Solid State Lithium Batteries Anode Design for High Performance

OCT 21, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Solid State Battery Anode Technology Background and Objectives

Solid state lithium batteries represent a revolutionary advancement in energy storage technology, promising to overcome the limitations of conventional lithium-ion batteries that use liquid electrolytes. The development of solid state batteries dates back to the 1970s, but significant progress has been made only in the last decade due to advancements in materials science and manufacturing techniques. The evolution of this technology has been driven by increasing demands for higher energy density, improved safety, and longer cycle life in various applications ranging from consumer electronics to electric vehicles and grid storage.

The anode component plays a critical role in determining the overall performance of solid state lithium batteries. Historically, graphite has been the dominant anode material in conventional lithium-ion batteries, but its limited theoretical capacity (372 mAh/g) constrains further improvements in energy density. This limitation has spurred research into alternative anode materials, particularly lithium metal, which offers an exceptionally high theoretical capacity of 3860 mAh/g and the lowest electrochemical potential (-3.04V vs. standard hydrogen electrode).

Current technological trends in solid state battery anode design focus on addressing key challenges associated with lithium metal anodes, including dendrite formation, volume expansion during cycling, and interfacial stability with solid electrolytes. Research is increasingly moving toward composite anode structures, protective coatings, and three-dimensional architectures that can accommodate volume changes while maintaining stable interfaces.

The global research landscape shows accelerating publication rates in this field, with annual scientific papers on solid state battery anodes increasing by approximately 300% between 2015 and 2022. Patent filings have similarly surged, indicating strong commercial interest and investment in this technology. Major research hubs have emerged in East Asia (particularly Japan, South Korea, and China), North America, and Europe, with distinct approaches reflecting regional industrial strengths.

The primary technical objectives for high-performance solid state battery anodes include achieving stable cycling of lithium metal anodes with current densities exceeding 3 mA/cm², extending cycle life beyond 1000 cycles with minimal capacity degradation, and developing manufacturing processes compatible with large-scale production. Additionally, researchers aim to design anodes that can operate effectively across wide temperature ranges (-20°C to 60°C) to meet the demands of various applications.

Looking forward, the technology roadmap for solid state battery anodes envisions progressive improvements in energy density, with targets exceeding 500 Wh/kg at the cell level by 2025 and approaching 700 Wh/kg by 2030. These ambitious goals will require fundamental breakthroughs in anode design and interface engineering, potentially revolutionizing energy storage capabilities across multiple industries and accelerating the transition to electrified transportation and renewable energy systems.

The anode component plays a critical role in determining the overall performance of solid state lithium batteries. Historically, graphite has been the dominant anode material in conventional lithium-ion batteries, but its limited theoretical capacity (372 mAh/g) constrains further improvements in energy density. This limitation has spurred research into alternative anode materials, particularly lithium metal, which offers an exceptionally high theoretical capacity of 3860 mAh/g and the lowest electrochemical potential (-3.04V vs. standard hydrogen electrode).

Current technological trends in solid state battery anode design focus on addressing key challenges associated with lithium metal anodes, including dendrite formation, volume expansion during cycling, and interfacial stability with solid electrolytes. Research is increasingly moving toward composite anode structures, protective coatings, and three-dimensional architectures that can accommodate volume changes while maintaining stable interfaces.

The global research landscape shows accelerating publication rates in this field, with annual scientific papers on solid state battery anodes increasing by approximately 300% between 2015 and 2022. Patent filings have similarly surged, indicating strong commercial interest and investment in this technology. Major research hubs have emerged in East Asia (particularly Japan, South Korea, and China), North America, and Europe, with distinct approaches reflecting regional industrial strengths.

The primary technical objectives for high-performance solid state battery anodes include achieving stable cycling of lithium metal anodes with current densities exceeding 3 mA/cm², extending cycle life beyond 1000 cycles with minimal capacity degradation, and developing manufacturing processes compatible with large-scale production. Additionally, researchers aim to design anodes that can operate effectively across wide temperature ranges (-20°C to 60°C) to meet the demands of various applications.

