Quantum Algorithms for Effective Risk Management Strategies

JUL 17, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Quantum Risk Management Evolution and Objectives

Quantum risk management has emerged as a cutting-edge field at the intersection of quantum computing and financial risk assessment. The evolution of this domain can be traced back to the early 2000s when researchers began exploring the potential of quantum algorithms to enhance computational finance. As classical risk management strategies faced limitations in handling complex financial models and large datasets, the need for more sophisticated approaches became apparent.

The primary objective of quantum risk management is to leverage the unique properties of quantum systems, such as superposition and entanglement, to develop more efficient and accurate risk assessment methodologies. These quantum-enhanced techniques aim to address the shortcomings of traditional risk management tools, particularly in areas such as portfolio optimization, option pricing, and Monte Carlo simulations.

One of the key milestones in the evolution of quantum risk management was the development of quantum algorithms for solving linear systems of equations, such as the HHL algorithm proposed by Harrow, Hassidim, and Lloyd in 2009. This breakthrough opened up new possibilities for quantum-accelerated financial modeling and risk analysis.

As quantum hardware capabilities have improved, the focus has shifted towards creating practical quantum algorithms tailored for specific risk management tasks. For instance, researchers have made significant progress in developing quantum-inspired algorithms for credit risk assessment, market risk analysis, and operational risk management.

The objectives of quantum risk management extend beyond mere computational speed-up. They encompass the development of more accurate risk models, the ability to process larger and more complex datasets, and the exploration of previously intractable financial scenarios. By harnessing the power of quantum computing, financial institutions aim to gain a competitive edge in risk assessment and decision-making processes.

Another crucial objective is the integration of quantum risk management techniques with existing classical systems. This hybrid approach seeks to leverage the strengths of both quantum and classical computing paradigms, creating a seamless workflow that can be gradually adopted by financial institutions.

As the field continues to evolve, researchers and industry practitioners are working towards creating standardized frameworks and benchmarks for quantum risk management. These efforts aim to facilitate the comparison of different quantum algorithms and assess their practical impact on real-world financial risk scenarios.

Looking ahead, the long-term goal of quantum risk management is to revolutionize the financial industry's approach to risk assessment and mitigation. By enabling more accurate predictions, faster computations, and deeper insights into complex financial systems, quantum algorithms have the potential to enhance overall market stability and resilience.

The primary objective of quantum risk management is to leverage the unique properties of quantum systems, such as superposition and entanglement, to develop more efficient and accurate risk assessment methodologies. These quantum-enhanced techniques aim to address the shortcomings of traditional risk management tools, particularly in areas such as portfolio optimization, option pricing, and Monte Carlo simulations.

One of the key milestones in the evolution of quantum risk management was the development of quantum algorithms for solving linear systems of equations, such as the HHL algorithm proposed by Harrow, Hassidim, and Lloyd in 2009. This breakthrough opened up new possibilities for quantum-accelerated financial modeling and risk analysis.

As quantum hardware capabilities have improved, the focus has shifted towards creating practical quantum algorithms tailored for specific risk management tasks. For instance, researchers have made significant progress in developing quantum-inspired algorithms for credit risk assessment, market risk analysis, and operational risk management.

The objectives of quantum risk management extend beyond mere computational speed-up. They encompass the development of more accurate risk models, the ability to process larger and more complex datasets, and the exploration of previously intractable financial scenarios. By harnessing the power of quantum computing, financial institutions aim to gain a competitive edge in risk assessment and decision-making processes.

Another crucial objective is the integration of quantum risk management techniques with existing classical systems. This hybrid approach seeks to leverage the strengths of both quantum and classical computing paradigms, creating a seamless workflow that can be gradually adopted by financial institutions.

As the field continues to evolve, researchers and industry practitioners are working towards creating standardized frameworks and benchmarks for quantum risk management. These efforts aim to facilitate the comparison of different quantum algorithms and assess their practical impact on real-world financial risk scenarios.

