Optimizing VRR for Energy-Conscious Manufacturing

SEP 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

VRR Technology Evolution and Energy Efficiency Goals

Variable Refresh Rate (VRR) technology has evolved significantly since its inception in the early 2000s. Initially developed for gaming displays to reduce screen tearing and stuttering, VRR has undergone substantial transformation to become a critical component in modern manufacturing systems. The evolution began with basic adaptive sync technologies that allowed displays to match their refresh rates with content frame rates, primarily focused on visual performance rather than energy efficiency.

By 2010, the technology expanded beyond consumer applications into industrial settings, where precise visual monitoring of manufacturing processes became increasingly important. This transition marked the first intersection between VRR technology and manufacturing efficiency, though energy considerations remained secondary to performance metrics.

The paradigm shift occurred around 2015-2018, when energy consumption emerged as a critical factor in manufacturing sustainability. VRR technology began incorporating sophisticated algorithms that could dynamically adjust not only to visual requirements but also to energy availability and consumption patterns. This evolution coincided with the broader Industry 4.0 movement, integrating VRR systems with IoT frameworks and advanced analytics.

Today's VRR technology in manufacturing environments represents a convergence of multiple technological streams: display technology, power management systems, AI-driven predictive algorithms, and real-time monitoring capabilities. Modern systems can adjust refresh rates based on production demands, worker presence, ambient lighting conditions, and even energy grid load balancing requirements.

The primary energy efficiency goals for VRR optimization in manufacturing settings have become increasingly ambitious. Current benchmarks aim for 30-40% reduction in display-related energy consumption compared to fixed refresh rate systems, with minimal impact on production monitoring capabilities. Advanced implementations target integration with facility-wide energy management systems to coordinate VRR adjustments with other energy-intensive processes.

Looking forward, the technological trajectory points toward ultra-efficient VRR systems capable of microsecond-level adjustments based on comprehensive environmental and operational inputs. These systems aim to reduce energy consumption by up to 60% while enhancing visual monitoring precision through selective refresh rate allocation – applying higher refresh rates only to critical production visualization areas while reducing rates in non-critical zones.

The ultimate goal extends beyond mere energy savings to creating manufacturing environments where VRR technology serves as an integral component of comprehensive sustainability strategies, balancing production requirements with environmental responsibility and economic efficiency.

By 2010, the technology expanded beyond consumer applications into industrial settings, where precise visual monitoring of manufacturing processes became increasingly important. This transition marked the first intersection between VRR technology and manufacturing efficiency, though energy considerations remained secondary to performance metrics.

The paradigm shift occurred around 2015-2018, when energy consumption emerged as a critical factor in manufacturing sustainability. VRR technology began incorporating sophisticated algorithms that could dynamically adjust not only to visual requirements but also to energy availability and consumption patterns. This evolution coincided with the broader Industry 4.0 movement, integrating VRR systems with IoT frameworks and advanced analytics.

Today's VRR technology in manufacturing environments represents a convergence of multiple technological streams: display technology, power management systems, AI-driven predictive algorithms, and real-time monitoring capabilities. Modern systems can adjust refresh rates based on production demands, worker presence, ambient lighting conditions, and even energy grid load balancing requirements.

The primary energy efficiency goals for VRR optimization in manufacturing settings have become increasingly ambitious. Current benchmarks aim for 30-40% reduction in display-related energy consumption compared to fixed refresh rate systems, with minimal impact on production monitoring capabilities. Advanced implementations target integration with facility-wide energy management systems to coordinate VRR adjustments with other energy-intensive processes.

Looking forward, the technological trajectory points toward ultra-efficient VRR systems capable of microsecond-level adjustments based on comprehensive environmental and operational inputs. These systems aim to reduce energy consumption by up to 60% while enhancing visual monitoring precision through selective refresh rate allocation – applying higher refresh rates only to critical production visualization areas while reducing rates in non-critical zones.

The ultimate goal extends beyond mere energy savings to creating manufacturing environments where VRR technology serves as an integral component of comprehensive sustainability strategies, balancing production requirements with environmental responsibility and economic efficiency.

Market Demand for Energy-Efficient Manufacturing Solutions

The global manufacturing sector is experiencing a significant shift towards energy-efficient solutions, driven by increasing energy costs, stringent environmental regulations, and growing corporate sustainability commitments. Variable Refresh Rate (VRR) technology, traditionally associated with display technologies, is now being adapted for manufacturing processes to optimize energy consumption while maintaining production efficiency. Market research indicates that energy costs represent between 10-40% of operational expenses in manufacturing facilities, making energy optimization a critical factor for competitive advantage.