Looking forward, the technology roadmap for solid state battery anodes envisions progressive improvements in energy density, with targets exceeding 500 Wh/kg at the cell level by 2025 and approaching 700 Wh/kg by 2030. These ambitious goals will require fundamental breakthroughs in anode design and interface engineering, potentially revolutionizing energy storage capabilities across multiple industries and accelerating the transition to electrified transportation and renewable energy systems.

Market Analysis for High-Performance Solid State Batteries

The global market for solid-state lithium batteries is experiencing unprecedented growth, driven by increasing demand for high-performance energy storage solutions across multiple sectors. Current market valuations indicate the solid-state battery market reached approximately 500 million USD in 2022, with projections suggesting a compound annual growth rate (CAGR) of 34.2% through 2030, potentially reaching 16 billion USD by the end of the decade.

The automotive sector represents the largest market opportunity, accounting for nearly 60% of projected demand. Major automotive manufacturers including Toyota, Volkswagen, and BMW have announced significant investments in solid-state battery technology, with commercial vehicle integration targeted between 2025-2028. This acceleration is primarily driven by the superior performance characteristics of solid-state batteries, particularly their enhanced safety profile and higher energy density compared to conventional lithium-ion batteries.

Consumer electronics constitutes the second-largest market segment, with manufacturers seeking batteries that offer longer life cycles and faster charging capabilities. Apple, Samsung, and other major electronics companies have filed numerous patents related to solid-state battery integration in portable devices, signaling strong industry commitment to this technology.

Geographically, Asia-Pacific dominates the market landscape, with Japan and South Korea leading in patent filings and commercial development. North America and Europe follow closely, with substantial government funding initiatives supporting research and development efforts. The European Union's Horizon Europe program has allocated 1.3 billion EUR specifically for advanced battery technologies, including solid-state designs.

Market analysis reveals that anode design represents a critical competitive differentiator, with silicon and lithium metal anodes showing particular promise for high-performance applications. Companies focusing on innovative anode materials have secured 43% of total venture capital investment in the solid-state battery sector during 2021-2022.

Customer demand patterns indicate strong preference for batteries offering energy densities exceeding 400 Wh/kg, fast charging capabilities (80% charge in under 15 minutes), and operational temperature ranges suitable for extreme environments. These performance requirements are directly influencing anode design priorities across the industry.

Supply chain considerations present significant market challenges, particularly regarding lithium metal availability and processing capabilities. Companies with vertically integrated supply chains or strategic partnerships with material suppliers demonstrate competitive advantages in this evolving market landscape.

The automotive sector represents the largest market opportunity, accounting for nearly 60% of projected demand. Major automotive manufacturers including Toyota, Volkswagen, and BMW have announced significant investments in solid-state battery technology, with commercial vehicle integration targeted between 2025-2028. This acceleration is primarily driven by the superior performance characteristics of solid-state batteries, particularly their enhanced safety profile and higher energy density compared to conventional lithium-ion batteries.

Consumer electronics constitutes the second-largest market segment, with manufacturers seeking batteries that offer longer life cycles and faster charging capabilities. Apple, Samsung, and other major electronics companies have filed numerous patents related to solid-state battery integration in portable devices, signaling strong industry commitment to this technology.

Geographically, Asia-Pacific dominates the market landscape, with Japan and South Korea leading in patent filings and commercial development. North America and Europe follow closely, with substantial government funding initiatives supporting research and development efforts. The European Union's Horizon Europe program has allocated 1.3 billion EUR specifically for advanced battery technologies, including solid-state designs.

Market analysis reveals that anode design represents a critical competitive differentiator, with silicon and lithium metal anodes showing particular promise for high-performance applications. Companies focusing on innovative anode materials have secured 43% of total venture capital investment in the solid-state battery sector during 2021-2022.

Customer demand patterns indicate strong preference for batteries offering energy densities exceeding 400 Wh/kg, fast charging capabilities (80% charge in under 15 minutes), and operational temperature ranges suitable for extreme environments. These performance requirements are directly influencing anode design priorities across the industry.

Supply chain considerations present significant market challenges, particularly regarding lithium metal availability and processing capabilities. Companies with vertically integrated supply chains or strategic partnerships with material suppliers demonstrate competitive advantages in this evolving market landscape.

