Quantum Algorithms for Financial Risk Analysis

JUL 17, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Quantum Finance Background and Objectives

Quantum finance represents a cutting-edge intersection of quantum computing and financial analysis, offering unprecedented potential for revolutionizing risk assessment and management in the financial sector. The field has evolved rapidly over the past decade, driven by advancements in quantum hardware and algorithms. As classical computing approaches the limits of Moore's Law, quantum technologies promise exponential speedups for complex financial calculations.

The primary objective of research on quantum algorithms for financial risk analysis is to develop and implement quantum-based solutions that can outperform classical methods in accuracy, speed, and scalability. This includes tackling computationally intensive tasks such as Monte Carlo simulations, portfolio optimization, and derivative pricing. By leveraging quantum phenomena like superposition and entanglement, these algorithms aim to provide more robust risk models and real-time analysis capabilities.

One of the key drivers behind this research is the increasing complexity of global financial markets and the growing need for sophisticated risk management tools. Traditional risk analysis methods often struggle with high-dimensional problems and non-linear relationships prevalent in modern financial systems. Quantum algorithms offer the potential to handle these challenges more effectively, enabling financial institutions to make more informed decisions and better protect against market volatility.

The development of quantum finance algorithms is closely tied to advances in quantum hardware. As quantum computers become more powerful and stable, the scope of financial problems they can address expands. Current research focuses on both near-term applications using Noisy Intermediate-Scale Quantum (NISQ) devices and long-term solutions that anticipate fault-tolerant quantum computers.

A significant goal in this field is to achieve quantum advantage – the point at which quantum algorithms demonstrably outperform their classical counterparts in practical financial applications. This milestone would mark a paradigm shift in financial risk analysis, potentially leading to more efficient markets, improved regulatory compliance, and enhanced financial stability.

Researchers are also exploring hybrid quantum-classical approaches, recognizing that the most effective solutions may combine the strengths of both computing paradigms. These hybrid models aim to leverage quantum speedups while mitigating the limitations of current quantum hardware, providing a bridge to fully quantum solutions in the future.

The primary objective of research on quantum algorithms for financial risk analysis is to develop and implement quantum-based solutions that can outperform classical methods in accuracy, speed, and scalability. This includes tackling computationally intensive tasks such as Monte Carlo simulations, portfolio optimization, and derivative pricing. By leveraging quantum phenomena like superposition and entanglement, these algorithms aim to provide more robust risk models and real-time analysis capabilities.

One of the key drivers behind this research is the increasing complexity of global financial markets and the growing need for sophisticated risk management tools. Traditional risk analysis methods often struggle with high-dimensional problems and non-linear relationships prevalent in modern financial systems. Quantum algorithms offer the potential to handle these challenges more effectively, enabling financial institutions to make more informed decisions and better protect against market volatility.

The development of quantum finance algorithms is closely tied to advances in quantum hardware. As quantum computers become more powerful and stable, the scope of financial problems they can address expands. Current research focuses on both near-term applications using Noisy Intermediate-Scale Quantum (NISQ) devices and long-term solutions that anticipate fault-tolerant quantum computers.

A significant goal in this field is to achieve quantum advantage – the point at which quantum algorithms demonstrably outperform their classical counterparts in practical financial applications. This milestone would mark a paradigm shift in financial risk analysis, potentially leading to more efficient markets, improved regulatory compliance, and enhanced financial stability.

Researchers are also exploring hybrid quantum-classical approaches, recognizing that the most effective solutions may combine the strengths of both computing paradigms. These hybrid models aim to leverage quantum speedups while mitigating the limitations of current quantum hardware, providing a bridge to fully quantum solutions in the future.

Market Demand for Quantum Financial Risk Analysis

The market demand for quantum algorithms in financial risk analysis has been growing rapidly in recent years, driven by the increasing complexity of financial markets and the need for more sophisticated risk management tools. Financial institutions, including banks, hedge funds, and insurance companies, are actively exploring quantum computing solutions to enhance their risk assessment capabilities and gain a competitive edge.

