Environmental And End-Of-Life Management Of Dielectric Fluids

AUG 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Dielectric Fluids Background and Objectives

Dielectric fluids have been integral components of electrical equipment since the early 20th century, with their development closely tied to the evolution of power transmission and distribution systems. Initially, mineral oils derived from petroleum were the predominant dielectric fluids due to their excellent insulating properties and thermal stability. The 1930s saw the introduction of polychlorinated biphenyls (PCBs) as superior alternatives, offering enhanced fire resistance and chemical stability.

However, the environmental trajectory of dielectric fluids changed dramatically in the 1970s when PCBs were identified as persistent organic pollutants with significant ecological and health impacts. This revelation triggered a global shift toward developing environmentally compatible alternatives, marking a critical turning point in the industry's approach to dielectric fluid formulation and management.

The technical evolution continued through the 1980s and 1990s with the development of synthetic esters, silicone fluids, and vegetable oil-based dielectrics. These innovations represented attempts to balance technical performance with reduced environmental footprint, reflecting growing awareness of sustainability concerns in industrial applications.

Current technological trends in dielectric fluid development focus on biodegradability, reduced toxicity, enhanced fire safety, and improved electrical characteristics. The industry is witnessing a progressive transition from traditional petroleum-based fluids toward bio-based alternatives derived from renewable resources, aligning with broader sustainability objectives and circular economy principles.

The primary technical objectives in dielectric fluid management encompass several dimensions. First, developing comprehensive end-of-life protocols that minimize environmental contamination while maximizing resource recovery. Second, establishing effective remediation techniques for legacy fluid contamination in soils and groundwater. Third, designing next-generation dielectric fluids with inherent biodegradability and reduced environmental persistence.

Additionally, the industry aims to standardize testing methodologies for environmental impact assessment, creating uniform metrics for comparing different dielectric fluid options. This standardization would facilitate more informed decision-making regarding fluid selection based on lifecycle environmental performance rather than solely on technical specifications.

The ultimate goal is to achieve a closed-loop system for dielectric fluid management, where materials are continuously reclaimed, regenerated, and reused, minimizing waste generation and resource consumption. This vision requires integrated approaches combining advanced material science, process engineering, and environmental management techniques to address the complex challenges associated with dielectric fluid lifecycle management.

However, the environmental trajectory of dielectric fluids changed dramatically in the 1970s when PCBs were identified as persistent organic pollutants with significant ecological and health impacts. This revelation triggered a global shift toward developing environmentally compatible alternatives, marking a critical turning point in the industry's approach to dielectric fluid formulation and management.

The technical evolution continued through the 1980s and 1990s with the development of synthetic esters, silicone fluids, and vegetable oil-based dielectrics. These innovations represented attempts to balance technical performance with reduced environmental footprint, reflecting growing awareness of sustainability concerns in industrial applications.

Current technological trends in dielectric fluid development focus on biodegradability, reduced toxicity, enhanced fire safety, and improved electrical characteristics. The industry is witnessing a progressive transition from traditional petroleum-based fluids toward bio-based alternatives derived from renewable resources, aligning with broader sustainability objectives and circular economy principles.

The primary technical objectives in dielectric fluid management encompass several dimensions. First, developing comprehensive end-of-life protocols that minimize environmental contamination while maximizing resource recovery. Second, establishing effective remediation techniques for legacy fluid contamination in soils and groundwater. Third, designing next-generation dielectric fluids with inherent biodegradability and reduced environmental persistence.

Additionally, the industry aims to standardize testing methodologies for environmental impact assessment, creating uniform metrics for comparing different dielectric fluid options. This standardization would facilitate more informed decision-making regarding fluid selection based on lifecycle environmental performance rather than solely on technical specifications.

The ultimate goal is to achieve a closed-loop system for dielectric fluid management, where materials are continuously reclaimed, regenerated, and reused, minimizing waste generation and resource consumption. This vision requires integrated approaches combining advanced material science, process engineering, and environmental management techniques to address the complex challenges associated with dielectric fluid lifecycle management.

