Dipropylene Glycol in Household Chemicals: Improving Product Application

JUL 7, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

DPG Background and Objectives

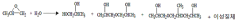

Dipropylene glycol (DPG) has been a key component in household chemicals for several decades, playing a crucial role in enhancing product performance and application. This versatile compound, derived from propylene oxide, has gained significant attention in the chemical industry due to its unique properties and wide range of applications.

The evolution of DPG in household chemicals can be traced back to the mid-20th century when manufacturers began seeking safer and more effective alternatives to traditional solvents. As environmental and health concerns grew, DPG emerged as a promising solution due to its low toxicity, biodegradability, and excellent solvency properties. Over time, its use expanded from simple cleaning products to a variety of household items, including air fresheners, cosmetics, and personal care products.

The primary objective of incorporating DPG into household chemicals is to improve product application and overall performance. DPG acts as a powerful solvent, effectively dissolving both water-soluble and oil-soluble ingredients, which allows for the creation of stable and homogeneous formulations. This property is particularly valuable in products that require the blending of diverse components, such as fragrances, dyes, and active ingredients.

Furthermore, DPG's hygroscopic nature helps maintain moisture levels in products, preventing them from drying out and extending their shelf life. This characteristic is especially beneficial in items like liquid soaps, lotions, and other personal care products where consistency and texture are crucial for consumer satisfaction.

Another significant objective of using DPG is to enhance the spreading and penetration properties of household chemicals. When applied to surfaces, DPG-containing products exhibit improved coverage and absorption, leading to more efficient cleaning, deodorizing, or treatment processes. This feature is particularly advantageous in products like surface cleaners, fabric softeners, and pest control solutions.

The ongoing technological advancements and increasing consumer demands have driven the continuous evolution of DPG applications in household chemicals. Current research focuses on optimizing DPG concentrations, exploring synergistic effects with other ingredients, and developing novel formulations to address specific consumer needs and environmental concerns.

As the household chemical industry progresses, the objectives for DPG usage are expanding to include sustainability and eco-friendliness. Manufacturers are exploring ways to incorporate bio-based DPG or develop more environmentally friendly alternatives that maintain the beneficial properties of traditional DPG. This shift aligns with the growing consumer preference for green and sustainable products, presenting new challenges and opportunities for innovation in the field.

The evolution of DPG in household chemicals can be traced back to the mid-20th century when manufacturers began seeking safer and more effective alternatives to traditional solvents. As environmental and health concerns grew, DPG emerged as a promising solution due to its low toxicity, biodegradability, and excellent solvency properties. Over time, its use expanded from simple cleaning products to a variety of household items, including air fresheners, cosmetics, and personal care products.

The primary objective of incorporating DPG into household chemicals is to improve product application and overall performance. DPG acts as a powerful solvent, effectively dissolving both water-soluble and oil-soluble ingredients, which allows for the creation of stable and homogeneous formulations. This property is particularly valuable in products that require the blending of diverse components, such as fragrances, dyes, and active ingredients.

Furthermore, DPG's hygroscopic nature helps maintain moisture levels in products, preventing them from drying out and extending their shelf life. This characteristic is especially beneficial in items like liquid soaps, lotions, and other personal care products where consistency and texture are crucial for consumer satisfaction.

Another significant objective of using DPG is to enhance the spreading and penetration properties of household chemicals. When applied to surfaces, DPG-containing products exhibit improved coverage and absorption, leading to more efficient cleaning, deodorizing, or treatment processes. This feature is particularly advantageous in products like surface cleaners, fabric softeners, and pest control solutions.

The ongoing technological advancements and increasing consumer demands have driven the continuous evolution of DPG applications in household chemicals. Current research focuses on optimizing DPG concentrations, exploring synergistic effects with other ingredients, and developing novel formulations to address specific consumer needs and environmental concerns.