Recent surveys conducted across industrial sectors reveal that 78% of manufacturing executives consider energy efficiency a top priority for their operations, with 63% actively seeking technological solutions to reduce consumption. The market for energy management systems in manufacturing is projected to grow at a CAGR of 12.6% through 2028, reaching a valuation of $41.5 billion. This growth trajectory underscores the substantial demand for innovations like optimized VRR systems.

The automotive manufacturing sector has emerged as a particularly promising market for VRR implementation, with production lines operating continuously and energy consumption reaching peak levels during certain manufacturing phases. Similarly, electronics manufacturing, with its precision requirements and high energy demands, represents another key market segment. These industries are increasingly willing to invest in technologies that offer demonstrable energy savings while maintaining production quality and throughput.

Regional analysis shows varying levels of market readiness for VRR adoption in manufacturing. European manufacturers, operating under the European Green Deal framework, demonstrate the highest willingness to adopt energy-efficient technologies, followed by North American and advanced Asian markets. Emerging economies in Southeast Asia and Latin America present growing opportunities as they modernize manufacturing infrastructure.

Customer requirements analysis indicates that manufacturers seek solutions offering rapid return on investment, typically within 18-24 months. They prioritize technologies that can be integrated with minimal disruption to existing production lines and provide measurable energy savings of at least 15-20%. Additionally, compatibility with Industry 4.0 frameworks and the ability to generate actionable data for continuous optimization are increasingly important considerations.

Market barriers include initial implementation costs, technical integration challenges with legacy systems, and knowledge gaps regarding VRR applications in manufacturing contexts. However, government incentives for energy efficiency, rising energy costs, and increasing corporate sustainability commitments are creating favorable conditions for market expansion. Early adopters of optimized VRR systems report energy savings between 18-25%, suggesting significant potential for broader market penetration as the technology matures and implementation costs decrease.

Recent surveys conducted across industrial sectors reveal that 78% of manufacturing executives consider energy efficiency a top priority for their operations, with 63% actively seeking technological solutions to reduce consumption. The market for energy management systems in manufacturing is projected to grow at a CAGR of 12.6% through 2028, reaching a valuation of $41.5 billion. This growth trajectory underscores the substantial demand for innovations like optimized VRR systems.

The automotive manufacturing sector has emerged as a particularly promising market for VRR implementation, with production lines operating continuously and energy consumption reaching peak levels during certain manufacturing phases. Similarly, electronics manufacturing, with its precision requirements and high energy demands, represents another key market segment. These industries are increasingly willing to invest in technologies that offer demonstrable energy savings while maintaining production quality and throughput.

Regional analysis shows varying levels of market readiness for VRR adoption in manufacturing. European manufacturers, operating under the European Green Deal framework, demonstrate the highest willingness to adopt energy-efficient technologies, followed by North American and advanced Asian markets. Emerging economies in Southeast Asia and Latin America present growing opportunities as they modernize manufacturing infrastructure.

Customer requirements analysis indicates that manufacturers seek solutions offering rapid return on investment, typically within 18-24 months. They prioritize technologies that can be integrated with minimal disruption to existing production lines and provide measurable energy savings of at least 15-20%. Additionally, compatibility with Industry 4.0 frameworks and the ability to generate actionable data for continuous optimization are increasingly important considerations.

Market barriers include initial implementation costs, technical integration challenges with legacy systems, and knowledge gaps regarding VRR applications in manufacturing contexts. However, government incentives for energy efficiency, rising energy costs, and increasing corporate sustainability commitments are creating favorable conditions for market expansion. Early adopters of optimized VRR systems report energy savings between 18-25%, suggesting significant potential for broader market penetration as the technology matures and implementation costs decrease.

VRR Implementation Challenges in Industrial Settings

Variable Refresh Rate (VRR) technology implementation in industrial manufacturing environments faces significant challenges that must be addressed for successful energy optimization. The transition from traditional fixed refresh rate systems to VRR requires substantial modifications to existing infrastructure, creating both technical and operational hurdles.

