Future Trends in Polycarbonate Manufacturing

JUL 1, 20258 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Polycarbonate Evolution

Polycarbonate, a versatile thermoplastic polymer, has undergone significant evolution since its discovery in 1953. Initially developed as a durable alternative to glass, polycarbonate has since found applications in various industries due to its unique combination of properties, including high impact resistance, optical clarity, and heat resistance.

The early stages of polycarbonate manufacturing focused on improving production efficiency and reducing costs. The interfacial polymerization process, developed in the 1960s, marked a significant milestone in polycarbonate production. This method allowed for the synthesis of high molecular weight polycarbonate at lower temperatures, leading to improved product quality and reduced energy consumption.

In the 1970s and 1980s, advancements in catalyst technology and reactor design further enhanced the efficiency of polycarbonate production. The introduction of continuous production processes, such as the melt polymerization method, enabled manufacturers to increase output while maintaining product quality. These developments also led to a reduction in the use of toxic chemicals, aligning with growing environmental concerns.

The 1990s saw a shift towards more sustainable production methods. Researchers began exploring alternative raw materials and catalysts to reduce the environmental impact of polycarbonate manufacturing. This period also witnessed the development of new grades of polycarbonate with enhanced properties, such as improved UV resistance and flame retardancy, expanding its application range.

The turn of the millennium brought about a focus on nanotechnology in polycarbonate production. The incorporation of nanoparticles and nanofibers into polycarbonate matrices resulted in nanocomposites with superior mechanical, thermal, and barrier properties. This innovation opened up new possibilities for polycarbonate in high-performance applications.

In recent years, the evolution of polycarbonate manufacturing has been driven by sustainability concerns and circular economy principles. Manufacturers have been developing bio-based polycarbonates derived from renewable resources, reducing reliance on fossil fuels. Additionally, advancements in recycling technologies have enabled the production of high-quality recycled polycarbonate, addressing end-of-life issues and promoting a closed-loop system.

The latest trend in polycarbonate evolution involves the integration of smart manufacturing technologies. Industry 4.0 concepts, such as the Internet of Things (IoT) and artificial intelligence, are being applied to polycarbonate production processes. These technologies enable real-time monitoring, predictive maintenance, and optimization of manufacturing parameters, leading to improved product quality, reduced waste, and increased energy efficiency.

The early stages of polycarbonate manufacturing focused on improving production efficiency and reducing costs. The interfacial polymerization process, developed in the 1960s, marked a significant milestone in polycarbonate production. This method allowed for the synthesis of high molecular weight polycarbonate at lower temperatures, leading to improved product quality and reduced energy consumption.

In the 1970s and 1980s, advancements in catalyst technology and reactor design further enhanced the efficiency of polycarbonate production. The introduction of continuous production processes, such as the melt polymerization method, enabled manufacturers to increase output while maintaining product quality. These developments also led to a reduction in the use of toxic chemicals, aligning with growing environmental concerns.

The 1990s saw a shift towards more sustainable production methods. Researchers began exploring alternative raw materials and catalysts to reduce the environmental impact of polycarbonate manufacturing. This period also witnessed the development of new grades of polycarbonate with enhanced properties, such as improved UV resistance and flame retardancy, expanding its application range.

The turn of the millennium brought about a focus on nanotechnology in polycarbonate production. The incorporation of nanoparticles and nanofibers into polycarbonate matrices resulted in nanocomposites with superior mechanical, thermal, and barrier properties. This innovation opened up new possibilities for polycarbonate in high-performance applications.

In recent years, the evolution of polycarbonate manufacturing has been driven by sustainability concerns and circular economy principles. Manufacturers have been developing bio-based polycarbonates derived from renewable resources, reducing reliance on fossil fuels. Additionally, advancements in recycling technologies have enabled the production of high-quality recycled polycarbonate, addressing end-of-life issues and promoting a closed-loop system.

The latest trend in polycarbonate evolution involves the integration of smart manufacturing technologies. Industry 4.0 concepts, such as the Internet of Things (IoT) and artificial intelligence, are being applied to polycarbonate production processes. These technologies enable real-time monitoring, predictive maintenance, and optimization of manufacturing parameters, leading to improved product quality, reduced waste, and increased energy efficiency.