As the household chemical industry progresses, the objectives for DPG usage are expanding to include sustainability and eco-friendliness. Manufacturers are exploring ways to incorporate bio-based DPG or develop more environmentally friendly alternatives that maintain the beneficial properties of traditional DPG. This shift aligns with the growing consumer preference for green and sustainable products, presenting new challenges and opportunities for innovation in the field.

Market Analysis for DPG-based Products

The market for Dipropylene Glycol (DPG) in household chemicals has shown significant growth in recent years, driven by increasing consumer demand for effective and versatile cleaning products. DPG's unique properties, including its ability to act as a solvent, coupling agent, and humectant, make it a valuable ingredient in a wide range of household chemical applications.

The global DPG market size in household chemicals is expected to expand at a steady rate, with a particular focus on its use in all-purpose cleaners, air fresheners, and laundry products. This growth is attributed to the rising awareness of hygiene and cleanliness among consumers, especially in the wake of global health concerns.

In the all-purpose cleaner segment, DPG-based products have gained traction due to their superior cleaning performance and low toxicity compared to traditional solvents. Manufacturers are increasingly incorporating DPG into their formulations to enhance product efficacy and meet consumer demands for safer, more environmentally friendly cleaning solutions.

The air freshener market has also seen a surge in DPG usage, as it helps to stabilize fragrances and extend their longevity. This has led to the development of long-lasting air fresheners that appeal to consumers seeking convenient and effective odor control solutions for their homes and vehicles.

In the laundry care sector, DPG has found applications in fabric softeners and detergents, where it acts as a solvent and helps to improve the overall cleaning performance. The trend towards concentrated laundry products has further boosted the demand for DPG, as it allows for more efficient formulations.

Regionally, North America and Europe lead the market for DPG-based household chemicals, owing to stringent regulations on volatile organic compounds (VOCs) and a higher consumer willingness to pay for premium, eco-friendly products. However, the Asia-Pacific region is expected to witness the fastest growth, driven by rapid urbanization, increasing disposable incomes, and changing lifestyle patterns.

Key market players in the DPG-based household chemicals sector include multinational corporations such as Procter & Gamble, Unilever, and Reckitt Benckiser, as well as regional manufacturers focusing on niche markets. These companies are investing in research and development to create innovative formulations that leverage DPG's properties to enhance product performance and sustainability.

The market analysis indicates that there is significant potential for growth in DPG-based household chemicals, particularly in emerging economies. However, manufacturers must navigate challenges such as raw material price fluctuations and increasing competition from alternative solvents and technologies. To maintain a competitive edge, companies are focusing on product differentiation, sustainable sourcing, and marketing strategies that highlight the benefits of DPG-based formulations to environmentally conscious consumers.

The global DPG market size in household chemicals is expected to expand at a steady rate, with a particular focus on its use in all-purpose cleaners, air fresheners, and laundry products. This growth is attributed to the rising awareness of hygiene and cleanliness among consumers, especially in the wake of global health concerns.

In the all-purpose cleaner segment, DPG-based products have gained traction due to their superior cleaning performance and low toxicity compared to traditional solvents. Manufacturers are increasingly incorporating DPG into their formulations to enhance product efficacy and meet consumer demands for safer, more environmentally friendly cleaning solutions.

The air freshener market has also seen a surge in DPG usage, as it helps to stabilize fragrances and extend their longevity. This has led to the development of long-lasting air fresheners that appeal to consumers seeking convenient and effective odor control solutions for their homes and vehicles.

In the laundry care sector, DPG has found applications in fabric softeners and detergents, where it acts as a solvent and helps to improve the overall cleaning performance. The trend towards concentrated laundry products has further boosted the demand for DPG, as it allows for more efficient formulations.

Regionally, North America and Europe lead the market for DPG-based household chemicals, owing to stringent regulations on volatile organic compounds (VOCs) and a higher consumer willingness to pay for premium, eco-friendly products. However, the Asia-Pacific region is expected to witness the fastest growth, driven by rapid urbanization, increasing disposable incomes, and changing lifestyle patterns.

