Optimizing supply chains for submersible pump components.

JUL 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Supply Chain Evolution

The evolution of supply chains for submersible pump components has undergone significant transformations over the past decades, driven by technological advancements, changing market demands, and global economic shifts. Initially, these supply chains were characterized by linear, localized structures with limited visibility and coordination among stakeholders.

As globalization accelerated in the late 20th century, supply chains for submersible pump components began to expand geographically. Manufacturers started sourcing materials and parts from diverse international suppliers, seeking cost advantages and specialized expertise. This expansion, however, introduced new complexities in logistics, quality control, and lead times.

The advent of digital technologies in the early 2000s marked a pivotal point in supply chain evolution. Enterprise Resource Planning (ERP) systems and electronic data interchange (EDI) enabled better information flow and coordination among supply chain partners. This digital integration improved inventory management, reduced lead times, and enhanced overall operational efficiency.

The concept of lean manufacturing, popularized in the automotive industry, found its way into submersible pump component supply chains. Manufacturers began implementing just-in-time (JIT) inventory systems and lean production techniques to minimize waste, reduce costs, and improve responsiveness to market demands.

The rise of e-commerce and the increasing expectations for faster delivery times led to the development of more agile and responsive supply chain models. Manufacturers and suppliers invested in advanced forecasting tools and real-time tracking systems to better anticipate and respond to fluctuations in demand.

In recent years, the focus has shifted towards sustainability and resilience in supply chains. Environmental concerns and regulatory pressures have prompted manufacturers to seek eco-friendly materials and processes. Additionally, the COVID-19 pandemic exposed vulnerabilities in global supply chains, leading to a renewed emphasis on risk management, diversification of suppliers, and the creation of more robust, adaptable supply networks.

The integration of Industry 4.0 technologies, such as the Internet of Things (IoT), artificial intelligence (AI), and blockchain, is currently reshaping supply chains for submersible pump components. These technologies enable real-time monitoring of production processes, predictive maintenance, and enhanced traceability throughout the supply chain.

Looking ahead, the evolution of supply chains for submersible pump components is likely to continue towards greater digitalization, automation, and sustainability. Emerging trends include the adoption of 3D printing for on-demand production of spare parts, the use of autonomous vehicles and drones for logistics, and the implementation of circular economy principles to minimize waste and maximize resource efficiency.

As globalization accelerated in the late 20th century, supply chains for submersible pump components began to expand geographically. Manufacturers started sourcing materials and parts from diverse international suppliers, seeking cost advantages and specialized expertise. This expansion, however, introduced new complexities in logistics, quality control, and lead times.

The advent of digital technologies in the early 2000s marked a pivotal point in supply chain evolution. Enterprise Resource Planning (ERP) systems and electronic data interchange (EDI) enabled better information flow and coordination among supply chain partners. This digital integration improved inventory management, reduced lead times, and enhanced overall operational efficiency.

The concept of lean manufacturing, popularized in the automotive industry, found its way into submersible pump component supply chains. Manufacturers began implementing just-in-time (JIT) inventory systems and lean production techniques to minimize waste, reduce costs, and improve responsiveness to market demands.

The rise of e-commerce and the increasing expectations for faster delivery times led to the development of more agile and responsive supply chain models. Manufacturers and suppliers invested in advanced forecasting tools and real-time tracking systems to better anticipate and respond to fluctuations in demand.

In recent years, the focus has shifted towards sustainability and resilience in supply chains. Environmental concerns and regulatory pressures have prompted manufacturers to seek eco-friendly materials and processes. Additionally, the COVID-19 pandemic exposed vulnerabilities in global supply chains, leading to a renewed emphasis on risk management, diversification of suppliers, and the creation of more robust, adaptable supply networks.

The integration of Industry 4.0 technologies, such as the Internet of Things (IoT), artificial intelligence (AI), and blockchain, is currently reshaping supply chains for submersible pump components. These technologies enable real-time monitoring of production processes, predictive maintenance, and enhanced traceability throughout the supply chain.

Looking ahead, the evolution of supply chains for submersible pump components is likely to continue towards greater digitalization, automation, and sustainability. Emerging trends include the adoption of 3D printing for on-demand production of spare parts, the use of autonomous vehicles and drones for logistics, and the implementation of circular economy principles to minimize waste and maximize resource efficiency.

