How Material Choice Influences Heat Sink Design Optimization

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Heat Sink Material Evolution and Design Objectives

Heat sink technology has evolved significantly over the past several decades, transitioning from simple aluminum extrusions to sophisticated designs utilizing advanced materials and manufacturing techniques. The earliest heat sinks, developed in the 1960s, were primarily made of aluminum due to its reasonable thermal conductivity, light weight, and cost-effectiveness. As electronic components became more powerful and compact in the 1980s and 1990s, copper began to gain prominence as a heat sink material due to its superior thermal conductivity, despite its higher weight and cost.

The 2000s witnessed the emergence of composite materials and metal alloys specifically engineered for thermal management applications. Aluminum-silicon carbide (AlSiC), copper-tungsten alloys, and various metal matrix composites offered improved performance characteristics by combining the beneficial properties of different materials. More recently, research has focused on incorporating advanced materials such as graphene, carbon nanotubes, and diamond-based composites, which demonstrate exceptional thermal conductivity values exceeding those of traditional metals.

The primary objective of heat sink design optimization is to maximize heat dissipation while minimizing factors such as weight, volume, cost, and manufacturing complexity. This involves achieving an optimal balance between thermal performance and practical constraints. Specifically, designers aim to minimize thermal resistance, which represents the opposition to heat flow from the source to the ambient environment. Lower thermal resistance translates to more efficient heat transfer and cooler operating temperatures for electronic components.

Another critical objective is to optimize the heat sink's performance within spatial constraints. As electronic devices continue to shrink in size while increasing in power density, heat sinks must deliver superior cooling performance within increasingly limited spaces. This has driven the development of high-aspect-ratio fin designs, micro-channel structures, and phase-change cooling solutions integrated into heat sink designs.

Energy efficiency represents another key objective, particularly in applications where power consumption is a concern. Passive heat sinks that rely solely on natural convection consume no energy but may offer limited cooling capacity. Active solutions incorporating fans or pumps provide enhanced cooling but require power input, necessitating careful optimization of the thermal performance versus energy consumption trade-off.

Material selection plays a fundamental role in meeting these objectives, as it directly influences thermal conductivity, weight, manufacturability, cost, and environmental impact. The ideal material choice depends on the specific application requirements, with considerations extending beyond mere thermal properties to include mechanical strength, corrosion resistance, coefficient of thermal expansion, and sustainability aspects.

The 2000s witnessed the emergence of composite materials and metal alloys specifically engineered for thermal management applications. Aluminum-silicon carbide (AlSiC), copper-tungsten alloys, and various metal matrix composites offered improved performance characteristics by combining the beneficial properties of different materials. More recently, research has focused on incorporating advanced materials such as graphene, carbon nanotubes, and diamond-based composites, which demonstrate exceptional thermal conductivity values exceeding those of traditional metals.

The primary objective of heat sink design optimization is to maximize heat dissipation while minimizing factors such as weight, volume, cost, and manufacturing complexity. This involves achieving an optimal balance between thermal performance and practical constraints. Specifically, designers aim to minimize thermal resistance, which represents the opposition to heat flow from the source to the ambient environment. Lower thermal resistance translates to more efficient heat transfer and cooler operating temperatures for electronic components.

Another critical objective is to optimize the heat sink's performance within spatial constraints. As electronic devices continue to shrink in size while increasing in power density, heat sinks must deliver superior cooling performance within increasingly limited spaces. This has driven the development of high-aspect-ratio fin designs, micro-channel structures, and phase-change cooling solutions integrated into heat sink designs.

Energy efficiency represents another key objective, particularly in applications where power consumption is a concern. Passive heat sinks that rely solely on natural convection consume no energy but may offer limited cooling capacity. Active solutions incorporating fans or pumps provide enhanced cooling but require power input, necessitating careful optimization of the thermal performance versus energy consumption trade-off.

Material selection plays a fundamental role in meeting these objectives, as it directly influences thermal conductivity, weight, manufacturability, cost, and environmental impact. The ideal material choice depends on the specific application requirements, with considerations extending beyond mere thermal properties to include mechanical strength, corrosion resistance, coefficient of thermal expansion, and sustainability aspects.

