Quantum Computing for Enhanced Operational Risk Management

JUL 17, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Quantum Computing in Risk Management: Background and Objectives

Quantum computing represents a paradigm shift in computational capabilities, offering unprecedented potential to revolutionize various industries, including risk management. The evolution of quantum technology has been marked by significant milestones, from theoretical concepts in the 1980s to the development of practical quantum devices in recent years. As the field progresses, the application of quantum computing to operational risk management emerges as a promising frontier.

The primary objective of integrating quantum computing into risk management is to enhance the accuracy, speed, and complexity of risk assessment and mitigation strategies. Traditional risk management approaches often struggle with the sheer volume and complexity of data in modern financial systems. Quantum computing aims to address these limitations by leveraging quantum mechanical phenomena such as superposition and entanglement.

One of the key trends in this technological evolution is the development of quantum algorithms specifically designed for risk analysis. These algorithms have the potential to process vast amounts of financial data simultaneously, enabling more comprehensive risk assessments. Additionally, quantum machine learning techniques are being explored to improve predictive models for risk forecasting.

The quantum approach to risk management is expected to significantly impact areas such as portfolio optimization, fraud detection, and stress testing. By simulating complex financial scenarios at an unprecedented scale, quantum computers could provide insights into systemic risks that are currently challenging to model effectively.

However, the journey towards fully realized quantum-enhanced risk management faces several challenges. Current quantum systems are still limited in their qubit count and coherence times, restricting their practical applications. Overcoming these technical hurdles is crucial for the widespread adoption of quantum technologies in the financial sector.

As research progresses, the integration of quantum computing with existing risk management frameworks is becoming a focal point. This integration aims to create hybrid systems that leverage the strengths of both classical and quantum computing paradigms. Such hybrid approaches could serve as a bridge, allowing financial institutions to gradually incorporate quantum capabilities into their risk management processes.

The ultimate goal of this technological pursuit is to develop a robust, quantum-enhanced risk management ecosystem. This ecosystem would enable financial institutions to navigate complex market conditions with greater agility, identify emerging risks with higher precision, and develop more effective mitigation strategies. As quantum computing continues to advance, its potential to transform operational risk management holds promise for creating a more resilient and stable financial landscape.

The primary objective of integrating quantum computing into risk management is to enhance the accuracy, speed, and complexity of risk assessment and mitigation strategies. Traditional risk management approaches often struggle with the sheer volume and complexity of data in modern financial systems. Quantum computing aims to address these limitations by leveraging quantum mechanical phenomena such as superposition and entanglement.

One of the key trends in this technological evolution is the development of quantum algorithms specifically designed for risk analysis. These algorithms have the potential to process vast amounts of financial data simultaneously, enabling more comprehensive risk assessments. Additionally, quantum machine learning techniques are being explored to improve predictive models for risk forecasting.

The quantum approach to risk management is expected to significantly impact areas such as portfolio optimization, fraud detection, and stress testing. By simulating complex financial scenarios at an unprecedented scale, quantum computers could provide insights into systemic risks that are currently challenging to model effectively.

However, the journey towards fully realized quantum-enhanced risk management faces several challenges. Current quantum systems are still limited in their qubit count and coherence times, restricting their practical applications. Overcoming these technical hurdles is crucial for the widespread adoption of quantum technologies in the financial sector.

As research progresses, the integration of quantum computing with existing risk management frameworks is becoming a focal point. This integration aims to create hybrid systems that leverage the strengths of both classical and quantum computing paradigms. Such hybrid approaches could serve as a bridge, allowing financial institutions to gradually incorporate quantum capabilities into their risk management processes.

The ultimate goal of this technological pursuit is to develop a robust, quantum-enhanced risk management ecosystem. This ecosystem would enable financial institutions to navigate complex market conditions with greater agility, identify emerging risks with higher precision, and develop more effective mitigation strategies. As quantum computing continues to advance, its potential to transform operational risk management holds promise for creating a more resilient and stable financial landscape.