Current Challenges in Solid State Lithium Battery Anode Design

Despite significant advancements in solid-state lithium battery technology, anode design remains a critical bottleneck limiting overall performance. The interface between solid electrolytes and lithium metal anodes presents substantial challenges, primarily due to the high reactivity of lithium metal with most solid electrolytes, leading to continuous interfacial degradation and increased impedance over cycling.

A fundamental challenge is the mechanical instability at the anode-electrolyte interface. During charging and discharging cycles, lithium deposition and stripping causes significant volume changes, creating mechanical stress that can lead to contact loss between the anode and electrolyte. This phenomenon increases interfacial resistance and creates potential pathways for dendrite growth, ultimately compromising battery safety and longevity.

Lithium dendrite formation represents another critical challenge. Even in solid-state configurations, lithium can penetrate through grain boundaries or defects in the solid electrolyte, forming dendrites that may eventually cause short circuits. The mechanical pressure exerted by growing dendrites can also fracture brittle ceramic electrolytes, further degrading battery performance.

The chemical stability between lithium metal anodes and solid electrolytes remains problematic. Many promising solid electrolytes, particularly sulfide-based materials, undergo reduction reactions when in contact with lithium metal, forming interphases with poor ionic conductivity. These reactions consume active lithium and electrolyte materials, reducing capacity and increasing cell impedance over time.

Manufacturing challenges further complicate anode design. Achieving uniform, void-free interfaces between solid electrolytes and lithium metal anodes at scale requires precise control of pressure, temperature, and surface properties. Current manufacturing techniques struggle to consistently produce high-quality interfaces needed for optimal performance.

Energy density optimization presents another significant hurdle. While lithium metal offers theoretical advantages in energy density, practical implementations often require excess lithium to compensate for irreversible losses, reducing the overall energy density advantage. Additionally, the need for external pressure to maintain good contact between components adds weight and complexity to battery designs.

The cost-effectiveness of advanced anode designs also remains challenging. Many proposed solutions involve expensive materials or complex manufacturing processes that may limit commercial viability. Finding the balance between performance enhancement and cost-effectiveness represents a significant obstacle to widespread adoption.

Temperature sensitivity adds another layer of complexity. The ionic conductivity of solid electrolytes and the kinetics of lithium transport at interfaces are highly temperature-dependent, often requiring elevated operating temperatures for optimal performance. Developing anode designs that perform well across a wide temperature range remains an ongoing challenge for researchers and engineers in this field.

A fundamental challenge is the mechanical instability at the anode-electrolyte interface. During charging and discharging cycles, lithium deposition and stripping causes significant volume changes, creating mechanical stress that can lead to contact loss between the anode and electrolyte. This phenomenon increases interfacial resistance and creates potential pathways for dendrite growth, ultimately compromising battery safety and longevity.

Lithium dendrite formation represents another critical challenge. Even in solid-state configurations, lithium can penetrate through grain boundaries or defects in the solid electrolyte, forming dendrites that may eventually cause short circuits. The mechanical pressure exerted by growing dendrites can also fracture brittle ceramic electrolytes, further degrading battery performance.

The chemical stability between lithium metal anodes and solid electrolytes remains problematic. Many promising solid electrolytes, particularly sulfide-based materials, undergo reduction reactions when in contact with lithium metal, forming interphases with poor ionic conductivity. These reactions consume active lithium and electrolyte materials, reducing capacity and increasing cell impedance over time.

Manufacturing challenges further complicate anode design. Achieving uniform, void-free interfaces between solid electrolytes and lithium metal anodes at scale requires precise control of pressure, temperature, and surface properties. Current manufacturing techniques struggle to consistently produce high-quality interfaces needed for optimal performance.

Energy density optimization presents another significant hurdle. While lithium metal offers theoretical advantages in energy density, practical implementations often require excess lithium to compensate for irreversible losses, reducing the overall energy density advantage. Additionally, the need for external pressure to maintain good contact between components adds weight and complexity to battery designs.

The cost-effectiveness of advanced anode designs also remains challenging. Many proposed solutions involve expensive materials or complex manufacturing processes that may limit commercial viability. Finding the balance between performance enhancement and cost-effectiveness represents a significant obstacle to widespread adoption.

Temperature sensitivity adds another layer of complexity. The ionic conductivity of solid electrolytes and the kinetics of lithium transport at interfaces are highly temperature-dependent, often requiring elevated operating temperatures for optimal performance. Developing anode designs that perform well across a wide temperature range remains an ongoing challenge for researchers and engineers in this field.

