Hastelloy Trends in Global Marine Applications

JUL 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Hastelloy Marine Evolution

Hastelloy alloys have undergone significant evolution in marine applications over the past decades. Initially developed in the 1920s, these nickel-chromium-molybdenum alloys have continuously adapted to meet the increasing demands of the marine industry. The early versions of Hastelloy, such as B and C, were primarily used in chemical processing equipment due to their excellent corrosion resistance.

As marine engineering advanced, the need for materials capable of withstanding harsh seawater environments became more pronounced. This led to the development of more specialized Hastelloy grades in the 1960s and 1970s, such as Hastelloy C-276, which offered superior resistance to pitting and crevice corrosion in chloride-rich environments. This grade quickly found applications in offshore oil and gas platforms, desalination plants, and marine heat exchangers.

The 1980s and 1990s saw further refinements in Hastelloy compositions, resulting in alloys like Hastelloy C-22 and C-2000. These newer grades provided enhanced resistance to a broader range of corrosive media, making them ideal for use in marine exhaust systems, pumps, and valves exposed to seawater. The improved formulations also offered better fabricability and weldability, crucial factors in marine construction and maintenance.

In the early 2000s, the focus shifted towards developing Hastelloy variants with improved strength-to-weight ratios, addressing the growing need for lightweight yet durable materials in shipbuilding and offshore structures. This led to the introduction of precipitation-hardened grades like Hastelloy C-22HS, which combined high strength with excellent corrosion resistance.

Recent developments in Hastelloy technology have been driven by the expansion of deep-sea exploration and the renewable energy sector. New grades have been engineered to withstand extreme pressures and temperatures encountered in subsea applications. Additionally, the growing interest in offshore wind farms and tidal energy systems has spurred the development of Hastelloy variants optimized for long-term exposure to dynamic marine environments.

The evolution of Hastelloy in marine applications has also been marked by advancements in manufacturing processes. Improved melting and refining techniques have resulted in alloys with more consistent properties and fewer impurities. Furthermore, the adoption of additive manufacturing technologies has opened up new possibilities for creating complex Hastelloy components with optimized geometries for marine use.

Looking ahead, the ongoing evolution of Hastelloy in marine applications is likely to focus on enhancing its sustainability profile. Research efforts are being directed towards developing recycling methods for Hastelloy components and exploring ways to reduce the environmental impact of its production process, aligning with the marine industry's growing emphasis on eco-friendly materials and practices.

As marine engineering advanced, the need for materials capable of withstanding harsh seawater environments became more pronounced. This led to the development of more specialized Hastelloy grades in the 1960s and 1970s, such as Hastelloy C-276, which offered superior resistance to pitting and crevice corrosion in chloride-rich environments. This grade quickly found applications in offshore oil and gas platforms, desalination plants, and marine heat exchangers.

The 1980s and 1990s saw further refinements in Hastelloy compositions, resulting in alloys like Hastelloy C-22 and C-2000. These newer grades provided enhanced resistance to a broader range of corrosive media, making them ideal for use in marine exhaust systems, pumps, and valves exposed to seawater. The improved formulations also offered better fabricability and weldability, crucial factors in marine construction and maintenance.

In the early 2000s, the focus shifted towards developing Hastelloy variants with improved strength-to-weight ratios, addressing the growing need for lightweight yet durable materials in shipbuilding and offshore structures. This led to the introduction of precipitation-hardened grades like Hastelloy C-22HS, which combined high strength with excellent corrosion resistance.

Recent developments in Hastelloy technology have been driven by the expansion of deep-sea exploration and the renewable energy sector. New grades have been engineered to withstand extreme pressures and temperatures encountered in subsea applications. Additionally, the growing interest in offshore wind farms and tidal energy systems has spurred the development of Hastelloy variants optimized for long-term exposure to dynamic marine environments.

The evolution of Hastelloy in marine applications has also been marked by advancements in manufacturing processes. Improved melting and refining techniques have resulted in alloys with more consistent properties and fewer impurities. Furthermore, the adoption of additive manufacturing technologies has opened up new possibilities for creating complex Hastelloy components with optimized geometries for marine use.