Market Demand for Advanced Risk Management Solutions

The demand for advanced risk management solutions in the financial sector has been steadily increasing, driven by the growing complexity of global markets, regulatory pressures, and the need for more accurate and timely risk assessments. Traditional risk management approaches are becoming increasingly inadequate in the face of rapidly evolving financial landscapes and the exponential growth of data.

Quantum computing presents a promising avenue for enhancing operational risk management capabilities. Financial institutions are actively seeking solutions that can process vast amounts of data and perform complex calculations at unprecedented speeds. The ability of quantum computers to analyze multiple scenarios simultaneously and optimize risk models in real-time is particularly attractive to banks, hedge funds, and insurance companies.

The market for quantum-enhanced risk management solutions is expected to grow significantly in the coming years. This growth is fueled by the increasing awareness of the limitations of classical computing in handling complex risk calculations and the potential of quantum algorithms to revolutionize the field. Financial institutions are investing heavily in research and development to gain a competitive edge through quantum-powered risk management tools.

Regulatory bodies are also driving the demand for more sophisticated risk management solutions. The Basel III and IV frameworks, along with other international regulations, require banks to maintain higher capital reserves and conduct more stringent stress tests. Quantum computing could enable financial institutions to meet these regulatory requirements more efficiently and accurately, potentially reducing capital costs and improving overall financial stability.

The insurance industry is another key driver of demand for advanced risk management solutions. Insurers are looking to quantum computing to improve their actuarial models, enhance underwriting processes, and better assess complex risks such as climate change-related events. The ability to process and analyze vast amounts of data from various sources, including IoT devices and satellite imagery, makes quantum computing particularly appealing for this sector.

Asset management firms and hedge funds are also showing increased interest in quantum-enhanced risk management tools. These institutions are seeking ways to optimize portfolio allocation, improve trading strategies, and better manage market risks. The potential of quantum algorithms to solve complex optimization problems and perform Monte Carlo simulations at unprecedented speeds is driving investment in this technology.

As the financial sector becomes increasingly digitized and interconnected, cybersecurity risks have become a major concern. Quantum computing offers potential solutions for enhancing encryption and developing more robust risk assessment models for cyber threats. This has led to a growing demand for quantum-safe cryptography and quantum-enhanced cybersecurity risk management tools.

Quantum computing presents a promising avenue for enhancing operational risk management capabilities. Financial institutions are actively seeking solutions that can process vast amounts of data and perform complex calculations at unprecedented speeds. The ability of quantum computers to analyze multiple scenarios simultaneously and optimize risk models in real-time is particularly attractive to banks, hedge funds, and insurance companies.

The market for quantum-enhanced risk management solutions is expected to grow significantly in the coming years. This growth is fueled by the increasing awareness of the limitations of classical computing in handling complex risk calculations and the potential of quantum algorithms to revolutionize the field. Financial institutions are investing heavily in research and development to gain a competitive edge through quantum-powered risk management tools.

Regulatory bodies are also driving the demand for more sophisticated risk management solutions. The Basel III and IV frameworks, along with other international regulations, require banks to maintain higher capital reserves and conduct more stringent stress tests. Quantum computing could enable financial institutions to meet these regulatory requirements more efficiently and accurately, potentially reducing capital costs and improving overall financial stability.

The insurance industry is another key driver of demand for advanced risk management solutions. Insurers are looking to quantum computing to improve their actuarial models, enhance underwriting processes, and better assess complex risks such as climate change-related events. The ability to process and analyze vast amounts of data from various sources, including IoT devices and satellite imagery, makes quantum computing particularly appealing for this sector.

Asset management firms and hedge funds are also showing increased interest in quantum-enhanced risk management tools. These institutions are seeking ways to optimize portfolio allocation, improve trading strategies, and better manage market risks. The potential of quantum algorithms to solve complex optimization problems and perform Monte Carlo simulations at unprecedented speeds is driving investment in this technology.

