How Quantum Computing Transforms Financial Forecasting Models

JUL 17, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Quantum Computing in Finance: Background and Objectives

Quantum computing represents a paradigm shift in computational capabilities, with profound implications for the financial sector, particularly in the realm of financial forecasting models. The evolution of quantum technology has its roots in the early 20th century, with the development of quantum mechanics. However, it wasn't until the late 1980s that the concept of quantum computing began to take shape, thanks to pioneering work by physicists such as Richard Feynman and David Deutsch.

The primary objective of integrating quantum computing into financial forecasting is to enhance the accuracy, speed, and complexity of predictive models. Traditional computing methods often struggle with the vast amounts of data and intricate variables involved in financial forecasting. Quantum computing offers the potential to process this information exponentially faster, allowing for more sophisticated and nuanced predictions.

In the context of financial forecasting, quantum computing aims to address several key challenges. These include improving risk assessment, optimizing portfolio management, and enhancing fraud detection mechanisms. By leveraging quantum algorithms, financial institutions can potentially analyze market trends and economic indicators with unprecedented depth and precision.

The quantum advantage in financial modeling stems from the unique properties of quantum systems, such as superposition and entanglement. These properties allow quantum computers to perform certain calculations exponentially faster than classical computers, particularly in areas involving optimization, sampling, and machine learning – all crucial components of advanced financial forecasting models.

As the field progresses, researchers and financial institutions are exploring various quantum algorithms tailored for financial applications. These include quantum amplitude estimation for risk analysis, quantum approximate optimization algorithms for portfolio optimization, and quantum machine learning techniques for pattern recognition in market data.

The trajectory of quantum computing in finance is closely tied to the overall development of quantum hardware. While current quantum systems are still in their infancy, with limitations in qubit count and error rates, the rapid pace of technological advancement suggests that more powerful and stable quantum computers will become available in the near future. This progression is expected to gradually unlock new capabilities in financial modeling and forecasting.

The integration of quantum computing into financial forecasting models represents a convergence of cutting-edge physics, computer science, and financial theory. As this technology matures, it has the potential to revolutionize how financial institutions approach risk management, investment strategies, and economic predictions, potentially leading to more stable and efficient financial markets.

The primary objective of integrating quantum computing into financial forecasting is to enhance the accuracy, speed, and complexity of predictive models. Traditional computing methods often struggle with the vast amounts of data and intricate variables involved in financial forecasting. Quantum computing offers the potential to process this information exponentially faster, allowing for more sophisticated and nuanced predictions.

In the context of financial forecasting, quantum computing aims to address several key challenges. These include improving risk assessment, optimizing portfolio management, and enhancing fraud detection mechanisms. By leveraging quantum algorithms, financial institutions can potentially analyze market trends and economic indicators with unprecedented depth and precision.

The quantum advantage in financial modeling stems from the unique properties of quantum systems, such as superposition and entanglement. These properties allow quantum computers to perform certain calculations exponentially faster than classical computers, particularly in areas involving optimization, sampling, and machine learning – all crucial components of advanced financial forecasting models.

As the field progresses, researchers and financial institutions are exploring various quantum algorithms tailored for financial applications. These include quantum amplitude estimation for risk analysis, quantum approximate optimization algorithms for portfolio optimization, and quantum machine learning techniques for pattern recognition in market data.

The trajectory of quantum computing in finance is closely tied to the overall development of quantum hardware. While current quantum systems are still in their infancy, with limitations in qubit count and error rates, the rapid pace of technological advancement suggests that more powerful and stable quantum computers will become available in the near future. This progression is expected to gradually unlock new capabilities in financial modeling and forecasting.

The integration of quantum computing into financial forecasting models represents a convergence of cutting-edge physics, computer science, and financial theory. As this technology matures, it has the potential to revolutionize how financial institutions approach risk management, investment strategies, and economic predictions, potentially leading to more stable and efficient financial markets.