Thermal Management Market Analysis

The global thermal management market has witnessed substantial growth in recent years, driven primarily by the increasing demand for efficient heat dissipation solutions across various industries. As of 2023, the market was valued at approximately 12.3 billion USD, with projections indicating a compound annual growth rate (CAGR) of 8.2% through 2028. This growth trajectory is particularly evident in sectors such as electronics, automotive, aerospace, and telecommunications, where thermal management has become a critical factor in product performance and reliability.

Heat sink solutions represent a significant segment within this market, accounting for roughly 24% of the total thermal management market share. The selection of materials for heat sink design has emerged as a key differentiator among manufacturers, with aluminum, copper, and various alloys dominating the commercial landscape. Aluminum-based heat sinks currently hold the largest market share at 58%, primarily due to their favorable balance of thermal conductivity, weight, and cost-effectiveness.

Regional analysis reveals that Asia-Pacific leads the thermal management market, contributing approximately 42% of global revenue. This dominance is attributed to the region's robust electronics manufacturing ecosystem and the presence of major semiconductor fabrication facilities. North America and Europe follow with market shares of 27% and 21% respectively, with both regions showing increased adoption of advanced thermal management solutions in high-performance computing and electric vehicle applications.

Consumer electronics remains the largest end-user segment, representing 36% of market demand, followed by automotive applications at 22%. The rapid expansion of data centers globally has created a new growth avenue, with this segment experiencing the fastest growth rate at 12.4% annually. This trend is expected to continue as cloud computing services expand and artificial intelligence applications demand increasingly powerful computing infrastructure.

Material innovation is reshaping market dynamics, with graphene-based solutions and metal matrix composites gaining traction despite their premium pricing. These advanced materials offer thermal conductivity improvements of up to 60% compared to traditional options, creating a premium segment within the market. Industry forecasts suggest that these high-performance materials will capture approximately 15% market share by 2027, primarily in applications where thermal performance justifies the additional cost.

The competitive landscape features both established players and innovative startups, with the top five companies controlling approximately 38% of the global market. Recent merger and acquisition activities indicate consolidation trends, as companies seek to expand their material expertise and technological capabilities to address the growing demand for optimized thermal management solutions across diverse applications.

Heat sink solutions represent a significant segment within this market, accounting for roughly 24% of the total thermal management market share. The selection of materials for heat sink design has emerged as a key differentiator among manufacturers, with aluminum, copper, and various alloys dominating the commercial landscape. Aluminum-based heat sinks currently hold the largest market share at 58%, primarily due to their favorable balance of thermal conductivity, weight, and cost-effectiveness.

Regional analysis reveals that Asia-Pacific leads the thermal management market, contributing approximately 42% of global revenue. This dominance is attributed to the region's robust electronics manufacturing ecosystem and the presence of major semiconductor fabrication facilities. North America and Europe follow with market shares of 27% and 21% respectively, with both regions showing increased adoption of advanced thermal management solutions in high-performance computing and electric vehicle applications.

Consumer electronics remains the largest end-user segment, representing 36% of market demand, followed by automotive applications at 22%. The rapid expansion of data centers globally has created a new growth avenue, with this segment experiencing the fastest growth rate at 12.4% annually. This trend is expected to continue as cloud computing services expand and artificial intelligence applications demand increasingly powerful computing infrastructure.

Material innovation is reshaping market dynamics, with graphene-based solutions and metal matrix composites gaining traction despite their premium pricing. These advanced materials offer thermal conductivity improvements of up to 60% compared to traditional options, creating a premium segment within the market. Industry forecasts suggest that these high-performance materials will capture approximately 15% market share by 2027, primarily in applications where thermal performance justifies the additional cost.

The competitive landscape features both established players and innovative startups, with the top five companies controlling approximately 38% of the global market. Recent merger and acquisition activities indicate consolidation trends, as companies seek to expand their material expertise and technological capabilities to address the growing demand for optimized thermal management solutions across diverse applications.

