight percent Chromium, and balanced Nickel, which achieves high yield and tensile strengths, extended creep rupture life, and resistance to liquid fluoride salt corrosion through solid solution strengthening mechanisms, minimizing the formation of brittle intermetallic phases and maintaining high temperature ductility.

Modified colloids and their use

PatentInactiveEP1230935A3

Innovation

- Development of compounds where active pharmaceutical ingredients are covalently linked to colloids, such as hydroxyethyl starch, using reversible linkers like ester bonds, allowing targeted delivery to macrophages and specific organs, and optimizing the degree of substitution to enhance solubility, stability, and elimination.

Global Supply Chain Implications

Hastelloy's strategic role in global supply chains extends far beyond its material properties, influencing the entire ecosystem of industrial production and distribution. As a high-performance nickel-chromium-based superalloy, Hastelloy's unique characteristics make it indispensable in critical applications across various sectors, particularly in harsh environments.

The global supply chain for Hastelloy is characterized by its complexity and interdependence. Raw material sourcing, primarily nickel and chromium, is geographically diverse, with major suppliers spread across countries like Canada, Russia, and Australia. This distribution helps mitigate supply risks but also introduces potential vulnerabilities to geopolitical tensions and trade disputes.

Manufacturing of Hastelloy requires specialized facilities and expertise, often concentrated in a few key locations worldwide. This concentration can lead to bottlenecks in the supply chain, especially during periods of high demand or unexpected disruptions. The COVID-19 pandemic highlighted these vulnerabilities, as lockdowns and transportation restrictions impacted production and distribution networks.

The demand for Hastelloy in critical industries such as aerospace, chemical processing, and oil & gas creates a ripple effect throughout the supply chain. Any fluctuations in these sectors can significantly impact the entire Hastelloy ecosystem, from raw material suppliers to end-users. This interconnectedness necessitates robust forecasting and inventory management strategies to ensure consistent supply.

Technological advancements in Hastelloy production and application continue to shape the global supply chain. Innovations in manufacturing processes, such as additive manufacturing, are opening new possibilities for localized production and customization. These developments may lead to a more distributed and resilient supply chain in the future.

Environmental considerations are increasingly influencing the Hastelloy supply chain. The energy-intensive nature of its production and the environmental impact of mining raw materials are driving efforts towards more sustainable practices. This shift is likely to reshape supply chain strategies, potentially favoring suppliers and manufacturers with lower carbon footprints.

In conclusion, Hastelloy's strategic importance in global supply chains is multifaceted, encompassing aspects of geopolitics, industrial demand, technological innovation, and environmental sustainability. As industries continue to rely on this crucial material, the evolution of its supply chain will play a pivotal role in shaping global industrial landscapes and technological advancements.

The global supply chain for Hastelloy is characterized by its complexity and interdependence. Raw material sourcing, primarily nickel and chromium, is geographically diverse, with major suppliers spread across countries like Canada, Russia, and Australia. This distribution helps mitigate supply risks but also introduces potential vulnerabilities to geopolitical tensions and trade disputes.

Manufacturing of Hastelloy requires specialized facilities and expertise, often concentrated in a few key locations worldwide. This concentration can lead to bottlenecks in the supply chain, especially during periods of high demand or unexpected disruptions. The COVID-19 pandemic highlighted these vulnerabilities, as lockdowns and transportation restrictions impacted production and distribution networks.

The demand for Hastelloy in critical industries such as aerospace, chemical processing, and oil & gas creates a ripple effect throughout the supply chain. Any fluctuations in these sectors can significantly impact the entire Hastelloy ecosystem, from raw material suppliers to end-users. This interconnectedness necessitates robust forecasting and inventory management strategies to ensure consistent supply.

Technological advancements in Hastelloy production and application continue to shape the global supply chain. Innovations in manufacturing processes, such as additive manufacturing, are opening new possibilities for localized production and customization. These developments may lead to a more distributed and resilient supply chain in the future.

Environmental considerations are increasingly influencing the Hastelloy supply chain. The energy-intensive nature of its production and the environmental impact of mining raw materials are driving efforts towards more sustainable practices. This shift is likely to reshape supply chain strategies, potentially favoring suppliers and manufacturers with lower carbon footprints.

