Silicon anode lifecycle and recyclability considerations

AUG 21, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Silicon Anode Evolution and Research Objectives

Silicon anodes have emerged as a promising alternative to traditional graphite anodes in lithium-ion batteries due to their significantly higher theoretical capacity. The evolution of silicon anode technology can be traced back to the early 2000s when researchers began exploring silicon as a potential anode material. Initially, the primary challenge was the substantial volume expansion (up to 300%) during lithiation, leading to mechanical degradation and rapid capacity fading.

The technological progression of silicon anodes has witnessed several key phases. The first generation focused on pure silicon particles, which demonstrated high initial capacity but suffered from severe capacity degradation. The second generation introduced silicon-carbon composites to buffer volume changes and improve conductivity. The third generation, currently under development, explores nanostructured silicon materials, silicon nanowires, and advanced composite architectures to further mitigate expansion issues.

Research objectives in silicon anode development have evolved from merely achieving high initial capacity to ensuring long-term cycling stability, cost-effectiveness, and environmental sustainability. Current research goals include developing silicon anodes with stable solid-electrolyte interphase (SEI) formation, minimizing irreversible capacity loss, and enhancing rate capability for fast-charging applications.

The lifecycle considerations of silicon anodes present unique challenges compared to traditional graphite anodes. The repeated volume changes during cycling lead to continuous SEI formation, consuming lithium and electrolyte. This necessitates research into electrolyte additives and surface coatings that can form stable interfaces and prevent continuous side reactions.

Recyclability has become an increasingly important research objective as the battery industry moves toward sustainability. Silicon anodes present both challenges and opportunities in recycling processes. The complex composite structures of commercial silicon anodes, often containing binders, conductive additives, and carbon matrices, complicate separation and recovery processes. However, silicon's abundance and lower environmental impact compared to other anode materials offer potential advantages.

Future research objectives include developing silicon anodes with self-healing capabilities to address mechanical degradation, creating environmentally benign manufacturing processes, and designing silicon anodes with end-of-life considerations built into their initial formulation. Additionally, research is focusing on understanding the degradation mechanisms at atomic and molecular levels to inform more rational design approaches.

The ultimate goal is to develop silicon anodes that not only deliver superior performance but also align with circular economy principles, where materials can be effectively recovered and reused at the end of battery life, minimizing environmental impact while maximizing resource efficiency.

The technological progression of silicon anodes has witnessed several key phases. The first generation focused on pure silicon particles, which demonstrated high initial capacity but suffered from severe capacity degradation. The second generation introduced silicon-carbon composites to buffer volume changes and improve conductivity. The third generation, currently under development, explores nanostructured silicon materials, silicon nanowires, and advanced composite architectures to further mitigate expansion issues.

Research objectives in silicon anode development have evolved from merely achieving high initial capacity to ensuring long-term cycling stability, cost-effectiveness, and environmental sustainability. Current research goals include developing silicon anodes with stable solid-electrolyte interphase (SEI) formation, minimizing irreversible capacity loss, and enhancing rate capability for fast-charging applications.

The lifecycle considerations of silicon anodes present unique challenges compared to traditional graphite anodes. The repeated volume changes during cycling lead to continuous SEI formation, consuming lithium and electrolyte. This necessitates research into electrolyte additives and surface coatings that can form stable interfaces and prevent continuous side reactions.

Recyclability has become an increasingly important research objective as the battery industry moves toward sustainability. Silicon anodes present both challenges and opportunities in recycling processes. The complex composite structures of commercial silicon anodes, often containing binders, conductive additives, and carbon matrices, complicate separation and recovery processes. However, silicon's abundance and lower environmental impact compared to other anode materials offer potential advantages.

Future research objectives include developing silicon anodes with self-healing capabilities to address mechanical degradation, creating environmentally benign manufacturing processes, and designing silicon anodes with end-of-life considerations built into their initial formulation. Additionally, research is focusing on understanding the degradation mechanisms at atomic and molecular levels to inform more rational design approaches.

The ultimate goal is to develop silicon anodes that not only deliver superior performance but also align with circular economy principles, where materials can be effectively recovered and reused at the end of battery life, minimizing environmental impact while maximizing resource efficiency.

