Electromagnetic Waves in High-Frequency Trading: Technical Insights

JUL 11, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

EM Wave HFT Background

Electromagnetic waves have played a pivotal role in the evolution of high-frequency trading (HFT) systems. The journey of utilizing electromagnetic waves in financial markets began in the early 2000s when traders recognized the potential of radio frequency technology to transmit data faster than traditional fiber optic cables. This realization sparked a technological arms race in the financial industry, with firms investing heavily in cutting-edge communication systems to gain microsecond advantages in trade execution.

The primary goal of implementing electromagnetic wave technology in HFT is to minimize latency in data transmission and trade execution. By leveraging the speed of light through air, traders aim to reduce the time it takes for market information to travel between exchanges and trading servers. This reduction in latency, even by fractions of a second, can translate into significant financial gains in the highly competitive world of algorithmic trading.

As the field progressed, the focus shifted from purely speed-based advantages to more sophisticated applications of electromagnetic wave technology. Firms began exploring advanced signal processing techniques, adaptive antenna systems, and novel modulation schemes to enhance the reliability and capacity of their wireless networks. These advancements not only improved the speed of data transmission but also increased the volume of information that could be sent simultaneously.

The technological evolution in this domain has been closely tied to regulatory changes and market structure developments. As exchanges and regulators became aware of the potential for unfair advantages, new rules and guidelines were implemented to ensure a level playing field. This regulatory environment has shaped the trajectory of electromagnetic wave applications in HFT, pushing firms to innovate within established boundaries.

Recent years have seen a growing interest in millimeter-wave and terahertz technologies for ultra-low latency communications. These higher frequency bands offer the potential for even faster data transmission, albeit with challenges related to signal propagation and atmospheric interference. Researchers and industry professionals are actively working on overcoming these obstacles to unlock the next generation of HFT communication systems.

The ongoing development of electromagnetic wave technologies in HFT reflects a broader trend towards the convergence of finance and cutting-edge physics. As the limits of current systems are approached, the industry continues to push the boundaries of what is possible, exploring quantum communication and other exotic technologies that may shape the future of financial markets.

The primary goal of implementing electromagnetic wave technology in HFT is to minimize latency in data transmission and trade execution. By leveraging the speed of light through air, traders aim to reduce the time it takes for market information to travel between exchanges and trading servers. This reduction in latency, even by fractions of a second, can translate into significant financial gains in the highly competitive world of algorithmic trading.

As the field progressed, the focus shifted from purely speed-based advantages to more sophisticated applications of electromagnetic wave technology. Firms began exploring advanced signal processing techniques, adaptive antenna systems, and novel modulation schemes to enhance the reliability and capacity of their wireless networks. These advancements not only improved the speed of data transmission but also increased the volume of information that could be sent simultaneously.

The technological evolution in this domain has been closely tied to regulatory changes and market structure developments. As exchanges and regulators became aware of the potential for unfair advantages, new rules and guidelines were implemented to ensure a level playing field. This regulatory environment has shaped the trajectory of electromagnetic wave applications in HFT, pushing firms to innovate within established boundaries.

Recent years have seen a growing interest in millimeter-wave and terahertz technologies for ultra-low latency communications. These higher frequency bands offer the potential for even faster data transmission, albeit with challenges related to signal propagation and atmospheric interference. Researchers and industry professionals are actively working on overcoming these obstacles to unlock the next generation of HFT communication systems.

The ongoing development of electromagnetic wave technologies in HFT reflects a broader trend towards the convergence of finance and cutting-edge physics. As the limits of current systems are approached, the industry continues to push the boundaries of what is possible, exploring quantum communication and other exotic technologies that may shape the future of financial markets.

Market Demand Analysis

The market demand for electromagnetic wave technology in high-frequency trading has experienced significant growth in recent years. Financial institutions and trading firms are increasingly recognizing the potential of this technology to gain a competitive edge in the fast-paced world of electronic trading. The primary driver of this demand is the need for ultra-low latency communication between trading venues and data centers.

High-frequency trading relies on the ability to execute trades at incredibly high speeds, often measured in microseconds or even nanoseconds. Traditional fiber optic networks, while fast, are limited by the speed of light traveling through glass. Electromagnetic waves, particularly in the microwave and millimeter-wave spectrum, offer the potential for even faster transmission speeds through air, approaching the theoretical limit of the speed of light in vacuum.