Market Demand Analysis

The market demand for submersible pump components has been experiencing steady growth, driven by increasing applications in various industries such as oil and gas, water and wastewater management, and mining. The global submersible pumps market is projected to expand significantly in the coming years, with a compound annual growth rate (CAGR) of over 6% from 2021 to 2026. This growth is primarily attributed to rising urbanization, industrialization, and the need for efficient water management systems worldwide.

In the oil and gas sector, the demand for submersible pump components remains robust due to ongoing exploration and production activities, particularly in offshore and deep-water environments. The industry's focus on enhancing operational efficiency and reducing downtime has led to increased investments in high-quality, durable pump components that can withstand harsh operating conditions.

The water and wastewater management industry is another key driver of market demand for submersible pump components. Growing concerns over water scarcity and the need for improved water treatment infrastructure in both developed and developing countries have spurred investments in advanced pumping systems. Municipalities and industrial facilities are increasingly adopting submersible pumps for their reliability and efficiency in handling various types of fluids.

Mining operations, particularly in remote locations, continue to rely heavily on submersible pumps for dewatering and slurry handling applications. As mining activities expand to more challenging environments, the demand for specialized pump components capable of handling abrasive materials and operating in extreme conditions has risen.

The agricultural sector is also contributing to the market growth, with farmers adopting submersible pumps for irrigation and water management purposes. The trend towards precision agriculture and smart farming practices has further boosted the demand for advanced pump components that offer improved energy efficiency and remote monitoring capabilities.

Geographically, Asia-Pacific is expected to witness the highest growth in demand for submersible pump components, driven by rapid industrialization, urbanization, and infrastructure development in countries like China and India. North America and Europe continue to be significant markets, with a focus on replacing aging infrastructure and adopting more energy-efficient pumping solutions.

The increasing emphasis on energy efficiency and environmental sustainability is shaping market trends, with a growing demand for pump components that reduce power consumption and minimize environmental impact. This has led to innovations in materials and designs, such as the use of corrosion-resistant alloys and advanced coatings to extend component lifespan and improve overall pump performance.

As the market expands, there is a rising need for localized supply chains to reduce lead times and transportation costs. This trend presents opportunities for regional manufacturers and suppliers to strengthen their position in the market by offering customized solutions and responsive after-sales support.

In the oil and gas sector, the demand for submersible pump components remains robust due to ongoing exploration and production activities, particularly in offshore and deep-water environments. The industry's focus on enhancing operational efficiency and reducing downtime has led to increased investments in high-quality, durable pump components that can withstand harsh operating conditions.

The water and wastewater management industry is another key driver of market demand for submersible pump components. Growing concerns over water scarcity and the need for improved water treatment infrastructure in both developed and developing countries have spurred investments in advanced pumping systems. Municipalities and industrial facilities are increasingly adopting submersible pumps for their reliability and efficiency in handling various types of fluids.

Mining operations, particularly in remote locations, continue to rely heavily on submersible pumps for dewatering and slurry handling applications. As mining activities expand to more challenging environments, the demand for specialized pump components capable of handling abrasive materials and operating in extreme conditions has risen.

The agricultural sector is also contributing to the market growth, with farmers adopting submersible pumps for irrigation and water management purposes. The trend towards precision agriculture and smart farming practices has further boosted the demand for advanced pump components that offer improved energy efficiency and remote monitoring capabilities.

Geographically, Asia-Pacific is expected to witness the highest growth in demand for submersible pump components, driven by rapid industrialization, urbanization, and infrastructure development in countries like China and India. North America and Europe continue to be significant markets, with a focus on replacing aging infrastructure and adopting more energy-efficient pumping solutions.

The increasing emphasis on energy efficiency and environmental sustainability is shaping market trends, with a growing demand for pump components that reduce power consumption and minimize environmental impact. This has led to innovations in materials and designs, such as the use of corrosion-resistant alloys and advanced coatings to extend component lifespan and improve overall pump performance.

