Piezoelectric Sensors in Autonomous Vehicles

JUL 17, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Piezoelectric Sensors in AVs: Background and Objectives

Piezoelectric sensors have emerged as a crucial technology in the rapidly evolving field of autonomous vehicles (AVs). These sensors, which convert mechanical stress into electrical signals, have a rich history dating back to the discovery of the piezoelectric effect by Pierre and Jacques Curie in 1880. Over the years, piezoelectric materials have found applications in various industries, from sonar systems to medical imaging devices.

In the context of autonomous vehicles, piezoelectric sensors represent a significant leap forward in sensing capabilities. The automotive industry has been increasingly focused on developing safer, more efficient, and environmentally friendly vehicles. This trend has accelerated with the advent of autonomous driving technologies, which require a comprehensive suite of sensors to perceive and interpret the vehicle's surroundings.

The primary objective of integrating piezoelectric sensors into AVs is to enhance the vehicle's ability to detect and respond to its environment with unprecedented precision. These sensors can be utilized in multiple ways, including tire pressure monitoring, engine knock detection, and most importantly, in advanced driver assistance systems (ADAS) and autonomous driving functions.

One of the key advantages of piezoelectric sensors is their ability to operate in harsh environments, making them ideal for automotive applications. They offer high sensitivity, fast response times, and the capability to measure both static and dynamic forces. This versatility allows for a wide range of applications within AVs, from collision detection to road condition monitoring.

The evolution of piezoelectric sensor technology in AVs is closely tied to the broader technological advancements in materials science, microelectronics, and data processing. As these fields progress, we can expect to see more sophisticated and efficient piezoelectric sensing systems that can provide even more detailed and accurate information about the vehicle's environment and performance.

Looking ahead, the development of piezoelectric sensors for AVs is likely to focus on several key areas. These include improving sensor durability and reliability, enhancing signal processing capabilities to filter out noise and interference, and developing new piezoelectric materials with superior properties. Additionally, there is a growing emphasis on integrating these sensors with other sensing technologies and AI systems to create a more comprehensive and intelligent perception system for autonomous vehicles.

In conclusion, piezoelectric sensors represent a critical component in the ongoing development of autonomous vehicle technology. Their unique properties and versatile applications make them an invaluable tool in the quest for safer, more efficient, and more capable autonomous vehicles. As research in this field continues to advance, we can anticipate significant improvements in AV performance and capabilities, driven in part by innovations in piezoelectric sensing technology.

In the context of autonomous vehicles, piezoelectric sensors represent a significant leap forward in sensing capabilities. The automotive industry has been increasingly focused on developing safer, more efficient, and environmentally friendly vehicles. This trend has accelerated with the advent of autonomous driving technologies, which require a comprehensive suite of sensors to perceive and interpret the vehicle's surroundings.

The primary objective of integrating piezoelectric sensors into AVs is to enhance the vehicle's ability to detect and respond to its environment with unprecedented precision. These sensors can be utilized in multiple ways, including tire pressure monitoring, engine knock detection, and most importantly, in advanced driver assistance systems (ADAS) and autonomous driving functions.

One of the key advantages of piezoelectric sensors is their ability to operate in harsh environments, making them ideal for automotive applications. They offer high sensitivity, fast response times, and the capability to measure both static and dynamic forces. This versatility allows for a wide range of applications within AVs, from collision detection to road condition monitoring.

The evolution of piezoelectric sensor technology in AVs is closely tied to the broader technological advancements in materials science, microelectronics, and data processing. As these fields progress, we can expect to see more sophisticated and efficient piezoelectric sensing systems that can provide even more detailed and accurate information about the vehicle's environment and performance.

Looking ahead, the development of piezoelectric sensors for AVs is likely to focus on several key areas. These include improving sensor durability and reliability, enhancing signal processing capabilities to filter out noise and interference, and developing new piezoelectric materials with superior properties. Additionally, there is a growing emphasis on integrating these sensors with other sensing technologies and AI systems to create a more comprehensive and intelligent perception system for autonomous vehicles.