Market Demand Analysis for Eco-friendly Dielectric Fluids

The global market for eco-friendly dielectric fluids is experiencing significant growth driven by increasing environmental regulations and corporate sustainability initiatives. Traditional mineral oil-based dielectric fluids, while effective for electrical insulation and cooling, pose substantial environmental risks through potential soil and groundwater contamination when leaked or improperly disposed of. This environmental concern has created a robust demand for biodegradable alternatives with reduced ecological impact.

The power transmission and distribution sector represents the largest market segment for eco-friendly dielectric fluids, with utilities worldwide seeking to replace aging infrastructure with environmentally responsible alternatives. According to industry analyses, the global market for biodegradable dielectric fluids is projected to grow at a compound annual growth rate of 7.2% through 2028, reaching a market value of 3.1 billion USD.

Regulatory frameworks are primary market drivers, with the European Union's REACH regulations and the United States EPA's Toxic Substances Control Act imposing strict guidelines on PCB-containing fluids and encouraging adoption of environmentally benign alternatives. Countries including Germany, Sweden, and Japan have implemented even more stringent regulations, creating premium markets for advanced eco-friendly solutions.

The industrial sector presents another significant market opportunity, particularly in manufacturing facilities located near water bodies or protected environmental zones where fluid leakage risks are heightened. These operations increasingly specify biodegradable dielectric fluids in their procurement requirements, despite higher initial costs, recognizing the long-term financial benefits of avoiding environmental remediation expenses.

Consumer awareness and corporate sustainability commitments are further expanding market demand. Major electrical equipment manufacturers report increasing customer inquiries about environmental performance metrics of insulating fluids, with procurement decisions increasingly influenced by total environmental impact considerations rather than solely purchase price.

Regional market analysis reveals that Europe currently leads in adoption of eco-friendly dielectric fluids, followed by North America, while the Asia-Pacific region represents the fastest-growing market due to rapid industrial expansion coupled with strengthening environmental regulations. Developing economies present substantial growth opportunities as they balance industrial development with environmental protection goals.

Price sensitivity remains a market challenge, with eco-friendly alternatives typically commanding a 15-30% premium over conventional mineral oil-based products. However, this price differential is narrowing as production scales increase and more competitors enter the market. The total cost of ownership calculation increasingly favors eco-friendly options when factoring in reduced end-of-life management costs and lower environmental liability risks.

The power transmission and distribution sector represents the largest market segment for eco-friendly dielectric fluids, with utilities worldwide seeking to replace aging infrastructure with environmentally responsible alternatives. According to industry analyses, the global market for biodegradable dielectric fluids is projected to grow at a compound annual growth rate of 7.2% through 2028, reaching a market value of 3.1 billion USD.

Regulatory frameworks are primary market drivers, with the European Union's REACH regulations and the United States EPA's Toxic Substances Control Act imposing strict guidelines on PCB-containing fluids and encouraging adoption of environmentally benign alternatives. Countries including Germany, Sweden, and Japan have implemented even more stringent regulations, creating premium markets for advanced eco-friendly solutions.

The industrial sector presents another significant market opportunity, particularly in manufacturing facilities located near water bodies or protected environmental zones where fluid leakage risks are heightened. These operations increasingly specify biodegradable dielectric fluids in their procurement requirements, despite higher initial costs, recognizing the long-term financial benefits of avoiding environmental remediation expenses.

Consumer awareness and corporate sustainability commitments are further expanding market demand. Major electrical equipment manufacturers report increasing customer inquiries about environmental performance metrics of insulating fluids, with procurement decisions increasingly influenced by total environmental impact considerations rather than solely purchase price.

Regional market analysis reveals that Europe currently leads in adoption of eco-friendly dielectric fluids, followed by North America, while the Asia-Pacific region represents the fastest-growing market due to rapid industrial expansion coupled with strengthening environmental regulations. Developing economies present substantial growth opportunities as they balance industrial development with environmental protection goals.

Price sensitivity remains a market challenge, with eco-friendly alternatives typically commanding a 15-30% premium over conventional mineral oil-based products. However, this price differential is narrowing as production scales increase and more competitors enter the market. The total cost of ownership calculation increasingly favors eco-friendly options when factoring in reduced end-of-life management costs and lower environmental liability risks.