Looking ahead, the ongoing evolution of Hastelloy in marine applications is likely to focus on enhancing its sustainability profile. Research efforts are being directed towards developing recycling methods for Hastelloy components and exploring ways to reduce the environmental impact of its production process, aligning with the marine industry's growing emphasis on eco-friendly materials and practices.

Global Demand Analysis

The global demand for Hastelloy in marine applications has been steadily increasing over the past decade, driven by the material's exceptional corrosion resistance and mechanical properties in harsh marine environments. The offshore oil and gas industry remains a significant consumer of Hastelloy, particularly for subsea equipment, pipelines, and processing facilities exposed to aggressive seawater and chemical conditions. As deep-sea exploration and production activities expand, the demand for Hastelloy components capable of withstanding extreme pressures and temperatures continues to grow.

In the shipbuilding sector, Hastelloy is gaining traction for use in critical components such as propulsion systems, heat exchangers, and exhaust gas cleaning systems. The implementation of stricter environmental regulations, such as the International Maritime Organization's (IMO) sulfur cap, has spurred the adoption of scrubber systems, many of which utilize Hastelloy for their corrosion-resistant properties. This trend is expected to continue as the maritime industry seeks to comply with increasingly stringent emissions standards.

The renewable energy sector, particularly offshore wind farms, represents an emerging market for Hastelloy applications. As wind turbines grow larger and are installed in more challenging marine environments, the demand for corrosion-resistant materials like Hastelloy in critical components is rising. Tidal and wave energy projects, although still in early stages of development, also show potential for increased Hastelloy usage in the future.

Desalination plants, crucial for addressing water scarcity in coastal regions, are another significant consumer of Hastelloy. The material's ability to withstand the corrosive effects of seawater and brine makes it ideal for use in high-pressure pumps, valves, and piping systems within these facilities. As global water demand increases and more countries invest in desalination technologies, the market for Hastelloy in this sector is projected to expand.

The aquaculture industry, which has been growing rapidly to meet global seafood demand, is also contributing to the increased use of Hastelloy. Fish farming equipment, particularly in offshore installations, benefits from the material's corrosion resistance and durability in seawater environments. As aquaculture operations move further offshore and adopt more advanced technologies, the demand for high-performance materials like Hastelloy is expected to rise.

While the overall trend for Hastelloy in marine applications is positive, market growth is not uniform across all regions. Developed maritime nations in North America and Europe continue to be major consumers, driven by stringent regulations and a focus on high-performance materials. However, the Asia-Pacific region, led by China and South Korea, is emerging as a significant market, fueled by rapid growth in shipbuilding, offshore energy projects, and coastal infrastructure development.

In the shipbuilding sector, Hastelloy is gaining traction for use in critical components such as propulsion systems, heat exchangers, and exhaust gas cleaning systems. The implementation of stricter environmental regulations, such as the International Maritime Organization's (IMO) sulfur cap, has spurred the adoption of scrubber systems, many of which utilize Hastelloy for their corrosion-resistant properties. This trend is expected to continue as the maritime industry seeks to comply with increasingly stringent emissions standards.

The renewable energy sector, particularly offshore wind farms, represents an emerging market for Hastelloy applications. As wind turbines grow larger and are installed in more challenging marine environments, the demand for corrosion-resistant materials like Hastelloy in critical components is rising. Tidal and wave energy projects, although still in early stages of development, also show potential for increased Hastelloy usage in the future.

Desalination plants, crucial for addressing water scarcity in coastal regions, are another significant consumer of Hastelloy. The material's ability to withstand the corrosive effects of seawater and brine makes it ideal for use in high-pressure pumps, valves, and piping systems within these facilities. As global water demand increases and more countries invest in desalination technologies, the market for Hastelloy in this sector is projected to expand.

The aquaculture industry, which has been growing rapidly to meet global seafood demand, is also contributing to the increased use of Hastelloy. Fish farming equipment, particularly in offshore installations, benefits from the material's corrosion resistance and durability in seawater environments. As aquaculture operations move further offshore and adopt more advanced technologies, the demand for high-performance materials like Hastelloy is expected to rise.