Key market players in the DPG-based household chemicals sector include multinational corporations such as Procter & Gamble, Unilever, and Reckitt Benckiser, as well as regional manufacturers focusing on niche markets. These companies are investing in research and development to create innovative formulations that leverage DPG's properties to enhance product performance and sustainability.

The market analysis indicates that there is significant potential for growth in DPG-based household chemicals, particularly in emerging economies. However, manufacturers must navigate challenges such as raw material price fluctuations and increasing competition from alternative solvents and technologies. To maintain a competitive edge, companies are focusing on product differentiation, sustainable sourcing, and marketing strategies that highlight the benefits of DPG-based formulations to environmentally conscious consumers.

DPG Technical Challenges

The integration of Dipropylene Glycol (DPG) in household chemicals presents several technical challenges that need to be addressed to improve product application. One of the primary issues is the stability of DPG in various formulations. Due to its hygroscopic nature, DPG can absorb moisture from the environment, potentially leading to changes in product consistency and efficacy over time. This necessitates careful consideration of packaging materials and storage conditions to maintain product integrity.

Another significant challenge lies in the compatibility of DPG with other ingredients commonly used in household chemicals. While DPG is generally versatile, certain combinations may result in unexpected interactions, affecting product performance or shelf life. Formulators must conduct extensive compatibility studies to ensure that DPG does not compromise the functionality of other active ingredients or additives in the final product.

The volatility of DPG also poses a technical hurdle, particularly in products designed for prolonged exposure or those requiring precise dosing. Although less volatile than some other glycols, DPG's evaporation rate can still impact the long-term effectiveness of certain household chemicals, especially in applications where residual activity is crucial. This challenge requires innovative approaches to formulation and delivery mechanisms to maintain the desired concentration of DPG throughout the product's intended use period.

Furthermore, the viscosity of DPG-containing formulations can be problematic in some applications. Depending on the concentration and other ingredients present, products may become too thick or too thin, affecting their ease of use and application properties. Achieving the optimal viscosity while maintaining the desired DPG content often requires a delicate balance and may involve the use of additional rheology modifiers or careful adjustment of the overall formulation.

The potential for skin irritation or sensitization is another technical challenge that must be addressed, particularly in household chemicals that come into direct contact with skin. While DPG is generally considered to have low toxicity, individual sensitivities can vary. Formulators must carefully consider the concentration of DPG and conduct thorough safety assessments to ensure that products are safe for consumer use across a wide range of applications and exposure scenarios.

Lastly, the environmental impact of DPG in household chemicals presents a growing technical challenge. As consumers and regulators increasingly demand eco-friendly products, manufacturers must explore ways to optimize DPG usage or find sustainable alternatives. This includes investigating biodegradability, potential for bioaccumulation, and overall environmental fate of DPG-containing products. Developing formulations that maintain efficacy while minimizing environmental footprint requires ongoing research and innovation in green chemistry approaches.

Another significant challenge lies in the compatibility of DPG with other ingredients commonly used in household chemicals. While DPG is generally versatile, certain combinations may result in unexpected interactions, affecting product performance or shelf life. Formulators must conduct extensive compatibility studies to ensure that DPG does not compromise the functionality of other active ingredients or additives in the final product.

The volatility of DPG also poses a technical hurdle, particularly in products designed for prolonged exposure or those requiring precise dosing. Although less volatile than some other glycols, DPG's evaporation rate can still impact the long-term effectiveness of certain household chemicals, especially in applications where residual activity is crucial. This challenge requires innovative approaches to formulation and delivery mechanisms to maintain the desired concentration of DPG throughout the product's intended use period.