Market Demand for Advanced Financial Forecasting

The financial sector has witnessed a growing demand for advanced forecasting models, driven by the increasing complexity of global markets and the need for more accurate predictions. Traditional forecasting methods often struggle to capture the intricate relationships and non-linear dynamics inherent in financial systems, leading to a surge in interest for quantum computing-based solutions.

Financial institutions, including banks, hedge funds, and investment firms, are actively seeking ways to enhance their forecasting capabilities to gain a competitive edge. The potential of quantum computing to revolutionize financial forecasting has sparked significant interest among these organizations, with many investing heavily in research and development efforts.

The market for quantum computing in finance is projected to grow substantially in the coming years. This growth is fueled by the promise of quantum algorithms to solve complex optimization problems and perform risk analysis at speeds unattainable by classical computers. As financial markets become increasingly interconnected and volatile, the ability to process vast amounts of data and generate accurate forecasts in real-time has become a critical differentiator for financial institutions.

One of the key drivers of market demand is the potential for quantum computing to improve portfolio optimization. Quantum algorithms can theoretically analyze a much larger number of potential scenarios and asset combinations, leading to more efficient and robust investment strategies. This capability is particularly valuable in the context of high-frequency trading and risk management, where split-second decisions can have significant financial implications.

Another area of high demand is in credit risk assessment and fraud detection. Quantum machine learning algorithms have the potential to identify patterns and anomalies in financial data that are invisible to classical computing methods. This enhanced analytical capability could lead to more accurate credit scoring models and more effective fraud prevention systems, addressing critical challenges faced by financial institutions.

The insurance industry is also showing keen interest in quantum-enhanced forecasting models. These models could potentially improve actuarial calculations, leading to more accurate pricing of insurance products and better management of long-term risks. The ability to simulate complex scenarios with quantum computers could revolutionize how insurers assess and price various types of risk.

Central banks and regulatory bodies are exploring the use of quantum computing for economic modeling and stress testing of financial systems. The increased computational power offered by quantum systems could enable more comprehensive and granular analyses of economic scenarios, potentially leading to more effective monetary policies and regulatory frameworks.

As the financial sector continues to digitize and embrace emerging technologies, the demand for quantum-enhanced forecasting models is expected to accelerate. This trend is further reinforced by the increasing availability of quantum computing resources through cloud services, making it more accessible for financial institutions to experiment with and implement quantum algorithms in their forecasting processes.

Financial institutions, including banks, hedge funds, and investment firms, are actively seeking ways to enhance their forecasting capabilities to gain a competitive edge. The potential of quantum computing to revolutionize financial forecasting has sparked significant interest among these organizations, with many investing heavily in research and development efforts.

The market for quantum computing in finance is projected to grow substantially in the coming years. This growth is fueled by the promise of quantum algorithms to solve complex optimization problems and perform risk analysis at speeds unattainable by classical computers. As financial markets become increasingly interconnected and volatile, the ability to process vast amounts of data and generate accurate forecasts in real-time has become a critical differentiator for financial institutions.

One of the key drivers of market demand is the potential for quantum computing to improve portfolio optimization. Quantum algorithms can theoretically analyze a much larger number of potential scenarios and asset combinations, leading to more efficient and robust investment strategies. This capability is particularly valuable in the context of high-frequency trading and risk management, where split-second decisions can have significant financial implications.

Another area of high demand is in credit risk assessment and fraud detection. Quantum machine learning algorithms have the potential to identify patterns and anomalies in financial data that are invisible to classical computing methods. This enhanced analytical capability could lead to more accurate credit scoring models and more effective fraud prevention systems, addressing critical challenges faced by financial institutions.

The insurance industry is also showing keen interest in quantum-enhanced forecasting models. These models could potentially improve actuarial calculations, leading to more accurate pricing of insurance products and better management of long-term risks. The ability to simulate complex scenarios with quantum computers could revolutionize how insurers assess and price various types of risk.