Current Anode Design Solutions for Solid State Lithium Batteries

01 Electrolyte materials for solid-state lithium batteries

Various electrolyte materials can be used in solid-state lithium batteries to enhance performance. These include ceramic electrolytes, polymer electrolytes, and composite electrolytes that combine different materials. The choice of electrolyte material significantly impacts ionic conductivity, interfacial resistance, and overall battery performance. Advanced electrolyte formulations can improve lithium-ion transport while maintaining mechanical stability and electrochemical compatibility with electrode materials.- Electrolyte materials for solid-state lithium batteries: Various electrolyte materials can be used in solid-state lithium batteries to enhance performance. These include ceramic electrolytes, polymer electrolytes, and composite electrolytes. The choice of electrolyte material affects ionic conductivity, interfacial resistance, and overall battery performance. Advanced electrolyte formulations can improve lithium-ion transport while maintaining mechanical stability, leading to better battery efficiency and longer cycle life.

- Electrode-electrolyte interface engineering: Engineering the interface between electrodes and solid electrolytes is crucial for solid-state lithium battery performance. Techniques include surface coatings, buffer layers, and gradient interfaces to reduce contact resistance and improve ion transfer. Proper interface design minimizes impedance growth during cycling and prevents unwanted side reactions. These engineering approaches help maintain structural integrity during battery operation and enhance overall energy density and power capability.

- Cathode materials and architectures: Advanced cathode materials and architectures significantly impact solid-state lithium battery performance. High-capacity cathode materials, optimized particle size distribution, and structured electrode designs can enhance energy density and rate capability. Innovations in cathode composition and morphology improve lithium-ion diffusion kinetics and electronic conductivity. These developments lead to batteries with higher energy density, better rate performance, and improved cycling stability.

- Manufacturing processes and scalability: Manufacturing processes significantly influence solid-state lithium battery performance and commercial viability. Techniques such as dry pressing, tape casting, and advanced deposition methods affect layer uniformity, interfacial contact, and overall battery quality. Scalable production methods that maintain precise control over material properties and interfaces are essential for consistent performance. Innovations in manufacturing technology help reduce production costs while ensuring high-quality batteries with reliable performance metrics.

- Safety and thermal stability enhancements: Solid-state lithium batteries offer improved safety and thermal stability compared to conventional liquid electrolyte batteries. Design features such as non-flammable solid electrolytes, thermal management systems, and structural reinforcements enhance safety under extreme conditions. Advanced materials and architectures prevent thermal runaway and dendrite formation. These safety enhancements make solid-state batteries suitable for applications requiring high reliability and operation in challenging environments.

02 Electrode-electrolyte interface engineering

Engineering the interface between electrodes and solid electrolytes is crucial for solid-state lithium battery performance. Techniques include surface coatings, buffer layers, and interface modification to reduce contact resistance and improve ion transfer. Proper interface engineering helps mitigate issues such as chemical incompatibility, mechanical stress, and formation of resistive layers during cycling, leading to enhanced battery performance and longevity.Expand Specific Solutions03 Cathode and anode materials optimization

The selection and optimization of cathode and anode materials significantly impact solid-state lithium battery performance. High-capacity cathode materials, such as nickel-rich layered oxides, and advanced anode materials, including silicon-based composites and lithium metal, can increase energy density. Structural modifications, particle size optimization, and doping strategies can enhance electrochemical stability, rate capability, and cycle life of these electrode materials.Expand Specific Solutions04 Manufacturing processes and battery architecture

Advanced manufacturing processes and innovative battery architectures can significantly improve solid-state lithium battery performance. Techniques such as dry film casting, hot pressing, and 3D printing enable better control over component integration and interfacial contact. Novel cell designs, including multilayer structures and gradient compositions, can optimize ion transport pathways and mechanical stability, leading to enhanced power density and cycling performance.Expand Specific Solutions05 Performance enhancement additives and treatments

Various additives and treatments can enhance the performance of solid-state lithium batteries. These include conductive additives to improve electron transport, stabilizing agents to prevent degradation reactions, and surface treatments to modify interfacial properties. Thermal treatments, pressure application during cycling, and specialized formation protocols can also optimize battery performance by improving component integration and electrochemical stability.Expand Specific Solutions