While the overall trend for Hastelloy in marine applications is positive, market growth is not uniform across all regions. Developed maritime nations in North America and Europe continue to be major consumers, driven by stringent regulations and a focus on high-performance materials. However, the Asia-Pacific region, led by China and South Korea, is emerging as a significant market, fueled by rapid growth in shipbuilding, offshore energy projects, and coastal infrastructure development.

Corrosion Challenges

Hastelloy alloys, renowned for their exceptional corrosion resistance, face significant challenges in marine applications due to the harsh and corrosive nature of seawater environments. The primary corrosion challenge stems from the high chloride content in seawater, which can lead to pitting and crevice corrosion even in highly resistant materials. This is particularly problematic in areas with stagnant water or in crevices where oxygen depletion can occur, creating localized corrosion cells.

Another major challenge is the presence of sulfate-reducing bacteria in marine environments. These microorganisms can accelerate corrosion processes by producing hydrogen sulfide, which is highly corrosive to many metals, including some grades of Hastelloy. This microbially influenced corrosion (MIC) can lead to unexpected and rapid deterioration of components, especially in low-flow or stagnant areas.

The varying oxygen concentrations in different parts of marine structures also pose a significant corrosion challenge. Areas exposed to splash zones or alternating wet and dry conditions are particularly vulnerable to accelerated corrosion due to the constant replenishment of oxygen. This can lead to differential aeration cells, causing localized corrosion even in highly resistant alloys like Hastelloy.