This technology has created a new frontier in the arms race for speed in financial markets. Firms that can shave off even a fraction of a millisecond in trade execution times can potentially generate significant profits. As a result, there is a growing market for infrastructure and equipment that can support electromagnetic wave-based trading systems.

The demand extends beyond just the trading firms themselves. There is a burgeoning ecosystem of technology providers, infrastructure developers, and service companies catering to this niche but lucrative market. This includes manufacturers of specialized antennas, transceivers, and other hardware components, as well as companies that design and build microwave towers and data centers optimized for high-frequency trading.

Geographically, the demand is concentrated in areas with major financial centers and exchanges. Key markets include the routes between New York and Chicago in the United States, London and Frankfurt in Europe, and various locations in Asia, particularly around Tokyo and Singapore. The specific geography of these routes plays a crucial role in the deployment of electromagnetic wave technology, as line-of-sight transmission is typically required for optimal performance.

Despite the high costs associated with implementing these systems, the potential returns have driven continued investment and expansion. However, the market is not without challenges. Regulatory scrutiny of high-frequency trading practices, concerns about market fairness, and the potential for technological arms races to destabilize markets have all contributed to a complex demand landscape.

Looking ahead, the market for electromagnetic wave technology in high-frequency trading is expected to continue growing, albeit with potential shifts in focus. As the technology matures, there may be increased emphasis on reliability, security, and integration with other emerging technologies such as artificial intelligence and quantum computing. Additionally, as more firms adopt these technologies, the competitive advantage may diminish, potentially leading to a plateau in demand or a shift towards other differentiating factors in trading performance.

High-frequency trading relies on the ability to execute trades at incredibly high speeds, often measured in microseconds or even nanoseconds. Traditional fiber optic networks, while fast, are limited by the speed of light traveling through glass. Electromagnetic waves, particularly in the microwave and millimeter-wave spectrum, offer the potential for even faster transmission speeds through air, approaching the theoretical limit of the speed of light in vacuum.

This technology has created a new frontier in the arms race for speed in financial markets. Firms that can shave off even a fraction of a millisecond in trade execution times can potentially generate significant profits. As a result, there is a growing market for infrastructure and equipment that can support electromagnetic wave-based trading systems.

The demand extends beyond just the trading firms themselves. There is a burgeoning ecosystem of technology providers, infrastructure developers, and service companies catering to this niche but lucrative market. This includes manufacturers of specialized antennas, transceivers, and other hardware components, as well as companies that design and build microwave towers and data centers optimized for high-frequency trading.

Geographically, the demand is concentrated in areas with major financial centers and exchanges. Key markets include the routes between New York and Chicago in the United States, London and Frankfurt in Europe, and various locations in Asia, particularly around Tokyo and Singapore. The specific geography of these routes plays a crucial role in the deployment of electromagnetic wave technology, as line-of-sight transmission is typically required for optimal performance.

Despite the high costs associated with implementing these systems, the potential returns have driven continued investment and expansion. However, the market is not without challenges. Regulatory scrutiny of high-frequency trading practices, concerns about market fairness, and the potential for technological arms races to destabilize markets have all contributed to a complex demand landscape.

Looking ahead, the market for electromagnetic wave technology in high-frequency trading is expected to continue growing, albeit with potential shifts in focus. As the technology matures, there may be increased emphasis on reliability, security, and integration with other emerging technologies such as artificial intelligence and quantum computing. Additionally, as more firms adopt these technologies, the competitive advantage may diminish, potentially leading to a plateau in demand or a shift towards other differentiating factors in trading performance.

Technical Challenges

The implementation of electromagnetic waves in high-frequency trading (HFT) faces several significant technical challenges. One of the primary obstacles is the need for ultra-low latency in signal transmission. HFT systems require data to be transmitted and processed in microseconds or even nanoseconds, pushing the limits of current electromagnetic wave technologies.

Signal integrity is another critical challenge. As trading data travels through various mediums, including air and optical fibers, it is susceptible to interference, attenuation, and distortion. Maintaining the quality and accuracy of signals over long distances and through complex network infrastructures is crucial for reliable HFT operations.

The issue of bandwidth limitations also poses a significant hurdle. With the ever-increasing volume of market data and the need for real-time processing, traditional electromagnetic wave technologies struggle to keep up with the bandwidth requirements of modern HFT systems. This challenge is further compounded by the need to transmit data across vast geographical distances, often between different continents.