In conclusion, piezoelectric sensors represent a critical component in the ongoing development of autonomous vehicle technology. Their unique properties and versatile applications make them an invaluable tool in the quest for safer, more efficient, and more capable autonomous vehicles. As research in this field continues to advance, we can anticipate significant improvements in AV performance and capabilities, driven in part by innovations in piezoelectric sensing technology.

Market Analysis for AV Sensor Technologies

The autonomous vehicle (AV) sensor market is experiencing rapid growth, driven by the increasing demand for advanced driver assistance systems (ADAS) and self-driving technologies. Piezoelectric sensors, as a crucial component in AV sensing systems, are gaining significant traction due to their ability to detect pressure, acceleration, and vibration with high precision.

The global AV sensor market is projected to expand at a compound annual growth rate (CAGR) of over 20% in the next five years. This growth is primarily fueled by the rising adoption of electric vehicles, stringent safety regulations, and advancements in sensor technologies. Piezoelectric sensors, in particular, are expected to witness substantial growth within this market due to their versatility and reliability in various AV applications.

One of the key drivers for the adoption of piezoelectric sensors in AVs is their ability to provide accurate and real-time data on vehicle dynamics, road conditions, and environmental factors. These sensors play a crucial role in enhancing the safety and performance of autonomous vehicles by enabling precise detection of obstacles, monitoring tire pressure, and assessing road surface conditions.

The market for piezoelectric sensors in AVs can be segmented based on application areas, including tire pressure monitoring systems (TPMS), engine management, chassis control, and occupant safety systems. Among these, TPMS is expected to hold a significant market share due to the increasing focus on vehicle safety and fuel efficiency.

Geographically, North America and Europe are currently leading the AV sensor market, with Asia-Pacific expected to witness the fastest growth in the coming years. This regional growth is attributed to the increasing investments in AV technologies by countries like China, Japan, and South Korea, as well as the presence of major automotive manufacturers and technology companies in these regions.

The competitive landscape of the AV sensor market is characterized by the presence of both established players and innovative startups. Key market players are focusing on research and development activities to enhance sensor performance, reduce costs, and improve integration capabilities. Collaborations between automotive manufacturers, technology companies, and sensor suppliers are becoming increasingly common, driving innovation and market growth.

Despite the promising outlook, the AV sensor market faces challenges such as high initial costs, concerns about data privacy and security, and the need for standardization in sensor technologies. However, ongoing technological advancements and supportive government initiatives are expected to address these challenges and further propel market growth.

The global AV sensor market is projected to expand at a compound annual growth rate (CAGR) of over 20% in the next five years. This growth is primarily fueled by the rising adoption of electric vehicles, stringent safety regulations, and advancements in sensor technologies. Piezoelectric sensors, in particular, are expected to witness substantial growth within this market due to their versatility and reliability in various AV applications.

One of the key drivers for the adoption of piezoelectric sensors in AVs is their ability to provide accurate and real-time data on vehicle dynamics, road conditions, and environmental factors. These sensors play a crucial role in enhancing the safety and performance of autonomous vehicles by enabling precise detection of obstacles, monitoring tire pressure, and assessing road surface conditions.

The market for piezoelectric sensors in AVs can be segmented based on application areas, including tire pressure monitoring systems (TPMS), engine management, chassis control, and occupant safety systems. Among these, TPMS is expected to hold a significant market share due to the increasing focus on vehicle safety and fuel efficiency.

Geographically, North America and Europe are currently leading the AV sensor market, with Asia-Pacific expected to witness the fastest growth in the coming years. This regional growth is attributed to the increasing investments in AV technologies by countries like China, Japan, and South Korea, as well as the presence of major automotive manufacturers and technology companies in these regions.

The competitive landscape of the AV sensor market is characterized by the presence of both established players and innovative startups. Key market players are focusing on research and development activities to enhance sensor performance, reduce costs, and improve integration capabilities. Collaborations between automotive manufacturers, technology companies, and sensor suppliers are becoming increasingly common, driving innovation and market growth.

Despite the promising outlook, the AV sensor market faces challenges such as high initial costs, concerns about data privacy and security, and the need for standardization in sensor technologies. However, ongoing technological advancements and supportive government initiatives are expected to address these challenges and further propel market growth.