Current Materials and Technical Challenges

Heat sink materials have evolved significantly over the decades, with aluminum and copper dominating the market due to their excellent thermal conductivity and cost-effectiveness. Aluminum, with a thermal conductivity of approximately 205-250 W/m·K, remains the most widely used material due to its lightweight properties, corrosion resistance, and relatively low cost. Copper, offering superior thermal conductivity of around 385-400 W/m·K, is preferred for high-performance applications despite its higher weight and cost.

Recent advancements have introduced advanced materials such as aluminum-silicon carbide (AlSiC) composites, which combine aluminum's lightweight properties with silicon carbide's enhanced thermal conductivity. These composites achieve thermal conductivity values of 170-200 W/m·K while offering better coefficient of thermal expansion (CTE) matching with semiconductor materials, reducing thermal stress in electronic assemblies.

Diamond-based materials represent the cutting edge in thermal management, with chemical vapor deposition (CVD) diamond offering extraordinary thermal conductivity exceeding 1500 W/m·K. However, prohibitive costs limit their application to specialized high-end electronics and aerospace applications.

The primary technical challenges in heat sink material selection center around several critical factors. Thermal conductivity versus cost trade-offs remain a fundamental challenge, with higher-performing materials generally commanding significantly higher prices. Weight considerations are particularly crucial in mobile and aerospace applications, where every gram matters. The coefficient of thermal expansion mismatch between heat sinks and semiconductor materials can lead to mechanical stress and reliability issues during thermal cycling.

Manufacturing complexity presents another significant challenge, as more advanced materials often require specialized production techniques. For instance, metal matrix composites demand precise control of reinforcement distribution and interface properties. Additionally, environmental considerations are increasingly important, with regulations restricting the use of certain materials and manufacturing processes.

Geographical distribution of material technologies shows concentration in specific regions. Advanced aluminum extrusion technologies are well-developed in North America and Europe, while copper-based solutions see significant innovation in East Asia, particularly Japan and South Korea. Emerging composite materials research is distributed across global research centers, with notable advancements in the United States, Germany, and China.

The integration of these materials into practical heat sink designs requires sophisticated thermal modeling and simulation capabilities. Current simulation tools struggle to accurately model the anisotropic thermal properties of composite materials and the complex thermal interfaces between different materials in hybrid designs, presenting additional challenges for engineers seeking to optimize heat sink performance.

Recent advancements have introduced advanced materials such as aluminum-silicon carbide (AlSiC) composites, which combine aluminum's lightweight properties with silicon carbide's enhanced thermal conductivity. These composites achieve thermal conductivity values of 170-200 W/m·K while offering better coefficient of thermal expansion (CTE) matching with semiconductor materials, reducing thermal stress in electronic assemblies.

Diamond-based materials represent the cutting edge in thermal management, with chemical vapor deposition (CVD) diamond offering extraordinary thermal conductivity exceeding 1500 W/m·K. However, prohibitive costs limit their application to specialized high-end electronics and aerospace applications.

The primary technical challenges in heat sink material selection center around several critical factors. Thermal conductivity versus cost trade-offs remain a fundamental challenge, with higher-performing materials generally commanding significantly higher prices. Weight considerations are particularly crucial in mobile and aerospace applications, where every gram matters. The coefficient of thermal expansion mismatch between heat sinks and semiconductor materials can lead to mechanical stress and reliability issues during thermal cycling.

Manufacturing complexity presents another significant challenge, as more advanced materials often require specialized production techniques. For instance, metal matrix composites demand precise control of reinforcement distribution and interface properties. Additionally, environmental considerations are increasingly important, with regulations restricting the use of certain materials and manufacturing processes.

Geographical distribution of material technologies shows concentration in specific regions. Advanced aluminum extrusion technologies are well-developed in North America and Europe, while copper-based solutions see significant innovation in East Asia, particularly Japan and South Korea. Emerging composite materials research is distributed across global research centers, with notable advancements in the United States, Germany, and China.

The integration of these materials into practical heat sink designs requires sophisticated thermal modeling and simulation capabilities. Current simulation tools struggle to accurately model the anisotropic thermal properties of composite materials and the complex thermal interfaces between different materials in hybrid designs, presenting additional challenges for engineers seeking to optimize heat sink performance.

