Global commercialization of fast charging protocols in EV networks

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

EV Fast Charging Evolution and Objectives

Electric vehicle (EV) fast charging technology has evolved significantly over the past decade, transforming from a nascent concept to a critical infrastructure component supporting global EV adoption. The initial fast charging systems, introduced around 2010, delivered approximately 50kW of power, enabling EVs to charge to 80% capacity in about 30 minutes. This represented a substantial improvement over standard Level 2 charging, which typically provided only 7-22kW.

The evolution accelerated between 2015-2018 with the introduction of 100-150kW systems, cutting charging times nearly in half. By 2020, ultra-fast charging stations capable of delivering 250-350kW began commercial deployment, theoretically allowing compatible vehicles to add 200+ miles of range in just 15 minutes. This rapid technological progression has been driven by both consumer demand for reduced charging times and automotive manufacturers' strategic push to eliminate "range anxiety" as a barrier to EV adoption.

Regional differences have characterized this evolution, with Europe embracing the Combined Charging System (CCS), China standardizing around GB/T, Japan and some American manufacturers supporting CHAdeMO, and Tesla developing its proprietary Supercharger network. This fragmentation has created significant challenges for global interoperability and universal access.

The primary objective of fast charging technology development is to achieve charging speeds comparable to traditional refueling experiences, targeting a complete charge in under 10 minutes. Secondary objectives include improving charging infrastructure density, enhancing grid integration capabilities, and developing smart charging systems that optimize energy usage based on grid conditions and user preferences.

Technical objectives focus on increasing power delivery while managing thermal constraints, improving connector designs for higher current capacity, and developing advanced battery management systems that can safely accept higher charging rates without compromising battery longevity. Simultaneously, there are efforts to standardize protocols globally to ensure interoperability across vehicle models and charging networks.

Commercial objectives include reducing infrastructure deployment costs, developing sustainable business models for charging network operators, and creating seamless payment and access systems. The industry is working toward establishing charging networks that can support mass EV adoption, with particular emphasis on highway corridors and urban centers where demand is highest.

Looking forward, the industry aims to achieve charging rates exceeding 500kW by 2025, potentially enabling charging times of less than 5 minutes for vehicles with compatible battery systems. This advancement would effectively eliminate the charging time disadvantage compared to conventional vehicles, representing a critical milestone in the global transition to electric mobility.

The evolution accelerated between 2015-2018 with the introduction of 100-150kW systems, cutting charging times nearly in half. By 2020, ultra-fast charging stations capable of delivering 250-350kW began commercial deployment, theoretically allowing compatible vehicles to add 200+ miles of range in just 15 minutes. This rapid technological progression has been driven by both consumer demand for reduced charging times and automotive manufacturers' strategic push to eliminate "range anxiety" as a barrier to EV adoption.

Regional differences have characterized this evolution, with Europe embracing the Combined Charging System (CCS), China standardizing around GB/T, Japan and some American manufacturers supporting CHAdeMO, and Tesla developing its proprietary Supercharger network. This fragmentation has created significant challenges for global interoperability and universal access.

The primary objective of fast charging technology development is to achieve charging speeds comparable to traditional refueling experiences, targeting a complete charge in under 10 minutes. Secondary objectives include improving charging infrastructure density, enhancing grid integration capabilities, and developing smart charging systems that optimize energy usage based on grid conditions and user preferences.

Technical objectives focus on increasing power delivery while managing thermal constraints, improving connector designs for higher current capacity, and developing advanced battery management systems that can safely accept higher charging rates without compromising battery longevity. Simultaneously, there are efforts to standardize protocols globally to ensure interoperability across vehicle models and charging networks.

Commercial objectives include reducing infrastructure deployment costs, developing sustainable business models for charging network operators, and creating seamless payment and access systems. The industry is working toward establishing charging networks that can support mass EV adoption, with particular emphasis on highway corridors and urban centers where demand is highest.

Looking forward, the industry aims to achieve charging rates exceeding 500kW by 2025, potentially enabling charging times of less than 5 minutes for vehicles with compatible battery systems. This advancement would effectively eliminate the charging time disadvantage compared to conventional vehicles, representing a critical milestone in the global transition to electric mobility.