As the market expands, there is a rising need for localized supply chains to reduce lead times and transportation costs. This trend presents opportunities for regional manufacturers and suppliers to strengthen their position in the market by offering customized solutions and responsive after-sales support.

Current Challenges

The optimization of supply chains for submersible pump components faces several significant challenges in the current technological and market landscape. These challenges stem from the complex nature of submersible pump manufacturing, global supply chain dynamics, and evolving industry requirements.

One of the primary challenges is the intricate network of suppliers and manufacturers involved in producing submersible pump components. The supply chain often spans multiple countries and continents, making coordination and synchronization of production and delivery schedules extremely difficult. This geographical dispersion also increases the risk of disruptions due to natural disasters, political instability, or trade disputes.

Quality control presents another major hurdle in the supply chain optimization process. Submersible pumps operate in harsh environments, often submerged in corrosive fluids or exposed to extreme pressures. Ensuring consistent quality across all components sourced from various suppliers is crucial but challenging. Variations in manufacturing processes, material quality, or quality control standards among different suppliers can lead to inconsistencies in the final product, potentially compromising performance and reliability.

The volatility of raw material prices and availability poses a significant challenge to supply chain optimization. Many submersible pump components require specialized materials, such as corrosion-resistant alloys or high-grade polymers. Fluctuations in the prices of these materials can have a substantial impact on production costs and lead times. Moreover, the limited availability of certain critical materials can create bottlenecks in the supply chain, affecting production schedules and delivery timelines.

Inventory management is another complex issue facing the industry. Balancing the need for readily available components with the costs associated with maintaining large inventories is a delicate task. Overstocking can tie up capital and increase storage costs, while understocking can lead to production delays and lost sales opportunities. This challenge is further complicated by the need to maintain inventories of spare parts for after-sales service and maintenance.

The rapid pace of technological advancements in pump design and manufacturing processes also presents a challenge to supply chain optimization. As new materials, production techniques, and design innovations emerge, supply chains must be flexible enough to adapt quickly. This requires continuous reassessment of supplier capabilities, updating of procurement strategies, and potential restructuring of the supply network.

Lastly, regulatory compliance and sustainability concerns add another layer of complexity to supply chain optimization. Increasingly stringent environmental regulations and growing demand for sustainable manufacturing practices require careful selection of suppliers and materials. Ensuring compliance across a global supply chain while maintaining cost-effectiveness and efficiency is a significant challenge for manufacturers of submersible pump components.

One of the primary challenges is the intricate network of suppliers and manufacturers involved in producing submersible pump components. The supply chain often spans multiple countries and continents, making coordination and synchronization of production and delivery schedules extremely difficult. This geographical dispersion also increases the risk of disruptions due to natural disasters, political instability, or trade disputes.

Quality control presents another major hurdle in the supply chain optimization process. Submersible pumps operate in harsh environments, often submerged in corrosive fluids or exposed to extreme pressures. Ensuring consistent quality across all components sourced from various suppliers is crucial but challenging. Variations in manufacturing processes, material quality, or quality control standards among different suppliers can lead to inconsistencies in the final product, potentially compromising performance and reliability.

The volatility of raw material prices and availability poses a significant challenge to supply chain optimization. Many submersible pump components require specialized materials, such as corrosion-resistant alloys or high-grade polymers. Fluctuations in the prices of these materials can have a substantial impact on production costs and lead times. Moreover, the limited availability of certain critical materials can create bottlenecks in the supply chain, affecting production schedules and delivery timelines.

Inventory management is another complex issue facing the industry. Balancing the need for readily available components with the costs associated with maintaining large inventories is a delicate task. Overstocking can tie up capital and increase storage costs, while understocking can lead to production delays and lost sales opportunities. This challenge is further complicated by the need to maintain inventories of spare parts for after-sales service and maintenance.

The rapid pace of technological advancements in pump design and manufacturing processes also presents a challenge to supply chain optimization. As new materials, production techniques, and design innovations emerge, supply chains must be flexible enough to adapt quickly. This requires continuous reassessment of supplier capabilities, updating of procurement strategies, and potential restructuring of the supply network.

