How to Sustain Competitive Edge with Polycarbonate?

JUL 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Polycarbonate Evolution

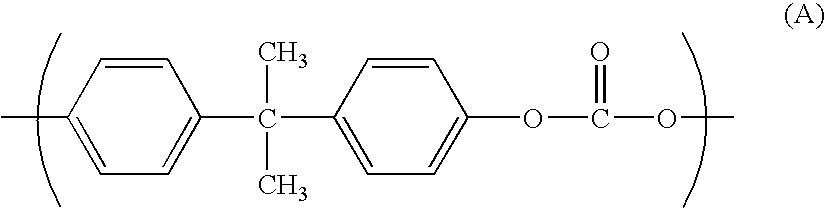

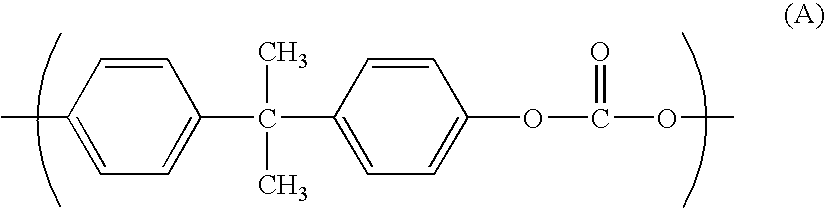

Polycarbonate, a versatile thermoplastic polymer, has undergone significant evolution since its discovery in 1953. Initially developed as a high-performance material for electrical and electronic applications, polycarbonate has continuously adapted to meet changing market demands and technological advancements.

In the 1960s and 1970s, polycarbonate gained popularity in the automotive industry due to its exceptional impact resistance and optical clarity. This period marked the beginning of its widespread use in headlamp lenses and other automotive components, revolutionizing vehicle design and safety standards.

The 1980s and 1990s saw polycarbonate's expansion into consumer electronics and data storage. Its heat resistance and electrical insulation properties made it an ideal material for computer housings, CD and DVD production, and other electronic devices. This era also witnessed advancements in polycarbonate blends and composites, enhancing its performance characteristics.

The turn of the millennium brought new challenges and opportunities for polycarbonate. Environmental concerns led to the development of more sustainable production methods and recycling techniques. Manufacturers began focusing on reducing the carbon footprint of polycarbonate production and exploring bio-based alternatives.

In recent years, polycarbonate has found new applications in cutting-edge technologies. Its use in 3D printing materials has opened up possibilities for rapid prototyping and customized manufacturing. The medical industry has also embraced polycarbonate for its biocompatibility, leading to innovations in medical devices and equipment.

The evolution of polycarbonate has been marked by continuous improvements in its properties. Advances in polymer science have resulted in grades with enhanced UV resistance, improved flame retardancy, and better chemical resistance. These developments have expanded polycarbonate's applicability across various industries.

Looking ahead, the future of polycarbonate lies in smart and functional materials. Research is underway to incorporate nanotechnology, creating polycarbonate composites with self-healing properties or embedded sensors. The potential for polycarbonate in flexible electronics and energy storage solutions is also being explored, promising exciting new applications in the coming years.

To sustain a competitive edge with polycarbonate, companies must focus on innovation in both material properties and manufacturing processes. This includes developing more environmentally friendly production methods, exploring novel applications in emerging technologies, and continuously improving the material's performance characteristics to meet evolving industry demands.

In the 1960s and 1970s, polycarbonate gained popularity in the automotive industry due to its exceptional impact resistance and optical clarity. This period marked the beginning of its widespread use in headlamp lenses and other automotive components, revolutionizing vehicle design and safety standards.

The 1980s and 1990s saw polycarbonate's expansion into consumer electronics and data storage. Its heat resistance and electrical insulation properties made it an ideal material for computer housings, CD and DVD production, and other electronic devices. This era also witnessed advancements in polycarbonate blends and composites, enhancing its performance characteristics.