Global Market Analysis for EV Fast Charging

The global electric vehicle (EV) fast charging market is experiencing unprecedented growth, driven by increasing EV adoption rates across major automotive markets. As of 2023, the global EV fast charging infrastructure market is valued at approximately $12 billion, with projections indicating a compound annual growth rate (CAGR) of 26.8% through 2030. This remarkable expansion is primarily fueled by government initiatives promoting clean transportation, declining battery costs, and growing consumer acceptance of electric mobility solutions.

North America, Europe, and Asia-Pacific represent the dominant regional markets for EV fast charging. China leads global deployment with over 1.2 million public charging points, of which approximately 500,000 are fast chargers. Europe follows with significant infrastructure development, particularly in countries like Norway, the Netherlands, and Germany, where EV penetration rates exceed 20% of new vehicle sales. The United States market, while developing more gradually, has seen accelerated investment following recent federal infrastructure legislation allocating $7.5 billion specifically for EV charging networks.

Consumer behavior analysis reveals critical market drivers for fast charging adoption. Range anxiety remains a primary concern among potential EV buyers, with 78% of consumers citing charging speed and infrastructure availability as decisive factors in purchase decisions. Fast charging protocols that can deliver 80% battery capacity in under 30 minutes are increasingly becoming the expected standard among consumers, particularly in urban centers and along major transportation corridors.

Market segmentation shows distinct patterns across different charging protocols. CCS (Combined Charging System) has emerged as the dominant standard in Europe and North America, while CHAdeMO maintains significant presence in Japan and parts of Asia. China's GB/T standard dominates its domestic market, which represents the world's largest EV ecosystem. Tesla's proprietary Supercharger network, with over 45,000 chargers globally, represents a significant market force that is gradually opening to non-Tesla vehicles in select markets.

Revenue models in the fast charging market continue to evolve, with subscription-based services gaining traction alongside traditional pay-per-use models. Network operators are increasingly exploring value-added services, including integrated renewable energy solutions, battery health management, and retail partnerships at charging locations. The average revenue per charging session has increased by 15% annually as consumers demonstrate willingness to pay premium rates for faster charging speeds.

Market forecasts indicate that ultra-fast charging (150+ kW) will represent the highest growth segment, with an anticipated CAGR of 35% through 2028. This trend is supported by technological advancements in battery chemistry enabling higher charging rates and vehicle architectures designed specifically for rapid power transfer. Interoperability between charging networks remains a significant market challenge, with standardization efforts progressing but still fragmented across regional markets.

North America, Europe, and Asia-Pacific represent the dominant regional markets for EV fast charging. China leads global deployment with over 1.2 million public charging points, of which approximately 500,000 are fast chargers. Europe follows with significant infrastructure development, particularly in countries like Norway, the Netherlands, and Germany, where EV penetration rates exceed 20% of new vehicle sales. The United States market, while developing more gradually, has seen accelerated investment following recent federal infrastructure legislation allocating $7.5 billion specifically for EV charging networks.

Consumer behavior analysis reveals critical market drivers for fast charging adoption. Range anxiety remains a primary concern among potential EV buyers, with 78% of consumers citing charging speed and infrastructure availability as decisive factors in purchase decisions. Fast charging protocols that can deliver 80% battery capacity in under 30 minutes are increasingly becoming the expected standard among consumers, particularly in urban centers and along major transportation corridors.

Market segmentation shows distinct patterns across different charging protocols. CCS (Combined Charging System) has emerged as the dominant standard in Europe and North America, while CHAdeMO maintains significant presence in Japan and parts of Asia. China's GB/T standard dominates its domestic market, which represents the world's largest EV ecosystem. Tesla's proprietary Supercharger network, with over 45,000 chargers globally, represents a significant market force that is gradually opening to non-Tesla vehicles in select markets.

Revenue models in the fast charging market continue to evolve, with subscription-based services gaining traction alongside traditional pay-per-use models. Network operators are increasingly exploring value-added services, including integrated renewable energy solutions, battery health management, and retail partnerships at charging locations. The average revenue per charging session has increased by 15% annually as consumers demonstrate willingness to pay premium rates for faster charging speeds.

Market forecasts indicate that ultra-fast charging (150+ kW) will represent the highest growth segment, with an anticipated CAGR of 35% through 2028. This trend is supported by technological advancements in battery chemistry enabling higher charging rates and vehicle architectures designed specifically for rapid power transfer. Interoperability between charging networks remains a significant market challenge, with standardization efforts progressing but still fragmented across regional markets.