Furthermore, the viscosity of DPG-containing formulations can be problematic in some applications. Depending on the concentration and other ingredients present, products may become too thick or too thin, affecting their ease of use and application properties. Achieving the optimal viscosity while maintaining the desired DPG content often requires a delicate balance and may involve the use of additional rheology modifiers or careful adjustment of the overall formulation.

The potential for skin irritation or sensitization is another technical challenge that must be addressed, particularly in household chemicals that come into direct contact with skin. While DPG is generally considered to have low toxicity, individual sensitivities can vary. Formulators must carefully consider the concentration of DPG and conduct thorough safety assessments to ensure that products are safe for consumer use across a wide range of applications and exposure scenarios.

Lastly, the environmental impact of DPG in household chemicals presents a growing technical challenge. As consumers and regulators increasingly demand eco-friendly products, manufacturers must explore ways to optimize DPG usage or find sustainable alternatives. This includes investigating biodegradability, potential for bioaccumulation, and overall environmental fate of DPG-containing products. Developing formulations that maintain efficacy while minimizing environmental footprint requires ongoing research and innovation in green chemistry approaches.

Current DPG Formulations

01 Cosmetic and personal care applications

Dipropylene glycol is widely used in cosmetic and personal care products due to its moisturizing properties and ability to act as a solvent and carrier for other ingredients. It is commonly found in skincare products, hair care formulations, and fragrances, helping to improve product texture and enhance the delivery of active ingredients.- Cosmetic and personal care applications: Dipropylene glycol is widely used in cosmetic and personal care products due to its moisturizing properties and ability to act as a solvent. It is commonly found in skincare formulations, hair care products, and fragrances. Its low toxicity and skin-friendly nature make it a popular choice in these applications.

- Industrial solvent and chemical intermediate: Dipropylene glycol serves as an important industrial solvent and chemical intermediate. It is used in the production of various chemicals, resins, and polymers. Its solvent properties make it useful in paints, coatings, and cleaning formulations. Additionally, it acts as a coupling agent in many industrial processes.

- Antifreeze and heat transfer fluid: Dipropylene glycol is utilized in antifreeze formulations and heat transfer fluids due to its low freezing point and high boiling point. It helps prevent freezing in various systems and equipment, making it valuable in automotive and industrial applications where temperature control is crucial.

- Plasticizer in polymer production: In polymer production, dipropylene glycol acts as a plasticizer, improving the flexibility and durability of various plastic materials. It is particularly useful in the manufacture of polyurethanes, polyester resins, and other polymeric products, enhancing their physical properties and performance.

- Food additive and flavor carrier: Dipropylene glycol finds applications in the food industry as a food additive and flavor carrier. It is used to dissolve and carry flavors in various food products, helping to enhance taste and aroma. Its low toxicity and stability make it suitable for use in food applications where safety is paramount.

02 Industrial solvent and chemical intermediate

Dipropylene glycol serves as an important industrial solvent and chemical intermediate in various manufacturing processes. It is used in the production of plastics, resins, and other polymers, as well as in the synthesis of various chemical compounds. Its solvent properties make it useful in paints, coatings, and cleaning formulations.Expand Specific Solutions03 Antifreeze and heat transfer fluid

Dipropylene glycol is utilized in antifreeze and heat transfer fluid formulations due to its low freezing point and high boiling point. It helps prevent freezing in cooling systems and provides efficient heat transfer in various industrial applications, including HVAC systems and automotive coolants.Expand Specific Solutions04 Food and beverage applications

Dipropylene glycol finds applications in the food and beverage industry as a solvent and carrier for flavors and fragrances. It is used in the production of artificial flavors, food additives, and as a humectant in certain food products to maintain moisture content and improve texture.Expand Specific Solutions05 Pharmaceutical and medical uses

In the pharmaceutical and medical fields, dipropylene glycol is used as a solvent and excipient in various drug formulations. It helps improve the solubility and stability of certain medications, and is also used in the production of medical devices and diagnostic equipment.Expand Specific Solutions