Looking ahead, the long-term goal of quantum risk management is to revolutionize the financial industry's approach to risk assessment and mitigation. By enabling more accurate predictions, faster computations, and deeper insights into complex financial systems, quantum algorithms have the potential to enhance overall market stability and resilience.

Market Demand for Quantum-Enhanced Risk Strategies

The market demand for quantum-enhanced risk management strategies is rapidly growing as financial institutions, insurance companies, and other risk-sensitive industries seek more sophisticated tools to navigate increasingly complex and volatile markets. Traditional risk management approaches often struggle to capture the intricate interdependencies and non-linear relationships inherent in modern financial systems, creating a significant opportunity for quantum algorithms to address these limitations.

Financial institutions are particularly interested in leveraging quantum computing to improve their risk assessment and mitigation capabilities. The potential for quantum algorithms to analyze vast amounts of data and simulate complex scenarios in real-time is highly attractive to banks, hedge funds, and asset managers. These organizations are looking to quantum-enhanced strategies to gain a competitive edge in areas such as portfolio optimization, fraud detection, and credit risk assessment.

Insurance companies are another key market segment driving demand for quantum-enhanced risk management. The ability of quantum algorithms to model complex, multi-variable systems could revolutionize actuarial science, enabling more accurate pricing of insurance products and better management of long-term risks. This is particularly relevant in areas such as climate risk assessment and catastrophe modeling, where traditional methods often fall short.

Regulatory pressures are also contributing to the growing market demand for quantum-enhanced risk strategies. As financial regulations become more stringent and complex, institutions are seeking more advanced tools to ensure compliance and demonstrate robust risk management practices. Quantum algorithms offer the potential to perform more comprehensive stress tests and scenario analyses, helping organizations meet regulatory requirements more effectively.

The energy sector is emerging as another significant market for quantum-enhanced risk management. With the increasing complexity of global energy markets and the transition to renewable sources, energy companies are looking to quantum computing to better model supply and demand dynamics, optimize resource allocation, and manage price volatility risks.

Government agencies and central banks are also showing interest in quantum-enhanced risk strategies, particularly for macroeconomic modeling and systemic risk assessment. The ability to simulate complex economic scenarios with greater accuracy could significantly improve policy-making and financial stability efforts.

As awareness of quantum computing's potential grows, we are seeing increased investment in research and development of quantum algorithms for risk management. This is driving a nascent but rapidly expanding ecosystem of quantum software startups, hardware providers, and consulting firms specializing in quantum-enhanced financial solutions.

Financial institutions are particularly interested in leveraging quantum computing to improve their risk assessment and mitigation capabilities. The potential for quantum algorithms to analyze vast amounts of data and simulate complex scenarios in real-time is highly attractive to banks, hedge funds, and asset managers. These organizations are looking to quantum-enhanced strategies to gain a competitive edge in areas such as portfolio optimization, fraud detection, and credit risk assessment.

Insurance companies are another key market segment driving demand for quantum-enhanced risk management. The ability of quantum algorithms to model complex, multi-variable systems could revolutionize actuarial science, enabling more accurate pricing of insurance products and better management of long-term risks. This is particularly relevant in areas such as climate risk assessment and catastrophe modeling, where traditional methods often fall short.

Regulatory pressures are also contributing to the growing market demand for quantum-enhanced risk strategies. As financial regulations become more stringent and complex, institutions are seeking more advanced tools to ensure compliance and demonstrate robust risk management practices. Quantum algorithms offer the potential to perform more comprehensive stress tests and scenario analyses, helping organizations meet regulatory requirements more effectively.

The energy sector is emerging as another significant market for quantum-enhanced risk management. With the increasing complexity of global energy markets and the transition to renewable sources, energy companies are looking to quantum computing to better model supply and demand dynamics, optimize resource allocation, and manage price volatility risks.

