Supply Chain And Fluid Availability Risks For Immersion Cooling

AUG 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Immersion Cooling Technology Background and Objectives

Immersion cooling technology has emerged as a revolutionary approach to thermal management in data centers and high-performance computing environments. Originating in the 1960s for cooling high-power electronics in military applications, this technology has evolved significantly over the past decade due to increasing power densities in computing systems. The fundamental principle involves submerging electronic components directly in dielectric fluids that conduct heat but not electricity, enabling more efficient heat transfer compared to traditional air cooling methods.

The evolution of immersion cooling has been marked by several key milestones. Initially limited to specialized applications, the technology gained broader attention around 2010 when cryptocurrency mining operations began adopting it to manage the intense heat generated by mining rigs. By 2015, major data center operators started exploring immersion cooling for high-density server racks, and by 2020, several commercial solutions had emerged in the market.

Current technological trends indicate a shift toward two primary approaches: single-phase immersion cooling, where the fluid remains in liquid form throughout the cooling process, and two-phase immersion cooling, where the fluid vaporizes as it absorbs heat and then condenses back to liquid form. Each approach offers distinct advantages depending on the specific application requirements and environmental conditions.

The primary objective of immersion cooling technology development is to address the escalating thermal challenges posed by increasingly powerful computing systems while simultaneously reducing energy consumption associated with cooling operations. Specific goals include achieving cooling efficiency improvements of 30-50% compared to air cooling, supporting power densities exceeding 100 kW per rack, and reducing data center PUE (Power Usage Effectiveness) to below 1.1.

Another critical objective is to develop sustainable cooling solutions that minimize environmental impact. This includes creating systems that use environmentally friendly dielectric fluids with low Global Warming Potential (GWP) and establishing closed-loop systems that prevent fluid loss and contamination. The industry aims to transition away from fluorocarbon-based fluids toward more sustainable alternatives such as engineered mineral oils and synthetic esters.

Supply chain resilience and fluid availability represent significant concerns for widespread adoption. As the technology scales, ensuring consistent access to specialized dielectric fluids becomes crucial. Current objectives include diversifying fluid suppliers, developing alternative fluid formulations, and establishing recycling programs to mitigate supply chain vulnerabilities and price volatility in this emerging market.

The evolution of immersion cooling has been marked by several key milestones. Initially limited to specialized applications, the technology gained broader attention around 2010 when cryptocurrency mining operations began adopting it to manage the intense heat generated by mining rigs. By 2015, major data center operators started exploring immersion cooling for high-density server racks, and by 2020, several commercial solutions had emerged in the market.

Current technological trends indicate a shift toward two primary approaches: single-phase immersion cooling, where the fluid remains in liquid form throughout the cooling process, and two-phase immersion cooling, where the fluid vaporizes as it absorbs heat and then condenses back to liquid form. Each approach offers distinct advantages depending on the specific application requirements and environmental conditions.

The primary objective of immersion cooling technology development is to address the escalating thermal challenges posed by increasingly powerful computing systems while simultaneously reducing energy consumption associated with cooling operations. Specific goals include achieving cooling efficiency improvements of 30-50% compared to air cooling, supporting power densities exceeding 100 kW per rack, and reducing data center PUE (Power Usage Effectiveness) to below 1.1.

Another critical objective is to develop sustainable cooling solutions that minimize environmental impact. This includes creating systems that use environmentally friendly dielectric fluids with low Global Warming Potential (GWP) and establishing closed-loop systems that prevent fluid loss and contamination. The industry aims to transition away from fluorocarbon-based fluids toward more sustainable alternatives such as engineered mineral oils and synthetic esters.

Supply chain resilience and fluid availability represent significant concerns for widespread adoption. As the technology scales, ensuring consistent access to specialized dielectric fluids becomes crucial. Current objectives include diversifying fluid suppliers, developing alternative fluid formulations, and establishing recycling programs to mitigate supply chain vulnerabilities and price volatility in this emerging market.

Market Demand Analysis for Immersion Cooling Solutions

The immersion cooling market is experiencing unprecedented growth driven by the rapid expansion of data centers and high-performance computing facilities worldwide. Current market analysis indicates that the global immersion cooling market is projected to grow from $250 million in 2021 to over $700 million by 2026, representing a compound annual growth rate exceeding 20%. This remarkable growth trajectory is primarily fueled by the increasing power density of computing equipment and the limitations of traditional air cooling systems in managing thermal loads efficiently.

