HEV Market Dynamics: Navigating Regulatory Landscapes

AUG 14, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

HEV Technology Evolution and Objectives

Hybrid Electric Vehicles (HEVs) have undergone significant technological evolution since their inception in the late 20th century. The primary objective of HEV technology has been to reduce fuel consumption and emissions while maintaining or improving vehicle performance. This goal has become increasingly important as global environmental regulations have become more stringent.

The development of HEV technology can be traced back to the 1900s, with early experiments in electric-gasoline hybrid vehicles. However, it wasn't until the late 1990s that HEVs gained commercial traction, marked by the launch of the Toyota Prius in Japan in 1997. Since then, HEV technology has rapidly advanced, driven by improvements in battery technology, power electronics, and control systems.

One of the key technological trends in HEV development has been the continuous improvement of battery performance. Early HEVs used nickel-metal hydride (NiMH) batteries, which have gradually been replaced by lithium-ion batteries offering higher energy density and longer lifespan. This transition has enabled HEVs to operate in electric-only mode for longer distances, further reducing emissions and fuel consumption.

Another significant trend has been the development of more sophisticated power management systems. These systems optimize the use of electric and gasoline power sources, maximizing efficiency across various driving conditions. Advanced control algorithms and predictive technologies have been instrumental in achieving this optimization, often leveraging artificial intelligence and machine learning techniques.

The evolution of HEV technology has also seen a diversification of hybrid architectures. From the initial parallel hybrid systems, manufacturers have developed series hybrids, power-split hybrids, and plug-in hybrid electric vehicles (PHEVs). Each of these architectures offers different advantages in terms of efficiency, performance, and cost, catering to diverse market segments and regulatory requirements.

Looking forward, the objectives of HEV technology continue to evolve. While reducing emissions and improving fuel efficiency remain core goals, there is an increasing focus on enhancing the electric-only range of HEVs, particularly for PHEVs. This aligns with the broader industry trend towards full electrification and helps bridge the gap between conventional vehicles and fully electric vehicles.

Another emerging objective is the integration of HEVs with smart grid technologies. This includes developing vehicle-to-grid (V2G) capabilities, allowing HEVs to not only draw power from the grid but also feed power back, potentially serving as distributed energy storage units. This integration aims to enhance grid stability and support the broader adoption of renewable energy sources.

The development of HEV technology can be traced back to the 1900s, with early experiments in electric-gasoline hybrid vehicles. However, it wasn't until the late 1990s that HEVs gained commercial traction, marked by the launch of the Toyota Prius in Japan in 1997. Since then, HEV technology has rapidly advanced, driven by improvements in battery technology, power electronics, and control systems.

One of the key technological trends in HEV development has been the continuous improvement of battery performance. Early HEVs used nickel-metal hydride (NiMH) batteries, which have gradually been replaced by lithium-ion batteries offering higher energy density and longer lifespan. This transition has enabled HEVs to operate in electric-only mode for longer distances, further reducing emissions and fuel consumption.

Another significant trend has been the development of more sophisticated power management systems. These systems optimize the use of electric and gasoline power sources, maximizing efficiency across various driving conditions. Advanced control algorithms and predictive technologies have been instrumental in achieving this optimization, often leveraging artificial intelligence and machine learning techniques.

The evolution of HEV technology has also seen a diversification of hybrid architectures. From the initial parallel hybrid systems, manufacturers have developed series hybrids, power-split hybrids, and plug-in hybrid electric vehicles (PHEVs). Each of these architectures offers different advantages in terms of efficiency, performance, and cost, catering to diverse market segments and regulatory requirements.

Looking forward, the objectives of HEV technology continue to evolve. While reducing emissions and improving fuel efficiency remain core goals, there is an increasing focus on enhancing the electric-only range of HEVs, particularly for PHEVs. This aligns with the broader industry trend towards full electrification and helps bridge the gap between conventional vehicles and fully electric vehicles.

