HEV Market Growth Trends: R&D Investment Insights

AUG 14, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

HEV Technology Evolution

The evolution of Hybrid Electric Vehicle (HEV) technology has been marked by significant milestones and continuous innovation over the past few decades. Initially, HEVs were introduced as a bridge between conventional internal combustion engine vehicles and fully electric vehicles, aiming to reduce fuel consumption and emissions while maintaining the convenience of traditional cars.

In the early stages of HEV development, the focus was primarily on improving the efficiency of the hybrid powertrain system. This involved optimizing the integration of electric motors with internal combustion engines, developing more advanced battery technologies, and refining power management systems. The first-generation HEVs, such as the Toyota Prius introduced in 1997, laid the foundation for future advancements in this field.

As the technology matured, HEV manufacturers began to diversify their offerings, introducing various hybrid configurations such as parallel, series, and power-split systems. This diversification allowed for better adaptation to different vehicle types and driving conditions, expanding the market appeal of HEVs beyond compact cars to SUVs, luxury vehicles, and even sports cars.

A crucial aspect of HEV technology evolution has been the continuous improvement in battery technology. The transition from nickel-metal hydride (NiMH) batteries to lithium-ion batteries marked a significant leap forward, offering higher energy density, longer lifespan, and improved performance. This shift enabled HEVs to achieve greater electric-only driving ranges and overall fuel efficiency.

The development of more sophisticated power electronics and control systems has been another key area of advancement. These improvements have led to smoother transitions between electric and gasoline power, more efficient energy recuperation through regenerative braking, and overall better vehicle performance and drivability.

Recent years have seen a growing focus on plug-in hybrid electric vehicles (PHEVs), which offer extended electric-only driving ranges and the ability to charge from external power sources. This development represents a significant step towards full electrification while still addressing range anxiety concerns.

The evolution of HEV technology has also been influenced by advancements in related fields such as lightweight materials, aerodynamics, and connected vehicle technologies. These complementary innovations have contributed to further improvements in fuel efficiency, performance, and user experience.

Looking ahead, the HEV technology roadmap is likely to include further advancements in battery technology, including the potential adoption of solid-state batteries, more efficient electric motors, and increasingly sophisticated energy management systems. Additionally, the integration of artificial intelligence and machine learning algorithms is expected to optimize HEV performance based on driving patterns and conditions.

In the early stages of HEV development, the focus was primarily on improving the efficiency of the hybrid powertrain system. This involved optimizing the integration of electric motors with internal combustion engines, developing more advanced battery technologies, and refining power management systems. The first-generation HEVs, such as the Toyota Prius introduced in 1997, laid the foundation for future advancements in this field.

As the technology matured, HEV manufacturers began to diversify their offerings, introducing various hybrid configurations such as parallel, series, and power-split systems. This diversification allowed for better adaptation to different vehicle types and driving conditions, expanding the market appeal of HEVs beyond compact cars to SUVs, luxury vehicles, and even sports cars.

A crucial aspect of HEV technology evolution has been the continuous improvement in battery technology. The transition from nickel-metal hydride (NiMH) batteries to lithium-ion batteries marked a significant leap forward, offering higher energy density, longer lifespan, and improved performance. This shift enabled HEVs to achieve greater electric-only driving ranges and overall fuel efficiency.

The development of more sophisticated power electronics and control systems has been another key area of advancement. These improvements have led to smoother transitions between electric and gasoline power, more efficient energy recuperation through regenerative braking, and overall better vehicle performance and drivability.

Recent years have seen a growing focus on plug-in hybrid electric vehicles (PHEVs), which offer extended electric-only driving ranges and the ability to charge from external power sources. This development represents a significant step towards full electrification while still addressing range anxiety concerns.

The evolution of HEV technology has also been influenced by advancements in related fields such as lightweight materials, aerodynamics, and connected vehicle technologies. These complementary innovations have contributed to further improvements in fuel efficiency, performance, and user experience.