Security and encryption of transmitted data present another layer of complexity. As HFT deals with sensitive financial information, protecting the integrity and confidentiality of data during transmission is paramount. Implementing robust encryption methods without significantly impacting latency is a delicate balance that engineers must strike.

Environmental factors also play a role in the challenges faced by electromagnetic wave technologies in HFT. Atmospheric conditions, solar activity, and even physical obstacles can affect signal propagation, potentially leading to delays or data corruption. Mitigating these environmental impacts requires sophisticated engineering solutions and redundancy measures.

The precision of timing synchronization across distributed HFT systems is another critical challenge. Ensuring that all components of the trading system are perfectly synchronized, often across different time zones, demands extremely accurate timekeeping mechanisms and distribution of timing signals.

Lastly, the regulatory landscape surrounding the use of electromagnetic waves in HFT is constantly evolving. Compliance with various national and international regulations, while maintaining competitive advantages, adds another layer of complexity to the technical implementation of these systems.

Signal integrity is another critical challenge. As trading data travels through various mediums, including air and optical fibers, it is susceptible to interference, attenuation, and distortion. Maintaining the quality and accuracy of signals over long distances and through complex network infrastructures is crucial for reliable HFT operations.

The issue of bandwidth limitations also poses a significant hurdle. With the ever-increasing volume of market data and the need for real-time processing, traditional electromagnetic wave technologies struggle to keep up with the bandwidth requirements of modern HFT systems. This challenge is further compounded by the need to transmit data across vast geographical distances, often between different continents.

Security and encryption of transmitted data present another layer of complexity. As HFT deals with sensitive financial information, protecting the integrity and confidentiality of data during transmission is paramount. Implementing robust encryption methods without significantly impacting latency is a delicate balance that engineers must strike.

Environmental factors also play a role in the challenges faced by electromagnetic wave technologies in HFT. Atmospheric conditions, solar activity, and even physical obstacles can affect signal propagation, potentially leading to delays or data corruption. Mitigating these environmental impacts requires sophisticated engineering solutions and redundancy measures.

The precision of timing synchronization across distributed HFT systems is another critical challenge. Ensuring that all components of the trading system are perfectly synchronized, often across different time zones, demands extremely accurate timekeeping mechanisms and distribution of timing signals.

Lastly, the regulatory landscape surrounding the use of electromagnetic waves in HFT is constantly evolving. Compliance with various national and international regulations, while maintaining competitive advantages, adds another layer of complexity to the technical implementation of these systems.

Current EM Wave Solutions

01 Electromagnetic wave detection and measurement

Various devices and methods for detecting and measuring electromagnetic waves are developed. These include sensors, antennas, and specialized equipment designed to capture and analyze electromagnetic signals across different frequencies and intensities.- Electromagnetic wave detection and measurement: Various devices and methods for detecting and measuring electromagnetic waves are described. These include sensors, antennas, and other specialized equipment designed to capture and analyze electromagnetic signals across different frequencies and intensities.

- Electromagnetic wave shielding and protection: Technologies for shielding and protecting against electromagnetic waves are presented. These involve materials and structures designed to block or absorb electromagnetic radiation, protecting sensitive equipment or living organisms from potential harmful effects.

- Electromagnetic wave communication systems: Advancements in communication systems utilizing electromagnetic waves are discussed. These include improvements in wireless communication technologies, signal processing techniques, and network architectures to enhance data transmission and reception.

- Electromagnetic wave energy harvesting: Innovations in harnessing energy from electromagnetic waves are explored. These technologies aim to capture and convert ambient electromagnetic radiation into usable electrical energy, potentially providing power for various applications.

- Electromagnetic wave applications in medical field: The use of electromagnetic waves in medical applications is presented. This includes diagnostic imaging techniques, therapeutic treatments, and monitoring systems that leverage electromagnetic properties for improved healthcare outcomes.