Market Analysis for Silicon Anode Batteries

The silicon anode battery market is experiencing significant growth, driven by the increasing demand for high-energy-density batteries in electric vehicles, consumer electronics, and energy storage systems. Current market projections indicate that the global silicon anode battery market is expected to reach $2.5 billion by 2027, growing at a compound annual growth rate of approximately 22% from 2022 to 2027. This remarkable growth trajectory is primarily attributed to silicon anodes' theoretical capacity of 4,200 mAh/g, which is approximately ten times higher than traditional graphite anodes.

The electric vehicle sector represents the largest market segment for silicon anode batteries, accounting for nearly 45% of the total market share. As governments worldwide implement stricter emission regulations and offer incentives for electric vehicle adoption, automotive manufacturers are increasingly investing in advanced battery technologies to extend driving range and reduce charging times. Silicon anode batteries, with their higher energy density, are positioned as a critical enabler for next-generation electric vehicles.

Consumer electronics constitutes the second-largest market segment, representing approximately 30% of the market share. Smartphone manufacturers, laptop producers, and wearable device companies are exploring silicon anode batteries to extend device operation time while maintaining or reducing battery size. This trend is particularly evident in premium device segments where battery performance is a key differentiator.

Geographically, Asia-Pacific dominates the silicon anode battery market with over 50% market share, led by China, Japan, and South Korea. These countries have established robust battery manufacturing ecosystems and supply chains. North America follows with approximately 25% market share, driven by significant investments in battery technology startups and research institutions. Europe accounts for about 20% of the market, with growing momentum due to its ambitious electrification goals.

Market challenges primarily revolve around cost considerations and lifecycle issues. The current production cost of silicon anode batteries remains 30-40% higher than conventional lithium-ion batteries with graphite anodes. Additionally, concerns regarding silicon's volume expansion during charging cycles and its impact on battery longevity have slowed widespread commercial adoption.

The recyclability aspect presents both challenges and opportunities. Currently, less than 5% of lithium-ion batteries are recycled globally, and silicon anodes introduce additional complexity to recycling processes. However, as regulatory frameworks increasingly emphasize circular economy principles, companies developing efficient silicon anode recycling technologies are attracting significant investment, with the battery recycling market projected to grow at 19% annually through 2030.

The electric vehicle sector represents the largest market segment for silicon anode batteries, accounting for nearly 45% of the total market share. As governments worldwide implement stricter emission regulations and offer incentives for electric vehicle adoption, automotive manufacturers are increasingly investing in advanced battery technologies to extend driving range and reduce charging times. Silicon anode batteries, with their higher energy density, are positioned as a critical enabler for next-generation electric vehicles.

Consumer electronics constitutes the second-largest market segment, representing approximately 30% of the market share. Smartphone manufacturers, laptop producers, and wearable device companies are exploring silicon anode batteries to extend device operation time while maintaining or reducing battery size. This trend is particularly evident in premium device segments where battery performance is a key differentiator.

Geographically, Asia-Pacific dominates the silicon anode battery market with over 50% market share, led by China, Japan, and South Korea. These countries have established robust battery manufacturing ecosystems and supply chains. North America follows with approximately 25% market share, driven by significant investments in battery technology startups and research institutions. Europe accounts for about 20% of the market, with growing momentum due to its ambitious electrification goals.

Market challenges primarily revolve around cost considerations and lifecycle issues. The current production cost of silicon anode batteries remains 30-40% higher than conventional lithium-ion batteries with graphite anodes. Additionally, concerns regarding silicon's volume expansion during charging cycles and its impact on battery longevity have slowed widespread commercial adoption.

The recyclability aspect presents both challenges and opportunities. Currently, less than 5% of lithium-ion batteries are recycled globally, and silicon anodes introduce additional complexity to recycling processes. However, as regulatory frameworks increasingly emphasize circular economy principles, companies developing efficient silicon anode recycling technologies are attracting significant investment, with the battery recycling market projected to grow at 19% annually through 2030.