The turn of the millennium brought new challenges and opportunities for polycarbonate. Environmental concerns led to the development of more sustainable production methods and recycling techniques. Manufacturers began focusing on reducing the carbon footprint of polycarbonate production and exploring bio-based alternatives.

In recent years, polycarbonate has found new applications in cutting-edge technologies. Its use in 3D printing materials has opened up possibilities for rapid prototyping and customized manufacturing. The medical industry has also embraced polycarbonate for its biocompatibility, leading to innovations in medical devices and equipment.

The evolution of polycarbonate has been marked by continuous improvements in its properties. Advances in polymer science have resulted in grades with enhanced UV resistance, improved flame retardancy, and better chemical resistance. These developments have expanded polycarbonate's applicability across various industries.

Looking ahead, the future of polycarbonate lies in smart and functional materials. Research is underway to incorporate nanotechnology, creating polycarbonate composites with self-healing properties or embedded sensors. The potential for polycarbonate in flexible electronics and energy storage solutions is also being explored, promising exciting new applications in the coming years.

To sustain a competitive edge with polycarbonate, companies must focus on innovation in both material properties and manufacturing processes. This includes developing more environmentally friendly production methods, exploring novel applications in emerging technologies, and continuously improving the material's performance characteristics to meet evolving industry demands.

Market Demand Analysis

The global polycarbonate market has been experiencing steady growth, driven by increasing demand across various industries. The automotive sector remains a key consumer, utilizing polycarbonate for lightweight components, contributing to improved fuel efficiency and reduced emissions. The construction industry also shows significant demand, particularly for glazing applications due to polycarbonate's durability and thermal insulation properties.

In the electronics sector, polycarbonate continues to be a material of choice for smartphone casings, laptop bodies, and other consumer electronics, owing to its impact resistance and aesthetic appeal. The medical industry's demand for polycarbonate is on the rise, especially for medical devices and equipment that require sterilization and transparency.

The packaging industry is another growing market for polycarbonate, particularly in food-grade applications where its clarity and durability are highly valued. Additionally, the optical media sector, although declining, still maintains a notable demand for polycarbonate in the production of CDs and DVDs.

Emerging trends in sustainable and eco-friendly materials are influencing market dynamics. There is an increasing demand for recycled and bio-based polycarbonates, driven by environmental concerns and regulatory pressures. This shift presents both challenges and opportunities for manufacturers to innovate and adapt their product offerings.

The Asia-Pacific region, particularly China and India, is expected to be the fastest-growing market for polycarbonate, fueled by rapid industrialization and urbanization. North America and Europe maintain stable demand, with a focus on high-performance and specialty grade polycarbonates.

Despite positive growth projections, the polycarbonate market faces challenges from alternative materials such as high-performance plastics and glass in certain applications. Price volatility of raw materials, particularly bisphenol A (BPA), also impacts market dynamics and profitability.

To sustain a competitive edge, manufacturers need to focus on developing innovative grades of polycarbonate with enhanced properties such as improved heat resistance, flame retardancy, and UV stability. Additionally, investing in sustainable production methods and recycling technologies will be crucial to meet evolving market demands and regulatory requirements.

The COVID-19 pandemic has had a mixed impact on the polycarbonate market. While demand in some sectors like automotive temporarily decreased, there was a surge in demand for medical applications and protective equipment. As economies recover, the overall demand for polycarbonate is expected to rebound, with new opportunities emerging in hygiene-related products and touchless technologies.

In the electronics sector, polycarbonate continues to be a material of choice for smartphone casings, laptop bodies, and other consumer electronics, owing to its impact resistance and aesthetic appeal. The medical industry's demand for polycarbonate is on the rise, especially for medical devices and equipment that require sterilization and transparency.

The packaging industry is another growing market for polycarbonate, particularly in food-grade applications where its clarity and durability are highly valued. Additionally, the optical media sector, although declining, still maintains a notable demand for polycarbonate in the production of CDs and DVDs.