Material-Specific Design Methodologies

01 Heat sink geometry optimization

Optimizing the geometry of heat sinks can significantly improve thermal performance. This includes designing specialized fin structures, optimizing fin spacing, height, and thickness to maximize heat dissipation while minimizing material usage. Advanced designs may incorporate variable fin heights, curved surfaces, or asymmetric patterns to enhance airflow and heat transfer efficiency. These geometric optimizations can lead to improved cooling performance in limited spaces.- Material selection for heat sink optimization: The choice of materials significantly impacts heat sink performance. High thermal conductivity materials like copper and aluminum alloys are preferred for efficient heat dissipation. Advanced composite materials and metal matrix composites can provide enhanced thermal properties while reducing weight. Material selection must balance thermal performance, weight considerations, manufacturing constraints, and cost-effectiveness for optimal heat sink design.

- Fin design and configuration optimization: The geometry and arrangement of fins are critical factors in heat sink performance. Optimized fin designs include variations in height, thickness, spacing, and shape to maximize surface area while minimizing airflow resistance. Pin fins, plate fins, and hybrid configurations can be employed based on specific cooling requirements. Computational fluid dynamics analysis helps determine optimal fin configurations for different thermal loads and space constraints.

- Liquid cooling and phase change technologies: Advanced heat sink designs incorporate liquid cooling channels or phase change materials to enhance thermal performance. Liquid cooling systems utilize water, glycol solutions, or specialized coolants circulating through the heat sink to remove heat more efficiently than air alone. Phase change materials absorb heat during state transitions, providing temperature stabilization. These technologies are particularly valuable for high-power density applications where conventional air cooling is insufficient.

- Surface treatment and interface optimization: Surface treatments and thermal interface materials significantly improve heat transfer efficiency. Techniques include micro-texturing, anodizing, and applying specialized coatings to enhance surface area and emissivity. Thermal interface materials like high-performance thermal pastes, pads, or liquid metal compounds reduce contact resistance between the heat source and heat sink. Proper interface pressure distribution and application methods ensure optimal thermal conductivity across the junction.

- Integrated and modular heat sink designs: Modern heat sink solutions feature integrated and modular approaches to thermal management. Integrated designs combine heat pipes, vapor chambers, or thermoelectric elements with traditional heat sinks to create hybrid cooling systems. Modular designs allow for customization and scalability based on specific thermal requirements. These approaches optimize space utilization while providing enhanced cooling performance for complex electronic systems with varying heat loads.

02 Material selection and composition for heat sinks

The choice of materials significantly impacts heat sink performance. High thermal conductivity materials like copper, aluminum, and their alloys are commonly used. Composite materials combining metals with ceramics or carbon-based materials can offer enhanced thermal properties while reducing weight. Material treatments and coatings can further improve surface properties for better heat dissipation. The selection process must balance thermal performance with considerations of weight, cost, and manufacturability.Expand Specific Solutions03 Integration of phase change materials and heat pipes

Advanced heat sink designs incorporate phase change materials and heat pipe technologies to enhance thermal management. Heat pipes utilize the evaporation and condensation of working fluids to transfer heat efficiently across distances. Phase change materials absorb thermal energy during state transitions, providing temperature stabilization during peak loads. These technologies can be integrated into traditional heat sink structures to create hybrid cooling solutions that offer superior performance for high-power electronic applications.Expand Specific Solutions04 Computational fluid dynamics for airflow optimization

Computational fluid dynamics (CFD) analysis is used to optimize airflow patterns around and through heat sink structures. This approach enables designers to predict thermal performance, identify hotspots, and optimize fan placement and orientation. Advanced algorithms can simulate various operating conditions to ensure optimal performance across different scenarios. CFD-guided designs can reduce air resistance, improve convection efficiency, and minimize acoustic noise in active cooling systems.Expand Specific Solutions05 Additive manufacturing techniques for complex heat sink designs

Additive manufacturing technologies enable the production of complex heat sink geometries that would be impossible with traditional manufacturing methods. 3D printing allows for intricate internal channels, lattice structures, and conformal cooling designs that maximize surface area while minimizing material usage. These manufacturing techniques permit rapid prototyping and customization of heat sinks for specific applications, leading to optimized thermal solutions for unique cooling challenges in electronics, aerospace, and automotive industries.Expand Specific Solutions