Key DPG Industry Players

The market for dipropylene glycol in household chemicals is in a mature growth stage, with a steady global market size estimated at over $1 billion. The technology is well-established, with major players like Dow Chemical, Eastman Chemical, and LyondellBasell dominating production. Consumer goods giants such as Procter & Gamble, Unilever, and Colgate-Palmolive are key end-users, incorporating dipropylene glycol into various household and personal care products. While the core technology is mature, ongoing research by companies like Bayer and L'Oréal focuses on enhancing product application and performance. The competitive landscape is characterized by established chemical manufacturers supplying to large consumer goods companies, with innovation centered on formulation and application improvements rather than fundamental technological breakthroughs.

Dow Global Technologies LLC

Technical Solution: Dow Global Technologies has developed innovative formulations incorporating dipropylene glycol (DPG) to enhance household chemical products. Their approach focuses on optimizing DPG's solvent properties and hygroscopic nature to improve product stability and performance. They have created a novel microemulsion system using DPG as a co-solvent, which allows for better dispersion of active ingredients and improved surface wetting characteristics[1]. This technology enables the development of more concentrated and effective cleaning formulations, reducing packaging waste and transportation costs. Additionally, Dow has engineered DPG-based gel formulations that provide controlled release of fragrances and active compounds, extending the longevity of household products[3].

Strengths: Advanced formulation expertise, improved product stability, and enhanced performance. Weaknesses: Potential higher raw material costs and the need for specialized manufacturing processes.

Procter & Gamble Co.

Technical Solution: Procter & Gamble has leveraged dipropylene glycol in their household chemical products to enhance solubility and stability of active ingredients. Their approach involves using DPG as a coupling agent in complex formulations, allowing for the incorporation of both hydrophilic and hydrophobic components[2]. P&G has developed a proprietary blend of DPG with other glycols and surfactants to create a versatile base for various household cleaners, providing excellent solvency and low volatility. This technology has been applied to their laundry detergents, fabric softeners, and all-purpose cleaners, resulting in improved product efficacy and longer shelf life[4]. Furthermore, P&G has utilized DPG's humectant properties to develop moisture-retaining formulations for air fresheners and toilet bowl cleaners, enhancing their performance in high-humidity environments[5].

Strengths: Wide range of applications, improved product stability, and enhanced cleaning performance. Weaknesses: Potential higher production costs and the need for careful formulation to avoid over-moisturizing effects.

DPG Innovation Insights

Dipropylene glycol composition and preparation method therefor

PatentWO2021075923A1

Innovation

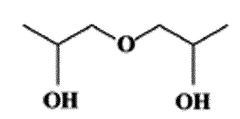

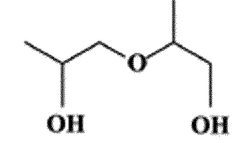

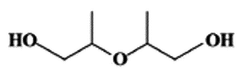

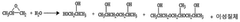

- A dipropylene glycol composition with a specific content range of 99.5% or more, combined with isomers like 1,1'-oxybis(2-propanol), 2-(2-hydroxypropoxy)-1-propanol, and 2,2-oxybis(1-propanol, and a deodorizing method involving heating with alcohol to remove odor-causing substances, ensuring high purity and reduced odor.

Dipropylene glycol composition and preparation method thereof

PatentInactiveKR1020210045798A

Innovation

- A dipropylene glycol composition with a content of 99.5% by weight or more, prepared through a multi-step distillation process involving two distillation columns, to minimize impurities and reduce odor.

Environmental Impact of DPG

The environmental impact of Dipropylene Glycol (DPG) in household chemicals is a crucial aspect to consider when evaluating its use in product applications. DPG, a synthetic organic compound, is widely used in various household products due to its versatile properties. However, its potential effects on the environment warrant careful examination.