Lastly, regulatory compliance and sustainability concerns add another layer of complexity to supply chain optimization. Increasingly stringent environmental regulations and growing demand for sustainable manufacturing practices require careful selection of suppliers and materials. Ensuring compliance across a global supply chain while maintaining cost-effectiveness and efficiency is a significant challenge for manufacturers of submersible pump components.

Existing Optimization

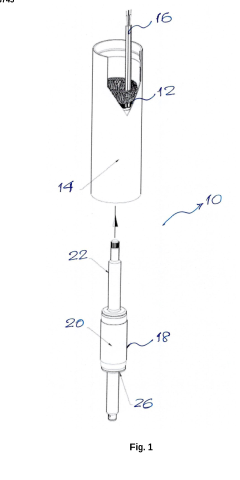

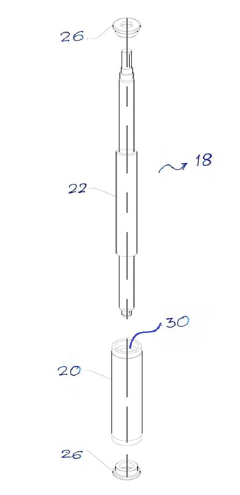

01 Pump assembly and components

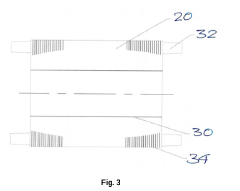

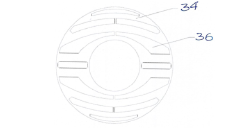

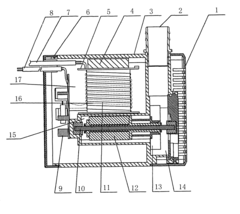

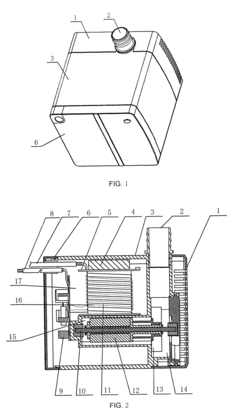

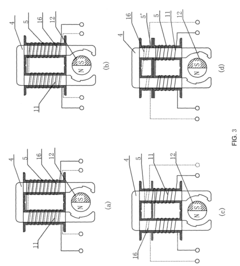

Submersible pump assemblies consist of various components such as impellers, casings, shafts, and seals. These components are designed to work efficiently in submerged conditions, often in challenging environments like oil wells or water treatment facilities. The supply chain for these components involves specialized manufacturing processes and materials selection to ensure durability and performance underwater.- Pump assembly and components: Submersible pump assemblies consist of various components such as impellers, shafts, bearings, and housings. These components are designed for efficient operation in submerged conditions. The supply chain involves sourcing and manufacturing these specialized parts to ensure durability and performance in underwater environments.

- Materials and manufacturing processes: The supply chain for submersible pump components involves selecting appropriate materials and manufacturing processes. This includes corrosion-resistant alloys, advanced polymers, and specialized coatings. Precision manufacturing techniques are employed to ensure tight tolerances and reliability in harsh underwater conditions.

- Supply chain management and logistics: Effective supply chain management for submersible pump components involves coordinating suppliers, manufacturers, and distributors. This includes inventory management, quality control, and timely delivery of components. Logistics considerations are crucial for ensuring the availability of parts for assembly and maintenance of submersible pumps.

- Specialized components for oil and gas applications: The supply chain for submersible pump components in the oil and gas industry involves sourcing specialized parts designed for extreme depths and harsh environments. This includes high-pressure seals, advanced motor systems, and robust power transmission components. The supply chain must ensure the availability of these critical components for offshore and subsea applications.

- Innovation and technological advancements: The supply chain for submersible pump components is influenced by ongoing technological advancements. This includes the development of smart sensors, improved energy efficiency, and enhanced materials. Suppliers and manufacturers must adapt to incorporate these innovations into their product lines and manufacturing processes.