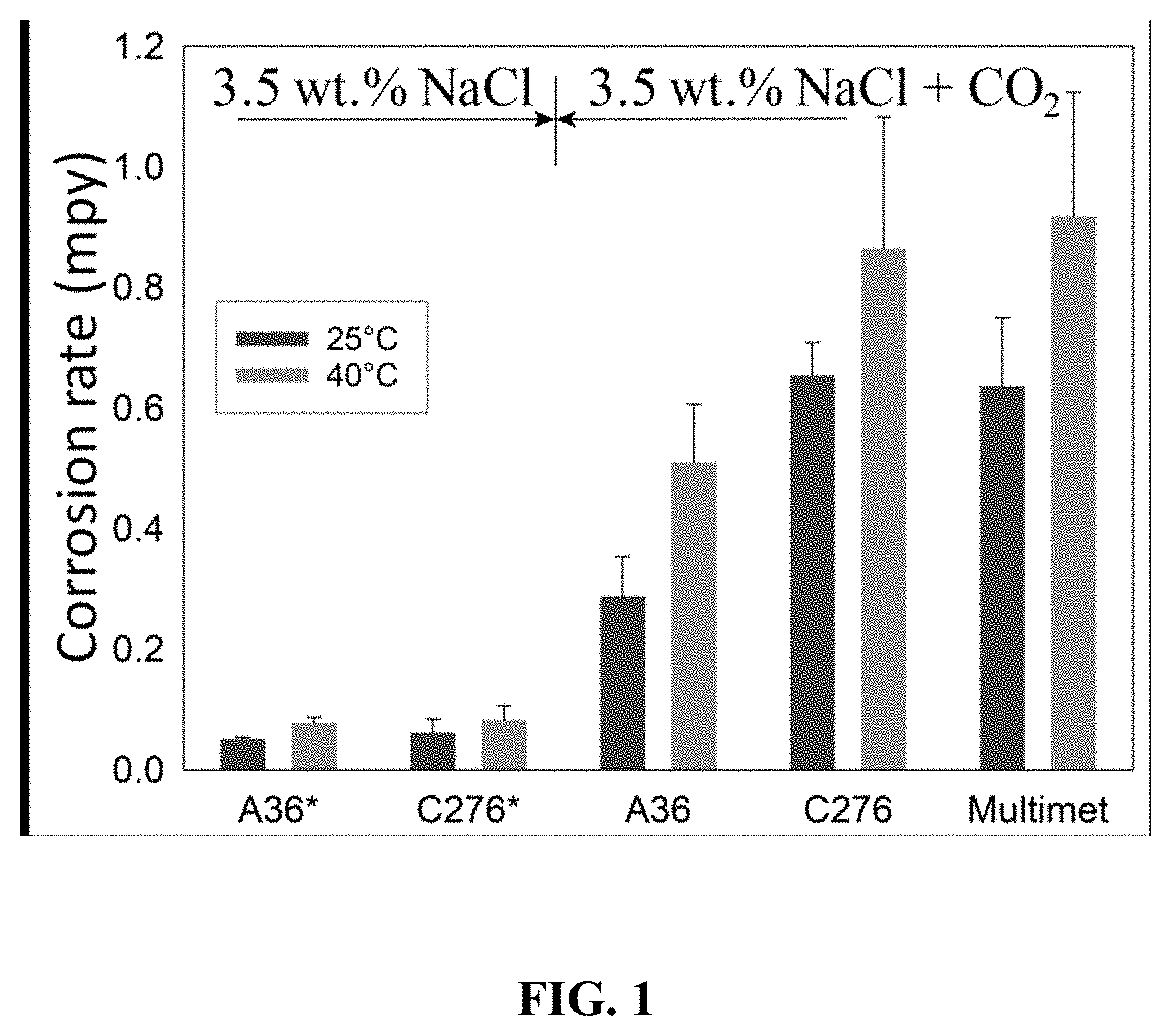

Temperature fluctuations in marine environments further complicate the corrosion landscape. Higher temperatures generally accelerate corrosion rates, and the cyclical heating and cooling experienced by marine components can lead to thermal fatigue and stress corrosion cracking. This is particularly relevant for Hastelloy components used in heat exchangers or other high-temperature applications in marine settings.

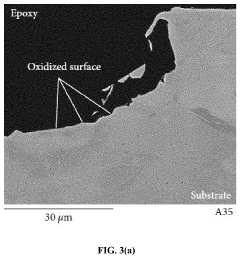

The presence of various pollutants and contaminants in seawater, such as industrial effluents or oil spills, can introduce additional corrosive agents. These may interact with the alloy surface in unpredictable ways, potentially compromising the protective oxide layer that gives Hastelloy its corrosion resistance. Understanding and mitigating these complex interactions is crucial for ensuring long-term performance in marine applications.

Erosion-corrosion is another significant challenge, especially in high-flow areas or where abrasive particles are present in the seawater. While Hastelloy alloys generally have good erosion resistance, the combination of mechanical wear and electrochemical corrosion can accelerate material loss and lead to premature failure of components.

Addressing these corrosion challenges requires a multifaceted approach, including careful material selection, optimized design to minimize crevices and stagnant areas, and the implementation of appropriate corrosion monitoring and prevention strategies. Ongoing research into advanced surface treatments, improved alloy compositions, and novel protective coatings is essential to enhance the performance of Hastelloy in increasingly demanding marine applications.

Another major challenge is the presence of sulfate-reducing bacteria in marine environments. These microorganisms can accelerate corrosion processes by producing hydrogen sulfide, which is highly corrosive to many metals, including some grades of Hastelloy. This microbially influenced corrosion (MIC) can lead to unexpected and rapid deterioration of components, especially in low-flow or stagnant areas.

The varying oxygen concentrations in different parts of marine structures also pose a significant corrosion challenge. Areas exposed to splash zones or alternating wet and dry conditions are particularly vulnerable to accelerated corrosion due to the constant replenishment of oxygen. This can lead to differential aeration cells, causing localized corrosion even in highly resistant alloys like Hastelloy.

Temperature fluctuations in marine environments further complicate the corrosion landscape. Higher temperatures generally accelerate corrosion rates, and the cyclical heating and cooling experienced by marine components can lead to thermal fatigue and stress corrosion cracking. This is particularly relevant for Hastelloy components used in heat exchangers or other high-temperature applications in marine settings.

The presence of various pollutants and contaminants in seawater, such as industrial effluents or oil spills, can introduce additional corrosive agents. These may interact with the alloy surface in unpredictable ways, potentially compromising the protective oxide layer that gives Hastelloy its corrosion resistance. Understanding and mitigating these complex interactions is crucial for ensuring long-term performance in marine applications.