Another emerging objective is the integration of HEVs with smart grid technologies. This includes developing vehicle-to-grid (V2G) capabilities, allowing HEVs to not only draw power from the grid but also feed power back, potentially serving as distributed energy storage units. This integration aims to enhance grid stability and support the broader adoption of renewable energy sources.

HEV Market Demand Analysis

The global market for Hybrid Electric Vehicles (HEVs) has experienced significant growth in recent years, driven by increasing environmental concerns, stringent emissions regulations, and rising fuel costs. This surge in demand is reshaping the automotive industry landscape and influencing consumer preferences worldwide.

In developed markets such as North America, Europe, and Japan, HEV adoption has been steadily increasing. These regions have well-established automotive industries and supportive government policies promoting cleaner transportation alternatives. The United States, in particular, has seen a notable uptick in HEV sales, with consumers attracted to the improved fuel efficiency and reduced environmental impact of these vehicles.

European countries have also witnessed a growing appetite for HEVs, particularly in urban areas where emissions regulations are becoming increasingly stringent. Countries like Germany, France, and the United Kingdom are leading the charge, with consumers embracing HEVs as a practical compromise between traditional internal combustion engines and fully electric vehicles.

In the Asia-Pacific region, Japan remains a pioneer and strong market for HEVs, with domestic manufacturers like Toyota and Honda dominating the segment. China, the world's largest automotive market, has also seen a surge in HEV demand, driven by government incentives and a growing middle class seeking more environmentally friendly transportation options.

Emerging markets, including India, Brazil, and Southeast Asian countries, are showing increasing interest in HEVs. However, adoption rates in these regions are still relatively low compared to developed markets, primarily due to higher initial costs and limited charging infrastructure.

The HEV market demand is closely tied to regulatory landscapes, with governments worldwide implementing stricter emissions standards and offering incentives for low-emission vehicles. These policies are creating a favorable environment for HEV adoption, encouraging automakers to invest in hybrid technology and expand their product offerings.

Consumer preferences are also shifting towards more fuel-efficient and environmentally friendly vehicles. HEVs are increasingly seen as a practical solution that offers improved fuel economy without the range anxiety associated with fully electric vehicles. This perception is driving demand across various vehicle segments, from compact cars to SUVs and luxury vehicles.

The COVID-19 pandemic has had a mixed impact on the HEV market. While overall automotive sales declined in 2020, the recovery phase has seen an increased interest in sustainable transportation options, potentially accelerating the shift towards HEVs and other electrified vehicles.

Looking ahead, the HEV market is expected to continue its growth trajectory, with increasing consumer awareness, technological advancements, and supportive regulatory environments driving demand. However, the pace of growth may vary across regions, influenced by factors such as economic conditions, infrastructure development, and the evolving competitive landscape of alternative powertrain technologies.

In developed markets such as North America, Europe, and Japan, HEV adoption has been steadily increasing. These regions have well-established automotive industries and supportive government policies promoting cleaner transportation alternatives. The United States, in particular, has seen a notable uptick in HEV sales, with consumers attracted to the improved fuel efficiency and reduced environmental impact of these vehicles.

European countries have also witnessed a growing appetite for HEVs, particularly in urban areas where emissions regulations are becoming increasingly stringent. Countries like Germany, France, and the United Kingdom are leading the charge, with consumers embracing HEVs as a practical compromise between traditional internal combustion engines and fully electric vehicles.

In the Asia-Pacific region, Japan remains a pioneer and strong market for HEVs, with domestic manufacturers like Toyota and Honda dominating the segment. China, the world's largest automotive market, has also seen a surge in HEV demand, driven by government incentives and a growing middle class seeking more environmentally friendly transportation options.

Emerging markets, including India, Brazil, and Southeast Asian countries, are showing increasing interest in HEVs. However, adoption rates in these regions are still relatively low compared to developed markets, primarily due to higher initial costs and limited charging infrastructure.

The HEV market demand is closely tied to regulatory landscapes, with governments worldwide implementing stricter emissions standards and offering incentives for low-emission vehicles. These policies are creating a favorable environment for HEV adoption, encouraging automakers to invest in hybrid technology and expand their product offerings.