Silicon Anode Technology Challenges

Silicon anodes represent a promising advancement in lithium-ion battery technology, offering theoretical capacity up to ten times that of conventional graphite anodes. However, several significant technical challenges impede their widespread commercial adoption. The most critical issue is the substantial volume expansion (up to 300-400%) that silicon undergoes during lithium insertion, leading to mechanical stress, particle fracturing, and eventual electrode pulverization after multiple charge-discharge cycles.

This volume expansion challenge cascades into several interconnected problems. The continuous expansion and contraction cycles cause the solid-electrolyte interphase (SEI) layer to repeatedly break and reform, consuming lithium ions and electrolyte components. This process results in rapid capacity fading and shortened battery lifespan, typically limiting silicon anodes to fewer than 100 effective cycles compared to the 1,000+ cycles achieved by graphite anodes.

Electrical conductivity presents another significant hurdle. Silicon's inherently low electrical conductivity (approximately 10^-3 S/cm compared to graphite's 10^2-10^3 S/cm) hampers electron transport within the electrode, reducing rate capability and power performance. This limitation becomes particularly problematic at high charge/discharge rates required for many applications.

The formation of unstable SEI layers on silicon surfaces further complicates implementation. Unlike graphite's relatively stable SEI, silicon's expanding and contracting surface creates continuously evolving interfaces with the electrolyte. This dynamic interface leads to ongoing parasitic reactions, electrolyte depletion, and impedance growth over time.

Manufacturing scalability also presents significant barriers. Current silicon anode production methods often involve complex nanostructuring approaches or specialized silicon-carbon composites that are difficult to scale economically. The cost-performance balance remains unfavorable compared to established graphite anode manufacturing processes.

From a lifecycle perspective, silicon anodes face additional challenges related to raw material sourcing and end-of-life management. While silicon is abundant, producing battery-grade silicon with appropriate morphology and purity requires energy-intensive processes. Furthermore, the complex composite structures being developed to address performance issues may complicate recycling efforts, potentially limiting circular economy integration.

The thermal stability of silicon anodes also raises safety concerns. The continuous SEI formation reactions are exothermic, potentially contributing to thermal runaway risks in battery systems. This necessitates careful thermal management system design for silicon-based batteries, adding complexity and cost to battery pack engineering.

This volume expansion challenge cascades into several interconnected problems. The continuous expansion and contraction cycles cause the solid-electrolyte interphase (SEI) layer to repeatedly break and reform, consuming lithium ions and electrolyte components. This process results in rapid capacity fading and shortened battery lifespan, typically limiting silicon anodes to fewer than 100 effective cycles compared to the 1,000+ cycles achieved by graphite anodes.

Electrical conductivity presents another significant hurdle. Silicon's inherently low electrical conductivity (approximately 10^-3 S/cm compared to graphite's 10^2-10^3 S/cm) hampers electron transport within the electrode, reducing rate capability and power performance. This limitation becomes particularly problematic at high charge/discharge rates required for many applications.

The formation of unstable SEI layers on silicon surfaces further complicates implementation. Unlike graphite's relatively stable SEI, silicon's expanding and contracting surface creates continuously evolving interfaces with the electrolyte. This dynamic interface leads to ongoing parasitic reactions, electrolyte depletion, and impedance growth over time.

Manufacturing scalability also presents significant barriers. Current silicon anode production methods often involve complex nanostructuring approaches or specialized silicon-carbon composites that are difficult to scale economically. The cost-performance balance remains unfavorable compared to established graphite anode manufacturing processes.

From a lifecycle perspective, silicon anodes face additional challenges related to raw material sourcing and end-of-life management. While silicon is abundant, producing battery-grade silicon with appropriate morphology and purity requires energy-intensive processes. Furthermore, the complex composite structures being developed to address performance issues may complicate recycling efforts, potentially limiting circular economy integration.

The thermal stability of silicon anodes also raises safety concerns. The continuous SEI formation reactions are exothermic, potentially contributing to thermal runaway risks in battery systems. This necessitates careful thermal management system design for silicon-based batteries, adding complexity and cost to battery pack engineering.