Global Technical Status and Challenges in Dielectric Fluid Management

The management of dielectric fluids presents significant technical challenges globally, with varying approaches and regulatory frameworks across different regions. Currently, mineral oil-based dielectric fluids dominate the market, particularly in power transformers and high-voltage equipment, accounting for approximately 80% of global usage. However, their environmental persistence and potential toxicity have prompted a shift toward more sustainable alternatives.

In developed economies such as the European Union, North America, and Japan, strict regulations have accelerated the transition to biodegradable alternatives like natural and synthetic esters. These regions have established comprehensive end-of-life management systems, including specialized recycling facilities and regeneration technologies that can extend fluid lifespans by up to 70%.

Emerging economies face distinct challenges, often lacking the infrastructure for proper disposal and recycling. Countries like China and India, despite rapid industrial growth, are still developing regulatory frameworks for dielectric fluid management. This has resulted in significant environmental contamination in some areas, with an estimated 40% of used dielectric fluids being improperly disposed of globally.

Technical challenges persist across all regions. PCB-contaminated oils from legacy equipment remain problematic, requiring specialized treatment technologies. Current dehalogenation methods are energy-intensive and costly, limiting their widespread adoption in resource-constrained regions. Additionally, the detection and quantification of contaminants in aged dielectric fluids require sophisticated analytical techniques not universally available.

The recycling and regeneration of dielectric fluids face efficiency barriers, with current technologies achieving purification rates of 85-95%, leaving residual contaminants that can affect performance in sensitive applications. Fuller's earth filtration, vacuum dehydration, and chemical treatments represent the mainstream approaches, but each has limitations in terms of throughput, energy consumption, or waste generation.

Climate considerations further complicate management strategies. In tropical regions, biodegradable alternatives may face accelerated degradation, while in extremely cold environments, the higher pour points of natural esters present operational challenges. These geographic variations necessitate regionally adapted solutions rather than universal approaches.

International knowledge transfer remains inadequate, with significant disparities in technical expertise between developed and developing nations. While international standards like IEC 60296 and ASTM D3487 provide guidelines for new fluids, end-of-life management standards lack global harmonization, creating inconsistencies in handling practices and environmental outcomes.

In developed economies such as the European Union, North America, and Japan, strict regulations have accelerated the transition to biodegradable alternatives like natural and synthetic esters. These regions have established comprehensive end-of-life management systems, including specialized recycling facilities and regeneration technologies that can extend fluid lifespans by up to 70%.

Emerging economies face distinct challenges, often lacking the infrastructure for proper disposal and recycling. Countries like China and India, despite rapid industrial growth, are still developing regulatory frameworks for dielectric fluid management. This has resulted in significant environmental contamination in some areas, with an estimated 40% of used dielectric fluids being improperly disposed of globally.

Technical challenges persist across all regions. PCB-contaminated oils from legacy equipment remain problematic, requiring specialized treatment technologies. Current dehalogenation methods are energy-intensive and costly, limiting their widespread adoption in resource-constrained regions. Additionally, the detection and quantification of contaminants in aged dielectric fluids require sophisticated analytical techniques not universally available.

The recycling and regeneration of dielectric fluids face efficiency barriers, with current technologies achieving purification rates of 85-95%, leaving residual contaminants that can affect performance in sensitive applications. Fuller's earth filtration, vacuum dehydration, and chemical treatments represent the mainstream approaches, but each has limitations in terms of throughput, energy consumption, or waste generation.

Climate considerations further complicate management strategies. In tropical regions, biodegradable alternatives may face accelerated degradation, while in extremely cold environments, the higher pour points of natural esters present operational challenges. These geographic variations necessitate regionally adapted solutions rather than universal approaches.

International knowledge transfer remains inadequate, with significant disparities in technical expertise between developed and developing nations. While international standards like IEC 60296 and ASTM D3487 provide guidelines for new fluids, end-of-life management standards lack global harmonization, creating inconsistencies in handling practices and environmental outcomes.