Consumer preferences are also shifting towards more fuel-efficient and environmentally friendly vehicles. HEVs are increasingly seen as a practical solution that offers improved fuel economy without the range anxiety associated with fully electric vehicles. This perception is driving demand across various vehicle segments, from compact cars to SUVs and luxury vehicles.

The COVID-19 pandemic has had a mixed impact on the HEV market. While overall automotive sales declined in 2020, the recovery phase has seen an increased interest in sustainable transportation options, potentially accelerating the shift towards HEVs and other electrified vehicles.

Looking ahead, the HEV market is expected to continue its growth trajectory, with increasing consumer awareness, technological advancements, and supportive regulatory environments driving demand. However, the pace of growth may vary across regions, influenced by factors such as economic conditions, infrastructure development, and the evolving competitive landscape of alternative powertrain technologies.

HEV Technical Challenges and Regulatory Hurdles

Hybrid Electric Vehicles (HEVs) face a complex landscape of technical challenges and regulatory hurdles as they continue to gain market share in the automotive industry. One of the primary technical challenges is the optimization of the powertrain system, which involves integrating the internal combustion engine with electric motors and batteries. Engineers must balance power output, fuel efficiency, and emissions reduction while maintaining vehicle performance and reliability.

Battery technology remains a critical area of focus, with ongoing efforts to improve energy density, charging speed, and overall lifespan. The development of more efficient and cost-effective battery systems is crucial for the widespread adoption of HEVs. Additionally, thermal management of battery packs and power electronics poses significant engineering challenges, particularly in extreme climate conditions.

Weight reduction is another key technical hurdle for HEV manufacturers. The addition of electric components increases the overall vehicle weight, which can negatively impact fuel efficiency and performance. Innovative materials and design strategies are necessary to offset this weight gain without compromising safety or structural integrity.

On the regulatory front, HEV manufacturers must navigate a complex and evolving landscape of emissions standards and fuel economy regulations. Different regions and countries have varying requirements, making it challenging for automakers to develop globally compliant vehicles. For instance, the European Union's stringent CO2 emissions targets have accelerated the adoption of HEV technology, while regulations in the United States vary by state, with California often setting the benchmark for others to follow.

Safety regulations also present challenges for HEV development. The presence of high-voltage electrical systems and lithium-ion batteries requires additional safety measures and testing protocols. Manufacturers must ensure compliance with evolving safety standards, including those related to crash protection, electrical isolation, and thermal runaway prevention.

The regulatory environment also impacts the supply chain for HEV components. Sourcing of critical materials, such as rare earth elements for electric motors and lithium for batteries, is subject to geopolitical considerations and trade regulations. Manufacturers must navigate these complexities while striving to maintain cost-effectiveness and ensure a stable supply of components.

Furthermore, end-of-life regulations for HEVs, particularly regarding battery recycling and disposal, are becoming increasingly stringent. Automakers are required to develop sustainable solutions for battery management throughout the vehicle lifecycle, from production to recycling, to comply with environmental regulations and reduce the overall carbon footprint of HEVs.

Battery technology remains a critical area of focus, with ongoing efforts to improve energy density, charging speed, and overall lifespan. The development of more efficient and cost-effective battery systems is crucial for the widespread adoption of HEVs. Additionally, thermal management of battery packs and power electronics poses significant engineering challenges, particularly in extreme climate conditions.

Weight reduction is another key technical hurdle for HEV manufacturers. The addition of electric components increases the overall vehicle weight, which can negatively impact fuel efficiency and performance. Innovative materials and design strategies are necessary to offset this weight gain without compromising safety or structural integrity.

On the regulatory front, HEV manufacturers must navigate a complex and evolving landscape of emissions standards and fuel economy regulations. Different regions and countries have varying requirements, making it challenging for automakers to develop globally compliant vehicles. For instance, the European Union's stringent CO2 emissions targets have accelerated the adoption of HEV technology, while regulations in the United States vary by state, with California often setting the benchmark for others to follow.