Leading Manufacturers and Material Suppliers

The heat sink design optimization market is currently in a growth phase, with increasing demand driven by thermal management needs in electronics, automotive, and industrial sectors. The market size is expanding due to rising power densities in electronic devices and the growing adoption of electric vehicles. Material choice plays a crucial role in heat sink performance, with companies demonstrating varying levels of technical maturity. Industry leaders like Hon Hai Precision (Foxconn) and Robert Bosch have established comprehensive thermal management portfolios, while specialized players such as NeoGraf Solutions and Global Graphene Group are advancing innovative materials like graphene for enhanced thermal conductivity. Asia Vital Components and Diabatix represent the emerging trend of computational optimization in heat sink design, combining advanced materials with AI-driven thermal simulation capabilities.

Hon Hai Precision Industry Co., Ltd.

Technical Solution: Hon Hai (Foxconn) has developed advanced vapor chamber thermal solutions that utilize copper as the primary material for heat dissipation in electronic devices. Their design incorporates sintered copper powder wicks with optimized porosity (40-60%) to enhance capillary action and fluid circulation. The company has patented a multi-layer vapor chamber structure that reduces thermal resistance by up to 30% compared to traditional designs. Their manufacturing process includes precision CNC machining of copper plates to create ultra-thin vapor chambers (as thin as 0.4mm) while maintaining structural integrity. Foxconn has also pioneered composite material approaches, integrating graphene layers with copper substrates to improve thermal conductivity by approximately 25% while reducing weight. Their recent innovations include automated production lines for heat sink manufacturing that ensure consistent quality and reduced production costs.

Strengths: Exceptional manufacturing capabilities at scale; advanced vapor chamber technology with superior thermal performance; strong integration with device design processes. Weaknesses: Higher production costs compared to aluminum solutions; weight considerations for mobile applications; limited customization options for smaller production runs.

NeoGraf Solutions LLC

Technical Solution: NeoGraf Solutions has pioneered advanced graphite-based thermal management materials specifically engineered for heat sink applications. Their flagship product, GrafTech® spreader sheets, utilizes highly oriented pyrolytic graphite (HOPG) with in-plane thermal conductivity exceeding 1,500 W/m·K, significantly outperforming traditional copper (400 W/m·K) and aluminum (200 W/m·K) solutions. The company employs a proprietary manufacturing process that aligns carbon molecules to create anisotropic thermal properties, directing heat flow along desired paths. NeoGraf's composite approach combines graphite with metal frames to address mechanical strength limitations while maintaining superior thermal performance. Their heat spreaders can be as thin as 0.025mm, enabling integration into space-constrained applications. Recent innovations include their eGraf® series, which incorporates engineered interfaces that reduce thermal contact resistance by up to 40% compared to standard graphite solutions, addressing a critical bottleneck in heat sink performance.

Strengths: Exceptional in-plane thermal conductivity; lightweight solutions (approximately 75% lighter than copper alternatives); flexibility for complex geometries; electrically conductive for EMI shielding benefits. Weaknesses: Lower through-plane thermal conductivity; requires careful interface management; higher material costs than traditional metals; potential mechanical fragility without proper reinforcement.

Key Innovations in Thermal Interface Materials

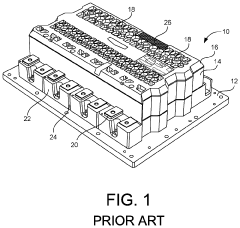

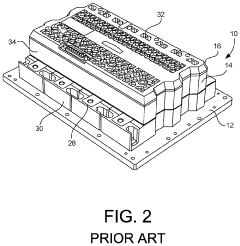

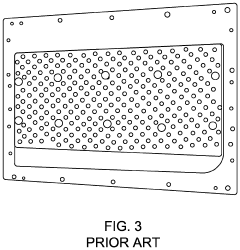

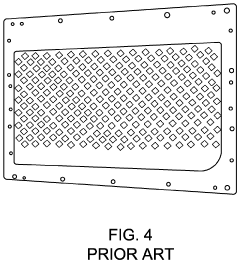

Heat sink for a power semiconductor module

PatentActiveUS20200279789A1

Innovation

- A heat sink with a large number of forged or impact-extruded pure aluminum pins of elongated cross-section, secured by molten salt dipped brazing, is used to enhance thermal conductivity and prevent condensation by creating an air-tight environment, thereby improving heat transfer and module longevity.