Market Demand Analysis

The global polycarbonate market has been experiencing steady growth, driven by increasing demand across various industries. The automotive sector remains a key consumer, with polycarbonate's lightweight and impact-resistant properties making it ideal for vehicle components. As the automotive industry shifts towards electric and autonomous vehicles, the demand for polycarbonate is expected to surge further, particularly in applications such as battery housings and sensor covers.

In the construction industry, polycarbonate's durability and thermal insulation properties have led to its increased use in roofing, glazing, and architectural elements. The growing trend towards sustainable and energy-efficient buildings is likely to boost the demand for polycarbonate in this sector. Additionally, the material's versatility in design and color options makes it attractive for modern architectural projects.

The electronics and electrical industry represents another significant market for polycarbonate. With the proliferation of smart devices and the Internet of Things (IoT), there is a rising demand for polycarbonate in the production of housings for electronic devices, connectors, and other components. The material's flame-retardant properties and electrical insulation capabilities make it particularly suitable for these applications.

In the medical and healthcare sector, polycarbonate's biocompatibility and sterilization resistance have led to its increased use in medical devices, equipment housings, and packaging. The ongoing global focus on healthcare infrastructure and the growing demand for advanced medical technologies are expected to drive further growth in this segment.

The packaging industry is also contributing to the expanding polycarbonate market. The material's clarity, impact resistance, and food-grade safety make it suitable for reusable water bottles, food containers, and other packaging applications. However, concerns about BPA (Bisphenol A) and environmental sustainability have led to the development of BPA-free alternatives and increased focus on recycling technologies for polycarbonate.

Emerging applications in 3D printing and additive manufacturing are opening new avenues for polycarbonate usage. The material's high strength-to-weight ratio and thermal stability make it suitable for producing complex parts and prototypes across various industries.

Geographically, Asia-Pacific is expected to remain the largest and fastest-growing market for polycarbonate, driven by rapid industrialization, urbanization, and increasing disposable incomes in countries like China and India. North America and Europe are also significant markets, with a focus on high-performance and specialty applications.

In the construction industry, polycarbonate's durability and thermal insulation properties have led to its increased use in roofing, glazing, and architectural elements. The growing trend towards sustainable and energy-efficient buildings is likely to boost the demand for polycarbonate in this sector. Additionally, the material's versatility in design and color options makes it attractive for modern architectural projects.

The electronics and electrical industry represents another significant market for polycarbonate. With the proliferation of smart devices and the Internet of Things (IoT), there is a rising demand for polycarbonate in the production of housings for electronic devices, connectors, and other components. The material's flame-retardant properties and electrical insulation capabilities make it particularly suitable for these applications.

In the medical and healthcare sector, polycarbonate's biocompatibility and sterilization resistance have led to its increased use in medical devices, equipment housings, and packaging. The ongoing global focus on healthcare infrastructure and the growing demand for advanced medical technologies are expected to drive further growth in this segment.

The packaging industry is also contributing to the expanding polycarbonate market. The material's clarity, impact resistance, and food-grade safety make it suitable for reusable water bottles, food containers, and other packaging applications. However, concerns about BPA (Bisphenol A) and environmental sustainability have led to the development of BPA-free alternatives and increased focus on recycling technologies for polycarbonate.

Emerging applications in 3D printing and additive manufacturing are opening new avenues for polycarbonate usage. The material's high strength-to-weight ratio and thermal stability make it suitable for producing complex parts and prototypes across various industries.

Geographically, Asia-Pacific is expected to remain the largest and fastest-growing market for polycarbonate, driven by rapid industrialization, urbanization, and increasing disposable incomes in countries like China and India. North America and Europe are also significant markets, with a focus on high-performance and specialty applications.

Technical Challenges

Polycarbonate manufacturing faces several significant technical challenges that need to be addressed to ensure its continued growth and sustainability in the future. One of the primary concerns is the environmental impact of traditional production methods. The current processes often rely on toxic chemicals like phosgene and bisphenol A (BPA), which pose risks to both human health and the environment. Developing greener synthesis routes that reduce or eliminate these harmful substances is a critical challenge for the industry.