Emerging trends in sustainable and eco-friendly materials are influencing market dynamics. There is an increasing demand for recycled and bio-based polycarbonates, driven by environmental concerns and regulatory pressures. This shift presents both challenges and opportunities for manufacturers to innovate and adapt their product offerings.

The Asia-Pacific region, particularly China and India, is expected to be the fastest-growing market for polycarbonate, fueled by rapid industrialization and urbanization. North America and Europe maintain stable demand, with a focus on high-performance and specialty grade polycarbonates.

Despite positive growth projections, the polycarbonate market faces challenges from alternative materials such as high-performance plastics and glass in certain applications. Price volatility of raw materials, particularly bisphenol A (BPA), also impacts market dynamics and profitability.

To sustain a competitive edge, manufacturers need to focus on developing innovative grades of polycarbonate with enhanced properties such as improved heat resistance, flame retardancy, and UV stability. Additionally, investing in sustainable production methods and recycling technologies will be crucial to meet evolving market demands and regulatory requirements.

The COVID-19 pandemic has had a mixed impact on the polycarbonate market. While demand in some sectors like automotive temporarily decreased, there was a surge in demand for medical applications and protective equipment. As economies recover, the overall demand for polycarbonate is expected to rebound, with new opportunities emerging in hygiene-related products and touchless technologies.

Technical Challenges

Polycarbonate, a versatile thermoplastic polymer, faces several technical challenges in maintaining its competitive edge in the market. One of the primary issues is its susceptibility to environmental stress cracking, particularly when exposed to certain chemicals or under prolonged stress. This vulnerability can limit its application in specific industries where chemical resistance is crucial.

Another significant challenge lies in the material's relatively high production costs compared to some alternative plastics. The complex manufacturing process and the need for high-quality raw materials contribute to this cost factor, potentially impacting its market competitiveness in price-sensitive applications.

The yellowing and degradation of polycarbonate under prolonged UV exposure present another technical hurdle. While UV stabilizers can mitigate this issue to some extent, finding more effective and long-lasting solutions remains a challenge, especially for outdoor applications where aesthetic and structural integrity are paramount.

Polycarbonate's high melt viscosity can pose difficulties in processing, particularly in injection molding applications requiring intricate designs or thin-walled parts. This characteristic can lead to increased cycle times and potential quality issues, affecting production efficiency and cost-effectiveness.

The material's inherent flammability is another area of concern, especially in applications requiring stringent fire safety standards. While flame retardants can be added, they often compromise other desirable properties of polycarbonate, such as transparency or impact resistance.

Recycling polycarbonate effectively presents a significant technical challenge. The presence of additives and the potential for contamination during the recycling process can degrade the material's properties, limiting the applications for recycled polycarbonate and impacting its sustainability profile.

Balancing the trade-off between impact resistance and scratch resistance remains an ongoing challenge. Enhancing one property often comes at the expense of the other, necessitating careful formulation and processing techniques to achieve an optimal balance for specific applications.

Addressing these technical challenges is crucial for sustaining polycarbonate's competitive edge. Innovations in material science, processing technologies, and additive formulations are key areas of focus for overcoming these limitations and expanding the material's applicability across various industries.

Another significant challenge lies in the material's relatively high production costs compared to some alternative plastics. The complex manufacturing process and the need for high-quality raw materials contribute to this cost factor, potentially impacting its market competitiveness in price-sensitive applications.

The yellowing and degradation of polycarbonate under prolonged UV exposure present another technical hurdle. While UV stabilizers can mitigate this issue to some extent, finding more effective and long-lasting solutions remains a challenge, especially for outdoor applications where aesthetic and structural integrity are paramount.

Polycarbonate's high melt viscosity can pose difficulties in processing, particularly in injection molding applications requiring intricate designs or thin-walled parts. This characteristic can lead to increased cycle times and potential quality issues, affecting production efficiency and cost-effectiveness.

