Advanced Steering Wheel Security Systems: Preventing Theft

JUL 18, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Steering Wheel Security Evolution and Objectives

The evolution of steering wheel security systems has been a critical aspect of automotive technology, driven by the persistent challenge of vehicle theft. Initially, steering wheel locks were simple mechanical devices that prevented the wheel from turning. However, as thieves became more sophisticated, so did the security measures.

In the 1980s and 1990s, aftermarket steering wheel locks gained popularity. These visible deterrents, such as the Club, were designed to make vehicles less attractive to thieves. While effective to some degree, they were not foolproof and could be defeated by determined criminals.

The advent of electronic immobilizers in the late 1990s marked a significant leap forward. These systems, integrated into the vehicle's electronics, prevented the engine from starting without the correct key. This technology dramatically reduced theft rates but did not specifically address steering wheel security.

As keyless entry systems became prevalent in the 2000s, new vulnerabilities emerged. Relay attacks, where thieves amplify the signal from a key fob to unlock and start a vehicle, highlighted the need for more advanced security measures focused on the steering wheel and ignition system.

Recent years have seen the development of biometric systems, including fingerprint recognition and facial scanning technologies, integrated into steering wheels. These advancements aim to ensure that only authorized individuals can operate the vehicle, adding an extra layer of security beyond traditional key-based systems.

The primary objective of advanced steering wheel security systems is to prevent unauthorized access and vehicle theft while maintaining user convenience. This involves creating robust, multi-layered security protocols that are difficult to bypass yet do not impede the legitimate user's experience.

Another key goal is to develop adaptive security measures that can respond to emerging threats. This includes the ability to update security protocols remotely, much like smartphone software updates, to address new vulnerabilities as they are discovered.

Integrating steering wheel security with other vehicle systems is also a crucial objective. This holistic approach aims to create a comprehensive security ecosystem that protects not just against theft, but also against cyber attacks on increasingly connected vehicles.

As vehicles become more autonomous, steering wheel security systems must evolve to maintain relevance. Future objectives include developing security measures that can authenticate users for different levels of vehicle control, from full manual operation to various degrees of autonomous driving.

In the 1980s and 1990s, aftermarket steering wheel locks gained popularity. These visible deterrents, such as the Club, were designed to make vehicles less attractive to thieves. While effective to some degree, they were not foolproof and could be defeated by determined criminals.

The advent of electronic immobilizers in the late 1990s marked a significant leap forward. These systems, integrated into the vehicle's electronics, prevented the engine from starting without the correct key. This technology dramatically reduced theft rates but did not specifically address steering wheel security.

As keyless entry systems became prevalent in the 2000s, new vulnerabilities emerged. Relay attacks, where thieves amplify the signal from a key fob to unlock and start a vehicle, highlighted the need for more advanced security measures focused on the steering wheel and ignition system.

Recent years have seen the development of biometric systems, including fingerprint recognition and facial scanning technologies, integrated into steering wheels. These advancements aim to ensure that only authorized individuals can operate the vehicle, adding an extra layer of security beyond traditional key-based systems.

The primary objective of advanced steering wheel security systems is to prevent unauthorized access and vehicle theft while maintaining user convenience. This involves creating robust, multi-layered security protocols that are difficult to bypass yet do not impede the legitimate user's experience.

Another key goal is to develop adaptive security measures that can respond to emerging threats. This includes the ability to update security protocols remotely, much like smartphone software updates, to address new vulnerabilities as they are discovered.

Integrating steering wheel security with other vehicle systems is also a crucial objective. This holistic approach aims to create a comprehensive security ecosystem that protects not just against theft, but also against cyber attacks on increasingly connected vehicles.

As vehicles become more autonomous, steering wheel security systems must evolve to maintain relevance. Future objectives include developing security measures that can authenticate users for different levels of vehicle control, from full manual operation to various degrees of autonomous driving.