Looking ahead, the HEV technology roadmap is likely to include further advancements in battery technology, including the potential adoption of solid-state batteries, more efficient electric motors, and increasingly sophisticated energy management systems. Additionally, the integration of artificial intelligence and machine learning algorithms is expected to optimize HEV performance based on driving patterns and conditions.

HEV Market Demand Analysis

The hybrid electric vehicle (HEV) market has experienced significant growth in recent years, driven by increasing environmental concerns, stricter emissions regulations, and rising fuel costs. This market demand analysis explores the current trends and future projections for HEV adoption across various regions and consumer segments.

Global HEV sales have shown a steady upward trajectory, with major automotive markets such as China, Europe, and North America leading the charge. The demand for HEVs is particularly strong in urban areas, where consumers are more environmentally conscious and face stricter emissions regulations. Additionally, fleet operators and ride-sharing companies are increasingly turning to HEVs to reduce their carbon footprint and operating costs.

Consumer preferences are shifting towards HEVs due to their improved fuel efficiency and lower environmental impact compared to traditional internal combustion engine vehicles. The growing awareness of climate change and air pollution has made eco-friendly transportation options more appealing to a broader range of consumers. Furthermore, advancements in HEV technology have led to improved performance and reduced costs, making these vehicles more accessible to mainstream buyers.

Government incentives and regulations play a crucial role in driving HEV market demand. Many countries have implemented tax breaks, subsidies, and other financial incentives to encourage HEV adoption. Stricter emissions standards and fuel economy regulations have also pushed automakers to invest more heavily in HEV technology, leading to a wider range of available models and increased consumer choice.

The COVID-19 pandemic has had a mixed impact on HEV market demand. While overall vehicle sales declined during the initial stages of the pandemic, the recovery phase has seen a renewed interest in personal mobility solutions, with HEVs benefiting from this trend. The pandemic has also heightened awareness of environmental issues, potentially accelerating the shift towards cleaner transportation options.

Looking ahead, the HEV market is expected to continue its growth trajectory, with several factors contributing to this trend. Technological advancements in battery technology and powertrain efficiency are likely to further improve HEV performance and reduce costs. The expansion of charging infrastructure and the development of smart grid systems will also support increased HEV adoption.

However, the HEV market faces competition from fully electric vehicles (EVs) and potential challenges in raw material supply chains for battery production. As EV technology improves and becomes more affordable, some consumers may opt for fully electric options over hybrids. Additionally, the availability and cost of critical materials for battery production could impact HEV market growth in the coming years.

Global HEV sales have shown a steady upward trajectory, with major automotive markets such as China, Europe, and North America leading the charge. The demand for HEVs is particularly strong in urban areas, where consumers are more environmentally conscious and face stricter emissions regulations. Additionally, fleet operators and ride-sharing companies are increasingly turning to HEVs to reduce their carbon footprint and operating costs.

Consumer preferences are shifting towards HEVs due to their improved fuel efficiency and lower environmental impact compared to traditional internal combustion engine vehicles. The growing awareness of climate change and air pollution has made eco-friendly transportation options more appealing to a broader range of consumers. Furthermore, advancements in HEV technology have led to improved performance and reduced costs, making these vehicles more accessible to mainstream buyers.

Government incentives and regulations play a crucial role in driving HEV market demand. Many countries have implemented tax breaks, subsidies, and other financial incentives to encourage HEV adoption. Stricter emissions standards and fuel economy regulations have also pushed automakers to invest more heavily in HEV technology, leading to a wider range of available models and increased consumer choice.

The COVID-19 pandemic has had a mixed impact on HEV market demand. While overall vehicle sales declined during the initial stages of the pandemic, the recovery phase has seen a renewed interest in personal mobility solutions, with HEVs benefiting from this trend. The pandemic has also heightened awareness of environmental issues, potentially accelerating the shift towards cleaner transportation options.

Looking ahead, the HEV market is expected to continue its growth trajectory, with several factors contributing to this trend. Technological advancements in battery technology and powertrain efficiency are likely to further improve HEV performance and reduce costs. The expansion of charging infrastructure and the development of smart grid systems will also support increased HEV adoption.