One of the primary environmental concerns associated with DPG is its potential for water pollution. When household products containing DPG are disposed of improperly or released into wastewater systems, there is a risk of contamination in aquatic ecosystems. Studies have shown that DPG can persist in water for extended periods, potentially affecting aquatic organisms and disrupting ecological balance.

Air quality is another area of environmental impact to consider. While DPG has a relatively low volatility compared to other solvents, it can still contribute to indoor air pollution when used in household products. This is particularly relevant in poorly ventilated spaces, where prolonged exposure may occur.

The biodegradability of DPG is an important factor in assessing its environmental footprint. Research indicates that DPG is inherently biodegradable under aerobic conditions, which is a positive attribute. However, the rate of biodegradation can vary depending on environmental conditions, and complete breakdown may take several weeks to months.

In terms of toxicity, DPG is generally considered to have low acute toxicity to aquatic organisms. Nevertheless, chronic exposure effects on aquatic life are less well-understood and require further investigation. The potential for bioaccumulation in the food chain is also a consideration, although current data suggests that DPG has a low potential for bioaccumulation.

The production and disposal of DPG-containing products also contribute to its environmental impact. Manufacturing processes may result in emissions and energy consumption, while improper disposal can lead to soil contamination. Efforts to improve production efficiency and promote responsible disposal practices are essential in mitigating these impacts.

It is worth noting that the environmental impact of DPG can be influenced by its concentration in products and the frequency of use. Manufacturers are increasingly focusing on optimizing formulations to minimize environmental risks while maintaining product efficacy. Additionally, regulatory bodies are implementing guidelines to ensure the safe use and disposal of DPG-containing products.

In conclusion, while DPG offers valuable properties for household chemical applications, its environmental impact must be carefully managed. Ongoing research, improved manufacturing processes, and responsible use and disposal practices are key to minimizing the potential negative effects on ecosystems and human health.

One of the primary environmental concerns associated with DPG is its potential for water pollution. When household products containing DPG are disposed of improperly or released into wastewater systems, there is a risk of contamination in aquatic ecosystems. Studies have shown that DPG can persist in water for extended periods, potentially affecting aquatic organisms and disrupting ecological balance.

Air quality is another area of environmental impact to consider. While DPG has a relatively low volatility compared to other solvents, it can still contribute to indoor air pollution when used in household products. This is particularly relevant in poorly ventilated spaces, where prolonged exposure may occur.

The biodegradability of DPG is an important factor in assessing its environmental footprint. Research indicates that DPG is inherently biodegradable under aerobic conditions, which is a positive attribute. However, the rate of biodegradation can vary depending on environmental conditions, and complete breakdown may take several weeks to months.

In terms of toxicity, DPG is generally considered to have low acute toxicity to aquatic organisms. Nevertheless, chronic exposure effects on aquatic life are less well-understood and require further investigation. The potential for bioaccumulation in the food chain is also a consideration, although current data suggests that DPG has a low potential for bioaccumulation.

The production and disposal of DPG-containing products also contribute to its environmental impact. Manufacturing processes may result in emissions and energy consumption, while improper disposal can lead to soil contamination. Efforts to improve production efficiency and promote responsible disposal practices are essential in mitigating these impacts.

It is worth noting that the environmental impact of DPG can be influenced by its concentration in products and the frequency of use. Manufacturers are increasingly focusing on optimizing formulations to minimize environmental risks while maintaining product efficacy. Additionally, regulatory bodies are implementing guidelines to ensure the safe use and disposal of DPG-containing products.

In conclusion, while DPG offers valuable properties for household chemical applications, its environmental impact must be carefully managed. Ongoing research, improved manufacturing processes, and responsible use and disposal practices are key to minimizing the potential negative effects on ecosystems and human health.

DPG Regulatory Compliance

Regulatory compliance is a critical aspect of using Dipropylene Glycol (DPG) in household chemicals. As the use of DPG becomes more prevalent in various consumer products, manufacturers must navigate a complex landscape of regulations to ensure product safety and legal compliance.