Government agencies and central banks are also showing interest in quantum-enhanced risk strategies, particularly for macroeconomic modeling and systemic risk assessment. The ability to simulate complex economic scenarios with greater accuracy could significantly improve policy-making and financial stability efforts.

As awareness of quantum computing's potential grows, we are seeing increased investment in research and development of quantum algorithms for risk management. This is driving a nascent but rapidly expanding ecosystem of quantum software startups, hardware providers, and consulting firms specializing in quantum-enhanced financial solutions.

Quantum Algorithm Challenges in Risk Management

Quantum algorithms for risk management face several significant challenges that hinder their widespread adoption and practical implementation. One of the primary obstacles is the current limitations of quantum hardware. Despite rapid advancements in quantum computing technology, the available quantum processors still lack the necessary qubit count and coherence times to handle complex risk management calculations effectively. This hardware constraint restricts the scale and complexity of quantum algorithms that can be executed in real-world scenarios.

Another major challenge lies in the development of quantum-resistant cryptography. As quantum computers become more powerful, they pose a potential threat to existing cryptographic systems used in financial transactions and risk management processes. The industry must invest in developing and implementing new cryptographic methods that can withstand attacks from quantum computers to ensure the security and integrity of sensitive financial data.

The integration of quantum algorithms with classical risk management systems presents a significant hurdle. Many financial institutions have invested heavily in traditional risk management infrastructure, and transitioning to quantum-based solutions requires substantial modifications to existing systems. This integration challenge is compounded by the need for hybrid quantum-classical approaches, as pure quantum solutions are not yet feasible for all aspects of risk management.

The lack of standardization in quantum algorithm development for risk management is another critical issue. Without established industry standards, it becomes difficult for financial institutions to compare and evaluate different quantum approaches, leading to fragmentation in the field and potential incompatibility between systems.

Furthermore, the shortage of skilled professionals with expertise in both quantum computing and risk management presents a significant workforce challenge. The interdisciplinary nature of quantum algorithms for risk management requires individuals with a unique skill set, combining knowledge of quantum physics, computer science, and financial risk analysis. This talent gap slows down the development and implementation of quantum solutions in the financial sector.

Lastly, the inherent uncertainty and probabilistic nature of quantum systems pose challenges in ensuring the reliability and reproducibility of risk management results. Financial institutions require consistent and verifiable outcomes for regulatory compliance and decision-making purposes. Addressing this challenge requires the development of robust error correction techniques and validation methods specifically tailored for quantum risk management algorithms.

Another major challenge lies in the development of quantum-resistant cryptography. As quantum computers become more powerful, they pose a potential threat to existing cryptographic systems used in financial transactions and risk management processes. The industry must invest in developing and implementing new cryptographic methods that can withstand attacks from quantum computers to ensure the security and integrity of sensitive financial data.

The integration of quantum algorithms with classical risk management systems presents a significant hurdle. Many financial institutions have invested heavily in traditional risk management infrastructure, and transitioning to quantum-based solutions requires substantial modifications to existing systems. This integration challenge is compounded by the need for hybrid quantum-classical approaches, as pure quantum solutions are not yet feasible for all aspects of risk management.

The lack of standardization in quantum algorithm development for risk management is another critical issue. Without established industry standards, it becomes difficult for financial institutions to compare and evaluate different quantum approaches, leading to fragmentation in the field and potential incompatibility between systems.

Furthermore, the shortage of skilled professionals with expertise in both quantum computing and risk management presents a significant workforce challenge. The interdisciplinary nature of quantum algorithms for risk management requires individuals with a unique skill set, combining knowledge of quantum physics, computer science, and financial risk analysis. This talent gap slows down the development and implementation of quantum solutions in the financial sector.

Lastly, the inherent uncertainty and probabilistic nature of quantum systems pose challenges in ensuring the reliability and reproducibility of risk management results. Financial institutions require consistent and verifiable outcomes for regulatory compliance and decision-making purposes. Addressing this challenge requires the development of robust error correction techniques and validation methods specifically tailored for quantum risk management algorithms.