However, the HEV market faces competition from fully electric vehicles (EVs) and potential challenges in raw material supply chains for battery production. As EV technology improves and becomes more affordable, some consumers may opt for fully electric options over hybrids. Additionally, the availability and cost of critical materials for battery production could impact HEV market growth in the coming years.

Current HEV Tech Challenges

The current landscape of Hybrid Electric Vehicle (HEV) technology presents several significant challenges that are shaping research and development efforts across the industry. One of the primary hurdles is the optimization of battery technology. While HEVs have made substantial progress in energy storage, there is still a pressing need for batteries with higher energy density, faster charging capabilities, and longer lifespans. This challenge is compounded by the necessity to reduce battery costs to make HEVs more accessible to a broader market.

Another critical challenge lies in the integration and control of hybrid powertrains. Engineers are grappling with the complexities of seamlessly blending electric and combustion power sources to maximize efficiency and performance. This involves sophisticated energy management systems and control algorithms that can adapt to various driving conditions and user preferences. The goal is to achieve optimal power distribution between the electric motor and internal combustion engine, which remains a significant technical hurdle.

Weight reduction and aerodynamic improvements present ongoing challenges for HEV manufacturers. As batteries and electric components add substantial weight to vehicles, there is a constant push to develop lighter materials and more efficient designs. This effort extends to improving overall vehicle aerodynamics to reduce energy consumption and increase range, particularly crucial for plug-in hybrid models.

Thermal management is another area of concern, especially as HEVs incorporate more powerful electric motors and higher-capacity batteries. Efficient cooling systems are essential to maintain optimal performance and longevity of electrical components, as well as to ensure passenger comfort. Developing compact, lightweight, and effective thermal management solutions remains a significant challenge for engineers.

The complexity of HEV systems also poses challenges in terms of reliability and maintenance. As these vehicles combine traditional automotive components with advanced electrical systems, ensuring long-term reliability and developing efficient diagnostic and repair procedures are ongoing concerns. This complexity also impacts manufacturing processes, requiring new assembly techniques and quality control measures.

Lastly, the industry faces the challenge of standardization, particularly in charging infrastructure for plug-in hybrids. The lack of universal standards for charging plugs and protocols can hinder widespread adoption and create confusion among consumers. Addressing this issue requires collaboration across manufacturers and regulatory bodies to establish common standards that can facilitate the growth of the HEV market.

These technical challenges are driving significant R&D investments as companies strive to overcome these hurdles and position themselves at the forefront of HEV technology. The resolution of these challenges will play a crucial role in shaping the future growth and adoption of hybrid electric vehicles in the global automotive market.

Another critical challenge lies in the integration and control of hybrid powertrains. Engineers are grappling with the complexities of seamlessly blending electric and combustion power sources to maximize efficiency and performance. This involves sophisticated energy management systems and control algorithms that can adapt to various driving conditions and user preferences. The goal is to achieve optimal power distribution between the electric motor and internal combustion engine, which remains a significant technical hurdle.

Weight reduction and aerodynamic improvements present ongoing challenges for HEV manufacturers. As batteries and electric components add substantial weight to vehicles, there is a constant push to develop lighter materials and more efficient designs. This effort extends to improving overall vehicle aerodynamics to reduce energy consumption and increase range, particularly crucial for plug-in hybrid models.

Thermal management is another area of concern, especially as HEVs incorporate more powerful electric motors and higher-capacity batteries. Efficient cooling systems are essential to maintain optimal performance and longevity of electrical components, as well as to ensure passenger comfort. Developing compact, lightweight, and effective thermal management solutions remains a significant challenge for engineers.

The complexity of HEV systems also poses challenges in terms of reliability and maintenance. As these vehicles combine traditional automotive components with advanced electrical systems, ensuring long-term reliability and developing efficient diagnostic and repair procedures are ongoing concerns. This complexity also impacts manufacturing processes, requiring new assembly techniques and quality control measures.

Lastly, the industry faces the challenge of standardization, particularly in charging infrastructure for plug-in hybrids. The lack of universal standards for charging plugs and protocols can hinder widespread adoption and create confusion among consumers. Addressing this issue requires collaboration across manufacturers and regulatory bodies to establish common standards that can facilitate the growth of the HEV market.