Current Environmental Management Solutions

01 Recycling and disposal methods for dielectric fluids

Various methods for recycling and disposing of dielectric fluids at the end of their lifecycle are described. These include specialized treatment processes to remove contaminants, regeneration techniques to restore fluid properties, and safe disposal protocols that comply with environmental regulations. These methods aim to minimize environmental impact while maximizing resource recovery from used dielectric fluids.- Recycling and disposal methods for dielectric fluids: Various methods have been developed for the recycling and disposal of dielectric fluids at the end of their lifecycle. These methods include specialized treatment processes to remove contaminants, separation techniques to recover valuable components, and safe disposal protocols that minimize environmental impact. These approaches help manage the environmental footprint of dielectric fluids while potentially recovering valuable materials for reuse.

- Biodegradable and environmentally friendly dielectric fluid formulations: Development of biodegradable and environmentally friendly dielectric fluid formulations addresses end-of-life management concerns. These formulations use natural or synthetic components that break down more readily in the environment, reducing long-term ecological impact. Such fluids may incorporate vegetable oils, esters, or other compounds that maintain necessary electrical properties while offering improved environmental profiles compared to traditional petroleum-based dielectric fluids.

- Monitoring and detection systems for dielectric fluid management: Advanced monitoring and detection systems help manage dielectric fluids throughout their lifecycle. These systems can detect degradation, contamination, or leakage in real-time, allowing for timely intervention before environmental contamination occurs. Monitoring technologies include sensors, analytical tools, and diagnostic systems that track fluid performance and condition, supporting better environmental management and extending fluid life where possible.

- Containment and spill management technologies: Specialized containment and spill management technologies have been developed to prevent environmental contamination from dielectric fluids. These include advanced containment systems, spill response protocols, and remediation techniques specifically designed for dielectric fluid incidents. Such technologies help minimize environmental impact when accidental releases occur and form an important part of comprehensive environmental management strategies.

- Lifecycle assessment and management systems: Comprehensive lifecycle assessment and management systems track dielectric fluids from production through disposal. These systems incorporate environmental impact analysis, regulatory compliance tracking, and documentation of handling procedures throughout the fluid's lifecycle. Digital platforms and management software help organizations implement best practices for environmental stewardship while maintaining records necessary for regulatory compliance and environmental reporting.

02 Monitoring and detection systems for dielectric fluid management

Advanced monitoring and detection systems are employed to assess the condition of dielectric fluids throughout their lifecycle. These systems include sensors that can detect contamination, degradation, or changes in electrical properties. Real-time monitoring allows for timely maintenance decisions, extending fluid life and preventing environmental incidents through early detection of potential issues.Expand Specific Solutions03 Biodegradable and environmentally friendly dielectric fluid formulations

Development of dielectric fluids with improved environmental profiles, including biodegradable formulations and those with reduced toxicity. These fluids are designed to minimize environmental impact throughout their lifecycle, particularly at disposal. The formulations maintain necessary electrical and thermal properties while incorporating components that break down more readily in the environment after use.Expand Specific Solutions04 Lifecycle assessment and management systems for dielectric fluids

Comprehensive systems for managing dielectric fluids throughout their entire lifecycle, from production to disposal. These include tracking systems, maintenance protocols, and decision support tools that optimize fluid performance while minimizing environmental impact. Such systems often incorporate digital technologies to maintain records of fluid history, treatment, and eventual disposal or recycling.Expand Specific Solutions05 Containment and spill prevention technologies

Technologies designed to prevent environmental contamination from dielectric fluid leaks or spills. These include specialized containment systems, leak detection equipment, and rapid response protocols. Such technologies are critical for environmental protection during both normal operation and end-of-life management of equipment containing dielectric fluids, particularly in sensitive environments or applications with high risk of fluid release.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The environmental and end-of-life management of dielectric fluids market is currently in a growth phase, with increasing regulatory pressure driving innovation. The global market size is expanding as utilities and industries seek sustainable alternatives to traditional dielectric fluids. Technologically, the field shows varying maturity levels across different solutions. Leading players include Dow Global Technologies and DuPont de Nemours developing advanced biodegradable fluids, while power utilities like State Grid Corporation of China and Siemens AG are implementing improved management systems. Oil companies such as Chevron and China National Petroleum are investing in recycling technologies, while specialized environmental firms like Hunan Sanyou Environmental Protection are emerging with innovative treatment solutions. Research institutions are actively contributing to technological advancement in this evolving sector.