02 Electromagnetic wave shielding and protection

Technologies for shielding and protecting against electromagnetic waves are implemented in various applications. This includes materials and structures designed to block or absorb electromagnetic radiation, protecting sensitive equipment or living organisms from potential harmful effects.Expand Specific Solutions03 Electromagnetic wave communication systems

Advanced communication systems utilizing electromagnetic waves are developed for various applications. These systems employ different frequencies and modulation techniques to transmit and receive information wirelessly, enabling long-distance communication and data transfer.Expand Specific Solutions04 Electromagnetic wave energy harvesting

Innovative methods and devices are created to harvest energy from electromagnetic waves present in the environment. These technologies aim to convert ambient electromagnetic radiation into usable electrical energy, potentially powering small devices or supplementing existing power sources.Expand Specific Solutions05 Electromagnetic wave imaging and sensing

Advanced imaging and sensing technologies using electromagnetic waves are developed for various applications. These include medical imaging, security screening, and non-destructive testing, utilizing different parts of the electromagnetic spectrum to visualize and analyze objects or materials.Expand Specific Solutions

Key HFT Players

The electromagnetic waves in high-frequency trading market is in a mature stage, with a significant global market size estimated in billions of dollars. The technology's maturity is evident from the involvement of major players like Chicago Mercantile Exchange, Trading Technologies International, and Intel Corp. These companies have developed sophisticated systems leveraging electromagnetic waves for ultra-low latency trading. However, the field continues to evolve with ongoing research and development efforts from universities such as the University of Delaware and University of Tokyo, indicating potential for further technological advancements and market growth in this highly competitive sector.

Chicago Mercantile Exchange

Technical Solution: Chicago Mercantile Exchange (CME) has developed advanced electromagnetic wave-based systems for high-frequency trading. Their technology utilizes ultra-low latency microwave networks to transmit market data and trade orders between financial centers. CME's system employs sophisticated signal processing techniques to optimize data transmission through the atmosphere, achieving speeds close to the theoretical limit of light[1]. The exchange has invested in a network of microwave towers strategically positioned to create direct line-of-sight paths, minimizing latency. Additionally, CME has implemented adaptive modulation schemes that dynamically adjust to atmospheric conditions, ensuring reliable communication even in adverse weather[2].

Strengths: Extremely low latency, giving traders a significant speed advantage. Highly reliable due to adaptive technologies. Weaknesses: High infrastructure costs, limited bandwidth compared to fiber optics, and potential for interference in urban environments.

Raytheon Co.

Technical Solution: Raytheon has applied its expertise in military-grade communications to develop cutting-edge electromagnetic wave solutions for high-frequency trading. Their system utilizes phased array antennas originally designed for radar applications, allowing for rapid and precise beam steering to optimize signal paths between trading venues[9]. Raytheon's technology incorporates advanced spread spectrum techniques to enhance signal robustness and security. The company has also developed a unique atmospheric modeling system that predicts and compensates for signal distortions caused by weather patterns and ionospheric conditions. Additionally, Raytheon's solution includes a proprietary quantum-resistant encryption method that secures data transmission against potential future threats from quantum computing[10].

Strengths: Extremely robust and secure communication, leveraging military-grade technology. Advanced atmospheric compensation capabilities. Weaknesses: High cost due to specialized hardware. Potential regulatory challenges due to the dual-use nature of some technologies.

Core EM Wave Innovations

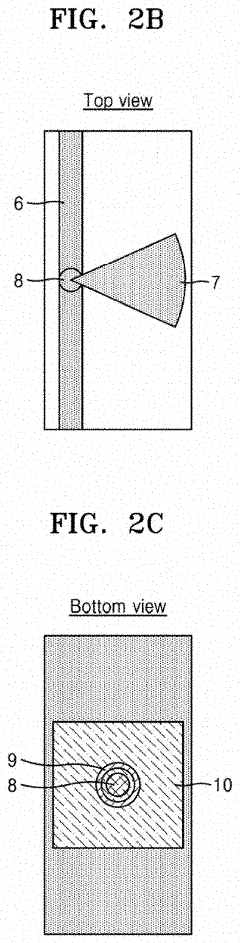

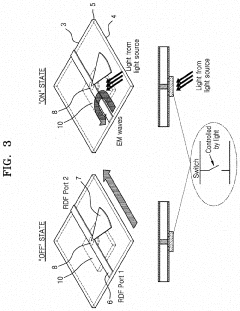

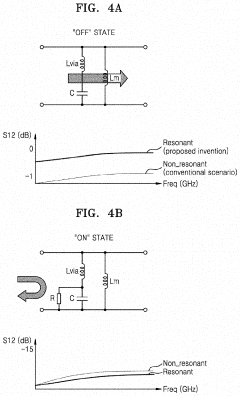

Method for controlling transmission of electromagnetic wave on basis of light, and device therefor

PatentActiveUS20210167764A1

Innovation

- A device using a photoconductive semiconductor switch with a shunt via and matching elements on a printed circuit board, where the photoconductive semiconductor can switch between a dielectric and conducting state based on an optical signal, allowing for simple and efficient control of electromagnetic waves by isolating the supply/bias circuit from the RF path and minimizing parasitic capacitance.