Safety regulations also present challenges for HEV development. The presence of high-voltage electrical systems and lithium-ion batteries requires additional safety measures and testing protocols. Manufacturers must ensure compliance with evolving safety standards, including those related to crash protection, electrical isolation, and thermal runaway prevention.

The regulatory environment also impacts the supply chain for HEV components. Sourcing of critical materials, such as rare earth elements for electric motors and lithium for batteries, is subject to geopolitical considerations and trade regulations. Manufacturers must navigate these complexities while striving to maintain cost-effectiveness and ensure a stable supply of components.

Furthermore, end-of-life regulations for HEVs, particularly regarding battery recycling and disposal, are becoming increasingly stringent. Automakers are required to develop sustainable solutions for battery management throughout the vehicle lifecycle, from production to recycling, to comply with environmental regulations and reduce the overall carbon footprint of HEVs.

Current HEV Regulatory Compliance Strategies

01 Powertrain and energy management systems for HEVs

Hybrid Electric Vehicles (HEVs) utilize advanced powertrain and energy management systems to optimize performance and efficiency. These systems integrate electric motors with internal combustion engines, manage power distribution, and control energy flow between various components. They often include sophisticated control algorithms to balance power output, battery charging, and fuel consumption based on driving conditions and vehicle demands.- Thermal management systems for HEVs: Advanced thermal management systems are crucial for maintaining optimal performance and efficiency in hybrid electric vehicles. These systems regulate the temperature of various components, including batteries, electric motors, and power electronics, to ensure proper functioning and longevity. Innovative cooling solutions and heat exchange mechanisms are employed to manage the thermal loads generated during vehicle operation.

- Battery systems and power management in HEVs: Efficient battery systems and power management are essential for HEVs. This includes advanced battery technologies, charging systems, and power distribution strategies. Innovations focus on improving energy density, reducing charging times, and optimizing power flow between the electric and combustion components of the vehicle. Smart power management systems help maximize the use of electric power and minimize fuel consumption.

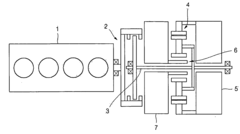

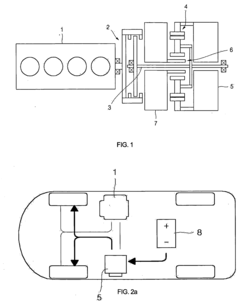

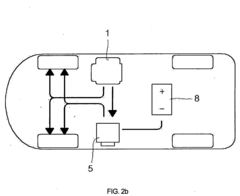

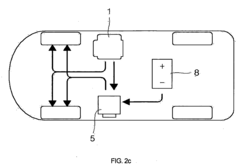

- Drivetrain and transmission systems for HEVs: Specialized drivetrain and transmission systems are developed for hybrid electric vehicles to efficiently integrate power from both electric motors and internal combustion engines. These systems often include advanced continuously variable transmissions (CVTs), power split devices, and intelligent control units that optimize power delivery based on driving conditions and energy efficiency requirements.

- Regenerative braking and energy recovery in HEVs: Regenerative braking systems are a key feature of hybrid electric vehicles, allowing for the recovery and storage of kinetic energy during deceleration. These systems convert the vehicle's kinetic energy into electrical energy, which is then stored in the battery for later use. Advanced control algorithms and hardware designs are employed to maximize energy recovery and improve overall vehicle efficiency.

- Control systems and software for HEVs: Sophisticated control systems and software are crucial for the efficient operation of hybrid electric vehicles. These systems manage the interplay between electric and combustion power sources, optimize energy usage, and control various vehicle subsystems. Advanced algorithms, including those utilizing artificial intelligence and machine learning, are developed to enhance vehicle performance, fuel efficiency, and emissions reduction.