Market Analysis for Anti-Theft Steering Systems

The market for anti-theft steering systems has experienced significant growth in recent years, driven by increasing vehicle theft rates and growing consumer awareness of automotive security. This segment of the automotive security market is expected to continue its upward trajectory, with a compound annual growth rate projected to exceed 5% over the next five years.

The demand for advanced steering wheel security systems is particularly strong in urban areas and regions with high vehicle theft rates. North America and Europe currently represent the largest markets, accounting for over 60% of global sales. However, emerging economies in Asia-Pacific and Latin America are showing rapid growth potential as vehicle ownership rates rise and security concerns increase.

Consumer preferences are shifting towards more sophisticated and integrated security solutions. There is a growing demand for systems that combine physical deterrents with electronic immobilizers and smart connectivity features. This trend is driving innovation in the sector, with manufacturers focusing on developing multi-layered security solutions that are both effective and user-friendly.

The market is characterized by a mix of established automotive security companies and new entrants specializing in advanced technologies. Key players are investing heavily in research and development to gain a competitive edge, with a focus on incorporating artificial intelligence, biometric authentication, and IoT connectivity into their products.

Regulatory factors are also influencing market dynamics. In several countries, insurance companies offer premium discounts for vehicles equipped with approved anti-theft devices, creating an additional incentive for consumers to invest in these systems. Furthermore, some governments are considering mandating advanced security features in new vehicles, which could significantly boost market growth.

Price sensitivity remains a challenge, particularly in the aftermarket segment. While high-end vehicles often come equipped with advanced security systems as standard, there is a need for cost-effective solutions for mid-range and economy vehicles. This presents an opportunity for manufacturers to develop scalable technologies that can be adapted to different vehicle segments.

The integration of anti-theft steering systems with other vehicle security and telematics systems is emerging as a key trend. This convergence is creating opportunities for cross-industry collaborations and partnerships, particularly between automotive manufacturers, security system providers, and technology companies specializing in IoT and cloud-based services.

The demand for advanced steering wheel security systems is particularly strong in urban areas and regions with high vehicle theft rates. North America and Europe currently represent the largest markets, accounting for over 60% of global sales. However, emerging economies in Asia-Pacific and Latin America are showing rapid growth potential as vehicle ownership rates rise and security concerns increase.

Consumer preferences are shifting towards more sophisticated and integrated security solutions. There is a growing demand for systems that combine physical deterrents with electronic immobilizers and smart connectivity features. This trend is driving innovation in the sector, with manufacturers focusing on developing multi-layered security solutions that are both effective and user-friendly.

The market is characterized by a mix of established automotive security companies and new entrants specializing in advanced technologies. Key players are investing heavily in research and development to gain a competitive edge, with a focus on incorporating artificial intelligence, biometric authentication, and IoT connectivity into their products.

Regulatory factors are also influencing market dynamics. In several countries, insurance companies offer premium discounts for vehicles equipped with approved anti-theft devices, creating an additional incentive for consumers to invest in these systems. Furthermore, some governments are considering mandating advanced security features in new vehicles, which could significantly boost market growth.

Price sensitivity remains a challenge, particularly in the aftermarket segment. While high-end vehicles often come equipped with advanced security systems as standard, there is a need for cost-effective solutions for mid-range and economy vehicles. This presents an opportunity for manufacturers to develop scalable technologies that can be adapted to different vehicle segments.

The integration of anti-theft steering systems with other vehicle security and telematics systems is emerging as a key trend. This convergence is creating opportunities for cross-industry collaborations and partnerships, particularly between automotive manufacturers, security system providers, and technology companies specializing in IoT and cloud-based services.

Current Challenges in Steering Wheel Security

The current landscape of steering wheel security systems faces several significant challenges that hinder their effectiveness in preventing theft. One of the primary issues is the prevalence of traditional mechanical locks, which are increasingly vulnerable to sophisticated theft techniques. These locks can often be bypassed using readily available tools and methods, making them an inadequate defense against determined thieves.