Hardware compatibility represents a primary obstacle, as many legacy manufacturing systems utilize outdated display technologies and control interfaces that lack native VRR support. Industrial equipment often operates on specialized firmware and proprietary systems designed for reliability rather than energy efficiency, necessitating complex integration solutions or complete hardware replacement.

Network infrastructure limitations further complicate VRR deployment in manufacturing settings. Industrial environments frequently rely on deterministic communication protocols prioritizing predictability over bandwidth, creating potential bottlenecks for the dynamic adjustments required by VRR systems. The real-time synchronization needed between production machinery, monitoring displays, and control systems demands robust, low-latency network capabilities that many facilities lack.

Power management systems in industrial settings present another significant challenge. Manufacturing facilities typically employ centralized power distribution architectures optimized for consistent, high-volume energy delivery rather than the variable consumption patterns that VRR implementation would create. Retrofitting these systems requires careful engineering to maintain production stability while enabling the dynamic power adjustments that make VRR beneficial.

Environmental factors inherent to manufacturing facilities—including electromagnetic interference, vibration, temperature fluctuations, and dust—can adversely affect sensitive VRR components. These harsh conditions necessitate ruggedized solutions with appropriate shielding and cooling systems, substantially increasing implementation costs and complexity.

Workforce adaptation represents a non-technical but equally critical challenge. Maintenance personnel and operators require specialized training to understand, troubleshoot, and optimize VRR systems. The learning curve associated with this technology transition can temporarily reduce operational efficiency and create resistance to adoption among staff accustomed to existing systems.

Regulatory compliance adds another layer of complexity, as industrial equipment modifications must adhere to strict safety standards and certification requirements. VRR implementations that alter equipment behavior or control systems may necessitate recertification processes that are both time-consuming and costly.

Return on investment timelines present perhaps the most significant barrier to widespread adoption. While VRR technology promises long-term energy savings, the substantial upfront costs for hardware upgrades, system integration, and workforce training create extended payback periods that may exceed typical industrial capital improvement thresholds, particularly for smaller manufacturers with limited investment capital.

Hardware compatibility represents a primary obstacle, as many legacy manufacturing systems utilize outdated display technologies and control interfaces that lack native VRR support. Industrial equipment often operates on specialized firmware and proprietary systems designed for reliability rather than energy efficiency, necessitating complex integration solutions or complete hardware replacement.

Network infrastructure limitations further complicate VRR deployment in manufacturing settings. Industrial environments frequently rely on deterministic communication protocols prioritizing predictability over bandwidth, creating potential bottlenecks for the dynamic adjustments required by VRR systems. The real-time synchronization needed between production machinery, monitoring displays, and control systems demands robust, low-latency network capabilities that many facilities lack.

Power management systems in industrial settings present another significant challenge. Manufacturing facilities typically employ centralized power distribution architectures optimized for consistent, high-volume energy delivery rather than the variable consumption patterns that VRR implementation would create. Retrofitting these systems requires careful engineering to maintain production stability while enabling the dynamic power adjustments that make VRR beneficial.

Environmental factors inherent to manufacturing facilities—including electromagnetic interference, vibration, temperature fluctuations, and dust—can adversely affect sensitive VRR components. These harsh conditions necessitate ruggedized solutions with appropriate shielding and cooling systems, substantially increasing implementation costs and complexity.

Workforce adaptation represents a non-technical but equally critical challenge. Maintenance personnel and operators require specialized training to understand, troubleshoot, and optimize VRR systems. The learning curve associated with this technology transition can temporarily reduce operational efficiency and create resistance to adoption among staff accustomed to existing systems.

Regulatory compliance adds another layer of complexity, as industrial equipment modifications must adhere to strict safety standards and certification requirements. VRR implementations that alter equipment behavior or control systems may necessitate recertification processes that are both time-consuming and costly.

Return on investment timelines present perhaps the most significant barrier to widespread adoption. While VRR technology promises long-term energy savings, the substantial upfront costs for hardware upgrades, system integration, and workforce training create extended payback periods that may exceed typical industrial capital improvement thresholds, particularly for smaller manufacturers with limited investment capital.