Current Protocols and Technical Barriers

The global electric vehicle (EV) charging landscape is currently fragmented with multiple competing fast charging protocols, creating significant challenges for universal adoption and seamless user experience. The predominant protocols include Combined Charging System (CCS) with its regional variants CCS1 (North America) and CCS2 (Europe), CHAdeMO (developed in Japan), Tesla's proprietary Supercharger network, and China's GB/T standard.

CCS has emerged as the most widely adopted protocol in Western markets, supporting DC fast charging up to 350kW. Its architecture combines AC and DC charging capabilities in a single inlet, offering flexibility across charging scenarios. However, implementation varies regionally, with CCS1 and CCS2 connectors being physically incompatible despite sharing the same underlying technology.

CHAdeMO, pioneered by Japanese automakers, initially led the fast-charging market but has seen declining adoption outside Asia. While it offers bi-directional charging capabilities valuable for vehicle-to-grid applications, its maximum charging rate typically caps at 150kW, falling behind newer CCS implementations.

Tesla's Supercharger network represents the most developed proprietary ecosystem, with over 45,000 chargers globally delivering up to 250kW. While historically closed to non-Tesla vehicles, recent initiatives to open the network in select regions signal a potential shift toward interoperability.

China's GB/T standard dominates the world's largest EV market but remains largely confined within Chinese borders, creating a significant regional technology island in the global charging landscape.

The technical barriers impeding global harmonization are substantial. Hardware incompatibility between connector types necessitates adapters that often limit charging speeds and introduce reliability concerns. Communication protocol differences further complicate interoperability, as vehicles and chargers must negotiate power delivery parameters through compatible software interfaces.

Authentication and payment systems vary widely across networks, creating a fragmented user experience. While some regions have implemented roaming agreements between charging providers, global standardization remains elusive.

Thermal management represents another critical barrier, particularly as charging powers increase. Different protocols implement varying approaches to cooling systems and temperature monitoring, creating challenges for universal high-power charging solutions.

Grid integration capabilities also differ significantly between protocols, with varying levels of support for smart charging, load balancing, and renewable energy integration. These differences complicate the development of unified grid management strategies essential for large-scale EV adoption.

CCS has emerged as the most widely adopted protocol in Western markets, supporting DC fast charging up to 350kW. Its architecture combines AC and DC charging capabilities in a single inlet, offering flexibility across charging scenarios. However, implementation varies regionally, with CCS1 and CCS2 connectors being physically incompatible despite sharing the same underlying technology.

CHAdeMO, pioneered by Japanese automakers, initially led the fast-charging market but has seen declining adoption outside Asia. While it offers bi-directional charging capabilities valuable for vehicle-to-grid applications, its maximum charging rate typically caps at 150kW, falling behind newer CCS implementations.

Tesla's Supercharger network represents the most developed proprietary ecosystem, with over 45,000 chargers globally delivering up to 250kW. While historically closed to non-Tesla vehicles, recent initiatives to open the network in select regions signal a potential shift toward interoperability.

China's GB/T standard dominates the world's largest EV market but remains largely confined within Chinese borders, creating a significant regional technology island in the global charging landscape.

The technical barriers impeding global harmonization are substantial. Hardware incompatibility between connector types necessitates adapters that often limit charging speeds and introduce reliability concerns. Communication protocol differences further complicate interoperability, as vehicles and chargers must negotiate power delivery parameters through compatible software interfaces.

Authentication and payment systems vary widely across networks, creating a fragmented user experience. While some regions have implemented roaming agreements between charging providers, global standardization remains elusive.

Thermal management represents another critical barrier, particularly as charging powers increase. Different protocols implement varying approaches to cooling systems and temperature monitoring, creating challenges for universal high-power charging solutions.

Grid integration capabilities also differ significantly between protocols, with varying levels of support for smart charging, load balancing, and renewable energy integration. These differences complicate the development of unified grid management strategies essential for large-scale EV adoption.