Current Challenges in Piezoelectric Sensing for AVs

Despite the promising potential of piezoelectric sensors in autonomous vehicles (AVs), several significant challenges currently hinder their widespread adoption and optimal performance. One of the primary obstacles is the sensitivity to environmental factors. Piezoelectric sensors are susceptible to temperature fluctuations, humidity, and vibrations, which can lead to inaccurate readings and reduced reliability in diverse driving conditions.

Signal-to-noise ratio (SNR) presents another critical challenge. The electrical signals generated by piezoelectric sensors can be relatively weak, especially when detecting subtle changes in pressure or vibration. This low SNR makes it difficult to distinguish between genuine sensor readings and background noise, potentially compromising the accuracy of data interpretation in AV systems.

Durability and longevity concerns also plague current piezoelectric sensing technologies. The constant exposure to harsh automotive environments, including extreme temperatures, mechanical stress, and chemical contaminants, can degrade sensor performance over time. This degradation may lead to reduced sensitivity or even complete sensor failure, raising questions about the long-term viability of these sensors in AVs.

Integration complexity is another significant hurdle. Incorporating piezoelectric sensors into existing AV architectures requires careful consideration of sensor placement, wiring, and data processing. The need for specialized interfaces and signal conditioning circuits adds to the overall system complexity and cost.

Power consumption and energy efficiency pose additional challenges. While piezoelectric sensors are generally considered low-power devices, the cumulative energy requirements of multiple sensors in an AV can be substantial. Optimizing power management without compromising sensor performance remains a key area of concern.

Calibration and standardization issues further complicate the implementation of piezoelectric sensors in AVs. The lack of industry-wide standards for sensor calibration and performance metrics makes it difficult to ensure consistent and comparable results across different vehicle models and manufacturers.

Lastly, the cost factor remains a significant barrier to widespread adoption. High-quality piezoelectric sensors capable of meeting the demanding requirements of AV applications can be expensive, potentially increasing the overall cost of autonomous vehicle production. Balancing performance with affordability is crucial for the commercial viability of these sensors in the automotive industry.

Addressing these challenges requires concerted efforts in research and development, focusing on improving sensor materials, signal processing techniques, and integration methodologies. Overcoming these obstacles will be essential for realizing the full potential of piezoelectric sensors in enhancing the safety, efficiency, and reliability of autonomous vehicles.

Signal-to-noise ratio (SNR) presents another critical challenge. The electrical signals generated by piezoelectric sensors can be relatively weak, especially when detecting subtle changes in pressure or vibration. This low SNR makes it difficult to distinguish between genuine sensor readings and background noise, potentially compromising the accuracy of data interpretation in AV systems.

Durability and longevity concerns also plague current piezoelectric sensing technologies. The constant exposure to harsh automotive environments, including extreme temperatures, mechanical stress, and chemical contaminants, can degrade sensor performance over time. This degradation may lead to reduced sensitivity or even complete sensor failure, raising questions about the long-term viability of these sensors in AVs.

Integration complexity is another significant hurdle. Incorporating piezoelectric sensors into existing AV architectures requires careful consideration of sensor placement, wiring, and data processing. The need for specialized interfaces and signal conditioning circuits adds to the overall system complexity and cost.

Power consumption and energy efficiency pose additional challenges. While piezoelectric sensors are generally considered low-power devices, the cumulative energy requirements of multiple sensors in an AV can be substantial. Optimizing power management without compromising sensor performance remains a key area of concern.

Calibration and standardization issues further complicate the implementation of piezoelectric sensors in AVs. The lack of industry-wide standards for sensor calibration and performance metrics makes it difficult to ensure consistent and comparable results across different vehicle models and manufacturers.

Lastly, the cost factor remains a significant barrier to widespread adoption. High-quality piezoelectric sensors capable of meeting the demanding requirements of AV applications can be expensive, potentially increasing the overall cost of autonomous vehicle production. Balancing performance with affordability is crucial for the commercial viability of these sensors in the automotive industry.

Addressing these challenges requires concerted efforts in research and development, focusing on improving sensor materials, signal processing techniques, and integration methodologies. Overcoming these obstacles will be essential for realizing the full potential of piezoelectric sensors in enhancing the safety, efficiency, and reliability of autonomous vehicles.