As the financial sector becomes increasingly digitized and interconnected, cybersecurity risks have become a major concern. Quantum computing offers potential solutions for enhancing encryption and developing more robust risk assessment models for cyber threats. This has led to a growing demand for quantum-safe cryptography and quantum-enhanced cybersecurity risk management tools.

Current State and Challenges in Quantum Risk Management

Quantum computing for operational risk management is currently in its nascent stages, with significant potential but also facing substantial challenges. The field is characterized by a mix of theoretical advancements and early-stage practical implementations, primarily in research settings and proof-of-concept demonstrations.

The current state of quantum risk management is marked by a growing recognition of its potential to revolutionize traditional risk assessment and mitigation strategies. Financial institutions and technology companies are increasingly investing in quantum research and development, aiming to leverage quantum algorithms for more accurate and efficient risk calculations. However, the practical application of quantum computing in operational risk management remains limited due to several technological and infrastructural constraints.

One of the primary challenges is the development of stable and scalable quantum hardware. Current quantum computers are prone to errors and decoherence, limiting their ability to perform complex risk calculations with the required precision and reliability. The quantum coherence time, which is crucial for maintaining quantum states during computations, is still too short for many practical applications in risk management.

Another significant hurdle is the lack of quantum-ready software and algorithms specifically tailored for operational risk management. While quantum algorithms like Shor's and Grover's have shown theoretical advantages in certain computational tasks, their adaptation to real-world risk management scenarios is still in progress. The development of quantum machine learning algorithms for risk assessment and prediction is an active area of research, but practical implementations are yet to be fully realized.

The integration of quantum systems with existing classical IT infrastructure poses another challenge. Operational risk management relies heavily on large datasets and complex models, which are currently managed by classical systems. Developing hybrid quantum-classical systems that can effectively bridge this gap is crucial for the practical implementation of quantum risk management solutions.

There is also a significant skills gap in the industry. The interdisciplinary nature of quantum risk management requires expertise in both quantum physics and financial risk modeling, a combination that is currently rare. This shortage of qualified professionals hinders the rapid development and adoption of quantum solutions in operational risk management.

Regulatory and compliance issues present another layer of complexity. As quantum technologies advance, regulatory frameworks will need to evolve to address new challenges in data security, privacy, and the validation of quantum-based risk models. The lack of standardized benchmarks and validation methods for quantum risk management systems is a significant obstacle to their widespread adoption in regulated industries like finance.

Despite these challenges, the field is progressing rapidly. Research collaborations between academic institutions, tech companies, and financial organizations are driving innovation in quantum algorithms and hardware specifically designed for risk management applications. As these efforts continue, we can expect gradual improvements in quantum coherence times, error correction techniques, and the development of more robust quantum algorithms for operational risk assessment and mitigation.

The current state of quantum risk management is marked by a growing recognition of its potential to revolutionize traditional risk assessment and mitigation strategies. Financial institutions and technology companies are increasingly investing in quantum research and development, aiming to leverage quantum algorithms for more accurate and efficient risk calculations. However, the practical application of quantum computing in operational risk management remains limited due to several technological and infrastructural constraints.

One of the primary challenges is the development of stable and scalable quantum hardware. Current quantum computers are prone to errors and decoherence, limiting their ability to perform complex risk calculations with the required precision and reliability. The quantum coherence time, which is crucial for maintaining quantum states during computations, is still too short for many practical applications in risk management.

Another significant hurdle is the lack of quantum-ready software and algorithms specifically tailored for operational risk management. While quantum algorithms like Shor's and Grover's have shown theoretical advantages in certain computational tasks, their adaptation to real-world risk management scenarios is still in progress. The development of quantum machine learning algorithms for risk assessment and prediction is an active area of research, but practical implementations are yet to be fully realized.