Standardization Approaches and Solutions

01 Standardization of fast charging protocols

The commercialization of fast charging technologies requires standardization of protocols to ensure compatibility across different devices and charging systems. These standards define communication methods between chargers and devices, voltage/current parameters, and safety mechanisms. Standardized protocols enable broader market adoption by allowing interoperability between various manufacturers' products while ensuring consistent charging performance and safety across the ecosystem.- Fast charging protocol standardization and implementation: Standardization of fast charging protocols is essential for widespread commercialization. These standards define communication methods between charging devices and batteries, ensuring compatibility across different manufacturers. Implementation involves developing hardware and software that comply with established protocols like USB Power Delivery, Quick Charge, or proprietary standards. Standardized protocols enable interoperability while maintaining safety parameters and optimal charging efficiency.

- Business models and monetization strategies for fast charging: Various business models have emerged for commercializing fast charging technologies, including subscription services, pay-per-use systems, and bundled offerings with other products or services. Companies are developing monetization strategies such as licensing proprietary charging protocols, creating charging networks with premium pricing, and establishing partnerships with automotive manufacturers. These approaches help recover R&D investments while making fast charging accessible to consumers.

- Hardware innovations for commercial fast charging solutions: Commercial fast charging solutions incorporate advanced hardware components such as high-power semiconductors, thermal management systems, and specialized connectors. These innovations enable higher power delivery while maintaining safety and reliability. Hardware developments include modular charging stations, compact power conversion systems, and integrated cooling mechanisms. These components are designed for durability in commercial settings while supporting various fast charging protocols.

- Market deployment and infrastructure development: Successful commercialization of fast charging protocols requires strategic infrastructure deployment across various locations. This includes installing charging stations in public spaces, commercial properties, and transportation hubs. Infrastructure development considers factors such as grid capacity, location accessibility, and user density. Companies are forming partnerships with property owners, utilities, and government entities to accelerate deployment while addressing regulatory requirements and ensuring adequate power supply.

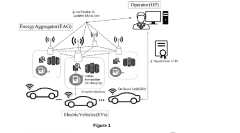

- Integration with energy management systems and smart grids: Fast charging commercialization increasingly involves integration with broader energy management systems and smart grid technologies. These integrations enable dynamic charging based on grid conditions, renewable energy availability, and electricity pricing. Advanced systems incorporate load balancing, peak shaving capabilities, and bidirectional charging functionality. Smart charging networks can communicate with utilities to optimize energy usage while providing grid services that generate additional revenue streams.

02 Business models for charging infrastructure

Various business models have emerged for commercializing fast charging infrastructure, including subscription services, pay-per-use systems, and bundled offerings with vehicle purchases. These models address the economic challenges of deploying charging networks by creating sustainable revenue streams while providing value to consumers. Innovative approaches include partnerships between charging providers, automotive manufacturers, and retail establishments to share costs and maximize utilization of charging facilities.Expand Specific Solutions03 Hardware implementation for commercial fast charging

Commercial fast charging systems require specialized hardware components designed to handle high power delivery while maintaining safety and efficiency. These implementations include advanced power conversion circuits, thermal management systems, and protective mechanisms. The hardware must be robust enough for continuous commercial use while being cost-effective for mass production. Innovations in semiconductor technology, connector design, and cooling systems have enabled increasingly compact and efficient charging hardware suitable for various commercial applications.Expand Specific Solutions04 Integration with smart grid and energy management systems

Commercial fast charging solutions increasingly integrate with smart grid technologies and energy management systems to optimize power usage, reduce costs, and minimize environmental impact. These integrated systems can balance charging loads, implement dynamic pricing, and utilize renewable energy sources when available. Advanced implementations include bidirectional charging capabilities that allow vehicles to serve as temporary energy storage units, providing grid services during peak demand periods while ensuring vehicles are charged when needed.Expand Specific Solutions05 User interface and authentication systems for commercial charging

Commercial fast charging systems incorporate sophisticated user interfaces and authentication mechanisms to enhance user experience and enable secure transactions. These systems include mobile applications, RFID authentication, and cloud-based user accounts that streamline the charging process. The interfaces provide real-time information about charging status, costs, and availability while supporting various payment methods. Authentication systems ensure proper billing and can implement different pricing tiers for various user categories while protecting against unauthorized access.Expand Specific Solutions

Leading Companies and Charging Networks

The global EV fast charging protocol market is in a growth phase, characterized by increasing adoption and technological advancements. The market is expanding rapidly with projections showing significant growth as EV adoption accelerates worldwide. Key players represent diverse geographical regions and industry segments, creating a competitive landscape. Companies like ABB E-mobility, StoreDot, PowerFlex Systems, and BorgWarner are leading innovation in charging technology, while automotive manufacturers including Hyundai, Kia, Honda, and Tata Motors are integrating compatible systems into their vehicles. State Grid Corp. of China and other utility providers are developing infrastructure networks. Technical maturity varies across regions, with established protocols in Europe and emerging standards in developing markets, driving the need for global interoperability solutions.