Another major challenge is the lack of integration between steering wheel security systems and other vehicle security measures. Many existing systems operate in isolation, failing to communicate with the car's central locking system, immobilizer, or alarm. This disconnection creates potential weak points that can be exploited by criminals, reducing the overall effectiveness of the vehicle's security infrastructure.

The rise of keyless entry systems has introduced new vulnerabilities in steering wheel security. While these systems offer convenience, they are susceptible to relay attacks, where thieves can amplify and relay the signal from a key fob to unlock and start the vehicle without physical access to the key. This vulnerability extends to the steering wheel, as once the vehicle is accessed, traditional steering locks can be easily overcome.

Advancements in technology have also led to the emergence of electronic steering locks. However, these systems face their own set of challenges, including potential software vulnerabilities and the risk of hacking. As vehicles become more connected, the possibility of remote attacks on steering security systems increases, requiring constant updates and cybersecurity measures to stay ahead of potential threats.

Cost considerations present another significant hurdle in implementing advanced steering wheel security systems. High-end security solutions can be expensive, leading manufacturers to opt for less robust options in lower-priced vehicle models. This creates a disparity in protection levels across different vehicle segments, leaving many cars more susceptible to theft.

The physical design of steering wheels also poses challenges for security system integration. The need to maintain ergonomics, incorporate airbags, and include various controls on the steering wheel limits the space and options for implementing robust security measures without compromising functionality or safety.

Lastly, the rapid evolution of theft techniques requires constant innovation in steering wheel security systems. Thieves are quick to adapt to new security measures, necessitating ongoing research and development to stay ahead of emerging threats. This cat-and-mouse game between security developers and criminals creates a continuous challenge in maintaining effective steering wheel security systems.

Another major challenge is the lack of integration between steering wheel security systems and other vehicle security measures. Many existing systems operate in isolation, failing to communicate with the car's central locking system, immobilizer, or alarm. This disconnection creates potential weak points that can be exploited by criminals, reducing the overall effectiveness of the vehicle's security infrastructure.

The rise of keyless entry systems has introduced new vulnerabilities in steering wheel security. While these systems offer convenience, they are susceptible to relay attacks, where thieves can amplify and relay the signal from a key fob to unlock and start the vehicle without physical access to the key. This vulnerability extends to the steering wheel, as once the vehicle is accessed, traditional steering locks can be easily overcome.

Advancements in technology have also led to the emergence of electronic steering locks. However, these systems face their own set of challenges, including potential software vulnerabilities and the risk of hacking. As vehicles become more connected, the possibility of remote attacks on steering security systems increases, requiring constant updates and cybersecurity measures to stay ahead of potential threats.

Cost considerations present another significant hurdle in implementing advanced steering wheel security systems. High-end security solutions can be expensive, leading manufacturers to opt for less robust options in lower-priced vehicle models. This creates a disparity in protection levels across different vehicle segments, leaving many cars more susceptible to theft.

The physical design of steering wheels also poses challenges for security system integration. The need to maintain ergonomics, incorporate airbags, and include various controls on the steering wheel limits the space and options for implementing robust security measures without compromising functionality or safety.

Lastly, the rapid evolution of theft techniques requires constant innovation in steering wheel security systems. Thieves are quick to adapt to new security measures, necessitating ongoing research and development to stay ahead of emerging threats. This cat-and-mouse game between security developers and criminals creates a continuous challenge in maintaining effective steering wheel security systems.

Existing Steering Wheel Security Solutions

01 Mechanical locking mechanisms

Various mechanical locking systems can be integrated into steering wheels to prevent theft. These include devices that lock the steering wheel in place, making it impossible to turn, or mechanisms that cover the entire steering wheel, rendering it unusable. Such systems often require a key or combination to disengage, providing an additional layer of security beyond the vehicle's standard ignition lock.- Steering wheel locking mechanisms: Various mechanical locking systems are designed to prevent unauthorized removal or rotation of the steering wheel. These can include physical bars, clamps, or internal locking mechanisms that engage with the steering column or wheel, making it difficult for thieves to steer the vehicle.