Current VRR Optimization Approaches

01 Energy-efficient VRR implementation techniques

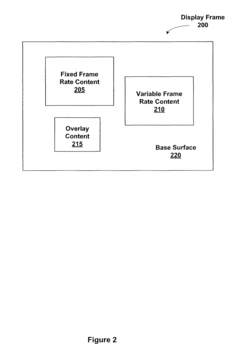

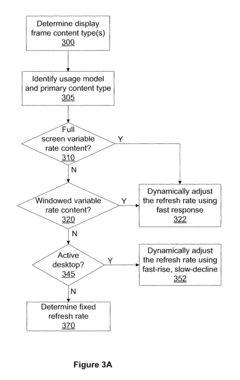

Various techniques can be implemented to optimize energy consumption in displays using Variable Refresh Rate technology. These include adaptive refresh rate algorithms that dynamically adjust the refresh rate based on content requirements, power-saving modes during static content display, and intelligent frame pacing. By reducing unnecessary screen refreshes during periods of low activity or static content, significant power savings can be achieved while maintaining visual quality.- Adaptive refresh rate techniques for energy efficiency: Variable Refresh Rate (VRR) technology allows displays to dynamically adjust their refresh rates based on content requirements, significantly reducing power consumption. By lowering the refresh rate during static or slow-moving content and increasing it only when necessary for smooth motion, these systems optimize energy usage while maintaining visual quality. This adaptive approach prevents unnecessary screen refreshes and processing, extending battery life in mobile devices and reducing power consumption in stationary displays.

- Panel-specific VRR power optimization methods: Different display panel technologies (OLED, LCD, etc.) require specialized VRR implementations to maximize energy savings. These methods include selective pixel refreshing, brightness adjustment algorithms, and panel-specific timing controllers that work with the unique characteristics of each display type. For OLED displays, VRR can reduce power by minimizing the time pixels are illuminated, while LCD implementations focus on backlight management and liquid crystal refresh optimization to achieve similar energy benefits.

- Content-aware VRR algorithms: Content-aware VRR systems analyze on-screen imagery to determine optimal refresh rates in real-time. These intelligent algorithms detect motion intensity, scene complexity, and user interaction patterns to make frame rate decisions that balance visual quality with power efficiency. By identifying static elements, video playback, gaming scenarios, or text reading, these systems can apply appropriate refresh rate policies that minimize energy consumption without compromising the user experience across different usage scenarios.

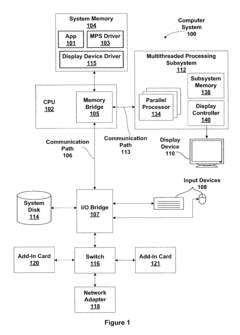

- Hardware-level VRR power management: Specialized hardware components enable efficient VRR implementation at the system level. These include dedicated power management integrated circuits, frame buffer controllers, and specialized display drivers that coordinate between the GPU, CPU, and display panel. By implementing VRR control at the hardware level, systems can achieve more granular refresh rate adjustments with minimal processing overhead, further reducing overall system power consumption and thermal output during variable refresh rate operation.

- Gaming-optimized VRR energy solutions: Gaming applications present unique challenges for VRR energy optimization due to their high performance requirements and variable frame rates. Specialized VRR implementations for gaming focus on synchronizing the display refresh rate with the GPU's frame rendering pace, eliminating screen tearing while avoiding unnecessary refreshes. These systems incorporate frame prediction algorithms, render queue management, and dynamic resolution scaling to maintain smooth gameplay while minimizing power consumption, particularly important for battery-powered gaming devices.

02 Display panel power management with VRR

Power management systems for display panels can leverage VRR to reduce energy consumption. These systems monitor content characteristics and user interaction patterns to determine optimal refresh rates. During periods of low activity or static content display, the refresh rate can be significantly reduced, leading to lower power draw from the display panel. Advanced implementations include content-aware algorithms that analyze on-screen motion to make frame-by-frame refresh rate decisions.Expand Specific Solutions03 GPU and processing optimizations for VRR systems

Graphics processing units and related components can be optimized to work efficiently with VRR technology. By synchronizing GPU rendering with variable display refresh rates, systems can avoid wasted computational cycles and reduce power consumption. These optimizations include dynamic clock gating, workload-based power scaling, and intelligent rendering pipelines that adjust processing resources based on the current refresh rate requirements.Expand Specific Solutions04 Battery life extension through VRR in mobile devices

Mobile devices with limited battery capacity can particularly benefit from VRR technology. Implementation strategies focus on balancing visual quality with power efficiency by dynamically adjusting refresh rates based on application requirements and battery status. Systems may employ more aggressive refresh rate reduction during low battery conditions or when running battery-intensive applications. These techniques can significantly extend device usage time between charges while maintaining acceptable visual performance.Expand Specific Solutions05 Thermal management considerations in VRR systems