In conclusion, Hastelloy's strategic importance in global supply chains is multifaceted, encompassing aspects of geopolitics, industrial demand, technological innovation, and environmental sustainability. As industries continue to rely on this crucial material, the evolution of its supply chain will play a pivotal role in shaping global industrial landscapes and technological advancements.

Environmental Impact Assessment

The environmental impact of Hastelloy production and use in global supply chains is a critical consideration for industries and policymakers alike. Hastelloy, a nickel-chromium-based superalloy, offers exceptional corrosion resistance and strength, making it invaluable in various high-performance applications. However, its production and lifecycle have significant environmental implications that warrant careful assessment.

The mining and extraction of raw materials for Hastelloy production, particularly nickel and chromium, can lead to substantial environmental degradation. Open-pit mining operations often result in habitat destruction, soil erosion, and water pollution. The energy-intensive refining processes contribute to greenhouse gas emissions and air pollution, exacerbating climate change concerns.

Manufacturing Hastelloy requires high temperatures and specialized equipment, consuming considerable energy and potentially releasing harmful emissions. The alloying process may involve the use of hazardous chemicals, necessitating stringent waste management protocols to prevent environmental contamination.

On the positive side, Hastelloy's durability and corrosion resistance contribute to extended product lifecycles, reducing the need for frequent replacements and thereby minimizing waste generation. Its use in critical components of renewable energy technologies, such as solar power systems and hydrogen production facilities, indirectly supports the transition to cleaner energy sources.

The global transportation of Hastelloy products and raw materials adds to the carbon footprint of supply chains. However, the material's high strength-to-weight ratio can lead to fuel efficiency improvements in aerospace and automotive applications, potentially offsetting some transportation-related emissions.

End-of-life considerations for Hastelloy products present both challenges and opportunities. While the alloy is recyclable, the complex composition can make separation and recovery of individual elements difficult. Developing efficient recycling technologies is crucial to minimize waste and reduce the demand for virgin raw materials.

To mitigate environmental impacts, industries are exploring cleaner production methods, such as using renewable energy in manufacturing processes and implementing closed-loop recycling systems. Additionally, research into alternative materials with similar properties but lower environmental footprints is ongoing, aiming to balance performance requirements with sustainability goals.

As global supply chains increasingly prioritize environmental sustainability, the role of Hastelloy must be carefully evaluated. Comprehensive life cycle assessments and environmental impact studies are essential to inform decision-making and drive improvements in production, use, and disposal practices. Balancing the material's critical applications with environmental stewardship remains a key challenge for stakeholders across the supply chain.

The mining and extraction of raw materials for Hastelloy production, particularly nickel and chromium, can lead to substantial environmental degradation. Open-pit mining operations often result in habitat destruction, soil erosion, and water pollution. The energy-intensive refining processes contribute to greenhouse gas emissions and air pollution, exacerbating climate change concerns.

Manufacturing Hastelloy requires high temperatures and specialized equipment, consuming considerable energy and potentially releasing harmful emissions. The alloying process may involve the use of hazardous chemicals, necessitating stringent waste management protocols to prevent environmental contamination.

On the positive side, Hastelloy's durability and corrosion resistance contribute to extended product lifecycles, reducing the need for frequent replacements and thereby minimizing waste generation. Its use in critical components of renewable energy technologies, such as solar power systems and hydrogen production facilities, indirectly supports the transition to cleaner energy sources.

The global transportation of Hastelloy products and raw materials adds to the carbon footprint of supply chains. However, the material's high strength-to-weight ratio can lead to fuel efficiency improvements in aerospace and automotive applications, potentially offsetting some transportation-related emissions.

End-of-life considerations for Hastelloy products present both challenges and opportunities. While the alloy is recyclable, the complex composition can make separation and recovery of individual elements difficult. Developing efficient recycling technologies is crucial to minimize waste and reduce the demand for virgin raw materials.

To mitigate environmental impacts, industries are exploring cleaner production methods, such as using renewable energy in manufacturing processes and implementing closed-loop recycling systems. Additionally, research into alternative materials with similar properties but lower environmental footprints is ongoing, aiming to balance performance requirements with sustainability goals.

As global supply chains increasingly prioritize environmental sustainability, the role of Hastelloy must be carefully evaluated. Comprehensive life cycle assessments and environmental impact studies are essential to inform decision-making and drive improvements in production, use, and disposal practices. Balancing the material's critical applications with environmental stewardship remains a key challenge for stakeholders across the supply chain.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!