State Grid Corp. of China

Technical Solution: State Grid Corporation of China has developed an extensive EV charging network utilizing their proprietary fast charging protocol. Their approach integrates high-power DC charging stations with intelligent grid management systems to optimize charging efficiency while maintaining grid stability. State Grid has implemented a standardized charging interface based on the GB/T protocol that delivers up to 237.5 kW of power through 950V DC charging. Their network architecture incorporates cloud-based management platforms that enable real-time monitoring, load balancing, and predictive maintenance across thousands of charging points. State Grid has pioneered vehicle-to-grid (V2G) integration within their fast charging network, allowing EVs to serve as distributed energy resources during peak demand periods. Their charging stations feature modular power units that can be scaled according to location requirements and upgraded as technology advances. By 2022, State Grid had deployed over 1.7 million charging points across China, creating the world's largest EV charging network with standardized fast charging capabilities.

Strengths: Massive deployment scale providing extensive coverage across China; integrated approach to grid management and charging infrastructure; standardized protocol implementation ensuring compatibility across the network; advanced V2G capabilities. Weaknesses: Limited international expansion of their proprietary charging standards; heavy reliance on government support and policy; potential challenges in adapting their system to markets with different grid characteristics.

Honda Motor Co., Ltd.

Technical Solution: Honda has developed a comprehensive approach to fast charging commercialization through their Honda Charging Network Strategy. Their technology focuses on multi-standard compatibility, supporting both CCS and CHAdeMO protocols to ensure global market adaptability. Honda's fast charging implementation incorporates their proprietary "Honda Smart Charge" system that optimizes charging times based on grid conditions, electricity rates, and user preferences. Their vehicles feature advanced battery management systems that dynamically adjust charging parameters to maximize speed while preserving battery health through precise temperature control and cell balancing. Honda has pioneered bidirectional charging capabilities in their newer EV models, enabling vehicle-to-grid and vehicle-to-home functionality that creates additional value for consumers and utilities. Their charging ecosystem includes integrated mobile applications that provide real-time charging status updates, charging station availability, and predictive range calculations based on driving conditions and charging infrastructure availability.

Strengths: Strong multi-protocol compatibility ensuring global market flexibility; intelligent charging management that optimizes for both speed and battery longevity; integrated ecosystem approach connecting vehicles, charging infrastructure, and user interfaces. Weaknesses: Later market entry compared to some competitors; limited deployment of Honda-specific charging infrastructure; current EV lineup with relatively modest charging speeds compared to industry leaders.

Key Patents and Technical Innovations

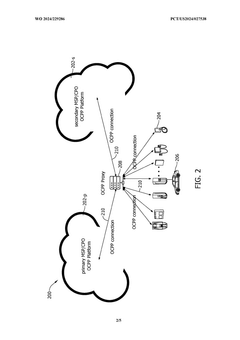

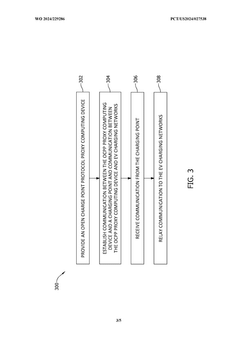

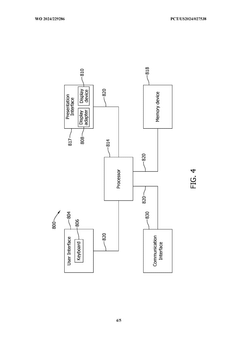

Systems and methods for managing electric vehicle charging networks using an open charge point protocol proxy

PatentWO2024229286A1

Innovation

- Implementing an Open Charge Point Protocol (OCPP) proxy computing device that enables two-way communication between a charging point and multiple EV charging networks, allowing for a one-to-many connection, facilitating communication relay, and providing backup networks to ensure stability and flexibility without modifying existing infrastructure.