Current Silicon Anode Lifecycle Solutions

01 Silicon anode lifecycle enhancement techniques

Various techniques have been developed to enhance the lifecycle of silicon anodes in batteries. These include structural modifications to accommodate volume changes during charge-discharge cycles, surface coatings to prevent electrolyte degradation, and composite formulations that improve mechanical stability. These enhancements help to prevent capacity fading and extend the overall battery lifespan by addressing the inherent expansion and contraction issues of silicon during lithiation and delithiation processes.- Silicon anode lifecycle enhancement techniques: Various techniques have been developed to enhance the lifecycle of silicon anodes in batteries. These include structural modifications to accommodate volume expansion during charging/discharging cycles, surface coatings to prevent electrolyte degradation, and composite materials that improve mechanical stability. These enhancements significantly extend the usable life of silicon anodes, making them more viable for commercial applications while maintaining their high energy density advantages.

- Recycling processes for silicon anode materials: Specialized recycling processes have been developed for silicon anode materials to recover valuable components and reduce environmental impact. These processes include hydrometallurgical methods, thermal treatments, and mechanical separation techniques that enable the extraction of silicon and other valuable materials from spent batteries. The recycled materials can be reprocessed and used in new battery manufacturing, creating a more sustainable lifecycle for silicon anode batteries.

- Silicon-carbon composite anodes for improved durability: Silicon-carbon composite materials have been developed to address the volume expansion issues of pure silicon anodes. By incorporating silicon into carbon matrices or using carbon coatings, these composite anodes maintain structural integrity during charge-discharge cycles. The carbon component provides mechanical stability and improved electrical conductivity, while the silicon delivers high energy capacity. This combination significantly extends the lifecycle of the anode while maintaining high performance characteristics.

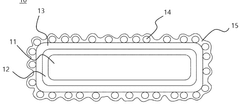

- Battery management systems for silicon anode longevity: Advanced battery management systems have been designed specifically for silicon anode batteries to optimize their lifecycle. These systems monitor and control charging parameters, temperature, and cycling protocols to minimize degradation mechanisms. By implementing adaptive charging algorithms and protective measures, these management systems can significantly extend the useful life of silicon anode batteries and improve their overall reliability in various applications.

- End-of-life assessment and circular economy approaches: Methods for assessing the end-of-life condition of silicon anodes and implementing circular economy approaches have been developed. These include diagnostic techniques to determine remaining capacity, structural integrity analysis, and decision frameworks for repurposing versus recycling. By establishing standardized assessment protocols and creating pathways for second-life applications, these approaches maximize the value extracted from silicon anode materials throughout their complete lifecycle.

02 Recycling processes for silicon anode materials

Specialized recycling processes have been developed for silicon anode materials to recover valuable components and reduce environmental impact. These processes include hydrometallurgical methods, thermal treatments, and mechanical separation techniques that enable the extraction of silicon and other valuable materials from spent batteries. The recycling approaches aim to create closed-loop systems that reduce the need for virgin material extraction while managing the unique challenges posed by silicon-based anode compositions.Expand Specific Solutions03 Silicon anode degradation mechanisms and mitigation

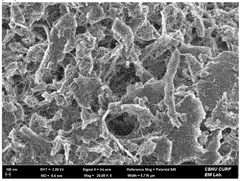

Research has identified key degradation mechanisms affecting silicon anodes, including pulverization, continuous SEI formation, and loss of electrical contact. Mitigation strategies involve nanostructuring silicon particles, incorporating elastic binders, and designing porous structures that can accommodate volume changes. Understanding these degradation pathways has led to the development of more resilient silicon anode formulations that maintain performance over extended cycling periods.Expand Specific Solutions04 End-of-life management and sustainability of silicon anodes

End-of-life management strategies for silicon anodes focus on sustainable practices including refurbishment, repurposing, and environmentally responsible disposal. These approaches consider the entire lifecycle of silicon anode batteries from raw material sourcing to final disposal or recycling. Assessment methodologies have been developed to evaluate the environmental impact of silicon anodes compared to traditional graphite anodes, with consideration for energy consumption, carbon footprint, and resource efficiency throughout the product lifecycle.Expand Specific Solutions05 Silicon-carbon composite anodes for improved recyclability