Energy efficiency is another major hurdle in polycarbonate production. The manufacturing process is energy-intensive, contributing to high production costs and carbon emissions. Improving energy efficiency through process optimization, advanced catalysts, and innovative reactor designs is essential for reducing the carbon footprint and enhancing the economic viability of polycarbonate production.

The quality and performance of polycarbonate materials also present ongoing challenges. While polycarbonate is known for its excellent impact resistance and optical clarity, there is a constant demand for enhanced properties such as improved heat resistance, chemical resistance, and weatherability. Developing new additives, modifiers, and processing techniques to achieve these superior properties without compromising other desirable characteristics is a complex technical challenge.

Recycling and circular economy considerations are becoming increasingly important in the polycarbonate industry. Current recycling methods for polycarbonate are limited and often result in downcycled products. Developing efficient and economically viable recycling technologies that can maintain the high quality of the material through multiple use cycles is a significant technical challenge that needs to be overcome.

The integration of smart manufacturing and Industry 4.0 technologies into polycarbonate production processes presents both opportunities and challenges. Implementing advanced process control systems, predictive maintenance, and real-time quality monitoring requires significant technological upgrades and expertise. Ensuring cybersecurity and managing the vast amounts of data generated by these systems are additional challenges that need to be addressed.

Lastly, the development of bio-based and biodegradable alternatives to traditional polycarbonate is an emerging area of research. While promising, these new materials often face challenges in matching the performance characteristics of petroleum-based polycarbonates. Improving the properties and scalability of bio-based polycarbonates while maintaining cost-competitiveness is a complex technical challenge that requires innovative approaches in polymer chemistry and process engineering.

Energy efficiency is another major hurdle in polycarbonate production. The manufacturing process is energy-intensive, contributing to high production costs and carbon emissions. Improving energy efficiency through process optimization, advanced catalysts, and innovative reactor designs is essential for reducing the carbon footprint and enhancing the economic viability of polycarbonate production.

The quality and performance of polycarbonate materials also present ongoing challenges. While polycarbonate is known for its excellent impact resistance and optical clarity, there is a constant demand for enhanced properties such as improved heat resistance, chemical resistance, and weatherability. Developing new additives, modifiers, and processing techniques to achieve these superior properties without compromising other desirable characteristics is a complex technical challenge.

Recycling and circular economy considerations are becoming increasingly important in the polycarbonate industry. Current recycling methods for polycarbonate are limited and often result in downcycled products. Developing efficient and economically viable recycling technologies that can maintain the high quality of the material through multiple use cycles is a significant technical challenge that needs to be overcome.

The integration of smart manufacturing and Industry 4.0 technologies into polycarbonate production processes presents both opportunities and challenges. Implementing advanced process control systems, predictive maintenance, and real-time quality monitoring requires significant technological upgrades and expertise. Ensuring cybersecurity and managing the vast amounts of data generated by these systems are additional challenges that need to be addressed.

Lastly, the development of bio-based and biodegradable alternatives to traditional polycarbonate is an emerging area of research. While promising, these new materials often face challenges in matching the performance characteristics of petroleum-based polycarbonates. Improving the properties and scalability of bio-based polycarbonates while maintaining cost-competitiveness is a complex technical challenge that requires innovative approaches in polymer chemistry and process engineering.

Current Production

01 Synthesis and modification of polycarbonates

Various methods for synthesizing and modifying polycarbonates are explored, including new catalysts, reaction conditions, and additives to improve properties such as molecular weight, thermal stability, and optical clarity. These techniques aim to enhance the overall performance and versatility of polycarbonate materials.- Synthesis and modification of polycarbonates: Various methods for synthesizing and modifying polycarbonates are explored, including novel catalysts, reaction conditions, and additives. These techniques aim to improve the properties and performance of polycarbonate materials, such as thermal stability, impact resistance, and optical clarity.

- Polycarbonate blends and composites: Polycarbonates are often blended with other polymers or reinforced with various materials to create composites with enhanced properties. These blends and composites can offer improved mechanical strength, flame retardancy, or specific functional characteristics for diverse applications.

- Polycarbonate applications in electronics: Polycarbonates find extensive use in electronic applications due to their excellent electrical insulation properties and durability. They are utilized in various components such as housings, connectors, and protective covers for electronic devices.