Erosion-corrosion is another significant challenge, especially in high-flow areas or where abrasive particles are present in the seawater. While Hastelloy alloys generally have good erosion resistance, the combination of mechanical wear and electrochemical corrosion can accelerate material loss and lead to premature failure of components.

Addressing these corrosion challenges requires a multifaceted approach, including careful material selection, optimized design to minimize crevices and stagnant areas, and the implementation of appropriate corrosion monitoring and prevention strategies. Ongoing research into advanced surface treatments, improved alloy compositions, and novel protective coatings is essential to enhance the performance of Hastelloy in increasingly demanding marine applications.

Current Marine Solutions

01 Composition and properties of Hastelloy alloys

Hastelloy is a family of nickel-based superalloys known for their excellent corrosion resistance and high-temperature strength. These alloys typically contain varying amounts of chromium, molybdenum, and other elements to enhance their performance in harsh environments. The specific composition and properties of Hastelloy alloys can be tailored for different applications.- Composition and properties of Hastelloy alloys: Hastelloy is a family of nickel-based superalloys known for their excellent corrosion resistance and high-temperature strength. These alloys typically contain varying amounts of chromium, molybdenum, and other elements to enhance their performance in extreme environments. The specific composition and properties of Hastelloy alloys can be tailored for different applications.

- Applications of Hastelloy in industrial equipment: Hastelloy alloys are widely used in the manufacturing of industrial equipment, particularly in chemical processing, oil and gas, and power generation industries. They are employed in the fabrication of components such as heat exchangers, reactors, and piping systems that are exposed to corrosive environments and high temperatures.

- Welding and fabrication techniques for Hastelloy: Specialized welding and fabrication techniques are required for Hastelloy alloys to maintain their unique properties. These may include specific heat treatment processes, controlled cooling rates, and the use of compatible filler materials. Proper fabrication methods are crucial to ensure the integrity and performance of Hastelloy components in demanding applications.

- Surface treatment and coating of Hastelloy: Various surface treatment and coating techniques can be applied to Hastelloy components to further enhance their properties or provide additional functionality. These may include electroplating, thermal spraying, or the application of specialized coatings to improve wear resistance, reduce friction, or provide thermal insulation.

- Hastelloy in additive manufacturing: Additive manufacturing techniques, such as 3D printing, are being explored for the production of Hastelloy components. This approach allows for the creation of complex geometries and potentially reduces material waste. Research is ongoing to optimize the printing parameters and post-processing techniques to achieve desired material properties in additively manufactured Hastelloy parts.

02 Applications of Hastelloy in industrial equipment

Hastelloy alloys are widely used in the manufacturing of industrial equipment, particularly in chemical processing, oil and gas, and power generation industries. They are employed in the fabrication of components such as heat exchangers, reactors, and piping systems that are exposed to corrosive environments and high temperatures.Expand Specific Solutions03 Welding and fabrication techniques for Hastelloy

Specialized welding and fabrication techniques are required for Hastelloy alloys to maintain their corrosion resistance and mechanical properties. These may include specific welding processes, heat treatment procedures, and surface preparation methods to ensure the integrity of Hastelloy components in their intended applications.Expand Specific Solutions04 Surface treatment and coating of Hastelloy

Various surface treatment and coating methods can be applied to Hastelloy components to further enhance their performance characteristics. These treatments may include electroplating, thermal spraying, or the application of specialized coatings to improve wear resistance, reduce friction, or provide additional corrosion protection.Expand Specific Solutions05 Development of new Hastelloy alloy compositions

Ongoing research and development efforts focus on creating new Hastelloy alloy compositions with improved properties. These may include alloys with enhanced resistance to specific corrosive media, better high-temperature stability, or improved mechanical properties for demanding applications in aerospace, nuclear, or other advanced industries.Expand Specific Solutions

Key Industry Players

The global marine applications of Hastelloy are in a mature stage of development, with a substantial market size driven by the material's excellent corrosion resistance in harsh marine environments. The technology's maturity is evident from its widespread adoption across various marine sectors. Key players in this field include Dalian Shipbuilding Industry Co., Ltd., which leverages Hastelloy in shipbuilding applications, and Zhoushan Haichuan Marine Machinery Co., Ltd., focusing on marine machinery components. Research institutions like Zhejiang Ocean University and Shanghai Maritime University contribute to advancing Hastelloy applications through academic studies and industry collaborations, further solidifying the material's position in marine engineering.