In the United States, the Environmental Protection Agency (EPA) regulates DPG under the Toxic Substances Control Act (TSCA). The EPA has established guidelines for the use of DPG in consumer products, including maximum concentration limits and labeling requirements. Manufacturers must adhere to these regulations to avoid potential fines and product recalls.

The European Union (EU) has its own set of regulations governing the use of DPG in household chemicals. The Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation requires manufacturers to register DPG and provide safety data before it can be used in products sold within the EU. Additionally, the Classification, Labeling, and Packaging (CLP) regulation mandates specific labeling requirements for products containing DPG.

In Asia, countries like China and Japan have implemented their own regulatory frameworks for chemical substances in consumer products. The China RoHS (Restriction of Hazardous Substances) regulation and Japan's Chemical Substances Control Law (CSCL) both have implications for the use of DPG in household chemicals exported to these markets.

To ensure compliance across multiple jurisdictions, manufacturers must implement robust quality control measures and maintain detailed documentation of their DPG sourcing and usage. This includes conducting regular safety assessments, monitoring changes in regulations, and updating product formulations as necessary.

The regulatory landscape for DPG is not static, and manufacturers must stay informed about emerging regulations and potential changes to existing ones. For instance, there is growing concern about the environmental impact of chemicals used in household products, which may lead to stricter regulations on DPG usage in the future.

Manufacturers can improve their regulatory compliance by investing in research and development to find alternative formulations that reduce DPG concentrations while maintaining product efficacy. This proactive approach can help companies stay ahead of potential regulatory changes and demonstrate their commitment to product safety and environmental responsibility.

In conclusion, navigating the regulatory landscape for DPG in household chemicals requires a comprehensive understanding of global regulations, ongoing monitoring of regulatory changes, and a commitment to product safety and environmental stewardship. By prioritizing regulatory compliance, manufacturers can ensure the continued success of their products in the global marketplace while minimizing legal and reputational risks.

In the United States, the Environmental Protection Agency (EPA) regulates DPG under the Toxic Substances Control Act (TSCA). The EPA has established guidelines for the use of DPG in consumer products, including maximum concentration limits and labeling requirements. Manufacturers must adhere to these regulations to avoid potential fines and product recalls.

The European Union (EU) has its own set of regulations governing the use of DPG in household chemicals. The Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation requires manufacturers to register DPG and provide safety data before it can be used in products sold within the EU. Additionally, the Classification, Labeling, and Packaging (CLP) regulation mandates specific labeling requirements for products containing DPG.

In Asia, countries like China and Japan have implemented their own regulatory frameworks for chemical substances in consumer products. The China RoHS (Restriction of Hazardous Substances) regulation and Japan's Chemical Substances Control Law (CSCL) both have implications for the use of DPG in household chemicals exported to these markets.

To ensure compliance across multiple jurisdictions, manufacturers must implement robust quality control measures and maintain detailed documentation of their DPG sourcing and usage. This includes conducting regular safety assessments, monitoring changes in regulations, and updating product formulations as necessary.

The regulatory landscape for DPG is not static, and manufacturers must stay informed about emerging regulations and potential changes to existing ones. For instance, there is growing concern about the environmental impact of chemicals used in household products, which may lead to stricter regulations on DPG usage in the future.

Manufacturers can improve their regulatory compliance by investing in research and development to find alternative formulations that reduce DPG concentrations while maintaining product efficacy. This proactive approach can help companies stay ahead of potential regulatory changes and demonstrate their commitment to product safety and environmental responsibility.

In conclusion, navigating the regulatory landscape for DPG in household chemicals requires a comprehensive understanding of global regulations, ongoing monitoring of regulatory changes, and a commitment to product safety and environmental stewardship. By prioritizing regulatory compliance, manufacturers can ensure the continued success of their products in the global marketplace while minimizing legal and reputational risks.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!