The material's inherent flammability is another area of concern, especially in applications requiring stringent fire safety standards. While flame retardants can be added, they often compromise other desirable properties of polycarbonate, such as transparency or impact resistance.

Recycling polycarbonate effectively presents a significant technical challenge. The presence of additives and the potential for contamination during the recycling process can degrade the material's properties, limiting the applications for recycled polycarbonate and impacting its sustainability profile.

Balancing the trade-off between impact resistance and scratch resistance remains an ongoing challenge. Enhancing one property often comes at the expense of the other, necessitating careful formulation and processing techniques to achieve an optimal balance for specific applications.

Addressing these technical challenges is crucial for sustaining polycarbonate's competitive edge. Innovations in material science, processing technologies, and additive formulations are key areas of focus for overcoming these limitations and expanding the material's applicability across various industries.

Current Solutions

01 Synthesis and modification of polycarbonates

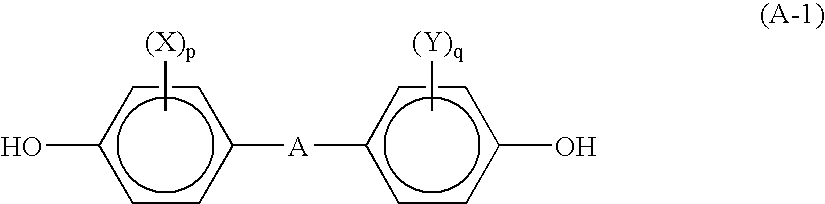

Various methods for synthesizing and modifying polycarbonates are explored, including new catalysts, reaction conditions, and additives to improve properties such as molecular weight, thermal stability, and optical clarity. These techniques aim to enhance the overall performance and versatility of polycarbonate materials for different applications.- Synthesis and modification of polycarbonates: Various methods for synthesizing and modifying polycarbonates are explored, including novel catalysts, reaction conditions, and additives. These techniques aim to improve the properties and performance of polycarbonate materials, such as thermal stability, impact resistance, and optical clarity.

- Polycarbonate blends and composites: Development of polycarbonate blends and composites with other polymers or materials to enhance specific properties. These formulations can improve characteristics such as flame retardancy, mechanical strength, or chemical resistance, expanding the range of applications for polycarbonate-based materials.

- Polycarbonate processing and manufacturing: Innovations in processing and manufacturing techniques for polycarbonate products, including extrusion, injection molding, and film formation. These advancements focus on improving production efficiency, reducing defects, and enhancing the quality of final polycarbonate products.

- Polycarbonate applications in electronics: Utilization of polycarbonates in electronic devices and components, such as display panels, circuit boards, and protective casings. The focus is on developing polycarbonate formulations with specific electrical and thermal properties suitable for various electronic applications.

- Recycling and sustainability of polycarbonates: Methods for recycling polycarbonate materials and developing more sustainable production processes. This includes chemical recycling techniques, bio-based polycarbonate alternatives, and strategies to reduce the environmental impact of polycarbonate manufacturing and disposal.

02 Polycarbonate blends and composites

Development of polycarbonate blends and composites with other polymers or materials to achieve improved mechanical, thermal, or electrical properties. These formulations often target specific applications such as automotive parts, electronic components, or construction materials, offering enhanced performance characteristics compared to pure polycarbonate.Expand Specific Solutions03 Flame retardant polycarbonate formulations

Creation of flame retardant polycarbonate formulations by incorporating various additives or modifying the polymer structure. These developments aim to improve fire safety in applications such as electronics, construction materials, and transportation, while maintaining other desirable properties of polycarbonate.Expand Specific Solutions04 Optical and electronic applications of polycarbonate

Utilization of polycarbonate in optical and electronic applications, including lenses, displays, and data storage devices. Research focuses on improving optical clarity, light transmission, and durability of polycarbonate materials for these high-performance applications.Expand Specific Solutions05 Recycling and sustainability of polycarbonate