Central banks and regulatory bodies are exploring the use of quantum computing for economic modeling and stress testing of financial systems. The increased computational power offered by quantum systems could enable more comprehensive and granular analyses of economic scenarios, potentially leading to more effective monetary policies and regulatory frameworks.

As the financial sector continues to digitize and embrace emerging technologies, the demand for quantum-enhanced forecasting models is expected to accelerate. This trend is further reinforced by the increasing availability of quantum computing resources through cloud services, making it more accessible for financial institutions to experiment with and implement quantum algorithms in their forecasting processes.

Current State of Quantum Computing in Finance

Quantum computing in finance is rapidly evolving, with significant advancements in recent years. Financial institutions are increasingly exploring the potential of quantum technologies to revolutionize their forecasting models and risk management strategies. Currently, several major banks and financial services companies are actively investing in quantum research and development.

The primary focus of quantum computing in finance lies in optimization problems, portfolio management, and risk analysis. Quantum algorithms have shown promise in solving complex financial calculations exponentially faster than classical computers. For instance, quantum-inspired algorithms are being used to optimize trading strategies and improve fraud detection systems.

However, the technology is still in its early stages, with most applications being proof-of-concept or small-scale implementations. Fully-fledged quantum computers capable of outperforming classical systems for real-world financial problems are yet to be realized. The current state is characterized by a mix of quantum-inspired algorithms running on classical hardware and small-scale quantum processors with limited qubit counts.

Several financial institutions have partnered with quantum computing companies to develop and test quantum algorithms for specific financial use cases. These collaborations aim to prepare for the quantum advantage, where quantum computers can solve problems beyond the reach of classical computers. Some notable partnerships include JPMorgan Chase with IBM, Goldman Sachs with QC Ware, and Barclays with Quantinuum.

The adoption of quantum computing in finance faces several challenges. Hardware limitations, such as qubit coherence and error rates, still restrict the complexity of problems that can be tackled. Additionally, there is a shortage of quantum talent in the finance sector, with companies competing to attract and retain specialists in this emerging field.

Despite these challenges, the potential impact of quantum computing on financial forecasting models is substantial. Quantum algorithms could potentially improve the accuracy of market predictions, enhance risk assessment, and optimize complex financial instruments. As the technology matures, it is expected to enable more sophisticated modeling of market dynamics and economic scenarios.

In conclusion, while quantum computing in finance is still in its nascent stages, it shows immense promise. The current state is characterized by active research, strategic partnerships, and a growing recognition of the technology's transformative potential in financial forecasting and risk management.

The primary focus of quantum computing in finance lies in optimization problems, portfolio management, and risk analysis. Quantum algorithms have shown promise in solving complex financial calculations exponentially faster than classical computers. For instance, quantum-inspired algorithms are being used to optimize trading strategies and improve fraud detection systems.

However, the technology is still in its early stages, with most applications being proof-of-concept or small-scale implementations. Fully-fledged quantum computers capable of outperforming classical systems for real-world financial problems are yet to be realized. The current state is characterized by a mix of quantum-inspired algorithms running on classical hardware and small-scale quantum processors with limited qubit counts.

Several financial institutions have partnered with quantum computing companies to develop and test quantum algorithms for specific financial use cases. These collaborations aim to prepare for the quantum advantage, where quantum computers can solve problems beyond the reach of classical computers. Some notable partnerships include JPMorgan Chase with IBM, Goldman Sachs with QC Ware, and Barclays with Quantinuum.

The adoption of quantum computing in finance faces several challenges. Hardware limitations, such as qubit coherence and error rates, still restrict the complexity of problems that can be tackled. Additionally, there is a shortage of quantum talent in the finance sector, with companies competing to attract and retain specialists in this emerging field.

Despite these challenges, the potential impact of quantum computing on financial forecasting models is substantial. Quantum algorithms could potentially improve the accuracy of market predictions, enhance risk assessment, and optimize complex financial instruments. As the technology matures, it is expected to enable more sophisticated modeling of market dynamics and economic scenarios.