- Recycling and sustainability of polycarbonates: Efforts to improve the recyclability and sustainability of polycarbonates are ongoing. This includes developing methods for efficient recycling, using bio-based sources for polycarbonate production, and creating more environmentally friendly manufacturing processes.

- Polycarbonate surface treatments and coatings: Various surface treatments and coating techniques are employed to enhance the properties of polycarbonate materials. These methods can improve scratch resistance, UV stability, and add functionalities such as anti-fogging or anti-microbial properties to polycarbonate surfaces.

02 Polycarbonate blends and composites

Development of polycarbonate blends and composites with other polymers or materials to achieve improved mechanical, thermal, or electrical properties. These combinations can result in materials with enhanced impact resistance, flame retardancy, or specific functional characteristics for various applications.Expand Specific Solutions03 Optical applications of polycarbonates

Utilization of polycarbonates in optical applications, such as lenses, displays, and light-guiding components. Research focuses on improving optical clarity, UV resistance, and scratch resistance while maintaining the material's inherent impact strength and dimensional stability.Expand Specific Solutions04 Polycarbonate processing techniques

Advancements in processing techniques for polycarbonates, including extrusion, injection molding, and film formation. These methods aim to optimize production efficiency, reduce defects, and enhance the final product's surface quality and dimensional accuracy.Expand Specific Solutions05 Sustainable and bio-based polycarbonates

Development of sustainable and bio-based alternatives to traditional polycarbonates, focusing on renewable resources and environmentally friendly production methods. This includes research into biodegradable polycarbonates and those derived from plant-based monomers to reduce environmental impact.Expand Specific Solutions

Industry Leaders

The polycarbonate manufacturing industry is in a mature stage, with a global market size expected to reach $25 billion by 2025. The technology is well-established, but innovation continues in areas such as sustainable production methods and high-performance grades. Key players like SABIC, Covestro, and LG Chem dominate the market, leveraging their extensive R&D capabilities and global production networks. Emerging companies from China, such as Wanhua Chemical, are increasingly competitive. The industry faces challenges in sustainability and raw material costs, driving research into bio-based alternatives and recycling technologies. Collaborations between industry leaders and research institutions, like Qingdao University of Science & Technology, are accelerating advancements in process efficiency and product performance.

SABIC Global Technologies BV

Technical Solution: SABIC is at the forefront of sustainable polycarbonate manufacturing, focusing on circular economy solutions. They have developed a portfolio of certified renewable polycarbonates, using bio-based feedstocks to reduce fossil fuel dependence[10]. SABIC is also investing in mechanical and chemical recycling technologies to create high-quality recycled polycarbonates. Their future research includes developing polycarbonates with enhanced thermal management properties for electric vehicle batteries and exploring new additives to improve the material's resistance to harsh environments. SABIC is also working on scalable solutions for mass production of sustainable polycarbonates to meet growing market demands[11].

Strengths: Global reach, strong commitment to sustainability, and extensive R&D capabilities. Weaknesses: Challenges in scaling up new technologies to industrial production levels.

Covestro Deutschland AG

Technical Solution: Covestro is pioneering sustainable polycarbonate manufacturing through its innovative CO2 technology. This process uses carbon dioxide as a raw material, replacing up to 20% of fossil-based resources[1]. The company is also developing bio-based polycarbonates, utilizing plant-based feedstocks to reduce the carbon footprint. Additionally, Covestro is investing in advanced recycling technologies, including chemical recycling, to create a circular economy for polycarbonates[2]. Their future focus includes improving energy efficiency in production processes and developing new high-performance, sustainable polycarbonate grades for emerging applications in electric vehicles and 5G infrastructure[3].

Strengths: Leader in sustainable polycarbonate production, strong R&D capabilities, and established market presence. Weaknesses: Dependence on petrochemical feedstocks for the majority of production, potential regulatory challenges related to chemical processes.