Regulatory Framework

The regulatory framework surrounding electromagnetic waves in high-frequency trading (HFT) is complex and evolving, reflecting the rapid technological advancements in this field. Financial regulators worldwide are grappling with the challenges posed by the use of ultra-fast communication technologies in trading environments. The primary focus of these regulations is to ensure fair market access, maintain market integrity, and prevent potential market manipulation.

In the United States, the Securities and Exchange Commission (SEC) has implemented several measures to address HFT-related concerns. Regulation Systems Compliance and Integrity (Reg SCI) requires market participants to have comprehensive policies and procedures in place to ensure the resilience of their technological systems. This includes safeguards against electromagnetic interference that could disrupt trading activities.

The European Union has introduced the Markets in Financial Instruments Directive II (MiFID II), which includes specific provisions for algorithmic trading and HFT. These regulations mandate strict testing and monitoring of trading algorithms and systems, including those utilizing electromagnetic waves for data transmission. Market participants are required to implement kill switches and circuit breakers to prevent market disruptions caused by technological failures or anomalies.

Regulatory bodies are also addressing the potential for market manipulation through the use of advanced communication technologies. The Commodity Futures Trading Commission (CFTC) in the United States has proposed rules to prevent spoofing and other forms of market manipulation that could be facilitated by high-speed trading systems relying on electromagnetic wave transmission.

Internationally, the International Organization of Securities Commissions (IOSCO) has issued guidelines for the regulation of electronic trading, including HFT. These guidelines emphasize the need for robust risk controls and surveillance mechanisms to detect and prevent market abuse facilitated by advanced technologies.

As the use of electromagnetic waves in HFT continues to evolve, regulators are increasingly focusing on the latency advantages provided by these technologies. Some jurisdictions are considering implementing minimum latency requirements or mandating equal access to market data to level the playing field between market participants. This reflects growing concerns about the fairness and integrity of markets in an era of microsecond-level trading.

The regulatory landscape also encompasses electromagnetic spectrum management, as the use of certain frequencies for HFT may intersect with other commercial and public uses of the spectrum. Regulatory bodies such as the Federal Communications Commission (FCC) in the United States and its counterparts in other countries are involved in allocating and managing spectrum usage to prevent interference and ensure efficient utilization of this limited resource.

In the United States, the Securities and Exchange Commission (SEC) has implemented several measures to address HFT-related concerns. Regulation Systems Compliance and Integrity (Reg SCI) requires market participants to have comprehensive policies and procedures in place to ensure the resilience of their technological systems. This includes safeguards against electromagnetic interference that could disrupt trading activities.

The European Union has introduced the Markets in Financial Instruments Directive II (MiFID II), which includes specific provisions for algorithmic trading and HFT. These regulations mandate strict testing and monitoring of trading algorithms and systems, including those utilizing electromagnetic waves for data transmission. Market participants are required to implement kill switches and circuit breakers to prevent market disruptions caused by technological failures or anomalies.

Regulatory bodies are also addressing the potential for market manipulation through the use of advanced communication technologies. The Commodity Futures Trading Commission (CFTC) in the United States has proposed rules to prevent spoofing and other forms of market manipulation that could be facilitated by high-speed trading systems relying on electromagnetic wave transmission.

Internationally, the International Organization of Securities Commissions (IOSCO) has issued guidelines for the regulation of electronic trading, including HFT. These guidelines emphasize the need for robust risk controls and surveillance mechanisms to detect and prevent market abuse facilitated by advanced technologies.

As the use of electromagnetic waves in HFT continues to evolve, regulators are increasingly focusing on the latency advantages provided by these technologies. Some jurisdictions are considering implementing minimum latency requirements or mandating equal access to market data to level the playing field between market participants. This reflects growing concerns about the fairness and integrity of markets in an era of microsecond-level trading.