One of the primary drivers of this demand is the potential for quantum algorithms to significantly improve the accuracy and speed of risk calculations. Traditional risk analysis methods often struggle with the high-dimensional nature of financial data and the complex correlations between different risk factors. Quantum algorithms, leveraging the principles of superposition and entanglement, offer the promise of exponential speedups in processing these complex datasets, potentially revolutionizing risk management practices.

The global financial risk management market, which includes quantum-based solutions, is projected to reach substantial growth in the coming years. This growth is partly attributed to the increasing adoption of advanced technologies like quantum computing in the financial sector. Major financial institutions are investing heavily in quantum research and development, recognizing its potential to transform their risk analysis capabilities.

Another key factor driving market demand is the need for more accurate pricing of complex financial instruments. Quantum algorithms show promise in areas such as Monte Carlo simulations, which are crucial for pricing derivatives and assessing market risks. The ability to perform these simulations more efficiently and accurately could lead to better risk-adjusted pricing and improved portfolio optimization strategies.

Regulatory pressures also contribute to the growing demand for quantum-based risk analysis tools. As financial regulations become more stringent, particularly in the wake of global financial crises, institutions are seeking more robust and comprehensive risk assessment methods. Quantum algorithms offer the potential to meet these regulatory requirements more effectively, providing more accurate stress testing and scenario analysis.

The market is also seeing increased interest from fintech companies and startups specializing in quantum finance. These entities are developing innovative quantum-based solutions for risk analysis, attracting attention from traditional financial institutions and venture capital firms. This trend is expected to further stimulate market growth and innovation in the quantum financial risk analysis sector.

However, it's important to note that the market for quantum algorithms in financial risk analysis is still in its early stages. While the potential is significant, practical implementation faces challenges such as the need for more powerful quantum hardware and the development of industry-specific quantum algorithms. Despite these challenges, the growing investment and research in this field indicate a strong belief in the transformative potential of quantum computing in financial risk management.

One of the primary drivers of this demand is the potential for quantum algorithms to significantly improve the accuracy and speed of risk calculations. Traditional risk analysis methods often struggle with the high-dimensional nature of financial data and the complex correlations between different risk factors. Quantum algorithms, leveraging the principles of superposition and entanglement, offer the promise of exponential speedups in processing these complex datasets, potentially revolutionizing risk management practices.

The global financial risk management market, which includes quantum-based solutions, is projected to reach substantial growth in the coming years. This growth is partly attributed to the increasing adoption of advanced technologies like quantum computing in the financial sector. Major financial institutions are investing heavily in quantum research and development, recognizing its potential to transform their risk analysis capabilities.

Another key factor driving market demand is the need for more accurate pricing of complex financial instruments. Quantum algorithms show promise in areas such as Monte Carlo simulations, which are crucial for pricing derivatives and assessing market risks. The ability to perform these simulations more efficiently and accurately could lead to better risk-adjusted pricing and improved portfolio optimization strategies.

Regulatory pressures also contribute to the growing demand for quantum-based risk analysis tools. As financial regulations become more stringent, particularly in the wake of global financial crises, institutions are seeking more robust and comprehensive risk assessment methods. Quantum algorithms offer the potential to meet these regulatory requirements more effectively, providing more accurate stress testing and scenario analysis.

The market is also seeing increased interest from fintech companies and startups specializing in quantum finance. These entities are developing innovative quantum-based solutions for risk analysis, attracting attention from traditional financial institutions and venture capital firms. This trend is expected to further stimulate market growth and innovation in the quantum financial risk analysis sector.

However, it's important to note that the market for quantum algorithms in financial risk analysis is still in its early stages. While the potential is significant, practical implementation faces challenges such as the need for more powerful quantum hardware and the development of industry-specific quantum algorithms. Despite these challenges, the growing investment and research in this field indicate a strong belief in the transformative potential of quantum computing in financial risk management.