Development of methods for recycling polycarbonate materials and improving their sustainability. This includes techniques for breaking down polycarbonate into its monomers for reuse, as well as creating more environmentally friendly production processes and additives to reduce the environmental impact of polycarbonate products.Expand Specific Solutions

Industry Leaders

The polycarbonate market is in a mature growth stage, with a global market size expected to reach $25 billion by 2027. The competitive landscape is characterized by established players like SABIC, Covestro, and Mitsubishi Engineering-Plastics, alongside emerging companies from Asia such as Wanhua Chemical and Kingfa Sci. & Tech. Technological maturity varies, with industry leaders focusing on advanced applications and sustainability. Companies are investing in R&D to develop bio-based polycarbonates and improve recycling processes, aiming to address environmental concerns and maintain a competitive edge. The market is seeing increased competition from Asian manufacturers, particularly in commodity-grade polycarbonates, while Western companies are shifting towards high-performance and specialty grades.

SABIC Global Technologies BV

Technical Solution: SABIC maintains its competitive edge in polycarbonate through continuous innovation. They've developed LEXAN™ polycarbonate resins with enhanced properties such as improved flame retardancy, weather resistance, and impact strength[1]. SABIC has introduced bio-based polycarbonates, reducing carbon footprint by up to 50% compared to fossil-based alternatives[2]. Their LEXAN™ EXL copolymers offer exceptional low-temperature impact resistance for automotive applications[3]. SABIC has also developed polycarbonate films and sheets for various industries, including their LEXAN™ CLINIWALL™ sheet for healthcare environments, featuring antimicrobial properties[4].

Strengths: Global presence, extensive product range, focus on sustainable solutions. Weaknesses: High competition in commodity plastics, potential exposure to geopolitical risks.

Wanhua Chemical Group Co., Ltd.

Technical Solution: Wanhua Chemical maintains its competitive edge in polycarbonate through technological innovation and vertical integration. They've developed a proprietary non-phosgene process for polycarbonate production, reducing environmental impact and production costs[1]. Wanhua has introduced flame-retardant polycarbonate grades for electronics and automotive applications, meeting stringent safety standards[2]. Their optical-grade polycarbonates offer high transparency and low birefringence for optical applications[3]. Wanhua has also focused on developing polycarbonate composites and blends, such as PC/ABS alloys, to expand their product portfolio and address diverse market needs[4].

Strengths: Vertically integrated production, cost-effective manufacturing processes, strong presence in Asian markets. Weaknesses: Less established brand in Western markets, potential geopolitical risks.

Key Patents Review

Polycarbonate-based resin composition for extrusion molding using sizing die and molded product

PatentInactiveUS7326467B2

Innovation

- A polycarbonate-based resin composition with specific integral values in 1H-NMR spectra, having a viscosity-average molecular weight of 17000 to 27000, and containing specific proton ratios (Pa, Pb, and Pc) that balance branching and unbranched structures, optimized through a transesterification reaction method, which reduces load on the extruder and improves moldability, impact resistance, and hue.

Polycarbonate having a high extensional viscosity

PatentWO2003080706A1

Innovation

- Development of a polycarbonate with increased elongational viscosity, specifically designed to maintain uniform wall thickness during processing, achieved by adjusting parameters such as molar mass and branching, and using suitable additives to enhance extensional rheological properties.

Sustainability Aspects

Sustainability has become a crucial aspect of maintaining a competitive edge in the polycarbonate industry. As environmental concerns grow, companies must adapt their strategies to align with sustainable practices while preserving the material's unique properties and applications.

One key sustainability aspect of polycarbonate is its potential for recycling. Unlike many other plastics, polycarbonate can be effectively recycled without significant loss of its mechanical properties. This characteristic allows for the development of closed-loop recycling systems, where post-consumer polycarbonate products can be reprocessed into new high-quality materials. Implementing such systems not only reduces waste but also decreases the demand for virgin raw materials, thereby lowering the overall environmental impact.