Data center operators are increasingly seeking immersion cooling solutions as they face mounting pressure to reduce energy consumption while accommodating higher computing densities. Research shows that immersion cooling can reduce cooling energy requirements by up to 95% compared to conventional air cooling systems, offering substantial operational cost savings. Additionally, the technology enables up to 10 times higher computing density, allowing data centers to maximize their physical space utilization.

The cryptocurrency mining sector has emerged as another significant market driver, particularly during periods of high cryptocurrency valuation. Mining operations require intensive computational power and generate substantial heat, making immersion cooling an attractive solution for optimizing mining efficiency and extending equipment lifespan. However, this segment exhibits volatility corresponding to cryptocurrency market fluctuations.

Geographically, North America currently dominates the immersion cooling market with approximately 40% market share, followed by Europe and Asia-Pacific regions. The Asia-Pacific region is expected to witness the highest growth rate due to rapid digital infrastructure development and increasing investments in data center technologies across countries like China, Japan, Singapore, and India.

From an end-user perspective, hyperscale data centers represent the largest market segment, followed by enterprise data centers and edge computing facilities. The edge computing segment is anticipated to grow at the fastest rate as organizations deploy more computing resources closer to data sources and users, often in space-constrained environments where immersion cooling's compact footprint provides significant advantages.

Despite the growing demand, customer adoption faces several barriers including concerns about fluid availability, supply chain reliability, compatibility with existing infrastructure, and initial capital investment requirements. Market surveys indicate that approximately 65% of potential customers cite supply chain uncertainties and fluid availability as significant concerns when evaluating immersion cooling implementation.

Data center operators are increasingly seeking immersion cooling solutions as they face mounting pressure to reduce energy consumption while accommodating higher computing densities. Research shows that immersion cooling can reduce cooling energy requirements by up to 95% compared to conventional air cooling systems, offering substantial operational cost savings. Additionally, the technology enables up to 10 times higher computing density, allowing data centers to maximize their physical space utilization.

The cryptocurrency mining sector has emerged as another significant market driver, particularly during periods of high cryptocurrency valuation. Mining operations require intensive computational power and generate substantial heat, making immersion cooling an attractive solution for optimizing mining efficiency and extending equipment lifespan. However, this segment exhibits volatility corresponding to cryptocurrency market fluctuations.

Geographically, North America currently dominates the immersion cooling market with approximately 40% market share, followed by Europe and Asia-Pacific regions. The Asia-Pacific region is expected to witness the highest growth rate due to rapid digital infrastructure development and increasing investments in data center technologies across countries like China, Japan, Singapore, and India.

From an end-user perspective, hyperscale data centers represent the largest market segment, followed by enterprise data centers and edge computing facilities. The edge computing segment is anticipated to grow at the fastest rate as organizations deploy more computing resources closer to data sources and users, often in space-constrained environments where immersion cooling's compact footprint provides significant advantages.

Despite the growing demand, customer adoption faces several barriers including concerns about fluid availability, supply chain reliability, compatibility with existing infrastructure, and initial capital investment requirements. Market surveys indicate that approximately 65% of potential customers cite supply chain uncertainties and fluid availability as significant concerns when evaluating immersion cooling implementation.

Current State and Supply Chain Challenges

Immersion cooling technology has gained significant traction in data center cooling applications, yet its widespread adoption faces substantial supply chain and fluid availability challenges. Currently, the global supply chain for immersion cooling fluids remains relatively immature compared to traditional cooling solutions. The primary fluids used—synthetic dielectric fluids, mineral oils, and engineered fluids—are produced by a limited number of manufacturers, creating potential bottlenecks in the supply chain.

The production capacity for specialized dielectric fluids is concentrated among a few chemical companies, with manufacturing facilities primarily located in North America, Western Europe, and East Asia. This geographical concentration increases vulnerability to regional disruptions such as natural disasters, political instability, or pandemic-related restrictions, as evidenced during the COVID-19 crisis when production and shipping delays significantly impacted availability.

Raw material constraints represent another critical challenge. Many high-performance dielectric fluids require specialized chemical compounds derived from petroleum or other increasingly scarce resources. The competition for these raw materials across multiple industries, including pharmaceuticals and consumer electronics, has intensified price volatility and supply uncertainty.