The integration of quantum systems with existing classical IT infrastructure poses another challenge. Operational risk management relies heavily on large datasets and complex models, which are currently managed by classical systems. Developing hybrid quantum-classical systems that can effectively bridge this gap is crucial for the practical implementation of quantum risk management solutions.

There is also a significant skills gap in the industry. The interdisciplinary nature of quantum risk management requires expertise in both quantum physics and financial risk modeling, a combination that is currently rare. This shortage of qualified professionals hinders the rapid development and adoption of quantum solutions in operational risk management.

Regulatory and compliance issues present another layer of complexity. As quantum technologies advance, regulatory frameworks will need to evolve to address new challenges in data security, privacy, and the validation of quantum-based risk models. The lack of standardized benchmarks and validation methods for quantum risk management systems is a significant obstacle to their widespread adoption in regulated industries like finance.

Despite these challenges, the field is progressing rapidly. Research collaborations between academic institutions, tech companies, and financial organizations are driving innovation in quantum algorithms and hardware specifically designed for risk management applications. As these efforts continue, we can expect gradual improvements in quantum coherence times, error correction techniques, and the development of more robust quantum algorithms for operational risk assessment and mitigation.

Existing Quantum Algorithms for Risk Assessment

01 Quantum-enhanced risk assessment models

Quantum computing techniques are applied to develop advanced risk assessment models for operational risk management. These models leverage quantum algorithms to process complex data sets and simulate various risk scenarios with higher accuracy and speed compared to classical computing methods. This approach enables more comprehensive risk analysis and prediction in financial and operational contexts.- Quantum-enhanced risk assessment models: Quantum computing techniques are applied to develop advanced risk assessment models for operational risk management. These models leverage quantum algorithms to process complex data sets and simulate various risk scenarios more efficiently than classical computing methods. This approach enables more accurate prediction and evaluation of potential operational risks in financial institutions and other organizations.

- Quantum-secure cryptography for risk data protection: Quantum-resistant cryptographic methods are implemented to protect sensitive risk management data and communications. These techniques aim to safeguard operational risk information against potential threats from quantum computers, ensuring long-term data security and integrity in risk management systems.

- Quantum-assisted decision support systems: Quantum computing is utilized to enhance decision support systems for operational risk management. These systems leverage quantum algorithms to analyze vast amounts of data, identify patterns, and provide real-time insights to risk managers. This enables more informed and timely decision-making in complex risk scenarios.

- Quantum machine learning for anomaly detection: Quantum machine learning algorithms are employed to improve anomaly detection in operational risk management. These techniques can process and analyze large datasets more efficiently than classical methods, enabling the identification of subtle patterns and potential risks that might otherwise go unnoticed. This approach enhances the overall effectiveness of risk monitoring and mitigation strategies.

- Quantum-powered scenario analysis and stress testing: Quantum computing techniques are applied to enhance scenario analysis and stress testing in operational risk management. These methods allow for more comprehensive and complex simulations of potential risk events, considering a wider range of variables and interdependencies. This results in more robust risk assessment and preparedness strategies for organizations.

02 Quantum-secure cryptography for risk mitigation

Quantum-resistant cryptographic methods are implemented to enhance the security of sensitive operational data and communications. This approach addresses the potential risks posed by quantum computers to traditional encryption systems, ensuring the integrity and confidentiality of critical information in risk management processes.Expand Specific Solutions03 Quantum-assisted decision support systems

Quantum computing is utilized to develop advanced decision support systems for operational risk management. These systems leverage quantum algorithms to analyze complex risk factors, optimize resource allocation, and provide real-time recommendations for risk mitigation strategies. This approach enhances the speed and accuracy of decision-making processes in high-stakes operational environments.Expand Specific Solutions04 Quantum machine learning for anomaly detection

Quantum machine learning algorithms are applied to enhance anomaly detection capabilities in operational risk management. These techniques leverage quantum computing's ability to process high-dimensional data and identify complex patterns, enabling more accurate and efficient detection of potential risks and fraudulent activities in large-scale operational systems.Expand Specific Solutions05 Quantum-enhanced simulation for stress testing