- Electronic immobilization systems: Advanced electronic systems use transponders, RFID tags, or biometric authentication to verify the driver's identity before allowing the steering wheel to function. These systems can disable the steering mechanism or other critical vehicle functions if an unauthorized attempt to start the car is detected.

- Integrated alarm and tracking systems: Some steering wheel security systems incorporate alarm features that trigger audible alerts and notifications to the owner's smartphone if tampering is detected. These may also include GPS tracking capabilities to locate the vehicle in case of theft.

- Smart steering wheel covers: Innovative steering wheel covers equipped with sensors and locking mechanisms can provide an additional layer of security. These covers can detect unauthorized attempts to remove them and may integrate with the vehicle's existing security systems.

- Steering column reinforcement: Techniques to strengthen the steering column and its connection to the vehicle frame can prevent thieves from forcibly removing the steering wheel or bypassing steering locks. This may involve reinforced materials, additional mounting points, or specialized anti-theft bolts.

02 Electronic immobilization systems

Advanced electronic systems can be incorporated into steering wheels to prevent unauthorized use. These may include biometric scanners, RFID technology, or keyless entry systems that communicate with the vehicle's onboard computer. When an unauthorized attempt to start the vehicle is detected, these systems can disable critical components, effectively immobilizing the vehicle and preventing theft.Expand Specific Solutions03 Alarm and notification systems

Steering wheel security systems can be equipped with sensors that trigger alarms when tampering is detected. These alarms may produce loud sounds to deter thieves and draw attention. Additionally, some systems can send notifications to the owner's smartphone or a security monitoring service, alerting them of potential theft attempts in real-time.Expand Specific Solutions04 Integrated tracking and recovery features

Some advanced steering wheel security systems incorporate GPS tracking technology. In the event of a theft, these systems can provide real-time location data to law enforcement or the vehicle owner, facilitating quick recovery. Some may also include remote shutdown capabilities, allowing the owner or authorities to disable the vehicle from a distance.Expand Specific Solutions05 Steering wheel covers and physical deterrents

Visible physical deterrents can be effective in preventing theft attempts. These may include steering wheel covers or bars that are clearly visible from outside the vehicle, discouraging potential thieves. Some designs incorporate high-strength materials or complex locking mechanisms that are difficult to bypass without specialized tools or knowledge.Expand Specific Solutions

Key Players in Automotive Security Industry

The advanced steering wheel security systems market is in a growth phase, driven by increasing vehicle theft concerns and technological advancements. The market size is expanding, with a growing demand for sophisticated anti-theft solutions. Technologically, the field is rapidly evolving, with companies like DENSO Corp., TOKAI RIKA CO., LTD., and Ford Global Technologies LLC leading innovation. These firms are developing advanced biometric systems, smart key integration, and AI-powered security features. Emerging players such as Chery Automobile Co., Ltd. and TVS Motor Co. Ltd. are also contributing to the competitive landscape, focusing on cost-effective solutions for emerging markets.

DENSO Corp.

Technical Solution: DENSO has developed a steering wheel security system that focuses on preventing theft through advanced immobilizer technology and environmental sensing. Their system utilizes a combination of RFID technology embedded in the steering wheel and a network of micro-sensors distributed throughout the vehicle's cabin[7]. The RFID system requires the presence of an authorized key fob to enable steering functionality. Additionally, the micro-sensor network creates a 3D map of the vehicle's interior, detecting any unauthorized presence or tampering attempts. DENSO has also implemented a unique "heartbeat" signature for each vehicle, which is continuously verified through the CAN bus network. Any interruption or alteration to this signature immediately triggers a shutdown of critical vehicle systems[8]. The company has further enhanced the system with AI-powered anomaly detection, which can identify unusual patterns in vehicle usage or driver behavior that may indicate a theft attempt[9].