Transportation logistics present additional complications. Dielectric fluids are classified as specialized chemicals, subjecting them to strict shipping regulations and handling requirements. The fluids' weight and volume make transportation costly, while their chemical properties necessitate specialized containers and handling procedures to prevent contamination or degradation during transit.

Environmental regulations increasingly impact the supply chain as well. Many traditional dielectric fluids face scrutiny regarding their environmental footprint, biodegradability, and end-of-life disposal options. Regulatory changes in different regions create a complex compliance landscape for manufacturers and distributors, potentially limiting availability in certain markets.

Inventory management challenges further complicate the landscape. The relatively low production volumes compared to conventional cooling solutions result in longer lead times, typically ranging from 8-16 weeks. This forces data center operators to maintain larger fluid inventories, increasing carrying costs and capital expenditure requirements.

Price volatility remains a significant concern, with fluid costs fluctuating based on petroleum prices, manufacturing capacity, and transportation expenses. The specialized nature of these fluids limits substitution possibilities, leaving customers vulnerable to price increases without viable alternatives.

These supply chain vulnerabilities collectively represent a substantial risk factor for organizations considering immersion cooling implementation. Without strategic planning for fluid procurement, maintenance of adequate reserves, and development of contingency plans for supply disruptions, organizations may face operational continuity risks that could undermine the benefits of immersion cooling technology.

The production capacity for specialized dielectric fluids is concentrated among a few chemical companies, with manufacturing facilities primarily located in North America, Western Europe, and East Asia. This geographical concentration increases vulnerability to regional disruptions such as natural disasters, political instability, or pandemic-related restrictions, as evidenced during the COVID-19 crisis when production and shipping delays significantly impacted availability.

Raw material constraints represent another critical challenge. Many high-performance dielectric fluids require specialized chemical compounds derived from petroleum or other increasingly scarce resources. The competition for these raw materials across multiple industries, including pharmaceuticals and consumer electronics, has intensified price volatility and supply uncertainty.

Transportation logistics present additional complications. Dielectric fluids are classified as specialized chemicals, subjecting them to strict shipping regulations and handling requirements. The fluids' weight and volume make transportation costly, while their chemical properties necessitate specialized containers and handling procedures to prevent contamination or degradation during transit.

Environmental regulations increasingly impact the supply chain as well. Many traditional dielectric fluids face scrutiny regarding their environmental footprint, biodegradability, and end-of-life disposal options. Regulatory changes in different regions create a complex compliance landscape for manufacturers and distributors, potentially limiting availability in certain markets.

Inventory management challenges further complicate the landscape. The relatively low production volumes compared to conventional cooling solutions result in longer lead times, typically ranging from 8-16 weeks. This forces data center operators to maintain larger fluid inventories, increasing carrying costs and capital expenditure requirements.

Price volatility remains a significant concern, with fluid costs fluctuating based on petroleum prices, manufacturing capacity, and transportation expenses. The specialized nature of these fluids limits substitution possibilities, leaving customers vulnerable to price increases without viable alternatives.

These supply chain vulnerabilities collectively represent a substantial risk factor for organizations considering immersion cooling implementation. Without strategic planning for fluid procurement, maintenance of adequate reserves, and development of contingency plans for supply disruptions, organizations may face operational continuity risks that could undermine the benefits of immersion cooling technology.

Current Supply Chain Risk Mitigation Strategies

01 Immersion cooling fluid supply chain management

Effective management of the immersion cooling fluid supply chain involves coordinating suppliers, manufacturers, and distributors to ensure consistent availability of cooling fluids. This includes establishing reliable procurement channels, implementing inventory management systems, and developing contingency plans for supply disruptions. Strategic partnerships with multiple suppliers can help mitigate risks associated with fluid shortages and price fluctuations, ensuring data centers maintain operational continuity.- Immersion cooling fluid compositions and availability: Various fluid compositions are used in immersion cooling systems, with specific formulations designed to optimize thermal performance while ensuring compatibility with electronic components. These fluids include dielectric liquids, fluorinated compounds, and specialized coolants that offer high heat transfer capabilities while being electrically non-conductive. The availability of these fluids depends on manufacturing capacity, raw material supply chains, and distribution networks that support the growing demand in data centers and high-performance computing environments.