VRR technology can be leveraged to manage thermal conditions in display systems. By reducing refresh rates during high-temperature conditions, systems can lower power consumption and heat generation. Advanced implementations include thermal-aware refresh rate controllers that monitor device temperature and adjust display parameters accordingly. This approach helps maintain device reliability and performance while preventing thermal throttling that could impact user experience.Expand Specific Solutions

Key Industry Players in Energy-Conscious Manufacturing

The VRR (Variable Refresh Rate) technology for energy-conscious manufacturing is currently in a growth phase, with an estimated market size of $3-5 billion and expanding at 15-20% annually. The competitive landscape features display technology leaders like BOE Technology, LG Display, and HKC Corp focusing on energy-efficient panel solutions, while industrial automation companies such as Siemens AG and Hitachi Ltd are integrating VRR into manufacturing systems. Energy specialists including Rondo Energy and State Grid Corp are developing complementary power management solutions. The technology is approaching maturity in consumer electronics but remains in early adoption for industrial applications, with BOE, LG Display, and Siemens leading innovation through significant R&D investments in adaptive refresh technologies that reduce energy consumption while maintaining performance.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed an advanced Variable Refresh Rate (VRR) technology for their display manufacturing processes that dynamically adjusts the refresh rate based on production demands and energy availability. Their system incorporates AI-driven predictive algorithms that analyze historical energy consumption patterns and production schedules to optimize refresh rates in real-time. BOE's solution includes specialized hardware controllers that can modulate power delivery to different manufacturing zones, reducing energy consumption by up to 27% during non-critical production phases. The technology also features a smart grid integration component that allows manufacturing facilities to respond to external energy pricing signals, automatically adjusting VRR parameters during peak electricity cost periods to minimize operational expenses while maintaining production quality.

Strengths: Comprehensive integration with existing manufacturing infrastructure; proven energy savings of 20-30% in real-world implementations; scalable across different display production lines. Weaknesses: Requires significant initial investment in control systems; optimization algorithms need extensive historical data to achieve maximum efficiency; potential production speed trade-offs during extreme energy conservation modes.

LG Display Co., Ltd.

Technical Solution: LG Display has pioneered an energy-efficient VRR manufacturing system called "E-Adaptive Production" that intelligently manages refresh rates across their production facilities. The technology employs a three-tier approach to energy optimization: First, a facility-wide energy monitoring system that provides real-time consumption metrics across all production stages; second, a dynamic VRR controller that can adjust refresh rates on individual production lines based on current workload and energy availability; and third, a predictive maintenance component that identifies energy-inefficient equipment before it impacts overall consumption. LG's solution has been implemented across their OLED manufacturing facilities, resulting in documented energy savings of approximately 22% compared to fixed refresh rate systems. The technology also incorporates weather forecasting data to anticipate renewable energy availability, allowing production schedules to be optimized around periods of abundant clean energy.

Strengths: Holistic approach that addresses both immediate energy savings and long-term sustainability goals; proven compatibility with high-precision manufacturing processes; modular design allows for incremental implementation. Weaknesses: Complex integration requirements with existing factory management systems; higher initial implementation costs compared to simpler solutions; requires specialized training for production engineers.

Critical Patents and Innovations in VRR Technology

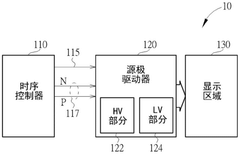

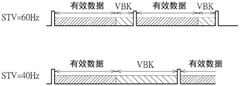

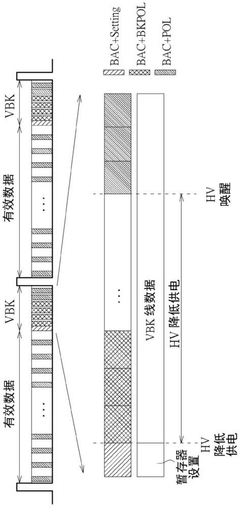

Method for performing energy-saving control on display device and related display equipment