Current Quantum Algorithms for Risk Assessment

01 Quantum-enhanced risk assessment algorithms

Quantum algorithms are applied to enhance risk assessment processes in financial and business contexts. These algorithms leverage quantum computing capabilities to analyze complex risk factors, improve prediction accuracy, and optimize decision-making in risk management scenarios.- Quantum-enhanced risk assessment algorithms: Quantum algorithms are applied to enhance risk assessment processes in financial and business contexts. These algorithms leverage quantum computing capabilities to analyze complex risk factors, perform scenario simulations, and provide more accurate risk predictions compared to classical methods. This approach enables organizations to make better-informed decisions in risk management strategies.

- Quantum-inspired optimization for portfolio management: Quantum-inspired algorithms are utilized to optimize portfolio management and asset allocation in financial risk management. These techniques aim to improve the efficiency of portfolio diversification, risk-return trade-offs, and overall investment strategies. By leveraging quantum principles, these methods can potentially outperform traditional optimization approaches in handling complex financial scenarios.

- Quantum machine learning for fraud detection and cybersecurity: Quantum machine learning algorithms are applied to enhance fraud detection capabilities and improve cybersecurity measures. These advanced algorithms can process and analyze large datasets more efficiently, identifying patterns and anomalies that may indicate fraudulent activities or security threats. This approach aims to strengthen risk management practices in digital environments and financial systems.

- Quantum-assisted Monte Carlo simulations for risk modeling: Quantum algorithms are employed to enhance Monte Carlo simulations used in risk modeling and analysis. By leveraging quantum computing capabilities, these simulations can process more complex scenarios and larger datasets, providing more accurate risk assessments and predictions. This approach is particularly useful in fields such as insurance, finance, and environmental risk management.

- Quantum encryption for secure risk data management: Quantum encryption techniques are utilized to enhance the security of sensitive risk management data and communications. These methods leverage quantum key distribution and other quantum-based cryptographic approaches to protect against potential security breaches and ensure the integrity of risk-related information. This technology is crucial for maintaining confidentiality in risk management processes across various industries.

02 Quantum-inspired classical algorithms for risk management

This approach involves developing classical algorithms inspired by quantum principles to address risk management challenges. These algorithms aim to provide improved performance in risk analysis and mitigation strategies without requiring actual quantum hardware.Expand Specific Solutions03 Quantum machine learning for financial risk modeling

Quantum machine learning techniques are applied to financial risk modeling, enabling more accurate predictions of market trends, credit risks, and investment outcomes. This approach combines quantum computing with machine learning algorithms to process and analyze large volumes of financial data.Expand Specific Solutions04 Quantum-secure cryptography for risk data protection

Quantum-resistant cryptographic methods are developed to protect sensitive risk management data and communications. These techniques aim to secure risk-related information against potential threats posed by future quantum computing capabilities.Expand Specific Solutions05 Hybrid quantum-classical systems for comprehensive risk analysis

This approach combines quantum and classical computing resources to create hybrid systems for risk analysis. These systems leverage the strengths of both quantum and classical algorithms to provide comprehensive risk assessment and management solutions across various industries.Expand Specific Solutions

Key Players in Quantum Finance and Risk Management

The quantum algorithms for effective risk management strategies market is in its early development stage, characterized by rapid technological advancements and growing interest from financial institutions. The market size is expanding, driven by the increasing need for sophisticated risk management tools in the finance sector. While the technology is still maturing, major players like IBM, Google, and JPMorgan Chase are investing heavily in quantum computing research and development. Startups such as Zapata Computing and Arqit are also making significant contributions, focusing on specialized quantum algorithms for risk management. The competitive landscape is dynamic, with both established tech giants and innovative startups vying for market share in this emerging field.

International Business Machines Corp.