Existing Piezoelectric Sensor Solutions for AVs

01 Piezoelectric sensor design and fabrication

This category focuses on the design and manufacturing processes of piezoelectric sensors. It includes innovative approaches to sensor construction, material selection, and fabrication techniques to enhance sensitivity and performance. These advancements aim to improve the overall efficiency and reliability of piezoelectric sensors for various applications.- Piezoelectric sensor design and fabrication: This category focuses on the design and manufacturing processes of piezoelectric sensors. It includes innovative approaches to sensor construction, material selection, and fabrication techniques to enhance sensitivity and performance. These advancements aim to improve the overall efficiency and reliability of piezoelectric sensors for various applications.

- Applications of piezoelectric sensors: Piezoelectric sensors find diverse applications across multiple industries. This category explores their use in areas such as automotive systems, consumer electronics, industrial monitoring, and medical devices. The versatility of these sensors allows for precise measurement of pressure, acceleration, and vibration in various environments.

- Signal processing and data analysis for piezoelectric sensors: This category covers techniques for processing and analyzing signals from piezoelectric sensors. It includes methods for noise reduction, signal amplification, and data interpretation to extract meaningful information from sensor outputs. Advanced algorithms and software solutions are developed to enhance the accuracy and reliability of measurements.

- Integration of piezoelectric sensors in smart systems: The integration of piezoelectric sensors into smart systems and Internet of Things (IoT) devices is a growing trend. This category explores how these sensors are incorporated into larger networks for real-time monitoring, data collection, and automated decision-making. It includes developments in sensor fusion, wireless communication, and energy harvesting for self-powered operation.

- Piezoelectric sensor materials and structures: This category focuses on the development of novel materials and structures for piezoelectric sensors. It includes research into new piezoelectric compounds, nanostructured materials, and composite structures that offer improved sensitivity, durability, and temperature stability. These advancements aim to expand the operating range and capabilities of piezoelectric sensors.

02 Applications of piezoelectric sensors

Piezoelectric sensors find diverse applications across multiple industries. This category explores their use in areas such as automotive systems, consumer electronics, industrial monitoring, and medical devices. The versatility of these sensors allows for precise measurement of pressure, acceleration, and vibration in various environments.Expand Specific Solutions03 Signal processing and data analysis for piezoelectric sensors

This category covers techniques for processing and analyzing signals from piezoelectric sensors. It includes methods for noise reduction, signal amplification, and data interpretation. Advanced algorithms and software solutions are developed to extract meaningful information from sensor outputs, enhancing the accuracy and reliability of measurements.Expand Specific Solutions04 Integration of piezoelectric sensors in smart systems

The integration of piezoelectric sensors into smart systems and Internet of Things (IoT) devices is a growing trend. This category explores how these sensors are incorporated into larger networks for real-time monitoring and control. It includes developments in wireless connectivity, energy harvesting, and miniaturization to enable seamless integration.Expand Specific Solutions05 Enhancements in piezoelectric materials and structures

This category focuses on advancements in piezoelectric materials and structural designs. It includes research into new piezoelectric compounds, nanostructured materials, and composite structures that offer improved sensitivity, durability, and temperature stability. These innovations aim to expand the capabilities and applications of piezoelectric sensors.Expand Specific Solutions

Key Players in AV Piezoelectric Sensor Industry

The research on piezoelectric sensors in autonomous vehicles is in a rapidly evolving phase, with the market showing significant growth potential. The technology's maturity varies across applications, but it's gaining traction due to its crucial role in enhancing vehicle safety and performance. Key players like Robert Bosch GmbH, Honda Motor Co., Ltd., and BMW AG are investing heavily in R&D, pushing the boundaries of sensor capabilities. Emerging companies such as Pony.ai, Inc. are also making strides in integrating these sensors into their autonomous driving systems. The competitive landscape is diverse, with traditional automotive giants competing alongside specialized sensor manufacturers and tech startups, indicating a dynamic and innovative market environment.