Electric vehicle flexible charging using internet of things

PatentPendingIN202441016646A

Innovation

- The integration of Internet of Things (IoT) technology into electric vehicle charging infrastructure enables dynamic and adaptable charging solutions through real-time data monitoring, predictive maintenance, and seamless integration with renewable energy sources, providing personalized charging schedules and enhanced user experience.

Cross-Border Compatibility Challenges

The global landscape of electric vehicle (EV) charging infrastructure faces significant cross-border compatibility challenges that hinder seamless international travel and complicate market expansion for manufacturers. Different regions have developed distinct charging protocols, creating a fragmented ecosystem that presents barriers to the global commercialization of fast charging networks. In North America, the Combined Charging System (CCS) Type 1 dominates, while Europe has standardized around CCS Type 2. Meanwhile, Japan supports CHAdeMO, and China has developed its own GB/T standard. This lack of harmonization creates significant technical barriers for vehicles crossing borders.

Regulatory frameworks compound these compatibility issues, with each region implementing different safety standards, grid connection requirements, and certification processes. For instance, European charging stations must comply with IEC standards, while North American stations follow UL requirements. These divergent regulatory approaches necessitate costly redesigns and recertifications for manufacturers seeking multi-market presence, ultimately increasing consumer costs and slowing adoption rates.

Payment systems present another layer of complexity in cross-border charging scenarios. Users traveling between countries often encounter incompatible payment platforms, subscription requirements, and authentication methods. While some networks have implemented roaming agreements, these remain limited in scope and often involve premium pricing for international users. The absence of standardized payment protocols creates a fragmented user experience that undermines consumer confidence in long-distance EV travel.

Communication protocols between vehicles and charging stations further complicate cross-border compatibility. Different regions utilize varying communication standards for handshaking, authentication, and power negotiation. This technical fragmentation requires vehicles to support multiple protocols or rely on adapters, adding complexity and potential points of failure. The ISO 15118 standard offers promise for harmonization but remains inconsistently implemented across global markets.

Market dynamics also influence compatibility challenges, with established players often resisting standardization that might erode competitive advantages. Tesla's proprietary Supercharger network exemplifies this tension, though recent moves toward limited compatibility with other vehicles signal potential shifts in the landscape. Similarly, CHAdeMO's declining global relevance outside Japan illustrates how regional standards can struggle to maintain relevance without broader international adoption.

Addressing these cross-border compatibility challenges requires coordinated international standardization efforts, regulatory harmonization, and industry collaboration. Organizations like CharIN are working toward unified standards, but progress remains slow against entrenched regional interests. The resolution of these compatibility issues will significantly impact the pace of global EV adoption and the development of truly borderless charging infrastructure.

Regulatory frameworks compound these compatibility issues, with each region implementing different safety standards, grid connection requirements, and certification processes. For instance, European charging stations must comply with IEC standards, while North American stations follow UL requirements. These divergent regulatory approaches necessitate costly redesigns and recertifications for manufacturers seeking multi-market presence, ultimately increasing consumer costs and slowing adoption rates.

Payment systems present another layer of complexity in cross-border charging scenarios. Users traveling between countries often encounter incompatible payment platforms, subscription requirements, and authentication methods. While some networks have implemented roaming agreements, these remain limited in scope and often involve premium pricing for international users. The absence of standardized payment protocols creates a fragmented user experience that undermines consumer confidence in long-distance EV travel.

Communication protocols between vehicles and charging stations further complicate cross-border compatibility. Different regions utilize varying communication standards for handshaking, authentication, and power negotiation. This technical fragmentation requires vehicles to support multiple protocols or rely on adapters, adding complexity and potential points of failure. The ISO 15118 standard offers promise for harmonization but remains inconsistently implemented across global markets.

Market dynamics also influence compatibility challenges, with established players often resisting standardization that might erode competitive advantages. Tesla's proprietary Supercharger network exemplifies this tension, though recent moves toward limited compatibility with other vehicles signal potential shifts in the landscape. Similarly, CHAdeMO's declining global relevance outside Japan illustrates how regional standards can struggle to maintain relevance without broader international adoption.