In conclusion, while quantum computing in finance is still in its nascent stages, it shows immense promise. The current state is characterized by active research, strategic partnerships, and a growing recognition of the technology's transformative potential in financial forecasting and risk management.

Existing Quantum-Enhanced Forecasting Models

01 Quantum-enhanced financial forecasting algorithms

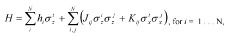

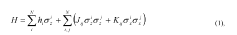

Quantum computing techniques are applied to develop advanced financial forecasting models. These algorithms leverage quantum superposition and entanglement to process complex financial data more efficiently than classical computers, potentially improving the accuracy and speed of market predictions and risk assessments.- Quantum-enhanced financial forecasting algorithms: Quantum computing techniques are applied to develop advanced financial forecasting models. These algorithms leverage quantum superposition and entanglement to process complex financial data more efficiently than classical computers. The models can analyze vast amounts of market data, identify patterns, and make predictions with higher accuracy and speed.

- Hybrid quantum-classical systems for risk assessment: Combining quantum and classical computing approaches to create hybrid systems for financial risk assessment and portfolio optimization. These systems utilize quantum algorithms for specific computationally intensive tasks while leveraging classical methods for other aspects of financial modeling, resulting in more comprehensive and accurate risk evaluations.

- Quantum machine learning for market trend prediction: Integrating quantum computing with machine learning techniques to enhance market trend prediction capabilities. Quantum machine learning algorithms can process high-dimensional financial data more effectively, enabling the identification of complex correlations and hidden patterns in market behavior that are difficult to detect using classical methods.

- Quantum-inspired optimization for portfolio management: Developing quantum-inspired algorithms for optimizing investment portfolios. These methods draw inspiration from quantum principles to solve complex optimization problems in portfolio management, such as asset allocation and rebalancing, potentially leading to improved returns and reduced risk compared to traditional optimization techniques.

- Quantum encryption for secure financial transactions: Implementing quantum encryption techniques to enhance the security of financial transactions and data exchange in forecasting models. Quantum key distribution and other quantum cryptographic methods provide a higher level of security against potential cyber threats, ensuring the integrity and confidentiality of sensitive financial information used in forecasting and decision-making processes.

02 Hybrid quantum-classical systems for financial modeling

Hybrid approaches combining quantum and classical computing elements are used to create more robust financial forecasting models. These systems utilize quantum processors for specific computationally intensive tasks while leveraging classical infrastructure for data preparation and result interpretation, optimizing overall performance and practicality.Expand Specific Solutions03 Quantum machine learning for financial prediction

Quantum machine learning algorithms are applied to financial forecasting, utilizing quantum circuits to enhance traditional machine learning techniques. These methods can potentially handle larger datasets and more complex patterns in financial markets, leading to more accurate predictions of market trends and asset valuations.Expand Specific Solutions04 Quantum-inspired optimization for portfolio management

Quantum-inspired algorithms are developed for optimizing financial portfolios. These techniques draw inspiration from quantum mechanics principles to solve complex optimization problems in portfolio allocation and risk management, potentially outperforming classical optimization methods in terms of efficiency and solution quality.Expand Specific Solutions05 Quantum encryption for secure financial transactions

Quantum encryption techniques are integrated into financial forecasting and transaction systems to enhance security. These methods leverage quantum key distribution and other quantum cryptographic protocols to protect sensitive financial data and communications, ensuring the integrity and confidentiality of financial forecasts and transactions.Expand Specific Solutions

Key Players in Quantum Finance

The quantum computing landscape for financial forecasting is evolving rapidly, with the market in its early growth stage. Major tech giants like Google, IBM, and Intel are leading the charge, investing heavily in quantum hardware and software development. Startups such as Zapata Computing and Multiverse Computing are focusing on quantum algorithms for finance. The market size is expanding, driven by the potential for quantum computers to revolutionize risk assessment, portfolio optimization, and fraud detection. However, the technology is still in its nascent stage, with limited practical applications. Companies like Origin Quantum and IQM are working on improving qubit stability and scalability, crucial for financial modeling. As the technology matures, we can expect increased adoption in the financial sector.