Quantum Computing Challenges in Finance

Quantum computing presents significant challenges in the financial sector, particularly in the realm of risk analysis. The complexity of financial systems, coupled with the need for real-time decision-making, pushes the boundaries of classical computing capabilities. Quantum algorithms offer promising solutions, but their implementation in finance faces several hurdles.

One of the primary challenges is the scalability of quantum systems. Current quantum computers have limited qubit counts, which restricts their ability to handle the vast amounts of data involved in financial risk analysis. While quantum supremacy has been demonstrated for specific problems, achieving practical quantum advantage for complex financial models remains elusive.

Error correction is another critical issue. Quantum states are inherently fragile and susceptible to environmental noise. This poses a significant challenge in maintaining the coherence necessary for accurate financial calculations. Developing robust error correction techniques is essential for reliable quantum computations in finance.

The integration of quantum algorithms with existing financial infrastructure presents another obstacle. Financial institutions have invested heavily in classical computing systems and software. Transitioning to quantum-based solutions requires not only technological advancements but also substantial changes in infrastructure and workforce skills.

Data security and privacy concerns are amplified in the quantum era. While quantum computing offers potential improvements in cryptography, it also threatens current encryption methods. Financial institutions must navigate this double-edged sword, ensuring data protection while leveraging quantum capabilities for risk analysis.

The development of quantum-specific algorithms for financial applications is an ongoing challenge. Many existing quantum algorithms are not directly applicable to financial problems. Researchers must bridge this gap, creating tailored quantum algorithms that address specific financial risk analysis needs while outperforming classical counterparts.

Lastly, the cost and accessibility of quantum computing resources pose significant barriers. Quantum hardware is expensive to develop and maintain, limiting its widespread adoption in the financial sector. Cloud-based quantum services offer a potential solution, but concerns about data privacy and latency persist.

Overcoming these challenges requires collaborative efforts between quantum physicists, computer scientists, and financial experts. As quantum technology evolves, its integration into financial risk analysis will likely occur gradually, with hybrid classical-quantum systems paving the way for full quantum implementations in the future.

One of the primary challenges is the scalability of quantum systems. Current quantum computers have limited qubit counts, which restricts their ability to handle the vast amounts of data involved in financial risk analysis. While quantum supremacy has been demonstrated for specific problems, achieving practical quantum advantage for complex financial models remains elusive.

Error correction is another critical issue. Quantum states are inherently fragile and susceptible to environmental noise. This poses a significant challenge in maintaining the coherence necessary for accurate financial calculations. Developing robust error correction techniques is essential for reliable quantum computations in finance.

The integration of quantum algorithms with existing financial infrastructure presents another obstacle. Financial institutions have invested heavily in classical computing systems and software. Transitioning to quantum-based solutions requires not only technological advancements but also substantial changes in infrastructure and workforce skills.

Data security and privacy concerns are amplified in the quantum era. While quantum computing offers potential improvements in cryptography, it also threatens current encryption methods. Financial institutions must navigate this double-edged sword, ensuring data protection while leveraging quantum capabilities for risk analysis.

The development of quantum-specific algorithms for financial applications is an ongoing challenge. Many existing quantum algorithms are not directly applicable to financial problems. Researchers must bridge this gap, creating tailored quantum algorithms that address specific financial risk analysis needs while outperforming classical counterparts.

Lastly, the cost and accessibility of quantum computing resources pose significant barriers. Quantum hardware is expensive to develop and maintain, limiting its widespread adoption in the financial sector. Cloud-based quantum services offer a potential solution, but concerns about data privacy and latency persist.

Overcoming these challenges requires collaborative efforts between quantum physicists, computer scientists, and financial experts. As quantum technology evolves, its integration into financial risk analysis will likely occur gradually, with hybrid classical-quantum systems paving the way for full quantum implementations in the future.