These technical challenges are driving significant R&D investments as companies strive to overcome these hurdles and position themselves at the forefront of HEV technology. The resolution of these challenges will play a crucial role in shaping the future growth and adoption of hybrid electric vehicles in the global automotive market.

HEV Powertrain Solutions

01 Advancements in HEV powertrain systems

Innovations in hybrid electric vehicle powertrains are driving market growth. These advancements include improved energy management systems, more efficient electric motors, and better integration of internal combustion engines with electric components. Such developments enhance fuel efficiency, reduce emissions, and improve overall vehicle performance, making HEVs more attractive to consumers.- Advancements in HEV powertrain systems: Innovations in hybrid electric vehicle powertrain systems are driving market growth. These advancements include improved energy management, enhanced power distribution, and more efficient integration of electric motors with internal combustion engines. Such developments are increasing the performance and efficiency of HEVs, making them more attractive to consumers.

- Battery technology improvements: Progress in battery technology is a key factor in HEV market growth. Developments in battery capacity, charging speed, and overall lifespan are making HEVs more practical and cost-effective. Advanced battery management systems and thermal management solutions are also contributing to improved vehicle performance and reliability.

- Enhanced charging infrastructure: The expansion of charging infrastructure is supporting HEV market growth. This includes the development of fast-charging stations, wireless charging technologies, and smart grid integration. Improved accessibility to charging points is addressing range anxiety concerns and encouraging wider adoption of hybrid electric vehicles.

- Advanced driver assistance systems (ADAS) integration: The integration of advanced driver assistance systems in HEVs is contributing to market growth. These systems include adaptive cruise control, lane-keeping assist, and autonomous parking features. The combination of hybrid technology with ADAS is enhancing safety, comfort, and overall driving experience, making HEVs more appealing to a broader range of consumers.

- Lightweight materials and aerodynamic design: The use of lightweight materials and aerodynamic design principles in HEV manufacturing is boosting market growth. These advancements reduce vehicle weight, improve fuel efficiency, and extend electric range. Innovative materials such as carbon fiber composites and advanced alloys, combined with optimized vehicle shapes, are enhancing the overall performance and appeal of hybrid electric vehicles.

02 Battery technology improvements

Enhancements in battery technology are crucial for HEV market growth. This includes the development of higher capacity batteries, faster charging solutions, and improved battery management systems. These advancements lead to increased driving range, reduced charging times, and longer battery life, addressing key consumer concerns and boosting HEV adoption.Expand Specific Solutions03 Thermal management solutions

Effective thermal management is essential for optimal HEV performance and longevity. Innovations in cooling systems for batteries, electric motors, and power electronics are contributing to market growth. These solutions help maintain ideal operating temperatures, improve efficiency, and extend the lifespan of critical components, enhancing overall vehicle reliability and performance.Expand Specific Solutions04 Charging infrastructure development

The expansion of charging infrastructure is crucial for HEV market growth. This includes the development of more efficient charging stations, integration of smart grid technologies, and implementation of wireless charging solutions. Improved charging infrastructure addresses range anxiety and enhances the convenience of owning and operating HEVs, driving wider adoption.Expand Specific Solutions05 Vehicle-to-grid (V2G) technology

The integration of vehicle-to-grid technology in HEVs is opening new opportunities for market growth. This technology allows HEVs to not only draw power from the grid but also feed excess energy back, providing grid stability and potential cost savings for owners. V2G capabilities make HEVs more attractive to both consumers and utility companies, driving adoption and market expansion.Expand Specific Solutions

Key HEV Industry Players

The HEV market is experiencing significant growth, driven by increasing environmental concerns and government regulations. The industry is in a transitional phase, moving from early adoption to mainstream acceptance. Market size is expanding rapidly, with major automotive players investing heavily in R&D. Companies like Toyota, Hyundai, and Ford are leading the charge, developing advanced HEV technologies. The market's technological maturity is improving, with innovations in battery efficiency, powertrain integration, and energy management systems. However, there's still room for further advancements, particularly in areas like battery longevity and charging infrastructure. As competition intensifies, collaborations between automakers and tech companies are becoming more common, accelerating innovation in this dynamic sector.