Energy efficiency in polycarbonate production is another critical sustainability factor. Manufacturers are increasingly focusing on optimizing their production processes to reduce energy consumption and greenhouse gas emissions. This includes the adoption of more efficient equipment, heat recovery systems, and the use of renewable energy sources in production facilities. By improving energy efficiency, companies can reduce their carbon footprint and operational costs, enhancing their competitive position in the market.

The development of bio-based polycarbonates represents a significant advancement in sustainability efforts. These materials, derived from renewable resources such as plant-based feedstocks, offer a more environmentally friendly alternative to traditional petroleum-based polycarbonates. While still in the early stages of commercialization, bio-based polycarbonates show promise in reducing reliance on fossil fuels and decreasing the overall carbon footprint of polycarbonate products.

Water conservation and management in polycarbonate production processes are also essential sustainability considerations. Implementing closed-loop water systems, improving wastewater treatment, and reducing overall water consumption can significantly enhance the environmental profile of polycarbonate manufacturing. These efforts not only conserve a vital resource but also help companies comply with increasingly stringent environmental regulations.

Extending the lifespan of polycarbonate products is another crucial aspect of sustainability. By improving the durability and resistance of polycarbonate materials, manufacturers can create products that last longer, reducing the need for frequent replacements and minimizing waste generation. This approach aligns with the principles of the circular economy and can enhance the material's overall sustainability profile.

Lastly, transparency and traceability in the polycarbonate supply chain are becoming increasingly important for sustainability. Companies that can demonstrate responsible sourcing of raw materials, ethical labor practices, and comprehensive life cycle assessments of their products are better positioned to meet the growing demand for sustainable materials. This transparency not only builds trust with consumers and stakeholders but also helps identify areas for further improvement in the sustainability of polycarbonate production and use.

One key sustainability aspect of polycarbonate is its potential for recycling. Unlike many other plastics, polycarbonate can be effectively recycled without significant loss of its mechanical properties. This characteristic allows for the development of closed-loop recycling systems, where post-consumer polycarbonate products can be reprocessed into new high-quality materials. Implementing such systems not only reduces waste but also decreases the demand for virgin raw materials, thereby lowering the overall environmental impact.

Energy efficiency in polycarbonate production is another critical sustainability factor. Manufacturers are increasingly focusing on optimizing their production processes to reduce energy consumption and greenhouse gas emissions. This includes the adoption of more efficient equipment, heat recovery systems, and the use of renewable energy sources in production facilities. By improving energy efficiency, companies can reduce their carbon footprint and operational costs, enhancing their competitive position in the market.

The development of bio-based polycarbonates represents a significant advancement in sustainability efforts. These materials, derived from renewable resources such as plant-based feedstocks, offer a more environmentally friendly alternative to traditional petroleum-based polycarbonates. While still in the early stages of commercialization, bio-based polycarbonates show promise in reducing reliance on fossil fuels and decreasing the overall carbon footprint of polycarbonate products.

Water conservation and management in polycarbonate production processes are also essential sustainability considerations. Implementing closed-loop water systems, improving wastewater treatment, and reducing overall water consumption can significantly enhance the environmental profile of polycarbonate manufacturing. These efforts not only conserve a vital resource but also help companies comply with increasingly stringent environmental regulations.

Extending the lifespan of polycarbonate products is another crucial aspect of sustainability. By improving the durability and resistance of polycarbonate materials, manufacturers can create products that last longer, reducing the need for frequent replacements and minimizing waste generation. This approach aligns with the principles of the circular economy and can enhance the material's overall sustainability profile.

Lastly, transparency and traceability in the polycarbonate supply chain are becoming increasingly important for sustainability. Companies that can demonstrate responsible sourcing of raw materials, ethical labor practices, and comprehensive life cycle assessments of their products are better positioned to meet the growing demand for sustainable materials. This transparency not only builds trust with consumers and stakeholders but also helps identify areas for further improvement in the sustainability of polycarbonate production and use.