Current Quantum Approaches for Risk Analysis

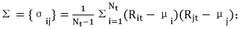

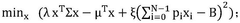

01 Quantum algorithm optimization for risk assessment

This approach focuses on developing and optimizing quantum algorithms specifically for risk analysis in various fields. These algorithms leverage quantum computing's ability to process complex probabilistic models and large datasets more efficiently than classical computers, potentially improving the accuracy and speed of risk assessments.- Quantum algorithm optimization for risk assessment: Quantum algorithms are being developed to optimize risk assessment processes in various fields. These algorithms leverage quantum computing's ability to process complex data sets and perform calculations exponentially faster than classical computers. This approach can lead to more accurate and efficient risk analysis, particularly in financial modeling, cybersecurity, and supply chain management.

- Quantum-resistant cryptography for secure communications: As quantum computers pose potential threats to current encryption methods, research is focused on developing quantum-resistant cryptographic algorithms. These algorithms aim to secure communications and data transfer against potential attacks from quantum computers, ensuring long-term data protection and privacy in the quantum era.

- Quantum machine learning for enhanced risk prediction: Quantum machine learning algorithms are being explored to improve risk prediction models. By combining quantum computing with machine learning techniques, these algorithms can process larger datasets and identify complex patterns more efficiently than classical methods. This approach has potential applications in financial risk management, healthcare diagnostics, and environmental risk assessment.

- Quantum simulation for scenario analysis in risk management: Quantum simulators are being developed to perform complex scenario analyses in risk management. These simulators can model intricate systems and their interactions, allowing for more accurate predictions of potential risks and their impacts. This technology has applications in climate risk assessment, financial market modeling, and supply chain risk analysis.

- Hybrid quantum-classical algorithms for risk mitigation strategies: Researchers are developing hybrid quantum-classical algorithms to create more effective risk mitigation strategies. These algorithms combine the strengths of quantum computing in solving certain types of problems with the reliability and accessibility of classical computing systems. This approach can lead to more robust risk management solutions across various industries, including finance, healthcare, and cybersecurity.

02 Quantum-enhanced cybersecurity risk analysis

This method involves using quantum algorithms to enhance cybersecurity risk analysis. It includes techniques for identifying vulnerabilities in cryptographic systems, assessing the potential impact of quantum attacks, and developing quantum-resistant security protocols to mitigate risks in the post-quantum era.Expand Specific Solutions03 Quantum machine learning for financial risk analysis

This approach combines quantum computing with machine learning techniques to analyze and predict financial risks. It involves developing quantum algorithms that can process and analyze large volumes of financial data, potentially offering more accurate risk assessments and predictions in areas such as market volatility, credit risk, and fraud detection.Expand Specific Solutions04 Quantum simulation for environmental and climate risk analysis

This method utilizes quantum algorithms to simulate complex environmental systems and climate models. By leveraging quantum computing's ability to handle multi-variable systems, it aims to provide more accurate predictions of environmental risks, climate change impacts, and potential mitigation strategies.Expand Specific Solutions05 Hybrid quantum-classical approaches for comprehensive risk analysis

This strategy combines quantum and classical computing techniques to create a comprehensive risk analysis framework. It involves developing algorithms that can leverage the strengths of both quantum and classical systems, potentially offering a more robust and versatile approach to risk assessment across various domains.Expand Specific Solutions

Key Players in Quantum Finance

The quantum algorithms for financial risk analysis market is in an early growth stage, characterized by increasing research and development efforts. While the market size is still relatively small, it is expected to expand rapidly as financial institutions recognize the potential of quantum computing to revolutionize risk assessment. The technology is still in its nascent stages, with varying levels of maturity among key players. Companies like IBM, Origin Quantum, and Zapata Computing are at the forefront, developing quantum hardware and software solutions. Traditional financial institutions such as ICBC, Wells Fargo, and JP Morgan Chase are exploring quantum applications, while specialized firms like Arx Nimbus and Arqit are focusing on quantum-enhanced cybersecurity for finance. As the technology matures, collaboration between quantum tech companies and financial institutions is likely to intensify, driving innovation and market growth.