Environmental Impact and Sustainability Considerations

The material selection for heat sink design carries significant environmental implications that extend beyond mere thermal performance. Traditional heat sink materials like aluminum and copper, while effective for thermal management, present substantial environmental challenges throughout their lifecycle. The extraction and processing of these metals are energy-intensive operations that contribute significantly to carbon emissions. Aluminum production, in particular, ranks among the most energy-demanding industrial processes, with each ton of aluminum requiring approximately 14,000 kWh of electricity. This energy consumption translates to considerable carbon footprints when fossil fuels power the production facilities.

Recycling considerations represent another critical dimension of environmental impact. Copper offers excellent recyclability with minimal performance degradation, potentially reducing its environmental footprint by up to 85% compared to primary production. Aluminum similarly benefits from established recycling infrastructure, though the presence of specialized alloys and surface treatments in heat sinks can complicate the recycling process. The increasing adoption of composite materials presents additional end-of-life management challenges due to the difficulty in separating different material components.

The manufacturing processes associated with different heat sink materials also vary in their environmental impact. Traditional subtractive manufacturing methods generate substantial material waste, with some processes utilizing only 20-30% of the raw material in the final product. Newer additive manufacturing techniques offer potential waste reduction but may introduce different environmental concerns through energy consumption and specialized material requirements.

Emerging alternative materials present promising sustainability opportunities. Phase change materials (PCMs) can enhance thermal performance while reducing overall material requirements. Biobased composites derived from agricultural waste or sustainable forestry products are beginning to demonstrate viable thermal properties with significantly reduced environmental impacts. Carbon-based materials like graphene and carbon nanotubes offer exceptional thermal conductivity with potentially lower environmental footprints, though their production methods currently limit widespread commercial adoption.

Regulatory frameworks increasingly influence material selection decisions. The Restriction of Hazardous Substances (RoHS) directive limits the use of certain toxic materials in electronic components, while Extended Producer Responsibility (EPR) policies in various regions place greater responsibility on manufacturers for end-of-life product management. These evolving regulations, combined with corporate sustainability initiatives and consumer preferences, are driving innovation toward more environmentally responsible heat sink materials and designs that balance thermal performance with reduced ecological impact.

Recycling considerations represent another critical dimension of environmental impact. Copper offers excellent recyclability with minimal performance degradation, potentially reducing its environmental footprint by up to 85% compared to primary production. Aluminum similarly benefits from established recycling infrastructure, though the presence of specialized alloys and surface treatments in heat sinks can complicate the recycling process. The increasing adoption of composite materials presents additional end-of-life management challenges due to the difficulty in separating different material components.

The manufacturing processes associated with different heat sink materials also vary in their environmental impact. Traditional subtractive manufacturing methods generate substantial material waste, with some processes utilizing only 20-30% of the raw material in the final product. Newer additive manufacturing techniques offer potential waste reduction but may introduce different environmental concerns through energy consumption and specialized material requirements.

Emerging alternative materials present promising sustainability opportunities. Phase change materials (PCMs) can enhance thermal performance while reducing overall material requirements. Biobased composites derived from agricultural waste or sustainable forestry products are beginning to demonstrate viable thermal properties with significantly reduced environmental impacts. Carbon-based materials like graphene and carbon nanotubes offer exceptional thermal conductivity with potentially lower environmental footprints, though their production methods currently limit widespread commercial adoption.

Regulatory frameworks increasingly influence material selection decisions. The Restriction of Hazardous Substances (RoHS) directive limits the use of certain toxic materials in electronic components, while Extended Producer Responsibility (EPR) policies in various regions place greater responsibility on manufacturers for end-of-life product management. These evolving regulations, combined with corporate sustainability initiatives and consumer preferences, are driving innovation toward more environmentally responsible heat sink materials and designs that balance thermal performance with reduced ecological impact.