Quantum computing techniques are employed to develop advanced simulation models for stress testing in operational risk management. These simulations leverage quantum algorithms to model complex, interconnected risk factors and scenarios, providing more accurate and comprehensive assessments of potential operational vulnerabilities and their impacts on organizational performance.Expand Specific Solutions

Key Players in Quantum Computing and Risk Management

The quantum computing landscape for enhanced operational risk management is in its early stages, with significant potential for growth. The market is characterized by a mix of established tech giants and specialized quantum startups. Companies like IBM, Google, and Intel are leveraging their extensive resources to advance quantum technologies, while startups such as Zapata Computing and Rigetti & Co. are focusing on niche quantum solutions. The technology is still evolving, with varying levels of maturity across different applications. Major financial institutions, including JP Morgan Chase and Wells Fargo, are exploring quantum computing's potential in risk management, indicating growing interest from the financial sector. As the technology matures, we can expect increased competition and collaboration between tech providers and industry adopters.

International Business Machines Corp.

Technical Solution: IBM's quantum computing approach for operational risk management leverages their advanced quantum hardware and software stack. They utilize Qiskit, an open-source quantum computing framework, to develop algorithms specifically tailored for risk assessment and mitigation. IBM's quantum risk management solution employs quantum amplitude estimation to achieve quadratic speedup in Monte Carlo simulations[1], enabling more accurate and faster risk calculations. Their system also incorporates quantum machine learning techniques to enhance pattern recognition in complex financial data, potentially identifying hidden risk factors. IBM's quantum-classical hybrid approach allows for seamless integration with existing risk management systems, ensuring a smooth transition to quantum-enhanced operations[3].

Strengths: Industry-leading quantum hardware, extensive software ecosystem, and strong integration capabilities with classical systems. Weaknesses: High implementation costs and the need for specialized quantum expertise to fully leverage the technology.

Google LLC

Technical Solution: Google's quantum computing solution for operational risk management centers around their Sycamore processor and Cirq framework. They focus on developing quantum algorithms that can efficiently solve optimization problems inherent in risk modeling. Google's approach utilizes quantum approximate optimization algorithms (QAOA) to address complex portfolio optimization and risk allocation challenges[2]. Their system also incorporates quantum machine learning techniques, such as quantum neural networks, to enhance predictive modeling of operational risks. Google's quantum supremacy demonstrations have shown potential for exponential speedups in certain computational tasks, which could revolutionize risk simulations and scenario analysis in financial institutions[4].

Strengths: Cutting-edge quantum hardware, strong focus on algorithmic development, and potential for quantum supremacy in specific tasks. Weaknesses: Limited commercial availability and challenges in scaling up to practical problem sizes for real-world risk management.

Core Innovations in Quantum Risk Modeling

Quantum circuit risk analysis

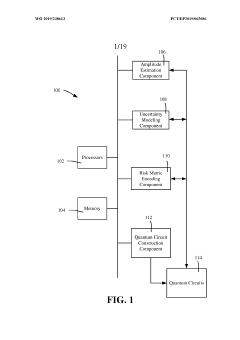

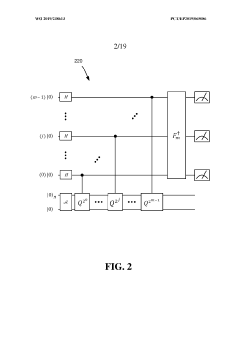

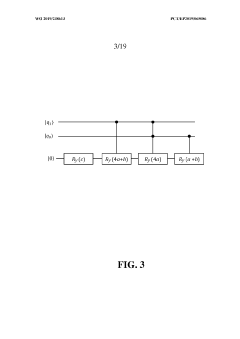

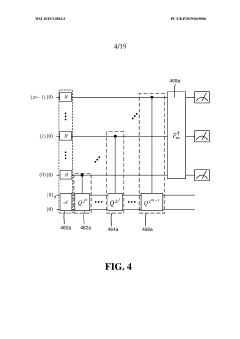

PatentWO2019238613A1

Innovation

- A quantum circuit approach that models uncertainty using qubits and performs amplitude estimation to encode and estimate risk metrics, providing a quadratic speedup over classical methods by mapping random variables to quantum states and using Y-rotations and ancilla qubits to extract probability values for risk metrics like expected value, variance, and value at risk.