Technical Solution: IBM has developed a quantum algorithm for risk management that leverages quantum amplitude estimation to achieve quadratic speedup over classical Monte Carlo methods[1]. Their approach uses Quantum Phase Estimation (QPE) to estimate financial risk metrics such as Value at Risk (VaR) and Conditional Value at Risk (CVaR) with significantly fewer samples than classical methods[2]. IBM's quantum risk analysis framework integrates with Qiskit, their open-source quantum computing software development kit, allowing for seamless implementation on various quantum hardware[3]. The algorithm demonstrates particular efficiency in high-dimensional problems, such as portfolio optimization with many assets, where classical methods struggle due to the curse of dimensionality[4].

Strengths: Quadratic speedup over classical methods, integration with established quantum software ecosystem, efficiency in high-dimensional problems. Weaknesses: Requires fault-tolerant quantum computers for full advantage, limited by current quantum hardware capabilities.

Google LLC

Technical Solution: Google has pioneered quantum algorithms for risk management through their quantum supremacy experiments and the development of the Sycamore processor[5]. Their approach focuses on using quantum random walks and quantum annealing techniques to optimize portfolio selection and risk assessment[6]. Google's quantum risk management strategy incorporates their TensorFlow Quantum framework, allowing for hybrid quantum-classical algorithms that can run on both quantum and classical hardware[7]. They have demonstrated the potential for quantum advantage in Monte Carlo simulations for financial modeling, achieving exponential speedups in certain scenarios[8]. Google's quantum algorithms also explore the use of variational quantum circuits for real-time risk analysis and fraud detection in financial transactions[9].

Strengths: Advanced quantum hardware capabilities, hybrid quantum-classical approach, potential for exponential speedups in financial modeling. Weaknesses: Still in early stages of practical implementation, requires significant scaling of quantum hardware for real-world applications.

Breakthrough Quantum Risk Management Techniques

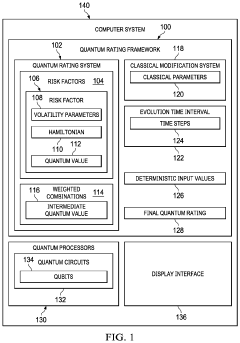

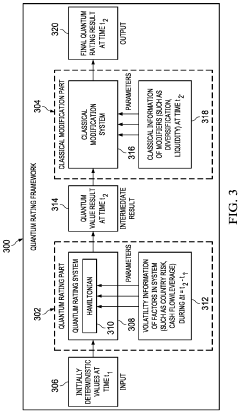

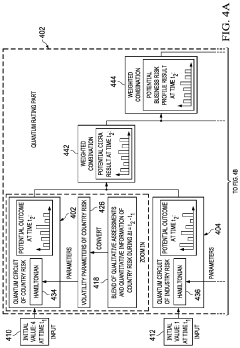

Quantum Rating Framework

PatentPendingUS20230259853A1

Innovation

- A quantum computing-based method that generates stochastic quantum risk values from deterministic input values using N-qubit quantum circuits, combining these values with classical parameters to produce a final quantum risk rating, enabling the processing of complex risk factors and sub-factors in a probabilistic framework.

Cybersecurity quantitative analysis software as a service

PatentInactiveUS20210201229A1

Innovation

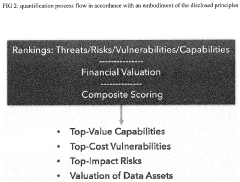

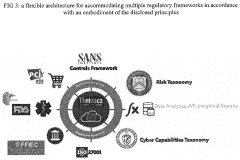

- A mathematical algorithm utilizing Probability Density distributions from real-world data, combined with an unlimited set of cybersecurity evaluation technologies, and multiple regulatory frameworks, to perform comprehensive risk analysis and visualization, incorporating internal and external data sources for refined probability ratings.