Dalian Shipbuilding Industry Co., Ltd.

Technical Solution: Dalian Shipbuilding Industry Co., Ltd. has been pioneering the use of Hastelloy in shipbuilding, particularly for vessels operating in harsh marine environments. They have developed a novel welding technique that allows for the efficient joining of Hastelloy components to traditional ship materials, reducing galvanic corrosion at interface points[2]. The company has also created a Hastelloy-clad steel composite material that combines the corrosion resistance of Hastelloy with the structural strength and cost-effectiveness of steel[4]. This innovation has been successfully implemented in the construction of chemical tankers and offshore support vessels. Additionally, Dalian Shipbuilding has established a dedicated Hastelloy fabrication facility, equipped with specialized tools and trained personnel to handle the unique properties of these alloys[6].

Strengths: Innovative welding techniques, development of cost-effective Hastelloy-clad materials, and specialized fabrication facilities. Weaknesses: Higher initial costs for Hastelloy implementation in shipbuilding, and the need for specialized maintenance procedures for Hastelloy-equipped vessels.

Baoshan Iron & Steel Co., Ltd.

Technical Solution: Baoshan Iron & Steel Co., Ltd. has been at the forefront of Hastelloy development for marine applications. Their research focuses on improving the corrosion resistance and mechanical properties of Hastelloy alloys. They have developed a proprietary heat treatment process that enhances the alloy's resistance to pitting and crevice corrosion in seawater environments[1]. The company has also invested in advanced manufacturing techniques, including precision casting and hot isostatic pressing, to produce complex Hastelloy components for marine equipment[3]. Their latest Hastelloy grade, specifically designed for offshore oil and gas platforms, demonstrates superior resistance to sulfide stress cracking and hydrogen embrittlement[5].

Strengths: Advanced manufacturing capabilities, proprietary heat treatment process, and tailored alloy compositions for specific marine environments. Weaknesses: Higher production costs compared to traditional marine-grade stainless steels, and limited global supply chain for specialized Hastelloy products.

Hastelloy Innovations

High-Performance Corrosion-Resistant High-Entropy Alloys

PatentActiveUS20200283874A1

Innovation

- Development of high-entropy alloys with a face-centered cubic (FCC) crystal structure, composed of iron, nickel, cobalt, molybdenum, and chromium, with minor elements, providing high corrosion resistance and ductility, suitable for use as coatings or bulk components in extreme environments.

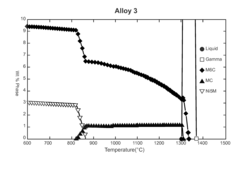

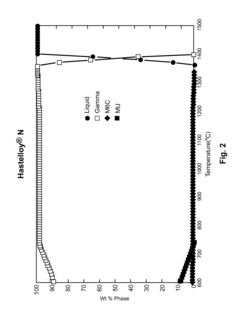

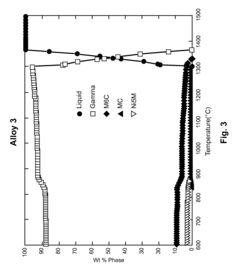

Intermediate Strength Alloys for High Temperature Service in Liquid-Salt Cooled Energy Systems

PatentActiveUS20150197832A1

Innovation

- Development of a new alloy with a composition of 6 to 8.5 Cr, 5.5 to 13.5 Mo, 0.4 to 7.5 W, 1 to 2 Ti, 0.7 to 0.85 Mn, 0.05 to 0.3 Al, up to 0.1 Co, 0.08 to 0.5 C, 1 to 5 Ta, 1 to 4 Nb, 1 to 3 Hf, and balance Ni, which provides improved high-temperature strength, creep resistance, and corrosion resistance through solid solution strengthening and carbide precipitation mechanisms.

Environmental Regulations

Environmental regulations play a crucial role in shaping the adoption and application of Hastelloy in global marine environments. The increasing focus on sustainability and environmental protection has led to stricter regulations governing the materials used in marine applications, particularly in areas such as emissions control and corrosion resistance.