Silicon-carbon composite anodes have been developed to improve both performance and recyclability of battery systems. These composites combine silicon's high capacity with carbon's stability and conductivity, resulting in anodes that not only perform better but are also easier to process at end-of-life. The carbon component helps maintain structural integrity during recycling processes, while specific composite designs facilitate separation of materials during recycling operations, enhancing material recovery rates and economic viability of recycling silicon-based battery components.Expand Specific Solutions

Key Industry Players and Competitive Landscape

Silicon anode technology for lithium-ion batteries is currently in the early commercialization phase, with a rapidly growing market expected to reach significant scale as electric vehicle adoption increases. The technology offers substantial energy density improvements over traditional graphite anodes but faces lifecycle and recyclability challenges. Companies like NanoGraf, Enevate, and Nexeon are leading innovation in silicon anode materials, while recycling specialists such as Guangdong Bangpu and Hunan Bangpu are developing processes for sustainable material recovery. Established battery manufacturers including LG Energy Solution, SK On, and CALB are integrating silicon anodes into their product roadmaps, while research institutions like California Institute of Technology and Arizona State University continue advancing fundamental understanding of silicon anode degradation mechanisms and recyclability solutions.

NanoGraf Corp.

Technical Solution: NanoGraf has developed a silicon-based anode technology that addresses lifecycle challenges through a proprietary silicon-graphene composite structure. Their approach encapsulates silicon particles within a protective graphene scaffold, creating a stable matrix that accommodates volume changes during cycling. This architecture prevents pulverization of silicon particles while maintaining electrical connectivity throughout the charge-discharge process. NanoGraf's silicon-graphene composite demonstrates up to 50% higher energy density than conventional graphite anodes while achieving over 1000 cycles with minimal capacity fade. For recyclability, the company has engineered their materials to be compatible with existing lithium-ion battery recycling infrastructure. The graphene component serves as a sacrificial material during recycling processes, facilitating easier separation and recovery of silicon. Their manufacturing process utilizes water-based processing techniques that eliminate toxic NMP solvents, reducing environmental impact and improving worker safety during both production and recycling operations.

Strengths: Superior energy density (up to 50% higher than graphite); excellent cycle stability through graphene protection; compatibility with existing manufacturing and recycling infrastructure. Weaknesses: Higher production costs due to graphene component; complex composite structure may limit silicon content; graphene production has its own environmental considerations.

Enevate Corp.

Technical Solution: Enevate has developed a silicon-dominant anode technology called HD-Energy® that addresses lifecycle challenges through a unique composite structure. Their approach uses pure silicon films with a specialized porous design that accommodates volume expansion during charging cycles. The company's XFC (Extreme Fast Charging) technology incorporates silicon microstructures with engineered porosity that allows for controlled expansion while maintaining structural integrity over thousands of cycles. For recyclability, Enevate has designed their anodes with end-of-life considerations, using silicon materials that can be more easily separated from other battery components compared to traditional graphite-silicon composites. Their manufacturing process utilizes lower temperatures than conventional methods, reducing the carbon footprint of production while creating anodes that maintain 90% capacity after 1000+ cycles.

Strengths: Superior cycle life compared to other silicon-dominant anodes; fast charging capability (0-75% in 5 minutes); higher energy density (30-40% improvement); manufacturing compatible with existing production lines. Weaknesses: Higher initial production costs; requires specialized electrolyte formulations; recovery of pure silicon from end-of-life batteries remains challenging despite improved separability.

Critical Patents in Silicon Anode Recyclability

Silicon anode comprising coated silicon particles, production method and use thereof

PatentWO2023161305A1

Innovation

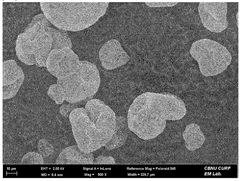

- A silicon anode is developed as a three-dimensional shaped body with silicon particles of 1 nm to 30 micrometers, bonded at contact points, and coated with a conductive metallic alloy or metal for electrical contacting, using a method that includes sintering, pressing, or melting, with a density of 0.1 to 2.3 g/cm³, and optionally coated with silanes or polyalkylene oxides to inhibit corrosion.