Google LLC

Technical Solution: Google's approach to quantum computing for financial forecasting leverages its Sycamore quantum processor, which has demonstrated quantum supremacy[1]. The company is developing quantum algorithms specifically tailored for financial modeling, including quantum Monte Carlo methods for risk assessment and portfolio optimization[2]. Google's quantum neural networks are being adapted to predict market trends and asset prices with potentially higher accuracy than classical models[3]. The company is also exploring quantum-inspired algorithms that can run on classical hardware, providing a bridge between current systems and future quantum computers[4].

Strengths: Access to vast computational resources, cutting-edge quantum hardware, and a strong research team. Weaknesses: Still in early stages of practical financial applications, and full-scale quantum computers are not yet available for commercial use.

Amazon Technologies, Inc.

Technical Solution: Amazon's approach to quantum computing in financial forecasting is centered around its Amazon Braket service, which provides access to various quantum hardware and simulators[9]. The company is developing hybrid quantum-classical algorithms for portfolio optimization and risk management, leveraging both quantum and classical resources[10]. Amazon is also exploring quantum annealing techniques for solving complex optimization problems in finance, such as asset allocation and trading strategy optimization[11]. Their focus on cloud-based quantum computing services allows financial institutions to experiment with quantum algorithms without significant hardware investments[12].

Strengths: Strong cloud infrastructure, access to multiple quantum hardware providers, and a growing ecosystem of financial services. Weaknesses: Reliance on third-party quantum hardware may limit control over hardware development and optimization.

Core Quantum Innovations for Financial Modeling

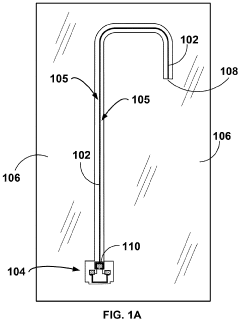

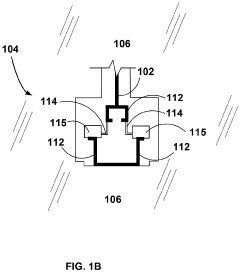

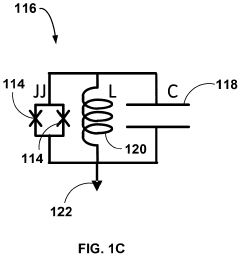

Programmable universal quantum annealing with co-planar waveguide flux qubits

PatentWO2017105429A1

Innovation

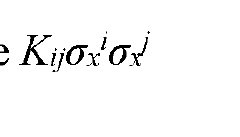

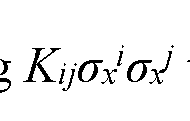

- The use of co-planar waveguide flux qubits with superconducting quantum interference devices (SQUIDs) and elongated thin film superconductor waveguides allows for full connectivity and extended decoherence times by enabling inductive coupling and reducing sources of decoherence through simplified material layers.

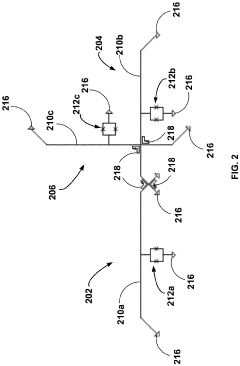

Coupling architectures for superconducting flux qubits

PatentPendingEP4307181A1

Innovation

- The proposed solution involves a lattice structure of qubits with offset arrays and inductive couplers, allowing for higher qubit density and greater interconnectedness through c-way coupling, with each qubit being offset relative to its neighbors, and the use of co-planar waveguide flux qubits with superconducting quantum interference devices (SQUIDs) for enhanced tunable interactions.