Leading Companies and Research Institutions in Solid State Battery Development

The solid-state lithium battery anode design market is currently in a transitional growth phase, moving from research to early commercialization. Market size is projected to expand significantly as electric vehicle adoption accelerates, with estimates suggesting a CAGR of 30-35% through 2030. Technologically, the field remains in development with varying maturity levels across competitors. Leading players include Samsung SDI and LG Energy Solution, who have established strong patent portfolios and pilot production capabilities. Other significant contributors include automotive manufacturers (Honda, GM) partnering with technology specialists, while research institutions like KAIST and University of California provide fundamental innovations. Companies like Piersica and Graphenix Development represent emerging specialized players focusing on novel anode materials and designs to overcome current performance limitations.

SAMSUNG SDI CO LTD

Technical Solution: Samsung SDI has developed innovative solid-state lithium battery anode designs focusing on silicon-carbon composite materials. Their approach incorporates nano-structured silicon particles embedded within a carbon matrix, allowing for controlled volume expansion during lithium insertion. The company has pioneered a gradient concentration design where silicon content varies from the particle surface to core, optimizing both capacity and stability[1]. Their proprietary surface coating technology creates a flexible artificial SEI (Solid Electrolyte Interphase) layer that accommodates volume changes while maintaining electrical conductivity. Samsung SDI has also developed specialized electrolyte additives that enhance compatibility between their anode materials and solid electrolytes, reducing interfacial resistance. Recent advancements include three-dimensional porous structures that provide void spaces for expansion while maintaining structural integrity during cycling[2].

Strengths: Superior energy density (up to 900 Wh/L) compared to conventional lithium-ion batteries; excellent cycle stability with over 1000 cycles at 80% capacity retention; improved safety with reduced risk of thermal runaway. Weaknesses: Higher manufacturing costs due to complex material processing; challenges in scaling production to commercial levels; potential interface degradation issues at high charging rates.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has developed a multi-layered composite anode architecture for solid-state lithium batteries featuring a lithium metal anode with engineered protective interfaces. Their design incorporates a gradient functional layer between the lithium metal and solid electrolyte to mitigate dendrite formation and improve interfacial contact[3]. The company utilizes a proprietary artificial SEI formulation containing lithium-conductive additives that enhance ion transport while suppressing side reactions. LG's approach includes a thin polymer/ceramic hybrid interlayer that accommodates volume changes during cycling while maintaining mechanical integrity. Their anode design also features nano-engineered surface texturing that increases the effective surface area for lithium deposition/dissolution, reducing local current densities and improving rate capability[4]. Recent advancements include the integration of lithiophilic frameworks that guide uniform lithium deposition and prevent dendrite propagation.

Strengths: Exceptional energy density exceeding 400 Wh/kg; superior fast-charging capability with reduced dendrite formation; excellent low-temperature performance down to -20°C. Weaknesses: Complex manufacturing process requiring precise control of multiple interfaces; potential long-term stability issues at elevated temperatures; higher cost compared to conventional lithium-ion technology.

Key Patents and Innovations in High-Performance Anode Materials

Solid-state battery anode and solid-state battery

PatentPendingUS20250112223A1

Innovation

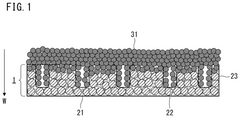

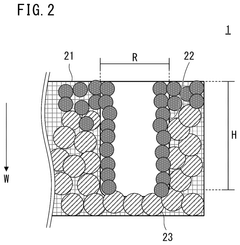

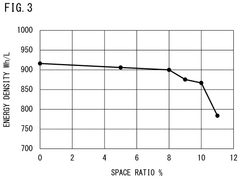

- The anode design includes a metallic porous body current collector with controlled pore portions, ranging from 100 μm to 180 μm in diameter and 3 μm to 5 μm in depth, with a porosity ratio of 8 vol% or less, allowing stable deposition of metallic lithium within these pores.