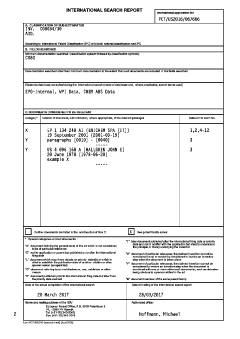

Innovative Patents

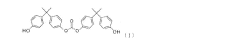

Method for producing polycarbonate

PatentInactiveEP1668061A1

Innovation

- A method involving the dissolution of DPC in acetone to create a liquid mixture for transport and processing, allowing for integrated raw material use and reducing the need for separate storage and handling, thereby avoiding the drawbacks of solid DPC transport and handling.

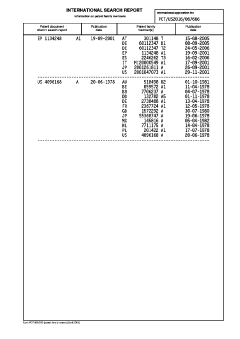

Method for producing polycarbonate

PatentInactiveJP2019503414A

Innovation

- A process involving the reaction of dihydroxy-capped carbonates with diaryl carbonates in the presence of a polymerization catalyst, reducing the need for diaryl carbonate and allowing for the recycling of phenol, thereby optimizing raw material usage and reaction efficiency.

Sustainability Aspects

Sustainability has become a critical focus in the polycarbonate manufacturing industry, driven by increasing environmental concerns and regulatory pressures. The future of polycarbonate production is likely to be shaped by several key sustainability trends.

One significant trend is the shift towards renewable feedstocks. Traditional polycarbonate production relies heavily on fossil fuel-based raw materials. However, research is advancing in the development of bio-based alternatives, such as those derived from plant sources. These renewable feedstocks have the potential to reduce the carbon footprint of polycarbonate manufacturing significantly.

Energy efficiency improvements are another crucial aspect of sustainable polycarbonate production. Manufacturers are investing in advanced process technologies and equipment upgrades to minimize energy consumption during production. This includes the implementation of heat recovery systems, optimized reaction conditions, and more efficient catalysts.

Circular economy principles are gaining traction in the industry, with a focus on recycling and upcycling of polycarbonate materials. Advanced recycling technologies are being developed to break down polycarbonate waste into its chemical building blocks, allowing for the production of new, high-quality polycarbonate products. This closed-loop approach not only reduces waste but also decreases the demand for virgin raw materials.

Water conservation is becoming increasingly important in polycarbonate manufacturing. Future trends point towards the development of water-efficient processes and the implementation of advanced water treatment and recycling systems within production facilities. This will help reduce the overall water footprint of polycarbonate manufacturing.

The use of green chemistry principles is expected to play a significant role in future polycarbonate production. This includes the development of safer, less toxic catalysts and additives, as well as the design of processes that minimize the generation of hazardous by-products. Such innovations will contribute to reducing the environmental impact of polycarbonate manufacturing and improve worker safety.

Lastly, the industry is likely to see increased adoption of life cycle assessment (LCA) methodologies to evaluate and improve the overall sustainability of polycarbonate products. This holistic approach will enable manufacturers to identify and address environmental hotspots throughout the entire product life cycle, from raw material extraction to end-of-life disposal or recycling.

One significant trend is the shift towards renewable feedstocks. Traditional polycarbonate production relies heavily on fossil fuel-based raw materials. However, research is advancing in the development of bio-based alternatives, such as those derived from plant sources. These renewable feedstocks have the potential to reduce the carbon footprint of polycarbonate manufacturing significantly.

Energy efficiency improvements are another crucial aspect of sustainable polycarbonate production. Manufacturers are investing in advanced process technologies and equipment upgrades to minimize energy consumption during production. This includes the implementation of heat recovery systems, optimized reaction conditions, and more efficient catalysts.

Circular economy principles are gaining traction in the industry, with a focus on recycling and upcycling of polycarbonate materials. Advanced recycling technologies are being developed to break down polycarbonate waste into its chemical building blocks, allowing for the production of new, high-quality polycarbonate products. This closed-loop approach not only reduces waste but also decreases the demand for virgin raw materials.

Water conservation is becoming increasingly important in polycarbonate manufacturing. Future trends point towards the development of water-efficient processes and the implementation of advanced water treatment and recycling systems within production facilities. This will help reduce the overall water footprint of polycarbonate manufacturing.