Origin Quantum Computing Technology (Hefei) Co., Ltd.

Technical Solution: Origin Quantum, a leading Chinese quantum computing company, has been actively researching quantum algorithms for financial applications, including risk analysis. The company has developed a quantum computing platform that supports the implementation of quantum algorithms for financial modeling and risk assessment[15]. Origin Quantum's research focuses on quantum machine learning techniques for credit risk analysis and fraud detection in the financial sector[16]. They have also explored quantum-enhanced Monte Carlo methods for more efficient risk calculations in complex financial instruments[17]. The company collaborates with Chinese financial institutions to test and validate their quantum algorithms in real-world scenarios[18].

Strengths: Strong government support for quantum research in China, growing ecosystem of quantum technologies, focus on practical applications in finance. Weaknesses: Potential limitations in international collaborations due to geopolitical factors, less established presence in global financial markets compared to Western competitors.

International Business Machines Corp.

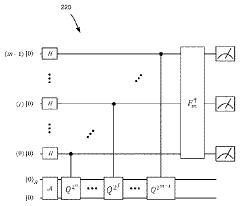

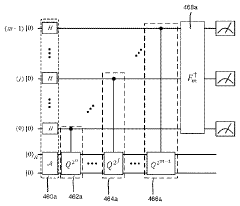

Technical Solution: IBM has developed quantum algorithms specifically tailored for financial risk analysis. Their approach utilizes Quantum Amplitude Estimation (QAE) to accelerate Monte Carlo simulations, which are crucial for risk assessment in finance[1]. IBM's quantum risk analysis solution can potentially achieve quadratic speedup compared to classical methods, significantly reducing computation time for complex financial models[2]. The company has also implemented these algorithms on their quantum hardware, demonstrating practical applications in portfolio optimization and option pricing[3]. IBM's quantum finance team collaborates with major financial institutions to refine and validate their quantum algorithms for real-world scenarios[4].

Strengths: Industry-leading quantum hardware and software stack, extensive partnerships with financial institutions, proven speedup in financial simulations. Weaknesses: Limited quantum hardware scale currently available, potential for near-term advantage still debated in some financial applications.

Breakthrough Quantum Algorithms for Finance

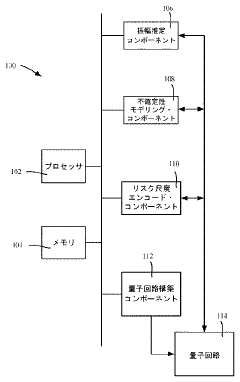

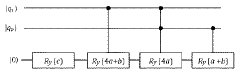

Quantum circuit risk analysis

PatentActiveJP2021531535A

Innovation

- Utilizing quantum circuits to model uncertainty and encode risk measures, enabling amplitude estimation to extract probability values for risk measures such as expected value, variance, and conditional value-at-risk, achieving a quadratic speedup over classical methods.

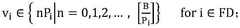

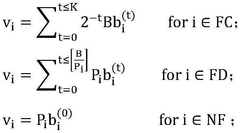

Method and device for processing combinatorial optimization problem, computer storage medium and terminal

PatentPendingCN118674555A

Innovation

- The discretized Markowitz model is used to construct a binary objective function by calculating the covariance matrix and mean value, and solve it using a quantum computer or a classical computer to achieve the acquisition of combinatorial optimization information.

Quantum-Classical Hybrid Solutions

Quantum-classical hybrid solutions represent a promising approach in the field of financial risk analysis, combining the strengths of both quantum and classical computing paradigms. These hybrid systems leverage quantum algorithms for specific computational tasks while utilizing classical computers for pre-processing, post-processing, and overall control of the workflow.