One of the primary drivers for Hastelloy usage in marine applications is the International Maritime Organization's (IMO) regulations on sulfur emissions. The IMO 2020 regulation, which came into effect on January 1, 2020, mandates a global sulfur cap of 0.5% m/m for marine fuels. This has led to increased demand for Hastelloy in exhaust gas cleaning systems, commonly known as scrubbers, due to its exceptional resistance to sulfuric acid corrosion.

Additionally, the Ballast Water Management Convention, enforced by the IMO, requires ships to manage their ballast water to remove, render harmless, or avoid the uptake of aquatic organisms and pathogens. Hastelloy's corrosion resistance makes it an ideal material for components in ballast water treatment systems, ensuring compliance with these regulations.

The European Union's Marine Equipment Directive (MED) also influences the use of Hastelloy in marine applications. The MED sets standards for marine equipment, including materials used in various shipboard systems. Hastelloy's compliance with these standards, particularly in terms of fire resistance and durability, has contributed to its increased adoption in European marine markets.

Furthermore, the United States Environmental Protection Agency (EPA) has implemented regulations under the Vessel General Permit (VGP) program, which addresses discharges incidental to the normal operation of vessels. These regulations have implications for materials used in marine applications, with Hastelloy being favored for its resistance to various chemicals and its ability to withstand harsh marine environments.

The International Convention for the Prevention of Pollution from Ships (MARPOL) has also indirectly influenced the use of Hastelloy in marine applications. MARPOL's regulations on preventing pollution from ships have led to the development of advanced waste treatment systems and emission control technologies, where Hastelloy's corrosion resistance and durability are highly valued.

As environmental regulations continue to evolve and become more stringent, the demand for materials that can withstand harsh marine environments while complying with these regulations is expected to grow. This trend is likely to further drive the adoption of Hastelloy in various marine applications, from offshore structures to shipboard systems and components.

One of the primary drivers for Hastelloy usage in marine applications is the International Maritime Organization's (IMO) regulations on sulfur emissions. The IMO 2020 regulation, which came into effect on January 1, 2020, mandates a global sulfur cap of 0.5% m/m for marine fuels. This has led to increased demand for Hastelloy in exhaust gas cleaning systems, commonly known as scrubbers, due to its exceptional resistance to sulfuric acid corrosion.

Additionally, the Ballast Water Management Convention, enforced by the IMO, requires ships to manage their ballast water to remove, render harmless, or avoid the uptake of aquatic organisms and pathogens. Hastelloy's corrosion resistance makes it an ideal material for components in ballast water treatment systems, ensuring compliance with these regulations.

The European Union's Marine Equipment Directive (MED) also influences the use of Hastelloy in marine applications. The MED sets standards for marine equipment, including materials used in various shipboard systems. Hastelloy's compliance with these standards, particularly in terms of fire resistance and durability, has contributed to its increased adoption in European marine markets.

Furthermore, the United States Environmental Protection Agency (EPA) has implemented regulations under the Vessel General Permit (VGP) program, which addresses discharges incidental to the normal operation of vessels. These regulations have implications for materials used in marine applications, with Hastelloy being favored for its resistance to various chemicals and its ability to withstand harsh marine environments.

The International Convention for the Prevention of Pollution from Ships (MARPOL) has also indirectly influenced the use of Hastelloy in marine applications. MARPOL's regulations on preventing pollution from ships have led to the development of advanced waste treatment systems and emission control technologies, where Hastelloy's corrosion resistance and durability are highly valued.

As environmental regulations continue to evolve and become more stringent, the demand for materials that can withstand harsh marine environments while complying with these regulations is expected to grow. This trend is likely to further drive the adoption of Hastelloy in various marine applications, from offshore structures to shipboard systems and components.

Lifecycle Cost Analysis

Lifecycle cost analysis is a critical aspect when considering the adoption of Hastelloy in marine applications. This analysis encompasses the total costs associated with the material's use throughout its entire lifecycle, from initial procurement to final disposal. In the context of marine environments, Hastelloy's superior corrosion resistance plays a significant role in reducing long-term maintenance and replacement costs.