Regulatory Framework for Quantum Finance Applications

The regulatory framework for quantum finance applications is rapidly evolving as quantum computing technology advances and its potential impact on financial systems becomes more apparent. Regulatory bodies worldwide are grappling with the need to balance innovation with risk management and consumer protection. The European Union has taken a proactive stance, with the European Commission proposing the AI Act, which includes provisions for high-risk AI systems in financial services. This legislation, while not specifically targeting quantum computing, sets a precedent for regulating advanced technologies in finance.

In the United States, the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are closely monitoring developments in quantum finance. They have initiated discussions on how existing regulations might apply to quantum-enhanced financial products and services. The Financial Stability Board (FSB), an international body that monitors and makes recommendations about the global financial system, has also begun to address the potential systemic risks posed by quantum computing in finance.

Key areas of regulatory focus include data privacy, cybersecurity, and algorithmic transparency. Quantum computing's ability to break current encryption standards has prompted regulators to consider new guidelines for quantum-resistant cryptography in financial institutions. The National Institute of Standards and Technology (NIST) in the U.S. is leading efforts to standardize post-quantum cryptography, which will likely form the basis for future financial regulations.

Regulators are also considering the implications of quantum advantage in financial modeling and risk assessment. There are concerns that quantum-enhanced algorithms could create unfair market advantages or exacerbate systemic risks if not properly governed. As a result, discussions are underway to establish guidelines for the use of quantum algorithms in high-frequency trading, derivatives pricing, and risk management models.

International cooperation is emerging as a crucial aspect of the regulatory framework. The Bank for International Settlements (BIS) has initiated working groups to explore the cross-border implications of quantum finance and to develop coordinated regulatory approaches. This collaborative effort aims to prevent regulatory arbitrage and ensure a level playing field in the global financial markets as quantum technologies become more prevalent.

In the United States, the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are closely monitoring developments in quantum finance. They have initiated discussions on how existing regulations might apply to quantum-enhanced financial products and services. The Financial Stability Board (FSB), an international body that monitors and makes recommendations about the global financial system, has also begun to address the potential systemic risks posed by quantum computing in finance.

Key areas of regulatory focus include data privacy, cybersecurity, and algorithmic transparency. Quantum computing's ability to break current encryption standards has prompted regulators to consider new guidelines for quantum-resistant cryptography in financial institutions. The National Institute of Standards and Technology (NIST) in the U.S. is leading efforts to standardize post-quantum cryptography, which will likely form the basis for future financial regulations.

Regulators are also considering the implications of quantum advantage in financial modeling and risk assessment. There are concerns that quantum-enhanced algorithms could create unfair market advantages or exacerbate systemic risks if not properly governed. As a result, discussions are underway to establish guidelines for the use of quantum algorithms in high-frequency trading, derivatives pricing, and risk management models.

International cooperation is emerging as a crucial aspect of the regulatory framework. The Bank for International Settlements (BIS) has initiated working groups to explore the cross-border implications of quantum finance and to develop coordinated regulatory approaches. This collaborative effort aims to prevent regulatory arbitrage and ensure a level playing field in the global financial markets as quantum technologies become more prevalent.