Dow Global Technologies LLC

Technical Solution: Dow has developed advanced biodegradable dielectric fluids based on natural esters and vegetable oils as alternatives to traditional mineral oil-based fluids. Their technology incorporates proprietary additives that enhance oxidation stability and thermal performance while maintaining biodegradability. Dow's approach includes a comprehensive lifecycle management system that tracks dielectric fluids from production through end-of-life, utilizing digital monitoring tools to optimize fluid performance and predict maintenance needs. Their solutions feature enhanced fire safety with high flash points (>300°C) and reduced environmental impact with >95% biodegradability rates. Dow has also pioneered recycling processes that can recover and repurpose up to 90% of used dielectric fluid components, significantly reducing waste disposal requirements.

Strengths: Industry-leading biodegradability rates with minimal environmental impact; comprehensive lifecycle tracking system; excellent fire safety characteristics. Weaknesses: Higher initial cost compared to mineral oil alternatives; may require specialized handling equipment; performance in extreme temperature conditions may be less reliable than traditional options.

Siemens AG

Technical Solution: Siemens has developed an innovative "Fluid Management Ecosystem" for dielectric fluids used in transformers and other electrical equipment. Their approach combines biodegradable ester-based fluids with IoT-enabled monitoring systems that continuously track fluid condition parameters including moisture content, acidity, and dissolved gas levels. The technology incorporates a closed-loop recycling system where aged fluids undergo on-site regeneration through multi-stage filtration and chemical reconditioning, extending fluid lifespan by up to 300% compared to conventional approaches. For end-of-life management, Siemens employs a proprietary thermal-chemical decomposition process that breaks down non-recyclable fluid components into environmentally benign substances, achieving near-zero landfill impact. Their system has demonstrated 40% reduction in lifecycle carbon footprint compared to traditional mineral oil management practices.

Strengths: Integrated IoT monitoring provides real-time fluid condition assessment; on-site regeneration capabilities significantly extend fluid lifespan; comprehensive end-of-life solution with minimal environmental impact. Weaknesses: Requires substantial initial investment in monitoring infrastructure; system complexity demands specialized technical expertise; regeneration process may not be economically viable for smaller installations.

Critical Patents and Innovations in Biodegradable Dielectrics

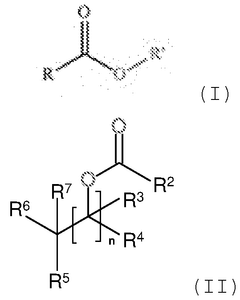

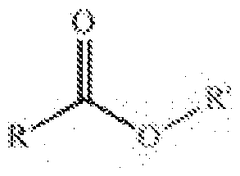

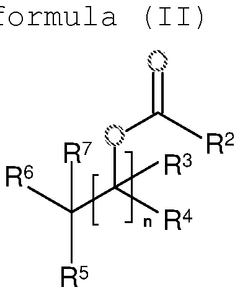

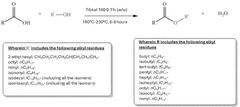

Use of esters as dielectric fluids for electrical discharge machines

PatentWO2025149895A1

Innovation

- The use of esters, such as those of formula (I) and (II), as dielectric fluids in EDM, which are derived from renewable sources and offer improved insulating capacity, higher flash point, reduced evaporation, and lower emissions of harmful compounds.

DIELECTRIC fluid ELECTRICAL DEVICE AND PROCESS

PatentActiveBR112013005641A2

Innovation

- A dielectric fluid composition comprising algal oils, fatty acid esters, microbial oils, mineral oils, or vegetable oils combined with hindered phenolic antioxidants and substituted diphenyl amine antioxidants, along with optional seaweed antioxidants and metal deactivators, to enhance thermal stability and insulation properties.