Carbon nanotube and carbon black composite network-type silicon negative electrode material for lithium-ion secondary battery

PatentWO2025110483A1

Innovation

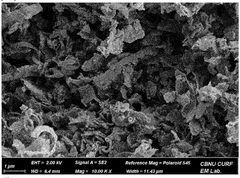

- A silicon anode material comprising a plate-shaped silicon aggregate with a silicon oxide layer, a silicon carbide layer, a mesh network structure of carbon nanotubes, and a carbon black layer, which improves electrical conductivity and stability during volume changes.

Environmental Impact Assessment

The environmental impact of silicon anodes throughout their lifecycle presents significant considerations for the battery industry's sustainability goals. Silicon extraction processes, primarily through silica mining and reduction, consume substantial energy and generate considerable carbon emissions. Compared to traditional graphite anodes, silicon production requires approximately 30-40% more energy per unit mass, contributing to a higher initial carbon footprint. Additionally, the chemical processes involved in silicon purification often utilize hazardous substances like hydrofluoric acid, creating potential environmental contamination risks if not properly managed.

Water usage represents another critical environmental concern, with silicon processing requiring 15-20 gallons of water per kilogram of processed material. This intensive water consumption can strain local resources, particularly in water-scarce regions where silicon production facilities may be located. The manufacturing phase also generates silicon particulate matter that, without proper filtration systems, can contribute to air pollution and associated respiratory health issues in surrounding communities.

During the operational phase, silicon anodes offer environmental benefits through improved energy density, potentially reducing the overall material requirements for battery systems. However, the accelerated degradation of silicon anodes compared to graphite counterparts can lead to shorter battery lifespans, potentially offsetting these gains through increased replacement frequency and associated manufacturing impacts.

End-of-life management presents both challenges and opportunities. Current recycling technologies struggle with efficiently separating silicon from other battery components, with recovery rates averaging only 15-25% compared to 50-70% for traditional materials. The energy intensity of silicon recycling processes further complicates the environmental equation, sometimes requiring more energy than virgin material production.

Regulatory frameworks worldwide are increasingly addressing these concerns, with the European Union's Battery Directive and similar initiatives in Asia and North America establishing more stringent requirements for battery lifecycle management. These regulations are driving innovation in both manufacturing processes and recycling technologies specific to silicon-based battery components.

Life Cycle Assessment (LCA) studies indicate that silicon anodes can achieve net environmental benefits only when their production incorporates renewable energy sources and when effective recycling systems are implemented. Recent research suggests that implementing closed-loop recycling systems could reduce the carbon footprint of silicon anodes by up to 45% compared to current practices, highlighting the importance of developing specialized recycling infrastructure alongside anode technology advancement.

Water usage represents another critical environmental concern, with silicon processing requiring 15-20 gallons of water per kilogram of processed material. This intensive water consumption can strain local resources, particularly in water-scarce regions where silicon production facilities may be located. The manufacturing phase also generates silicon particulate matter that, without proper filtration systems, can contribute to air pollution and associated respiratory health issues in surrounding communities.

During the operational phase, silicon anodes offer environmental benefits through improved energy density, potentially reducing the overall material requirements for battery systems. However, the accelerated degradation of silicon anodes compared to graphite counterparts can lead to shorter battery lifespans, potentially offsetting these gains through increased replacement frequency and associated manufacturing impacts.

End-of-life management presents both challenges and opportunities. Current recycling technologies struggle with efficiently separating silicon from other battery components, with recovery rates averaging only 15-25% compared to 50-70% for traditional materials. The energy intensity of silicon recycling processes further complicates the environmental equation, sometimes requiring more energy than virgin material production.

Regulatory frameworks worldwide are increasingly addressing these concerns, with the European Union's Battery Directive and similar initiatives in Asia and North America establishing more stringent requirements for battery lifecycle management. These regulations are driving innovation in both manufacturing processes and recycling technologies specific to silicon-based battery components.

Life Cycle Assessment (LCA) studies indicate that silicon anodes can achieve net environmental benefits only when their production incorporates renewable energy sources and when effective recycling systems are implemented. Recent research suggests that implementing closed-loop recycling systems could reduce the carbon footprint of silicon anodes by up to 45% compared to current practices, highlighting the importance of developing specialized recycling infrastructure alongside anode technology advancement.