- Supply chain management for immersion cooling systems: Effective supply chain management is critical for immersion cooling implementation, involving coordination between fluid manufacturers, hardware suppliers, and cooling system integrators. The supply chain encompasses procurement of raw materials, production of specialized cooling fluids, quality control processes, and logistics for delivery to end users. Challenges in the supply chain include ensuring consistent quality, managing inventory levels to meet fluctuating demand, and establishing reliable distribution channels for global deployment of immersion cooling solutions.

- Immersion cooling fluid recycling and sustainability: Sustainability considerations in immersion cooling include fluid recycling processes, environmental impact assessment, and end-of-life management. Systems for filtering, purifying, and reconditioning used cooling fluids help extend their operational lifespan and reduce waste. Closed-loop systems that minimize fluid loss and contamination are being developed to improve the environmental profile of immersion cooling technologies. These approaches address concerns about the availability of specialized cooling fluids by reducing dependence on continuous new fluid production.

- Immersion cooling system design for fluid efficiency: System designs that optimize fluid usage and circulation are essential for efficient immersion cooling operations. These designs incorporate specialized fluid flow patterns, heat exchangers, and component layouts that maximize thermal transfer while minimizing the total volume of cooling fluid required. Advanced monitoring systems track fluid parameters such as temperature, viscosity, and contamination levels to ensure optimal performance and extend fluid lifespan. By improving fluid efficiency, these designs help mitigate supply chain constraints and reduce operational costs.

- Quality control and testing of immersion cooling fluids: Rigorous quality control and testing protocols are implemented throughout the immersion cooling fluid supply chain to ensure performance and reliability. These processes include chemical composition analysis, thermal property verification, electrical resistivity testing, and compatibility assessment with various materials used in electronic components. Standardized testing methodologies help maintain consistency across fluid batches and suppliers, while certification programs provide assurance to end users about fluid quality and performance characteristics. These quality measures are crucial for establishing trust in the supply chain and supporting wider adoption of immersion cooling technologies.

02 Dielectric fluid formulations and availability

Dielectric fluids used in immersion cooling systems require specific properties including high thermal conductivity, low viscosity, and chemical stability. The availability of these specialized fluids depends on raw material sources, manufacturing capabilities, and distribution networks. Various formulations exist, including synthetic oils, fluorocarbons, and mineral-based solutions, each with different supply chain considerations and regional availability factors that impact data center deployment strategies.Expand Specific Solutions03 Recycling and sustainability of cooling fluids

Sustainable practices in immersion cooling involve recycling and reclaiming cooling fluids to reduce environmental impact and address supply constraints. This includes implementing closed-loop systems that filter and reuse fluids, establishing collection programs for end-of-life fluids, and developing purification technologies to extend fluid lifespan. These practices not only improve fluid availability but also reduce the carbon footprint associated with immersion cooling deployments.Expand Specific Solutions04 Quality control and fluid performance monitoring

Maintaining cooling fluid quality throughout the supply chain requires robust testing and monitoring protocols. This includes regular analysis of fluid properties, contamination detection systems, and performance validation procedures. Advanced monitoring technologies can track fluid degradation in real-time, allowing for predictive maintenance and timely replacement. Quality control measures ensure optimal thermal performance and prevent system failures due to fluid deterioration.Expand Specific Solutions05 Regional availability and regulatory considerations

The availability of immersion cooling fluids varies by region due to differences in manufacturing capabilities, import/export regulations, and transportation infrastructure. Regulatory frameworks governing chemical substances can impact fluid formulation, distribution, and usage across different jurisdictions. Understanding these regional variations is crucial for global data center operators to ensure consistent fluid supply and compliance with local environmental and safety standards.Expand Specific Solutions

Key Industry Players and Suppliers Analysis

The immersion cooling market for data centers is currently in a growth phase, with increasing adoption driven by high-density computing demands and energy efficiency requirements. The market size is expanding rapidly, projected to reach several billion dollars by 2025, though supply chain vulnerabilities present significant challenges. From a technical maturity perspective, the ecosystem shows varied development levels: established technology leaders like Microsoft, Intel, IBM, and Google are advancing standardization efforts, while specialized cooling innovators such as Green Revolution Cooling and LiquidStack are refining fluid technologies. Manufacturing partners including Supermicro, Wistron, and Delta Electronics are addressing hardware compatibility issues. Chemical suppliers like Chemours and 3M face particular scrutiny regarding fluid availability and environmental sustainability, representing a critical potential bottleneck in the supply chain.

3M Innovative Properties Co.