Regulatory Implications for Quantum Finance

The integration of quantum computing into financial forecasting models brings forth significant regulatory implications that demand careful consideration. As this transformative technology reshapes the landscape of financial analysis, regulatory bodies face the challenge of adapting existing frameworks to address the unique characteristics and potential risks associated with quantum-enhanced financial models.

One of the primary regulatory concerns is the need for transparency and explainability in quantum-powered financial forecasting models. Traditional regulatory approaches often rely on the ability to audit and understand the decision-making processes of financial models. However, the inherent complexity and probabilistic nature of quantum algorithms may pose challenges in providing clear explanations for model outputs. Regulators will need to develop new methodologies and standards to ensure that quantum-enhanced models remain transparent and accountable.

Data privacy and security represent another critical area of regulatory focus. Quantum computing's ability to process vast amounts of data at unprecedented speeds raises concerns about the protection of sensitive financial information. Regulatory bodies must establish robust guidelines for data handling, encryption, and access control in quantum finance applications. This may include the development of quantum-resistant cryptographic protocols to safeguard financial data from potential quantum-enabled attacks.

The potential for quantum computing to disrupt existing market dynamics also necessitates regulatory attention. As quantum-enhanced forecasting models provide more accurate predictions and faster execution of trades, there is a risk of exacerbating market volatility or creating unfair advantages for those with access to quantum technologies. Regulators may need to implement measures to ensure fair market practices and prevent the concentration of power among a select few quantum-enabled financial institutions.

Furthermore, the global nature of financial markets requires international cooperation in developing regulatory frameworks for quantum finance. Harmonizing regulations across jurisdictions will be crucial to prevent regulatory arbitrage and ensure a level playing field for all market participants. This may involve the establishment of international working groups or task forces dedicated to addressing the regulatory challenges posed by quantum computing in finance.

Lastly, regulators must consider the implications of quantum computing on systemic risk and financial stability. The increased accuracy and speed of quantum-enhanced forecasting models could potentially amplify market reactions and lead to more rapid propagation of financial shocks. Regulatory bodies will need to develop new stress-testing methodologies and risk assessment frameworks that account for the unique characteristics of quantum-powered financial models.

One of the primary regulatory concerns is the need for transparency and explainability in quantum-powered financial forecasting models. Traditional regulatory approaches often rely on the ability to audit and understand the decision-making processes of financial models. However, the inherent complexity and probabilistic nature of quantum algorithms may pose challenges in providing clear explanations for model outputs. Regulators will need to develop new methodologies and standards to ensure that quantum-enhanced models remain transparent and accountable.

Data privacy and security represent another critical area of regulatory focus. Quantum computing's ability to process vast amounts of data at unprecedented speeds raises concerns about the protection of sensitive financial information. Regulatory bodies must establish robust guidelines for data handling, encryption, and access control in quantum finance applications. This may include the development of quantum-resistant cryptographic protocols to safeguard financial data from potential quantum-enabled attacks.

The potential for quantum computing to disrupt existing market dynamics also necessitates regulatory attention. As quantum-enhanced forecasting models provide more accurate predictions and faster execution of trades, there is a risk of exacerbating market volatility or creating unfair advantages for those with access to quantum technologies. Regulators may need to implement measures to ensure fair market practices and prevent the concentration of power among a select few quantum-enabled financial institutions.

Furthermore, the global nature of financial markets requires international cooperation in developing regulatory frameworks for quantum finance. Harmonizing regulations across jurisdictions will be crucial to prevent regulatory arbitrage and ensure a level playing field for all market participants. This may involve the establishment of international working groups or task forces dedicated to addressing the regulatory challenges posed by quantum computing in finance.

Lastly, regulators must consider the implications of quantum computing on systemic risk and financial stability. The increased accuracy and speed of quantum-enhanced forecasting models could potentially amplify market reactions and lead to more rapid propagation of financial shocks. Regulatory bodies will need to develop new stress-testing methodologies and risk assessment frameworks that account for the unique characteristics of quantum-powered financial models.