Quantum-Classical Hybrid Approaches for Risk

Quantum-classical hybrid approaches for risk management represent a cutting-edge frontier in the field of financial technology. These approaches leverage the strengths of both quantum and classical computing systems to address complex risk assessment and mitigation challenges. By combining the computational power of quantum algorithms with the reliability and accessibility of classical systems, hybrid approaches offer a promising pathway for enhancing risk management strategies.

One key aspect of quantum-classical hybrid approaches is the use of variational quantum algorithms (VQAs) in conjunction with classical optimization techniques. VQAs, such as the Quantum Approximate Optimization Algorithm (QAOA) and Variational Quantum Eigensolver (VQE), can be employed to solve combinatorial optimization problems related to portfolio optimization and risk assessment. These algorithms utilize quantum circuits to prepare and manipulate quantum states, while classical computers handle parameter optimization and result interpretation.

Another significant application of hybrid approaches in risk management is quantum-enhanced Monte Carlo simulations. Traditional Monte Carlo methods are widely used for risk analysis but can be computationally intensive for complex financial models. Quantum algorithms, such as Quantum Amplitude Estimation (QAE), can accelerate certain aspects of Monte Carlo simulations, potentially leading to more accurate risk estimates in shorter timeframes.

Quantum-inspired algorithms represent another important category within hybrid approaches. These algorithms draw inspiration from quantum computing principles but are designed to run on classical hardware. Examples include tensor network methods and quantum-inspired optimization algorithms, which can be applied to risk modeling and portfolio management tasks.

The integration of quantum machine learning techniques with classical data processing pipelines is also gaining traction in risk management. Quantum kernels and quantum feature maps can be used to enhance the performance of classical machine learning models, potentially improving the accuracy of credit risk assessment and fraud detection systems.

Hybrid approaches also extend to the realm of cryptography and cybersecurity, which are crucial aspects of risk management in the digital age. Post-quantum cryptography algorithms, designed to withstand attacks from future quantum computers, are being developed and integrated into existing classical cryptographic systems to ensure long-term data security.

As quantum hardware continues to advance, the synergy between quantum and classical systems in risk management is expected to grow. This evolution will likely lead to more sophisticated hybrid algorithms and architectures, capable of addressing increasingly complex risk scenarios in finance, insurance, and other industries where effective risk management is paramount.

One key aspect of quantum-classical hybrid approaches is the use of variational quantum algorithms (VQAs) in conjunction with classical optimization techniques. VQAs, such as the Quantum Approximate Optimization Algorithm (QAOA) and Variational Quantum Eigensolver (VQE), can be employed to solve combinatorial optimization problems related to portfolio optimization and risk assessment. These algorithms utilize quantum circuits to prepare and manipulate quantum states, while classical computers handle parameter optimization and result interpretation.

Another significant application of hybrid approaches in risk management is quantum-enhanced Monte Carlo simulations. Traditional Monte Carlo methods are widely used for risk analysis but can be computationally intensive for complex financial models. Quantum algorithms, such as Quantum Amplitude Estimation (QAE), can accelerate certain aspects of Monte Carlo simulations, potentially leading to more accurate risk estimates in shorter timeframes.

Quantum-inspired algorithms represent another important category within hybrid approaches. These algorithms draw inspiration from quantum computing principles but are designed to run on classical hardware. Examples include tensor network methods and quantum-inspired optimization algorithms, which can be applied to risk modeling and portfolio management tasks.

The integration of quantum machine learning techniques with classical data processing pipelines is also gaining traction in risk management. Quantum kernels and quantum feature maps can be used to enhance the performance of classical machine learning models, potentially improving the accuracy of credit risk assessment and fraud detection systems.

Hybrid approaches also extend to the realm of cryptography and cybersecurity, which are crucial aspects of risk management in the digital age. Post-quantum cryptography algorithms, designed to withstand attacks from future quantum computers, are being developed and integrated into existing classical cryptographic systems to ensure long-term data security.