Quantum-Safe Cryptography in Risk Management Systems

Quantum-safe cryptography is emerging as a critical component in risk management systems, particularly in the context of operational risk management enhanced by quantum computing. As quantum computers advance, they pose a significant threat to traditional cryptographic methods, potentially compromising the security of sensitive financial data and risk models. To address this challenge, quantum-safe cryptography aims to develop encryption algorithms that can withstand attacks from both classical and quantum computers.

The implementation of quantum-safe cryptography in risk management systems involves several key aspects. Firstly, it requires the adoption of post-quantum cryptographic algorithms, such as lattice-based, hash-based, and code-based cryptography. These algorithms are designed to resist quantum attacks and maintain the confidentiality and integrity of risk-related data. Financial institutions and risk management firms are increasingly exploring these algorithms to future-proof their systems against potential quantum threats.

Another crucial element is the integration of quantum key distribution (QKD) technologies into existing risk management infrastructures. QKD leverages the principles of quantum mechanics to generate and distribute secure encryption keys, providing an additional layer of security that is theoretically impervious to quantum attacks. This technology is particularly relevant for securing communication channels used in risk data transmission and model sharing between different entities within a financial ecosystem.

The transition to quantum-safe cryptography also necessitates a comprehensive review and upgrade of current risk management protocols. This includes reassessing data encryption practices, secure communication channels, and authentication mechanisms. Organizations must develop strategies for cryptographic agility, allowing for the seamless transition between different cryptographic schemes as quantum computing capabilities evolve.

Furthermore, the implementation of quantum-safe cryptography in risk management systems requires collaboration between cryptographers, risk management experts, and quantum computing specialists. This interdisciplinary approach ensures that the cryptographic solutions are not only mathematically sound but also practically applicable within the complex landscape of operational risk management. It also facilitates the development of hybrid systems that combine both classical and quantum-safe cryptographic methods, providing a robust defense against current and future threats.

As regulatory bodies become increasingly aware of the quantum threat, financial institutions are likely to face new compliance requirements related to quantum-safe cryptography. Proactive adoption of these technologies in risk management systems can help organizations stay ahead of regulatory curves and maintain a competitive edge in the financial sector. This forward-thinking approach also demonstrates a commitment to long-term data security and risk mitigation strategies.

The implementation of quantum-safe cryptography in risk management systems involves several key aspects. Firstly, it requires the adoption of post-quantum cryptographic algorithms, such as lattice-based, hash-based, and code-based cryptography. These algorithms are designed to resist quantum attacks and maintain the confidentiality and integrity of risk-related data. Financial institutions and risk management firms are increasingly exploring these algorithms to future-proof their systems against potential quantum threats.

Another crucial element is the integration of quantum key distribution (QKD) technologies into existing risk management infrastructures. QKD leverages the principles of quantum mechanics to generate and distribute secure encryption keys, providing an additional layer of security that is theoretically impervious to quantum attacks. This technology is particularly relevant for securing communication channels used in risk data transmission and model sharing between different entities within a financial ecosystem.

The transition to quantum-safe cryptography also necessitates a comprehensive review and upgrade of current risk management protocols. This includes reassessing data encryption practices, secure communication channels, and authentication mechanisms. Organizations must develop strategies for cryptographic agility, allowing for the seamless transition between different cryptographic schemes as quantum computing capabilities evolve.

Furthermore, the implementation of quantum-safe cryptography in risk management systems requires collaboration between cryptographers, risk management experts, and quantum computing specialists. This interdisciplinary approach ensures that the cryptographic solutions are not only mathematically sound but also practically applicable within the complex landscape of operational risk management. It also facilitates the development of hybrid systems that combine both classical and quantum-safe cryptographic methods, providing a robust defense against current and future threats.

As regulatory bodies become increasingly aware of the quantum threat, financial institutions are likely to face new compliance requirements related to quantum-safe cryptography. Proactive adoption of these technologies in risk management systems can help organizations stay ahead of regulatory curves and maintain a competitive edge in the financial sector. This forward-thinking approach also demonstrates a commitment to long-term data security and risk mitigation strategies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!