02 Supply chain management for pump components

Effective supply chain management for submersible pump components involves coordinating suppliers, manufacturers, and distributors. This includes inventory management, quality control, and logistics planning to ensure timely delivery of parts. Advanced supply chain technologies and software systems are often employed to optimize the flow of components from raw materials to finished products.Expand Specific Solutions03 Materials and manufacturing processes

The selection of materials and manufacturing processes is crucial for submersible pump components. Corrosion-resistant alloys, advanced polymers, and composite materials are often used to withstand harsh underwater environments. Manufacturing processes may include precision machining, casting, and 3D printing to produce complex geometries and ensure tight tolerances for optimal pump performance.Expand Specific Solutions04 Quality control and testing

Rigorous quality control and testing procedures are essential in the supply chain of submersible pump components. This includes material inspections, dimensional checks, and performance testing under simulated operating conditions. Advanced non-destructive testing methods and automated inspection systems are often employed to ensure component reliability and longevity in demanding underwater applications.Expand Specific Solutions05 Global sourcing and logistics

The supply chain for submersible pump components often involves global sourcing strategies to access specialized materials and manufacturing capabilities. This requires efficient logistics management, including international shipping, customs clearance, and inventory distribution across multiple locations. Supply chain resilience and risk management are crucial to mitigate disruptions and ensure consistent component availability for pump manufacturers and end-users.Expand Specific Solutions

Key Industry Players

The optimization of supply chains for submersible pump components is currently in a growth phase, with increasing market demand driven by various industries such as oil and gas, water management, and mining. The global market size for submersible pumps is expanding, with key players like Baker Hughes, Schlumberger, and KSB SE & Co. KGaA leading technological advancements. The technology's maturity varies across applications, with established solutions in oil extraction and water management, while emerging technologies focus on efficiency improvements and smart monitoring systems. Companies like Grundfos International and Flowserve Management Co. are investing in R&D to enhance component reliability and performance, indicating a competitive landscape with ongoing innovation.

Baker Hughes Co.

Technical Solution: Baker Hughes has developed an advanced supply chain optimization system for submersible pump components. Their approach integrates real-time data analytics, predictive maintenance, and digital twin technology to streamline the entire supply chain process. The company utilizes AI-driven demand forecasting models to anticipate component needs, reducing inventory costs and minimizing downtime[1]. Baker Hughes has also implemented blockchain technology to enhance traceability and transparency across their supply chain network, ensuring the authenticity and quality of pump components[3]. Additionally, they have developed a modular pump design that allows for easier assembly and disassembly, reducing maintenance time and improving overall efficiency[5].

Strengths: Comprehensive digital integration, advanced predictive analytics, and improved component traceability. Weaknesses: High initial implementation costs and potential cybersecurity risks associated with increased digital connectivity.

Saudi Arabian Oil Co.

Technical Solution: Saudi Aramco has implemented a state-of-the-art supply chain optimization system for submersible pump components. Their approach leverages big data analytics and machine learning algorithms to optimize inventory management and logistics. The company has developed a proprietary AI-powered platform that analyzes historical data, market trends, and operational parameters to predict component demand with high accuracy[2]. Aramco has also invested in advanced 3D printing technology for on-demand production of certain pump components, reducing lead times and transportation costs[4]. Furthermore, they have established a network of strategic partnerships with key suppliers, implementing just-in-time delivery systems to minimize inventory holding costs while ensuring component availability[6].

Strengths: Cutting-edge AI and machine learning integration, innovative 3D printing capabilities, and strong supplier relationships. Weaknesses: Potential over-reliance on technology and the need for continuous investment in AI model refinement.

Innovative Solutions

Submersible pump-set for underwater use for supply of water with constant water flow at defined voltage range

PatentPendingIN202321063745A

Innovation

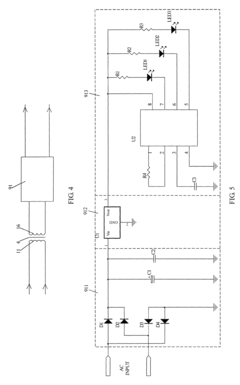

- The improved submersible pump-set employs a rotor assembly with aluminum cage-filled slots for starting torque and a synchronous reluctance torque mechanism, combined with an aluminum die casting process, to maintain constant speed and power at defined voltage ranges, eliminating rotor losses and enhancing efficiency.