The use of green chemistry principles is expected to play a significant role in future polycarbonate production. This includes the development of safer, less toxic catalysts and additives, as well as the design of processes that minimize the generation of hazardous by-products. Such innovations will contribute to reducing the environmental impact of polycarbonate manufacturing and improve worker safety.

Lastly, the industry is likely to see increased adoption of life cycle assessment (LCA) methodologies to evaluate and improve the overall sustainability of polycarbonate products. This holistic approach will enable manufacturers to identify and address environmental hotspots throughout the entire product life cycle, from raw material extraction to end-of-life disposal or recycling.

Regulatory Landscape

The regulatory landscape for polycarbonate manufacturing is evolving rapidly, driven by increasing environmental concerns and a global push towards sustainability. Governments and international bodies are implementing stricter regulations to address the environmental impact of plastic production and waste management.

One of the key trends in regulatory frameworks is the emphasis on circular economy principles. Policymakers are introducing legislation that encourages the recycling and reuse of polycarbonate materials. This includes extended producer responsibility (EPR) schemes, which require manufacturers to take responsibility for the entire lifecycle of their products, including disposal and recycling.

Chemical safety regulations are becoming more stringent, with a focus on reducing the use of potentially harmful additives in polycarbonate production. The European Union's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation is setting global standards for chemical safety, influencing polycarbonate manufacturing practices worldwide.

Carbon emissions regulations are also impacting the industry. Many countries are implementing carbon pricing mechanisms and emissions trading schemes, pushing manufacturers to adopt more energy-efficient processes and explore low-carbon alternatives in polycarbonate production.

Waste management regulations are becoming increasingly important. Governments are setting ambitious targets for plastic waste reduction and recycling, which directly affects polycarbonate manufacturers. This includes bans on single-use plastics and requirements for increased recycled content in new products.

The regulatory landscape is also shifting towards promoting bio-based and biodegradable alternatives to traditional polycarbonates. Incentives and research funding are being directed towards the development of more sustainable materials, potentially reshaping the future of polycarbonate manufacturing.

Compliance with these evolving regulations presents both challenges and opportunities for the industry. Manufacturers must invest in research and development to meet new standards, but this also drives innovation in materials and processes. The ability to adapt to and anticipate regulatory changes will be crucial for companies to maintain competitiveness in the polycarbonate market.

As global environmental policies continue to align, we can expect further harmonization of regulations across different regions. This trend towards global standardization may simplify compliance for multinational corporations but could also increase pressure on smaller manufacturers to meet international standards.

One of the key trends in regulatory frameworks is the emphasis on circular economy principles. Policymakers are introducing legislation that encourages the recycling and reuse of polycarbonate materials. This includes extended producer responsibility (EPR) schemes, which require manufacturers to take responsibility for the entire lifecycle of their products, including disposal and recycling.

Chemical safety regulations are becoming more stringent, with a focus on reducing the use of potentially harmful additives in polycarbonate production. The European Union's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation is setting global standards for chemical safety, influencing polycarbonate manufacturing practices worldwide.

Carbon emissions regulations are also impacting the industry. Many countries are implementing carbon pricing mechanisms and emissions trading schemes, pushing manufacturers to adopt more energy-efficient processes and explore low-carbon alternatives in polycarbonate production.

Waste management regulations are becoming increasingly important. Governments are setting ambitious targets for plastic waste reduction and recycling, which directly affects polycarbonate manufacturers. This includes bans on single-use plastics and requirements for increased recycled content in new products.

The regulatory landscape is also shifting towards promoting bio-based and biodegradable alternatives to traditional polycarbonates. Incentives and research funding are being directed towards the development of more sustainable materials, potentially reshaping the future of polycarbonate manufacturing.

Compliance with these evolving regulations presents both challenges and opportunities for the industry. Manufacturers must invest in research and development to meet new standards, but this also drives innovation in materials and processes. The ability to adapt to and anticipate regulatory changes will be crucial for companies to maintain competitiveness in the polycarbonate market.

As global environmental policies continue to align, we can expect further harmonization of regulations across different regions. This trend towards global standardization may simplify compliance for multinational corporations but could also increase pressure on smaller manufacturers to meet international standards.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!