Ford Global Technologies LLC

Technical Solution: Ford has been investing heavily in HEV technology as part of its electrification strategy. The company's PowerSplit hybrid architecture combines two electric motors with a gasoline engine, allowing for multiple power flow paths[8]. Ford has focused on improving the efficiency of its HEV powertrains, with recent models achieving up to 20% better fuel economy compared to previous generations[9]. The company has also developed an advanced battery management system that extends battery life and optimizes performance across various driving conditions. Ford's EcoBoost engine technology, when combined with their hybrid systems, provides a balance of power and efficiency[10]. The company plans to invest $11 billion in electrification by 2022, with a significant portion allocated to HEV development[11].

Strengths: Strong presence in the SUV and truck HEV market, advanced powertrain integration. Weaknesses: Later entry into the HEV market compared to some competitors.

Hyundai Motor Co., Ltd.

Technical Solution: Hyundai has made significant strides in HEV technology, focusing on their Blue Drive eco-friendly vehicle lineup. Their HEV system combines a gasoline engine with an electric motor and a lithium-polymer battery. Hyundai has invested in developing a compact and lightweight power control unit, which improves overall vehicle efficiency[4]. The company has also introduced a predictive energy management system that uses GPS and road topography data to optimize the use of electric power[5]. Hyundai's latest HEV models feature regenerative braking systems that can recover up to 70% of the vehicle's kinetic energy[6]. The company plans to invest $52 billion in R&D for future mobility technologies, including HEVs, by 2025[7].

Strengths: Rapid technological advancement, competitive pricing, and a focus on lightweight materials. Weaknesses: Smaller market share compared to some competitors in the HEV segment.

Breakthrough HEV Patents

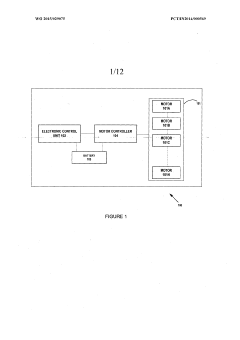

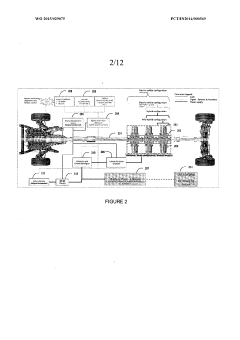

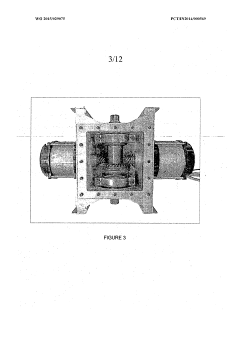

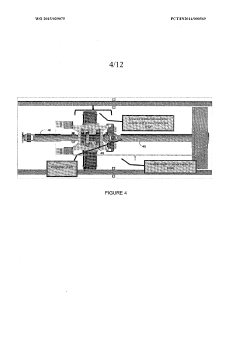

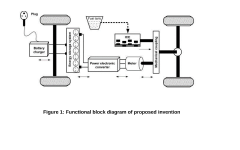

Retrofit system for converting a vehicle into one of a hybrid electric vehicle (HEV) and electric vehicle (EV)

PatentWO2015029075A2

Innovation

- A retrofit system with multiple electric power sources and attachable electric power gear assemblies, coupled with an electronic control unit, allows for dynamic motor control based on torque requirements, harnessing braking energy and optimizing battery consumption, and enabling conversion of existing vehicles into various hybrid and electric vehicle configurations.

Hybrid electric vehicle with electric motor providing strategic power assist to load balance internal combustion engine

PatentPendingIN202441000035A

Innovation

- A Hybrid Electric Vehicle (HEV) system with an electric motor providing strategic power assist to the internal combustion engine, optimizing power distribution and energy management through advanced control algorithms.