02 Battery and thermal management in HEVs

Effective battery and thermal management are crucial for HEV performance and longevity. This includes advanced battery technologies, cooling systems, and temperature control mechanisms. Innovations in this area focus on improving battery life, enhancing charging efficiency, and maintaining optimal operating temperatures for both the battery pack and other powertrain components.Expand Specific Solutions03 Regenerative braking and energy recovery systems

HEVs employ regenerative braking systems to recover kinetic energy during deceleration and braking. This energy is typically converted to electrical energy and stored in the battery, improving overall vehicle efficiency. Advanced systems may also incorporate other forms of energy recovery, such as from exhaust heat or suspension movement.Expand Specific Solutions04 Electric drive and motor technologies for HEVs

Electric drive systems and motor technologies are key components in HEVs. This includes advancements in electric motor design, power electronics, and control systems. Innovations focus on improving motor efficiency, reducing size and weight, and enhancing overall performance of the electric drivetrain in hybrid configurations.Expand Specific Solutions05 HEV integration and vehicle architecture

The integration of hybrid systems into vehicle architectures presents unique challenges and opportunities. This includes optimizing vehicle layout to accommodate both electric and combustion components, designing efficient power transfer systems, and developing modular architectures that can be adapted for different hybrid configurations. Innovations in this area aim to improve packaging efficiency, reduce weight, and enhance overall vehicle performance.Expand Specific Solutions

Key HEV Industry Players

The HEV (Hybrid Electric Vehicle) market is in a dynamic growth phase, driven by increasing environmental regulations and consumer demand for fuel-efficient vehicles. The market size is expanding rapidly, with major automotive players like Ford, GM, Toyota, Nissan, and Hyundai heavily investing in HEV technology. The competitive landscape is intensifying as these established manufacturers compete with newer entrants like Tesla. Technological maturity varies, with companies like Toyota leading in hybrid systems, while others are catching up. The regulatory landscape plays a crucial role in shaping market dynamics, with governments worldwide implementing stricter emissions standards, incentivizing HEV adoption and influencing automakers' strategies.

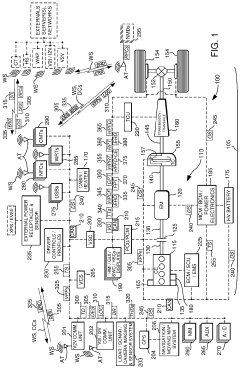

Ford Global Technologies LLC

Technical Solution: Ford has developed a comprehensive HEV strategy focusing on regulatory compliance and market adaptation. Their approach includes advanced powertrain technologies such as the PowerSplit hybrid system, which optimizes engine and electric motor operation for improved fuel efficiency[1]. Ford's HEVs utilize regenerative braking and intelligent energy management systems to maximize electric-only driving range. The company has also invested in flexible manufacturing capabilities, allowing them to quickly adjust production volumes of HEVs in response to changing market demands and regulatory requirements[3]. Ford's HEV lineup includes popular models like the Fusion Hybrid and Escape Hybrid, which have been designed to meet stringent emissions standards in various global markets.

Strengths: Strong brand recognition, extensive dealer network, and established manufacturing infrastructure. Weaknesses: Relatively late entry into some HEV segments compared to competitors, potential for higher production costs during transition.

Hyundai Motor Co., Ltd.

Technical Solution: Hyundai has implemented a multi-faceted approach to HEV technology, focusing on both regulatory compliance and market competitiveness. Their HEV system, branded as "Blue Drive," incorporates a parallel hybrid architecture with a lithium-ion polymer battery pack[2]. Hyundai's HEVs feature advanced thermal management systems for improved battery life and performance in various climates. The company has also developed a predictive energy management system that uses GPS and topographical data to optimize hybrid operation[4]. Hyundai's HEV lineup includes models like the Sonata Hybrid and Ioniq, which are designed to meet diverse global regulatory standards while offering competitive fuel economy and performance.

Strengths: Competitive pricing, rapidly improving technology, and strong presence in emerging markets. Weaknesses: Less established reputation in HEV technology compared to some competitors, potential for increased R&D costs to catch up in certain areas.