Regulatory Landscape

The regulatory landscape surrounding polycarbonate plays a crucial role in shaping its competitive edge in various industries. As environmental concerns and safety standards continue to evolve, manufacturers and users of polycarbonate must navigate an increasingly complex web of regulations to maintain market relevance and compliance.

In recent years, there has been a growing focus on the safety of bisphenol A (BPA), a key component in polycarbonate production. Regulatory bodies worldwide have implemented varying degrees of restrictions on BPA use, particularly in food contact applications and products for infants and young children. This has led to the development of BPA-free alternatives and a shift in market demand towards these options.

The European Union has been at the forefront of stringent regulations, with the European Food Safety Authority (EFSA) continuously reviewing and updating its stance on BPA. The EU's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation also impacts polycarbonate manufacturers, requiring extensive documentation and testing to ensure compliance.

In the United States, the Food and Drug Administration (FDA) has banned BPA in baby bottles and sippy cups, while continuing to monitor its use in other applications. Individual states have implemented their own regulations, creating a patchwork of compliance requirements for manufacturers operating across different regions.

Asian countries, particularly China and Japan, have also introduced regulations on BPA and polycarbonate use, reflecting a global trend towards stricter oversight. These regulations often focus on specific applications, such as food packaging and children's products, but are expanding to cover a broader range of industries.

The automotive and construction sectors face their own set of regulations related to polycarbonate use. Safety standards for automotive glazing and building materials continue to evolve, driving innovation in polycarbonate formulations to meet these requirements while maintaining performance characteristics.

To sustain a competitive edge, polycarbonate manufacturers must proactively engage with regulatory bodies, invest in research and development to create compliant alternatives, and stay ahead of emerging regulations. This may involve developing new grades of polycarbonate that meet or exceed regulatory standards, as well as exploring novel applications that leverage polycarbonate's unique properties within the bounds of current and anticipated regulations.

Furthermore, companies must implement robust tracking and documentation systems to ensure compliance across global markets. This includes maintaining detailed records of material composition, production processes, and quality control measures to meet the diverse regulatory requirements of different regions and industries.

In recent years, there has been a growing focus on the safety of bisphenol A (BPA), a key component in polycarbonate production. Regulatory bodies worldwide have implemented varying degrees of restrictions on BPA use, particularly in food contact applications and products for infants and young children. This has led to the development of BPA-free alternatives and a shift in market demand towards these options.

The European Union has been at the forefront of stringent regulations, with the European Food Safety Authority (EFSA) continuously reviewing and updating its stance on BPA. The EU's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation also impacts polycarbonate manufacturers, requiring extensive documentation and testing to ensure compliance.

In the United States, the Food and Drug Administration (FDA) has banned BPA in baby bottles and sippy cups, while continuing to monitor its use in other applications. Individual states have implemented their own regulations, creating a patchwork of compliance requirements for manufacturers operating across different regions.

Asian countries, particularly China and Japan, have also introduced regulations on BPA and polycarbonate use, reflecting a global trend towards stricter oversight. These regulations often focus on specific applications, such as food packaging and children's products, but are expanding to cover a broader range of industries.

The automotive and construction sectors face their own set of regulations related to polycarbonate use. Safety standards for automotive glazing and building materials continue to evolve, driving innovation in polycarbonate formulations to meet these requirements while maintaining performance characteristics.

To sustain a competitive edge, polycarbonate manufacturers must proactively engage with regulatory bodies, invest in research and development to create compliant alternatives, and stay ahead of emerging regulations. This may involve developing new grades of polycarbonate that meet or exceed regulatory standards, as well as exploring novel applications that leverage polycarbonate's unique properties within the bounds of current and anticipated regulations.

Furthermore, companies must implement robust tracking and documentation systems to ensure compliance across global markets. This includes maintaining detailed records of material composition, production processes, and quality control measures to meet the diverse regulatory requirements of different regions and industries.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!