Regulatory Framework and Compliance Requirements

The regulatory landscape governing dielectric fluids has evolved significantly over the past decades, primarily driven by environmental concerns and public health considerations. At the international level, the Stockholm Convention on Persistent Organic Pollutants (POPs) established in 2001 has been instrumental in phasing out polychlorinated biphenyls (PCBs), which were once common in transformer oils. Signatories to this convention are obligated to eliminate PCB use by 2025 and ensure environmentally sound waste management by 2028.

In the United States, the Environmental Protection Agency (EPA) regulates dielectric fluids under multiple frameworks, including the Toxic Substances Control Act (TSCA) and the Resource Conservation and Recovery Act (RCRA). The TSCA specifically addresses PCBs through 40 CFR Part 761, which establishes strict requirements for the handling, storage, and disposal of PCB-containing equipment. Additionally, the Spill Prevention, Control, and Countermeasure (SPCC) regulations mandate containment measures for oil-filled electrical equipment to prevent environmental contamination.

The European Union has implemented the Restriction of Hazardous Substances (RoHS) Directive and the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation, which impact the composition and use of dielectric fluids. The Waste Electrical and Electronic Equipment (WEEE) Directive further governs the end-of-life management of equipment containing these fluids, promoting recovery and recycling.

Compliance requirements typically include detailed record-keeping of fluid inventories, regular equipment inspections, certified disposal procedures, and spill response planning. Organizations must maintain documentation of fluid composition, equipment maintenance history, and disposal manifests for regulatory audits. Many jurisdictions require accredited third-party verification of disposal processes, particularly for hazardous dielectric fluids.

Emerging regulations are increasingly focusing on per- and polyfluoroalkyl substances (PFAS) in newer dielectric fluid formulations, with several countries implementing or considering restrictions. The trend toward circular economy principles is also reflected in evolving regulations that emphasize material recovery and recycling rather than disposal.

Companies operating globally face the challenge of navigating this complex regulatory mosaic, which varies significantly by region. Multinational corporations often adopt the most stringent standards across their operations to ensure compliance in all jurisdictions. Industry associations such as IEEE and CIGRE have developed technical standards and best practices that complement regulatory requirements and provide practical implementation guidance for compliance.

In the United States, the Environmental Protection Agency (EPA) regulates dielectric fluids under multiple frameworks, including the Toxic Substances Control Act (TSCA) and the Resource Conservation and Recovery Act (RCRA). The TSCA specifically addresses PCBs through 40 CFR Part 761, which establishes strict requirements for the handling, storage, and disposal of PCB-containing equipment. Additionally, the Spill Prevention, Control, and Countermeasure (SPCC) regulations mandate containment measures for oil-filled electrical equipment to prevent environmental contamination.

The European Union has implemented the Restriction of Hazardous Substances (RoHS) Directive and the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation, which impact the composition and use of dielectric fluids. The Waste Electrical and Electronic Equipment (WEEE) Directive further governs the end-of-life management of equipment containing these fluids, promoting recovery and recycling.

Compliance requirements typically include detailed record-keeping of fluid inventories, regular equipment inspections, certified disposal procedures, and spill response planning. Organizations must maintain documentation of fluid composition, equipment maintenance history, and disposal manifests for regulatory audits. Many jurisdictions require accredited third-party verification of disposal processes, particularly for hazardous dielectric fluids.

Emerging regulations are increasingly focusing on per- and polyfluoroalkyl substances (PFAS) in newer dielectric fluid formulations, with several countries implementing or considering restrictions. The trend toward circular economy principles is also reflected in evolving regulations that emphasize material recovery and recycling rather than disposal.

Companies operating globally face the challenge of navigating this complex regulatory mosaic, which varies significantly by region. Multinational corporations often adopt the most stringent standards across their operations to ensure compliance in all jurisdictions. Industry associations such as IEEE and CIGRE have developed technical standards and best practices that complement regulatory requirements and provide practical implementation guidance for compliance.