Quantum Computing Infrastructure for Finance

The quantum computing infrastructure for finance is rapidly evolving, offering unprecedented computational power to tackle complex financial forecasting models. This infrastructure comprises both hardware and software components specifically designed to leverage quantum mechanics principles for financial applications. At the hardware level, quantum computers utilize qubits, which can exist in multiple states simultaneously, enabling parallel processing of vast amounts of data. Leading quantum hardware providers like IBM, Google, and D-Wave are developing increasingly stable and scalable quantum systems tailored for financial use cases.

On the software front, quantum algorithms and frameworks are being developed to harness the potential of quantum hardware for financial modeling. Quantum machine learning algorithms, such as quantum support vector machines and quantum neural networks, are being adapted for financial forecasting tasks. These algorithms can potentially process high-dimensional financial data more efficiently than classical counterparts. Additionally, quantum-inspired optimization algorithms are being implemented to solve complex portfolio optimization problems and risk management scenarios.

Cloud-based quantum computing services are emerging as a crucial component of the quantum infrastructure for finance. Major cloud providers like Amazon Web Services, Microsoft Azure, and IBM Quantum are offering quantum computing as a service, allowing financial institutions to access quantum resources without significant upfront investments. These platforms provide integrated development environments, quantum circuit designers, and simulation tools that enable financial analysts to experiment with quantum algorithms and assess their potential impact on forecasting models.

Quantum-classical hybrid systems are also gaining traction in the financial sector. These systems combine the strengths of both quantum and classical computing paradigms, allowing for seamless integration of quantum algorithms into existing financial modeling workflows. Hybrid approaches are particularly useful for near-term applications, as they can leverage the power of quantum computing for specific computationally intensive tasks while relying on classical systems for other parts of the financial analysis pipeline.

As the quantum computing infrastructure for finance continues to mature, we can expect to see more specialized quantum hardware and software solutions tailored to the unique requirements of financial forecasting. This may include quantum-enhanced data preprocessing techniques, quantum-resistant cryptography for secure financial transactions, and quantum-powered real-time market analysis tools. The ongoing development of this infrastructure is paving the way for a new era of financial modeling, where quantum computing could potentially revolutionize the accuracy and speed of financial forecasts, risk assessments, and investment strategies.

On the software front, quantum algorithms and frameworks are being developed to harness the potential of quantum hardware for financial modeling. Quantum machine learning algorithms, such as quantum support vector machines and quantum neural networks, are being adapted for financial forecasting tasks. These algorithms can potentially process high-dimensional financial data more efficiently than classical counterparts. Additionally, quantum-inspired optimization algorithms are being implemented to solve complex portfolio optimization problems and risk management scenarios.

Cloud-based quantum computing services are emerging as a crucial component of the quantum infrastructure for finance. Major cloud providers like Amazon Web Services, Microsoft Azure, and IBM Quantum are offering quantum computing as a service, allowing financial institutions to access quantum resources without significant upfront investments. These platforms provide integrated development environments, quantum circuit designers, and simulation tools that enable financial analysts to experiment with quantum algorithms and assess their potential impact on forecasting models.

Quantum-classical hybrid systems are also gaining traction in the financial sector. These systems combine the strengths of both quantum and classical computing paradigms, allowing for seamless integration of quantum algorithms into existing financial modeling workflows. Hybrid approaches are particularly useful for near-term applications, as they can leverage the power of quantum computing for specific computationally intensive tasks while relying on classical systems for other parts of the financial analysis pipeline.

As the quantum computing infrastructure for finance continues to mature, we can expect to see more specialized quantum hardware and software solutions tailored to the unique requirements of financial forecasting. This may include quantum-enhanced data preprocessing techniques, quantum-resistant cryptography for secure financial transactions, and quantum-powered real-time market analysis tools. The ongoing development of this infrastructure is paving the way for a new era of financial modeling, where quantum computing could potentially revolutionize the accuracy and speed of financial forecasts, risk assessments, and investment strategies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!