In the context of financial risk analysis, quantum-classical hybrid solutions offer several advantages. Quantum algorithms can efficiently handle complex optimization problems and large-scale simulations, which are crucial for accurate risk assessment. Meanwhile, classical computers excel at data management, user interfaces, and integration with existing financial systems.

One key application of hybrid solutions in financial risk analysis is portfolio optimization. Quantum algorithms, such as the Quantum Approximate Optimization Algorithm (QAOA), can be used to solve quadratic optimization problems associated with portfolio selection. The quantum component focuses on finding optimal asset allocations, while classical algorithms handle data preparation and result interpretation.

Another important area is Monte Carlo simulations for risk assessment. Quantum algorithms can accelerate these simulations by leveraging quantum parallelism to explore multiple scenarios simultaneously. Classical computers manage the overall simulation process and analyze the results to derive risk metrics.

Hybrid solutions also show promise in credit risk modeling. Quantum machine learning algorithms can be employed to improve the accuracy of credit scoring models, while classical systems handle data preprocessing and model deployment.

Implementing quantum-classical hybrid solutions for financial risk analysis presents several challenges. These include the need for seamless integration between quantum and classical components, managing the limitations of current quantum hardware, and ensuring the reliability and accuracy of results.

To address these challenges, researchers are developing robust frameworks for hybrid quantum-classical computing. These frameworks aim to optimize the allocation of tasks between quantum and classical resources, manage quantum error correction, and provide scalable interfaces for financial applications.

As quantum hardware continues to advance, the potential of hybrid solutions in financial risk analysis is expected to grow. Future developments may include more sophisticated quantum algorithms tailored for specific financial risk scenarios, improved quantum-classical interfaces, and enhanced error mitigation techniques to increase the reliability of hybrid systems in real-world financial applications.

In the context of financial risk analysis, quantum-classical hybrid solutions offer several advantages. Quantum algorithms can efficiently handle complex optimization problems and large-scale simulations, which are crucial for accurate risk assessment. Meanwhile, classical computers excel at data management, user interfaces, and integration with existing financial systems.

One key application of hybrid solutions in financial risk analysis is portfolio optimization. Quantum algorithms, such as the Quantum Approximate Optimization Algorithm (QAOA), can be used to solve quadratic optimization problems associated with portfolio selection. The quantum component focuses on finding optimal asset allocations, while classical algorithms handle data preparation and result interpretation.

Another important area is Monte Carlo simulations for risk assessment. Quantum algorithms can accelerate these simulations by leveraging quantum parallelism to explore multiple scenarios simultaneously. Classical computers manage the overall simulation process and analyze the results to derive risk metrics.

Hybrid solutions also show promise in credit risk modeling. Quantum machine learning algorithms can be employed to improve the accuracy of credit scoring models, while classical systems handle data preprocessing and model deployment.

Implementing quantum-classical hybrid solutions for financial risk analysis presents several challenges. These include the need for seamless integration between quantum and classical components, managing the limitations of current quantum hardware, and ensuring the reliability and accuracy of results.

To address these challenges, researchers are developing robust frameworks for hybrid quantum-classical computing. These frameworks aim to optimize the allocation of tasks between quantum and classical resources, manage quantum error correction, and provide scalable interfaces for financial applications.

As quantum hardware continues to advance, the potential of hybrid solutions in financial risk analysis is expected to grow. Future developments may include more sophisticated quantum algorithms tailored for specific financial risk scenarios, improved quantum-classical interfaces, and enhanced error mitigation techniques to increase the reliability of hybrid systems in real-world financial applications.

Regulatory Implications of Quantum Finance

The integration of quantum computing into financial risk analysis brings forth significant regulatory implications that demand careful consideration. As quantum algorithms enhance the capabilities for complex financial modeling and risk assessment, regulatory bodies face the challenge of adapting existing frameworks to accommodate these technological advancements.