Regulatory Framework for Battery Recycling

The regulatory landscape for battery recycling is evolving rapidly in response to the growing adoption of silicon anode batteries and other advanced energy storage technologies. In the United States, the Resource Conservation and Recovery Act (RCRA) provides the primary framework for managing hazardous waste, including spent lithium-ion batteries with silicon anodes. The Environmental Protection Agency (EPA) has recently updated its guidelines to specifically address the unique challenges posed by silicon-based battery components, recognizing their distinct chemical properties compared to traditional graphite anodes.

The European Union has implemented more stringent regulations through the Battery Directive (2006/66/EC) and its recent update, the Battery Regulation (2023), which explicitly includes provisions for silicon anode materials. These regulations mandate minimum recycling efficiencies of 70% for lithium-ion batteries and require producers to recover at least 50% of silicon content from spent batteries by 2025, with targets increasing to 70% by 2030.

China, as the world's largest battery producer, has established the "New Energy Vehicle Power Battery Recycling Management Provisional Measures," which now includes specific protocols for handling silicon-rich battery components. These measures emphasize the establishment of specialized recycling facilities capable of processing silicon anodes without contaminating other recyclable materials.

Internationally, the Basel Convention on the Control of Transboundary Movements of Hazardous Wastes governs the global transport of battery waste. Recent amendments have reclassified silicon anode materials to reflect their potential environmental impact, requiring additional documentation and handling procedures for cross-border shipment.

Industry-specific standards are also emerging through organizations like the Institute of Electrical and Electronics Engineers (IEEE) and the International Electrotechnical Commission (IEC), which have developed technical guidelines for silicon anode battery recycling. These standards address the challenges of separating silicon from other battery components and preventing silicon oxide formation during recycling processes.

Extended Producer Responsibility (EPR) programs are increasingly incorporating silicon anode considerations, with several jurisdictions now requiring manufacturers to establish take-back systems specifically designed for advanced battery chemistries. Financial incentives, including tax credits and subsidies, are being implemented in various regions to encourage the development of specialized recycling technologies capable of efficiently recovering silicon materials.

The regulatory framework continues to adapt as research reveals more about the environmental impacts of silicon anodes throughout their lifecycle, with particular attention to the potential release of nanosilicon particles during recycling operations and the energy-intensive nature of silicon recovery processes.

The European Union has implemented more stringent regulations through the Battery Directive (2006/66/EC) and its recent update, the Battery Regulation (2023), which explicitly includes provisions for silicon anode materials. These regulations mandate minimum recycling efficiencies of 70% for lithium-ion batteries and require producers to recover at least 50% of silicon content from spent batteries by 2025, with targets increasing to 70% by 2030.

China, as the world's largest battery producer, has established the "New Energy Vehicle Power Battery Recycling Management Provisional Measures," which now includes specific protocols for handling silicon-rich battery components. These measures emphasize the establishment of specialized recycling facilities capable of processing silicon anodes without contaminating other recyclable materials.

Internationally, the Basel Convention on the Control of Transboundary Movements of Hazardous Wastes governs the global transport of battery waste. Recent amendments have reclassified silicon anode materials to reflect their potential environmental impact, requiring additional documentation and handling procedures for cross-border shipment.

Industry-specific standards are also emerging through organizations like the Institute of Electrical and Electronics Engineers (IEEE) and the International Electrotechnical Commission (IEC), which have developed technical guidelines for silicon anode battery recycling. These standards address the challenges of separating silicon from other battery components and preventing silicon oxide formation during recycling processes.

Extended Producer Responsibility (EPR) programs are increasingly incorporating silicon anode considerations, with several jurisdictions now requiring manufacturers to establish take-back systems specifically designed for advanced battery chemistries. Financial incentives, including tax credits and subsidies, are being implemented in various regions to encourage the development of specialized recycling technologies capable of efficiently recovering silicon materials.

The regulatory framework continues to adapt as research reveals more about the environmental impacts of silicon anodes throughout their lifecycle, with particular attention to the potential release of nanosilicon particles during recycling operations and the energy-intensive nature of silicon recovery processes.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!