Strengths: Comprehensive approach combining physical and digital security measures; integration with existing vehicle networks. Weaknesses: Complexity of the system may lead to higher costs; potential for false alarms in anomaly detection.

TOKAI RIKA CO., LTD.

Technical Solution: TOKAI RIKA has engineered a steering wheel security system that emphasizes physical deterrence and integration with smart city infrastructure. Their solution incorporates a reinforced steering column lock with a hardened steel shackle that engages when the vehicle is parked[10]. This is complemented by a smart key system using rolling code technology to prevent code grabbing attempts. The company has also developed a unique "steering wheel fingerprinting" technology, which uses high-resolution sensors to map the microscopic surface patterns of the steering wheel, creating a unique identifier for each vehicle[11]. This identifier is registered with a secure, distributed ledger shared among law enforcement agencies and insurance companies. In the event of a theft, the stolen vehicle's steering wheel can be quickly identified even if other identifiers are altered. TOKAI RIKA has further enhanced their system with V2X (Vehicle-to-Everything) communication capabilities, allowing the vehicle to report suspicious activities to nearby infrastructure and other vehicles in real-time[12].

Strengths: Strong physical deterrent combined with advanced digital security; integration with broader security ecosystems. Weaknesses: Reliance on external infrastructure for some features; potential for steering wheel damage affecting the fingerprinting system.

Innovative Patents in Steering Wheel Protection

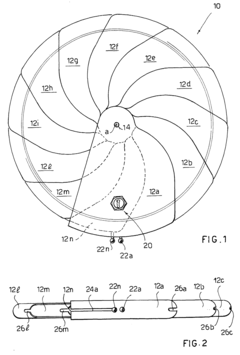

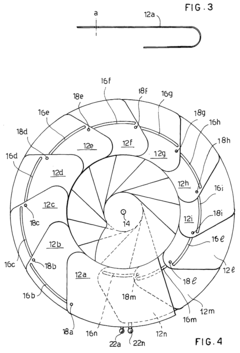

Vehicle anti-theft device in the form of a steering wheel cover adaptable to a steering wheel with play

PatentInactiveEP0989037A1

Innovation

- A device comprising rigid U-shaped slats that fit around the steering wheel, allowing limited access and featuring a locking mechanism with convex protuberances for additional security, preventing the steering wheel from being turned by encasing it in a rigid casing.

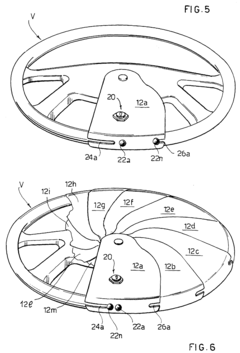

Vehicle steering-wheel lock

PatentInactiveEP0547130A1

Innovation

- A steering wheel lock featuring a tough, lockable cover with a rigid arm and pin mechanism that extends beyond the cover perimeter, preventing effective steering control and collision with surrounding vehicle structures, even if the arm is cut.

Regulatory Framework for Vehicle Security Systems

The regulatory framework for vehicle security systems plays a crucial role in shaping the development and implementation of advanced steering wheel security systems aimed at preventing theft. Governments and regulatory bodies worldwide have established various standards and guidelines to ensure the effectiveness and reliability of these systems.

In the United States, the National Highway Traffic Safety Administration (NHTSA) has set forth regulations under the Federal Motor Vehicle Safety Standards (FMVSS) that address vehicle theft protection. These standards require manufacturers to incorporate certain anti-theft features into their vehicles, including immobilizer systems and steering column locks.

The European Union has implemented similar regulations through the United Nations Economic Commission for Europe (UNECE) Regulation No. 116, which outlines specific requirements for vehicle alarm systems and immobilizers. This regulation mandates the use of advanced security features in vehicles sold within the EU market.