Solid-state lithium-ion batteries

PatentWO2025145155A1

Innovation

- A lithium-ion battery cell design featuring a porous lithium storage layer with silicon-containing segments and a modification layer on the surface and sidewalls, enhancing lithium-ion conduction and reducing overpotential, while using a solid-state electrolyte interposed between the anode and cathode.

Manufacturing Scalability and Cost Analysis

The manufacturing scalability of solid-state lithium battery anodes represents a critical challenge in transitioning from laboratory prototypes to commercial production. Current manufacturing processes for conventional lithium-ion batteries are highly optimized, with production costs continuing to decrease. However, solid-state battery anode designs introduce new materials and fabrication requirements that significantly impact manufacturing complexity and cost structures.

Analysis of manufacturing processes for high-performance solid-state battery anodes reveals several key challenges. The precise deposition and interface engineering required for materials like lithium metal, silicon-carbon composites, and ceramic-polymer hybrid structures demand specialized equipment and tightly controlled environments. These requirements translate to higher capital expenditures compared to conventional battery manufacturing lines, with initial estimates suggesting 30-40% higher equipment costs.

Material costs present another significant consideration. High-performance solid-state anodes often incorporate specialized materials such as engineered carbon structures, lithium metal foils, or proprietary ceramic formulations. These materials currently command premium prices due to limited production scale and specialized processing requirements. For instance, high-purity lithium metal suitable for battery applications costs approximately $120-150/kg, significantly higher than graphite at $15-20/kg used in conventional batteries.

Process yield and throughput metrics further impact economic viability. Current pilot-scale production of solid-state battery anodes demonstrates yields of 70-85%, considerably lower than the 92-97% achieved in mature lithium-ion manufacturing. This yield gap directly affects unit economics and must be addressed through process optimization and quality control improvements.

Energy consumption during manufacturing represents another cost factor. The high-temperature sintering processes often required for ceramic components in solid-state battery anodes can consume 2-3 times more energy than conventional electrode coating and drying processes. This increased energy intensity affects both production costs and environmental footprint.

Scaling pathways for solid-state battery anode manufacturing will likely require phased approaches. Near-term strategies focus on adapting existing production infrastructure where possible, while developing specialized equipment for critical process steps. Medium-term approaches emphasize continuous processing techniques to replace batch operations, potentially reducing capital intensity by 25-30% while improving throughput.

Cost modeling projections indicate that with manufacturing scale reaching 1-2 GWh annual capacity, solid-state battery anodes could approach cost parity with advanced conventional anodes. However, this requires significant process innovation and supply chain development, particularly in specialized material production and interface engineering techniques.

Analysis of manufacturing processes for high-performance solid-state battery anodes reveals several key challenges. The precise deposition and interface engineering required for materials like lithium metal, silicon-carbon composites, and ceramic-polymer hybrid structures demand specialized equipment and tightly controlled environments. These requirements translate to higher capital expenditures compared to conventional battery manufacturing lines, with initial estimates suggesting 30-40% higher equipment costs.

Material costs present another significant consideration. High-performance solid-state anodes often incorporate specialized materials such as engineered carbon structures, lithium metal foils, or proprietary ceramic formulations. These materials currently command premium prices due to limited production scale and specialized processing requirements. For instance, high-purity lithium metal suitable for battery applications costs approximately $120-150/kg, significantly higher than graphite at $15-20/kg used in conventional batteries.

Process yield and throughput metrics further impact economic viability. Current pilot-scale production of solid-state battery anodes demonstrates yields of 70-85%, considerably lower than the 92-97% achieved in mature lithium-ion manufacturing. This yield gap directly affects unit economics and must be addressed through process optimization and quality control improvements.

Energy consumption during manufacturing represents another cost factor. The high-temperature sintering processes often required for ceramic components in solid-state battery anodes can consume 2-3 times more energy than conventional electrode coating and drying processes. This increased energy intensity affects both production costs and environmental footprint.

Scaling pathways for solid-state battery anode manufacturing will likely require phased approaches. Near-term strategies focus on adapting existing production infrastructure where possible, while developing specialized equipment for critical process steps. Medium-term approaches emphasize continuous processing techniques to replace batch operations, potentially reducing capital intensity by 25-30% while improving throughput.

Cost modeling projections indicate that with manufacturing scale reaching 1-2 GWh annual capacity, solid-state battery anodes could approach cost parity with advanced conventional anodes. However, this requires significant process innovation and supply chain development, particularly in specialized material production and interface engineering techniques.