Innovative HEV Regulatory Adaptation Approaches

Hybrid electric vehicle fuel conservation system

PatentActiveUS10793135B2

Innovation

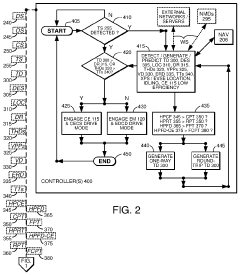

- The implementation of advanced controller systems that estimate trip distances, detect thermal demands, and adjust drive modes based on real-time data from navigation systems, sensors, and historical probabilities to optimize the engagement of electric drive modes and combustion engine modes, ensuring efficient energy use and minimizing fuel consumption.

Apparatus and method for controlling command torques in hybrid electric vehicle

PatentInactiveUS20070102206A1

Innovation

- The proposed solution involves dividing the hybrid control unit (HCU) into first and second levels, with the first level setting operating points and monitoring torques, and the second level diagnosing signals, restricting outputs, and resetting software to maintain command torque within safe ranges, preventing hardware damage.

Global HEV Policy Landscape

The global HEV policy landscape is characterized by a complex interplay of regulatory frameworks, incentive programs, and emission standards across different regions. In the European Union, stringent CO2 emission targets have been a key driver for HEV adoption. The EU's target of reducing new car CO2 emissions by 37.5% by 2030 compared to 2021 levels has prompted automakers to invest heavily in hybrid technologies. Member states have implemented various incentives, including tax breaks and purchase subsidies, to encourage consumer uptake of HEVs.

In North America, the regulatory approach has been more varied. The United States, under the Biden administration, has set ambitious goals for electrification, with a target of 50% electric vehicle sales share by 2030. This includes plug-in hybrids, providing a significant boost to the HEV market. California, often a trendsetter in environmental regulations, has maintained its own stricter emission standards, influencing other states to follow suit.

Asia presents a diverse policy landscape for HEVs. Japan, a pioneer in hybrid technology, has long supported HEVs through tax incentives and fuel efficiency standards. China, while primarily focusing on battery electric vehicles, has included HEVs in its New Energy Vehicle (NEV) credit system, recognizing their role in the transition to cleaner transportation. South Korea has also implemented policies to promote HEVs, including subsidies and tax benefits.

Emerging markets are increasingly recognizing the potential of HEVs as a bridge technology. Countries like India and Brazil have introduced policies to encourage HEV adoption, often as part of broader strategies to reduce air pollution and dependence on fossil fuels. These policies typically include a mix of tax incentives, import duty reductions, and local manufacturing support.

Global policy trends indicate a gradual shift towards more stringent emission standards and increased support for electrification. However, the approach to HEVs varies, with some regions viewing them as a transitional technology while others see them as a long-term solution alongside fully electric vehicles. This diversity in policy approaches creates a complex landscape for automakers and suppliers operating in the global HEV market, necessitating adaptive strategies to navigate different regulatory environments.

In North America, the regulatory approach has been more varied. The United States, under the Biden administration, has set ambitious goals for electrification, with a target of 50% electric vehicle sales share by 2030. This includes plug-in hybrids, providing a significant boost to the HEV market. California, often a trendsetter in environmental regulations, has maintained its own stricter emission standards, influencing other states to follow suit.

Asia presents a diverse policy landscape for HEVs. Japan, a pioneer in hybrid technology, has long supported HEVs through tax incentives and fuel efficiency standards. China, while primarily focusing on battery electric vehicles, has included HEVs in its New Energy Vehicle (NEV) credit system, recognizing their role in the transition to cleaner transportation. South Korea has also implemented policies to promote HEVs, including subsidies and tax benefits.

Emerging markets are increasingly recognizing the potential of HEVs as a bridge technology. Countries like India and Brazil have introduced policies to encourage HEV adoption, often as part of broader strategies to reduce air pollution and dependence on fossil fuels. These policies typically include a mix of tax incentives, import duty reductions, and local manufacturing support.

Global policy trends indicate a gradual shift towards more stringent emission standards and increased support for electrification. However, the approach to HEVs varies, with some regions viewing them as a transitional technology while others see them as a long-term solution alongside fully electric vehicles. This diversity in policy approaches creates a complex landscape for automakers and suppliers operating in the global HEV market, necessitating adaptive strategies to navigate different regulatory environments.