Addressing these cross-border compatibility challenges requires coordinated international standardization efforts, regulatory harmonization, and industry collaboration. Organizations like CharIN are working toward unified standards, but progress remains slow against entrenched regional interests. The resolution of these compatibility issues will significantly impact the pace of global EV adoption and the development of truly borderless charging infrastructure.

Grid Integration and Infrastructure Requirements

The successful integration of fast charging networks into existing power grids represents one of the most significant challenges for global EV charging infrastructure deployment. Power grids worldwide were not originally designed to accommodate the high-power demands of fast charging stations, which can range from 50kW to 350kW per charging point. This creates substantial localized power demands that can strain distribution networks, particularly during peak usage periods.

Grid capacity assessments are essential prerequisites for fast charging infrastructure deployment. Studies indicate that a single 350kW charger requires approximately the same peak power as 30-40 average households. When multiple charging points operate simultaneously at a station, the cumulative demand necessitates significant grid reinforcement or alternative solutions such as battery storage systems or local renewable generation.

Transformer upgrades represent a critical infrastructure requirement, with many existing distribution transformers requiring replacement to handle increased loads. The cost of such upgrades varies significantly by region, ranging from $10,000 to over $100,000 per site, creating substantial barriers to entry for charging network operators in areas with aging infrastructure.

Power quality issues present another significant challenge, as fast charging stations can introduce harmonics, voltage fluctuations, and power factor issues into the grid. Advanced power electronics with active filtering capabilities are increasingly being incorporated into charging equipment to mitigate these effects and comply with grid codes that vary across different jurisdictions.

Smart grid technologies offer promising solutions for optimizing fast charging integration. Dynamic load management systems can modulate charging rates based on grid conditions, while vehicle-to-grid (V2G) capabilities allow EVs to provide grid services during peak demand periods. Several pilot projects in Europe and North America have demonstrated up to 30% reduction in peak demand through intelligent charging management.

Regulatory frameworks significantly impact infrastructure development, with interconnection requirements and permitting processes varying widely across regions. Countries with streamlined approval processes for charging infrastructure have demonstrated accelerated deployment rates, while those with complex regulatory environments experience delays averaging 6-18 months for high-power installations.

The economic viability of grid upgrades remains a contentious issue, with various stakeholder models emerging globally. Some jurisdictions place upgrade costs entirely on charging providers, while others implement cost-sharing mechanisms between utilities, charging operators, and government entities to distribute the financial burden and accelerate infrastructure deployment.

Grid capacity assessments are essential prerequisites for fast charging infrastructure deployment. Studies indicate that a single 350kW charger requires approximately the same peak power as 30-40 average households. When multiple charging points operate simultaneously at a station, the cumulative demand necessitates significant grid reinforcement or alternative solutions such as battery storage systems or local renewable generation.

Transformer upgrades represent a critical infrastructure requirement, with many existing distribution transformers requiring replacement to handle increased loads. The cost of such upgrades varies significantly by region, ranging from $10,000 to over $100,000 per site, creating substantial barriers to entry for charging network operators in areas with aging infrastructure.

Power quality issues present another significant challenge, as fast charging stations can introduce harmonics, voltage fluctuations, and power factor issues into the grid. Advanced power electronics with active filtering capabilities are increasingly being incorporated into charging equipment to mitigate these effects and comply with grid codes that vary across different jurisdictions.

Smart grid technologies offer promising solutions for optimizing fast charging integration. Dynamic load management systems can modulate charging rates based on grid conditions, while vehicle-to-grid (V2G) capabilities allow EVs to provide grid services during peak demand periods. Several pilot projects in Europe and North America have demonstrated up to 30% reduction in peak demand through intelligent charging management.

Regulatory frameworks significantly impact infrastructure development, with interconnection requirements and permitting processes varying widely across regions. Countries with streamlined approval processes for charging infrastructure have demonstrated accelerated deployment rates, while those with complex regulatory environments experience delays averaging 6-18 months for high-power installations.

The economic viability of grid upgrades remains a contentious issue, with various stakeholder models emerging globally. Some jurisdictions place upgrade costs entirely on charging providers, while others implement cost-sharing mechanisms between utilities, charging operators, and government entities to distribute the financial burden and accelerate infrastructure deployment.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!