Robert Bosch GmbH

Technical Solution: Bosch has developed advanced piezoelectric sensors for autonomous vehicles, focusing on high-precision pressure and force measurement. Their technology integrates multiple sensing elements on a single chip, allowing for multi-axis force detection[1]. The sensors utilize a novel crystal structure that enhances sensitivity and reduces cross-axis interference[2]. Bosch's piezoelectric sensors are designed to withstand harsh automotive environments, with operating temperatures ranging from -40°C to 125°C[3]. The company has also implemented advanced signal processing algorithms to filter out noise and vibrations, improving the overall accuracy of sensor readings in dynamic driving conditions[4].

Strengths: High precision, multi-axis sensing capability, and robust design for automotive use. Weaknesses: Potentially higher cost due to advanced materials and complex manufacturing processes.

Kistler Holding AG

Technical Solution: Kistler has pioneered the development of piezoelectric sensors specifically tailored for autonomous vehicle applications. Their sensors utilize a proprietary quartz crystal technology that offers exceptional stability and linearity over a wide range of forces[5]. Kistler's sensors feature an integrated charge amplifier, which allows for direct voltage output and simplifies integration into vehicle systems[6]. The company has also developed a unique temperature compensation technique that maintains sensor accuracy across varying environmental conditions[7]. Kistler's piezoelectric sensors are capable of measuring both static and dynamic forces, making them versatile for various autonomous vehicle applications, including tire pressure monitoring and collision detection[8].

Strengths: High stability, wide measurement range, and integrated signal conditioning. Weaknesses: May require specialized interfaces for some vehicle systems.

Core Innovations in Piezoelectric Sensing for AVs

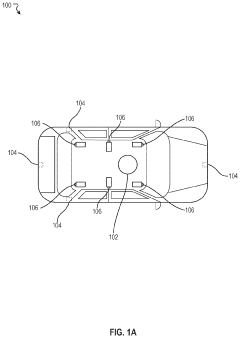

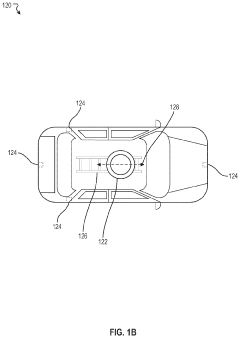

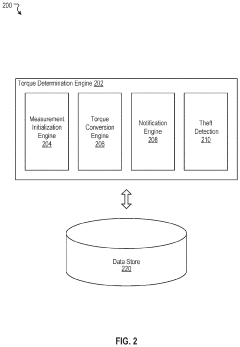

Systems and methods of using piezoelectric sensors for theft detection of enclosures

PatentActiveUS20210024036A1

Innovation

- The use of piezoelectric sensors to measure torque values of mechanical coupling devices securing the enclosure to a fixture, allowing for real-time monitoring and alert generation upon unauthorized removal or tampering.

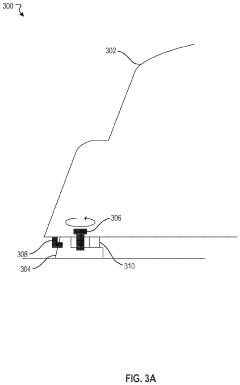

Accident avoidance using piezoelectric sensors on curved roads

PatentPendingIN202441039274A

Innovation

- The integration of piezoelectric sensors embedded in road surfaces to detect vehicle pressure, speed, and weight, triggering alerts through visual and digital means if the vehicle exceeds safe speed limits, while also communicating potential hazards to traffic management centers.

Safety and Regulatory Framework for AV Sensors

The safety and regulatory framework for autonomous vehicle (AV) sensors, particularly piezoelectric sensors, is a critical aspect of their development and deployment. As AVs become more prevalent, governments and regulatory bodies worldwide are working to establish comprehensive guidelines to ensure public safety and standardize the use of these technologies.

In the United States, the National Highway Traffic Safety Administration (NHTSA) has been at the forefront of developing safety standards for AVs and their sensor systems. The NHTSA has proposed a framework that includes performance requirements for sensor systems, including piezoelectric sensors, to ensure their reliability and accuracy in various environmental conditions. These standards address issues such as sensor calibration, data processing, and fault detection mechanisms.