Safety and Environmental Considerations for Solid State Battery Materials

The safety and environmental aspects of solid-state battery materials represent critical considerations in the advancement of high-performance lithium battery technology, particularly in anode design. Traditional lithium-ion batteries with liquid electrolytes pose significant safety risks including thermal runaway, flammability, and potential leakage. Solid-state batteries inherently mitigate many of these concerns through their non-flammable solid electrolytes, substantially reducing fire hazards and improving operational safety under extreme conditions.

Material selection for solid-state battery anodes must prioritize both performance and safety parameters. Silicon and lithium metal anodes, while offering high energy density, present unique safety challenges including volume expansion and dendrite formation respectively. Advanced engineering approaches such as nanostructuring and protective coatings are being developed to address these issues without compromising performance or introducing new safety concerns.

Environmental considerations extend throughout the entire lifecycle of solid-state battery materials. The extraction of lithium, silicon, and other anode materials raises significant sustainability questions regarding water usage, habitat disruption, and energy consumption. Manufacturers are increasingly exploring more environmentally responsible sourcing methods and considering alternative, more abundant materials to reduce ecological impact.

Manufacturing processes for solid-state battery components typically require lower solvent usage compared to conventional batteries, reducing toxic emissions and waste. However, high-temperature sintering processes often needed for solid electrolyte preparation can be energy-intensive, presenting a trade-off between manufacturing simplicity and environmental footprint that researchers must carefully balance.

End-of-life management represents another crucial environmental dimension. Solid-state batteries potentially offer improved recyclability due to their simpler construction and absence of toxic liquid electrolytes. Developing efficient recycling protocols specifically designed for solid-state configurations could significantly reduce waste and recover valuable materials, though these systems remain in early development stages.

Regulatory frameworks worldwide are evolving to address the unique safety and environmental considerations of advanced battery technologies. Standards organizations are establishing new testing protocols specifically for solid-state batteries, while environmental regulations increasingly emphasize responsible material sourcing and end-of-life management. Companies developing high-performance anodes must navigate this complex regulatory landscape while maintaining innovation momentum.

The industry is witnessing growing collaboration between battery manufacturers, materials scientists, and environmental specialists to develop comprehensive safety and sustainability strategies that address the entire value chain of solid-state battery production, from raw material extraction to recycling and disposal.

Material selection for solid-state battery anodes must prioritize both performance and safety parameters. Silicon and lithium metal anodes, while offering high energy density, present unique safety challenges including volume expansion and dendrite formation respectively. Advanced engineering approaches such as nanostructuring and protective coatings are being developed to address these issues without compromising performance or introducing new safety concerns.

Environmental considerations extend throughout the entire lifecycle of solid-state battery materials. The extraction of lithium, silicon, and other anode materials raises significant sustainability questions regarding water usage, habitat disruption, and energy consumption. Manufacturers are increasingly exploring more environmentally responsible sourcing methods and considering alternative, more abundant materials to reduce ecological impact.

Manufacturing processes for solid-state battery components typically require lower solvent usage compared to conventional batteries, reducing toxic emissions and waste. However, high-temperature sintering processes often needed for solid electrolyte preparation can be energy-intensive, presenting a trade-off between manufacturing simplicity and environmental footprint that researchers must carefully balance.

End-of-life management represents another crucial environmental dimension. Solid-state batteries potentially offer improved recyclability due to their simpler construction and absence of toxic liquid electrolytes. Developing efficient recycling protocols specifically designed for solid-state configurations could significantly reduce waste and recover valuable materials, though these systems remain in early development stages.

Regulatory frameworks worldwide are evolving to address the unique safety and environmental considerations of advanced battery technologies. Standards organizations are establishing new testing protocols specifically for solid-state batteries, while environmental regulations increasingly emphasize responsible material sourcing and end-of-life management. Companies developing high-performance anodes must navigate this complex regulatory landscape while maintaining innovation momentum.

The industry is witnessing growing collaboration between battery manufacturers, materials scientists, and environmental specialists to develop comprehensive safety and sustainability strategies that address the entire value chain of solid-state battery production, from raw material extraction to recycling and disposal.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!