The regulatory landscape also encompasses electromagnetic spectrum management, as the use of certain frequencies for HFT may intersect with other commercial and public uses of the spectrum. Regulatory bodies such as the Federal Communications Commission (FCC) in the United States and its counterparts in other countries are involved in allocating and managing spectrum usage to prevent interference and ensure efficient utilization of this limited resource.

Cybersecurity Concerns

The integration of electromagnetic waves in high-frequency trading systems introduces significant cybersecurity concerns that must be addressed to ensure the integrity and security of financial transactions. One primary vulnerability lies in the potential for signal interception and manipulation. As high-frequency trading relies on the rapid transmission of data through electromagnetic waves, malicious actors could potentially intercept these signals, leading to unauthorized access to sensitive financial information or market strategies.

Furthermore, the use of electromagnetic waves in trading systems increases the risk of electromagnetic interference (EMI) attacks. Adversaries could deliberately generate electromagnetic pulses or noise to disrupt trading operations, potentially causing financial losses or market instability. This type of attack could be particularly devastating in high-frequency trading environments where milliseconds can make a significant difference in trade execution and profitability.

Another critical cybersecurity concern is the potential for spoofing attacks. Malicious entities could attempt to inject false electromagnetic signals into the trading system, mimicking legitimate trade orders or market data. This could lead to erroneous trading decisions, market manipulation, or financial fraud on a large scale. The high-speed nature of these systems makes it challenging to detect and prevent such attacks in real-time.

The complexity of electromagnetic wave-based trading systems also introduces vulnerabilities in the form of software and hardware exploits. As these systems often rely on specialized hardware and software to process and act on electromagnetic signals, any vulnerabilities in these components could be exploited by cybercriminals. This could potentially lead to unauthorized access, data breaches, or the introduction of malware into critical financial infrastructure.

Moreover, the increasing reliance on wireless communication in high-frequency trading raises concerns about the security of data transmission. While encryption techniques are employed to protect sensitive information, the constant evolution of cryptographic attacks means that these systems must be continually updated and strengthened to maintain their security posture. Any breach in the encryption could lead to the exposure of proprietary trading algorithms or confidential financial data.

Lastly, the use of electromagnetic waves in trading systems introduces new challenges in regulatory compliance and auditing. Ensuring that these systems adhere to financial regulations and can be effectively audited for security and compliance becomes more complex when dealing with high-speed, electromagnetic-based communications. This complexity could potentially create blind spots in security oversight, making it difficult for regulators and auditors to detect and prevent cybersecurity threats effectively.

Furthermore, the use of electromagnetic waves in trading systems increases the risk of electromagnetic interference (EMI) attacks. Adversaries could deliberately generate electromagnetic pulses or noise to disrupt trading operations, potentially causing financial losses or market instability. This type of attack could be particularly devastating in high-frequency trading environments where milliseconds can make a significant difference in trade execution and profitability.

Another critical cybersecurity concern is the potential for spoofing attacks. Malicious entities could attempt to inject false electromagnetic signals into the trading system, mimicking legitimate trade orders or market data. This could lead to erroneous trading decisions, market manipulation, or financial fraud on a large scale. The high-speed nature of these systems makes it challenging to detect and prevent such attacks in real-time.

The complexity of electromagnetic wave-based trading systems also introduces vulnerabilities in the form of software and hardware exploits. As these systems often rely on specialized hardware and software to process and act on electromagnetic signals, any vulnerabilities in these components could be exploited by cybercriminals. This could potentially lead to unauthorized access, data breaches, or the introduction of malware into critical financial infrastructure.

Moreover, the increasing reliance on wireless communication in high-frequency trading raises concerns about the security of data transmission. While encryption techniques are employed to protect sensitive information, the constant evolution of cryptographic attacks means that these systems must be continually updated and strengthened to maintain their security posture. Any breach in the encryption could lead to the exposure of proprietary trading algorithms or confidential financial data.

Lastly, the use of electromagnetic waves in trading systems introduces new challenges in regulatory compliance and auditing. Ensuring that these systems adhere to financial regulations and can be effectively audited for security and compliance becomes more complex when dealing with high-speed, electromagnetic-based communications. This complexity could potentially create blind spots in security oversight, making it difficult for regulators and auditors to detect and prevent cybersecurity threats effectively.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!