HEV Environmental Impact Assessment

The environmental impact assessment of Hybrid Electric Vehicles (HEVs) is a critical component in understanding their overall sustainability and regulatory compliance. HEVs, which combine conventional internal combustion engines with electric propulsion systems, offer a transitional technology between traditional vehicles and fully electric alternatives.

One of the primary environmental benefits of HEVs is their reduced greenhouse gas emissions compared to conventional vehicles. By utilizing electric power for a portion of their operation, HEVs can significantly decrease their carbon footprint, particularly in urban environments where stop-and-go traffic is common. Studies have shown that HEVs can reduce CO2 emissions by up to 30% compared to their conventional counterparts, depending on driving conditions and vehicle specifications.

However, the environmental impact of HEVs extends beyond tailpipe emissions. The production of batteries for these vehicles involves energy-intensive processes and the extraction of rare earth metals, which can have significant environmental consequences. The mining and processing of materials like lithium, cobalt, and nickel for battery production can lead to habitat destruction, water pollution, and increased carbon emissions in the manufacturing phase.

Life cycle assessments (LCAs) of HEVs reveal a complex picture of their environmental impact. While they generally outperform conventional vehicles in terms of overall emissions over their lifespan, the initial manufacturing phase can have a higher environmental cost. This highlights the importance of considering the entire life cycle of the vehicle, from production to end-of-life disposal and recycling.

The end-of-life management of HEV batteries presents both challenges and opportunities. Proper recycling of these batteries is crucial to mitigate environmental risks and recover valuable materials. Advancements in battery recycling technologies are essential to improve the overall sustainability of HEVs and reduce their long-term environmental impact.

Energy source considerations play a significant role in the environmental assessment of HEVs. The carbon intensity of the electricity grid used to charge these vehicles can greatly influence their overall emissions profile. In regions with a high proportion of renewable energy sources, the environmental benefits of HEVs are more pronounced.

Regulatory frameworks are increasingly incorporating life cycle assessments and comprehensive environmental impact evaluations in their approach to HEVs. This holistic view ensures that policies and incentives are aligned with the true environmental costs and benefits of these vehicles, promoting sustainable transportation solutions that address both immediate and long-term environmental concerns.

One of the primary environmental benefits of HEVs is their reduced greenhouse gas emissions compared to conventional vehicles. By utilizing electric power for a portion of their operation, HEVs can significantly decrease their carbon footprint, particularly in urban environments where stop-and-go traffic is common. Studies have shown that HEVs can reduce CO2 emissions by up to 30% compared to their conventional counterparts, depending on driving conditions and vehicle specifications.

However, the environmental impact of HEVs extends beyond tailpipe emissions. The production of batteries for these vehicles involves energy-intensive processes and the extraction of rare earth metals, which can have significant environmental consequences. The mining and processing of materials like lithium, cobalt, and nickel for battery production can lead to habitat destruction, water pollution, and increased carbon emissions in the manufacturing phase.

Life cycle assessments (LCAs) of HEVs reveal a complex picture of their environmental impact. While they generally outperform conventional vehicles in terms of overall emissions over their lifespan, the initial manufacturing phase can have a higher environmental cost. This highlights the importance of considering the entire life cycle of the vehicle, from production to end-of-life disposal and recycling.

The end-of-life management of HEV batteries presents both challenges and opportunities. Proper recycling of these batteries is crucial to mitigate environmental risks and recover valuable materials. Advancements in battery recycling technologies are essential to improve the overall sustainability of HEVs and reduce their long-term environmental impact.

Energy source considerations play a significant role in the environmental assessment of HEVs. The carbon intensity of the electricity grid used to charge these vehicles can greatly influence their overall emissions profile. In regions with a high proportion of renewable energy sources, the environmental benefits of HEVs are more pronounced.

Regulatory frameworks are increasingly incorporating life cycle assessments and comprehensive environmental impact evaluations in their approach to HEVs. This holistic view ensures that policies and incentives are aligned with the true environmental costs and benefits of these vehicles, promoting sustainable transportation solutions that address both immediate and long-term environmental concerns.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!