Technical Solution: 3M has established itself as a leading provider of immersion cooling fluids with their Novec Engineered Fluids product line. As both a manufacturer and implementer of immersion cooling technology, 3M has developed a vertically integrated approach to managing supply chain risks. Their strategy includes maintaining production facilities for key fluid components across multiple continents, with manufacturing capabilities in North America, Europe, and Asia. 3M has invested in diversifying their raw material supply chain, qualifying multiple suppliers for critical chemical precursors and maintaining 6-12 month strategic reserves of essential components. Their fluids are engineered for exceptional stability, with demonstrated field lifespans of 5+ years under proper operating conditions, significantly reducing replacement frequency and overall supply requirements. 3M has also developed a closed-loop reclamation program that can purify and reprocess used cooling fluids, recovering up to 95% of the original material for reuse. Additionally, they maintain a fluid innovation pipeline focused on developing next-generation coolants with more readily available precursors, reducing dependency on potentially constrained chemical supply chains.

Strengths: Vertical integration provides greater control over the entire supply chain; global manufacturing presence reduces regional disruption risks; long fluid lifespan minimizes replacement requirements; reclamation program creates circular supply model. Weaknesses: As both supplier and technology implementer, 3M faces potential conflicts between their roles; customers may be concerned about dependency on a single company for both technology and essential consumables.

Green Revolution Cooling, Inc.

Technical Solution: Green Revolution Cooling has developed a single-phase immersion cooling solution called CarnotJet that uses a specialized dielectric fluid (GRC ICE) to submerge servers directly. Their system includes fluid distribution units that circulate coolant through racks, removing heat from IT equipment. The company has implemented a comprehensive supply chain risk management strategy that includes maintaining multiple fluid suppliers across different geographic regions to mitigate regional disruptions. They've also developed proprietary fluid formulations with components sourced from multiple vendors to reduce dependency on single suppliers. GRC maintains strategic reserves of cooling fluids at key distribution centers, typically keeping 3-6 months of inventory based on projected customer demand. Their system is designed with fluid recovery mechanisms that can recapture up to 98% of the coolant during maintenance, significantly reducing operational fluid requirements.

Strengths: Multiple supplier relationships across regions provide resilience against localized disruptions; proprietary fluid formulations reduce dependency on single vendors; fluid recovery systems minimize ongoing fluid requirements. Weaknesses: Still vulnerable to global chemical supply chain disruptions; specialized fluid requirements may limit immediate alternatives in case of severe shortages.

Critical Patents and Innovations in Cooling Fluids

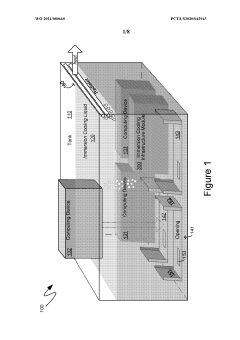

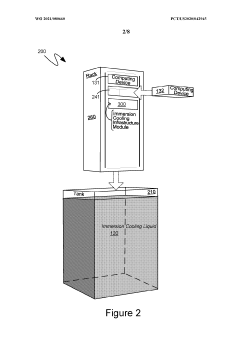

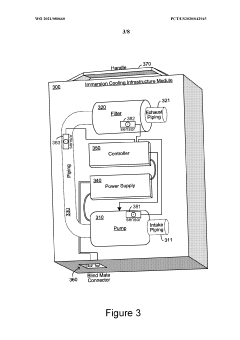

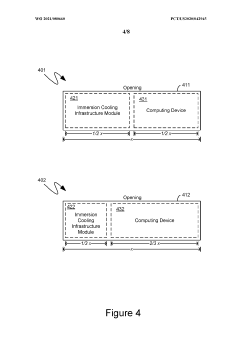

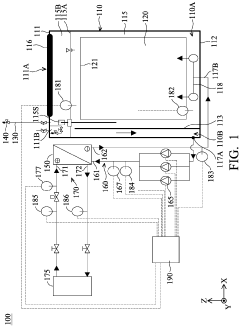

Immersion cooling infrastructure module having compute device form factor

PatentWO2021080660A1

Innovation

- A removable immersion cooling infrastructure module with a compute device form factor that separates repairable components from the main tank, allowing for efficient installation, removal, and replacement of immersion cooling infrastructure, including filters and pumps, without requiring modifications to the tank, and enabling redundancy with fewer spare components.