HEV Policy & Regulations

The regulatory landscape for Hybrid Electric Vehicles (HEVs) has been evolving rapidly, reflecting the growing emphasis on reducing carbon emissions and promoting sustainable transportation. Governments worldwide are implementing a range of policies and regulations to encourage the adoption of HEVs and support the transition to cleaner mobility solutions.

In many countries, financial incentives play a crucial role in promoting HEV adoption. These may include tax credits, rebates, or subsidies for purchasing HEVs. For instance, the United States offers federal tax credits for eligible hybrid vehicles, while several European countries provide substantial rebates or tax reductions. These incentives aim to bridge the price gap between conventional vehicles and HEVs, making the latter more attractive to consumers.

Emissions standards and fuel efficiency regulations are becoming increasingly stringent, indirectly benefiting HEV technologies. The European Union's CO2 emissions targets for new cars and vans, and similar regulations in other regions, are pushing automakers to invest more in hybrid technologies to meet these standards. This regulatory pressure is a significant driver for R&D investments in HEV technologies.

Many urban areas are implementing low-emission zones or congestion charging schemes, where HEVs often enjoy preferential treatment. These policies not only encourage HEV adoption but also stimulate demand for R&D to improve HEV performance in urban environments.

Government procurement policies are another important aspect of HEV regulations. Many countries and cities are setting targets for electrifying their public vehicle fleets, including buses and government cars, with HEVs often playing a significant role in this transition. These policies create a stable demand for HEVs and encourage manufacturers to invest in R&D to meet specific requirements for public sector vehicles.

Research and development tax credits or grants specifically for HEV technologies are being offered by various governments. These incentives aim to accelerate innovation in key areas such as battery technology, power electronics, and drivetrain efficiency. Such policies directly influence the allocation of R&D resources within automotive companies and their suppliers.

Standardization efforts are also shaping the HEV landscape. Governments and industry bodies are working to establish common standards for charging infrastructure, battery systems, and other critical components. These standards not only ensure interoperability but also provide a clear framework for R&D investments, allowing companies to focus their efforts on areas that align with established or emerging standards.

As the HEV market continues to grow, policymakers are also addressing end-of-life considerations. Regulations regarding battery recycling and the circular economy are being developed, which will likely influence future R&D directions in battery technology and vehicle design for easier recycling and reuse.

In many countries, financial incentives play a crucial role in promoting HEV adoption. These may include tax credits, rebates, or subsidies for purchasing HEVs. For instance, the United States offers federal tax credits for eligible hybrid vehicles, while several European countries provide substantial rebates or tax reductions. These incentives aim to bridge the price gap between conventional vehicles and HEVs, making the latter more attractive to consumers.

Emissions standards and fuel efficiency regulations are becoming increasingly stringent, indirectly benefiting HEV technologies. The European Union's CO2 emissions targets for new cars and vans, and similar regulations in other regions, are pushing automakers to invest more in hybrid technologies to meet these standards. This regulatory pressure is a significant driver for R&D investments in HEV technologies.

Many urban areas are implementing low-emission zones or congestion charging schemes, where HEVs often enjoy preferential treatment. These policies not only encourage HEV adoption but also stimulate demand for R&D to improve HEV performance in urban environments.

Government procurement policies are another important aspect of HEV regulations. Many countries and cities are setting targets for electrifying their public vehicle fleets, including buses and government cars, with HEVs often playing a significant role in this transition. These policies create a stable demand for HEVs and encourage manufacturers to invest in R&D to meet specific requirements for public sector vehicles.

Research and development tax credits or grants specifically for HEV technologies are being offered by various governments. These incentives aim to accelerate innovation in key areas such as battery technology, power electronics, and drivetrain efficiency. Such policies directly influence the allocation of R&D resources within automotive companies and their suppliers.

Standardization efforts are also shaping the HEV landscape. Governments and industry bodies are working to establish common standards for charging infrastructure, battery systems, and other critical components. These standards not only ensure interoperability but also provide a clear framework for R&D investments, allowing companies to focus their efforts on areas that align with established or emerging standards.