PatentPendingCN119580611A

Innovation

- 通过在显示设备的源极驱动器中引入节能模式,利用时序控制器产生节能起始和终止指示,控制源极驱动器在垂直空白间隔期间切换至节能模式,降低未使用部分电路的供电。

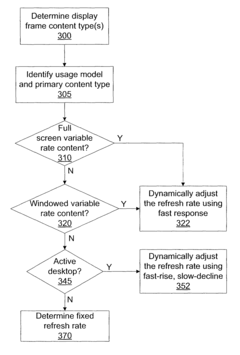

Method and system for optimizing display power reduction through a continuously variable refresh rate adjustment

PatentActiveUS8542221B1

Innovation

- A system and method that continuously adjusts the refresh rate of the display based on the effective frame rate of the content being displayed, dynamically reducing power consumption by lowering the refresh rate when content is static and increasing it when content changes, using a combination of hardware and software components to manage the display controller and parallel processors.

Regulatory Framework for Industrial Energy Consumption

The regulatory landscape governing industrial energy consumption has evolved significantly in response to global climate change concerns and sustainability goals. Manufacturing facilities implementing Variable Refresh Rate (VRR) technologies must navigate a complex framework of international agreements, national policies, and industry-specific standards. The Paris Agreement serves as the overarching global framework, requiring signatory nations to establish progressively ambitious targets for reducing greenhouse gas emissions, directly impacting energy-intensive manufacturing operations.

At the national level, countries have implemented varying regulatory approaches. The European Union's Energy Efficiency Directive mandates large enterprises to conduct energy audits every four years, with specific provisions for manufacturing facilities exceeding certain energy consumption thresholds. Similarly, China's Energy Conservation Law imposes stringent efficiency requirements on industrial processes, with particular focus on high-energy-consumption industries where VRR implementation could yield significant benefits.

In the United States, the regulatory framework operates through a combination of federal standards and state-level initiatives. The Department of Energy's Better Plants Program offers technical assistance and recognition for manufacturers achieving substantial energy reductions, while states like California have established their own aggressive efficiency standards through programs such as the Title 24 Building Energy Efficiency Standards, which include provisions for industrial facilities.

Industry-specific standards further complement these regulatory frameworks. ISO 50001 for Energy Management Systems provides a globally recognized framework for continuous improvement in energy performance, with specific guidance for manufacturing environments. The International Electrotechnical Commission (IEC) has developed standards specifically addressing variable speed drives and motor systems, which directly relate to VRR implementation in manufacturing settings.

Financial mechanisms also form a critical component of the regulatory landscape. Carbon pricing schemes, whether through carbon taxes or cap-and-trade systems, create economic incentives for energy efficiency improvements. The EU Emissions Trading System represents the world's largest carbon market, while similar mechanisms are emerging in other regions, creating financial drivers for VRR adoption.

Compliance reporting requirements add another layer of complexity. Manufacturers must typically document energy consumption patterns, efficiency improvements, and carbon emissions reductions. These reporting obligations vary significantly by jurisdiction but generally require detailed monitoring and verification protocols that must be considered when implementing VRR technologies.

Looking forward, regulatory frameworks are trending toward greater stringency and broader scope. Emerging policies increasingly focus on lifecycle energy consumption and embodied carbon, potentially expanding regulatory considerations beyond operational energy use to include manufacturing processes themselves.

At the national level, countries have implemented varying regulatory approaches. The European Union's Energy Efficiency Directive mandates large enterprises to conduct energy audits every four years, with specific provisions for manufacturing facilities exceeding certain energy consumption thresholds. Similarly, China's Energy Conservation Law imposes stringent efficiency requirements on industrial processes, with particular focus on high-energy-consumption industries where VRR implementation could yield significant benefits.

In the United States, the regulatory framework operates through a combination of federal standards and state-level initiatives. The Department of Energy's Better Plants Program offers technical assistance and recognition for manufacturers achieving substantial energy reductions, while states like California have established their own aggressive efficiency standards through programs such as the Title 24 Building Energy Efficiency Standards, which include provisions for industrial facilities.

Industry-specific standards further complement these regulatory frameworks. ISO 50001 for Energy Management Systems provides a globally recognized framework for continuous improvement in energy performance, with specific guidance for manufacturing environments. The International Electrotechnical Commission (IEC) has developed standards specifically addressing variable speed drives and motor systems, which directly relate to VRR implementation in manufacturing settings.