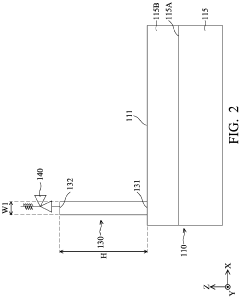

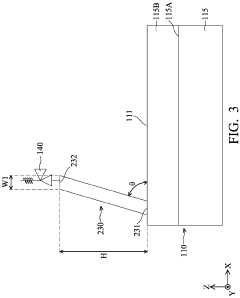

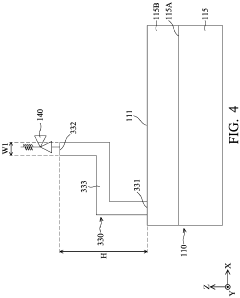

Immersion cooling system

PatentPendingEP4329450A1

Innovation

- The immersion cooling system incorporates a pressure seal tank with a pressure balance pipe and a relief valve, where the pressure balance pipe's design allows for the concentration of vaporized coolant to be higher at the discharge point, reducing the amount of coolant released outside, and a relief valve that automatically opens to manage pressure within acceptable ranges.

Regulatory Compliance and Environmental Considerations

Immersion cooling systems are subject to a complex web of regulatory frameworks that vary significantly across regions and jurisdictions. In the United States, the Environmental Protection Agency (EPA) regulates coolants under the Significant New Alternatives Policy (SNAP) program, which evaluates substitutes for ozone-depleting substances. For immersion cooling fluids, compliance with these regulations is critical, particularly as many traditional dielectric fluids contain compounds that may face future restrictions due to their environmental impact.

The European Union's approach is generally more stringent, with the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation and the Restriction of Hazardous Substances (RoHS) Directive imposing additional requirements on cooling fluid composition. Data center operators implementing immersion cooling must navigate these regulations carefully, as non-compliance can result in significant penalties and operational disruptions.

Environmental considerations extend beyond regulatory compliance to include the entire lifecycle assessment of cooling fluids. The Global Warming Potential (GWP) and Ozone Depletion Potential (ODP) of dielectric fluids are increasingly scrutinized metrics. Synthetic fluids typically used in immersion cooling systems often have lower GWP compared to traditional refrigerants, but their production, transportation, and disposal still contribute to environmental footprints that must be managed responsibly.

Waste management presents another critical regulatory challenge. Used cooling fluids may be classified as hazardous waste in certain jurisdictions, necessitating specialized disposal procedures. The development of closed-loop recycling systems for these fluids is emerging as both an environmental imperative and a potential solution to supply chain vulnerabilities, though such systems remain in nascent stages of implementation.

Energy efficiency certifications such as ENERGY STAR and the EU Code of Conduct for Data Centers are increasingly incorporating considerations for liquid cooling technologies. While immersion cooling can significantly improve Power Usage Effectiveness (PUE), certification standards are still adapting to properly account for these newer cooling methodologies, creating regulatory uncertainty for early adopters.

Local building codes and fire safety regulations also impact immersion cooling deployments. Many jurisdictions have not yet updated their codes to specifically address the unique characteristics of immersion cooling systems, leading to inconsistent interpretation and application of existing standards. This regulatory ambiguity can delay project approvals and increase compliance costs for data center operators.

The European Union's approach is generally more stringent, with the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation and the Restriction of Hazardous Substances (RoHS) Directive imposing additional requirements on cooling fluid composition. Data center operators implementing immersion cooling must navigate these regulations carefully, as non-compliance can result in significant penalties and operational disruptions.

Environmental considerations extend beyond regulatory compliance to include the entire lifecycle assessment of cooling fluids. The Global Warming Potential (GWP) and Ozone Depletion Potential (ODP) of dielectric fluids are increasingly scrutinized metrics. Synthetic fluids typically used in immersion cooling systems often have lower GWP compared to traditional refrigerants, but their production, transportation, and disposal still contribute to environmental footprints that must be managed responsibly.

Waste management presents another critical regulatory challenge. Used cooling fluids may be classified as hazardous waste in certain jurisdictions, necessitating specialized disposal procedures. The development of closed-loop recycling systems for these fluids is emerging as both an environmental imperative and a potential solution to supply chain vulnerabilities, though such systems remain in nascent stages of implementation.

Energy efficiency certifications such as ENERGY STAR and the EU Code of Conduct for Data Centers are increasingly incorporating considerations for liquid cooling technologies. While immersion cooling can significantly improve Power Usage Effectiveness (PUE), certification standards are still adapting to properly account for these newer cooling methodologies, creating regulatory uncertainty for early adopters.