As the HEV market continues to grow, policymakers are also addressing end-of-life considerations. Regulations regarding battery recycling and the circular economy are being developed, which will likely influence future R&D directions in battery technology and vehicle design for easier recycling and reuse.

HEV Supply Chain Analysis

The HEV (Hybrid Electric Vehicle) supply chain is a complex network of manufacturers, suppliers, and service providers that collaborate to produce and distribute hybrid electric vehicles. This chain encompasses raw material extraction, component manufacturing, vehicle assembly, distribution, and after-sales services.

At the core of the HEV supply chain are the major automakers, who design and assemble the final vehicles. These companies, such as Toyota, Honda, and Ford, rely on a vast network of tier 1, 2, and 3 suppliers to provide components and subsystems. Tier 1 suppliers, like Bosch and Denso, provide major systems such as powertrains and battery management systems. Tier 2 suppliers manufacture individual components, while tier 3 suppliers provide raw materials and basic parts.

A critical element of the HEV supply chain is the battery production sector. This includes companies specializing in lithium-ion battery technology, such as Panasonic, LG Chem, and CATL. These firms are responsible for developing and manufacturing the high-capacity batteries that power HEVs, often working closely with automakers to optimize performance and integration.

The electric motor and power electronics sectors also play crucial roles in the HEV supply chain. Companies like Continental and ZF Friedrichshafen produce electric motors, while firms such as Infineon and STMicroelectronics supply the necessary power electronics components.

Raw material suppliers form the foundation of the HEV supply chain. This includes mining companies that extract lithium, cobalt, and rare earth elements essential for battery and electric motor production. The increasing demand for these materials has led to concerns about supply chain resilience and sustainability.

Logistics and distribution networks are vital for connecting the various stages of the HEV supply chain. This involves transportation of components between suppliers and manufacturers, as well as the distribution of finished vehicles to dealerships and end consumers.

The HEV supply chain also extends to the aftermarket sector, which includes maintenance, repair, and recycling services. As HEVs become more prevalent, specialized service providers are emerging to handle battery replacement, electric drivetrain maintenance, and end-of-life vehicle recycling.

As the HEV market continues to grow, the supply chain is evolving to meet increasing demand and technological advancements. This includes the development of more localized supply chains to reduce transportation costs and improve resilience, as well as increased investment in research and development to enhance component performance and reduce costs.

At the core of the HEV supply chain are the major automakers, who design and assemble the final vehicles. These companies, such as Toyota, Honda, and Ford, rely on a vast network of tier 1, 2, and 3 suppliers to provide components and subsystems. Tier 1 suppliers, like Bosch and Denso, provide major systems such as powertrains and battery management systems. Tier 2 suppliers manufacture individual components, while tier 3 suppliers provide raw materials and basic parts.

A critical element of the HEV supply chain is the battery production sector. This includes companies specializing in lithium-ion battery technology, such as Panasonic, LG Chem, and CATL. These firms are responsible for developing and manufacturing the high-capacity batteries that power HEVs, often working closely with automakers to optimize performance and integration.

The electric motor and power electronics sectors also play crucial roles in the HEV supply chain. Companies like Continental and ZF Friedrichshafen produce electric motors, while firms such as Infineon and STMicroelectronics supply the necessary power electronics components.

Raw material suppliers form the foundation of the HEV supply chain. This includes mining companies that extract lithium, cobalt, and rare earth elements essential for battery and electric motor production. The increasing demand for these materials has led to concerns about supply chain resilience and sustainability.

Logistics and distribution networks are vital for connecting the various stages of the HEV supply chain. This involves transportation of components between suppliers and manufacturers, as well as the distribution of finished vehicles to dealerships and end consumers.

The HEV supply chain also extends to the aftermarket sector, which includes maintenance, repair, and recycling services. As HEVs become more prevalent, specialized service providers are emerging to handle battery replacement, electric drivetrain maintenance, and end-of-life vehicle recycling.

As the HEV market continues to grow, the supply chain is evolving to meet increasing demand and technological advancements. This includes the development of more localized supply chains to reduce transportation costs and improve resilience, as well as increased investment in research and development to enhance component performance and reduce costs.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!