Financial mechanisms also form a critical component of the regulatory landscape. Carbon pricing schemes, whether through carbon taxes or cap-and-trade systems, create economic incentives for energy efficiency improvements. The EU Emissions Trading System represents the world's largest carbon market, while similar mechanisms are emerging in other regions, creating financial drivers for VRR adoption.

Compliance reporting requirements add another layer of complexity. Manufacturers must typically document energy consumption patterns, efficiency improvements, and carbon emissions reductions. These reporting obligations vary significantly by jurisdiction but generally require detailed monitoring and verification protocols that must be considered when implementing VRR technologies.

Looking forward, regulatory frameworks are trending toward greater stringency and broader scope. Emerging policies increasingly focus on lifecycle energy consumption and embodied carbon, potentially expanding regulatory considerations beyond operational energy use to include manufacturing processes themselves.

ROI Analysis of VRR Implementation

Implementing Variable Refrigerant Flow (VRR) systems in manufacturing environments represents a significant capital investment that requires thorough financial analysis. When evaluating the return on investment for VRR implementation in energy-conscious manufacturing facilities, organizations typically observe payback periods ranging from 3 to 7 years, depending on facility size, existing infrastructure, and energy costs in the region.

Initial implementation costs for VRR systems average between $20-30 per square foot, significantly higher than conventional HVAC systems. However, this premium is offset by operational savings that typically range from 30% to 40% in energy consumption compared to traditional systems. For a 100,000 square foot manufacturing facility, this can translate to annual energy savings of $50,000-$75,000, depending on local utility rates and production schedules.

The ROI calculation must account for several key factors beyond direct energy savings. Maintenance costs for VRR systems are generally 15-20% lower than conventional systems due to fewer mechanical components and reduced wear. Additionally, the zonal control capabilities of VRR systems allow for targeted cooling or heating only in areas where production is active, further enhancing energy efficiency by an additional 10-15% in facilities with variable production schedules.

Tax incentives and energy rebates can significantly improve the financial outlook of VRR implementations. Many regions offer incentives covering 10-30% of implementation costs for energy-efficient systems, potentially reducing the payback period by 1-2 years. Organizations should thoroughly research available programs at local, state, and federal levels to maximize these benefits.

Productivity improvements represent an often-overlooked component of ROI calculations. Manufacturing environments with optimized temperature control typically report 5-8% increases in worker productivity and 3-5% reductions in error rates. For precision manufacturing operations, these improvements can translate to substantial financial benefits that may exceed direct energy savings.

Long-term financial modeling should incorporate the extended lifespan of VRR systems (typically 15-20 years) compared to conventional systems (10-15 years). When calculating net present value (NPV) and internal rate of return (IRR), this extended operational life significantly enhances the financial attractiveness of VRR implementations, with typical IRR values ranging from 15-25% for manufacturing facilities with high cooling loads.

Initial implementation costs for VRR systems average between $20-30 per square foot, significantly higher than conventional HVAC systems. However, this premium is offset by operational savings that typically range from 30% to 40% in energy consumption compared to traditional systems. For a 100,000 square foot manufacturing facility, this can translate to annual energy savings of $50,000-$75,000, depending on local utility rates and production schedules.

The ROI calculation must account for several key factors beyond direct energy savings. Maintenance costs for VRR systems are generally 15-20% lower than conventional systems due to fewer mechanical components and reduced wear. Additionally, the zonal control capabilities of VRR systems allow for targeted cooling or heating only in areas where production is active, further enhancing energy efficiency by an additional 10-15% in facilities with variable production schedules.

Tax incentives and energy rebates can significantly improve the financial outlook of VRR implementations. Many regions offer incentives covering 10-30% of implementation costs for energy-efficient systems, potentially reducing the payback period by 1-2 years. Organizations should thoroughly research available programs at local, state, and federal levels to maximize these benefits.

Productivity improvements represent an often-overlooked component of ROI calculations. Manufacturing environments with optimized temperature control typically report 5-8% increases in worker productivity and 3-5% reductions in error rates. For precision manufacturing operations, these improvements can translate to substantial financial benefits that may exceed direct energy savings.

Long-term financial modeling should incorporate the extended lifespan of VRR systems (typically 15-20 years) compared to conventional systems (10-15 years). When calculating net present value (NPV) and internal rate of return (IRR), this extended operational life significantly enhances the financial attractiveness of VRR implementations, with typical IRR values ranging from 15-25% for manufacturing facilities with high cooling loads.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!