Submersible pump capable of providing low voltage power supply

PatentInactiveUS8529227B2

Innovation

- A submersible pump design incorporating a silicon steel sheet group, stator coil, and a low voltage coil to form an internal transformer, enabling the provision of AC or DC low voltage power supply, with an optional rectifier filter circuit and voltage regulator circuit for safe and reliable operation.

Regulatory Compliance

Regulatory compliance plays a crucial role in optimizing supply chains for submersible pump components. The industry is subject to various regulations and standards that govern the manufacturing, distribution, and use of these components. Compliance with these regulations is essential not only for legal reasons but also for ensuring product quality, safety, and environmental protection.

One of the primary regulatory bodies overseeing the submersible pump industry is the International Organization for Standardization (ISO). ISO standards, such as ISO 9001 for quality management systems and ISO 14001 for environmental management systems, are widely adopted in the industry. These standards help ensure consistent quality and environmental responsibility throughout the supply chain.

In addition to ISO standards, regional regulations also impact the supply chain. For instance, in the European Union, the ATEX Directive governs equipment used in potentially explosive atmospheres, which is relevant for submersible pumps used in certain industrial applications. Similarly, the North American market is influenced by regulations set by organizations like the National Electrical Manufacturers Association (NEMA) and Underwriters Laboratories (UL).

Material compliance is another critical aspect of regulatory adherence. The Restriction of Hazardous Substances (RoHS) Directive and the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation in the EU significantly impact the selection of materials used in submersible pump components. These regulations aim to reduce the use of hazardous substances and ensure the safe use of chemicals.

To optimize the supply chain while maintaining regulatory compliance, companies must implement robust tracking and documentation systems. This includes maintaining detailed records of material sourcing, manufacturing processes, and quality control measures. Such systems not only facilitate compliance audits but also enable quick responses to regulatory changes or product recalls if necessary.

Supplier management is a critical component of regulatory compliance in the supply chain. Companies must carefully vet and monitor their suppliers to ensure they adhere to relevant regulations and standards. This often involves conducting regular audits, requiring certifications, and establishing clear communication channels for updates on regulatory changes.

As regulations continue to evolve, staying informed and adaptable is crucial for supply chain optimization. This may involve investing in regulatory intelligence systems, participating in industry associations, and maintaining close relationships with regulatory bodies. By proactively addressing compliance requirements, companies can avoid costly disruptions and maintain a competitive edge in the market.

One of the primary regulatory bodies overseeing the submersible pump industry is the International Organization for Standardization (ISO). ISO standards, such as ISO 9001 for quality management systems and ISO 14001 for environmental management systems, are widely adopted in the industry. These standards help ensure consistent quality and environmental responsibility throughout the supply chain.

In addition to ISO standards, regional regulations also impact the supply chain. For instance, in the European Union, the ATEX Directive governs equipment used in potentially explosive atmospheres, which is relevant for submersible pumps used in certain industrial applications. Similarly, the North American market is influenced by regulations set by organizations like the National Electrical Manufacturers Association (NEMA) and Underwriters Laboratories (UL).

Material compliance is another critical aspect of regulatory adherence. The Restriction of Hazardous Substances (RoHS) Directive and the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation in the EU significantly impact the selection of materials used in submersible pump components. These regulations aim to reduce the use of hazardous substances and ensure the safe use of chemicals.

To optimize the supply chain while maintaining regulatory compliance, companies must implement robust tracking and documentation systems. This includes maintaining detailed records of material sourcing, manufacturing processes, and quality control measures. Such systems not only facilitate compliance audits but also enable quick responses to regulatory changes or product recalls if necessary.

Supplier management is a critical component of regulatory compliance in the supply chain. Companies must carefully vet and monitor their suppliers to ensure they adhere to relevant regulations and standards. This often involves conducting regular audits, requiring certifications, and establishing clear communication channels for updates on regulatory changes.

As regulations continue to evolve, staying informed and adaptable is crucial for supply chain optimization. This may involve investing in regulatory intelligence systems, participating in industry associations, and maintaining close relationships with regulatory bodies. By proactively addressing compliance requirements, companies can avoid costly disruptions and maintain a competitive edge in the market.