Lifecycle Assessment Methodologies

Lifecycle Assessment Methodologies for dielectric fluids have evolved significantly over the past decade, providing comprehensive frameworks to evaluate environmental impacts throughout their entire lifecycle. These methodologies typically follow ISO 14040 and 14044 standards, which establish principles for conducting Life Cycle Assessment (LCA) studies. For dielectric fluids specifically, these assessments encompass raw material extraction, manufacturing processes, transportation, usage phase, and end-of-life management.

The cradle-to-grave approach represents the most comprehensive methodology, tracking environmental impacts from resource extraction through disposal. This approach is particularly valuable for dielectric fluids due to their long operational lifespans in electrical equipment, often exceeding 30 years. More focused methodologies include cradle-to-gate assessments, which evaluate impacts up to the point of distribution, and gate-to-gate analyses that concentrate on specific manufacturing or processing stages.

Recent advancements have introduced specialized LCA tools designed specifically for electrical insulation materials and dielectric fluids. These tools incorporate industry-specific parameters such as electrical loss factors, thermal degradation rates, and maintenance requirements that significantly influence the overall environmental footprint. Software platforms like SimaPro, GaBi, and OpenLCA have developed specialized modules for power industry applications, facilitating more accurate assessments of dielectric fluid impacts.

Carbon footprint analysis has emerged as a critical component within these methodologies, particularly as the energy sector faces increasing pressure to reduce greenhouse gas emissions. For dielectric fluids, this analysis quantifies emissions associated with production, transportation, operational losses, and end-of-life treatment. Bio-based dielectric fluids typically demonstrate lower carbon footprints compared to mineral oil-based alternatives, though comprehensive assessment must account for land use changes and agricultural inputs.

Water footprint assessment has gained prominence in recent years, especially relevant for manufacturing processes and potential environmental contamination scenarios. This methodology evaluates both direct water consumption and potential impacts on water quality throughout the fluid's lifecycle. For PCB-containing legacy fluids, this assessment is particularly crucial due to potential groundwater contamination risks during disposal phases.

Toxicity potential assessment methodologies have become increasingly sophisticated, incorporating bioaccumulation factors, persistence metrics, and exposure pathways specific to dielectric fluid applications. USEtox models have been adapted to better represent the unique characteristics of these specialized industrial chemicals, providing more accurate toxicity characterizations for different fluid formulations.

The cradle-to-grave approach represents the most comprehensive methodology, tracking environmental impacts from resource extraction through disposal. This approach is particularly valuable for dielectric fluids due to their long operational lifespans in electrical equipment, often exceeding 30 years. More focused methodologies include cradle-to-gate assessments, which evaluate impacts up to the point of distribution, and gate-to-gate analyses that concentrate on specific manufacturing or processing stages.

Recent advancements have introduced specialized LCA tools designed specifically for electrical insulation materials and dielectric fluids. These tools incorporate industry-specific parameters such as electrical loss factors, thermal degradation rates, and maintenance requirements that significantly influence the overall environmental footprint. Software platforms like SimaPro, GaBi, and OpenLCA have developed specialized modules for power industry applications, facilitating more accurate assessments of dielectric fluid impacts.

Carbon footprint analysis has emerged as a critical component within these methodologies, particularly as the energy sector faces increasing pressure to reduce greenhouse gas emissions. For dielectric fluids, this analysis quantifies emissions associated with production, transportation, operational losses, and end-of-life treatment. Bio-based dielectric fluids typically demonstrate lower carbon footprints compared to mineral oil-based alternatives, though comprehensive assessment must account for land use changes and agricultural inputs.

Water footprint assessment has gained prominence in recent years, especially relevant for manufacturing processes and potential environmental contamination scenarios. This methodology evaluates both direct water consumption and potential impacts on water quality throughout the fluid's lifecycle. For PCB-containing legacy fluids, this assessment is particularly crucial due to potential groundwater contamination risks during disposal phases.

Toxicity potential assessment methodologies have become increasingly sophisticated, incorporating bioaccumulation factors, persistence metrics, and exposure pathways specific to dielectric fluid applications. USEtox models have been adapted to better represent the unique characteristics of these specialized industrial chemicals, providing more accurate toxicity characterizations for different fluid formulations.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!