As quantum hardware continues to advance, the synergy between quantum and classical systems in risk management is expected to grow. This evolution will likely lead to more sophisticated hybrid algorithms and architectures, capable of addressing increasingly complex risk scenarios in finance, insurance, and other industries where effective risk management is paramount.

Regulatory Framework for Quantum Finance Technologies

The regulatory framework for quantum finance technologies is rapidly evolving to keep pace with the advancements in quantum computing and its applications in the financial sector. As quantum algorithms for effective risk management strategies gain traction, regulatory bodies worldwide are grappling with the need to establish comprehensive guidelines that ensure the responsible and secure implementation of these cutting-edge technologies.

At the forefront of this regulatory landscape is the need to address the unique challenges posed by quantum computing in financial risk management. Regulatory agencies are focusing on developing standards for quantum-resistant cryptography to safeguard sensitive financial data against potential quantum attacks. This includes the development of post-quantum cryptographic algorithms and protocols that can withstand the computational power of quantum computers.

Another key aspect of the regulatory framework is the establishment of guidelines for the validation and verification of quantum algorithms used in risk management. Regulators are working on creating standardized methodologies to assess the accuracy, reliability, and robustness of quantum-based risk models. This includes defining benchmarks and performance metrics specific to quantum algorithms in financial applications.

Data privacy and security regulations are also being adapted to account for the unique characteristics of quantum computing. Regulators are exploring ways to ensure that quantum-enhanced risk management strategies comply with existing data protection laws while addressing new challenges such as quantum-secure data transmission and storage.

The regulatory framework is also addressing the issue of transparency and explainability in quantum-based risk management models. Given the complex nature of quantum algorithms, regulators are emphasizing the need for financial institutions to provide clear explanations of their quantum-enhanced risk assessment methodologies to both regulators and stakeholders.

Collaboration between regulatory bodies, financial institutions, and quantum technology providers is crucial in shaping this framework. International cooperation is being fostered to develop harmonized standards and best practices for the implementation of quantum technologies in finance. This includes efforts to create a common language and understanding of quantum risk management across different jurisdictions.

As the field of quantum finance continues to evolve, regulators are adopting an adaptive approach to keep pace with technological advancements. This includes the establishment of regulatory sandboxes and pilot programs to test and refine quantum-based risk management strategies in controlled environments before wider implementation.

At the forefront of this regulatory landscape is the need to address the unique challenges posed by quantum computing in financial risk management. Regulatory agencies are focusing on developing standards for quantum-resistant cryptography to safeguard sensitive financial data against potential quantum attacks. This includes the development of post-quantum cryptographic algorithms and protocols that can withstand the computational power of quantum computers.

Another key aspect of the regulatory framework is the establishment of guidelines for the validation and verification of quantum algorithms used in risk management. Regulators are working on creating standardized methodologies to assess the accuracy, reliability, and robustness of quantum-based risk models. This includes defining benchmarks and performance metrics specific to quantum algorithms in financial applications.

Data privacy and security regulations are also being adapted to account for the unique characteristics of quantum computing. Regulators are exploring ways to ensure that quantum-enhanced risk management strategies comply with existing data protection laws while addressing new challenges such as quantum-secure data transmission and storage.

The regulatory framework is also addressing the issue of transparency and explainability in quantum-based risk management models. Given the complex nature of quantum algorithms, regulators are emphasizing the need for financial institutions to provide clear explanations of their quantum-enhanced risk assessment methodologies to both regulators and stakeholders.

Collaboration between regulatory bodies, financial institutions, and quantum technology providers is crucial in shaping this framework. International cooperation is being fostered to develop harmonized standards and best practices for the implementation of quantum technologies in finance. This includes efforts to create a common language and understanding of quantum risk management across different jurisdictions.

As the field of quantum finance continues to evolve, regulators are adopting an adaptive approach to keep pace with technological advancements. This includes the establishment of regulatory sandboxes and pilot programs to test and refine quantum-based risk management strategies in controlled environments before wider implementation.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!