One primary concern is the potential for quantum algorithms to outpace traditional risk management models, potentially creating information asymmetries in financial markets. Regulators must address how to ensure fair market practices when some institutions have access to superior quantum-powered risk analysis tools. This may necessitate the development of new standards for risk disclosure and reporting that account for the enhanced predictive capabilities of quantum algorithms.

Data privacy and security regulations also require reevaluation in light of quantum finance. While quantum encryption promises enhanced security, the potential for quantum computers to break current encryption methods poses a significant threat to financial data protection. Regulatory bodies need to establish guidelines for quantum-resistant cryptography and data handling practices to safeguard sensitive financial information.

The increased speed and complexity of quantum-powered financial transactions may strain existing market surveillance systems. Regulators must invest in upgrading their technological infrastructure to effectively monitor and analyze quantum-enhanced trading activities. This may involve developing quantum-based surveillance tools to keep pace with market participants utilizing quantum algorithms.

Regulatory frameworks governing algorithmic trading and high-frequency trading strategies will need to be expanded to encompass quantum algorithms. The potential for quantum computers to execute complex trading strategies at unprecedented speeds raises concerns about market stability and fairness. New regulations may be required to prevent market manipulation and ensure transparency in quantum-powered trading activities.

The global nature of financial markets necessitates international cooperation in developing regulatory standards for quantum finance. Harmonizing regulations across jurisdictions will be crucial to prevent regulatory arbitrage and ensure consistent oversight of quantum-powered financial activities. This may lead to the establishment of international working groups or task forces dedicated to addressing the regulatory challenges posed by quantum finance.

As quantum algorithms enable more sophisticated risk modeling, regulators may need to reassess capital adequacy requirements and stress testing methodologies for financial institutions. The enhanced predictive capabilities of quantum algorithms could lead to more accurate risk assessments, potentially influencing how regulators determine capital buffers and evaluate institutional resilience to economic shocks.

One primary concern is the potential for quantum algorithms to outpace traditional risk management models, potentially creating information asymmetries in financial markets. Regulators must address how to ensure fair market practices when some institutions have access to superior quantum-powered risk analysis tools. This may necessitate the development of new standards for risk disclosure and reporting that account for the enhanced predictive capabilities of quantum algorithms.

Data privacy and security regulations also require reevaluation in light of quantum finance. While quantum encryption promises enhanced security, the potential for quantum computers to break current encryption methods poses a significant threat to financial data protection. Regulatory bodies need to establish guidelines for quantum-resistant cryptography and data handling practices to safeguard sensitive financial information.

The increased speed and complexity of quantum-powered financial transactions may strain existing market surveillance systems. Regulators must invest in upgrading their technological infrastructure to effectively monitor and analyze quantum-enhanced trading activities. This may involve developing quantum-based surveillance tools to keep pace with market participants utilizing quantum algorithms.

Regulatory frameworks governing algorithmic trading and high-frequency trading strategies will need to be expanded to encompass quantum algorithms. The potential for quantum computers to execute complex trading strategies at unprecedented speeds raises concerns about market stability and fairness. New regulations may be required to prevent market manipulation and ensure transparency in quantum-powered trading activities.

The global nature of financial markets necessitates international cooperation in developing regulatory standards for quantum finance. Harmonizing regulations across jurisdictions will be crucial to prevent regulatory arbitrage and ensure consistent oversight of quantum-powered financial activities. This may lead to the establishment of international working groups or task forces dedicated to addressing the regulatory challenges posed by quantum finance.

As quantum algorithms enable more sophisticated risk modeling, regulators may need to reassess capital adequacy requirements and stress testing methodologies for financial institutions. The enhanced predictive capabilities of quantum algorithms could lead to more accurate risk assessments, potentially influencing how regulators determine capital buffers and evaluate institutional resilience to economic shocks.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!