The initial investment in Hastelloy is typically higher compared to conventional materials used in marine applications. However, this upfront cost is often offset by the material's extended lifespan and reduced maintenance requirements. Marine environments are notoriously harsh, with constant exposure to saltwater, varying temperatures, and potential chemical contaminants. Hastelloy's ability to withstand these conditions results in fewer instances of material failure, leading to reduced downtime and associated costs.

Maintenance costs for Hastelloy components are generally lower than those for traditional materials. The alloy's resistance to pitting, crevice corrosion, and stress corrosion cracking means less frequent inspections and repairs are necessary. This reduction in maintenance frequency not only saves on direct repair costs but also minimizes operational disruptions, which can be particularly costly in marine industries such as shipping or offshore energy production.

The longevity of Hastelloy in marine applications contributes significantly to its favorable lifecycle cost profile. While the exact lifespan depends on specific environmental conditions and application requirements, Hastelloy components often outlast their counterparts made from less resistant materials by a considerable margin. This extended service life translates to fewer replacement cycles over the operational lifetime of a marine vessel or structure, reducing both material and labor costs associated with replacements.

Energy efficiency is another factor to consider in lifecycle cost analysis. Hastelloy's resistance to fouling and scaling can help maintain the efficiency of heat exchangers and other components in marine systems. This sustained efficiency can lead to lower energy consumption over time, contributing to overall cost savings and reduced environmental impact.

End-of-life considerations also factor into the lifecycle cost analysis. While Hastelloy components may have a higher initial cost, their longer lifespan means fewer materials entering the waste stream over time. Additionally, the recyclability of Hastelloy can potentially offset some costs at the end of its service life, although the specialized nature of the alloy may limit recycling options compared to more common materials.

When conducting a lifecycle cost analysis for Hastelloy in marine applications, it's essential to consider not only direct costs but also indirect benefits such as improved reliability, reduced risk of catastrophic failures, and potential improvements in operational efficiency. These factors, while sometimes challenging to quantify, can significantly impact the overall value proposition of using Hastelloy in marine environments.

The initial investment in Hastelloy is typically higher compared to conventional materials used in marine applications. However, this upfront cost is often offset by the material's extended lifespan and reduced maintenance requirements. Marine environments are notoriously harsh, with constant exposure to saltwater, varying temperatures, and potential chemical contaminants. Hastelloy's ability to withstand these conditions results in fewer instances of material failure, leading to reduced downtime and associated costs.

Maintenance costs for Hastelloy components are generally lower than those for traditional materials. The alloy's resistance to pitting, crevice corrosion, and stress corrosion cracking means less frequent inspections and repairs are necessary. This reduction in maintenance frequency not only saves on direct repair costs but also minimizes operational disruptions, which can be particularly costly in marine industries such as shipping or offshore energy production.

The longevity of Hastelloy in marine applications contributes significantly to its favorable lifecycle cost profile. While the exact lifespan depends on specific environmental conditions and application requirements, Hastelloy components often outlast their counterparts made from less resistant materials by a considerable margin. This extended service life translates to fewer replacement cycles over the operational lifetime of a marine vessel or structure, reducing both material and labor costs associated with replacements.

Energy efficiency is another factor to consider in lifecycle cost analysis. Hastelloy's resistance to fouling and scaling can help maintain the efficiency of heat exchangers and other components in marine systems. This sustained efficiency can lead to lower energy consumption over time, contributing to overall cost savings and reduced environmental impact.

End-of-life considerations also factor into the lifecycle cost analysis. While Hastelloy components may have a higher initial cost, their longer lifespan means fewer materials entering the waste stream over time. Additionally, the recyclability of Hastelloy can potentially offset some costs at the end of its service life, although the specialized nature of the alloy may limit recycling options compared to more common materials.

When conducting a lifecycle cost analysis for Hastelloy in marine applications, it's essential to consider not only direct costs but also indirect benefits such as improved reliability, reduced risk of catastrophic failures, and potential improvements in operational efficiency. These factors, while sometimes challenging to quantify, can significantly impact the overall value proposition of using Hastelloy in marine environments.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!