Local building codes and fire safety regulations also impact immersion cooling deployments. Many jurisdictions have not yet updated their codes to specifically address the unique characteristics of immersion cooling systems, leading to inconsistent interpretation and application of existing standards. This regulatory ambiguity can delay project approvals and increase compliance costs for data center operators.

Global Sourcing Strategies and Alternative Materials

In addressing supply chain and fluid availability risks for immersion cooling systems, global sourcing strategies play a pivotal role in ensuring operational continuity. Organizations implementing immersion cooling technology must develop robust multi-regional procurement networks that span across North America, Europe, and Asia-Pacific regions. This geographical diversification helps mitigate risks associated with regional supply disruptions, regulatory changes, or geopolitical tensions that could impact the availability of specialized cooling fluids.

Strategic partnerships with multiple fluid manufacturers represent another critical component of risk mitigation. By establishing relationships with at least 2-3 major suppliers and several secondary sources, organizations can reduce dependency on single vendors. These partnerships should include contractual agreements specifying guaranteed supply volumes, priority allocation during shortages, and collaborative forecasting to anticipate demand fluctuations.

The exploration of alternative cooling fluids has emerged as a promising approach to supply chain resilience. Recent advancements have identified several viable substitutes for traditional dielectric fluids, including bio-based alternatives derived from plant oils that offer comparable thermal performance with reduced environmental impact. Synthetic alternatives with modified chemical compositions can provide enhanced stability and longevity while maintaining compatibility with existing immersion cooling infrastructure.

Material science innovations are enabling the development of next-generation cooling fluids with improved characteristics. These include higher flash points, extended operational lifespans, and reduced viscosity at lower temperatures. Research indicates that some alternative formulations can achieve thermal conductivity values within 85-95% of traditional solutions while presenting fewer supply chain vulnerabilities due to their composition from more readily available base materials.

Vertical integration strategies are being adopted by larger technology providers who are investing in fluid production capabilities or acquiring specialized manufacturers. This approach provides greater control over the supply chain but requires significant capital investment and specialized expertise. For organizations without such resources, consortium-based purchasing models offer an alternative by aggregating demand across multiple buyers to secure preferential supply arrangements and pricing structures.

Localized production and recycling initiatives represent emerging approaches to reducing dependency on global supply chains. By establishing regional fluid manufacturing facilities closer to data center operations and implementing closed-loop recycling systems that can reclaim and reprocess used cooling fluids, organizations can significantly reduce vulnerability to international logistics disruptions while simultaneously advancing sustainability objectives.

Strategic partnerships with multiple fluid manufacturers represent another critical component of risk mitigation. By establishing relationships with at least 2-3 major suppliers and several secondary sources, organizations can reduce dependency on single vendors. These partnerships should include contractual agreements specifying guaranteed supply volumes, priority allocation during shortages, and collaborative forecasting to anticipate demand fluctuations.

The exploration of alternative cooling fluids has emerged as a promising approach to supply chain resilience. Recent advancements have identified several viable substitutes for traditional dielectric fluids, including bio-based alternatives derived from plant oils that offer comparable thermal performance with reduced environmental impact. Synthetic alternatives with modified chemical compositions can provide enhanced stability and longevity while maintaining compatibility with existing immersion cooling infrastructure.

Material science innovations are enabling the development of next-generation cooling fluids with improved characteristics. These include higher flash points, extended operational lifespans, and reduced viscosity at lower temperatures. Research indicates that some alternative formulations can achieve thermal conductivity values within 85-95% of traditional solutions while presenting fewer supply chain vulnerabilities due to their composition from more readily available base materials.

Vertical integration strategies are being adopted by larger technology providers who are investing in fluid production capabilities or acquiring specialized manufacturers. This approach provides greater control over the supply chain but requires significant capital investment and specialized expertise. For organizations without such resources, consortium-based purchasing models offer an alternative by aggregating demand across multiple buyers to secure preferential supply arrangements and pricing structures.

Localized production and recycling initiatives represent emerging approaches to reducing dependency on global supply chains. By establishing regional fluid manufacturing facilities closer to data center operations and implementing closed-loop recycling systems that can reclaim and reprocess used cooling fluids, organizations can significantly reduce vulnerability to international logistics disruptions while simultaneously advancing sustainability objectives.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!