Cost-Performance Analysis of Heat Sink Materials

The economic aspect of heat sink material selection represents a critical dimension in thermal management system design. When evaluating different materials for heat sink applications, engineers must balance thermal performance against manufacturing costs, weight considerations, and long-term operational expenses. Aluminum alloys, despite offering approximately half the thermal conductivity of copper (237 W/m·K for copper versus 180-200 W/m·K for aluminum), remain the predominant choice in many commercial applications due to their significantly lower cost-per-volume ratio, which can be 3-4 times more economical than copper alternatives.

Cost sensitivity analysis reveals that material selection decisions become increasingly complex when factoring in production volumes. For high-volume consumer electronics, the material cost differential between aluminum and copper can translate to millions in manufacturing expenses annually. However, this analysis must extend beyond raw material costs to include fabrication expenses. Copper's higher density and hardness increase machining costs by approximately 25-30% compared to aluminum, while also accelerating tool wear during manufacturing processes.

Performance-to-cost ratios demonstrate that exotic materials like diamond-based composites and graphene, despite their superior thermal conductivity (up to 2000 W/m·K), remain economically prohibitive for most applications with cost premiums exceeding 50-100 times that of conventional materials. The exception exists in specialized sectors such as aerospace, defense, and high-performance computing where thermal performance requirements justify premium material investments.

Lifecycle cost analysis further complicates material selection decisions. While copper heat sinks may require higher initial investment, their superior thermal performance can reduce operational energy costs in data centers by 3-7% annually compared to aluminum alternatives. This energy savings can potentially offset the higher initial material costs within 2-3 years of continuous operation in high-power density applications.

Weight-sensitive applications introduce additional economic considerations. In portable electronics and transportation systems, the weight penalty associated with higher density materials like copper (8.96 g/cm³ versus 2.7 g/cm³ for aluminum) can increase fuel consumption or reduce battery life, creating hidden operational costs that may outweigh thermal performance benefits. This has driven increased interest in aluminum-graphene composites that offer enhanced thermal conductivity with minimal weight penalties.

Regional manufacturing capabilities and supply chain considerations also influence material economics. Fluctuations in global metal markets can create significant price volatility, with copper historically demonstrating greater price instability than aluminum. This market uncertainty often drives conservative material selection decisions favoring more stable-priced options, particularly for products with long development cycles.

Cost sensitivity analysis reveals that material selection decisions become increasingly complex when factoring in production volumes. For high-volume consumer electronics, the material cost differential between aluminum and copper can translate to millions in manufacturing expenses annually. However, this analysis must extend beyond raw material costs to include fabrication expenses. Copper's higher density and hardness increase machining costs by approximately 25-30% compared to aluminum, while also accelerating tool wear during manufacturing processes.

Performance-to-cost ratios demonstrate that exotic materials like diamond-based composites and graphene, despite their superior thermal conductivity (up to 2000 W/m·K), remain economically prohibitive for most applications with cost premiums exceeding 50-100 times that of conventional materials. The exception exists in specialized sectors such as aerospace, defense, and high-performance computing where thermal performance requirements justify premium material investments.

Lifecycle cost analysis further complicates material selection decisions. While copper heat sinks may require higher initial investment, their superior thermal performance can reduce operational energy costs in data centers by 3-7% annually compared to aluminum alternatives. This energy savings can potentially offset the higher initial material costs within 2-3 years of continuous operation in high-power density applications.

Weight-sensitive applications introduce additional economic considerations. In portable electronics and transportation systems, the weight penalty associated with higher density materials like copper (8.96 g/cm³ versus 2.7 g/cm³ for aluminum) can increase fuel consumption or reduce battery life, creating hidden operational costs that may outweigh thermal performance benefits. This has driven increased interest in aluminum-graphene composites that offer enhanced thermal conductivity with minimal weight penalties.

Regional manufacturing capabilities and supply chain considerations also influence material economics. Fluctuations in global metal markets can create significant price volatility, with copper historically demonstrating greater price instability than aluminum. This market uncertainty often drives conservative material selection decisions favoring more stable-priced options, particularly for products with long development cycles.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!