In addition to national and regional regulations, international standards such as ISO 15764 provide guidelines for the design and testing of vehicle security systems. These standards ensure interoperability and consistency across different manufacturers and markets.

Many countries have also introduced legislation that mandates the installation of certain security features in vehicles. For example, the United Kingdom's Vehicle Theft Reduction Act requires all new vehicles to be fitted with electronic immobilizers and visible vehicle identification numbers.

Regulatory bodies are increasingly focusing on cybersecurity aspects of vehicle security systems. The UN Regulation No. 155 on Cyber Security and Cyber Security Management System addresses the need for manufacturers to implement robust cybersecurity measures in their vehicles, including those related to steering wheel security systems.

As technology advances, regulators are adapting their frameworks to accommodate new innovations. For instance, the emergence of biometric authentication systems in vehicles has prompted discussions on privacy regulations and data protection standards specific to automotive applications.

Compliance with these regulatory frameworks is essential for manufacturers developing advanced steering wheel security systems. Failure to meet these standards can result in significant penalties and market access restrictions. As such, companies must stay informed about evolving regulations and incorporate compliance measures into their product development processes.

The regulatory landscape also influences innovation in the field of vehicle security. While stringent standards can sometimes pose challenges for rapid technological advancement, they also drive research and development efforts towards more secure and reliable solutions. This dynamic interaction between regulation and innovation continues to shape the future of advanced steering wheel security systems and their role in preventing vehicle theft.

In the United States, the National Highway Traffic Safety Administration (NHTSA) has set forth regulations under the Federal Motor Vehicle Safety Standards (FMVSS) that address vehicle theft protection. These standards require manufacturers to incorporate certain anti-theft features into their vehicles, including immobilizer systems and steering column locks.

The European Union has implemented similar regulations through the United Nations Economic Commission for Europe (UNECE) Regulation No. 116, which outlines specific requirements for vehicle alarm systems and immobilizers. This regulation mandates the use of advanced security features in vehicles sold within the EU market.

In addition to national and regional regulations, international standards such as ISO 15764 provide guidelines for the design and testing of vehicle security systems. These standards ensure interoperability and consistency across different manufacturers and markets.

Many countries have also introduced legislation that mandates the installation of certain security features in vehicles. For example, the United Kingdom's Vehicle Theft Reduction Act requires all new vehicles to be fitted with electronic immobilizers and visible vehicle identification numbers.

Regulatory bodies are increasingly focusing on cybersecurity aspects of vehicle security systems. The UN Regulation No. 155 on Cyber Security and Cyber Security Management System addresses the need for manufacturers to implement robust cybersecurity measures in their vehicles, including those related to steering wheel security systems.

As technology advances, regulators are adapting their frameworks to accommodate new innovations. For instance, the emergence of biometric authentication systems in vehicles has prompted discussions on privacy regulations and data protection standards specific to automotive applications.

Compliance with these regulatory frameworks is essential for manufacturers developing advanced steering wheel security systems. Failure to meet these standards can result in significant penalties and market access restrictions. As such, companies must stay informed about evolving regulations and incorporate compliance measures into their product development processes.

The regulatory landscape also influences innovation in the field of vehicle security. While stringent standards can sometimes pose challenges for rapid technological advancement, they also drive research and development efforts towards more secure and reliable solutions. This dynamic interaction between regulation and innovation continues to shape the future of advanced steering wheel security systems and their role in preventing vehicle theft.

Cost-Benefit Analysis of Advanced Security Measures

The implementation of advanced steering wheel security systems to prevent theft requires a thorough cost-benefit analysis to determine the viability and effectiveness of such measures. This analysis must consider both the direct and indirect costs associated with developing, manufacturing, and installing these security systems, as well as the potential benefits in terms of reduced theft rates and increased customer satisfaction.