The European Union has also been proactive in developing regulations for AV sensors through the European New Car Assessment Programme (Euro NCAP). Their guidelines focus on the performance of advanced driver assistance systems (ADAS), which rely heavily on sensor technologies like piezoelectric sensors. The Euro NCAP protocols evaluate the effectiveness of these sensors in detecting obstacles, pedestrians, and other vehicles under different scenarios.

In addition to government regulations, industry standards play a crucial role in ensuring the safety and reliability of AV sensors. Organizations such as the International Organization for Standardization (ISO) and the Society of Automotive Engineers (SAE) have developed standards specifically for AV sensor technologies. These standards cover aspects such as sensor performance metrics, testing methodologies, and data communication protocols.

One of the key challenges in developing a regulatory framework for piezoelectric sensors in AVs is addressing the issue of sensor fusion. As AVs typically rely on multiple sensor types working in concert, regulations must consider how piezoelectric sensors interact with other sensing technologies such as LiDAR, radar, and cameras. This includes establishing guidelines for data integration and decision-making processes based on multi-sensor inputs.

Privacy and cybersecurity concerns are also significant considerations in the regulatory framework for AV sensors. As these sensors collect and process vast amounts of data, regulations must address data protection, storage, and transmission. The General Data Protection Regulation (GDPR) in the EU and similar laws in other jurisdictions provide a foundation for addressing these concerns, but specific guidelines for AV sensor data are still evolving.

Looking ahead, the regulatory landscape for AV sensors is expected to continue evolving as technology advances and real-world deployment increases. Regulatory bodies are likely to adopt a more adaptive approach, allowing for regular updates to standards as new sensor technologies emerge and as more data on their performance becomes available. This dynamic regulatory environment will be crucial in ensuring that safety standards keep pace with technological innovations in the field of autonomous vehicles and their sensor systems.

In the United States, the National Highway Traffic Safety Administration (NHTSA) has been at the forefront of developing safety standards for AVs and their sensor systems. The NHTSA has proposed a framework that includes performance requirements for sensor systems, including piezoelectric sensors, to ensure their reliability and accuracy in various environmental conditions. These standards address issues such as sensor calibration, data processing, and fault detection mechanisms.

The European Union has also been proactive in developing regulations for AV sensors through the European New Car Assessment Programme (Euro NCAP). Their guidelines focus on the performance of advanced driver assistance systems (ADAS), which rely heavily on sensor technologies like piezoelectric sensors. The Euro NCAP protocols evaluate the effectiveness of these sensors in detecting obstacles, pedestrians, and other vehicles under different scenarios.

In addition to government regulations, industry standards play a crucial role in ensuring the safety and reliability of AV sensors. Organizations such as the International Organization for Standardization (ISO) and the Society of Automotive Engineers (SAE) have developed standards specifically for AV sensor technologies. These standards cover aspects such as sensor performance metrics, testing methodologies, and data communication protocols.

One of the key challenges in developing a regulatory framework for piezoelectric sensors in AVs is addressing the issue of sensor fusion. As AVs typically rely on multiple sensor types working in concert, regulations must consider how piezoelectric sensors interact with other sensing technologies such as LiDAR, radar, and cameras. This includes establishing guidelines for data integration and decision-making processes based on multi-sensor inputs.

Privacy and cybersecurity concerns are also significant considerations in the regulatory framework for AV sensors. As these sensors collect and process vast amounts of data, regulations must address data protection, storage, and transmission. The General Data Protection Regulation (GDPR) in the EU and similar laws in other jurisdictions provide a foundation for addressing these concerns, but specific guidelines for AV sensor data are still evolving.

Looking ahead, the regulatory landscape for AV sensors is expected to continue evolving as technology advances and real-world deployment increases. Regulatory bodies are likely to adopt a more adaptive approach, allowing for regular updates to standards as new sensor technologies emerge and as more data on their performance becomes available. This dynamic regulatory environment will be crucial in ensuring that safety standards keep pace with technological innovations in the field of autonomous vehicles and their sensor systems.