Environmental Impact

The environmental impact of optimizing supply chains for submersible pump components is a critical consideration in the pursuit of sustainable manufacturing practices. As industries strive to reduce their ecological footprint, the entire lifecycle of submersible pump components must be scrutinized, from raw material extraction to end-of-life disposal.

One of the primary environmental benefits of supply chain optimization is the reduction of transportation-related emissions. By strategically locating manufacturing facilities closer to raw material sources and end-users, companies can significantly decrease the carbon footprint associated with logistics. This localization approach not only minimizes fuel consumption but also reduces the need for excessive packaging, further diminishing waste generation.

Efficient inventory management, a key aspect of supply chain optimization, contributes to environmental conservation by preventing overproduction and reducing waste. Just-in-time manufacturing techniques, when applied to submersible pump components, ensure that resources are utilized more effectively, minimizing the environmental impact of excess inventory storage and potential obsolescence.

The selection of environmentally friendly materials for submersible pump components is another crucial factor in reducing ecological impact. Optimized supply chains can facilitate the sourcing of recycled or biodegradable materials, promoting circular economy principles. Additionally, by working closely with suppliers, manufacturers can encourage the adoption of sustainable practices throughout the entire supply network.

Energy efficiency in the production process is a significant environmental concern. Supply chain optimization can lead to the implementation of more energy-efficient manufacturing technologies and processes, reducing the overall energy consumption and associated greenhouse gas emissions. This may include the use of renewable energy sources in production facilities and the adoption of energy-saving equipment.

Water conservation is particularly relevant in the context of submersible pump components. Optimized supply chains can incorporate water-saving technologies in the manufacturing process and promote the use of closed-loop water systems. This not only reduces water consumption but also minimizes the discharge of potentially harmful effluents into the environment.

Lastly, an optimized supply chain can improve the end-of-life management of submersible pump components. By designing for disassembly and recyclability, and establishing efficient reverse logistics systems, manufacturers can ensure that materials are recovered and reused, reducing the environmental impact of waste disposal and conserving natural resources.

In conclusion, the environmental impact of optimizing supply chains for submersible pump components extends far beyond mere operational efficiencies. It encompasses a holistic approach to sustainability, addressing emissions reduction, resource conservation, and responsible waste management throughout the entire product lifecycle.

One of the primary environmental benefits of supply chain optimization is the reduction of transportation-related emissions. By strategically locating manufacturing facilities closer to raw material sources and end-users, companies can significantly decrease the carbon footprint associated with logistics. This localization approach not only minimizes fuel consumption but also reduces the need for excessive packaging, further diminishing waste generation.

Efficient inventory management, a key aspect of supply chain optimization, contributes to environmental conservation by preventing overproduction and reducing waste. Just-in-time manufacturing techniques, when applied to submersible pump components, ensure that resources are utilized more effectively, minimizing the environmental impact of excess inventory storage and potential obsolescence.

The selection of environmentally friendly materials for submersible pump components is another crucial factor in reducing ecological impact. Optimized supply chains can facilitate the sourcing of recycled or biodegradable materials, promoting circular economy principles. Additionally, by working closely with suppliers, manufacturers can encourage the adoption of sustainable practices throughout the entire supply network.

Energy efficiency in the production process is a significant environmental concern. Supply chain optimization can lead to the implementation of more energy-efficient manufacturing technologies and processes, reducing the overall energy consumption and associated greenhouse gas emissions. This may include the use of renewable energy sources in production facilities and the adoption of energy-saving equipment.

Water conservation is particularly relevant in the context of submersible pump components. Optimized supply chains can incorporate water-saving technologies in the manufacturing process and promote the use of closed-loop water systems. This not only reduces water consumption but also minimizes the discharge of potentially harmful effluents into the environment.

Lastly, an optimized supply chain can improve the end-of-life management of submersible pump components. By designing for disassembly and recyclability, and establishing efficient reverse logistics systems, manufacturers can ensure that materials are recovered and reused, reducing the environmental impact of waste disposal and conserving natural resources.

In conclusion, the environmental impact of optimizing supply chains for submersible pump components extends far beyond mere operational efficiencies. It encompasses a holistic approach to sustainability, addressing emissions reduction, resource conservation, and responsible waste management throughout the entire product lifecycle.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!