On the cost side, the primary factors to consider include research and development expenses, which can be substantial given the complexity of integrating advanced security features into steering wheel designs. These may involve biometric authentication systems, electronic immobilizers, or sophisticated locking mechanisms. Manufacturing costs will likely increase due to the incorporation of additional components and more complex assembly processes. Installation costs, both at the factory level and for aftermarket solutions, must also be factored in.

Additionally, there are ongoing costs to consider, such as maintenance, software updates, and potential warranty claims related to the security systems. These recurring expenses can significantly impact the long-term cost structure of implementing advanced steering wheel security measures.

The benefits of such systems are multifaceted. Primarily, a reduction in vehicle theft rates can lead to substantial savings for insurance companies, potentially resulting in lower premiums for consumers. This, in turn, can become a selling point for manufacturers, enhancing brand value and customer loyalty. The increased security may also lead to higher resale values for vehicles equipped with these advanced systems.

Furthermore, the implementation of cutting-edge security measures can position a manufacturer as an industry leader in vehicle safety and technology, potentially driving increased sales and market share. This reputational benefit can have far-reaching effects on the company's overall performance and profitability.

When conducting the cost-benefit analysis, it is crucial to consider the varying levels of security that can be implemented and their corresponding costs and benefits. A tiered approach, offering different levels of security at various price points, may provide the best balance between cost-effectiveness and market appeal.

Lastly, the analysis should account for potential regulatory impacts. As vehicle security standards evolve, manufacturers who have already invested in advanced security systems may find themselves ahead of compliance requirements, potentially saving on future adaptation costs.

In conclusion, while the initial costs of implementing advanced steering wheel security systems may be significant, the long-term benefits in terms of reduced theft, enhanced brand value, and potential regulatory compliance could outweigh these expenses. A comprehensive cost-benefit analysis will provide crucial insights for decision-makers in determining the optimal approach to vehicle security in an increasingly technology-driven automotive landscape.

On the cost side, the primary factors to consider include research and development expenses, which can be substantial given the complexity of integrating advanced security features into steering wheel designs. These may involve biometric authentication systems, electronic immobilizers, or sophisticated locking mechanisms. Manufacturing costs will likely increase due to the incorporation of additional components and more complex assembly processes. Installation costs, both at the factory level and for aftermarket solutions, must also be factored in.

Additionally, there are ongoing costs to consider, such as maintenance, software updates, and potential warranty claims related to the security systems. These recurring expenses can significantly impact the long-term cost structure of implementing advanced steering wheel security measures.

The benefits of such systems are multifaceted. Primarily, a reduction in vehicle theft rates can lead to substantial savings for insurance companies, potentially resulting in lower premiums for consumers. This, in turn, can become a selling point for manufacturers, enhancing brand value and customer loyalty. The increased security may also lead to higher resale values for vehicles equipped with these advanced systems.

Furthermore, the implementation of cutting-edge security measures can position a manufacturer as an industry leader in vehicle safety and technology, potentially driving increased sales and market share. This reputational benefit can have far-reaching effects on the company's overall performance and profitability.

When conducting the cost-benefit analysis, it is crucial to consider the varying levels of security that can be implemented and their corresponding costs and benefits. A tiered approach, offering different levels of security at various price points, may provide the best balance between cost-effectiveness and market appeal.

Lastly, the analysis should account for potential regulatory impacts. As vehicle security standards evolve, manufacturers who have already invested in advanced security systems may find themselves ahead of compliance requirements, potentially saving on future adaptation costs.

In conclusion, while the initial costs of implementing advanced steering wheel security systems may be significant, the long-term benefits in terms of reduced theft, enhanced brand value, and potential regulatory compliance could outweigh these expenses. A comprehensive cost-benefit analysis will provide crucial insights for decision-makers in determining the optimal approach to vehicle security in an increasingly technology-driven automotive landscape.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!