Environmental Impact of Piezoelectric Sensors in AVs

The integration of piezoelectric sensors in autonomous vehicles (AVs) brings both benefits and potential environmental concerns. These sensors, which convert mechanical stress into electrical signals, play a crucial role in enhancing the safety and efficiency of AVs. However, their environmental impact throughout their lifecycle must be carefully considered.

During the production phase, the manufacturing of piezoelectric sensors involves the use of certain materials that may have environmental implications. Some piezoelectric materials, such as lead zirconate titanate (PZT), contain lead, which is known for its toxicity. The extraction and processing of these materials can contribute to environmental degradation if not managed properly. However, research is ongoing to develop lead-free alternatives, such as bismuth sodium titanate (BNT) and potassium sodium niobate (KNN), which could significantly reduce the environmental footprint of sensor production.

In the operational phase, piezoelectric sensors in AVs contribute to improved energy efficiency and reduced emissions. By providing precise data on vehicle dynamics and road conditions, these sensors enable optimized driving patterns and more efficient use of energy. This can lead to lower fuel consumption in hybrid vehicles and extended range in electric vehicles, ultimately reducing the overall carbon footprint of transportation.

The durability and longevity of piezoelectric sensors also play a role in their environmental impact. High-quality sensors can last for many years, reducing the need for frequent replacements and minimizing electronic waste. However, when sensors do reach the end of their life cycle, proper disposal and recycling procedures are essential to prevent harmful materials from entering the environment.

From a broader perspective, the use of piezoelectric sensors in AVs contributes to the development of more sustainable transportation systems. By enabling more efficient traffic flow and reducing accidents, these sensors indirectly help to decrease congestion and the associated environmental impacts of idling vehicles and traffic jams.

However, the increased reliance on electronic components in vehicles, including piezoelectric sensors, raises concerns about electronic waste (e-waste) management. As the automotive industry transitions towards more autonomous and electric vehicles, there is a growing need for comprehensive recycling and disposal strategies for these components.

In conclusion, while piezoelectric sensors in AVs offer significant environmental benefits through improved vehicle efficiency and safety, their production and end-of-life management present challenges that need to be addressed. Ongoing research into more environmentally friendly materials and improved recycling techniques will be crucial in minimizing the negative environmental impacts of these essential components in autonomous vehicle technology.

During the production phase, the manufacturing of piezoelectric sensors involves the use of certain materials that may have environmental implications. Some piezoelectric materials, such as lead zirconate titanate (PZT), contain lead, which is known for its toxicity. The extraction and processing of these materials can contribute to environmental degradation if not managed properly. However, research is ongoing to develop lead-free alternatives, such as bismuth sodium titanate (BNT) and potassium sodium niobate (KNN), which could significantly reduce the environmental footprint of sensor production.

In the operational phase, piezoelectric sensors in AVs contribute to improved energy efficiency and reduced emissions. By providing precise data on vehicle dynamics and road conditions, these sensors enable optimized driving patterns and more efficient use of energy. This can lead to lower fuel consumption in hybrid vehicles and extended range in electric vehicles, ultimately reducing the overall carbon footprint of transportation.

The durability and longevity of piezoelectric sensors also play a role in their environmental impact. High-quality sensors can last for many years, reducing the need for frequent replacements and minimizing electronic waste. However, when sensors do reach the end of their life cycle, proper disposal and recycling procedures are essential to prevent harmful materials from entering the environment.

From a broader perspective, the use of piezoelectric sensors in AVs contributes to the development of more sustainable transportation systems. By enabling more efficient traffic flow and reducing accidents, these sensors indirectly help to decrease congestion and the associated environmental impacts of idling vehicles and traffic jams.

However, the increased reliance on electronic components in vehicles, including piezoelectric sensors, raises concerns about electronic waste (e-waste) management. As the automotive industry transitions towards more autonomous and electric vehicles, there is a growing need for comprehensive recycling and disposal strategies for these components.

In conclusion, while piezoelectric sensors in AVs offer significant environmental benefits through improved vehicle efficiency and safety, their production and end-of-life management present challenges that need to be addressed. Ongoing research into more environmentally friendly materials and improved recycling techniques will be crucial in minimizing the negative environmental impacts of these essential components in autonomous vehicle technology.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!